About 3 years ago I was walking home one day when a cute little malnourished cat started following me step for step. When I stopped, she would stop, and when I turned the corner, she turned with me, never more than 3 feet behind. As luck had it, I lived two blocks away from a vet, and so we walked over there to see if anyone had lost her. Nobody had, so I told the vet to check her and I'd take her until I found her owner. I knew she had to have been a house cat because she was so docile and easy to pick up. We left the vet; she followed me home, ate, and took a nap; and then we went to search for her home. We had no luck finding her owner, but I soon got used to walking with a cat in tow. I tried using a leash, but it didn't look very masculine, so I gave up on that idea. Since she enjoyed going out so much, I started taking her to the park across from my apartment every night. One day in the park she saw a bunch of pigeons and crept up close to them, crouched real low, watched them for a few minutes, and then walked back to me. A few days later though, she saw a small sparrow sitting atop some bushes. She crept up to the area and again crouched real low, trying to hide behind the blades of grass. This time she waited without moving, intensely looking at the sparrow for about 15 minutes. Eventually the sparrow flew down off the bush and toward the grass, and Sophie wiggled her behind, leapt about 6 feet, grabbed the sparrow in midair, and pinned it to the ground. I was able to stop her from doing any harm to the sparrow; it flew away a little stunned but unharmed.

The point of this story is that one should trade the way Sophie captured the sparrow. She knew that the pigeons were too big for her and might be a little risky to tackle; maybe she might have gotten one, but there were too many, they were too large to be a sure thing, and there was a good possibility of her getting hurt. Besides, she had just had a good meal at home, and so it wasn't worth the risk. But the sparrow didn't pose much of a risk because it was alone and quite small. Sophie knew she had only one chance at it before it would fly away, and it was too high up in the bushes. Therefore, she waited patiently for the sparrow to make its move, giving her a higher probability of catching it. This wait paid off for her as her timing was perfect. If a trader would have this kind of patience to wait for the market to present itself with low-risk, higher probability opportunities, he would also fare much better.

One of the things that will make a trader better than the rest is being able to distinguish between high probability and low probability trades. Traders will improve their chances of success as soon as they can do this. When I tell people I trade for a living, many are convinced that there is no difference between trading and gambling. Sure, some traders have the same luck as gamblers, but there is a difference; trading is not gambling. A professional trader can make money consistently if he follows a trading plan with strict money management principles and a sound trading strategy. Part of that trading plan is to consistently make only trades that have a high probability of working out and a low risk/reward ratio. Unless one can do this, then yes trading is no more than gambling.

A high probability trade is one that is carefully made with a defined exit strategy and predetermined stop levels. It is a trade that historically has a high degree of working and in which the potential risk is low compared to how much can be made. You also must have a good reason for making a trade, one that you would not be ashamed to explain to someone. Some people make irrational trades with little thought behind them; whether they work or not, these trades are not high probability ones. As you trade more and more, you will know if a trade has a great setup or is being made haphazardly; the goal is to cut out the haphazard trades.

High probability trading is made up of many things, and one of the most important is to make sure the trade is worth the risk. Making high probability trades doesn't mean you will not make losing trades, but at least you will make trades that shouldn't cost you much when they are wrong and have the potential for a nice profit when they are correct. The other important aspect of making high probability trades is using all your knowledge and tools and having the patience to wait for the market to present good trading opportunities. The important thing is to not take unwarranted risk. I've found that a trader does better by trading less, only taking trades that have a great setup, even if it means missing some opportunities. By trading less you can weed out many trades that aren't worth the risk or historically haven't worked out.

Much of the rest of this book will deal with having and making a trading plan and a game plan. A trading plan consists of a mixture of money management and the proven strategy behind one's trades. This plan helps a trader make smart trades and keeps him from making those which are not so carefully thought out. A game plan meanwhile is the strategy a trader uses everyday to carry out his trading plan. A game plan ensures that each trade has a reason behind it and is not made merely on a whim. Unfortunately, many people trade without the aid of a good trading plan and game plan. A good trading plan should permit you to make only high probability trades. Once you have a plan, the hard part is to follow it. One way to follow a plan is to use purely mechanical systems as the basis for your decision making. Whether you design them yourself or purchase them, these systems should include all the aspects of making high probability trades, including exits, and should be backtested to ensure that they will work. I'll discuss system making, trading, and backtesting in Chap. 12 and 13.

A Few of the Ingredients in Making High Probability Trades

Using different time frames to confirm and time trades

Trading in the direction of the major trend

Waiting for pullbacks

Having a predetermined exit strategy

Planning trades before the market opens

Using a combination of trend-following and oscillating indicators

Having a reason for every trade

Knowing the risks involved

Staying focused

Having discipline

The following is a perfect example of a high probability trading situation. The different indicators I chose on each time frame were random, but I'm sure they would have worked the same no matter where I used them. Start by looking at Chart 10—1, a daily chart of crude. The shaded area is where the smaller time frames will focus. The daily chart gives you a clear picture of the major trend, which is quite bullish. The reading in the RSI above the 50 line but below the overbought area shows that the market is strong and still has room to go up. The market has been in a strong uptrend for months and is making what looks like another upwave after breaking a monthlong congestion area from $32 to $34.

CHART 10—1

Daily Crude Oil: Getting the Big Picture

Now take a look at a 60-minute chart (Chart 10—2). This will help you find a good place to get involved. In this chart you can see the congestion area a lot better than you can in the daily chart. What you can't see here, though, is that the market has been in a strong uptrend. Say you were a patient trader and had been waiting for a pullback in crude so that you could get in on the long side. Between November 1 and November 3 you got a little pullback to the bottom of the congestion area, and with it you got divergence between the stochastics and the market at Point D1. You also can see that at Point A the market was testing a previous low it had made a few days earlier and that the stochastics were oversold and had recently turned up; you also know the market is in a roaring uptrend. Now you are thinking that this may not be a bad place to buy since the risk would be to get out if the market broke the previous low just a few ticks away.

CHART 10—2

60-Minute Crude Oil: Getting a Better Picture

The next step is to look at an even smaller time frame (Chart 10—3) to time a trade. Just before Point A you can see that the market gapped lower that morning, went down for about 30 minutes, and then started to rally (you could use the 30-minute breakout system from Chap. 8 to get you into this trade). As the market rallied, the MACD lines crossed over to the upside and started uptrending, indicating a buying opportunity. Once the market started breaking the highs of the day, this became a great trade to make, first as a day trade and then to hold for the longer term. In this time frame you can easily see where the previous low was and how little you would have to risk before knowing you were wrong. As far as potential profit, it is fair to say that the market could rally to the top of the congestion area at 33.80. The risk versus reward in this trade is 30 cents versus $1.50. Even if you are dead wrong, this trade has a great potential payoff-to-risk ratio and should not be missed. As a longer-term trade you can use the congestion area in Chart 10—2 to estimate how much the market could move. This would give you a target of about 36, making for an even lower risk/reward potential.

CHART 10—3

10-Minute Crude Oil: Timing the Trade

There are several other possible places one could make trades. Two that I would consider high probability ones are at Point B, when the market breaks out of the congestion area, and at Point C, after the market pulls back from the breakout and retests the trend-line. The one at Point C is a better trade because you've waited for a pullback and it is at a trendline, and so the risk is much lower. Here a little patience pays off; even though the trade at Point B ends up being profitable, one gets a better price by waiting.

As far as an exit for any of these trades, since the market was in such a strong trend, as can be seen in the longer-term charts, one would want to hold on as long as possible, using a trailing stop along the way. The first clear exit sign I see is on Chart 10—2 at Point D2. Here the market is reaching the top of the channel, and the stochastics are showing divergence with the market and starting to come out of overbought territory. This is also close enough to the $36 target gotten by measuring the congestion, and so one should have been starting to think about exiting at around that time anyway.

Part of making high probability trades is having a good reason for every trade you make as opposed to making rushed, randomly tossed out trades. This is why planning trades in advance can help improve one's trading performance. Sometimes a trader puts on a trade after spending little time looking thoroughly at the risks and rewards involved. He gets impatient, doesn't wait for pullbacks, chases the market, or has too much going on to think properly. Since there are many reasons for making stupid trades and every trade one makes should have a good reason behind it, you may want to take a second before pulling the trigger. Ask yourself, "Why am I making this trade?" If you truly have a good reason after asking yourself that, then make it, but if the reason is not worthy of a trade, lay off it.

Here are some answers to the question "Why do I want to buy now?"

Good Responses

The stock is stronger than the market, and the sector is doing well.

The trend is up, and the market just pulled back to the moving average.

There was bad news on the stock, and it is not going down. There was a moving average crossover.

I got a signal from my system.

The market broke through a major level and still has plenty of room to go.

There was a reversal day yesterday, and today it looks like it will continue.

The market has dropped its average daily range and now looks to be reversing.

Stochastics are coming out of oversold territory.

The market has just retraced to the bottom of its range, and the MACD is oversold.

Bad Responses

I want to make money.

I've lost a #!$%load of money, and I need a highflier to make it all back with.

I'm bored.

The market is open.

I already bought the stock, and it's cheaper now.

My broker recommended it.

News is about to come out.

It's down a lot already and just has to bounce.

It does nothing but go up.

I don't want to miss the move.

I have extra margin available.

I'm looking for a short-term counterrally.

Maria Bartiromo said it was strong.

Sometimes a trader knows exactly what he should be doing but still loses money because he is not focused on the market as he should be. Some traders look at too many markets and/or have too many positions on, and so they spread themselves too thin. Instead of looking at every market, traders should take the time to become experts on the ones they trade best. Remember that the best traders tend to trade only one market or sector and are experts in it.

Individual trades will suffer when one is looking at too many markets, as one cannot as easily concentrate on waiting for the higher probability trades. If one focuses on a few select markets, stocks, or sectors, it's easier to time entry and exit points, and risk can be controlled better. I know that unless the markets are having a runaway bullish or bearish day where I can put on as many trades as possible and sit back and watch, my best trading comes when I have only two or three positions, as I can concentrate better on them. It's hard to say you made all high probability trades when you have 15 positions on. Unless you use a purely mechanical system on a basket of stocks or commodities, you will never be able to concentrate properly on that many positions, especially when it's time to exit.

I keep repeating how important patience and waiting for the market are. I can't stress this point enough. Like a smart gambler who will only play out poker hands that have a high probability of winning, a trader must wait for the high probability situations. You don't have to make every trade you see or be in a rush to make those you do make. As a trader you have the luxury of doing nothing; it's okay to watch a market, like a cat waiting for a sparrow to land, before trading it. Wait until you get a good confirmation that the trade may work before rushing into it. There is no need to trade on dull, rangeless, volumeless days; you are at a disadvantage on those days. If I had been able to walk away and go home on those days, I would have done much better over the years. Not trading is always a viable option; after all, some of the best trading decisions you'll make involve the trades you are smart enough not to make. I've been a little of an overtrader, and it has hurt me. If I had been a more patient trader and had made only the best-looking trades, I certainly could have turned the corner much sooner.

Over the years I've realized that it's okay to miss a move. There was a time when I would try to catch every blip in the market, but I'm learning to restrain myself and wait for a better opportunity to get in. Not only does there have to be a good reason to make a trade, the timing has to be as good as possible. Rushing into a trade usually means that your timing will be off. A trader is better off missing a few good trades while weeding out the bad and mediocre ones as he waits for the trades that have a higher probability of working with a lower risk/reward ratio. Some moves are prebroadcast and easy to predict. It is worth waiting around for these moves instead of trading on every whim. A trader who is scared of missing a move will keep finding himself always in the market, and many of his trades will be mediocre at best. Once a trader learns to wait for the high probability trades, his chances will improve dramatically.

SOME EARLY ADVICE I GOT One of the first pieces of advice I got when I started trading on the floor was that you have to make only one good trade a day to make a living. If you can sit back and wait for that perfect setup and make 6 to 10 ticks on it, that's all you need. Every day you'll get one or two situations that look and feel great. Just be patient and wait for them; there is no need to try to beat the market all day long. |

A big part of high probability trading is making trades that have a good mix of risk and reward. To do this, you need to determine how much can be lost on the trade, understand the worst-case scenario, and have some sort of profit target in advance. Of course, the higher the reward/risk ratio is, the better the trade is, but an acceptable ratio will differ from trader to trader and will depend on hold times. On day trades I like to find trades with a minimum of a 2:1 or 3:1 potential payoff, the higher the better. On long-term trades I look for at least a 5:1 reward/risk ratio. Timing trades will help you cut down on the risk portion of the equation.

Once you have a minimum ratio you are comfortable trading with, look at a chart to decide if you will make a trade. Start by looking at the risk; this is where your stop level should be. Next, try to figure out how much can be made if everything works out. This is not always easy to see, but it can be done by using Fibonacci ratios, measuring previous congestions and waves, looking at how much room an oscillator has to move before reaching an extreme reading, and using higher time frames to find resistance levels. If you were looking at a trade that had a $200 risk, would you take it if the potential reward was $100? I hope not. But what if it was $400, $500, or $1000? Yes, you should. Even if you are wrong, it is worth the risk.

Some trades, such as the 30-minute breakout system, have a historically good chance of working. When that is the case you can give yourself a little more leeway on how much you will risk because they will work more often. However, when you are trying to catch quick reversals or are making other risky trades, the amount you are willing to risk must be much less because the odds are high that you will get stopped out.

WHY PROFESSIONAL POKER PLAYERS WIN A top poker player makes money consistently because he knows the odds of getting any hand. He will only make bets that have a better payoff ratio than the odds involved. Say he needs a 6 to pull out an inside straight and the odds of getting it are 11 to 1. Someone bet $10, and now it's his turn to bet. He will make the bet only if there is more than $110 in the pot. It makes no sense to chase this card if he can make only $50. That's a 5:1 payoff and is not worth the 11:1 chance of not pulling the card. But if the pot has $400, then assuming he thinks his straight will beat all the other hands, he will make the bet every time, as it has a 40:1 payoff. Even if he doesn't get his 6, he still has made the smart bet. |

Knowing how to use position size correctly is another thing that will help a trader immensely. Some people think this is one of the most critical aspects of trading. By knowing when to trade more heavily or lightly, a trader can take advantage of good situations when they arise. Those who always put on the same number of contracts aren't distinguishing between different types of market scenarios or determining how risky a trade is. I know there are some trades that I do to test the waters, and I'll trade more lightly, for example, in the morning. During the first half hour the market can move randomly until it picks a direction. I always have trouble making money in the first hour of trading. If I want to trade in the morning, I do so with less volume. The same holds true for choppy markets. They are harder to trade, and so I trade them with less conviction. When the market is trending, however, and just retraced to the trendline and there is a clear stop not too far away, I consider this a high probability opportunity and trade it with more size. I'm not afraid to risk more here because the payoff can be worth it. Most good traders trade with light volume a good percentage of the time. They prefer to wait until the right opportunity presents itself to load up and make money. You need only 2 or 3 good days a month to get rewarded in this business. There is no need to try and make a killing every trade or every day.

Get to know the behavior of a stock, sector, or market and you can improve your odds of making money in that market. I've noticed that most markets behave uniquely compared with other markets. This may be due to the psychology of the traders in them. Different markets have different batches of traders behind them, and so they behave slightly differently. One market may have a habit of trending, while another has a habit of staying range-bound. When one sits down at a poker game, one wants to pay attention to how the other players play and what their "tell" (something that gives them away) is. As you learn the behavior of markets better, you'll notice that they repeat similar patterns and have set things they do in both the short and the long time frames on which an alert trader can capitalize. For instance, I used to trade the stock IDTI, and every day it seemed to open down a few dollars, only to run up about $6 after it opened. This worked only when the stock was in an uptrend and not too far overextended beyond the trend. I got used to this behavior and capitalized on it. It didn't work on other stocks, and it lasted for only a few months before it collapsed, but it was rather predictable for a time. By concentrating on a few markets and taking mental notes you will begin to see patterns in the market that you should be able to capitalize on.

MY MORNING DRILLERS TRADE I've noticed a trend in oil drillers. Every day for the last 3 months they seem to rally at about 10 a.m. for about 45 to 90 minutes. The market shows its hand by first going down and then stalling on a 1-minute chart. As soon as that happens, you have to act quickly because it seems that everybody is looking at the same thing and is rushing to get long. This has become my trade de jour lately, and I'll do it until it stops working. Since this trade has been working so often and has become a high probability trade, I do it with decent size. On this trade I use a stop of the low of the day or a time stop of 45 minutes if it is not working. |

One way to increase your chances of making money is to know how to recognize low probability scenarios and then avoid them like a hotel I saw in Paris while I was backpacking through Europe after college. The hotel had a sign on its front door that read, "This hotel has lice." Though the rooms were really cheap, it wasn't worth the risk to stay there. Anybody who stayed there was taking an unnecessary risk. Those who were patient enough to walk a little farther would have been rewarded by staying at a hotel nearby that featured only roaches; sure it cost a little more, but it had a lower risk/reward ratio.

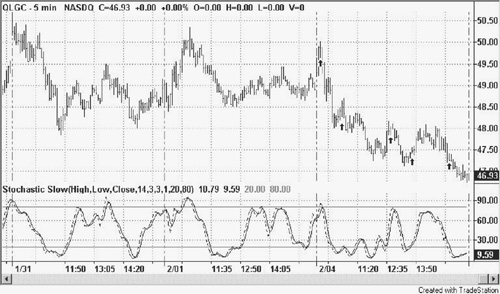

An example of low probability trading is trying to pick the tops and bottoms in strongly trending markets. Picking the bottom is known as trying to catch a falling knife. When a market is dropping straight down and you keep trying to pick a bottom, you can get hurt. February 4, 2002, was one of those days when I left my brain at home and traded poorly. I ended positive for the day but I could have had a great day; instead, I barely broke even. The market opened weak after being in a little downtrend after it had peaked a few weeks earlier. Chart 10—4 shows the daily S&P 500 Index, which is clearly coming off. Chart 10—5 shows a daily chart of QLGC, a typical stock I trade. Here too you can see that it was starting to come off again after having just formed a double top.

So what did I do? I bought it and a few of its friends every chance I could because I thought they were due for a bounce. Chart 10—6 is the 5-minute chart, and the up arrows show where I tried to buy. Except for the fourth time, when I made on average about 20 cents per share, I lost on average 50 cents per share every time I tried buying. Playing for these bounces when everything is pointing down in the long run is a waste of money. The only thing it does for sure is add commission costs to my P&L statement. I managed to make money on that day because I had a lot of stocks short during the day and had more share size on the shorts than on the longs. This was a day that I hope will teach me not to trade low probability situations. I bought near the lows in the market four times, trying to catch a bottom; even if I truly believed that the market would bounce, the smart play was to do nothing.

CHART 10—4

Daily S&P: Looking at a Weak Market

CHART 10—5

Daily QLGC: Looking at a Weak Stock

CHART 10—6

5-Minute QLGC: Catching a Falling Knife

Other situations to avoid include buying after a market has made a substantial move and is in overbought territory and buying when the market is at the top of a channel or a resistance level. Buying after it has broken below an upward-sloping trendline is also a poor trade, as this may indicate that the trend has ended. Not having exit strategies and ignoring stops is another technique that will help you lose money. Distinguishing between high probability and low probability trades is something that a trader will learn as he trades more and more. Eventually, knowing which trades are worth taking and which are not becomes second nature to the best traders.

Becoming a better trader means being able to distinguish between high probability and low probability situations the same way my cat was able to do. Once you can do this, you can start trading like a pro. In my opinion the best way to do this is by always being aware of what the market is doing in its different time frames so that you are not caught on the wrong side of the major moves. By using a combination of time frames and different technical analysis techniques one can isolate trades that have a better potential to work no matter what time frame is preferred.

Having a reason for making every trade and planning trades thoroughly will help you identify which trades may not be worth the risk they represent. However, unless you take the time to plan out trades, you never know how much is at risk or could be made. Without these two factors it is hard to distinguish between a good trade and a bad trade. Not all trades work out, but if you can eliminate as many poor-percentage and high-risk trades from your repertoire as possible, you will see dramatic improvements in your overall results. Trading less and taking only the best-percentage trades are such an important part of being a great trader that this should be repeated over and over. Ask yourself before each trade, "Why am I making this trade?" If you can't justify the answer, skip the trade. Two of the most crucial things you need to develop a high probability mentality are having the discipline to make and wait for the right trades and having the money management skills to act accordingly when the better trading opportunities come along.

How To Become a Low Probability Trader in 14 Easy Steps

1. Not timing your trades

2. Trading choppy markets

3. Trading the opening of the market

4. Trading against the trend

5. Not looking at charts

6. Trading the news regardless of what the market does

7. Always risking the same amount

8. Always trying to catch the falling knife

9. Overtrading

10. Failing to distinguish between high probability and low probability trades

11. Trading randomly

12. Not bothering with exit strategies

13. Ignoring money management when considering a trade

14. Chasing markets into overbought territory

Becoming a High Probability Trader

1. Use multiple time frames.

2. Trade with the trend.

3. Wait for pullbacks.

4. Think like Sophie the cat.

5. Be patient and wait for the best opportunities.

6. Know the odds.

7. Understand that it's okay to miss trades.

8. Use mechanical systems.

9. Trade only when the risk/reward ratio merits a trade.

10. Learn to adjust risk per trade.

11. Trade more heavily when the odds are in your favor.

12. Do not gamble.

13. Trade only when everything seems right.

14. Have a reason for every trade.

15. Have a plan.

16. Plan your trades before the market opens.

17. Have the discipline to follow your plan.

18. Stay focused.

19. Learn how a market behaves.

20. Think your trades through.

Helpful Questions to Ask Yourself

Did I have a good reason for that trade?

Did I think it through properly?

Do I know how much is at risk?

Am I trading the right number of shares? Did I wait for a golden opportunity?

Am I trading with the major trend?