The title of this chapter is a little tongue-in-cheek, but when it comes to applying the principles of good property management, size really doesn’t matter. Period. When you don’t apply sound property management principles, however, and things start to go horribly wrong, then this principle applies: The larger the property, the greater the financial loss.

![]()

Rich Dad Tip

![]()

Sound Principles of Property Management Translate to Success No Matter What the Size of an Investment

I can think of two properties that illustrate this point perfectly. One was a large multifamily property in Arizona my company managed, the other, a single-family home in Washington that was owned by my inlaws. (All names and identifying details have been changed.) Not only are these stories tragic in their own way, but they’re also common. Investors continually make the same mistakes when it comes to managing real estate, and the effects are devastating no matter what size the property is.

My company managed a building in Arizona that perfectly illustrates common mistakes and the results of not applying sound property management principles. To this day the property is infamous in my company even though we haven’t managed it for years.

The building consisted of 200 units in a very nice suburban area of town, and was purchased by a group outside the state. Of the many mistakes made by the group, they had purchased the property sight unseen nor did they have anyone to inspect the property. Additionally, they knew nothing about the market. Instead of hiring a local management company with knowledge of the market, and connections with local vendors, they chose to manage in-house to “save” on management fees, and hired an inexperienced person, a “friend” they knew, to fly to Arizona and look after the property once a month. The result was a disaster. This basic mistake cost their investors millions of dollars.

After realizing that they were in a very serious financial predicament, the managing owners contacted me and asked my company to manage the property for them. Reluctantly, I told them I would. I knew that this would not be easy by any means, and my initial fears were validated after we took over the property and thoroughly investigated all aspects of its operations. The following is a letter I wrote to the owners, explaining the steps we took to begin getting the property in order. The amazing thing is we spent every single day of an entire month using full-time labor to produce the information in this letter. If you find yourself shaking your head in disbelief as you read, believe me, you are not alone.

In accordance with our conversation today, following is a summary of issues encountered in our first three weeks at the property.

1. Property Status—

Upon our arrival at the property, occupancy was 160 units, 80%, with 14 units pre-leased plus four un-leased on notice to vacate. Of the vacant pre-leased units, five were cancelled/denied. In looking at the Rent Roll history, we have determined that the number of move-ins per month averaged 12 all of last year.

February rentals thus far total 13, of which 1 has been denied due to poor credit. We anticipate several more rentals this month. We have targeted units based on a combination of length of time vacant, location and style. Premiums have been implemented on downstairs units ($25, based on larger patio). Large three bedroom units have also been increased by $45 to $l,050/mo.

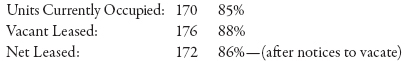

Current Update—(160 units occupied upon take over)

2. Maintenance Issues—

A. Market Ready Units—Of the 40 units vacant when we began, none were ready to rent. We walked all units and assessed damages. Per the breakdown sent to you February 20th we have found that 70% of the vacant units have moderate to extensive damages. Some of these require major renovation and have been “down” over 200 days. Currently, there are five units market ready, and we have moved in nine units.

B. Maintenance Service Requests—Outstanding maintenance service requests upon take over totaled 59. Over the course of the past three weeks, we have utilized maintenance staff from other McElroy properties to help us turn units and get caught up on all service requests except for those that are roofing related. Because of the roof issues, there are some very upset residents who are ready to move out.

C. Staff—The existing maintenance staff has been assessed, and we have determined that both the supervisor and technician will need to be replaced. Schedules for make readies, service requests and grounds work were not being met. We have hired replacements for both positions.

D. Roofing—Roof leaks have been detected throughout the property, specifically in five occupied, and twelve vacant units. Additionally, virtually every building has some degree of breezeway and/or patio lid damage. The result of these leaks has created major interior damage to the drywall, carpet, appliances, and paint. Additionally, we have detected mold in a number of units that will need professional remediation. It is our understanding that there is no warranty from the recent roofs replaced in the last two years. As a result, we have contacted one of our preferred vendors, who has assessed all damage. What they found was that the method used in repairing the roofs previously was a layer over the existing built up roof. They further indicated that the storage units, where we are having severe leaking, were not treated beyond application of tar paper and roofing cement. The bid is based on long and short term repairs. In the meantime, minor remedial repairs will be made immediately. Estimated Cost: $30,000

E. Patios—Seven occupied, and two vacant upstairs patio decks have rotted, and are a major liability. This is a result of standing water on artificial turf. We have determined that the best and least costly repair will be to remove the turf, and overlay the existing plywood (if viable) with another sheet of plywood using drywall screws. An elastomeric product will then be applied to prevent future damage. This is something that we will be addressing immediately, since it is a safety issue. Residents cannot use their decks because they could fall through the dry rot and seriously injure themselves. Estimated Cost: Nine decks @ $250 each = $2,250

F. Hot Water Heaters—Five hot water heaters have required replacement this month as a result of rusting out. This work has been done in-house. Estimated Cost: $2,000

G. Carpets/Flooring—Upon walking all vacant units, there are 10 that will need carpet replacements, with a potential of an additional two that may not come clean. It appears, however, that the vinyl in all of the vacant units is in good condition. Estimated Cost: $9,000

H. Interior Doors—31 doors are damaged/missing due to resident neglect in vacant units. Estimated Cost: $1,000

I. Appliances—Seven refrigerators and one range are missing or damaged and need replacement in vacant units. Estimated Cost: $3,500

J. Windows—Due to vandalism, six windows are broken in vacant units. Downstairs windows are boarded up. Estimated Cost: $750

K. HVAC—Two condenser fan motors need to be replaced (robbed for use in other units). Estimated Cost: $550

L. Drywall Repairs—Many of the vacant units have significant drywall damage due to roof leaks and resident abuse. The prior assistant manager’s unit has major drywall damage due to vandalism. The recently evicted assistant manager moved into the adjacent unit and kicked a hole through the drywall to gain access to her previous unit. Mold is also a concern, and units may need remediation. Estimated Cost: $ 15,000

M. Cabinets and Drawers—A combination of 15 drawers and cabinet doors are missing/damaged in vacant units. Estimated Cost: $500

N. Tennis Court—It has become necessary to lock up the tennis court due to the broken fence. Several support poles are rusted through and present a liability. We are accepting bids for repairs. Estimated Cost—$2,000

3. Cash Position—Collections thus far this month total $92,000.

This amount does not include the $12,000 in pre-paid rent that was deposited into your account. Expenses so far, including open accounts payable and the invoices you turned over to us yesterday, total $110,800. We estimated a negative cash flow for the next six months of approximately $100,000 (after payment of the monthly accounts payable).

4. Other Issues—

A. Delinquent rental payments are high, due to very poor resident profile. We will most likely evict 30-40 residents.

B. Due to the recent murder and vandalism, we have experienced unanticipated turnover. We are working with our on-site officer to step up his patrol to help deter future instances of crime. We have also met with the city crime-free officer. Police tape with “STAY BACK” makes it hard to show units.

C. We are currently auditing the resident files, and have found several errors and unsigned leases.

D. Reorganization of the office has been completed. Resident files were not in filing cabinets, and the office was in disarray.

E. Maintenance shop has been cleared of trash and broken furniture. Maintenance parts have been inventoried and organized.

F. Upon take over we found that nothing had been entered into the computer system for two weeks. We consequently updated the January activity and completed your month end close out.

Summary of Costs: |

|

Estimated Management Neglect |

$104,800 |

Unpaid Bills at Turnover to Us |

$110,800 |

Negative Cash Flow Months 1-6 |

$100,000 |

Monies Needed from Ownership |

$315,600 |

As you can see, there are many issues and adversities facing us with probably more to come. I feel the majority of the issues have been identified and we have plans for each to be corrected. We will keep you updated. We need to talk about funding these issues.

Sincerely,

Ken McElroy

President

As I mentioned earlier, it took us nearly an entire month to put this letter together. We had to audit every file on the property, walk every unit, and inspect every aspect of the building exteriors. We are talking about major man-hours. All the result of bad management.

In addition to the challenges that my management company faced with the operations of the property at takeover, we also had to deal with an ownership that was uncooperative and hostile toward us. The reason for the hostility stemmed from the bruised egos of the ownership. Unfortunately, they had no idea of the magnitude of damage that had been done to their investment. Once we finally compiled all the information and presented it to them in monetary form, denial began to set in. Instead of wanting to take responsibility for their poor management decisions, or lack of any management at all, really, they chose to ignore our feedback.

The labor involved in meetings, working with subcontractors, interacting with residents, rehiring and retraining staff, holding conference calls, faxing and e-mailing, doing projections, spreadsheets, and budgets, and dealing with very upset and unpaid vendors was a huge strain and a mental drain on me and my staff. Oh, and by the way, my company did all this for about $3,000 per month in fees. That’s less than I pay my assistant.

The ownership had let the accounts payable slip into the red until the hole was too big to dig out of. And a constant point of contention was the fact that it would not give us the money to pay the outstanding payables amassed for services rendered before we even took over the property.

The managing ownership delayed the inevitable and blamed “new management” (my company) for lack of cash flow. What was even worse was that it was not communicating any of this to its investors. Who wants to tell investors who have placed millions of dollars with you that you royally screwed up and lost the money? It’s much easier to live in denial and place blame on someone else, which is exactly what they were doing. And because of the fact that the managing owners were not communicating with their investors, the investors were calling us with lots of questions. This placed even more stress on the relationship between my company and the managing ownership.

As I mentioned, the managing ownership would not provide the money necessary to pay the outstanding bills. Even worse, because of the precarious financial state of the property when we took over, it became apparent that we wouldn’t even have money to pay staff salaries and the property’s mortgage. Finally, because the ownership was not willing to relinquish the money needed, even though they were contractually bound to do so, we exercised our contractual right to go around the managing ownership and call all the investors ourselves, asking them for more money on top of what they had invested to pay the accounts and payroll. This did not go over well as you can imagine, and, once again, rather than taking responsibility as they should have, the managing owners fired my company.

The next management company they hired lasted six months. At which point, the state of the property was so completely beyond repair that they had to sell the building at a significant loss.

Did you catch the reference to the murder in my letter to the ownership? That too was a direct result of bad management. The prior management didn’t screen their prospective residents properly and thus allowed criminal elements to slowly creep in. The murder was a professional hit according to the city crime unit. It was a horrible reminder that without good management, even a good property in a nice location can become an eyesore—and a danger—for the community.

Beyond the condition of the property itself, we assisted the ownership in settling an overpayment in sewer fees to the city to the tune of $35,460. The property had sixty-eight units demolished to make room for a highway, and the sewer billing was based on a cost-per-unit basis. The existing owner had not thought to inform the city that the number of units had changed due to the demolition and had been overpaying their sewer bill for forty-two months.

What is worse, we discovered that even before the demolition the city had been billing the property for 280 units. The property was only 268 units before the demolition. They had been doing that for forty-nine months. All said and done, the property had been overbilled continually on a monthly basis by the city for ninety-one months—seven and a half years!

Many in my company jokingly refer to this property as cursed. The truth of the matter is that no property is cursed, only mismanaged. No matter the size, a property that is managed well, will perform well, and grow in value.

The irony of this situation is that although the managing ownership was in denial about the situation they micromanaged our every move. Cash was tight and their problems became our problems. In the end, being frustrated with us for constantly asking for money to fix the property, and with themselves for constantly avoiding their investors, we developed an adversarial relationship and soon parted ways.

The Problem Renter

If your primary investments are in smaller rental properties like single-family houses or duplexes, you might be thinking, “Sure, the decision to hire a property manager is a no-brainer when it comes to large buildings like the one in the previous story. But how does that apply to me? Do I really need a property manager for a house or a duplex?”

Many times I talk to people who feel that professional property management is something that only makes sense for people who own big apartment buildings—for professional investors that have the money to hire a company. That couldn’t be further from the truth.

Those same people tend to think that they should manage their rental house themselves. It’s no big deal they say. How hard could it be to collect rent! Boy, are they in for a surprise. Managing any property is time-consuming and demanding no matter what size it is. The reason for this is just as I said earlier. Size doesn’t matter. The same principles always apply. You have to find renters, collect rents, perform maintenance, complete capital projects, take legal action—the list goes on and on.

This is not to say that you can’t manage your own property, and that you can’t do it successfully. Many people do. But more often than you might expect, people wander blindly into managing their own properties, and often with disastrous financial results. It’s not that they are dull or incompetent. I’ve known many brilliant people that have horror stories when it comes to managing property. Rather, it’s often a fundamental lack of understanding of the basic principles that can lead to disaster. Usually, this doesn’t come in the form of a major catastrophe. Instead, one little mistake leads to another, and another, and another—and, well, you get the point. All these little mistakes add up to one major mess. In the end, most amateur investors rationalize the situation by placing the blame on the real estate and that it was just “a bad investment.”

I’m not speaking in generalities. My in-laws bought a house in Washington state as a rental property. The house was at the end of a cul-de-sac in a nice neighborhood consisting of mainly home owners. It was a good size with four bedrooms and three bathrooms, so they usually rented it to families. They bought the house in the early 1980s for about $70,000, and today it is worth about $350,000. In that respect they have done very well with the house as an investment. They even had pretty good luck with renters for the first ten years or so, with only minor damage to repair here or there, and not too many challenges in collecting the rent. But all that came to an end when they met the “problem renter.”

I had the opportunity to sit and have dinner with my in-laws and discuss with them the experience they had with their house. They are wonderful, warm, and intelligent people who faced an overwhelmingly difficult situation regarding their rental property—a situation that was unfortunately nobody’s fault but their own. We spent over two hours talking about the heartbreak and the challenges that they faced with this house and this renter.

My in-laws found the problem renter, we will call him Ross, through an ad they placed in the paper. They went through the usual process they used when assessing a potential renter. They performed some reference checks and had a personal meeting with him. Right up front he said that he’d just filed for bankruptcy, but because my in-laws are very nice people they still felt compelled to rent to him. Here’s how my mother-in-law put it:

“They were you know good Christian people and they did go to church and their pastor co-signed for them. We required that. And he did. Ross’s brother was in jail, and he and his wife were taking care of his two kids, and they were living in an apartment. Ross and his wife had two small children of their own at the time. And the sob story was they needed more space. Well, that’s where our hearts took over and we rented to them... I think the bottom line is that we really made the mistake of not checking. Although I think we knew that we had taken a chance, but the fact that here they were taking care of his children and his brother’s children and they needed the space. We just made a huge mistake.”

Immediately Ross’s deposit check bounced. He had a story for that too. (They always do, by the way.) Still, my in-laws continued to cut him slack. Here’s how my father-in-law summed it up:

“He always had some story for it, which even I believed initially. You know you don’t want to kick somebody out right away. We didn’t really have a big problem with the rent initially back then. I laugh about it now, because the biggest problem was that we didn’t get the rent on time. Compared to what we went through later, it was not that bad. And when we would go down there to visit, the house was always clean, always looked good. Initially.”

By now you are probably sensing that as the situation developed, late rent was the least of their concerns—and you’re right. Eventually, Ross started not only paying late, but not paying at all—$15,000 in back rent when all was said and done, over nineteen months’ worth of rent.

On top of all that, Ross was a self-proclaimed handyman, who had worked as a carpenter and as a landscaper. Without the permission of my in-laws, he began to initiate projects around the house that he deemed to be improvements. Not necessarily a bad thing, except that he never finished any of them. Over the course of time that he was in the house, Ross had started the following projects:

• Completely tore out the front and back yards, including retaining rockeries on both sides of the backyard, causing damage to the neighbor’s yard. He also accidentally knocked the deck of the back of the house.

• Removed every interior door in the house.

• Removed every baseboard in the house.

• Removed all kitchen cabinets and all kitchen appliances.

• Tore out all bathroom vanities.

• Started to install a Jacuzzi.

• Expanded a closet into the garage, making it impossible to park a car in the garage.

• Demolished a wall in the downstairs utility room because he wanted a bigger bathroom.

• Removed all carpet in the upstairs in order to lay down hardwood flooring.

• Started rounding corners on all walls.

• Started installing an oversized shower in the downstairs bathroom.

None of these projects was overseen by a licensed contractor. Consequently, there was a host of plumbing and electrical issues to be dealt with, as well.

Beyond all of these issues, Ross had also stolen money from my in-laws.

“This happened the summer that we finally got him out of there,” says my mother-in-law. “I finally said, “We need to go find out where the rest of these landscape blocks are that had been in the backyard,’ and so we went up to the business where we paid for the blocks. And after some head scratching and ‘No, I don’t remember,’ the block company finally found that Ross had actually come in the summer before and returned the blocks for a refund of over $600.”

You might be asking yourself, “How could they let this happen?” My in-laws are by no means novice investors. They own four properties in the Seattle area, and until the problem renter they managed the properties themselves while living in Scottsdale, Arizona, part of the year. They make a point of saying that until the problem renter they never really had any issues, but that is more from the luck of the draw than from calculated strategy. In fact, it was their lack of sound property management fundamentals that landed them in this very grave situation. They suffered from “hold on and hope it gets better” disease, which makes you believe that someone will change their behavior this time regardless of an established pattern of past behavior. It almost inevitably starts out sounding a little something like this:

“But, when somebody has been renting for years and paid you over $100,000 in rent, you cut him a little bit of slack, knowing that he was capable of doing good work if he would just focus on it. We tried our darndest to try to get him to focus on some of these projects to try and get them done.”

And it always ends sounding like this:

“But that turns out it was too much to hope for. It became very obvious in the last year and a half that things were not going to get done. The only way they were going to get done was for us to get him out of there and finish them ourselves, along with the help that we hired. Once we came to that conclusion, then the effort was directed at getting him out of the house.”

My in-laws ended up hiring a property manager who was responsible for evicting Ross from the house. The damage, however, was already done. And in the fall of 2004, they came out of retirement and traveled to Seattle from Scottsdale to begin repairs on the house.

They had to enlist the help of two friends as well as a contractor. It took five people in all to do the work needed. Those five people worked every day for six to eight hours from September until November in order to get the house livable again. Three months of their retirement were gone.

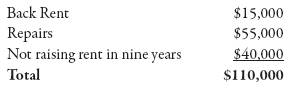

All said and done, the costs associated with their decision to rent to Ross were:

Pretty unbelievable, huh? The most amazing part is that my father-in-law had only paid $70,000 for the house when he bought it. Expenses stemming directly from poor property management had cost him over 1.5 times the original cost of the house. Ouch.

Beyond the economic impact, however, there were deep emotional costs. This is important to understand. My in-laws had to deal with not only their own emotions, but also those of their tenant and his family and the neighbors, who had contacted the city and every government agency in attempts to get them removed. They found the stress unbearable at times. In the end, my in-laws were very much affected by the situation, both individually and as a couple.

“That’s the only thing that we ever fought about,” says my mother-in-law. “Ever, ever, that I can think of. And I mean we had some shouting matches over it. I know it was hard on my husband because he kept everything inside and I’d blow everything out. And I wanted to talk about it. And he didn’t want to talk about it because it was unpleasant. It was terrible, terrible.”

Over the course of many family get-togethers, I heard this story unfold. It was a constant source of stress and emotional turbulence for my wife’s parents. That was one of the hardest parts for me to watch.

They would ask me for my advice, but would not act on it. It’s not that I was any better than they, but I had over twenty years of experience running companies that dealt with situations exactly like theirs. I knew what needed to be done, but only they could do it. And when they finally did, it was much too late.