Chapter Thirteen

Adding Alternative Investments to Your Portfolio

Finding Your Portfolio’s G-Spot

The time has come to put the 1,000-piece puzzle together. Having been to the big city and seen the bright lights of Wall Street, it’s time to go back to the farm, sit by the stream, and soberly reflect.

As you read this Little Book, you may have noticed that some of the alternative investments discussed are complicated. Some of the alternative investing strategies can be difficult to understand. Even if you pore over the mutual fund’s prospectuses, you will often find a lot more legal boilerplate and bland generalities than detailed explanations of investment policy.

When it comes to night driving, we are admonished not to drive beyond our headlights. This is a good rule when it comes to alternatives as well. Do not invest deeper than your understanding. Do not invest in them a lot if you only understand them a little.

Don’t invest beyond your headlights.

In that respect, these alternatives might be likened to a collectible. There is the ever-present possibility for a serious hobbyist in many fields to make some money by leveraging his time and intellectual effort. If investing for you is a serious hobby, these alternatives can be worthwhile. Even if it turns out that you didn’t do much better than you would have with a vanilla indexed portfolio from Vanguard or Fidelity, you will at least have enjoyed the study and learned something along the way. If you end up making some good calls that enhance your risk-adjusted returns, so much the better.

With this in mind, we’re going to share our ideas on how to incorporate these alternative strategies into your existing portfolio.

Our first great idea is: Do nothing at all. Just because an investment idea exists, it does not mean that you have to chase after it. The idea needs to persuade you that it is better than what you are already doing.

Here’s something else to remember: Incredible as it sounds, we might be wrong. Do your own analysis. You are playing with real money and people can get hurt. We have given the matter some thought but your thinking may be better than ours. This is our snapshot from the early innings.

Our conclusions are probably of less interest than our process in arriving at them, so we are going to share our reasoning, if any. In approaching our recommendations, we wanted to avoid the tiresome game of picking actively managed mutual funds based on their recent performance. We’ve been around that block twice and didn’t like it either time. We also have to weigh the possible desirability of having exposure to an alternative asset class against the fact that we have to choose from a very limited palette of offerings. It might be the case that having an undistinguished Global Macro manager is better than none at all. Or, it might be the case that having no exposure is better. These are judgment calls.

Let’s revisit the tough, gritty questions we posed at the beginning of this book: Do these approaches work? Are their returns reliable? Are they sustainable or will they disappear? Do they hedge? Do they add value to a portfolio?

There is less agreement that these approaches deliver a return premium than there is about the stock market or the bond market. Still, most investment professionals would agree that these approaches provide an alternative source of returns that should diversify a portfolio and improve its risk-adjusted returns. While no style is in favor all the time, the returns are reliable to the extent that a fund follows a consistent discipline within its domain. Ideally, the fund manager is a quant who stops in the office each morning to turn on the computer, but also sticks around to make sure that what the computer is saying makes sense. What we want to avoid is a guy watching Mad Money and going with his gut. That might or might not deliver good returns, but it would not deliver alternative beta.

The performance of these funds could diminish over time as each investment space gets more crowded. There is currently an amount approaching $2 trillion chasing these quarks of opportunity, and they are not infinitely scalable. If there were $6 trillion pursuing the same strategies, their returns could be cut significantly. For the present, a lot of this money is going into long/short equity strategies. These managers are making stock picks. This approach can be scaled up quite a bit. Convertible arbitrage, on the other hand, is a niche market that can get crowded more easily. We have to admit that there have been many market anomalies or occult market risk factors that have existed for decades and continue to reward investors despite all the money poured into them—the value premium, or the small company premium, for example. Hedge fund returns may turn out to be more robust relative to cash inflows than people expect.

Additionally, some opportunities exist not in spite of efficient markets but because of them. Here is an example from hedge fund manager Andrew Redleaf: Every day your bank sorts thousands of pennies into rolls. Some of those pennies might be quite valuable to a coin collector. Nevertheless, your banker does not take time to examine each penny under a magnifying glass to see if it might be worth hundreds or even thousands of dollars. The good and bad pennies all get rolled up together into a tube priced at 100 pennies to the dollar.

The coin collector, on the other hand, is happy to examine pennies looking for that 1909-S VDB Lincoln cent that will make him rich. But just as it does not make economic sense for the banker to spend his time looking at pennies, it does not make sense for the rare coin dealer to take deposits and make loans. They are both profit-maximizing agents, but the banker in the normal course of his activity leaves an opportunity on the table for the coin dealer. The big fish has a big mouth that necessarily leaves some scraps for the little fish.

The hedging properties of these funds vis-à-vis the stock market indexes are less than we would wish and possibly they are lessening over time. Over the last five years, hedge fund correlations to the S&P 500 index have hovered in the 0.70 range—about what you might expect from, say, emerging market equity funds. Yet everyone still diversifies into emerging market funds. The fact that they don’t deliver as much diversification as we want is not an argument against getting as much diversification as we can. This is true even where that diversification can be relatively expensive to obtain, as it is with these funds.

Our plan is to walk through how a traditional investor might use alternatives, and then push this all the way to how a new-school, risk-diversified investor would apply them. Interestingly, even a large allocation to most of these alternatives should not by itself be unusually risky. By employing alternatives, we are diversifying our risk exposure. If we put a lot of our portfolios into them, we might lower our risk profiles significantly. But how many of us are in a position to put a large portion of our wealth into relatively new (to us) and untried (by us) strategies? For most of us, a smaller allocation would make more sense, at least initially. With a smaller allocation comes a smaller amount of protection.

In other words, at the levels that most of us will be using them, alternatives will not save us from the next crisis. But they should help. If they improve our risk-adjusted returns in small ways, across an investment lifetime this can make an important difference.

We’ll wade into the lake one step at a time, so you can judge for yourself where your comfort level lies.

If you are a conventional investor with 60 percent of his assets in stocks and 40 percent in bonds (or some similar ratio), the first thing to consider is: Have I maximized the returns from my baseline portfolio?

Then ask yourself the following questions:

- Am I invested in global equities (U.S., foreign developed, and emerging markets), with anywhere from 30 to 60 percent of my assets parked abroad?

- Am I passively accessing the returns from these markets using low-expense, tax-efficient index funds?

- If I am tweaking my stock portfolio, am I tilting it in ways that have historically demonstrated long-term, risk-adjusted outperformance, such as by overweighting small company, value, and low beta stocks?

- On the fixed income side, am I keeping credit quality high and maturities short?

- Do I have a stash of cash put away so that I can sleep at night through the next (personal or national) financial crisis?

- Am I saving regularly so that I can fund my retirement?

- Do I have enough life insurance to take care of my family and keep my wife in candy bars, magazines, and nylon stockings after I’m gone?

If so, you’ll be a Man, my son.

No, what we meant to say is, the above checklist is the place to start. Once you have these questions scratched off, it makes sense to think about further diversification. If you are unemployed and sitting around watching TV all day with $30,000 in revolving credit card debt and you haven’t made a mortgage payment in six months, there are more important places to begin. The last thing you need to worry about is alternative investments. That fact that you are even reading about them suggests that you are in denial. You need to wake up and smell the coffee (and we mean the breakfast beverage, not the commodity).

If you are unemployed and sitting around watching TV all day with $30,000 in revolving credit card debt and you haven’t made a mortgage payment in six months, you have more important things to do than worry about alternative investments.

Assuming that the rest of your financial house is in order, and that you have understood the gist of this book if not the fine points of all the strategies, and you want to take a next step, here is what we would propose.

We want to lay out three ways to go. The first is for an investor with less money, less investment experience, who is self-managing and wants to take a step in this direction. The second is for an investor with more money, more investment experience, who possibly uses the guidance of an investment professional, who has some experience with alternatives and wants to take a bigger step. Finally, just for completeness, we will sketch what a risk-parity portfolio including hedge fund strategies might look like.

Regardless of your profile, we do not recommend that you jump from one end to the other—from a 60/40 portfolio to a risk-parity portfolio—in a single bound unless you have had a long talk with your therapist about it. You should probably begin with a small allocation to alternatives, and then build on this over time as you gain a feel for how they work and then, based on your understanding and appreciation of them, decide whether you want more.

There is rarely any point in making drastic or sudden moves with your portfolio. The paradox is that the more conservative you are, the more you can allocate to alternatives. But this has to be tempered by the psychological imperative of understanding and being comfortable with what you are doing.

A sensible initial move for all investors, if you haven’t done so already, would be to lop about 10 percent from the equity side and put it into commodities and REITs. That is to say, if you have 60 percent of your portfolio in stocks, then take 10 percent of that—which is 6 percent (do the math)—and invest it in commodities and REITs. Three percent in each wouldn’t be a bad place to start, using low-expense index funds like those we mentioned in Chapters 6 and 7. This brings us to a point where we can consider adding the hedge fund strategies.

The Hedge Fund Couch Potato Portfolio

Having diversified into commodities and REITs, the next step would be to take an additional 10 percent of our portfolio and put it into hedge fund strategies. If our fundamental stance is a 60/40 portfolio, we could take 6 percent for alternatives. If we want to lower our risk profile, we could take the whole 6 percent from the equity side (since equities are typically the more risky asset). If we want to keep a level of risk and return similar to what we have now, we could take 3 percent from stocks and 3 percent from bonds.

What funds would we recommend?

Strange to say, we are not as wild about the replication funds that deliver hedge fund beta by tracking a general hedge fund index as we would like to be.

Here’s why not: When it comes to the composite hedge fund indexes, the correlations between them and the stock market are too high for our taste. In other words, these funds can be seen as a bundled sale of an ordinary stock index fund plus the hedge fund index’s attempt to add a low correlated, positive return. This means that we are paying high fees for the embedded stock index fund, which we could buy separately from Vanguard for next to nothing. It also means we are paying a lot for the uncorrelated part that constitutes the thin slice of hedge fund salami that we really want. These costs are a meaningful hurdle for an investment vehicle whose expected returns are in the mid-single digits.

Our whole point in making this alternative investment allocation is that we want it to be alternative. We already own a stock market portfolio. We don’t want to buy it all over again at high expense. We would prefer that the companies who package these funds deliver the alternative beta piece without the stock market sidecar that everyone already owns anyway.

For this reason, for a one-fund solution (if that is what you want), we prefer a multi-strategy fund like Natixis ASG Diversifying Strategies, which has both its volatility and its correlation to the equity market actively managed. The retail class shares (ticker: DSFAX) have a low dollar minimum but carry a sales load, while the Y shares (ticker: DSFYX) are cheaper but you will need an investment advisor to obtain them due to the high minimum.

However, if you have as little as $6,000 to devote to hedge fund strategies and want to get your feet wet, here are some suggestions for getting started.

Event-Driven: In this category, we like the Merger Fund (ticker: MERFX) or the Arbitrage Fund (ticker: ARBFX). Both have a $2,000 minimum purchase requirement.

Confidence Level: Moderately high, surprisingly. While both funds are actively managed, the managers have a long tenure and work within a circumscribed domain, buying the targets and shorting the acquirers in corporate mergers. Domains like merger arbitrage are narrow and there is generally only a small difference among manager performances.

Global Macro: Global macro is difficult to automate and usually relies on the insights of the particular active manager. However, the Powershares DB G10 Currency Harvest Fund (ticker: DBV) captures the currency side (the “carry trade”) of global macro passively and efficiently. This is a beta factor to which most investors are underexposed. Just remember that DBV sends out a K-1 to shareholders every year, and your life will be simpler if you hold this fund in a tax-deferred account.

Confidence Level: High. It looks to us like DBV could be—indeed, it probably is—run by a computer.

Managed Futures: When it comes to Managed Futures, we recommend the Elements S&P Citi ETN (ticker: LSC), which uses a trend-following system to go long and short on commodities. It has relatively low expenses of 0.75 percent annually. Among all the hedge fund strategies, managed futures have especially good diversifying properties and tend to show up for us in times of need.

Confidence Level: High. The fund should extract the beta of commodity trends, for good or evil.

These three funds give us access to some core alternative/hedge fund strategies at reasonable expense. Take our proposed allocation to hedge funds, divide it by 3, and put one-third of the money into each one (in this example, that would be 2 percent of your total portfolio into each fund). This gives us a straightforward, set-it-and-forget-it baseline exposure to the hedge fund alternatives.

Research by Ibbotson Associates suggests that while the most conservative investors should be all in cash and the most aggressive investors all in stocks, most of us who fall in between can allocate 15 to 25 percent of our portfolios to hedge fund strategies without batting an eye. We might condense this insight by just taking whatever we are doing and adding 20 percent to hedge fund strategies. This is in addition to the allocation already made to commodities and REITs.

Where should this 20 percent come from? Again, if we want to stay about where we were before on the risk/return continuum, take 10 percent from the stock side and 10 percent from the bond side. If we want less risk (at the price of lower expected returns), we could take the whole 20 percent from the equity side. If we want to make a shift toward higher risk and returns, we would take the 20 percent from the bond side.

With this understanding of how much to allocate, which strategies should we invest in and how much should we put into each?

Multi-Strategy: For do-it-yourselfers, there is the new iShares Diversified Alternatives Trust (ticker: ALT). This fund delivers three hedge fund strategies: fixed income arbitrage, managed futures, and global macro. If you buy it inside an IRA you can probably avoid filing a K-1 partnership form for tax purposes.

For those with an investment advisor, we like Natixis ASG Diversifying Strategies Fund (ticker: DSFYX), as we have already mentioned. The Natixis fund has a higher risk/return profile than the iShares fund does, which is fine by us.

Confidence Level: Moderate. Even though ALT is new, it has a low expense ratio of 0.95, no benchmark, and pursues strategies that historically have low correlations to the S&P 500. We love that DSFYX is directly correlation-managed to make sure its correlation to the S&P 500 does not climb above 0.25. Both funds also actively cap their volatility (standard deviation), a nifty feature.

Long/Short Equity: Long/short equity generally relies heavily on individual manager skill, going long and short stocks according to the manager’s judgment. Here we like the TFS Market Neutral (ticker: TFSMX) for both retail investors and those with advisors. Yes, it’s actively managed and has an expense ratio of 2.5 percent, but it has delivered the goods. It is closed to new retail investors as we go to press, but some advisors can get you in. Our fallback would be Quaker Akros Absolute Return (ticker: AARFX).

Confidence Level: Just fair. These are bets on active managers, albeit quantitatively minded ones in the case of TFSMX.

Market Neutral: In this category, we like the new ProShares RAFI Long/Short fund (ticker: RALS), and several additional ones for investors with advisors: DWS Market Neutral (ticker: DDMSX) or JPMorgan Research Market Neutral (ticker: JPMNX), or Managers AMG Global Alternatives (ticker: MGAIX). We like Research Affiliates because it operates passively to capture durable market misvaluations at reasonable expense.

Confidence Level: Medium. These funds are quantitatively driven so there may not be a high degree of individual manager risk (or benefit). The ProShares fund has just opened and daily volume and total assets are currently low, but we would expect these to pick up by the time you read this. In other words, don’t just put in a market order for 100,000 shares and go to the movies. If this fund operates as intended, it could quickly be promoted to our coveted couch potato hedge fund portfolio pantheon above.

Dedicated Short Bias: Although hedge fund investors in aggregate devote 0.3 percent of their assets to this strategy, we suggest that you invest 0.3 percent less than this, or 0.0 percent. We don’t see that the strategy adds value, either historically or theoretically. Until somebody figures out how to deliver returns when the market is down without surrendering returns when the market is up, we would pass here.

Confidence Level: High. It’s easy to be confident when you’re not recommending anything.

Although hedge fund investors in aggregate currently devote 0.3 percent of their assets to dedicated short bias funds, we suggest that you invest 0.3 percent less than this amount, or 0.0 percent.

Global Macro: This is an area where there can be a lot of individual manager variability, to which we are constitutionally allergic. We would just as soon stick DB G10 Currency Harvest Fund (ticker: DBV) for the currency carry trade piece and/or the hybrid Global Macro/Emerging Market IQ Hedge Macro Tracker (ticker: MCRO) to bag some of what the hedge fund managers here are getting. With MCRO, remember that trading volume is still thin. Don’t place orders large enough to impact the price.

Confidence Level: Good. These are passive, mechanical strategies, and we like ’em that way.

Managed Futures: Along with the Elements S&P Citi ETN (ticker: LSC) already mentioned for the couch potato investor, we recommend the AQR Managed Futures Fund (ticker: AQMIX) or the just slightly more expensive Natixis ASG Managed Futures Fund (ticker: AMFAX). These last two funds go beyond commodities to use their trend-following system across the whole range of futures markets, which is why we prefer them.

Confidence Level: High. AQR and AlphaSimplex are at the head of the class.

Fixed-Income Arbitrage: There is a short list of offerings in this group. We mentioned the Western Asset Absolute Return Fund (ticker: WAARX) and the Forward Long/Short Credit Analysis institutional shares (ticker: FLSIX) in Chapter 12, but you’ll need an investment advisor to get either one. Why do we like them? Our pathetic answer would be because recent performance has been fairly good, and in the case of Western Asset, the expense ratio is low at 0.80.

The alternative—recommending a fund whose recent performance has been bad—seems even less appetizing. However, we would just as soon skip the category altogether until something more appealing comes along. If you do wade in here, remember that these funds are tax intensive and you will be happiest if you find a home for them inside your IRA.

Confidence Level: Unknown to us. We would prefer a fund that mechanically captures the beta of fixed-income arbitrage across a number of strategies.

Event-Driven + Convertible Arbitrage: In this hybrid category, we like the AQR Diversified Arbitrage Strategy Fund (ticker: ADAIX). You will need an investment advisor to get in due to the high minimum investment. This fund takes down two hedge fund strategies with a single blow. Otherwise, consider the Merger Fund or the Arbitrage Fund above, but recognize that they won’t deliver the convertible arbitrage part. You could also add to those the Calamos convertible arbitrage fund (ticker: CVSIX), but recognize that this fund is diluted by the covered-call fund attached to it.

Confidence Level: High. AQR eats hedge fund beta for breakfast.

Emerging Markets: The only offering in Emerging Markets is the IQ Hedge Macro Tracker (ticker: MCRO), which is a replicating hedge fund that also targets Global Macro. If you already own emerging market equities, we think that’s close enough, but we also like this fund in the Global Macro arena, so it may be worth having the emerging markets along for the ride.

Confidence Level: High, and we’ll like it even better when it has more assets under its belt and a higher daily trading volume.

Okay, there are some picks. How do we hook them up to our chariot?

After lots of fiddling with the dials, the least dumb approach we can think of is to weight them equally. That is, we take the total dollars we are planning to invest in these hedge fund strategies, and divide by the number of strategies we are employing. To make things even simpler, we could just divide our money among the number of funds we are using.

We could get fancy using some kind of historical or risk-adjusted correlated weightings for each strategy, but that is too clever. We are not able to implement each strategy perfectly. We are often relying on one manager’s idiosyncratic take on the strategy. In Platonic philosophy, you might say we are dealing with images of images. It doesn’t make sense to try to optimize this: we are only optimizing noise. Let’s get some meaningful exposure to a mixed bag of hedge fund strategies and call it a day.

A self-managing retail investor could allocate his money equally among the following, giving him access to five or six different hedge fund strategies.

- Multi-Strategy: ALT

- Long/Short: AARFX

- Market Neutral: RALS

- Global Macro: DBV or MCRO

- Managed Futures: LSC

- Event-Driven: MERFX or ARBFX

An investor using an investment advisor could allocate his alternative investment dollars among the following seven funds:

- Multi-Strategy: DSFYX

- Long/Short: TFSMX

- Market Neutral: RALS or DDMSX

- Global Macro: DBV or MCRO

- Managed Futures: AQMIX

- Convertible Arbitrage: ADAIX

- Event-Driven: ADAIX

Please note: Unlike with the simple three-fund solution above, if you are picking a bunch of individual funds to track hedge fund categories, someone needs to monitor them. This should be an ongoing hobby of yours, or you should work with someone who manages money in this territory.

Back in Chapter 2 we talked about how equity risk dominates the typical 60/40 portfolio, and suggested that the portfolio of the future might be budgeted according to its risk exposure. The problem was and is that a risk-balanced portfolio using only stocks and bonds would have such a high percentage of bonds that its expected return would be far lower than from a conventional 60/40 portfolio. AQR Capital has recently launched its Risk Parity Fund (ticker: AQRNX) that offers an even exposure to the risks of stocks, inflation, and the term and credit risks of bonds. Their solution is to use leverage to bring the returns back up to those expected from a 60/40 portfolio.

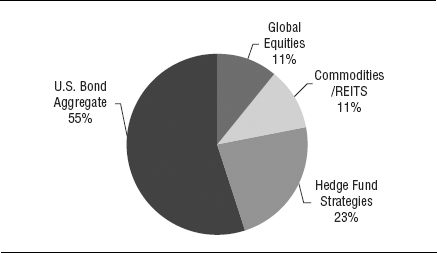

Another possible way to address the problem is to add more asset classes. By Phil’s calculations—and reasonable men will disagree—a four-way risk-balanced portfolio would look something like Figure 13.1.

Figure 13.1 A More Risk-Diversified Portfolio (Dollar Weights)

This new industrial-strength hedge fund allocation could be divided equally among the six or seven funds just mentioned. In this portfolio, the risks are budgeted approximately 25 percent to stocks, 25 percent to term and credit, 25 percent to inflation-sensitive assets, and 25 percent to alternatives. These risks are not completely uncorrelated, nor could they ever be, but they are considerably more spread out than they would be in the standard 60/40.

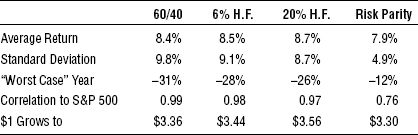

How does this portfolio stack up? To figure this out, let’s conveniently assume that our hedge funds would have tracked the Dow Jones Credit Suisse Hedge Fund Index. Table 13.1 shows our estimate of the risks and returns of these portfolios from 1995 to 2010, after expenses.

Table 13.1 Portfolio Comparison 1995–2010

Table 13.1 starts with the 60/40 stock/bond portfolio, and as we go across the columns from left to right, it adds 6 percent in hedge fund strategies, then 20 percent in hedge fund strategies, and ends with the tribal rock-love risk-parity portfolio shown in Figure 13.1.

The risk-balanced investor on the far right of the table has less drag from the volatility baggage that the 60/40 investor is carrying on the far left. He has decoupled his life to a considerable extent from the vicissitudes of the stock market—a good thing. He will lag his neighbors when the stock market skyrockets, but he will sleep more soundly when it crashes. It looks as if it gives us a big slice of the returns of the 60/40 portfolio with considerably less risk.

Importantly, the risks and returns won’t show up at the same time. There will be times when the 60/40 portfolio performs a lot better and we will feel like chuckleheads for being more diversified in a risk-parity portfolio. If the disparity in performance becomes great enough, we will be tempted to run back to stocks. But a prerequisite to embracing more deviation from the Dow is the responsibility to stay the course at such times. This implies sufficient self-knowledge—truly a rare-earth element—to know that we won’t punch the eject button at exactly the wrong time.

We are not, repeat not, suggesting that you drop everything and put all your money into a risk parity portfolio. We just want to put it out there to stimulate your thinking. This is the path that alternative investments take you toward, and it is one closer to the way many institutional portfolios are managed.

The Alternative Reality

There are going to be more alternative funds coming out. How can you evaluate them? Are you just supposed to sit on your hands waiting for Stein and DeMuth to write another book? Possibly . . . but not necessarily.

You may have noticed that some companies seem to specialize in providing funds in this area. AQR Capital and AlphaSimplex seem to have well thought out implementations of hedge fund strategies; any new offerings from their laboratories deserve scrutiny. If Dimensional Funds ever move into this space (we hope they do and doubt they will), we would be quick to put their funds on a short list to review.

For retail investors, Index IQ has created a number of hedge fund replication indexes and we expect more funds to come out from people who license their indexes.

We also expect that there will be more individual offerings from hedge fund managers going retail. Mutual fund ranker Morningstar is always on the lookout for these strategies and is more likely to review even a relatively new fund if it is in this area. Your authors occasionally kick around the idea of starting a fund-of-funds themselves to provide a one-stop diversification into these alternatives. If and when we ever do—and believe us, that day may never come—we will post a notice on the dazzlingly high-tech Stein-DeMuth website (www.stein-demuth.com).