A large proportion of all business transactions are credit transactions. One way of extending credit is by the acceptance of a promissory note, a contract in which one person (the maker) promises to pay another person (the payee) a specific sum of money at a specific time, with or without interest. A promissory note is used for the following reasons:

1. The holder of a note can usually obtain money by taking the note to the bank and selling it (discounting the note).

2. The note is a written acknowledgment of a debt and is better evidence than an open account. It takes precedence over accounts in the event that the debtor becomes bankrupt.

3. The note facilitates the sale of merchandise on long-term or installment plans.

For a note to be negotiable, it must meet the requirements of the Uniform Negotiable Instrument Law. This legislation states that the instrument:

1. Must be in writing and signed by the maker

2. Must contain an order to pay a definite sum of money

3. Must be payable to order on demand or at a fixed future time

EXAMPLE 1

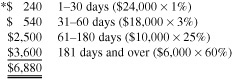

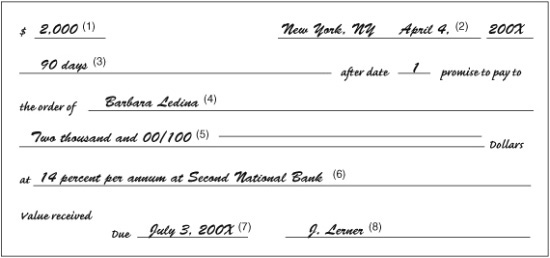

The promissory note on the next page contains the following information:

(1) Face or principal—the amount of the note

(2) Date of the note—date note was written

(3) Term period—time allowed for payment

(4) Payee—individual to whom payment must be made

(5) Face or principal—[see (1)]

(6) Interest—percentage of annual interest

(7) Maturity date—date the note is to be paid

(8) Maker—person liable for payment of the note

For the sake of simplicity, interest is commonly computed on the basis of a 360-day year divided into 12 months of 30 days each. Two widely used methods are (1) the cancellation method and (2) the 6 percent, 60-days method.

The Cancellation Method

The basic formula is

Interest = principal × rate × time

EXAMPLE 2

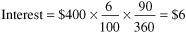

Consider a note for $400 at 6 percent for 90 days. The principal is the face amount of the note ($400). The rate of interest is written as a fraction: 6%/100% = 6/100. The time, if less than a year, is expressed as a fraction by dividing the number of days the note runs by the number of days in a year: 90/360. Thus,

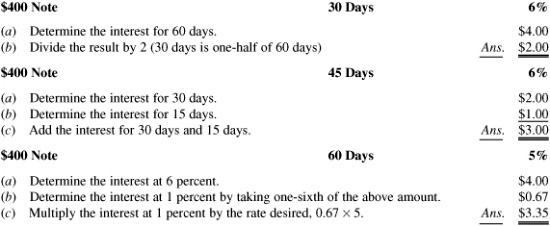

The 6 Percent, 60-Days Method

The 6 percent, 60-days method is a variation of the cancellation method, based on the fact that 60 days, or  year, at 6 percent is equivalent to 1 percent, so that the interest is obtained simply by shifting the decimal point of the principal two places to the left.

year, at 6 percent is equivalent to 1 percent, so that the interest is obtained simply by shifting the decimal point of the principal two places to the left.

EXAMPLE 3

The method also applies to other time periods or other interest rates. For instance:

Determining Maturity Date

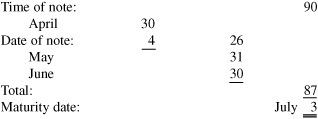

The maturity days are the number of days after the note has been issued and may be determined by:

1. Subtracting the date of the note from the number of days in the month in which it was written.

2. Adding the succeeding full months (in terms of days), stopping with the last full month before the number of days in the note are exceeded.

3. Subtracting the total days of the result of steps 1 and 2 above from the time of the note. The resulting number is the due date in the upcoming month.

EXAMPLE 4

The maturity date of a 90-day note dated April 4 would be computed as follows:

If the due date of a note is expressed in months, the maturity date can be determined by counting that number of expressed months from the date of writing:

EXAMPLE 5

A 5-month note dated March 17 would be due for payment on August 17. A 1-month note dated March 31 would mature on April 30.

A promissory note is a note payable from the standpoint of the maker; it is a note receivable from the standpoint of the payee.

Notes Payable

A note payable is a written promise to pay a creditor an amount of money in the future. Notes are used by a business to (1) purchase items, (2) settle an open account, or (3) borrow money from a bank.

1. Purchase items

EXAMPLE 6

Office Equipment costing $2,000 was purchased by giving a note.

2. Settle an open account

EXAMPLE 7

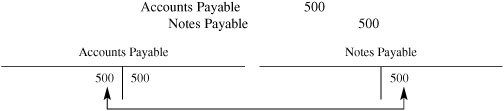

There are times when a corporation must issue a note payable for settlement of an account payable. Assume that the Harmin Agency bought merchandise from Laska Corporation for $500, terms 2/10, n/30. The entry would be recorded in the purchases journal and would appear in the general ledger as:

However, 30 days later, the agency is unable to pay and gives to the Laska Company a 12 percent, 60-day note for $500 to replace its open account. When the Harmin Agency issues the note payable, an entry is made in the general journal that will decrease the accounts payable and increase the notes payable.

Note that the Harmin Agency still owes the debt to the Laska Company. However, it now becomes a different form of an obligation, as it is a written, signed promise in the form of a note payable.

When the maker pays the note in 60 days at 12 percent, the amount of his payment will be the total of the principal and interest will be recorded in the cash disbursements journal.

3. Borrow money from a bank. On occasions, businesses find that it may be necessary to borrow money by giving a note payable to the bank. Frequently, banks require the interest that will be owed to them to be paid in advance. This is accomplished by deducting the amount of the interest from the principal immediately when the loan is made and is known as discounting a note payable. The proceeds will be that amount of money that the maker of the note receives after the discount has been taken from the principal.

EXAMPLE 8

Assume that the Rhulen Agency seeks to borrow $3,000 for 60 days at 14 percent from the Commercial National Bank. The bank will deduct the interest ($70.00) from the $3,000 principal and will give the difference of $2,930 (proceeds) to the Rhulen Agency.

The entry recorded in the cash receipts journal of the Rhulen Agency would be

Sixty days after the issuance of the instrument, the note becomes due, and the Rhulen Agency sends a check for the face of the note ($3,000). Because the interest was deducted immediately when the loan was made, no further interest will be paid at that time. The entry to record the payment of the note will be made in the cash payments journal:

Note: When a business issues many notes payable, a special subsidiary book, known as the notes payable register, may be used. This register will give the complete data for all notes issued and paid by the business. It must be noted, however, that this is merely a source of information and not a journal, as no postings are made from it to the ledger.

Notes Receivable

A note received from a customer is an asset because it becomes a claim against the buyer for the amount due.

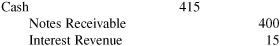

EXAMPLE 9

Assume that Ira Sochet owes S. Wyde $400 and gives him a 15 percent, 90-day note in settlement. On Mr. Wyde’s Books, the entry is

Only the principal ($400) is recorded when the note is received, since it represents the amount of the unpaid account. The interest is not due until the date of collection, 90 days later. At that time the interest earned (revenue) will be part of the entry recognizing the receipt of the proceeds from the note:

The negotiability of a notes receivable based upon its maturity value enables the holder to receive cash from the bank before the due date. This is known as discounting.

Once the interest to be paid has been determined, the procedure for discounting a note is quite simple. We define the maturity value of a note by

1. Maturity value = face of note + interest revenue

where the face is the principal and the interest income is computed as in Section 13.2. The holder of a note may discount it at the bank prior to its due date. He or she will receive the maturity value, less the discount, or interest charge imposed by the bank for holding the note for the unexpired portion of its term. In other words,

2. Discount = maturity value × discount rate × unexpired time

and

3. Net proceeds = maturity value − discount

EXAMPLE 10

Mr. Wyde holds a $400, ninety-day, 15 percent note written on April 10. (See Example 9.) As the holder of the note, he decides to discount it on May 10. The bank’s rate of discount will be assumed to be 15 percent. The interest on the note, as found in Example 9, amounts to $15. Hence,

1. Maturity value = $400 + $15 = $415

Since, at the time of discounting, Mr. Wyde has held the note for only 30 days, the bank will have to wait 90 − 30 = 60 days until it can receive the maturity value. The discount charge is then

2.

and Mr. Wyde receives

3. Net proceeds = $415 − $10.38 = $404.62

In this example, the bank’s discount rate happened to be equal to the interest rate of the note; this need not always be the case.

If the issuer of a note does not make payment on the due date, the note is said to be dishonored. It is no longer negotiable, and the amount is charged back to Accounts Receivable. The reasons for transferring the dishonored notes receivable to the Accounts Receivable account are: (1) the Notes Receivable account is then limited to current notes that have not yet matured; and (2) the Accounts Receivable account will then show the dishonoring of the note, giving a better picture of the transaction.

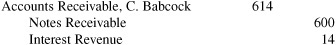

EXAMPLE 11

A $600, sixty-day, 14 percent note written by C. Babcock was dishonored on the date of maturity. The entry is:

Observe that the interest revenue is recorded and is charged to the customer’s account.

When a payee discounts a note receivable, he or she creates a contingent (potential) liability. This occurs because there is a possibility that the maker may dishonor the note. Bear in mind that the payee has already received payment from the bank in advance of the maturity date. The payee is, therefore, contingently liable to the bank to make good on the amount (maturity value) in the event of default by the maker. Any protest fee arising from the default of the note is charged to the maker of the note and is added to the amount to be charged against his or her account.

EXAMPLE 12

An $800, ninety-day, 14 percent note, dated May 1, is discounted on May 31 at 14 percent. Upon presentation on the due date, the note is dishonored. The entry will be:

Had the bank issued a protest fee of $20, the amount charged to the customer would be $848.

Businesses must expect to sustain some losses from uncollectible accounts and should therefore show on the balance sheet the net amount of accounts receivable, the amount expected to be collected, rather than the gross amount. The difference between the gross and net amounts represents the estimated uncollectible accounts, or bad debts. These expenses are attributed to the year in which the sale is made, though they may be realized at a later date.

There are two methods of recording uncollectible accounts, the direct write-off method and the allowance method.

Direct Write-Off Method

In small businesses, losses that arise from uncollectible accounts are recognized in the accounts in the period in which they become uncollectible. Under this method, when an account is deemed uncollectible, it is written off the books by a debit to the expense account, Uncollectible Accounts Expense, and a credit to the individual customer’s account and to the controlling account.

EXAMPLE 13

If William Anderson’s $300 account receivable, dated May 15, 200X, was deemed uncollectible the following January 200Y, the entry in 200Y would be:

Allowance Method

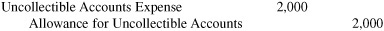

As has been stated before, one of the fundamentals of accounting is that revenue be matched with expenses in the same year. Under the direct write-off method, in Example 13, the loss was not recorded until a year after the revenue had been recognized. The allowance method does not permit this. The income statement for each period must include all losses and expenses related to the revenue earned in that period. Therefore, losses from uncollectible accounts should be deducted in the year the sale was made. Since it is impossible to predict which particular accounts will not be collected, an adjusting entry is made, usually at the end of the year.

EXAMPLE 14

Assume that in the first year of operation a firm has estimated that $2,000 of accounts receivable will be uncollectible. The adjusting entry would be:

The credit balance of Allowance for Uncollectible Accounts (contra asset) appears on the balance sheet as a deduction from the total amount of Accounts Receivable:

The $27,920 will become the estimated realizable value of the accounts receivable at that date. The uncollectible accounts expense will appear as an operating expense in the income statement.

There are two generally accepted methods of calculating the amount of uncollectible accounts. One method is to use a flat percentage of the net sales for the year. The other method takes into consideration the ages of the individual accounts at the end of the fiscal year.

Percentage of Sales Method

Under the percentage of sales method, a fixed percentage of the total sales on account is taken. For example, if charge sales were $200,000 and experience has shown that approximately 1 percent of such sales will become uncollectible at a future date, the adjusting entry for the uncollectible accounts would be:

The same amount is used whether or not there is a balance in Allowance for Uncollectible Accounts. However, if any substantial balance should accumulate in the allowance account, a change in the percentage figure would become appropriate.

Percentage of Receivables Method

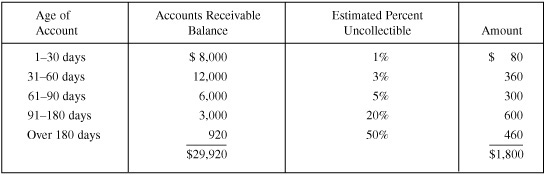

Under the percentage of receivables method, every account is “aged”; that is, each item in its balance is related to the sale date. The further past due the account, the more probable it is that the customer is unwilling or unable to pay. A typical analysis is shown in Example 15.

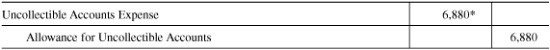

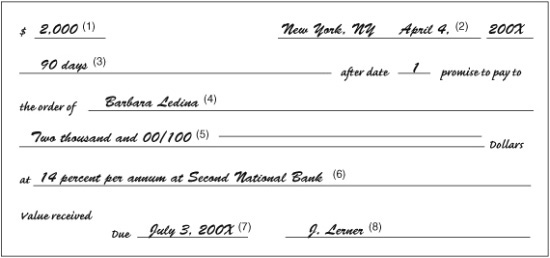

EXAMPLE 15

The calculated allowance for uncollectible accounts ($1,800 in Example 15) is reconciled at the end of the year with the actual balance in the allowance account, and an adjusting entry is made. The amount of the adjusting entry must take into consideration the balance of the Allowance for Uncollectible Accounts. The percentage of sales method does not follow this procedure.

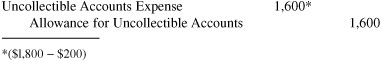

EXAMPLE 16

The analysis showed that $1,800 would be required in the Allowance for Uncollectible Accounts at the end of the period. The Allowance for Uncollectible Accounts has a credit balance of $200. The adjusting entry at the end of the year would be:

If, however, there had been a debit balance of $200, a credit to Allowance for Uncollectible Accounts of $2,000 would be necessary to bring the closing balance to $1,800.

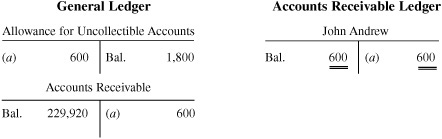

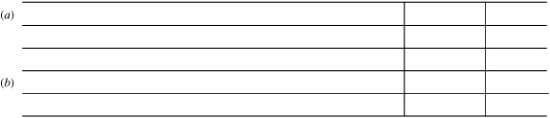

When it becomes evident that a customer’s account is uncollectible, it is written off the books. This is done by crediting Accounts Receivable (and the individual customer’s account in the subsidiary ledger for the amount deemed uncollectible) and by debiting Allowance for Uncollectible Accounts. Note that there is no expense at this time, as it had already been estimated as a loss in the previous year.

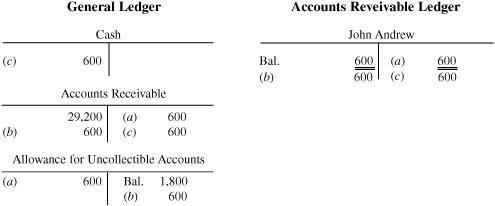

EXAMPLE 17

John Andrew’s account (a) was deemed uncollectible.

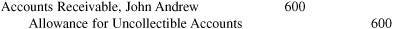

If a written-off account is later collected in full or in part (a recovery of bad debts), the write-off will be reversed for the amount received.

EXAMPLE 18

At a later date, Mr. Andrew (see Example 17) pays his account in full. The reversing entry (b) to restore his account will be:

A separate entry, (c), will then be made in the cash receipts journal to record the collection, debiting Cash $600 and crediting Accounts Receivable, John Andrew. If a partial collection was made, the reversing entry should be made for the amount recovered.

1. If Robert Glatt issues an $800 note to Richard Tobey, Glatt is called the _______________ and Tobey the _______________.

2. What effect does the acceptance of a note receivable, in settlement of an account, have on the total assets of a firm?

3. The holder of a note can usually obtain money by taking it to a bank and _______________ it.

4. A note is written evidence of a _______________.

5. When a payee discounts a note receivable, he or she creates a _______________ liability.

6. The face of a note plus the interest due is known as _______________.

7. Banks will normally take their discount on the _______________ of the note.

8. A written promise to pay a creditor an amount of money in the future is known as a _______________.

9. The _______________ will be that amount of money that the maker of the note receives after the discount has been taken from the principal.

10. If many notes are issued by a firm, a _______________ may be needed.

11. The two methods of recording uncollectible accounts are the _______________ method and the _______________ method.

12. There are two methods of calculating the amount of uncollectible accounts. They are the _______________ method and the _______________ method.

Answers:

1. maker, payee;

2. no effect—both are current assets;

3. discounting;

4. debit (obligation);

5. contingent;

6. maturity value;

7. maturity value;

8. note payable;

9. proceeds;

10. notes payable register;

11. direct write-off, allowance;

12. percentage of sales, balance sheet

13.1 Below is an example of a note receivable.

(a) Who is the maker of the note? (b) Who is the payee of the note? (c) What is the maturity date of the note? (d) What is the maturity value of the note?

SOLUTION

(a) Ruth Brent; (b) Concord, Inc.; (c) September 29; (d) $931.50

13.2 A note written on August 1 and due on November 15 was discounted on October 15. (a) How many days was the note written for? (b) How many days did the bank charge for in discounting the note?

SOLUTION

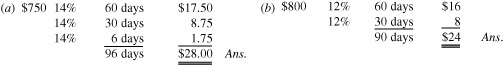

13.3 Determine the interest on the following notes: (a) $750 principal, 14 percent interest, 96 days; (b) $800 principal, 12 percent interest, 90 days.

SOLUTION

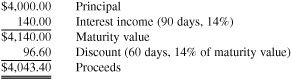

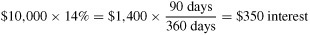

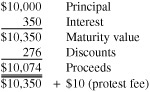

13.4 A $4,000, ninety-day, 14 percent note receivable in settlement of an account, dated June 1, is discounted at 14 percent on July 1. Compute the proceeds of the note.

SOLUTION

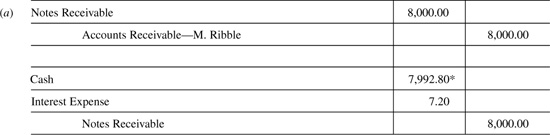

13.5 What are the entries needed to record the information in Problem 13.4 (a) on June 1? (b) on July 1?

SOLUTION

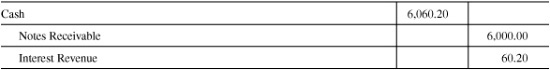

13.6 A $6,000, 120-day, 14 percent note receivable, dated September 1, is discounted at 14 percent on October 1. What is the entry needed on October 1?

SOLUTION

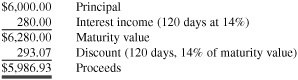

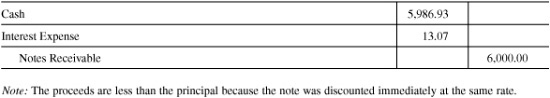

13.7 Based on the information in Problem 13.6, what entry would be needed if the note were discounted immediately?

SOLUTION

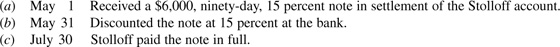

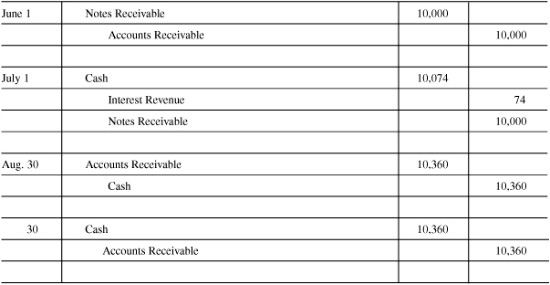

13.8 Record the following transactions in the books of John Agin Company:

SOLUTION

(c) No entry

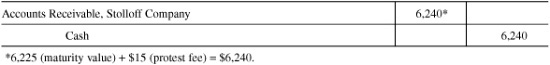

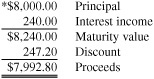

13.9 If, in Problem 13.8, Stolloff dishonored his obligation on July 30 and a $15 protest fee was imposed by the bank, what entry would be required to record this information?

SOLUTION

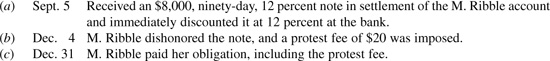

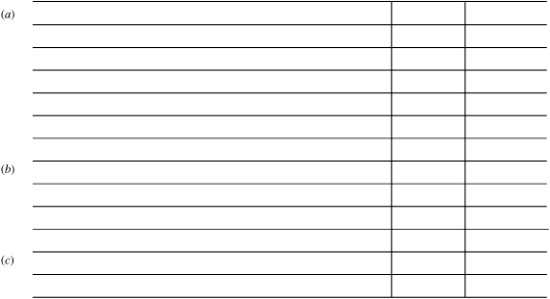

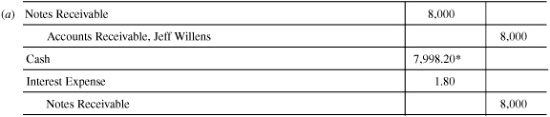

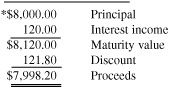

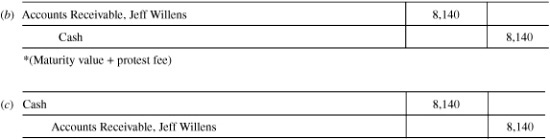

13.10 Record the following transactions in the books of Carl Bresky:

SOLUTION

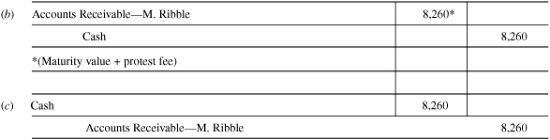

13.11 The Erin Corporation borrowed $5,000 for 90 days at 16 percent from the Sullivan National Bank. What entries are needed to (a) record the loan and (b) record the repayment?

SOLUTION

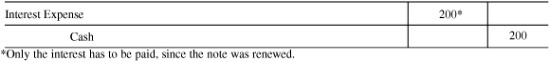

13.12 Based on the information in Problem 13.11, what entry would be necessary if, after 90 days, Erin Corp. was unable to repay the loan and was granted another 90-day renewal?

SOLUTION

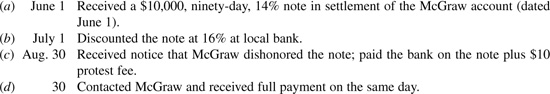

13.13 Record the following transactions in the books of B. K. Logging:

Journal Entries

SOLUTION

Journal Entries

July 1:

August 30:

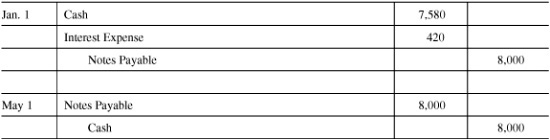

13.14 Hill Top Diner borrowed $8,000 for 120 days at 15.75 percent from the local bank. The note was dated January 1. Show the entries recording the loan and the payback of the note.

Journal Entries

SOLUTION

Journal Entries

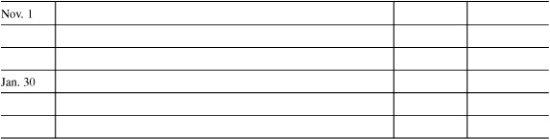

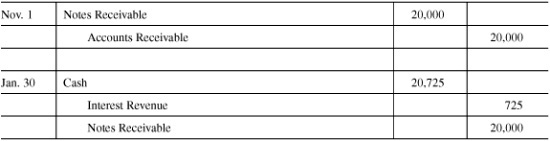

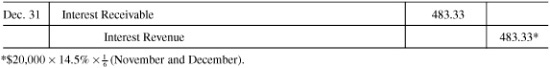

13.15 Received a $20,000, ninety-day, 14.50 percent note from Sun Town Company on account (note was dated November 1). Sun Town paid the note on the due date. Show the entries for this transaction.

Journal Entries

Journal Entries

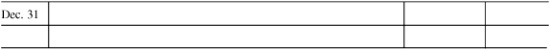

13.16 From the preceding problem, what would the adjusting entry be on December 31 if that was the last day of the accounting period?

Journal Entry

SOLUTION

Journal Entry

13.17 Record the following transactions in the books of Carl Klein:

SOLUTION

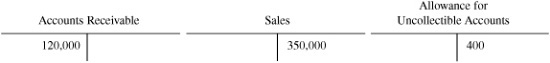

13.18 Shown are balances for Prurient Press:

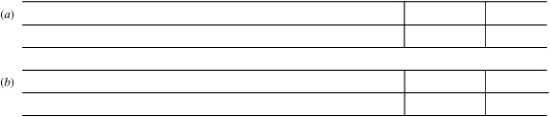

What is the adjusting entry needed to record the provision for uncollectible accounts if the uncollectible expense is estimated (a) as 1 percent of net sales? (b) by aging the accounts receivable, the allowance balance being estimated as $3,600?

SOLUTION

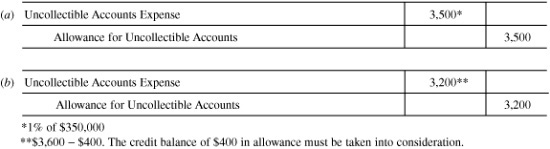

13.19 Below are some accounts of the Jay Balding Company, as of January 200X.

Prepare entries needed to record the following information:

SOLUTION

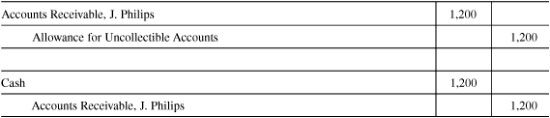

13.20 If, in Problem 13.19, J. Philips later paid his account in full, what entries would be necessary?

SOLUTION

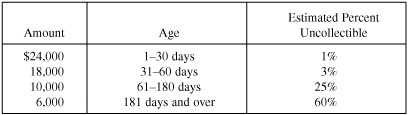

13.21 Using the aging schedule below, prepare the adjusting entry providing for the uncollectible accounts expense.

SOLUTION