2016

A perfect storm is brewing for the oil market. There is an economic slowdown and too much storage because of contango. The world seems to be floating in oil, whose price falls to 26 USD in February 2016. But the night is always darkest before dawn, and crude oil and other commodities find their multiyear lows.

“Everybody be cool. You—be cool.”

—Seth Gecko in From Dusk till Dawn

“The crude oil supply glut is gone.”

—Nick Cunningham, www.oilprice.com

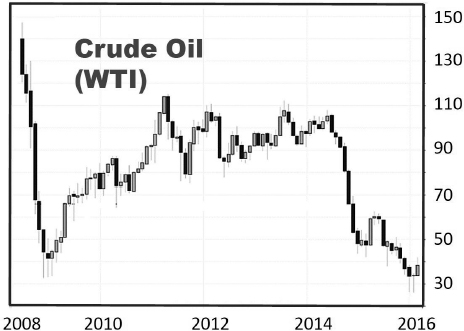

The Armageddon of the global financial crisis had been stopped by the massive bailouts and unconventional monetary policy of central banks around the world. As for oil, WTI crashed from almost 150 USD/barrel in June 2008 and traded temporarily below 33 USD during spring 2009. By the end of that year, crude prices had recovered to 80 USD, and between 2011 and 2014 the reference point for crude oil was 100 USD.

But in hindsight, the summer of 2014 proved to be just the quiet before a massive storm: WTI fell from almost 110 USD to less than 26 USD—a drop of 76 percent, even lower than it had been during the financial crisis. (Actually it was the lowest level for crude prices since 2003.)

Crude oil was not the only victim. The year 2016 began as an ugly one for all commodities as the Chinese domestic stock market plunged, and many other equity indices around the world followed in a case of Asian contagion. Demand in China was of fundamental importance for commodities because of demographics, growth, and the country’s immense raw material purchases. The US dollar retreated massively from highs of 100 on the Dollar Index, and raw material prices dropped further.

Figure 39. Crude oil (WTI): recovery and bear market, 2008–2016. Data: Bloomberg, 2019.

The massive price drop during the financial crisis had caused the term structure for crude oil to flip into contango, in which spot prices are below those of future delivery dates. It made more sense to store oil than to sell it, but the glut in supply overtaxed existing holding facilities, eventually leading to the use of supertankers as floating storage.

By the end of summer 2015, crude inventories were still rising and prices had started to crash. In early 2016, storage levels had barely declined from their 80-year highs of 490 million barrels in the United States alone, leading to pessimism about the future.

The International Energy Agency (IEA) noted that crude oil markets could “drown in over-supply” because of rising storage levels around the world. The agency said that the world had added 1 billion barrels of oil in storage in 2015, and storage levels were still rising. Even in the fourth quarter, normally when stocks are drawn down, inventories continued to climb.

Crude oil crashed because of a massive global supply glut. Oil prices fell to less than 26 USD.

There were dire warnings that the world could soon run out of storage space for oil, which would depress prices even further. Oil tumbled to its lowest level in more than 12 years, as the crude stockpiled at the delivery point for New York futures reached a record.

On February 11, 2016, when the S&P 500 index posted a 12 percent loss on the year, the Baltic Dry Index—which measures the shipping activity of dry bulk cargos around the world—fell to an all-time low of 290. The activity in commodity markets came to a halt, and the Bloomberg Commodity Index posted a 30 percent loss on the year. However, February 11 marked the lows for many assets, and the markets began to improve in the weeks and months that followed.

OPEC and Russia agreed to a joint production cut to fight the supply glut. Finally prices started to recover.

Capitulation Price Levels

In early February 2016, the S&P Goldman Sachs Commodity Index and Bloomberg Commodity Index, two important commodity market references, posted double-digit losses. Investors were devastated since 2015 had already been a bloodbath for commodities. Crude oil traded as low as 26 USD/barrel, copper below 2 USD/lb, and even gold traded as low as 1,050 USD/oz. Cryptocurrencies weren’t given much attention from investors at that time. Bitcoins, for example, had a bad year in 2015, trading below 200 BTC/USD, and started to recover in 2016.

Gold was the first among the group of more than 20 commodities to indicate a turnaround, as prices started to climb, and exceeded its 200-day moving average rather quickly, a strong technical indicator for bullish markets.

In the face of the massive supply glut, OPEC and Russia agreed to a joint cut in production. It was OPEC’s first agreed cut since 2008, when oil prices collapsed late in the year after hitting record levels during the summer. And it had the potential to restore some longer-term stability to the global oil market. The wild card was renewed production in the United States, pushed by shale oil and fracking on the back of rising prices. Some feared that this could simply end up prolonging the glut and pushing prices back down.

But there was also evidence that the massive inventories of raw materials were declining, and demand was finally picking up. And demographic trends continued to support the rationale that more people in the world would require more commodities in the years ahead. Both classic economic theory and common sense dictate that as demand rises, inventories fall and prices rise.

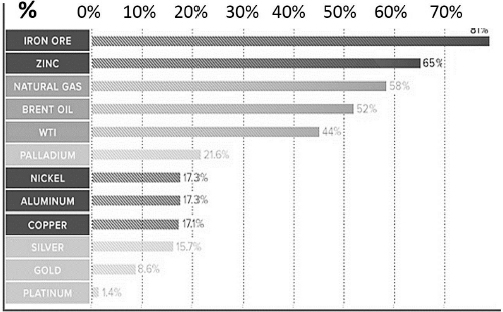

Figure 40. Commodity performance in 2016. Data: Bloomberg, 2019.

Meanwhile commodity prices were rising, with gold leading the way. The precious yellow metal traded to more than 1,380 USD in the wake of Britain’s Brexit vote, and silver shot up above 21 USD. Crude oil rose from just above 26 USD per barrel in February to more than 50 USD at the beginning of October. The price of sugar increased from 10 US cents per pound in August 2015 to more than 24 US cents on September 29, 2016. The prices of iron ore, zinc, tin, nickel, and lead all posted double-digit gains in 2016. In perhaps the most optimistic signal for commodity markets, the Baltic Dry Index rose from 290 in February to 915 in early October, an increase of more than 215 percent.

Crude oil prices doubled from their lows in 2009, and commodities started to shine again.

It appeared that prices for raw materials had reached a significant bottom. Commodities as an asset class posted impressive gains, rising by more than 20 percent from its lows in 2016 to the end of the year. WTI more than doubled in that period to above 55 USD/barrel.

Production cuts that had been in place since the start of 2017 helped halve the excess of global oil stocks, although, according to OPEC, those remained above the five-year average, at 140 million barrels. It was not until May 2018 that OPEC said the global oil supply surplus had nearly been eliminated.

Key Takeaways

•“Super-contango” had caused a massive supply glut in crude oil, during which storage facilities for WTI in Cushing, Oklahoma, reached maximum capacity: The world seemed to be floating in oil, and WTI crashed from almost 110 USD to less than 26 USD in February 2016—a drop of 76 percent and the lowest level for crude oil prices since 2003.

•During 2016, the Chinese domestic stock market plunged, and many other equity indices around the world followed, leading commodity markets lower as well. However, in spring 2016, commodity markets found a bottom, and commodities as an asset class posted impressive gains over the full year, rising by more than 20 percent. The price of WTI more than doubled in that period to more than 55 USD/barrel.

•Nevertheless, it would take until May 2018 until OPEC confirmed that the global oil supply surplus had nearly been eliminated.