Chapter 5

Five key performance indicators for a successful company

In every company I’ve been involved with, I always recommend that each year the management team should do an honest assessment of how they’ve been executing against their plan.

I use the five key performance indicators (KPIs) listed on the next page, all of which are of equal importance – they don’t belong in any particular order.

You can use these KPIs to rate your company out of five, according to how you have performed over the past year. As founder, your job is to ensure that you achieve a higher rating this year in every one of the five categories, compared with your assessment of the business last year. Anything else and you’re going backwards.

So, here are the five KPIs:

- Market standing

- Innovative performance

- Digital transformation/Productivity

- Profitability

- Cash flow

Market standing

Never in business history has it been as easy to build or destroy a brand as it is today. Consider how long it took Coca Cola or McDonald’s to build a global brand, compared with Amazon, Google or Facebook. Afterpay became a household name in Australia after only a few years of operation. When you execute well, social media gives you the ability to build your brand at breakneck speed. But screw up, and all the good is gone.

Market awareness is your ability to attract AND retain customers, staff and business partners to your company. There is nothing better than people knocking on your door saying, ‘I want to work for you.’ Bear in mind that headhunters, like your company, also have to meet sales targets to make their budget. My experience is that most want to place people to make their numbers, not because they have found the perfect new staff member for your company. At Com Tech, I don’t think we used a recruiter for the first five years of our existence. All our staff came through referrals from our existing staff. And because we were a brand that people in the industry wanted to work for, we had the pick of the bunch. The quality was exceptional and the cost was zilch! Would you rather be the HR manager at Apple or Nokia?

Having industry-standard, market-leading business partners wanting your company to represent their products makes it a whole lot easier than begging ‘me too’ players to partner with you. Once Com Tech had secured Novell as our key business partner and did an exceptional job representing them, the whole world of networking and communications wanted us to be their partner in Australia. That’s how we got SynOptics (now irrelevant) and then became Cisco’s first global, two-tier distribution partner. You wouldn’t have to be a great salesperson to get Harvey Norman to stock your products if you worked for Apple. That sale was made because of the unbelievable market awareness that Apple has created globally. It would be a whole lot tougher if you worked for Blackberry.

Customers

In every company that I have been involved with, customer service generally wins the day. Repeat customers keep coming back and are willing to try new products and services from your company. Remember, Amazon started out selling books. Uber started with hire cars. All great leaders, like Jeff Bezos, commit their company to what Bezos calls ‘fanatical’ customer service. How often have you bought a product or used a service because a friend or associate recommended it? A happy customer is the best salesperson that a company can have, and all it costs is delivering legendary customer service to your existing customers – not a dollar spent on marketing. With social media so pervasive, companies live or die by how their customers rate them.

At Com Tech, how lucky was I that my main competitor, Datamatic, a large listed company, had no regard for customer service? They had abused the privilege of their exclusive partnership with Novell and paid the price. From sitting on a gold mine, they went out of business, not because of the product they sold – we sold the same, identical product – but simply because of the service that they delivered to their customers. I couldn’t believe it when I returned a call and a customer said, ‘Thank you so much for getting back to me.’ Why wouldn’t I? Maybe they wanted to spend some money with me. What it told me was that Datamatic didn’t even bother to return a customer call. Customers vote with their wallets: the better the service, the more they spend with you. Many years later I met the CFO of Datamatic and he told me that they used to have strategy meetings debating how we were taking so much market share. I don’t know what they were strategising about. It was simple: return calls when your customers call, or they may become Com Tech customers. It wasn’t just the calls – there was so much more.

Staff

Think about your ability to attract and retain the best in the industry. The better your team, the more value you will be able to add to your customers. The more value you add, the more you will sell. Remember Richard Branson: ‘Employees come first.’ If you believe this, make sure that you deliver. I have dedicated an entire chapter to staff later in this book.

Business partners

I have always believed business partners are an extension of your business. In the case of Com Tech, they included our suppliers, Novell, Microsoft, Cisco, our couriers, the company that did our cabling, outside investors, everyone. If we wanted to deliver legendary customer service, sometimes we needed to rely on a third party to provide part of the service. Maybe a customer needed a product urgently – we relied on the courier to get it to the customer on time. We treated all our partners as if they worked for Com Tech and usually included them at our company kick-offs, treating them as genuine partners in our business and not just as another supplier. It really paid dividends.

Innovative performance

What are you doing this year that you didn’t do last year? When Steve Jobs sadly passed away, the big concern was: ‘What will happen with innovation?’ Every company, big or small, has to continually reinvent themselves, each and every year. If you’re still offering the same products and services that you did last year, you’re going to have problems.

Every year, Com Tech took on new products – we wanted the industry to know that we had vision, that we knew where the market was going. We signed up SynOptics, the company that invented Ethernet networking over unshielded twisted pair cabling; Cisco, the market leader in wide area networking; Lotus Notes; and PictureTel for video conferencing, before it became pervasive. And we were the world’s first distributor for Netscape, the company founded by Marc Andreessen.

Every year we held the Com Tech Open Systems Forum, a four-day event that became the leading networking conference in Australia. The forum was sponsored by our business partners, and customers paid to attend. It was our opportunity to show the industry our technical prowess. We had amazing speakers, including Marc Andreessen – he didn’t have a passport before he came to Australia as the keynote speaker at Com Tech Open Systems Forum in 1996. It was our continual innovation in product, services and support that enabled us to lead the market from 1987 until today.

There are three types of companies:

1. Those that make things happen – leaders

2. Those that watch things happen – followers

3. Those that say, ‘What happened?’ – the irrelevant, the dying or the dead

You want to be the founder of a company that makes things happen and leads the industry. It’s hard work – but, boy, it’s so rewarding.

Many companies have become irrelevant because they did not innovate, either because they became complacent or they didn’t want to disrupt their core business (like Kodak, Blockbuster and Fairfax Media). Some companies simply didn’t have a strategy of continually ‘innovating in innovation’.

Microsoft, today the world’s second most valuable company, almost fell into this trap. Until the current CEO, Satya Nadella, took the helm, the company might well have been on its way to irrelevance. Like Blackberry, Novell, Fairfax and many others, Microsoft could have continued to exist for several years but would ultimately have become irrelevant. (If Blackberry dies, would anyone care?) Nadella, with the same people and products his predecessor had, turned the behemoth Microsoft on a dime to re-emerge as a dominant technology player for many years to come. So, it doesn’t matter whether you have 10 people or over 100,000 people – innovate, or die.

Digital transformation/Productivity

What are you doing to make it easier:

- for your customers to do business with you, and

- for your staff to work in your company?

In a world characterised by increased competition, reduced margins and customers demanding better customer service, you can’t just keep throwing people at the problem. You have to invest in systems and processes without hiring additional people – and somehow not compromise on the quality of the service delivered.

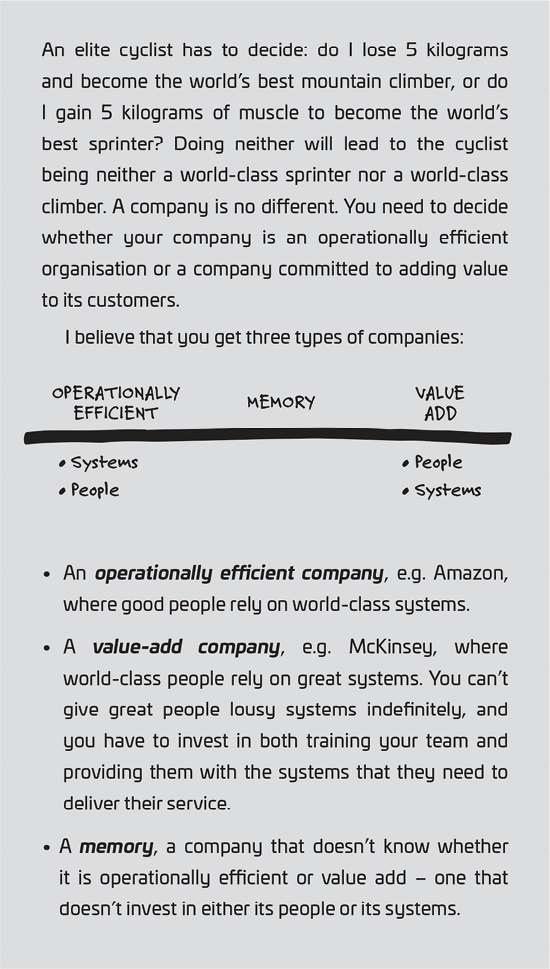

As an example, at Com Tech, by implementing a new enterprise resource planning (ERP) system, which enabled both our staff and our customers to use self-service technology to transact, we were able to double our revenues without hiring any additional sales or warehouse personnel. You may say big deal – but this was in 1992, well before the internet. I was proud of what we achieved. We went from being a distribution company with the best people in the industry and the worst systems – we ran on people power – to a company with both the best people and the best systems in the industry. While our staff were always our number one asset, you can’t give great people lousy systems forever.

Cash flow and profitability

I have combined these two KPIs because – as any accountant (even a bad one like me) will tell you – if you’re not profitable and generating positive cash flow, you probably won’t be around for long. Sometimes you can be profitable but not cash-flow positive: you may have made some great sales, but you haven’t been able to collect your cash quickly enough. Cash flow is like the blood that flows through your body – you may have the best brain, heart, lungs, liver and kidneys, but without blood flowing through your veins you cease to exist. It’s the same with cash in a company.

So, when you think of the world’s great companies, like Amazon, Apple, Microsoft, Google and Facebook, they tick ALL five KPI boxes. For a while Apple was seen as innovative, but until the iPod, their cash flow and profitability were poor. For many years, Microsoft was unbelievably profitable and cash-flow positive, but seemed to lack innovation. It was only when both companies excelled in all five KPI areas that they became great companies (again).

If you want your company to be great, you have to deliver on all five KPIs. Four is not good enough. You could increase your profits by laying off staff, compromising on customer service or not investing in a new product, but that’s a short-term decision. Conversely, you could keep investing in R&D without commensurate levels of sales and profitability.

Managing short is managing your cash flow and profitability, managing long is your investment in market awareness, innovation and systems. Any good founder can manage short and any good founder can manage long, but only an exceptional founder can manage short and long at the same time. Make that your challenge!

And what about startups?

It’s quite common for a startup to burn cash and not generate cash for some time. Facebook, Amazon and Google didn’t make a profit or generate cash for years – but every company has to have a plan and path to profitability, like these three did. Today, they print money. Eventually Uber is going to have to make a buck, or else they may just become irrelevant. I’m sure they have a plan and a path to profitability.

As an early-stage startup, what impacts your cash flow is your ability to raise cash from outside investors. To ensure that you can continue to fund your growth, you will have to show the positive momentum that you have generated since your last raise. What is different to last year? How many customers did you have at the last raise and how many more do you have now? Have you managed to attract new management and staff to the business? Are your existing customers spending more money with you this year than last year? Is your product better than it was at the time of your last raise? Are you selling into international markets that you hadn’t yet cracked last raise? If you can’t answer yes to these questions, you may have trouble raising your next round. You have to show positive momentum in all of these five KPIs to ensure that venture capital companies are banging at your door to give you more money to get to the next stage.

• • •