30

Rice: The Oracle

2008

The Thai “Rice Oracle,” Vichai Sriprasert, predicts in 2007 that rice will increase in price from 300 USD to 1,000 USD, and he becomes a figure of ridicule and mockery. However, a dangerous chain reaction affecting the rice harvest is about to start in Asia and, with Cyclone Nargis, culminates in a catastrophe.

“National hoarding really doesn’t help the market.”

—Robert Zeigler,

International Rice Research Institute

At 65, Vichai Sriprasert was one of Thailand’s largest rice exporters, nicknamed the “Rice Oracle.” Years of experience with the interrelationship between supply, demand, and price development had earned Vichai a lot of money as well as the honorary chairmanship of the Thai Association of Rice Traders. As the world’s largest exporter of rice, Thailand was a determining factor in international trade.

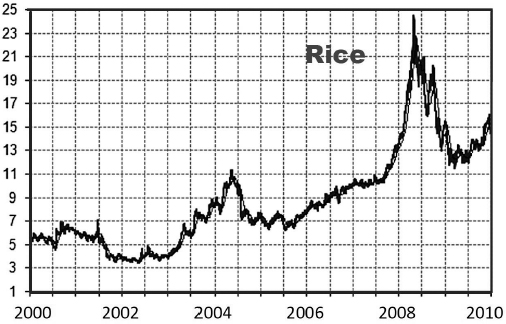

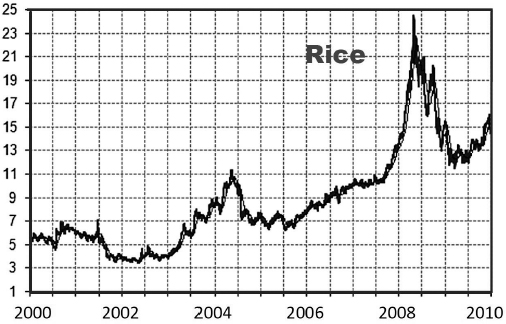

Disbelief and ridicule were the initial reactions to Vichai’s prediction, in 2007, that rice prices were likely to exceed 1,000 USD per ton in the following year. At the time Thai export rice was priced at around 300 USD per ton. After a rapid increase in the price of oil and dramatically higher prices for wheat and corn, however, the laughter disappeared. In spring 2008, the price of rice actually broke Vichai’s targeted 1,000 USD mark. And it would continue to rise. For Vichai, the situation was comparable to the 1970s, when in the shadow of the oil crisis, rice prices rose to around 2,700 USD per metric ton.

Rice Realities

According to figures from the Food and Agriculture Organization (FAO), rice—along with corn and wheat—is one of the most widely cultivated cereals in the world, with an annual production of around 650 million metric tons. The largest producer countries are China, India, Indonesia, Bangladesh, Vietnam, and Thailand. Due to its predominantly wet cultivation, between 3,000 and 5,000 liters of flowing water are needed per kilogram of rice. On the one hand, this has a positive effect in terms of lower pest and weed infestation; on the other hand, this can lead to serious crop failures in periods of dry weather.

Despite the importance of rice, futures trading is insignificant, with less liquidity than the wheat or corn market. The most important trading place for rice is the Chicago Board of Trade (CBOT) in the United States. Traded contracts are quoted in US cents per American centner or hundredweight (1 cwt equals 100 lb equals 45.359 kg), with one contract covering 2,000 hundredweights.

What had happened? Driven by the rising price of crude oil, the prices of many agricultural goods rose sharply in 2007, a condition called “agflation.” The food price index, calculated by the FAO, had risen by 57 percent within just one year, from March 2007 to March 2008. Wheat and soybean prices also doubled, and the price of corn had increased by 66 percent since autumn 2007.

Figure 27. Rice prices in US cents/cwt, 2000–2010, Chicago Board of Trade. Data: Bloomberg, 2019.

However, the price of rice was still well above that of other agricultural goods and was developing its own momentum in spring 2008. From June 2007 to April 2008, rice prices rose by around 75 percent—even more in Asia. Prices increased from 400 USD per metric ton to more than 1,000 USD.

The price spike had widespread consequences. Rice is a staple food for around three billion people, and in many countries nearly half of household income is spent on nutrition. The rise in prices threatened political stability in several countries and caused serious unrest around the world. In Haiti several people were killed in protests, and uprisings were reported in Egypt, Burkina Faso, Cameroon, Indonesia, Côte d’Ivoire, Mauritania, Mozambique, and Senegal. How did all this happen?

The globally traded rice volume of 30 million tons was very low compared to the total production of 650 million tons.

The rice market is generally subject to structural deficits. The average amount of rice traded on the world markets per year—around 30 million metric tons—is very low compared to global production of around 650 million tons. This makes global prices extremely vulnerable to short-term fluctuations in supply and demand. Urbanization, demographics, and the demand for alternative energies and weather conditions all are influential factors and also apply to other agricultural goods to some extent.

For example, rapid urbanization in Asia has destroyed more and more agricultural acreage, and increasing prosperity on that continent has also led to more meat consumption, increasing the amount of grain needed to feed livestock. The consumption of meat in China alone increased by about 150 percent in the past 30 years. Furthermore, the rice fields of Asia have had to absorb an annual birth rate of about 80 million babies in the region. Indirectly, the high price of oil and a related increase in demand for biofuels are also driving up the price of rice, as many farmers switch to the more profitable cultivation of corn, wheat, and oilseeds.

Some countries recorded significant losses in their rice harvest due to weather in 2007–2008. Thunderstorms and floods destroyed more than 20 million hectares of fields within one year, twice the total acreage of Thailand. Bangladesh, generally a major exporter of rice, suffered significant crop losses in 2007 from floods and Tropical Storm Sidr, which destroyed almost the entire crop. The rice harvest in Vietnam was also hampered by severe pest infestation and disease. As a result, the price of rice continued to rise, and the situation gradually worsened.

With panic buying and export restrictions, the dominoes were falling: In Asia, supplies continued to be stretched. The rice-exporting countries of Vietnam and India issued restrictions on the export of rice, while India slowed exports to stabilize prices at home. Other exporting countries, such as China, Egypt, and Cambodia, joined in with quotas and taxes. China was so worried about supplying its own population that it waived exports until further notice, while in Thailand, farmers, traders, and rice mills began to hoard their rice.

In Asia, hoarding and export restrictions worsened the already tight supply.

Everywhere in the region there was panic buying. Even in the United States, Wal-Mart rationed its sales to customers. The world’s largest importer, the Philippines, announced massive purchases to forestall further supply shortages. Importing countries like Bangladesh, Indonesia, and Iran were also affected. And then, on the night of May 3, a catastrophe occurred.

Cyclone Nargis hit the coast of Myanmar, devastating the rice supply region in the middle of the harvest season and leaving between 50,000 and 100,000 people dead. The price of rice shot up again, and the risk of famine and revolts caused by hunger rose. As the price of rice quadrupled, many regions were threatened by unrest. In addition to the tight supply and the unfavorable weather, export restrictions and hoarding had created an artificial shortage, dramatically exacerbating the situation. Even Vichai did not foresee how bad the situation would become.

In May 2008, however, the supply situation eased. Pakistan, one of the largest rice producers, loosened its export restrictions, and the crop in India was more than 2 million metric tons larger than expected. However, the structural problems of the rice market would remain. Given a comparatively small international market, repeated supply bottlenecks in Asia are to be expected in the future.

Key Takeaways

•In the beginning of 2007, Vichai Sriprasert, the “Rice Oracle” of Thailand, predicted a massive increase in the price of rice, a ridiculous thought at that time.

•Later in 2007, however, prices of many agricultural goods rose sharply, driven by increasing crude oil prices (“agflation”). The situation in the rice market was especially critical.

•From June 2007 to April 2008, rice prices in Asia increased from 400 USD to more than 1,000. Hoarding and export restrictions worsened an already tight supply.

•When Cyclone Nargis hit Myanmar in May 2008, it devastated that country’s rice harvest and left as many as 100,000 people dead.

•The price of rice quadrupled, and many regions were threatened by unrest, causing difficulties that even the Rice Oracle did not foresee.