) in the Posting Reference column of the journal to indicate that a posting has been completed.

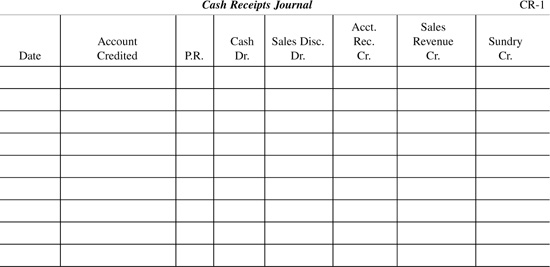

) in the Posting Reference column of the journal to indicate that a posting has been completed.We have observed that the use of the sales journal and the purchases journal enable us to carry out the journalizing and posting processes more efficiently. These special journals save space by permitting the recording of an entry on one line and the posting of total columns rather than individual figures. This is also true of the cash receipts journal and the cash disbursements journal.

All receipts (cash and checks) received by a business are recorded daily in either a cash receipts or a combination cash journal. For control purposes, the cash handling and recording processes are separated. In addition, whenever feasible, receipts are deposited intact (without cash disbursements being made from them) daily. The most common sources of cash receipts are cash sales and collections on account.

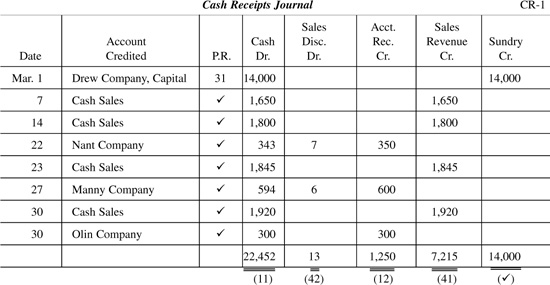

The steps for recording and posting the cash receipts journal are described below and illustrated in Example 1.

1. Record the cash receipts in the cash receipts journal, debiting Cash for the amount received (Cash column) and crediting the appropriate column. Indicate in the Account Credited space:

(a) The customer’s name (subsidiary account) for collections on account.

(b) An explanation (cash sale) for cash sales.

(c) The title of the item involved in the Sundry account.

2. After recording collections on account, post by date to the appropriate subsidiary ledger (customer’s) account.

(a) In the customer’s account, record the amount credited and indicate the source of the entry (Cr.) in the Posting Reference column.

(b) Put a ( ) in the Posting Reference column of the journal to indicate that a posting has been completed.

) in the Posting Reference column of the journal to indicate that a posting has been completed.

3. At the end of the month, total all the columns of the journal and check to be sure that all the columns balance before posting. If they do balance, put a double line under the column totals.

4. Post the column totals (except the Sundry Credit column) to the appropriate general ledger account.

(a) In the appropriate general ledger account, record the amount debited or credited and indicate the source of the entry (Cr.) in the Posting Reference column.

(b) Place the account number of the account posted to under the column totals, to indicate that a posting has been completed.

(c) Each item in the Sundry account is posted individually to the general ledger. The total of the Sundry account is not posted.

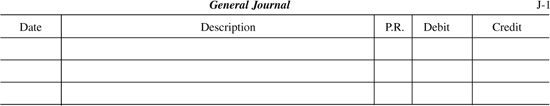

EXAMPLE 1

Centennial Company had the following receipts in March:

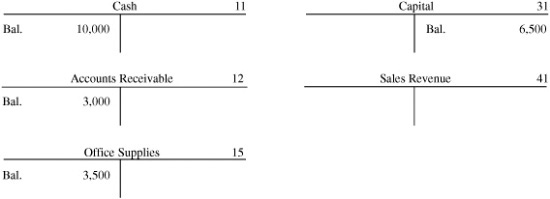

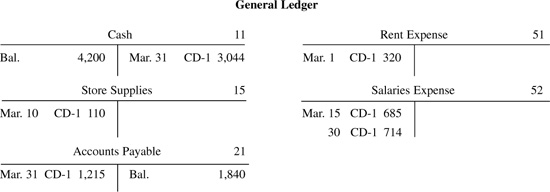

General Ledger

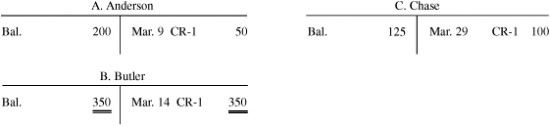

Accounts Receivable Ledger

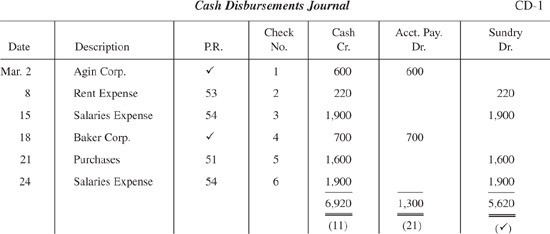

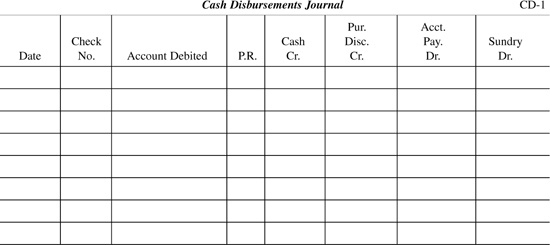

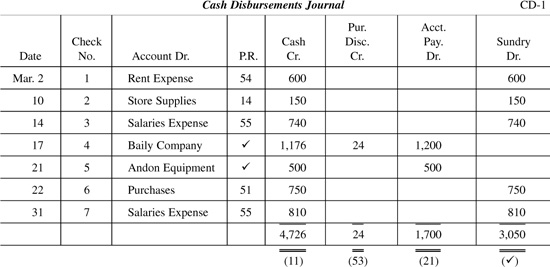

The cash disbursements journal is used to record all transactions that reduce cash. These transactions may arise from payments to creditors, from cash purchases (of supplies, equipment, or merchandise), from the payment of expenses (salary, rent, insurance, and so on), as well as from personal withdrawals.

The procedure for recording and posting the cash disbursements journal parallels that of the cash receipts journal:

1. A check is written each time a payment is made; the check numbers provide a convenient reference, and they help in controlling cash and in reconciling the bank account.

2. The cash credit column is posted in total to the general ledger at the end of the month.

3. Debits to Accounts Payable represent cash paid to creditors. These individual amounts will be posted to the creditors’ accounts in the accounts payable subsidiary ledger. At the end of the month, the total of the accounts payable column is posted to the general ledger.

4. The Sundry column is used to record debits for any account that cannot be entered in the other special columns. These would include purchases of equipment, inventory, payment of expenses, and cash withdrawals. Each item is posted separately to the general ledger. The total of the Sundry column is not posted.

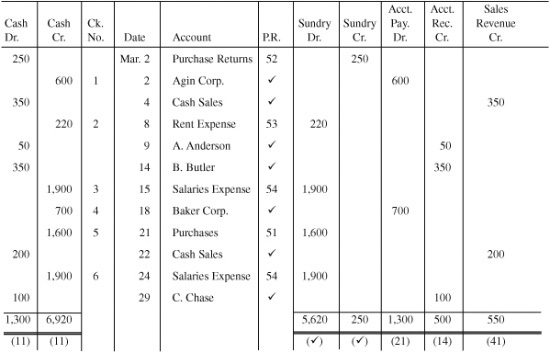

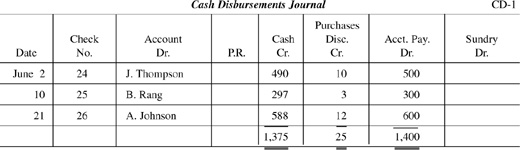

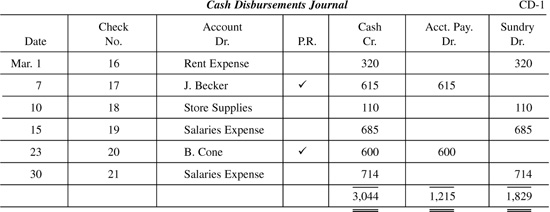

EXAMPLE 2

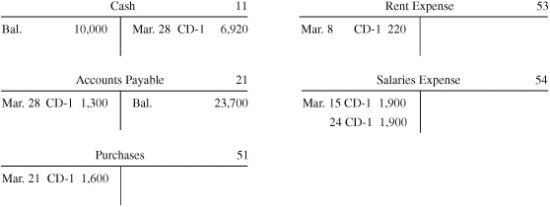

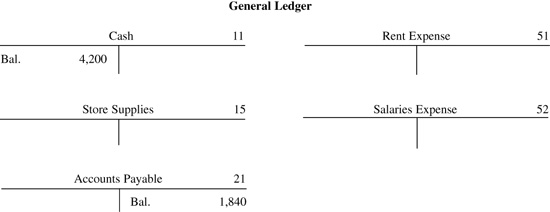

General Ledger

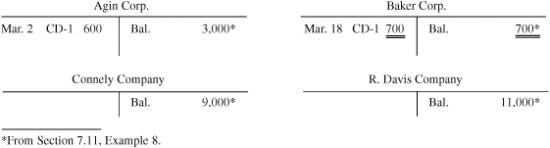

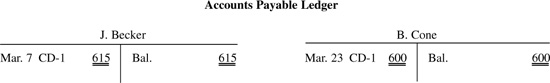

Accounts Payable Subsidiary Ledger

Some companies, primarily for convenience, prefer to record all cash transactions (receipts and disbursements) in one journal. This combination cash journal uses basically the same account columns as the cash receipts and cash disbursements journals, but with a different arrangement of accounts.

This journal makes it easier to keep track on a day-to-day basis of changes in the Cash account, since the debit and credit to Cash are adjacent to one another.

EXAMPLE 3

The combination cash journal below is constructed from the same entries involved in the cash receipts journal (Example 1) and the cash disbursements journal (Example 2).

Combination Cash Journal

1. Receipts of a firm include _____________ and _____________.

2. For cash control purposes, cash handling and _____________ must be separated.

3. The _____________ journal is used to record all transactions that reduce cash.

4. The cash column in the cash receipts journal is _____________, whereas the same column in the cash payments journal is _____________ whenever cash is received or disbursed.

5. In order to record a cash disbursement, a _____________ must be written and assigned a number.

6. _____________ to Accounts Payable represent cash paid to creditors.

7. Accounts Payable is to the cash disbursements journal as _____________ is to the cash receipts journal.

8. Sales Discounts and Purchase Discounts appear in the _____________ statement as reductions of Sales and of Purchases, respectively.

9. Terms of 2/10, n/30 on a $800 purchase of March 6 paid within the discount period would provide a discount of _____________ and a net cost of _____________.

10. The _____________ journal contains all records of cash transactions (receipts and disbursements).

Answers:

1. cash, checks;

2. recording;

3. cash disbursements;

4. debited, credited;

5. check;

6. Debits;

7. Accounts Receivable;

8. income;

9. $16, $784;

10. combination cash

8.1 A sales invoice totaling $3,000 and dated January 14 has discount terms of 2/10, n/30. If it is paid by January 23, what would be the entry (in general journal form) to record this transaction?

SOLUTION

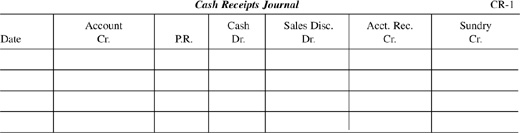

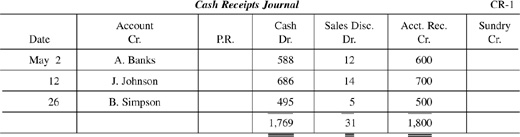

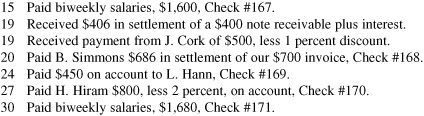

8.2 The cash receipts journal below utilizes a special column for sales discounts. Record the following cash transactions in the journal:

May 2 Received a check for $588 from A. Banks in settlement of his $600 April invoice.

12 Received $686 in settlement of the April invoice of $700 from J. Johnson.

26 Received a check for $495 in settlement of B. Simpson’s April account of $500.

SOLUTION

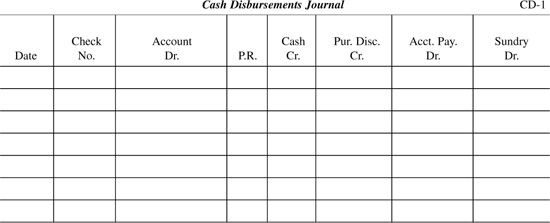

8.3 The cash disbursements journal below utilizes the special column Purchases Discount. Record the cash transactions into the cash disbursements journal.

June 2 Paid J. Thompson $490 in settlement of our April invoice for $500, Check 24.

10 Sent a check to B. Rang, $297, in settlement of the May invoice of $300, Check 25.

21 Paid A. Johnson $588 in settlement of the $600 invoice of last month, Check 26.

SOLUTION

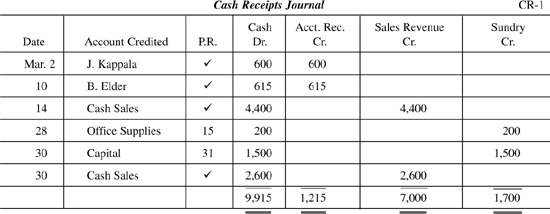

8.4 Record the following transactions in the cash receipts journal:

Mar. 2 Received $600 from J. Kappala in full settlement of her account.

10 Received $615 from B. Elder in full settlement of his account.

14 Cash sales for a 2-week period, $4,400.

28 Sold $200 of office supplies (not a merchandise item) to Smith Company as a courtesy.

30 Owner made additional investment, $1,500.

30 Cash sales for the last 2 weeks, $2,600.

SOLUTION

8.5 Post the information from Problem 8.4 into the accounts receivable subsidiary ledger.

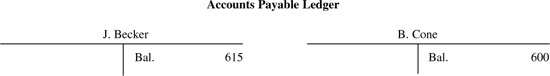

Accounts Payable Ledger

SOLUTION

Accounts Payable Ledger

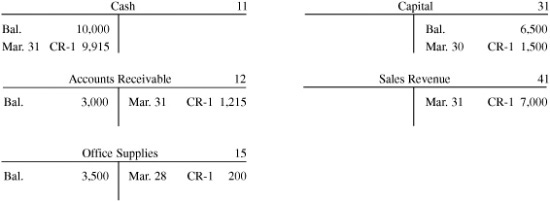

8.6 Post the cash receipts journal totals from Problem 8.4 to the accounts in the general ledger.

General Ledger

SOLUTION

General Ledger

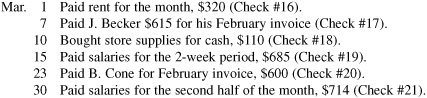

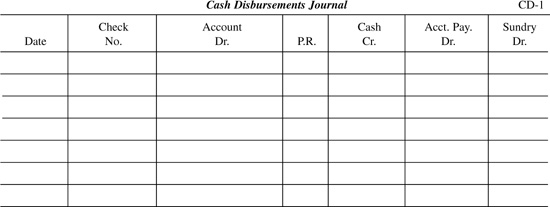

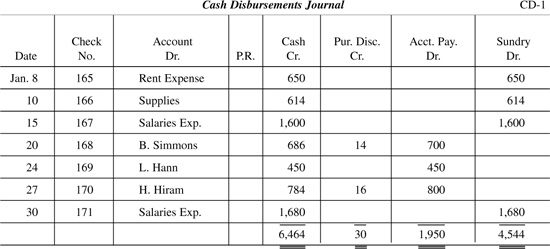

8.7 Record the following transactions in the cash disbursements journal:

SOLUTION

8.8 Post the information from Problem 8.7 into the accounts payable subsidiary ledger.

SOLUTION

8.9 Post the cash disbursements journal from Problem 8.7 to the accounts in the general ledger.

SOLUTION

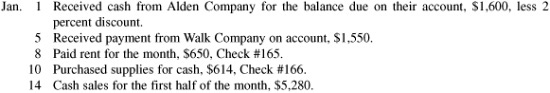

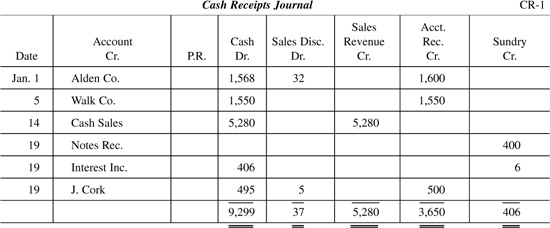

8.10 All transactions affecting the cash account of Park Company for the month of January 200X are presented below:

Record the above transactions in both the cash receipts and the cash disbursements journals.

SOLUTION

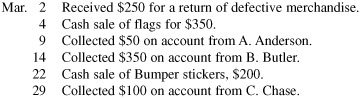

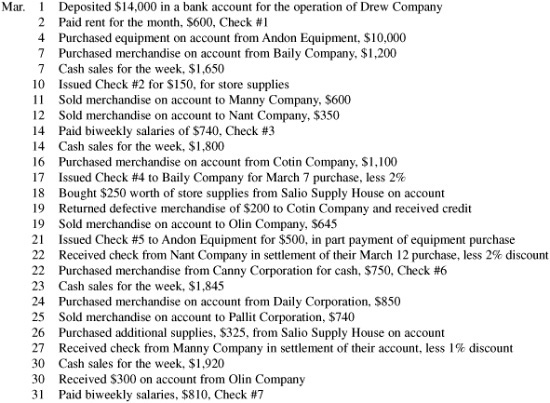

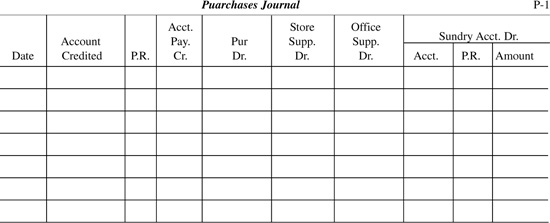

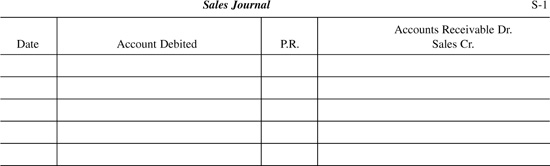

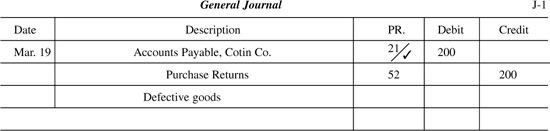

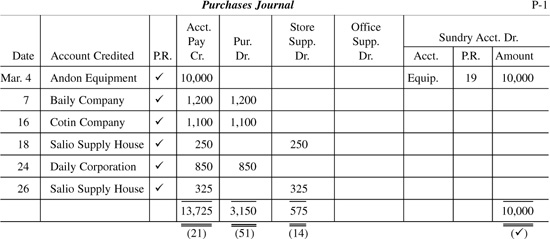

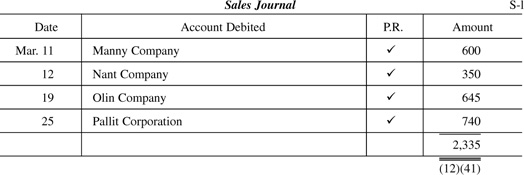

1. William Drew began business on March 1, 200X. The transactions completed by the Drew Company for the month of March are listed below. Record these transactions, using the various journals provided.

SOLUTION

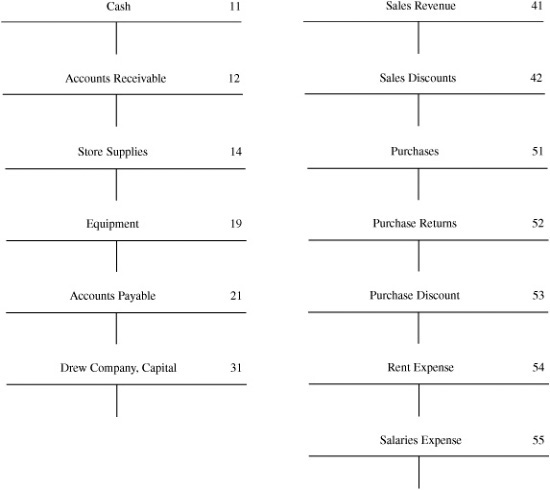

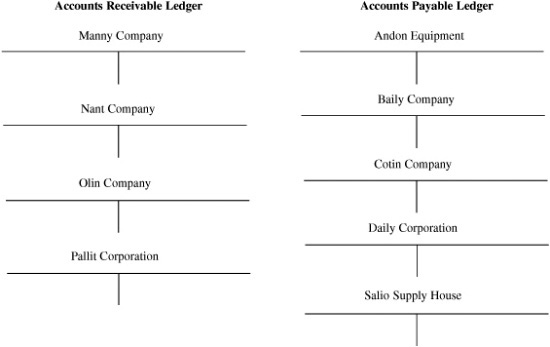

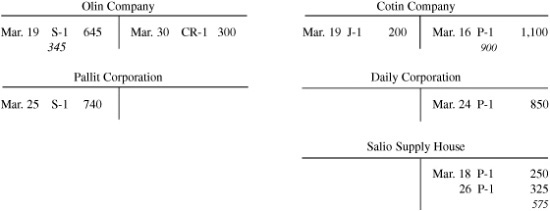

2. Based on the work in part 1, post all transactions to the appropriate accounts in the general ledger, the accounts receivable ledger, and the accounts payable ledger.

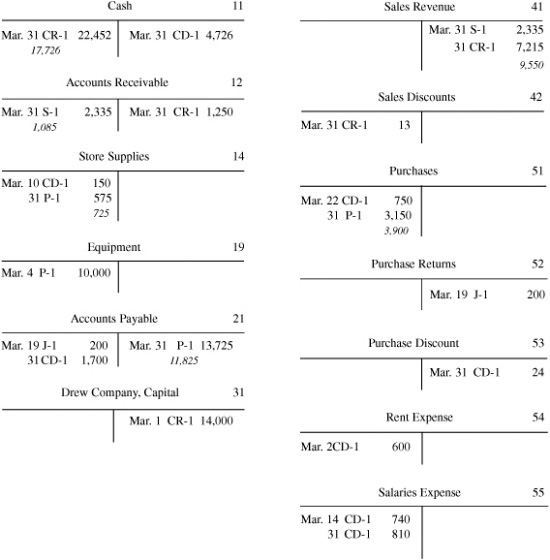

General Ledger

SOLUTION

General Ledger

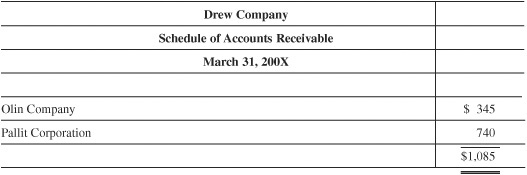

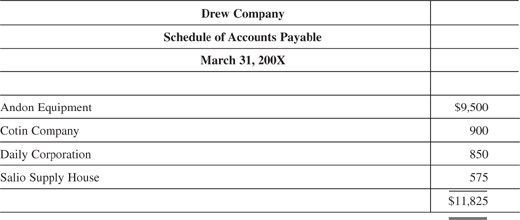

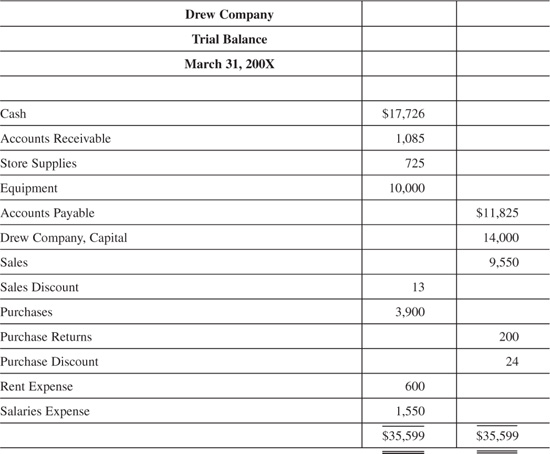

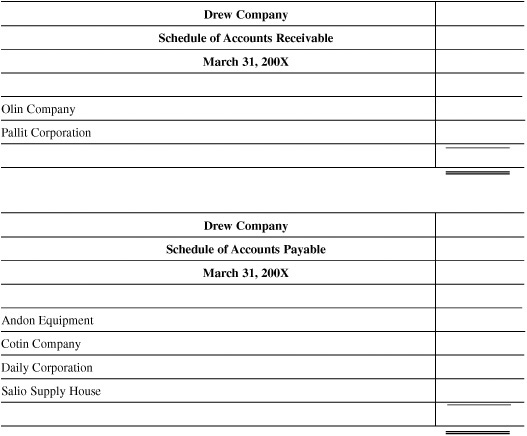

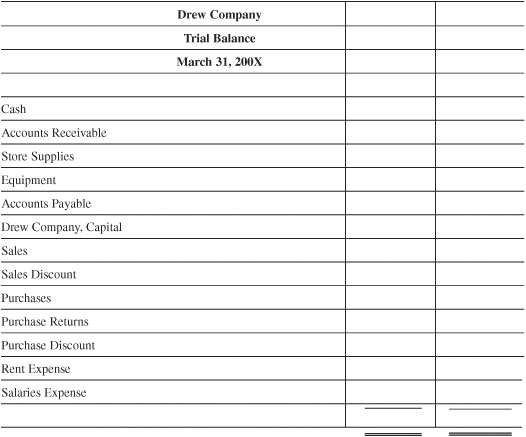

3. Based on the information in parts 1 and 2, prepare a schedule of accounts receivable, a schedule of accounts payable, and a trial balance.

SOLUTION