31

Wheat: Working in Memphis

2008

The price of wheat speeds from record to record. Trader Evan Dooley bets on the wrong direction, juggling 1 billion USD and dropping the ball. This results in a loss of 140 million USD for his employer, MF Global, in February 2008.

“I simply do not know where the money is.”

—Jon Corzine, CEO of MF Global

Less than a month after Jérôme Kerviel’s catastrophic bet on European equity indices, which resulted in losses of nearly 5 billion USD to French investment bank Société Générale, another trader caused difficulties for his employer.

This time it was through speculation on wheat futures. At the end of February 2008, MF Global, one of the world’s largest futures and options brokers, had to admit that one of its traders in Memphis, Tennessee, had speculated on wheat futures with corporate accounts. Within hours, a loss of about 140 million USD occurred.

Spun out of Man Financial Group in 2007, MF Global was a commodity brokerage house that offered clearing and execution services. It had ambitions to become a financial services firm on the order of a Goldman Sachs or JPMorgan, and its CEO was Jon Corzine, former chairman of Goldman Sachs and onetime governor of New Jersey. Although it was a niche player on Wall Street, MF Global was a force on the Chicago Mercantile Exchange (CME), with 3 million futures and options positions open with a face value of more than 100 billion USD. Its customers made up almost 30 percent of the trading volume on the CME.

Trading Wheat

After corn, wheat is the second-biggest agricultural crop in the world, and it is traded worldwide on commodity futures exchanges. On the Chicago Board of Trade (CBOT), wheat is traded under the symbol W and the current contract month (e.g., W Z0 for wheat December 2020). One contract refers to 5,000 bushels of wheat, and each bushel is equivalent to 27.2 kilograms.

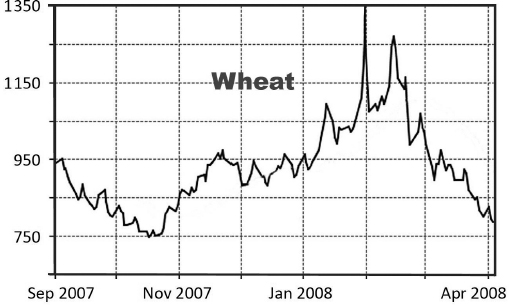

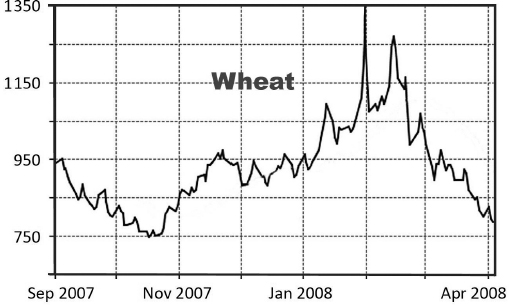

Priced at 7.50 USD per bushel in November 2007, US wheat was already trading above 8 USD by the beginning of 2008. In part this was due to a tightening supply, but the increase was also increasingly driven by speculative capital, along with a weak US currency. The price broke through 9 and 10 USD per bushel within days, and at the end of February the situation had really gotten out of hand. On February 27, wheat contracts close to delivery experienced price movements of as much as 25 percent within a day. Although trading opened positive, by noon the price had fallen to 10.80 USD.

Trader Evan Dooley speculated on falling

prices of 2 million tons of wheat.

In the afternoon, however, the price jumped again, to 13.50 USD per bushel. The news that Kazakhstan, one of the largest exporters of wheat, wanted to introduce export taxes to reduce sales was boosting the US wheat price. It was the strongest intraday price movement in wheat ever observed.

However, there was also another explanation for the price swings: Evan Dooley, who had been a trader at MF Global since November 2005, had quickly entered significant positions in wheat futures on his own account in the morning hours of February 27. With these unauthorized actions, the 40-year-old trader exceeded his limits by far.

Betting on a falling wheat price, Dooley is said to have traded around 15,000 futures—2 million metric tons of wheat. The value of the position varied between 800 million and 1 billion USD. However, as the wheat price continued to rise sharply, the company was forced to close the position with losses, that is, to buy further futures contracts. This led to a further price jump to a level that the market would not reach again, despite continuing strength, for several years.

Figure 28. Wheat prices in US cents/bushel, 2007–2008, Chicago Board of Trade. Data: Bloomberg, 2019.

MF Global shares lost more than 25 percent in value on that day. The losses came to approximately 140 million USD and represented four times the previous quarter. Concerned about the extent of the loss, MF Global promised to revise its internal policies and risk management. Dooley was fired immediately, and MF Global was fined 10 million USD for lack of supervision of its traders. Dooley himself was sentenced to five years in federal prison and had to make restitution of 140 million USD.

On a side note, MF Global collapsed in 2011 when the company reported a 192 million USD quarterly loss. Client funds disappeared in the aftermath, which became a huge scandal. However, the failure of MF Global, with more than 40 billion USD in assets—the eighth-biggest bankruptcy in US history—was modest compared with the chaotic 2008 failure of Lehman Brothers, which had a 691 billion USD balance sheet. Regulators were eager to show that not all Wall Street firms were too big to fail. They happily let MF Global go under.

Key Takeaways

•Less than a month after Jérôme Kerviel’s catastrophic bet on European equity indices in 2008, another trader caused trouble for his employer: Evan Dooley of MF Global speculated on falling wheat prices and built up a short position of almost 1 billion USD.

•Wheat prices kept climbing higher and higher, however, from 7.50 USD per bushel in late 2007 to more than 10 USD per bushel in January 2008.

•On February 27, 2008, the price of wheat traded in Chicago fluctuated in the course of the day by 25 percent—falling back to 10.80 USD per bushel, then jumping again to 13.50 USD in the afternoon. MF Global accumulated a loss of about 140 million USD within hours.