We are at the dawn of the 2020s and the commodity and crypto markets are in the starting blocks for a new rally. At the beginning of 2016, commodity investors looked back on five painful bear market years. In 2015, the Bloomberg Commodity Index, which measures the performance of 22 commodities like crude oil, gold, copper, wheat, and corn, lost 25 percent of value. And it got worse: In January 2016, commodity markets traded down an additional 7 percent. The Bloomberg Commodity Index was trading at its lowest level since its inception in 1991. Since spring 2014, investors had lost almost half of their invested funds. Investors in gold and silver mining companies, in particular, were hit hardest. The Arca Gold BUGS Index and Philadelphia Gold and Silver Index, both representing the biggest gold and silver mines, traded down to levels last reached at the beginning of 2000, when a troy ounce of gold was 260 USD.

From summer 2011 to the beginning of 2016, investors saw 80 percent of their principal vanish into thin air, while gold in the same period traded down from above 1,900 USD to 1,050 USD (–45 percent). Mining in general suffered greatly. Market capitalization of companies included in the MSCI World Metals & Mining Index dropped by more than 80 percent since their peak valuation during the commodity super cycle in 2008. Shares of Glencore, the biggest mining and commodity trading company in the world, traded down to 67 GBP at the end of September 2015. From its highest prices in 2011, investors lost more than 80 percent of their capital. Compared to its closing price of 527 GBP for its initial public offering in May 2011, this represented a loss of shareholder value of almost 90 percent!

Market exaggerations drove credit default swaps for mining companies into the stratosphere. For example, Glencore’s 2.5 percent yielding bond, maturing in 2019, dropped by 25 percent within three months to 75 US cents per dollar, offering a yield to maturity of more than 17 percent per year for investors. The same held true, for example, for bonds of Freeport-McMoRan, Teck Resources, First Quantum, or Lundin Mining, all large cap mining companies. Investors anticipated the bankruptcy of a whole industry.

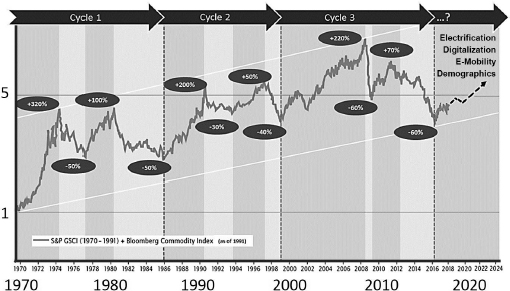

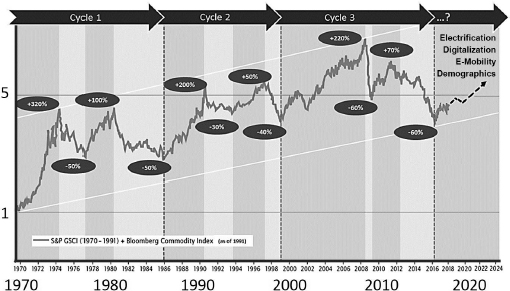

Figure 45. 50 years of commodity markets ups and downs. Did we see the beginning of a new bullish cycle in 2016? Data: Bloomberg, 2019.

In retrospect, we witnessed capitulation levels at the beginning of the year 2016. However, bold investors were able to make a killing in commodities during an early recovery. Compared to January 2016, gold mines tripled in value in just half of a year while gold gained 30 percent. Shares of Glencore approached 300 GBP, quadrupling in value compared to its lows just a couple of months before.

While commodity markets crumbled and value in mining evaporated, world equity and bond markets celebrated the time of their life. MSCI World increased steadily after its drop by almost 60 percent during the financial crisis of 2008–2009. In the United States, the Dow Jones and S&P 500 were both trading at all-time highs in late 2016 and continued their path of success until January 2018. At the same time, yields of 10-year bonds in the United States fell below 1.5 percent, while in Europe, German 10-year bonds dropped into negative territory. Bond investors woke up every day believing their party would never stop.

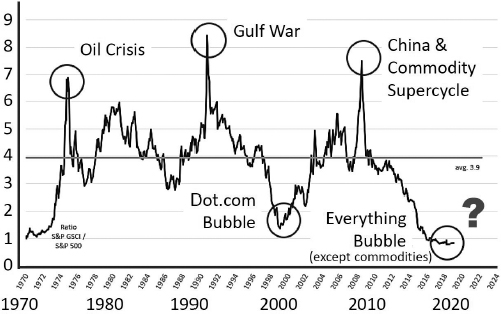

Looking at the long-term relationship between equities and commodities by taking the ratio of S&P Goldman Sachs Commodity Index versus the S&P 500, one fact is striking: Relative valuation is extreme. Compared to equities, commodities have been stuck in the penalty box since the China-fueled commodity super cycle burst. Similar to the tech bubble 15 years ago, Alphabet (Google) today is valued equal to the aggregated market capitalization of all companies included in MSCI World Metals & Mining Index (more than 180 companies, including mining giants like BHP Group, Rio Tinto, Glencore, Vale, Barrick Gold, and Newmont Mining)! One has to ask: What is cheap, and what is expensive?

Figure 46. Relative valuation of commodities versus equities. Buy commodities! Data: Bloomberg, 2019.

Therefore, it is no surprise that after a severe five-year bear market, a 15 percent rise in commodity markets in 2016 passed the majority of investors unnoticed. From their intra-year lows, commodity market indices like the Bloomberg Commodity Index (BCOM), S&P Goldman Sachs Commodity Index (S&P GSCI), and Rogers International Commodity Index (RICI) all gained more than 25 percent and surpassed equity-index performance. Furthermore, metals and mining as well as oil and gas led the equity-index sector performance in the United States and Europe, but fund manager surveys show that investors continued to be massively underweighted in resources equities.

Recent history aside, investors can refer to several commodity markets that are still in oversupply. But in terms of supply-demand imbalances following the boom of the commodity super cycle, the worst is behind us. Slashes of industry investments in mining, as well as in oil and gas, will have brutal results in 2020–2030, when natural depletion will combine with and outweigh reduced exploration and development expenditures. With fundamental market data for commodities just starting to improve, commodity prices reached a technical bottom. A shift of the 200-day moving average to the upside in April 2016 was a first positive sign for a bullish market environment in commodities in the future.

In conclusion, 2016 might prove to have been the dawn of a new cycle for commodity investors, a multiyear period of rising prices, which also reflects healthy prospects for the global mining industry. In the coming years, new trends like battery metals for electrification, e-mobility, and the megatrend of digitalization, which includes cryptocurrencies, will become an important and enormous driver for productivity, growth, and commodity markets. Electric vehicles might not need gasoline or diesel, but demand for gold, copper, nickel, cobalt, lithium, and rare earths increases drastically. If this scenario holds true, we witnessed the beginning of a new cycle which can only be compared to the awakening of the Chinese economy almost 20 years ago. It is also the beginning of a more mature stage in blockchain and bitcoins, as the exuberance of the early years is gone and opens the path to future applications.