Accounting records are kept on an accrual basis, except in the case of very small businesses. To accrue means to collect or accumulate. This means that revenue is recognized when it is earned, regardless of when cash is actually collected, and expense is matched to the revenue, regardless of when cash is paid out. Most revenue is earned when goods or services are delivered. At this time, title to the goods or services is transferred, and there is created a legal obligation to pay for such goods or services. Some revenue, such as rental income, is recognized on a time basis and is earned when the specified period of time has passed. The accrual concept demands that expenses be kept in step with revenue, so that each month sees only that month’s expenses applied against the revenue for that month. The necessary matching is brought about through a type of journal entry called an adjusting entry. In this chapter, we shall discuss these adjusting entries and also the closing entries through which the adjusted balances are ultimately transferred to balance sheet accounts at the end of the fiscal year.

To adjust expense or income items that have already been recorded, only a reclassification is required; that is, amounts have only to be transferred from one account (for example, Prepaid Insurance) to another (Insurance Expense). The following examples will show how adjusting entries are made for the principal types of recorded expenses.

EXAMPLE 1 Prepaid Insurance

Assume that a business paid a $1,200 premium on April 1 for 1 year’s insurance in advance. This represents an increase in one asset (prepaid expense) and a decrease in another asset (cash). Thus, the entry would be:

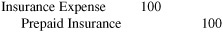

At the end of April, one-twelfth of the $1,200, or $100, had expired (been used up). Therefore, an adjustment has to be made, decreasing or crediting Prepaid Insurance and increasing or debiting Insurance Expense. The entry would be:

Thus, $100 would be shown as Insurance Expense in the income statement for April, and the balance of $1,100 would be shown as Prepaid Insurance in the balance sheet as an asset.

EXAMPLE 2 Prepaid Rent

Assume that on March 1 a business paid $1,500 to cover rent for the balance of the year. The full amount would have been recorded as a debit to prepaid expense in March. Since there is a 10-month period involved, the rent expense each month is $150. The balance of Prepaid Rent would be $1,350 at the beginning of April. The adjusting entry for April would be:

At the end of April, the balance in the prepaid rent account would be $1,200.

EXAMPLE 3 Supplies on Hand

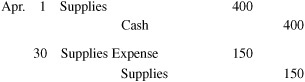

A type of prepayment that is somewhat different from those previously described is the payment for office or factory supplies. Assume that $400 worth of supplies were purchased on April 1. At the end of April, when expense and revenue are to be matched and statements prepared, a count of the amount on hand will be made. Assume that the inventory count shows that $250 of supplies are still on hand. Then the amount consumed during April was $150 ($400 − $250). The two entries would be as follows:

Supplies Expense of $150 will be included in the April income statement; Supplies on Hand of $250 will be included as an asset on the balance sheet of April 30.

In each of the above examples, the net effect of the adjusting entry is to credit the same account as was originally debited. The following examples illustrate what are called valuation or offset accounts.

EXAMPLE 4 Accumulated Depreciation

In the previous three adjusting entries, the balances of the assets mentioned (Prepaid Insurance, Prepaid Rent, and Supplies) were all reduced. These assets usually lose their value in a relatively short period of time. However, assets that have a longer life expectancy (such as a building, equipment, etc.) are treated differently because the accounting profession wants to keep a balance sheet record of the equipment’s original (historical) cost. Thus the adjusting entry needed to reflect the true value of the long-term asset each year must allocate (spread) the cost of its original price. This cost allocation concept is known as depreciation. In order to accomplish the objectives of keeping the original cost of the equipment and also maintaining a running total of the depreciation allocated, we must create a new account entitled Accumulated Depreciation. This account is known as a contra asset (which has the opposite balance of its asset), and it summarizes and accumulates the amount of depreciation over the equipment’s total useful life. Assume that machinery costing $15,000 was purchased on February 1 of the current year and was expected to last 10 years. With the straight-line method of accounting (i.e., equal charges each period), the depreciation would be $1,500 a year, or $125 a month. The adjusting entry would be:

At the end of April, Accumulated Depreciation would have a balance of $375, representing 3 months’ accumulated depreciation. The account would be shown in the balance sheet as follows:

EXAMPLE 5 Allowance for Uncollectible Accounts

A business with many accounts receivable will reasonably expect to have some losses from uncollectible accounts. It will not be known which specific accounts will not be collected, but past experience furnishes an estimate of the total uncollectible amount.

Assume that a company estimates that 1 percent of sales on account will be uncollectible. Then, if such sales are $10,000 for April, it is estimated that $100 will be uncollectible. The actual loss may not definitely be determined for a year or more, but the loss attributed to April sales would call for an adjusting entry:

If the balance in Accounts Receivable at April 30 was $9,500 and the previous month’s balance in Allowance for Uncollectible Accounts was $300, the balance sheet at April 30 would show the following:

In the previous section we discussed various kinds of adjustments to accounts to which entries had already been made. Now we consider those instances in which an expense has been incurred. For example, if salaries are paid on a weekly basis, the last week of the month may apply to 2 days. If April ends on a Tuesday, then the first 2 days of the week will apply to April and be an April expense, while the last 3 days will be a May expense. To arrive at the proper total for salaries for the month of April, we must include, along with the April payrolls that were paid in April, the 2 days’ salary that was not paid until May. Thus, we make an entry to accrue the 2 days’ salary. As mentioned earlier, to accrue means to collect or accumulate.

The following example shows an adjusting entry for the most common type of unrecorded expenses (accrued expenses).

EXAMPLE 6 Accrued Salaries

Assume that April 30 falls on Tuesday for the last weekly payroll period. Then, 2 days of that week will apply to April and 3 days to May. The payroll is $500 per day, for the week, or $2,500. For this example, $1,000 would apply to April (Monday and Tuesday) and $1,500 to May (Wednesday, Thursday, and Friday). The entries would be as follows:

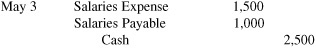

When the payment of the payroll is made—say, on May 3—the entry would be as follows:

As can be seen, $1,000 was charged to expense in April and $1,500 in May. The debit to Salaries Payable of $1,000 in May merely canceled the credit entry made in April, when the liability was set up for the April salaries expense.

After the income statement, balance sheet, and cash flow statement have been prepared, a summary account—variously known as Income Summary, Profit and Loss Summary, and so on—is set up. Then, by means of closing entries, each expense account is credited so as to produce a zero balance, and the total amount for the closed-out accounts is debited to Income Summary. Similarly, the individual revenue accounts are closed out by debiting, and the total amount is credited to the summary account. Thus, the new fiscal year starts with zero balances in the revenue and expense accounts, whereas the Income Summary account balance gives the net income or the net loss for the old year.

EXAMPLE 7

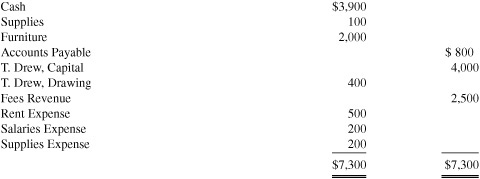

To illustrate the closing procedure, we refer to the accounts of T. Drew (see Chapter I).

T. Drew Trial Balance January 31 200X

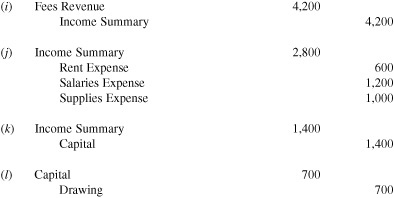

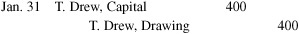

The closing entries are as follows.

(1) Close revenue accounts. Debit the individual revenue accounts and credit the total to Income Summary. Here, there is only one income account.

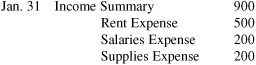

(2) Close expense accounts. Credit the individual expense accounts and debit the total to Income Summary.

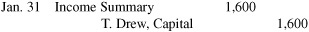

(3) Close the Income Summary account. If there is a profit, the credit made for total income in (1) above will exceed the debit made for total expense in (2) above. Therefore, to close out the balance to zero, a debit entry will be made to Income Summary account. A credit will be made to the capital account to transfer the net income for the period. If expenses exceed revenue, then a loss has been sustained, and a credit is made to Income Summary account and a debit to the capital account. Based on the information given, the entry is:

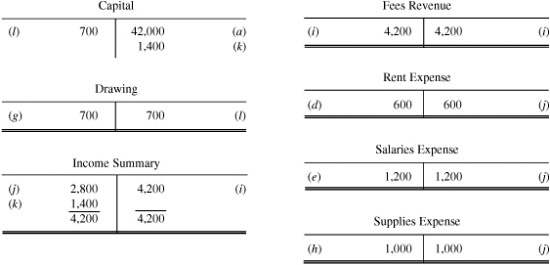

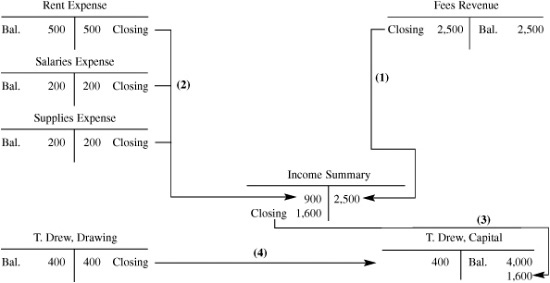

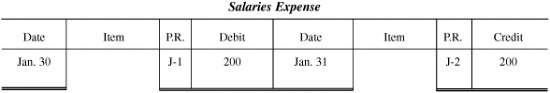

(4) Close out the Drawing account. The drawing account would be credited for the total amount of the drawings for the period and the capital account would be debited for that amount. The difference between net income and drawing for the period represents the net change in the capital account for the period. The net income of $1,600, less drawings of $400, results in a net increase of $1,200 in the capital account. The closing entry for the drawing account is:the various accounts will appear as shown below. The income and expense accounts and the drawing account are ruled off or closed out, thus showing no balance. The net profit for the period and the drawing account balance were transferred to T. Drew, Capital, a balance sheet account.

In summary, the procedure is as follows:

After the closing entries (1) through (4) are made,

(1) Close Fees Revenue account to Income Summary account

(2) Close all expense accounts to Income Summary account

(3) Close Income Summary account to the Capital account

(4) Close the Drawing account to the Capital account

Note: The above transactions are based on the sole proprietorship form of business. If this business were a corporation the Capital account would be replaced by the Retained Earnings account.

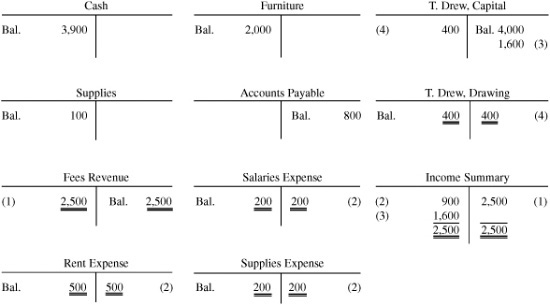

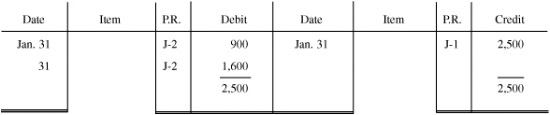

After the posting of the closing entries, all revenue and expense accounts and the summary accounts are closed. When ruling an account where only one debit and one credit exist, a double rule is drawn below the entry across the debit and credit money columns. The date and reference columns also have a double rule, in order to separate the transactions from the period just ended and the entry to be made in the subsequent period.

EXAMPLE 8

Salaries Expense

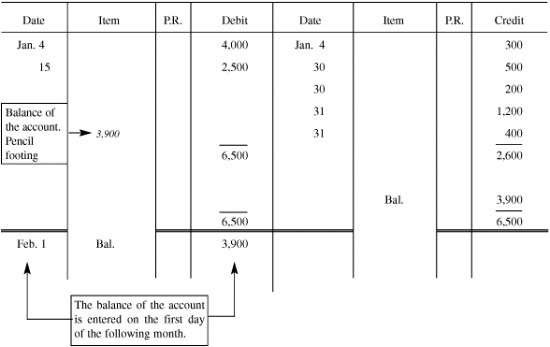

If more than one entry appears on either side of the account, a single ruled line is drawn below the last entry across the debit and credit money columns. The totals are entered just below the single line, and a double ruling line is drawn below the totals. The date and reference column also will have a double ruling line.

EXAMPLE 9

Income Summary

Only assets, liabilities, and capital accounts will have balances. These open accounts are ruled so that their balances are carried forward to the new fiscal year.

EXAMPLE 10

Cash

Note: When there are several entries on each side, both the debit column and the credit column are pencil-footed. The pencil footing of one side is subtracted from the other side. The difference is written in the “Item” column on the side of the account that has the larger total.

After the closing entries have been made and the accounts ruled, only balance sheet accounts—assets, liabilities, and owner’s equity—remain open. It is desirable to produce another trial balance to ensure that the accounts are in balance. This is known as a post-closing trial balance.

EXAMPLE 11

T. Drew Post-Closing Trial Balance January 31, 200X

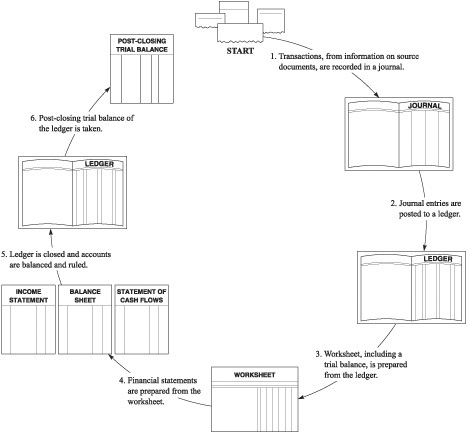

Figure 5-1 illustrates the steps involved in recording transactions of a business.

Fig. 5-1

1. The basis of accounting that recognizes revenue when it is earned, regardless of when cash is received, and matches the expenses to the revenue, regardless of when cash is paid out, is known as the ____________ .

2. An adjusting entry that records the expired amount of prepaid insurance would create the ____________ account.

3. Supplies on hand is classified as an ____________ and appears in the ____________, whereas supplies expense is an ____________ and appears in the ____________ .

4. Accrued salaries is treated in the balance sheet as a ____________, whereas salaries expense appears in the income statement as an ____________ .

5. Both Allowance for Uncollectible Accounts and Accumulated Depreciation appear in the balance sheet as ____________ from their related assets.

6. The related accounts discussed in Question 5 are ____________ and ____________ .

7. An expense paid in advance is known as a ____________ .

8. The revenue and expense accounts are closed out to the summary account known as ____________ .

9. Eventually, all income, expense, and drawing accounts, including summaries, are closed into the __________ account.

10. The post-closing trial balance involves only ____________, ____________, and ____________ accounts.

Answers:

1. accrual basis;

2. insurance expense;

3. asset, balance sheet, expense, income statement;

4. liability account, expense account;

5. deductions;

6. Accounts Receivable, Equipment;

7. Prepaid Expense;

8. Income Summary account;

9. Capital;

10. asset, liability, owner’s equity

5.1 A business pays weekly salaries of $10,000 on Friday for the 5-day week. Show the adjusting entry when the fiscal period ends on (a) Tuesday; (b) Thursday.

SOLUTION

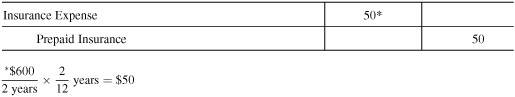

5.2 An insurance policy covering a 2-year period was purchased on November 1 for $600. The amount was debited to Prepaid Insurance. Show the adjusting entry for the 2-month period ending December 31.

SOLUTION

5.3 Office supplies purchases of $900 were debited to Office Supplies. A count of the supplies at the end of the period showed $500 on hand. Make the adjusting entry at the end of the period.

SOLUTION

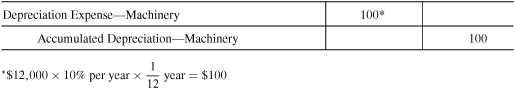

5.4 Machinery costing $12,000, purchased November 30, is being depreciated at the rate of 10 percent per year. Show the adjusting entry for December 31.

SOLUTION

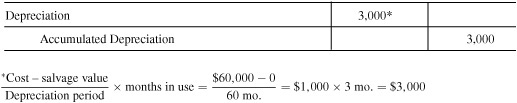

5.5 A large tractor costing $60,000 was purchased on September 30, is being depreciated by the straight-line method over 5 years, and has no salvage value. Show the year-end adjusting entry. (The tractor was put into use on October 1.)

SOLUTION

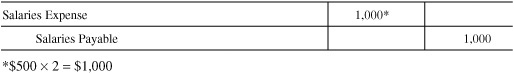

5.6 Salaries paid to employees are $500 per day. The weekly payroll ends on Friday, but Tuesday is the last day of the accounting period. Show the necessary adjusting entry (5-day week).

SOLUTION

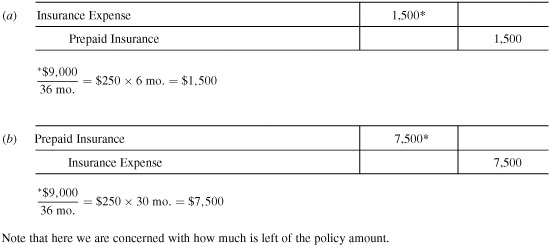

5.7 On June 1, Dry Lake camps purchased a 3-year fire insurance policy costing $9,000. This was debited to a Prepaid Insurance account. The camp’s year ends on November 30. (a) Show the necessary adjusting entry. (b) Show the entry if the above insurance policy was debited to an Insurance Expense account.

SOLUTION

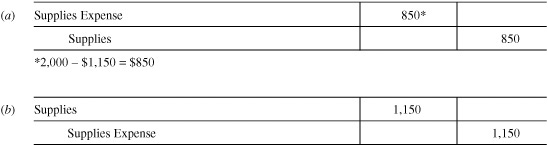

5.8 Supplies costing $2,000 were debited to Supplies. The year-end inventory showed $1,150 of supplies on hand. (a) Show the necessary year-end adjusting entry. (b) Show the above adjusting entry if the supplies were debited to a Supplies Expense account when purchased.

SOLUTION

5.9 (a) The balance in the Prepaid Insurance account, before adjustments, is $1,800, and the amount expired during the year is $1,200. The amount needed for the adjusting entry required is ____________ .

(b) A business pays weekly salaries (5-day week) of $4,000 on Friday. The amount of the adjusting entry necessary at the end of the fiscal period ending on Wednesday is ____________ .

(c) On December 31, the end of the fiscal year, the supplies account had a balance before adjustment of $650. The physical supply of inventory account on December 31 is $170. The amount of the adjusting entry is ____________ .

(d) The supplies account on December 31 has an inventory of $500. The supplies used during the year is $200. The amount of the adjusting entry to record this information is ____________ .

SOLUTION

(a) $1,200

(b) $2,400 ($4,000 ÷ 5 days = $800 per day; $800 × 3 days = $2,400)

(c) $480 ($650 − $170)

(d) $200

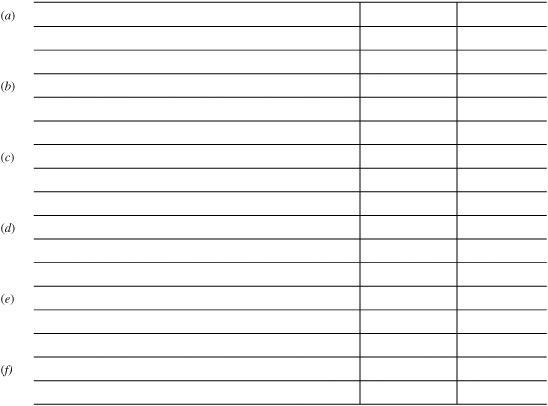

5.10 Listed are the T accounts of Douglas Money, financial advisor. The year-end adjustments necessary to bring the accounts up to date are as follows:

(a) Inventory of supplies at end of year was $395.

(b) Depreciation for the year was $900.

(c) Wages owed but not paid were $725.

(d) Utilities owed but not paid were $215.

(e) Insurance expense for the year was $1,150.

(f) Cash sales not yet posted were $2,175.

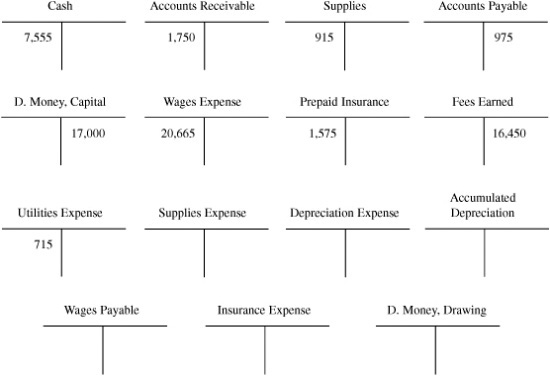

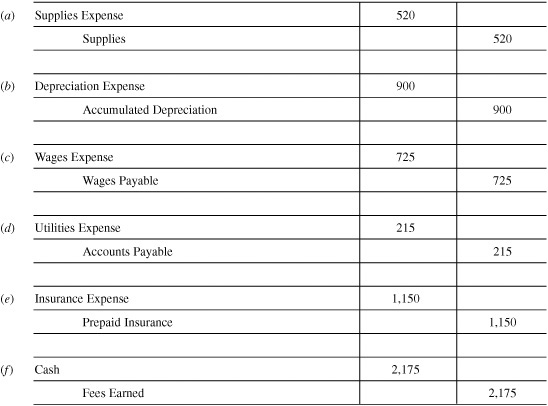

First, prepare the adjusting journal entries. Then, make the necessary adjustments to the T accounts.

Adjusting Entries

SOLUTION

Adjusting Entries

5.11 From the preceding problem about Douglas Money, prepare the closing entries from the T accounts after you made the necessary adjustments.

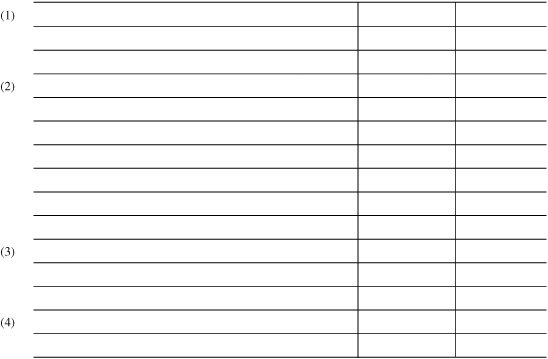

Closing Entries

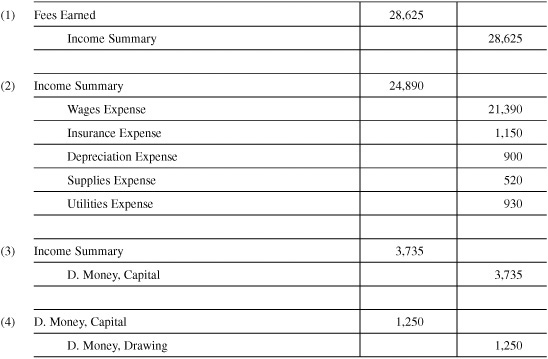

SOLUTION

Closing Entries

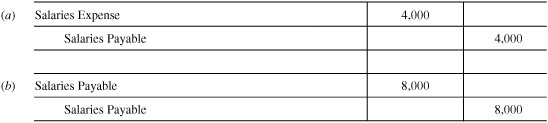

5.12 Prior to the adjustment on December 31, the Salaries Expense account had a debit of $200,000. Salaries owed, but not yet paid, totaled $5,000. Present the entries required to record the following:

(a) Accrued salary as of December 31

(b) The closing of the salary expense account

SOLUTION

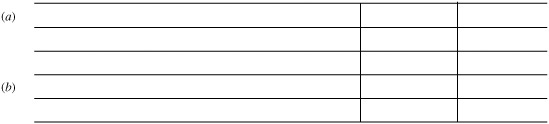

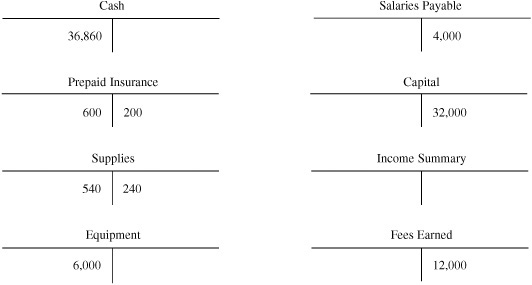

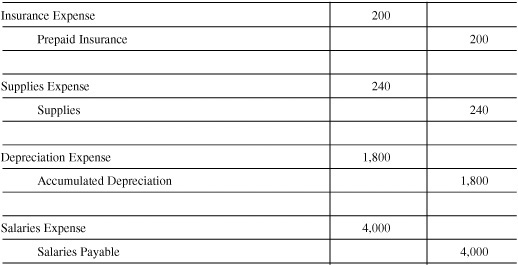

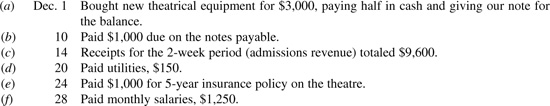

5.13 Selected accounts from the ledger are presented in T-account form below. Journalize the adjusting entries that have been posted to the accounts.

SOLUTION

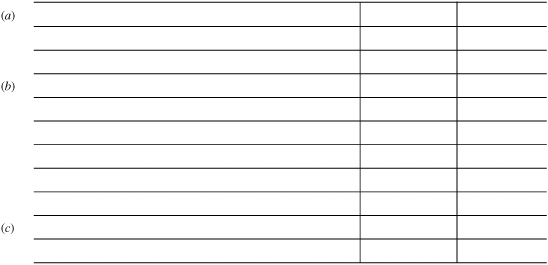

5.14 From the information in Problem 5.13, present the necessary closing entries.

SOLUTION

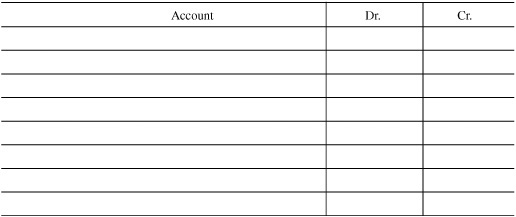

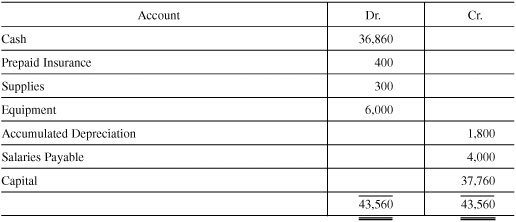

5.15 From the information in Problem 5.14, prepare a post-closing trial balance.

SOLUTION

Post Closing Trial Balance

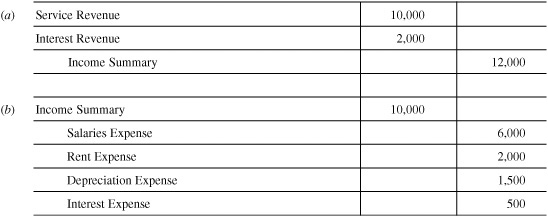

5.16 The trial balance before closing shows service revenue of $10,000 and interest revenue of $2,000. The expenses are: salaries, $6,000; rent, $2,000; depreciation, $1,500; and interest, $500. Give the closing entries to be made to Income Summary for (a) revenues and (b) expenses.

SOLUTION

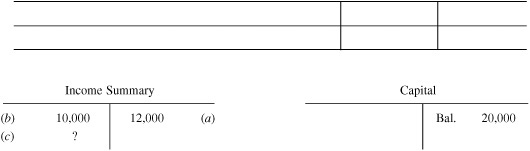

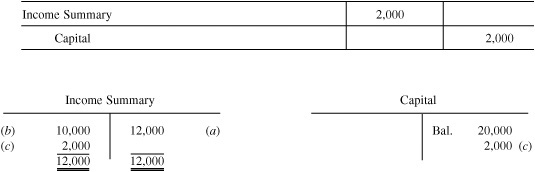

5.17 Using the solution to Problem 5.16, prepare the closing entry for net income, and post the transactions to the Income Summary account and to the Capital account, which had a prior balance of $20,000. Finally, close out the applicable account.

SOLUTION

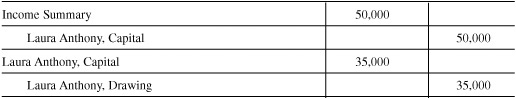

5.18 After all revenue and expense accounts were closed at the end of the fiscal year, the Income Summary account had a debit total of $100,000 and a credit total of $150,000. The capital account for Laura Anthony had a credit balance of $50,000; and Laura Anthony, Drawing, had a debit balance of $35,000. Journalize the closing entries.

SOLUTION

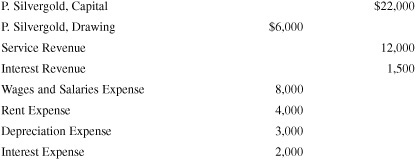

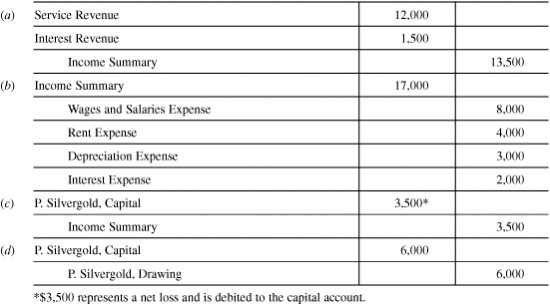

5.19 Based on the balances below, prepare entries to close out (a) revenue accounts, (b) expense accounts, (c) Income Summary account, (d) drawing account.

SOLUTION

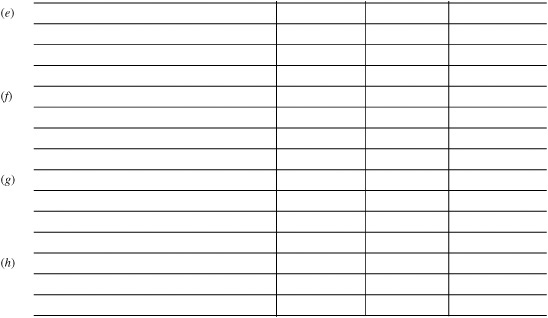

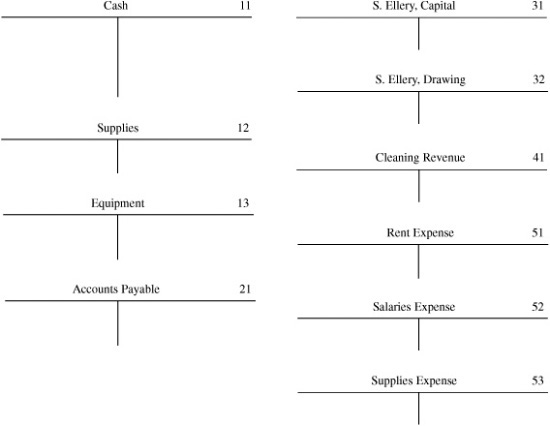

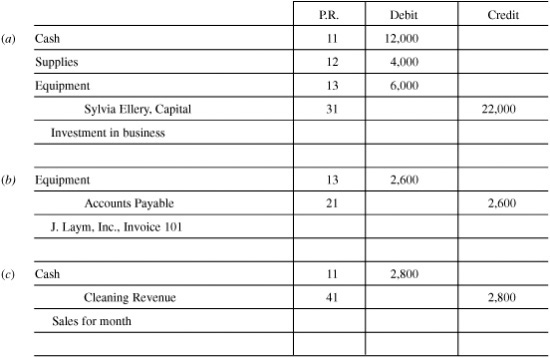

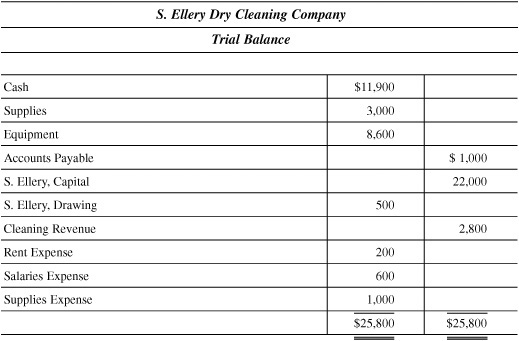

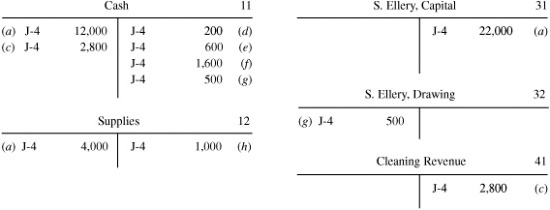

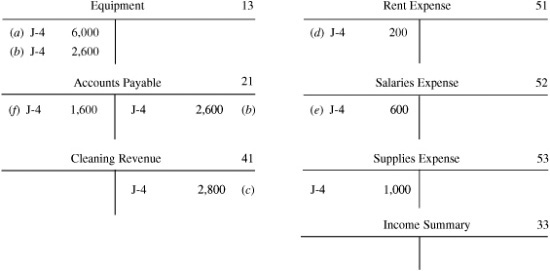

1. Journalize the following transactions and post them to their respective accounts: (a) Sylvia Ellery opened a dry cleaning store on March 1, 200X, investing $12,000 cash, $6,000 in equipment, and $4,000 worth of supplies; (b) bought $2,600 worth of equipment on account from J. Laym, Inc., Invoice 101; (c) received $2,800 from cash sales for the month; (d) paid rent, $200; (e) paid salaries, $600; (f) paid $1,600 on account to J. Laym, Inc.; (g) withdrew $500 for personal use; (h) used $1,000 worth of supplies during the month.

SOLUTION

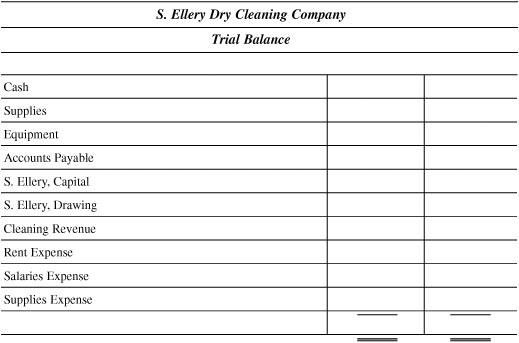

2. Prepare a trial balance from the information for Ellery Dry Cleaners.

SOLUTION

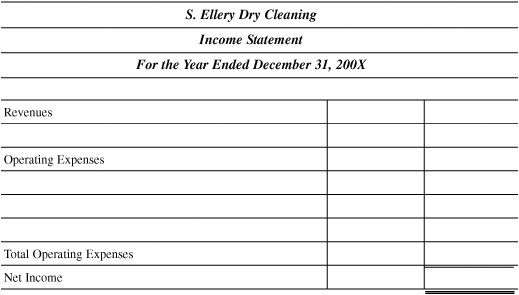

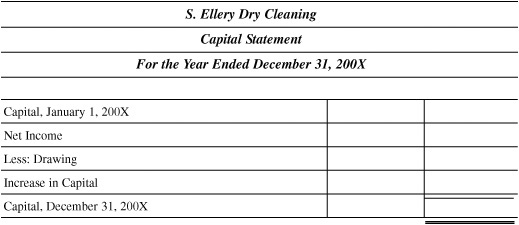

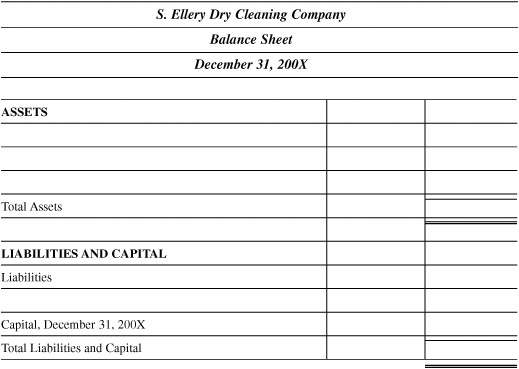

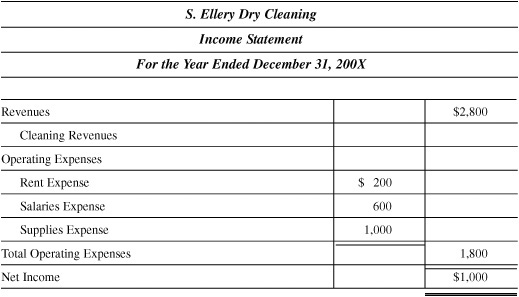

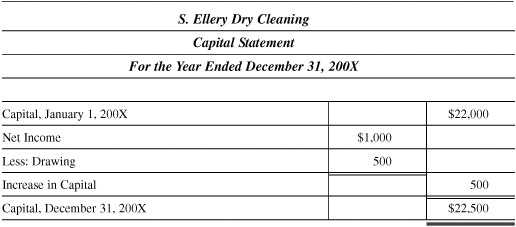

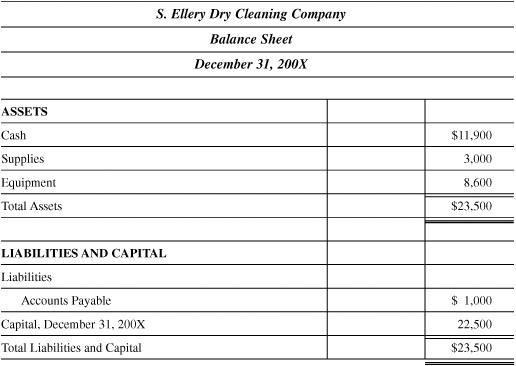

3. Prepare all financial statements needed to reflect the information in the Ellery Dry Cleaners accounts.

SOLUTION

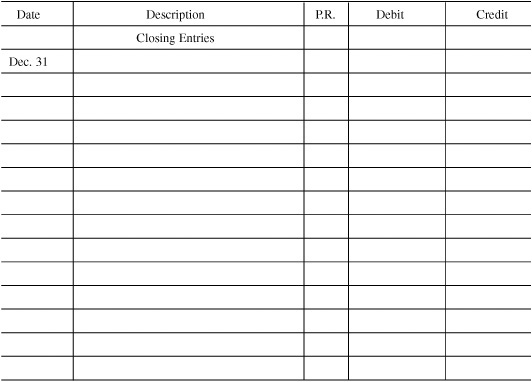

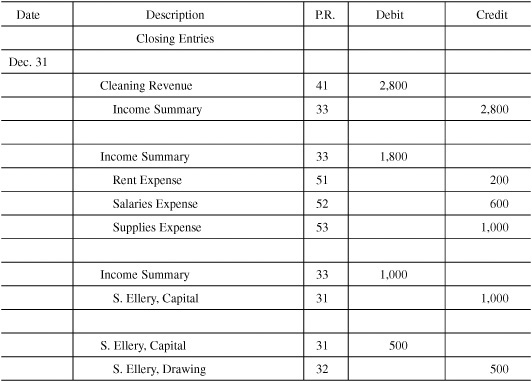

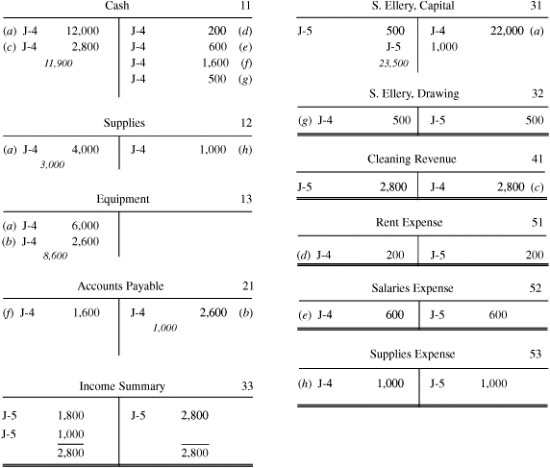

4. Prepare closing entries and post them.

Journal

SOLUTION

Journal

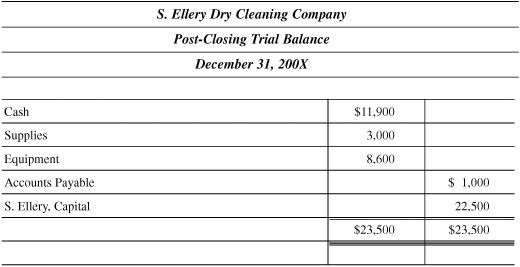

5. Prepare a Post-Closing Trial Balance.

SOLUTION

Part I: Multiple Choice

1. The statement that presents assets, liabilities, and capital of a business entity as of a specific date is termed the (a) balance sheet, (b) income statement, (c) Statement of Owner’s Equity, (d) Statement of Cash Flows.

2. A business paid creditors on account. The effect of this transaction on the accounting equation was to (a) increase one asset, decrease another asset; (b) increase an asset, increase a liability; (c) decrease an asset, decrease a liability; (d) decrease an asset, decrease capital.

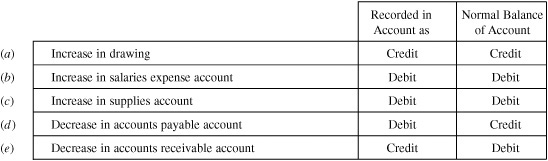

3. Which of the following applications of the rules of debit and credit is false?

4. Which of the following errors, each considered individually, would cause the trial balance totals to be unequal? (a) A payment of $600 to a creditor was posted as a debit of $600 to Accounts Payable and a credit of $60 to Cash. (b) Cash received from customers on account was posted as a debit of $200 to Cash and a debit of $200 to Accounts Receivable. (c) A payment of $285 for equipment was posted as a debit of $285 to Equipment and a credit of $258 to Cash. (d) All of the above. (e) None of the above.

5. Entries journalized at the end of an accounting period to remove the balances from the temporary accounts so that they will be ready for use in accumulating data for the following accounting period are termed: (a) adjusting entries, (b) closing entries, (c) correcting entries, (d) all of the above, (e) none of the above.

6. If the effect of the debit portion of an adjusting entry is to increase the balance of an expense account, which of the following describes the effect of the credit portion of the entry? (a) decreases the balance of an asset account, (b) increases the balance of an asset account, (c) decreases the balance of a liability account, (d) increases the balance of a revenue account, (e) decreases the balance of the capital account.

7. Which of the following accounts should be closed to Income Summary at the end of the year? (a) depreciation expense, (b) sales revenue, (c) supplies expense, (d) rent revenue, (e) all of the above.

8. The adjusting entry to record depreciation of equipment is: (a) debit depreciation expense, credit depreciation payable; (b) debit depreciation payable, credit depreciation expense; (c) debit depreciation expense, credit accumulated depreciation; (d) debit equipment, credit depreciation expense.

9. The difference between the balance of a plant asset account and the related contra-asset account is termed: (a) expired cost, (b) accrual, (c) book value, (d) depreciation, (e) none of the above.

10. At the end of the preceding fiscal year the usual adjusting entry for accrued salaries owed to employees was inadvertently omitted. This error was not corrected, but the accrued salaries were included in the first salary payment in the current fiscal year. Which of the following statements is true? (a) Salary expense was understated, and net income was overstated for the preceding year. (b) Salary expense was overstated, and net income was understated for the current year. (c) Salaries payable was understated at the end of the preceding fiscal year. (d) All of the above. (e) None of the above.

11. If total assets decreased by $5,000 during a period of time and capital increased by $15,000 during the same period, the amount and direction (increase or decrease) of the period’s change in total liabilities is: (a) $10,000 increase, (b) $10,000 decrease, (c) $20,000 increase, (d) $20,000 decrease.

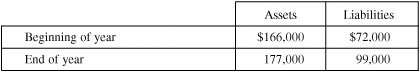

12. The total assets and total liabilities of a particular business enterprise at the beginning and at the end of the year appear below. During the year, the owner had withdrawn $18,000 for personal use and had made an additional investment in the enterprise of $5,000. The amount of net income or net loss for the year was (a) net income of $11,000; (b) net income of $13,000; (c) net loss of $27,000; (d) net loss of $3,000.

13. The balance in the prepaid insurance account before adjustment at the end of the year is $1,840, and the amount of insurance expired during the year is $720. The adjusting entry required is: (a) debit insurance expense, $720; credit prepaid insurance, $720; (b) debit prepaid insurance, $720; credit insurance expense, $720; (c) debit insurance expense, $1,120; credit prepaid insurance, $1,120; (d) debit prepaid insurance, $1,120; credit insurance expense, $1,120.

14. A business enterprise pays weekly salaries of $5,000 on Friday for a 5-day week ending on that day. The adjusting entry necessary at the end of the fiscal period ending on Tuesday is: (a) debit salaries payable, $2,000; credit salaries expense, $2,000; (b) debit salaries expense, $2,000; credit salaries payable, $2,000; (c) debit salaries expense, $2,000; credit drawings, $2,000; (d) debit drawings, $2,000; credit salaries payable, $2,000.

15. Cash of $650 received from a customer on account was recorded as a $560 debit to Accounts Receivable and a credit to Cash. The necessary correcting entry is: (a) debit Cash, $90; credit Accounts Receivable, $90; (b) debit Accounts Receivable, $90; credit Cash, $90; (c) debit Cash, $650; credit Accounts Receivable, $650; (d) debit Cash, $1,210; credit Accounts Receivable, $1,210.

Part II: Problems

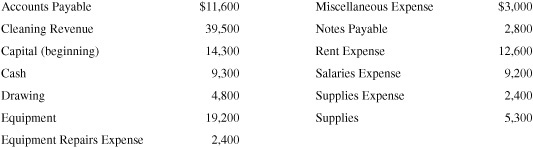

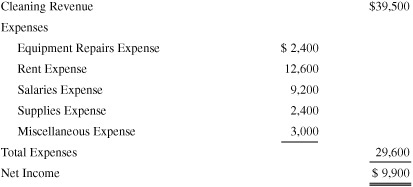

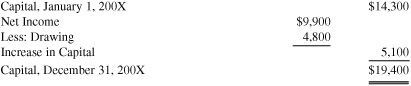

1. Below are the account balances of the State-Rite Cleaning Company as of December 31, 200X. Prepare (a) an income statement, (b) a statement of owner’s equity, (c) a balance sheet.

2. For each numbered transaction below, indicate the account to be debited and the account to be credited by placing the letter representing the account in the appropriate column: Accounts Payable (a); Capital (b); Cash (c); Drawing (d); Equipment (e); Fees Revenue (f); Notes Payable (g); Rent Expense (h); Salaries Expense (i); Supplies (j); Supplies Expense (k).

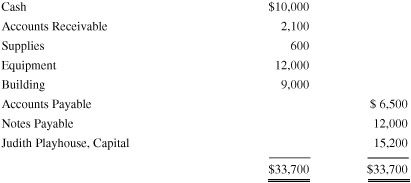

3. The balances of the accounts of the Judith Playhouse, as of November 30, were as follows:

Judith Playhouse Trial Balance November 30

Selected transactions for the month of December were:

Prepare all necessary entries to record the above transactions.

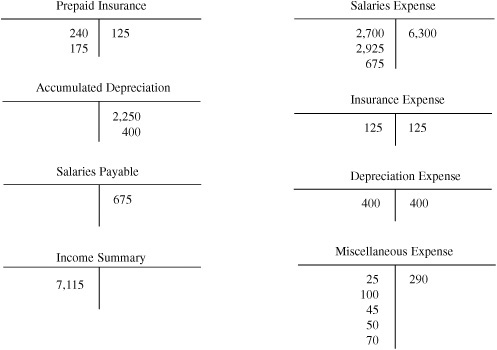

4. Using the following data, prepare journal entries for the month of December.

(a) Weekly salaries of $8,000 are payable on Friday for a 5-day week. What is the adjusting entry if the fiscal period ends on Wednesday?

(b) An insurance policy covering a 4-year period was purchased on February 1 for $1,200. What is the adjusting entry on December 31?

(c) Office supplies of $700 were debited to Office Supplies during the month. The account has $300 worth still on hand. Prepare the adjusting entry.

5. After all income and expense accounts of the Gold Silver Company were closed at the end of the year, the income summary had a debit balance of $125,000 and a credit balance of $190,000. The capital account had a credit balance of $72,000, whereas the drawing account had a debit balance of $12,000. Journalize the closing entries.

6. Selected accounts from a ledger are presented in T-account form. (a) Journalize the adjusting entries that have been posted to the account. (b) Journalize the closing entries that have been posted to the account.

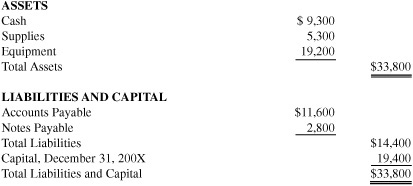

7. Journalize the following transactions:

(a) Ronald Henderson began his dentistry practice by investing $24,000 cash, $12,000 in equipment, and $6,000 in supplies.

(b) Bought $5,000 worth of equipment, paying $1,000 and owing the balance to Halpern Company.

(c) Received $4,200 from fees for the month.

(d) Paid rent of $600.

(e) Paid salaries of $1,200.

(f) Paid half of the amount owed to Halpern Company.

(g) Withdrew $700 for personal use.

(h) Supplies on hand, $5,000.

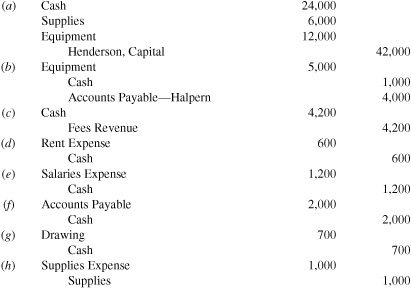

8. Post from the journal in Problem 7 and present a trial balance.

9. Based on the information presented in Problem 8, journalize all necessary entries to close the accounts. Then post and rule them.

Part I

1. (a);

2. (c);

3. (a);

4. (d);

5. (b);

6. (a);

7. (e);

8. (c);

9. (c);

10. (d);

11. (d);

12. (d);

13. (a);

14. (b);

15. (d)

Part II

1. (a)

State-Rite Cleaning Company Income Statement For the Period Ending December 31, 200X

(b)

State-Rite Cleaning Company Statement of Owner’s Equity For the Period Ending December 31, 200X

(c)

State-Rite Cleaning Company Balance Sheet December 31, 200X

2.

3.

4.

5.

6.

7.

8.

Trial Balance

9.