34

Chocolate Finger

2010

Due to declining harvests in Côte d’Ivoire (the Ivory Coast)—the largest cocoa exporter on the world market—prices are rising on the international commodity futures markets. In the summer of 2010, cocoa trader Anthony Ward, “Chocolate Finger,” wagers more than 1 billion USD on cocoa futures.

“Of course they are people. They’re Oompa Loompas.“

—Willy Wonka in the movie

Charlie and the Chocolate Factory

Cocoa, native to Central and South America, was considered by the Maya and the Aztecs to be a gift from the gods and therefore sacred. The seeds of the cacao tree also served as a means of payment. In the treasuries of Aztec king Moctezuma II, the Spanish conquistadors discovered, in addition to gold, more than 1,200 tons of cocoa—tax revenues and a huge currency reserve.

Today cocoa is an important cash crop, an export commodity for many developing countries, and the raw material for the production of chocolate. (In Germany, one of the countries with the highest per capita consumption of chocolate worldwide, every person eats an average of around 9 kilos per year.) Production costs for chocolate depend on the cocoa content, cocoa quality, and processing time, so that for a normal chocolate bar, the price of cocoa accounts only for about 10 percent of the cost of production.

Cocoa is traded in New York on the New York Board of Trade (NYBOT) and in London on the London International Financial Futures Exchange (LIFFE) in contracts of 10 tons each in USD and GBP, respectively.

The 10 largest cocoa producers account for more than 90 percent of the world’s crop. Côte d’Ivoire dominates global production with a market share of more than a third of world production.

In July 2010, market rumors in London suggested that the Armajaro hedge fund had placed a 1 billion USD bet in the cocoa market. Fund manager Anthony Ward was said to have bought around 240,000 tons of cocoa in an attempt to corner the market. This would have accounted for about 7 percent of global cocoa production and the majority of the available quantities. While some traders saw this as a bet that cocoa prices would continue to rise due to a declining supply, others argued that Ward was creating an artificial shortage and manipulating the market through his massive purchases just before the start of the annual cocoa harvest in October.

Where’s the Cocoa?

Cocoa’s main growing areas have shifted in recent years from Central America to Africa. The 10 largest producer countries account for more than 90 percent of the global cocoa harvest. Of these, Côte d’Ivoire is the largest supplier of cocoa in the world, with a market share of more than 33 percent. Indonesia, Ghana, Nigeria, Brazil, and Cameroon follow far behind. By 2010, however, cocoa production in Côte d’Ivoire had fallen by more than 15 percent over the previous five years, largely due to poor crop maintenance and pest infestation. Cocoa production in 2008–2009 was the smallest harvest in the previous five years, at just 1.2 million metric tons, a trend that market participants expected for the 2009–2010 crop as well.

At age 50, Anthony Ward was considered a genius in trading cocoa. His attempt to corner the market for cocoa was spectacular but not an isolated event. In 2002, Ward had purchased more than 200,000 tons of cocoa—the equivalent of 5 percent of the world’s cocoa market—through futures contracts. That was not the biggest cocoa transaction, however. The cocoa trading desk at Phibro, Salomon Smith Barney’s commodity trading business, had taken a position of 300,000 tons of cocoa in 1997. The head of the cocoa trading desk at that time? Anthony Ward.

Anthony Ward had been a cocoa trader and industry expert since 1979. In the first months of 2010, the price rose more than 20 percent because of his trades.

Anthony Ward gained his first trading experiences in 1979 with tea, rice, cocoa, and rubber. In 1998 he co-founded Armajaro with Richard Gower, initially focusing on cocoa, then adding coffee and, later, other agricultural goods. Today Armajaro manages 1.5 billion USD and, with a local presence in Côte d’Ivoire, Indonesia, and Ecuador, is one of the largest cocoa suppliers to the world market. After Ward’s trades in July 2010, the British press dubbed Ward “Willy Wonka,” after the character in Charlie and the Chocolate Factory, and “Chocolate Finger,” in homage to a James Bond villain.

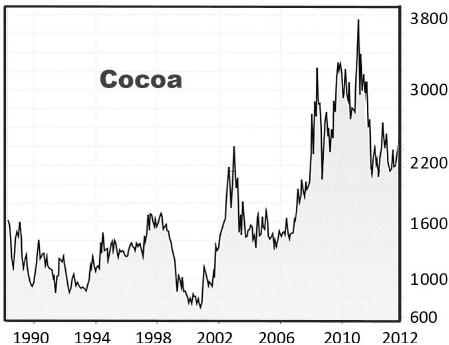

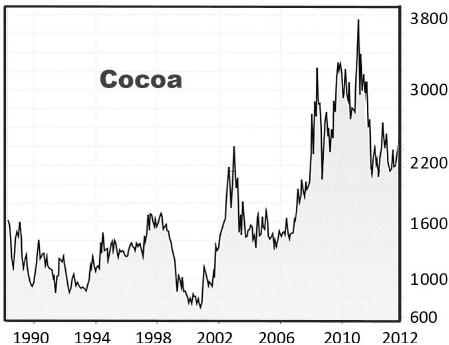

Figure 33. Cocoa prices in USD/ton, 1990–2012. Data: Bloomberg, 2019.

In 2009 and 2010, increasing demand, declines in production, and price speculation by hedge funds caused cocoa prices to rise more than 150 percent within two and a half years and to reach their highest level since 1977. A ton of cocoa in mid-July cost more than 3,600 USD. Because of Armajaro’s purchases, the short-term price of cocoa rose: A July contract carried a 300 USD premium compared to a December 2010 contract. Customers had to pay a premium of around 15 percent compared to a later delivery (backwardation).

In a letter to the NYSE and LIFFE, 16 companies and trading houses complained about market manipulation of the cocoa market. However, LIFFE declared that “indications for a market manipulation are not recognized.”

Key Takeaways

•The cocoa market is relatively small and highly concentrated: Côte d’Ivoire dominates global cocoa production with a market share of more than a third of world production. The 10 largest cocoa-producing countries account for more than 90 percent of the world’s crop.

•During the summer of 2010, rumors spread that hedge fund Armajaro had placed a bet of 1 billion USD in the cocoa market. Fund manager Anthony Ward, nicknamed “Willy Wonka” and “Chocolate Finger,” is said to have bought around 240,000 tons of cocoa in an attempt to corner the market.

•Compared to price levels in early 2009, cocoa prices in London and New York rose by more than 150 percent and reached their highest level since 1977. A ton of cocoa cost more than 3,600 USD in July 2010—an increase of more than 500 percent compared to 2002. It was a successful bet for Chocolate Finger.