CHAPTER 17

SWAPS AND THEIR PARTICIPANTS

One of the concepts that apparently people understand when they are very young but seem to misunderstand as they grow older is the word “swap.” Ask any child between the ages of five and ten years old if they “want to swap” and they understand they have the option to give up something in exchange for something else. Yet some articles in newspapers and periodicals seem to ignore this simple factual explanation—either that, or they’ve replaced the simple explanation with fantasy language. The swap product is real, though, and used in many parts of the industry for a multitude of purposes. We will introduce the swap and its participants in this chapter.

• SWAP OVERVIEW •

A swap is an agreement between two or more parties to exchange value on some prearranged schedule. The form that this value takes is usually that of cash flows. As such, one of its benefits is allowing a company to rebalance its debt cost to better accommodate current needs. A simple example of this concept would be two companies that are active in the debt market. One is engaged in making medium- to short-term loans, whereas the other company’s business model requires the continuous ability to offer long-term loans. The object of both of these companies is to profit from the spread between what the money being borrowed cost and the interest being received from the loans they make. Both companies know with a good degree of certainty what their cost of money is versus their expected revenue receivable. Both companies have to continually come to the debt market to borrow the funds that they need to make the loans.

As the debt market is multifaceted, different events or forces will change some rates of one time period while having little or no effect on rates from other time periods. The interest rate spread between short-term interest rates and long-term interest rates is constantly changing to the point where it is possible that the interest rate curve could be convex, with short-term rates being more expensive than long-term rates.

There are many different kinds of swaps. On one layer, there are interest rate swaps, domestic currency swaps, foreign currency swaps, exchange for physical (EFP) swaps, equity swaps, credit swaps, and swaptions. Then in the next layer down the instruments are fine tuned to meet the users’ need. There are fixed-for-floating rate swaps, which involve the swapping of fixed continuous periodic payments for floating rate payments that are continuous, though variable. In this market there is also fixed rate for fixed rate, with the difference being the payment dates. There is a floating-for-floating rate swap with different reset dates as well as forward swaps, where payments start in a later time period, and so on. As each swap is a negotiation in and of itself, each one is different and stands alone.

Here’s an example:

Let’s suppose that the company making long-term loans finds itself in a very tight market where the interest rate for funds borrowed is almost the same as or higher than the rates being received on long-term loans, and therefore the company looks for alternative funding sources and finds them in the short-term funds market. The company may have to borrow the short-term money to maintain its business. At a different time, the lenders of short-term loans find their source of funds dried up, or the interest rates of long-term loans are now more attractive than the short-term rates, so they borrow long-term funds and continue to make their short-term loans. Both companies now have market risk because cash inflow of funds is not directly tied to their cash outflow. In other words, both companies cannot “pair off” their payables against their receivables as the spread between the two is constantly changing. This exposure can be minimized or greatly reduced by a swap broker or swap dealer who will “find the other side.”

The long-term borrower will swap the borrowed contracts with a short-term borrower, thereby allowing both companies to “parallel their loans versus borrows” or “match receivables versus payables,” which in turn gives them better control of the profitability. The swap has freed both companies from the risk of a market segment they do not belong in or want to be in. The long-term lender now has borrowed long-term funds; the short-term lender has borrowed short-term funds.

• PARTICIPANTS •

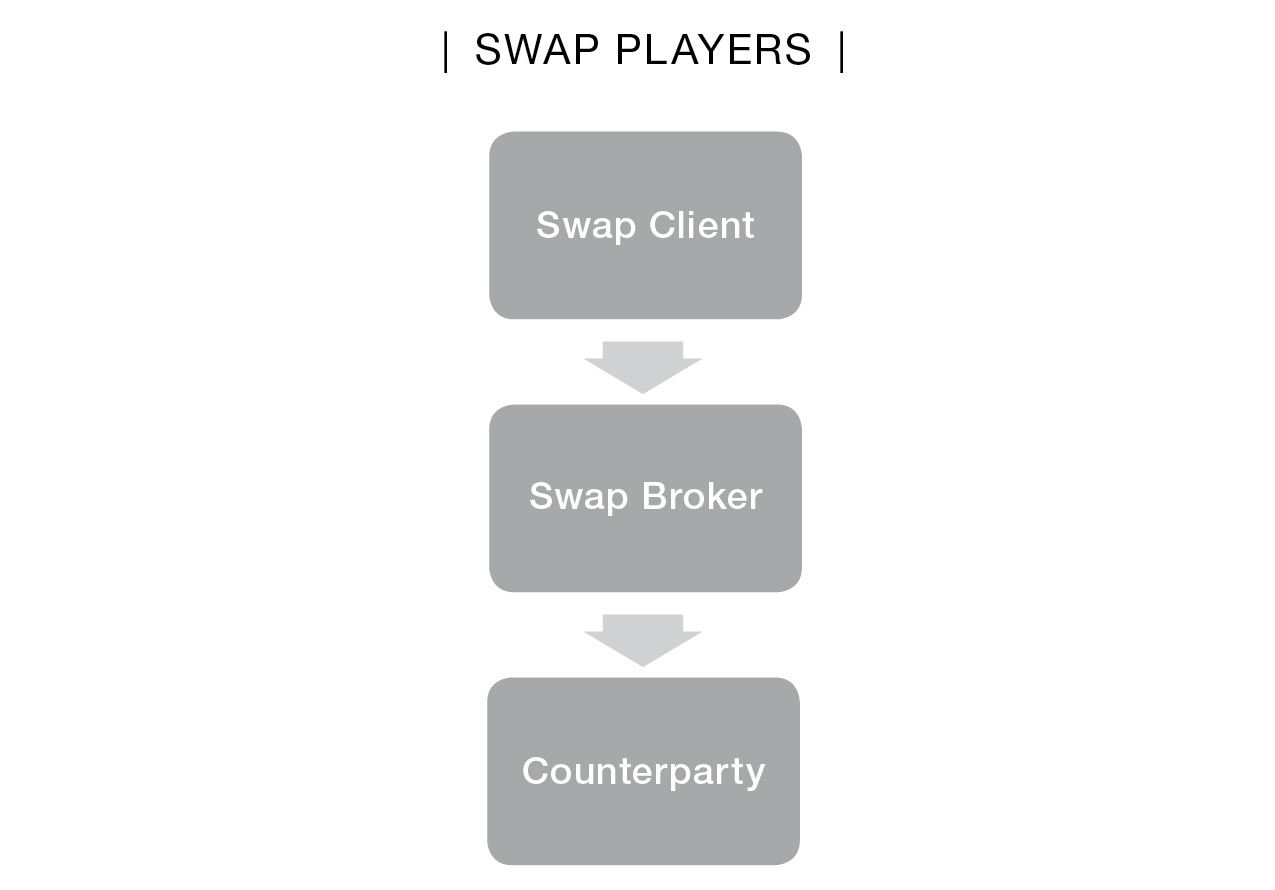

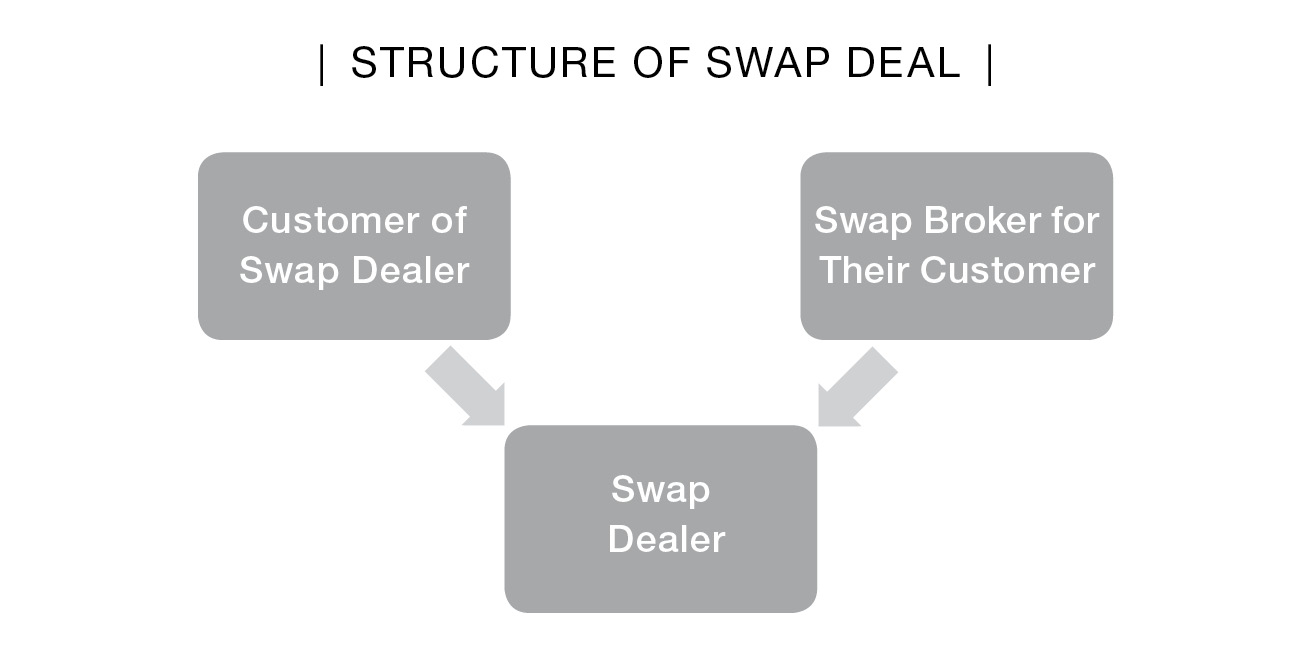

In the above example we saw how the swap product was used to efficiently “better” an existing situation for two companies. Only three entities know the swap took place, namely the two companies and the swap broker or dealer. The terms “swap broker” and “swap dealer” are often used interchangeably, even though there is a major difference between the two functions.

Swap Broker

A swap broker does not take positions. It acts as a conduit between parties for which it collects a fee. The swap broker maintains a cadre of financial institutions that have exposed their needs to the swap broker in the past and because of the nature of their business may be willing to be the contra party to a swap if offered interesting terms. Think of the swap broker as a clearinghouse for swap information. When a broker is contacted, the caller explains what he or she is trying to accomplish along with the size, duration, quality, and other pertinent information. Armed with this information, the broker determines if there are any known parties that may be interested in participating in this swap. If there aren’t any, the broker will so inform the inquirer, who will, in turn, have to go elsewhere. If the broker believes there could be interest, the broker will call that party or those parties that may have an interest, and find a contra party to the swap. Depending on the size and/or the asset being swapped, the broker may have to assemble the contra side from several sources. The time used by the broker in assembling the deal frees the participant up to perform other functions.

Another benefit offered by a swap broker is participants’ anonymity. While the broker is working to put the swap together, the broker doesn’t have to divulge who is being represented until the deal is just about agreed to. The nondisclosure could be important to the initiating party for financial or security reasons. Brokers obtain knowledge from conversations containing facts or rumors, and some participating firms have the power or ability to stir the market by just the mention of their name. Also the initiating party may be operating for a client who wants anonymity and fears that, if the initiating party was known, others would put the pieces together as to who was behind this transaction and make its completion more difficult.

Let’s assume the Starfire Corporation realizes that based on current market and economic conditions, it would be better if it could extend its debt borrowings for a longer period of time. Some of the short-term debt the firm is facing was originally issued as long-term debt, which was issued a long time ago but now makes up part of its short-term debt. Starfire Corporation is concerned that if this strategic realignment of its debt—converting short-term debt into longer-term debt—was known, it might have a negative impact on its ability to continue day-to-day financing. The company would seek out a broker who would shield its name until the broker and Starfire were sure that the deal could be done. If it couldn’t be accomplished, then the effort remains a secret.

Swap Dealer

A swap dealer will position, when necessary, the whole or part of a swap transaction that will be traded out of its position at a later time. Like a broker, the dealer will choose those opportunities that are attractive to him or her. Unlike a broker, the dealer can participate in a transaction—either to make up the deficient side so that a trade can be completed, or closing out an existing position to establish a new position. Swap dealers are profit-oriented businesspeople who earn their livelihood trading. Swap dealers rely on swap brokers for the merchandise or inventory that the brokers bring to the market. The brokers are, in effect, the dealer’s customers. Occasionally a dealer will even be asked to do a facilitation trade to satisfy a client of a good broker customer of the dealer’s. The facilitation trade is one that the dealer wouldn’t usually take the other side of, but because of the relationship with the broker, the trader takes it on. The dealer includes this transaction when assessing his market risk.

While the swap broker has to be concerned about the creditworthiness of those they transact business with, the dealer must also be concerned with market risk. The dealer will hedge his swap positions using futures, options, or other derivative products. A broker renders an execution and information service while a dealer trades against his positions. The misuse of the terms “broker” and “dealer” generally comes from the party to a swap transaction; it is insignificant to the party whether it is dealing with a swap dealer or a swap broker, as long as it accomplishes the desired results.

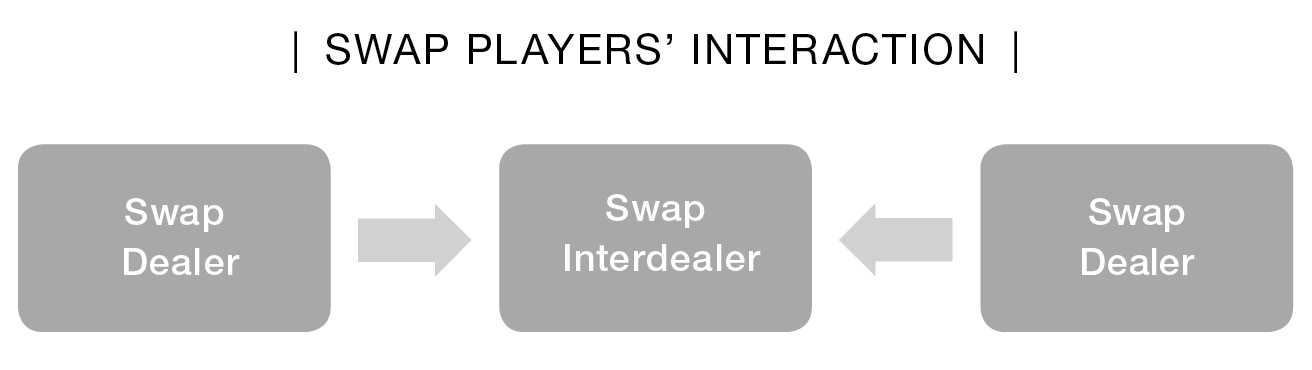

Interdealer Broker

The last participant in the swap marketplace that we will look at is the interdealer broker. One of the attractions of any market is its liquidity, or to put it another way, the ease of getting into and out of a position. Some markets are order driven, such as the listed equity markets where the volume of trades propels the market. Other markets require an intermediary to step in and trade against buyers and sellers, when the two cannot agree on price. That party is referred to as a market maker. They exist in many over-the-counter markets. This brings us to a unique member of the community, which operates as a broker between dealers.

In thin markets or ones where there are voluminous variations of a product and a need for anonymity, the dealer’s broker function thrives. Such is the case with some products in the swap markets. Dealers will look for interdealer brokers when they are trying to unwind a position, or hedge a position, or disguise the brokerage firm they are representing. Dealers will also seek out interdealer brokers when they do a facilitation trade. The contacts and current market knowledge that the interdealer broker has can be most helpful in the dealer’s closing out or hedging the facilitation trade.