2011

The weather phenomenon known as La Niña causes drastic crop failures in Pakistan, China, and India due to flooding and bad weather conditions. Panic buying and hoarding drive the price of cotton to a level that has not been reached since the end of the American Civil War 150 years ago.

“It’s not something you’re going to see again in your lifetime.”

—Sharon Johnson, senior cotton analyst

“I think there’s still hope for prices to go higher.”

—Yu Lianmin, Chinese cotton farmer

In ancient Babylon, cotton was known as “white gold,” and the fabric has remained popular throughout history, woven by hand for hundreds of years. At the end of the 18th century, however, spinning and weaving mills began to produce fabrics and clothing at a much lower cost than could be done by hand. By the 19th century, the cotton business was booming, due to recent inventions such as the steam engine, the cotton gin, the spinning jenny, and mechanical looms.

The textile industry of the United Kingdom required ever larger quantities of the raw material, which was produced in its colonies or elsewhere abroad, especially in the southern United States, where cotton had expanded tremendously in the early 1800s. The crop thrived everywhere that was moist and warm, and labor was cheap in the American South. For about 250 years enslaved Africans had toiled on southern plantations, and cotton production grew from just 10,000 bales a year to more than 4 million until slavery was abolished after the end of the American Civil War in 1865. During that war, the price of cotton rose to dizzying heights that would only be reached again in spring 2011, almost 150 years later.

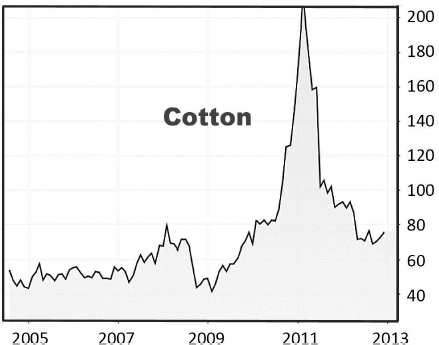

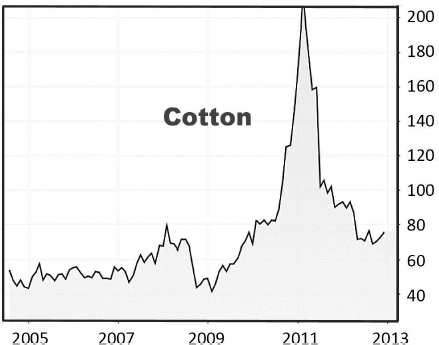

The last time cotton reached almost 2 USD per pound was after the American Civil War.

Since 1995, cotton had traded mostly between 0.40 and 0.80 USD, but at the end of September 2010, for the first time in 15 years, the price of cotton broke the 1 USD/lb level. A few months earlier, in May, the German magazine Der Spiegel had bemoaned “the end of cheap jeans,” as it noted the price explosion in cotton. But that was only the beginning. By November, cotton prices had increased another 40 percent. A sharp correction followed, but by the end of December cotton was up to 1.40 USD. And, beginning in January 2011, the market was unstoppable. The price spiked to more than 2.15 USD in March 2011—four times the level of early 2000 and a 480 percent increase over the November 2008 price.

It was the highest price ever paid for cotton since the introduction of cotton trading on the New York Cotton Exchange in 1870.

Figure 36. Cotton prices in US cents/lb, 2005–2013. Data: Bloomberg, 2019.

The price had actually been rising for several years. At the end of 2009, the global textile industry had forecast robust growth of around 3 percent for the following year. However, flooding and bad weather conditions in several important producer countries such as China, India, Pakistan, and Australia led to significant crop losses. Because of the falling inventory, high premiums were paid for material that was available in the short term.

Once again, severe weather conditions influenced agriculture prices.

In Pakistan, the world’s fourth-largest cotton-producing country, floods hit more than 14 million people in 2010, according to UN estimates. The exceptionally heavy monsoon season was considered the strongest in more than 80 years, and rain destroyed more than 280,000 hectares of cotton. According to the Pakistan Cotton Ginners Association, the flood destroyed 2 million bales of cotton. The All Pakistan Textile Mills Association also reported a worrying shortage of cotton. Only 30 percent of the mills had raw material in stock for the next 90 days, and Pakistan would soon stop exporting cotton.

A few weeks later, India, the second-largest cotton producer in the world, followed suit. The Indian Ministry of Textiles stopped exports, since without the ban the Indian textile industry would not have been guaranteed an adequate supply of cotton. Indian exports dropped to 0.5 million metric tons, having exceeded 1.5 million tons in the 2007–2008 season.

There were several reasons for the shortage beyond the dynamic growth of the domestic Indian textile industry. The world’s largest cotton producer and importer, China, was also enduring a shrinking cotton harvest for the second year in a row, due to low temperatures and too much rain. China Cotton Association statistics in December 2010 showed monthly imports doubling year over year.

Cotton Basics

Most cotton species and varieties are cultivated as annual plants and have high requirements for heat and water. In the Northern Hemisphere, sowing takes place from the beginning of February to the beginning of June, depending on the location.

China, India, the United States, Pakistan, Brazil, and Uzbekistan together account for around 85 percent of the world’s cotton production, with China and India producing more than half of the global market volume. In the 2009–2010 harvest, the amount of cotton grown worldwide reached 25 million metric tons.

Cotton is used mainly in textiles, accounting for about one-third of the world’s textile fibers. These can be categorized into natural fibers—such as vegetable fibers (e.g., cotton or linen) and animal fibers (e.g., wool, hair, and silk)—or artificial (synthetic) fibers. Synthetic fibers actually dominate the industry, accounting for almost 60 percent. They can be divided into cellulosic fibers (e.g., viscose) and those derived from petroleum. The most important synthetic fibers are polyester, polyamide, and polyacrylic fibers.

Cotton is traded on the commodity futures exchanges in the United States under the symbol CT and the respective contract month in a contract size of 50,000 lb per contract.

In late 2010 and early 2011, flooding and Cyclone Yasi caused severe damage in Australia, which ranked eighth among the top 10 cotton producers worldwide. The Australian Cotton Shippers Association, which had predicted a bumper harvest of more than 4 million bales, reduced its forecast by more than 10 percent.

Blocks on cotton exports worsened the situation, and panic buying and hoarding were the result.

Cotton processors in the region reacted in panic. Willing to pay any price for raw material, they pushed prices ever higher. Cotton farmers who still had inventory continued to aggravate the situation. The China National Cotton Information Center estimated that around 2 million tons of available material never reached the market in China. For example, in Huji, in Shandong province, about 220 kilometers from Beijing, growers held back more than 50 percent of their harvest at the end of January, expecting prices to continue to rise. Because of the short shelf life of cotton, that strategy could only be maintained until April or May.

In any case, the price boom in cotton was short lived. The International Cotton Advisory Committee in Washington estimated that the acreage for the 2011–2012 season would increase to 36 million hectares, the most in 17 years. It was a natural response to record prices. In the short term, however, most processors had no choice but to mix cheaper synthetic fibers with the more expensive cotton.

Key Takeaways

•If you thought that the exciting times of trading cotton took place more than 100 years ago, events in 2010 proved you wrong.

•The first impacts of global climate change were evident in a series of extreme weather events. Flooding and bad weather conditions caused by La Niña accounted for significant crop losses in several important cotton-producing countries, such as China, India, Pakistan, and Australia.

•Cotton processors in the region reacted in panic, driving prices higher. Cotton farmers who still had stocks held back their supply in expectation of even higher profits.

•As a consequence, cotton prices shot through the roof. Cotton, which once traded at 40 US cents per pound in 2009, doubled in value within a year to 80 US cents and skyrocketed to 2 USD in 2011. This was an increase of 500 percent in two years!

•Because of short supplies, export restrictions, panic buying, and hoarding, the price of cotton rose to a level not reached since the end of the American Civil War 150 years ago.