2006

John Fredriksen controls a corporate empire founded on transporting crude oil. Among the pearls of that empire is Marine Harvest, the largest fish-farming company in the world.

“You stand on dead men’s legs. You’ve never had any of your own. You couldn’t walk alone between two sunrises and hustle the meat for your belly . . .”

—Jack London, The Sea Wolf

Acomparison with socialite Paris Hilton is inevitable: The twin sisters Kathrine and Cecilie, 26, are young, beautiful, and rich. In the list of Forbes magazine’s “Hottest Billionaire Heiresses,” the twins are next to Ivanka Trump and Holly Branson. The sisters have so far kept their names out of scandals, but they are already following in the business footsteps of their father, John Fredriksen. Forbes rates the private wealth of the 74-year-old Norwegian shipowner—by far the richest Norwegian—at more than 8 billion USD. Due to high taxes in Norway, however, Fredriksen lives in London and holds Cypriot citizenship.

Fredriksen, born May 11, 1944, near Oslo, became rich in the crude oil business, as have many before him. He was already working in the shipping business when he set up his own company during the oil crises of the 1970s and built up a tanker fleet, today one of the largest in the world. He earned money on risky ventures during the Iran-Iraq War in the 1980s and delivered crude oil to the apartheid regime in South Africa.

Today Frederiksen heads a huge corporate empire, directly or through its investment firms. He is the largest shareholder of the Bermuda-registered shipping company Frontline, which controls a fleet of Liquefied Natural Gas (LNG) tankers with Golar LNG, and is involved in the oil rig operator SeaDrill and the shipping companies Golden Ocean Group and Overseas Shipholding Group. In Germany, Fredriksen is known as a major shareholder of the TUI Group and an advocate of selling the container shipping division Hapag-Lloyd, in order to promote the consolidation of the industry. Prior to 2010 John Fredriksen held the largest stake in TUI Travel and had a significant influence upon its direction and strategy. The Norwegian had already made a name for himself in the world of fish farming and today controls the largest fish-farming company in the world—Marine Harvest.

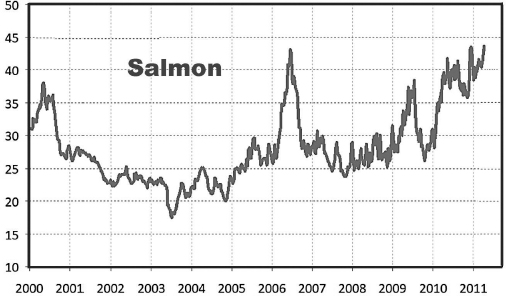

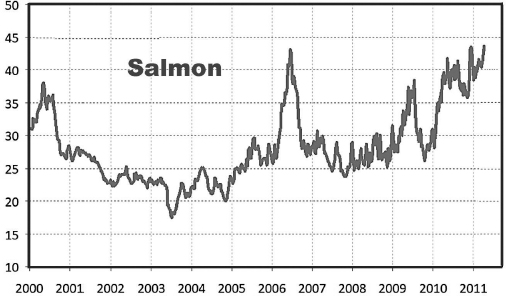

Figure 22. Norwegian salmon prices in NOK/kg, 2000–2011. Data: Bloomberg, 2019.

In the 1971 German TV adaptation of Jack London’s famous adventure novel The Sea Wolf, Raimund Harmstorf, in his role as Wolf Larsen, crushes a raw potato to illustrate his worldview—eat, or be eaten. It’s an apt metaphor for the dealings of John Fredriksen, the Norwegian Sea Wolf.

In the first years of the new millennium, the Norwegian fish-farming industry was experiencing financial difficulties due to low prices for fish. In particular, the company Pan Fish, founded in 1992, had been struggling since 2000.

What’s the Catch?

By far the world’s largest fishing nations are China, Peru, India, and Japan. In Europe, Norway, Denmark, and Spain haul in the largest harvests. The value of world exports of fish and fishery products in 2015 reached 96 billion USD. Aquaculture deals with the controlled cultivation of fish, mussels, crabs, and algae, and there’s a rapidly growing global market for these products: According to figures from the UN’s Food and Agriculture Organization (FAO), slightly more than a third of the almost 150 million metric tons of fish caught come from aquaculture—and the number is rising. The Organisation for Economic Co-operation and Development (OECD) and FAO estimate that by 2020 the proportion of farmed fish will account for almost 50 percent of the total fishery.

Farmed fish have the advantage of lower prices, and some argue that fish farms can also counteract the overfishing of the oceans; according to FAO estimates, more than 70 percent of the fishing grounds are already considered “overfished.” However, others point out some disadvantages: Aquaculture’s carnivorous fish, such as salmon and trout, consume many times the body weight of wild-caught fish; and there are particularly negative consequences to keeping fish in unnaturally large and dense pens, especially in countries with low ecological standards, such as in Southeast Asia or South America, because of over-fertilization or the use of antibiotics.

Fredricksen controlled an almost 50 percent stake in Pan Fish through his investment company Greenwich Holding and the two vehicles Geveran Trading and Westborough Holdings. In June 2005, he bid successfully for the remaining shares of the company. In the second quarter of 2005, Fredriksen also acquired 24 percent of Fjord Seafood through Geveran Trading. His shares would soon amount to nearly 50 percent of the company. Then, in October 2005, Fjord Seafood made an offer to the state fish-farming company Cermaq, but the bid failed due to opposition from the Norwegian government.

Fredricksen made his next big move in March 2006: Nutreco, today the largest manufacturer of fish feed worldwide, sold 75 percent of Marine Harvest—which had been involved in Chilean fish farming since the mid-1970s—to Geveran Trading for nearly 900 million euros. The remaining 25 percent was acquired by the Norwegian firm Stolt-Nielsen.

On December 29, 2006, Pan Fish, Fjord Seafood, and Marine Harvest merged to form the new Marine Harvest Group. What was by far the largest fish-farming corporation in the world was now under the control of John Fredriksen.

Key Takeaways

•John Fredriksen, a modern version of Jack London’s Sea Wolf, made his fortune in the crude oil market, then became active in oil drilling, the transport of crude oil, shipping, and liquified natural gas. Today he controls an extensive corporate empire.

•During the first years of the new millennium, the Norwegian fish-farming industry experienced severe financial difficulties due to low salmon prices.

•By active industry consolidation over two years, Fredriksen built the Marine Harvest Group in 2006. Today it’s the world leader in fish farming and aquaculture.