Preparing a new equation A = L + OE after each transaction would be cumbersome and costly, especially when there are a great many transactions in an accounting period. Also, information for a specific item such as cash would be lost as successive transactions were recorded. This information could be obtained by going back and summarizing the transactions, but that would be very time-consuming. Thus we begin with the account.

An account may be defined as a record of the increases, decreases, and balances in an individual item of asset, liability, owner’s equity, income (revenue), or expense.

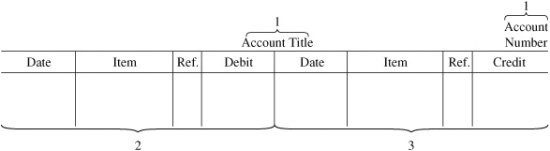

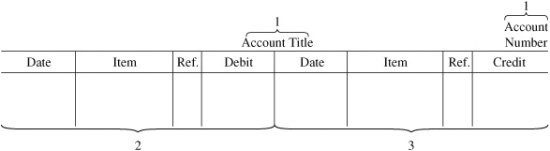

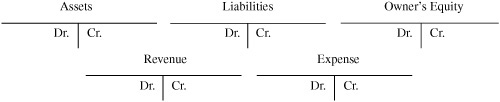

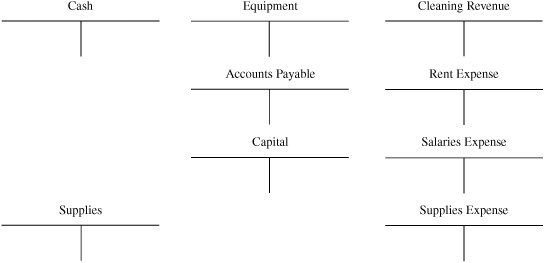

The simplest form of the account is known as the “T” account because it resembles the letter “T.” The account has three parts: (1) the name of the account and the account number, (2) the debit side (left side), and (3) the credit side (right side). The increases are entered on one side, the decreases on the other. The balance (the excess of the total of one side over the total of the other) is inserted near the last figure on the side with the larger amount.

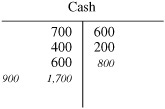

EXAMPLE 1

Note that the left side of the account adds up to $1,700, while the right side totals $800. The $1,700 and $800 totals, respectively, are written in smaller type and are known as footings. The difference between the total amounts is $900 and is called the ending balance. Since the larger total $1,700 appears on the left side of the account, the ending balance of $900 is placed there. Had the right side total been greater than the left, the ending balance would have appeared on the right side.

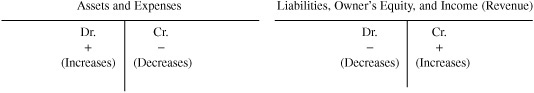

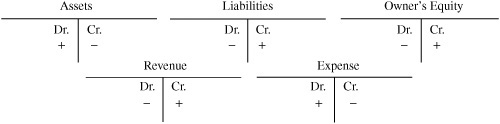

When an amount is entered on the left side of an account, it is a debit, and the account is said to be debited. When an amount is entered on the right side, it is a credit, and the account is said to be credited. The abbreviations for debit and credit are Dr. and Cr., respectively.

Whether an increase in a given item is credited or debited depends on the category of the item. By convention, asset and expense increases are recorded as debits, whereas liability, capital, and income increases are recorded as credits. Asset and expense decreases are recorded as credits, whereas liability, capital, and income decreases are recorded as debits. The following tables summarize the rule.

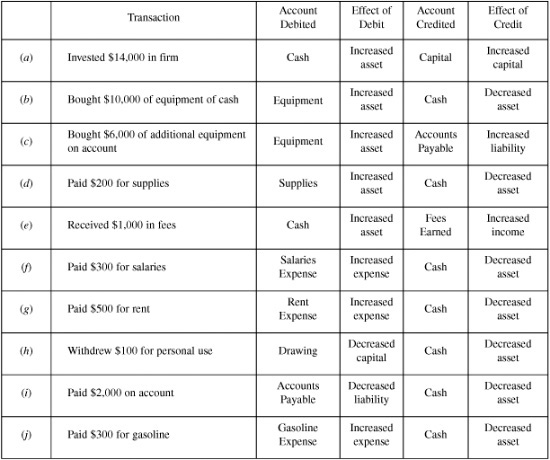

EXAMPLE 2

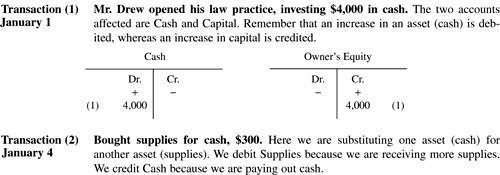

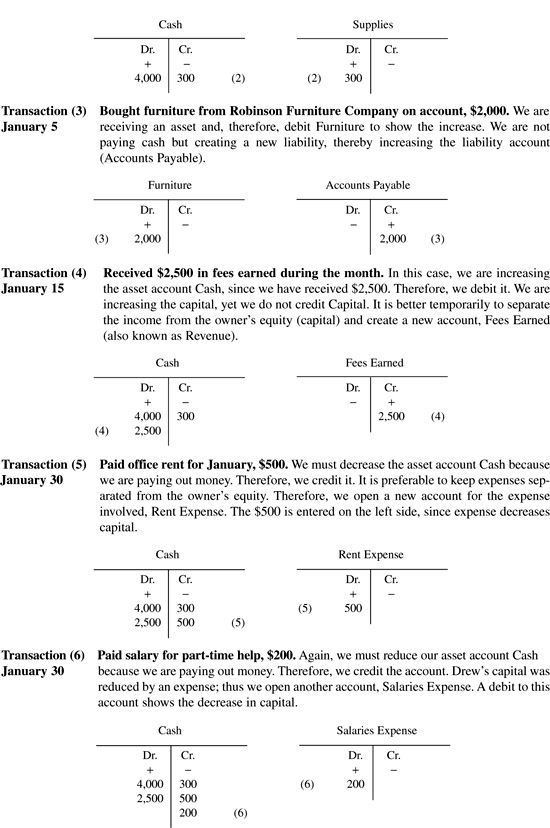

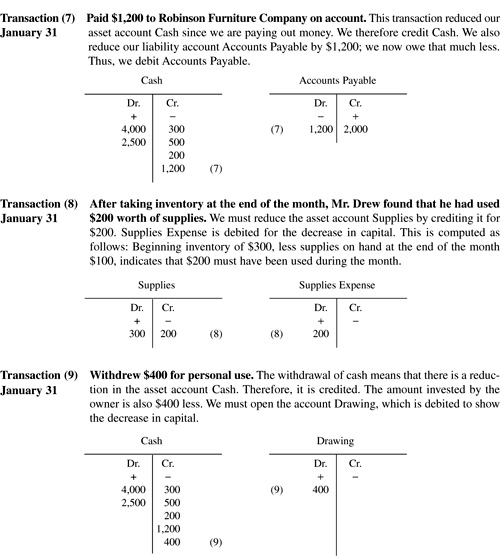

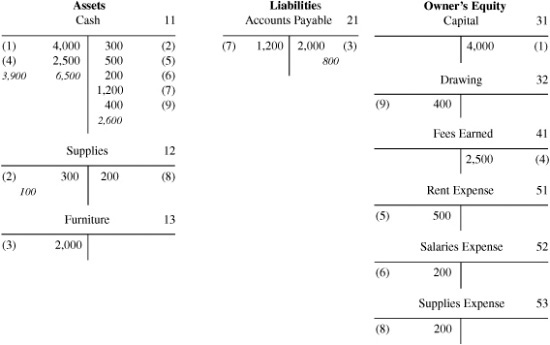

Let us reexamine the transactions that occurred in T. Drew’s practice during the first month of operation. These are the same as in Chapter 1, except that accounts are now used to record the transactions.

An account has a debit balance when the sum of its debits exceeds the sum of its credits; it has a credit balance when the sum of the credits is the greater. In double-entry accounting, which is in almost universal use, there are equal debit and credit entries for every transaction. Where only two accounts are affected, the debit and credit amounts are equal. If more than two accounts are affected, the total of the debit entries must equal the total of the credit entries.

The complete set of accounts for a business entity is called a ledger. It is the “reference book” of the accounting system and is used to classify and summarize transactions and to prepare data for financial statements. It is also a valuable source of information for managerial purposes, giving, for example, the amount of sales for the period or the cash balance at the end of the period.

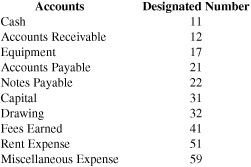

It is desirable to establish a systematic method of identifying and locating each account in the ledger. The chart of accounts, sometimes called the code of accounts, is a listing of the accounts by title and numerical designation. In some companies, the chart of accounts may run to hundreds of items.

In designing a numbering structure for the accounts, it is important to provide adequate flexibility to permit expansion without having to revise the basic system. Generally, blocks of numbers are assigned to various groups of accounts, such as assets, liabilities, and so on. There are various systems of coding, depending on the needs and desires of the company.

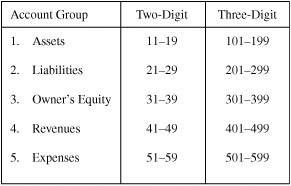

EXAMPLE 3

A simple chart structure is to have the first digit represent the major group in which the account is located. Thus, accounts that have numbers beginning with 1 are Assets; 2, Liabilities; 3, Owner’s Equity; 4, Revenues; and 5, Expenses. The second or third digit designates the position of the account in the group.

In the two-digit system, assets are assigned the block of numbers 11–19, and liabilities 21–29. In larger firms, a three-digit (or higher) system may be used, with assets assigned 101–199 and liabilities 201–299. Following are the numerical designations for the account groups under both methods.

Thus, Cash may be account 11 under the first system and 101 under the second system. The cash account may be further broken down as: 101, Cash—First National Bank; 102, Cash—Second National Bank; and so on.

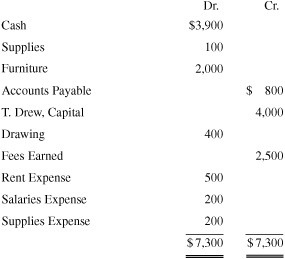

As every transaction results in an equal amount of debits and credits in the ledger, the total of all debit entries in the ledger should equal the total of all credit entries. At the end of the accounting period, we check this equality by preparing a two-column schedule called a trial balance, which compares the total of all debit balances with the total of all credit balances. The procedure is as follows:

1. List account titles in numerical order.

2. Record balances of each account, entering debit balances in the left column and credit balances in the right column.

Note: Asset and expense accounts are debited for increases and normally would have debit balances. Liabilities, Owner’s Equity, and Revenue accounts are credited for increases and normally would have credit balances.

3. Add the columns and record the totals.

4. Compare the totals. They must be the same.

If the totals agree, the trial balance is in balance, indicating that debits and credits are equal for the hundreds or thousands of transactions entered in the ledger. While the trial balance provides arithmetic proof of the accuracy of the records, it does not provide theoretical proof. For example, if the purchase of equipment was incorrectly charged to Expense, the trial balance columns may agree, but theoretically the accounts would be wrong, as Expense would be overstated and Equipment understated. In addition to providing proof of arithmetic accuracy in the accounts, the trial balance facilitates the preparation of the periodic financial statements. Generally, the trial balance comprises the first two columns of a worksheet, from which financial statements are prepared. The worksheet procedure is discussed in Chapter 9.

EXAMPLE 4

The summary of the transactions for Mr. Drew (see Example 2), and their effect on the accounts, is shown below. The trial balance is then taken.

T. Drew

Trial Balance

January 31, 200X

1. To classify and summarize a single item of an account group, we use a form called an __________.

2. The accounts make up a book called a ____________.

3. The left side of the account is known as the ____________, while the right side is the ____________.

4. Increases in all asset accounts are ____________.

5. Increases in all liability accounts are ____________.

6. Increases in all owner’s equity accounts are ____________.

7. Increases in all revenue accounts are ____________.

8. Increases in all expense accounts are ____________.

9. Expenses are debited because they decrease ____________.

10. The schedule showing the balance of each account at the end of the period is known as the ____________.

Answers:

1. account;

2. ledger;

3. debit side, credit side;

4. debited;

5. credited;

6. credited;

7. credited;

8. debited;

9. owner’s equity;

10. trial balance

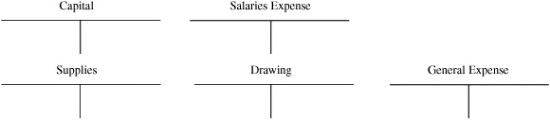

2.1 In each of the following types of T accounts, enter an increase (by writing +) and a decrease (by writing −).

SOLUTION

2.2 Below is a list of accounts. Rearrange the accounts as they would appear in the ledger and assign a numerical designation for each one from these numbers: 17, 22, 32, 59, 12, 51, 41, 11, 21, 31.

Accounts

Accounts Payable

Accounts Receivable

Capital

Cash

Drawing

Equipment

Fees Earned

Miscellaneous Expense

Notes Payable

Rent Expense

SOLUTION

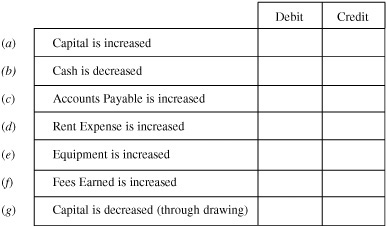

2.3 Indicate in the columns below the increases and decreases in each account by placing a check mark in the appropriate column.

SOLUTION

(a) Cr.

(b) Cr.

(c) Cr.

(d) Dr.

(e) Dr.

(f) Cr.

(g) Dr.

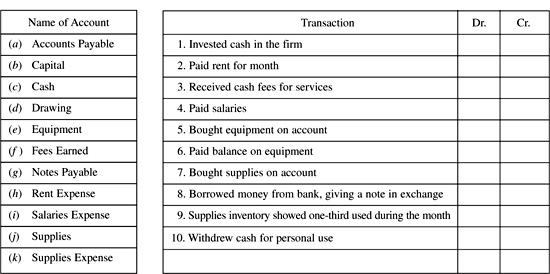

2.4 For each transaction in the table below, indicate the account to be debited and the account to be credited by placing the letter representing the account in the appropriate column.

SOLUTION

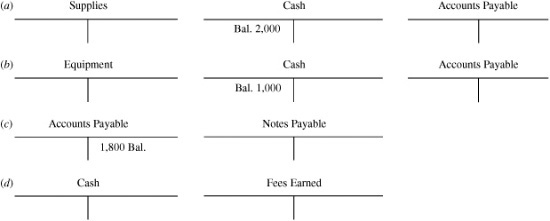

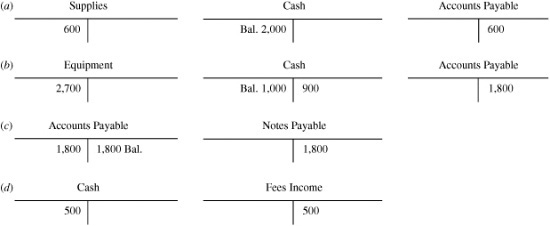

2.5 Record each separate transaction in the accompanying accounts.

(a) Bought supplies on account for $600.

(b) Bought equipment for $2,700, paying one-third down and owing the balance.

(c) Gave a note in settlement of transaction (b).

(d) Received $500 in plumbing fees.

SOLUTION

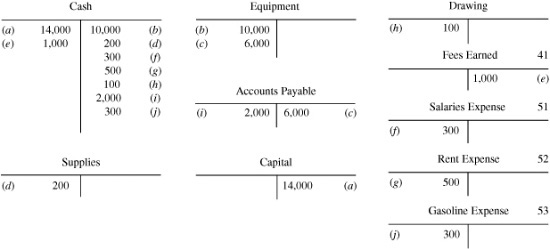

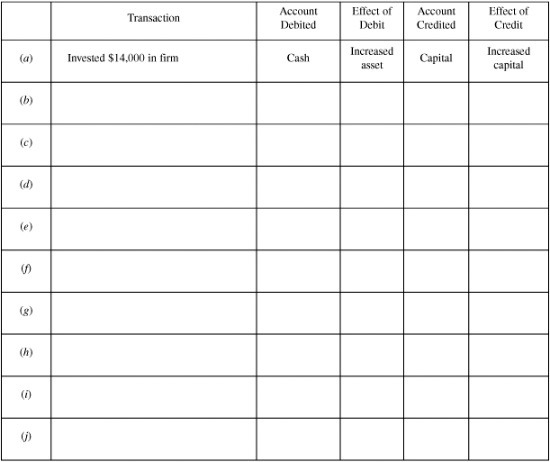

2.6 The ten accounts that follow summarize the first week’s transactions of the Charles Taxi Company.

Complete the form below. (The analysis of the first transaction is given as a sample.)

SOLUTION

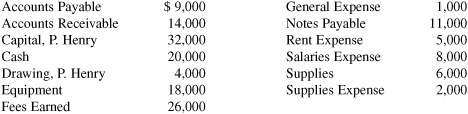

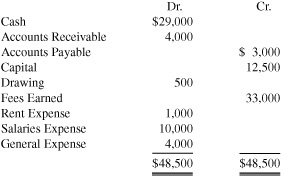

2.7 Rearrange the following alphabetical list of the accounts and produce a trial balance.

SOLUTION

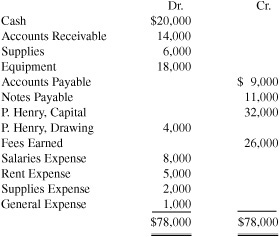

2.8 The M. Ramirez Company’s trial balance appears below. Certain accounts have been recorded improperly from the ledger to the trial balance, causing it not to balance. Present a corrected trial balance based on normal balances of each account.

M. Ramirez

Trial Balance

January 31, 200X

SOLUTION

M. Ramirez

Trial Balance

January 31, 200X

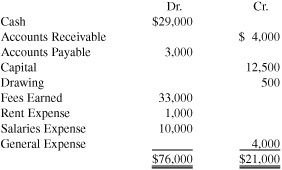

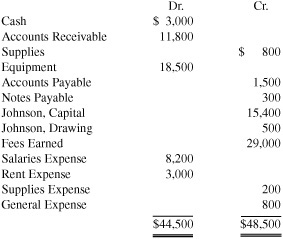

2.9 The trial balance of P. Johnson does not balance as presented. In reviewing the ledger, you discover the following:

(1) The debits and credits in the cash account total $24,100 and $21,400, respectively.

(2) The $400 received in settlement of an account was not posted to the Accounts Receivable account.

(3) The balance of the Salaries Expense account should be $200 less.

(4) No balance should exist in the Notes Payable account.

(5) Each account should have a normal balance.

Prepare a corrected trial balance.

P. Johnson

Trial Balance

December 31, 200X

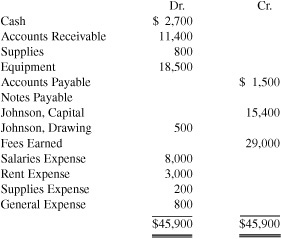

SOLUTION

P. Johnson

Trial Balance

December 31, 200X

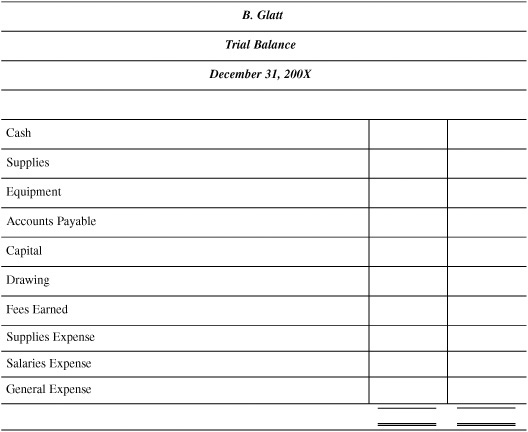

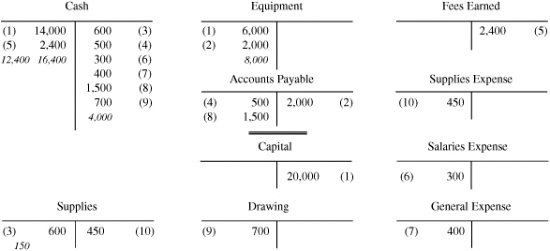

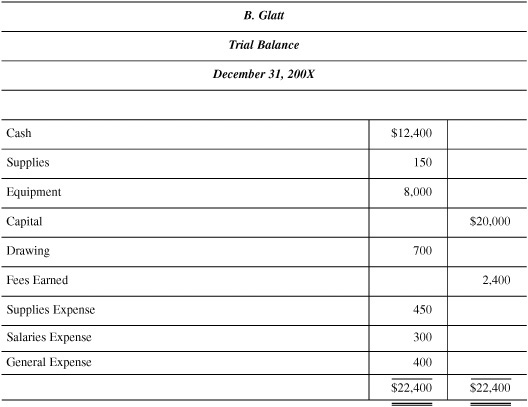

2.10 Using the information of Problem 1.11, record the entries in the accounts below for B. Glatt, labeling each item by number as in Problem 1.11. Then prepare a trial balance.

SOLUTION

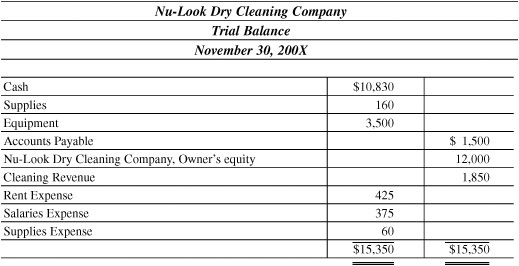

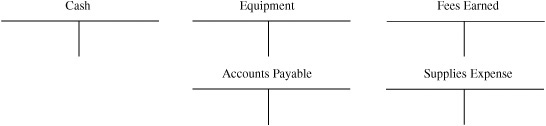

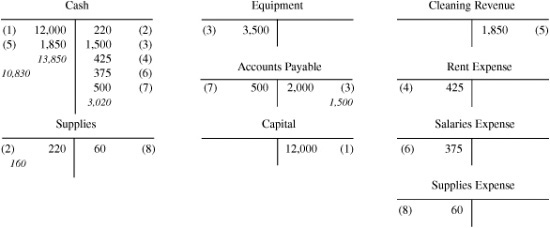

2.11 For each transaction below, record the entry in the T accounts furnished.

(1) The Nu-Look Dry Cleaning Company opened a business bank account by depositing $12,000 on Nov. 1.

(2) Purchased supplies for cash, $220.

(3) Purchased dry cleaning equipment for $3,500, paying $1,500 in cash with the balance on account.

(4) Paid rent for the month, $425.

(5) Cash sales for the month totaled $1,850.

(6) Paid salaries of $375.

(7) Paid $500 on account.

(8) The cost of supplies used was determined to be $60.

SOLUTION

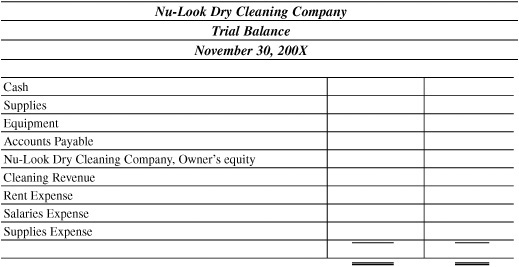

2.12 Prepare a trial balance as of November 30 for the Nu-Look Dry Cleaning Company, using the account balances in Problem 2.11.

SOLUTION