CHAPTER 11

The Customer Intelligence You Didn't Know You Needed

As a general rule, the most successful man in life is the man who has the best information.

—Benjamin Disraeli, British politician

If you ask salespeople what their biggest obstacles are, they'll often tell you they're price and competition. Sales leaders tend to have a different perspective. We frequently get inquiries from sales leaders, asking if we can help their team improve their closing skills.

These are real challenges, but in most cases, they're actually symptoms of a larger problem. Issues with price, competition, and closing show up at the end of the sales process, but the real problem occurs much earlier. The root cause is often lack of customer intelligence.

Telling a salesperson to become a “better closer” is putting the cart before the horse because his or her closing skills aren't usually the root issue. The real problem is the salesperson doesn't know enough about the customer to establish differentiation, value, or urgency.

Selling with Noble Purpose requires you to develop a deeper understanding of your customers. You have to truly know your customers to understand how you can make a difference to them. When your sales team fails to establish a concrete link between your solution and the customer's most compelling goals and challenges, you'll quickly become commoditized.

Lack of customer intelligence is a substantial and largely hidden obstacle. Most salespeople don't even realize what this shortcoming costs them. Rarely will you hear a customer say, “You don't know us well enough to close the deal.” More often, they'll tell you they prefer the competition or claim that your price is too high. Or they simply won't take any action at all.

If two salespeople have similar products and pricing, the salesperson who does a better job connecting his or her solution to meaningful customer goals will win the business. The only way to demonstrate real value is to connect the dots. This is how you activate your NSP. You must show, in concrete and meaningful ways, how this specific customer's life and organization will be different—and better—as a result of doing business with you.

To be clear, if you have inferior products, inflated pricing, or a terrible reputation, customer intelligence alone will not make up for those shortfalls. However, if you've met the basic table stakes of your industry, your sales team's ability to understand and connect with high‐priority customer goals gives you a huge competitive advantage.

The Five Categories of Critical Customer Information

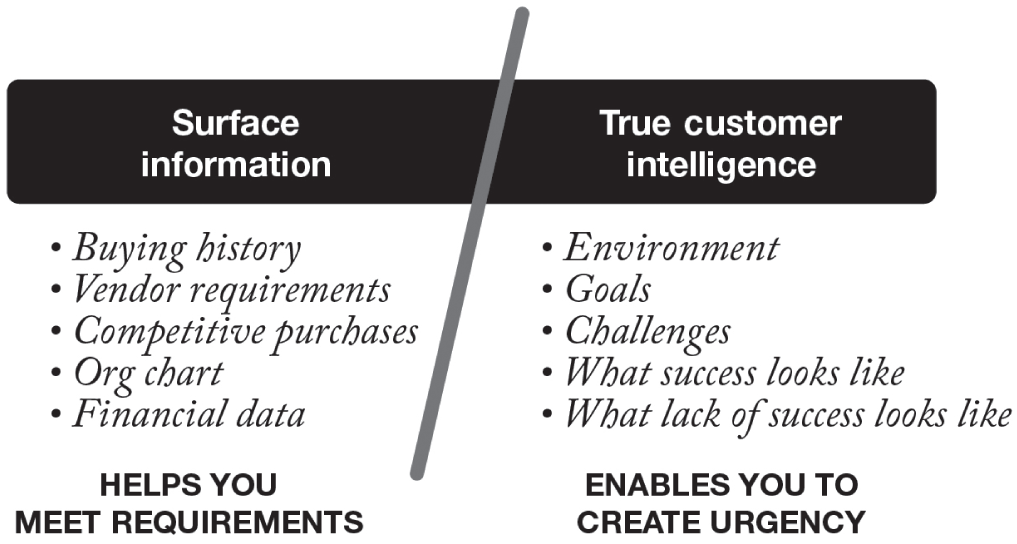

Most sales organizations gather some level of customer intelligence. The information traditionally deemed important includes things like the customer's buying history, vendor requirements, competitive purchases, financial data, and org charts. These matter, but they don't tell you anything about the customer's high‐priority goals and challenges.

You can differentiate yourself and bring your NSP to life by understanding five critical categories of customer information:

- Customer environment

- Customer goals

- Customer challenges

- What success looks like for the customer

- What lack of success looks like for the customer

Think of these five categories as file folders. They provide a system for organizing customer intelligence that will help your sales force do a better job of linking your solution to the issues the customer cares about.

Here are some examples of what salespeople need to know in each area. As you read this list, ask yourself, how well does my sales team understand these about our customers?

Environment

This will help you understand how your contact relates to the organization as a whole and how the organization is positioned within the context of its marketplace. You want to know things such as:

- What's your contact's core function or role?

- What's going on in his or her organization or life?

- Who is the competition, and how do they stack up?

- What is the customer's position in its marketplace?

- What's happening politically inside the organization?

Goals

You want to find out what your contact's objectives are, as well as that of his or her department and the overall organization. The types of things you want to know are:

- What does your contact need to accomplish?

- How is your contact evaluated?

- What does the senior leadership believe is most important?

- What measurements does the customer have in place?

- Where does the customer stand with its goals to date?

Challenges

This area is where you want to find out more about problems and issues that concern both your contact and his or her boss. You want to know things such as:

- What are they worried about?

- What obstacles do they face?

- What are the competitive threats inside and outside the company?

- What resources do they have, and where do they need more?

What Success Looks Like

You'll want to know what an organizational or personal win means for this customer, specifically:

- What is your customer passionate about?

- What does your contact's boss care about most?

- How does your contact define and measure success?

- How will your contact know when he or she has achieved success?

- How does your contact's boss define and measure success?

- How does their organization define and measure success?

What Lack of Success Looks Like

This area is where you want to find out about the potential risks your customer is facing and what the customer's senior leadership is concerned about. You'll want to know:

- What are they afraid of?

- What will happen to the organization if they fail?

- What are the consequences for your contact?

As you scan these lists, you'll notice this information isn't about your product or solution, nor is it about your revenue pipeline or order history. It's about the customer. Product‐ or quota‐focused salespeople—the average performers—tend to view customer information through the lens of their products or solutions. NSP‐driven salespeople—the top performers—take a more holistic approach.

I cannot emphasize enough how important it is to provide your team with a clear template for the types of information you want them to gather. These five categories of information go beyond purchase requirements. NSP sellers make a concerted effort to understand the customer's complete business environment and the goals and challenges that matter most to their organization. NSP‐driven salespeople gather customer information with an eye toward what they're selling; however, they don't limit themselves to the areas that pertain directly to their products.

For example, if they're calling on a technology company, they figure out where that company is in the market and what the firm's long‐term plans are. If they're calling on a medical practice, they don't focus on one treatment or disease state; they look at the practice's clinical and financial goals. If they're calling on a bakery, they make a point to understand the bakery's customer base.

Top performers know the difference between purchase requirements and true goals. An average performer will tell you that the customer's goal is to buy a certain type of product. A Noble Purpose seller will give you the full story about a customer or potential customer. The NSP rep knows what the customer does, which markets they compete in, what the most pressing issues are, who the customer's competition is, and what challenges they face. NSP reps understand that buying products or services is never a goal. Customers buy products and services to accomplish the goals they've set forth for their own organizations.

This broader focus enables an NSP salesperson to make strong, concrete recommendations when it's time to close. The five categories of critical customer information are drawn from our study of top performers. These categories represent the body of critical customer intelligence top performers use to differentiate themselves and forge more meaningful connections with their clients.

How Information Improves Your Win Rate

NSP‐driven salespeople close bigger deals at higher margins because they connect their solutions to the customer's high‐priority goals, challenges, and success factors, rather than narrowly focusing on purchase requirements.

Let's compare the difference between these two sales approaches.

Imagine two salespeople who both sell automated order‐processing systems. Both systems have the potential to make the customers 20% more efficient.

The first salesperson has been coached to find out who the buyer is, what the budget is, and who the competition might be. After uncovering this information, the rep gives a presentation. This rep's presentation will most likely be organized around the salesperson's key benefit, which conveys: “Our solution makes you 20% more efficient.”

It sounds good. But it's generic. This salesperson is leaving it up to the customer to figure out how a 20% efficiency improvement will affect his or her organization. Average salespeople tend to use the same benefit statements with all their customers.

The second salesperson works for an NSP‐driven organization, so the approach differs. They uncover the standard information about the buyer, the buying criteria, and the competition. But this rep's manager also requires the sales rep to uncover information about the customer's environment, goals, challenges, and success factors. The rep knows his or her manager will ask about these things before the presentation. The rep is trained to uncover this information. Uncovering this information early in the process makes calls last longer; the discovery process takes a bit more time and involves a few more players than it did for the first salesperson, who just uncovered basic information.

When it's time to prepare the presentation, the NSP rep has much better customer intelligence. The NSP message connects the dots between the customer information and the salesperson's key benefit.

The NSP rep uses the five categories of critical information to illustrate the impact of a 20% improvement:

- Customer environment: “I know you're in a competitive market where customers focus heavily on delivery times.”

- Customer goals: “Your primary objective is growing market share.”

- Customer challenge: “Slow turnaround time is costing you customers.”

- What success looks like: “Improving efficiency will give you a competitive advantage that will help you grow market share.”

- What lack of success looks like: “If you can't improve efficiency, you're likely to lose customers.”

Only then does the NSP rep deliver the message: “Our solution will help you win more customers because your system will be 20% more efficient.”

Which one of these sellers created a more compelling case? If you're a buyer, which one of these reps are you more likely to take in to see your CEO or CFO? The first salesperson, who speaks in general terms about efficiency, or the second salesperson, who directly links to your high‐priority goals and challenges?

It's worth noting that the difference between these two presentations is only five sentences. Good advance intel enabled the NSP rep to create a powerful framing for their solution: it's seen in a totally different context. It now has urgency; it's not just a purchase, it's a way to advance the client's business.

The difference between the preceding two presentations isn't in the product or benefits.

The difference is the customer information.

The first presentation is generic because the salesperson didn't uncover enough relevant customer information to make a compelling case for the proposed solution.

The reason the salesperson is able to give a more compelling message isn't because of better presentation skills. It's because of better information‐gathering skills. The second presentation—for the exact same product—describes the impact the solution will have on this specific customer.

The NSP salesperson is able to do this because they did a more thorough job during the fact‐finding calls. The NSP rep knows the customer's environment, goals, challenges, and success factors, making it possible to present a more concrete case. You can't make a difference to your customers if you don't understand them.

Without a solid understanding of the customer's environment, goals, challenges, and success factors, salespeople wind up giving generic presentations and proposals. They can't provide concrete descriptions of how the customer will be different because they don't have a thorough understanding of where the customer is today or where the customer wants to go.

Here's the leadership challenge. The reason the NSP salesperson did a better job of fact‐finding isn't because a manager said, “Ask better questions” or “Be a better closer.” It's because the manager asked very specifically about the five categories of customer information.

Remember Chapter 7, where I talked about how specificity is sexy? Now we're getting even more specific (and, by my definition, even sexier). Generically telling your team to gather more customer intelligence is better than telling them to ignore customer information. But if you want to gain a true competitive advantage, give your team specific direction about the kind of information you want them to gather, give them a place to store it, and give them the skills to uncover it.

The reason the first rep—the average rep—didn't uncover the information isn't because the rep doesn't care about his or her customers. It's because the rep doesn't have a good blueprint.

When a manager focuses exclusively on customer order history, contact information, and buying patterns, the salesperson is much less likely to gather the customer intelligence needed to make a compelling presentation.

Go back and look at the questions under the five categories. Imagine asking your reps these questions about their customers during the sales process. What impact would that have on their behavior?

When the manager focuses on true customer intelligence—the customer's environment, goals, challenges, what success looks like, and what lack of success looks like—the salesperson is prompted to look for that information during the discovery stage of the sales process. You don't have to gather information about all of these on every sales call. You can explore these at different levels of depth in different ways for different types of buyers. Much of the information is readily available on the internet.

Some salespeople argue that they don't have time to gather this kind of customer intelligence. The people who make these claims tend to be mid‐level performers. Field observation of top‐performing salespeople revealed that they spend more time than average performers in the fact‐finding stage of the sales cycle. That time reduces objections, generates urgency, strengthens the relationship, and connects to value, which, in turn, increases their close rate and shortens their sales cycle.

Think about one of your upcoming presentations. Look at each of the five categories. How can you and your team do a better job of linking your solution to critical customer information?

You learned in Chapter 5 that asking a salesperson, “How will this customer be different as a result of doing business with us?” ignites a new line of thinking. Asking your sales team about the five critical categories of customer information takes this thinking to the next level and activates it on a behavioral level. It also shows you, the leader, where the gaps are.

Questioning with Purpose

It's easier to identify the information you want to know before you try to come up with specific questions. Once you identify the gaps in the five categories, you can craft questions for your customers to help you get a full picture.

Following are 10 great questions to ask customers. There's space after each question for you to fill in the information you're seeking. For example, say you're calling on a bank. You know a big merger has happened in their market. You want to know: Are they at risk for losing customers? Or are they trying to capitalize on the uncertainty in the market? Once you know what you're looking for, you can use the format, asking something like “What impact does the recent M&A activity have on your strategic plan?” Keep in mind that the word order in the questions is important. These questions are based on our observations about which phrasing gets the best response from customers.

- 10 Great Questions to Ask Your Customers

Great questions are sincere and well planned, and zero in on the customer's environment, goals, challenges, and success factors:

- What impact does this (change, event, challenge, competitive situation) have on your organization?

The tendency is to ask, “What do you think about this?” But asking how something affects a person gets you a much deeper, more meaningful response.

- What's the most challenging part of (something about the person's role or function)?

This demonstrates that you're genuinely interested in what it's like to live in his or her world.

- If you could change anything about (a current pressing situation), what would it be?

This helps you understand your contact's goals and challenges. Warning: You want to be sure to ask this in a nonmanipulative way. You're not fishing; you're interested.

- When you look at X (challenge) and Y (other challenge), how do you prioritize between the two?

This prompts inner reflection, which, in turn, gives you clues about the customer's thought process and lets you uncover what's really important to him or her.

- What do you enjoy most about (insert important job activity)?

Asking someone to describe the best part of his or her job creates a positive tone and opens a window into that person's world.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

- How do you feel about this (key initiative or goal in the customer's organization)?

This demonstrates that you're interested in your customer's perspective, not just making the sale.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

- What do you think is causing (situation that's on his or her mind)?

This prompts your customer to think about root causes, which will enable you to connect the dots—and discover what issues are likely most important to senior leadership.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

- How can I best support you on (big project, goal, or challenge)?

This enables your contact to define what he or she really wants, and it tees you up to provide specific, requested help.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

- What is your deepest fear about (something important to your customer)?

This allows your contact to share an area of vulnerability. While counterintuitive, most people actually like to do this, as long as the listener makes it nonjudgmental and safe.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

- What are your highest hopes for (your job, company, or project)?

When someone shares his or her hopes with you, that person is telling you what really matters to him or her and giving you a chance to join the team.

____________________________________________________________

____________________________________________________________

____________________________________________________________

____________________________________________________________

These questions are designed to jump‐start thoughtful, more meaningful conversations. Customers can tell if you're coming from a place of genuine interest. This is not a check the box, fill it out, get it turned into the boss questionnaire. If you're just trying to check the box, customers will sense this—and won't reveal as much information.

When you start asking your sales team about the five categories, don't be surprised or frustrated if it's slow going at first. Most salespeople don't think about their customers in this way, and that's why they're not top performers—yet.

If a salesperson answers with product‐focused answers (as opposed to true customer information), then push harder. You want your salespeople to take off their product lens and look more holistically at the customer.

When salespeople know that you, the leader, are always going to ask about the customer's environment, goals, and challenges, they will in turn begin seeking that very information on their sales calls. When they're aware that you expect them to understand what success and lack of success look like for each customer, they will come prepared with an answer.

Capturing the right customer information also helps the rest of your organization. When you have accurate information about your customer's goals and challenges, you can share it with your marketing and product development teams. Your salespeople are the conduit to the customer. Sharing the information that salespeople capture about customers broadly gives everyone in your organization better insights into your customers' world.

Understanding customers on a deep level makes your salespeople more empathetic and more assertive at the same time. When you know exactly how the customer will benefit from doing business with you, you have more urgency about closing the deal.