Failing to plan is planning to fail

Mistake 3: not having a clearly defined and documented trading plan

Without goals and plans to achieve them, you are like a ship that has set sail without a destination.

Anon.

As a trader or investor, the need to have a well-researched and documented plan, or set of rules, for engaging any market is paramount to success. This applies regardless of your chosen time frame or chosen market. The necessity of a trading plan applies to day traders just as much as it applies to longer term share investors. It is a common theme that is stressed by all of the interviewees in this book. Each and every one of them has a plan for engaging the market and has a written set of rules that specify the plan regardless of their trading time frame or chosen market.

From Davin Clarke (see chapter 7) trading extremely short-term moves on Australian shares and derivatives, to Russell Sands (see chapter 6) trading long-term trend moves in the commodity markets — all of these professional traders have a written trading plan that specifies in detail every aspect of their trading strategy. Those trading multiple strategies across multiple markets, such as Jake Bernstein (see chapter 12), will have a plan for each of these, plus an overall set of rules which includes details of their maximum risk exposure and other money management and risk management parameters.

Australian trader Justine Pollard, author of the book Smart Trading Plans, offers these words of advice to those setting out to document their trading plan:

Every trading plan is personal and individual and you need to document your own rules for all aspects of your trading business—what may suit one trader will not necessarily suit another. As a trader, you are totally responsible for your own decisions and actions in the market, so your plan needs to be unique. It needs to reflect your personal motivations for trading and be based on a method that suits your personality and lifestyle. This will be influenced by how much time you have to devote to trading, the amount of available capital you have to trade, and your personal risk profile.

You need to include everything about your trading business in your plan, from your goals, to your trading system right up to all worst-case scenarios. Following is a quick summary of the main areas that need to be covered in any trading plan for someone serious about their trading business.

- Goals and objectives—consider why you want to be a trader and what you want to achieve. Create a vision around trading.

- Trading structure—decide if you will trade under your own personal name (which you might start with) or a business structure, such as a company, trust, partnership or even self-manage your super fund and take control of your investments.

- Trading tools—what are all the tools that you will use to trade the market: website, newspapers, magazines, brokers, newsletters, software programs and data sources?

- Trading style—do you want to be a day trader, short-term trader of a few days or a week, medium-term trader of a week to a few months, or long-term trader of months to years?

- Trading indicators—what indicators will you use to help your trading decisions? Will it be technical indicators, such as moving averages, RSI, MACD, ATR, stochastic, and so on, or fundamental indicators such as P/E ratios and dividend yields?

- Order execution—will you use a full-service broker to place your buy and sell orders, or will you trade from an online platform and execute all the orders yourself?

- Trade exit rules—this will include: initial stop-loss criteria; rules for trailing stops; profit targets or trend-following rules; if and when you will pyramid into positions; and if you will use a time-based rule to exit trades that are just drifting.

- Risk and money management—this is the most important part of your trading plan and is the only control you have over the market. It determines how you open the trade with a position sizing methodology and how you will manage the trade once it is open through a stoploss strategy. It also guides how you will track and set a heat level to manage your maximum drawdown at any point in the market. It will also include details of when you will increase position size as your account value increases and when you will reduce position sizes if your account suffers a string of losses.

- Market exposure guidelines— how you plan to expose yourself to the market after a cluster of losses or when the market trend changes.

- Trading systems—this is your set-up and trigger criteria for selecting trades and your specific exit strategy and management plan for each trade. Will these systems be ones you design and build yourself, learn from someone else and adapt for your own use, or a commercially available system that you buy or lease from a system vendor?

- Trading routine—what do you plan to do on a daily, weekly and quarterly basis to analyse the market, select shares and manage your trades?

- Trading performance and analysis—you need to regularly evaluate your performance as a trader and understand how your trading business is performing and if you need to take any specific action if things are not going well. This will include performance parameters for your trading systems based on all the relevant numbers, and perhaps for yourself based on personal parameters such as stress levels, time to take a holiday, and so on.

- Contingency plan for all worst-case scenarios—consider all things that could go wrong with your trading business and have a plan for how to handle these if they were to occur.

The need to have rules for trading becomes even more important during ‘tough’ times and periods of uncertainty. During buoyant times when markets are trending up and trading appears an easy way to make money, rules are forgotten and traders become slack in applying their rules, if they have even bothered to create a structured set of rules or approach. During such market phases, with steadily rising prices and continued good news forever emanating from all sources, mistakes are often covered by the constant upward push of prices. Stops are forgotten about, position sizing models go out the window, and entry and exit rules become haphazard and slack. Talk to the average punter during these times and the majority will have never considered a plan for trading, let alone documented rules. Easy money is made listening to tips from various sources, trading by ‘gut’ feel, and even just haphazardly buying and selling based on news snippets and rumours.

It all ends in tears when the tide turns and prices crash, a down-trending bear market begins, or the market goes into a long period of sideways consolidation where prices chop around within a range. The reckless punters are left battered and bruised and wondering where the train came from that just slammed into them at 100 kilometres an hour, knocking them and their bank accounts backwards. However, the professional traders and investors have exited their long positions and are now profiting from the move occurring in the opposite direction. They have been able to do this through being educated and running their trading enterprise as a professional business, and predominantly through the use of a written set of rules for all aspects of their market activities. Their trading plans have allowed them to exit trades cleanly and decisively without any conjecture or agonising over what to do. The decisions are made almost clinically as they are taken out of trades on profit targets or stops, and they exit these trades without fear or any emotional attachment. Meanwhile, the punters are agonising over their decisions and watching portfolios get decimated by a relentless downtrend. They continue to look for any reasons to justify why they are still in a losing trade. They will cling to any useless piece of information that appears to justify this lack of activity and inability to get out of these losing trades.

Transfer the funds to my account, please

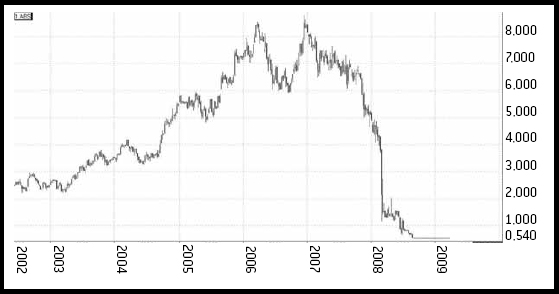

Markets will always separate the professional or prepared trader from the unprepared. They will also continue to transfer money and wealth from the unprepared to the prepared. Sometimes it takes a while, sometimes not so long. The huge worldwide surge in equity prices in the four years up to late 2007, followed by the huge and continuing downtrend in 2008, is such an example. The years of extended upward moving equity prices led to complacency and neglect of the usual discipline for many traders. Prices seemed to be in a never-ending upward movement. The eagerness to participate in this move and not get left behind was further precipitated by relentless news stories (see chapter 14). This continually talked prices up and encouraged people to buy, buy, buy as the mega-cycle of rising prices was ‘set to continue for years’ and we would all be multimillionaires by buying shares, particularly in mining and resource stocks supposedly fuelled by China’s insatiable demand for these resources. On the back of this, all sorts of people were drawn to the share market. Their buying decisions were based on almost everything but a well-researched plan. Broker advice, newspaper stories, hot tips from mates, lunar cycles, dreams, anything and everything became fair game for buying shares. The majority of these people had little or any idea of what they were really doing, and what was really happening. And then it all went sour, as shown in figure 3.1.

Figure 3.1: chart of the 2003–2007 bull market and the 2008 crash

Source: Trade Navigator © Genesis Financial Technologies, Inc

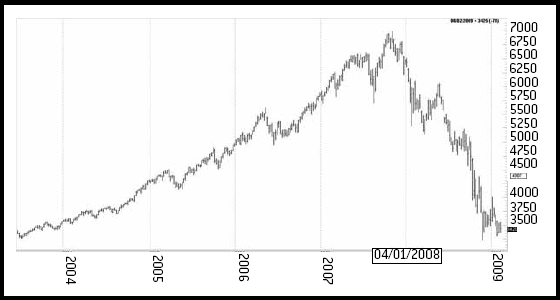

The prepared and disciplined traders and investors knew what to do. They had a predefined set of rules that had been documented well in advance of the events that unfolded. They knew at what point they were to exit any long trades and open positions, and they did so swiftly and decisively. They were prepared. Then there were the unprepared—those who had no idea what had happened or what they now needed to do. They simply sat stunned and inert as prices crashed and their beloved shares were decimated at the hands of the bear market. They watched as portfolios halved in value and some companies that were once the darlings of the market were wiped out, taking them down with them. An example is shown in figure 3.2.

The prepared traders were now also short selling and profiting from the downtrend. Their trading plans contained rules for now trading in the opposite direction to the one they had been trading in for the past several years. To these traders, there was no difference. They simply took the short sell signals, again without emotional attachment or subjective reasoning, and got on with the business of trading. They made no judgement call on the rationale behind this sudden change in sentiment or direction, and had no reason to do so. They simply executed the trades according to the rules of their system or trading plan and continued playing by their rules to successfully and profitably engage the equity markets.

It took a while, but the wealth created by the unprepared was eventually transferred to the prepared. Those who had been complacent during the supposedly never-ending bull market for equities and super-cycle of commodity prices were smashed up on the rocks. Their lack of a professional approach to trading had cost them dearly. Those who had scoffed at the need for a trading plan and had blindly entered the markets on a whim were now lamenting this decision, searching for someone else to blame and crying into their beers to anyone who would listen to their stories of self-pity and grief. They had broken the number one rule of successfully running any business: have a plan. Without a plan they had no idea what to do when things went bad. During the good times they had simply ridden the coat-tails of the market in general and had been able to profit by doing this. As the saying goes, ‘a rising tide lifts all boats’. When the market turned against them, they had no idea of what to do, and many of their sources for hot tips and advice had now either disappeared or changed their tune.

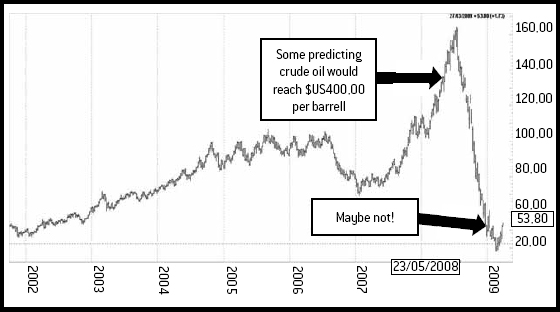

This prolonged fall in equity markets, brought about by what is being termed the ‘global financial crisis’, is an extreme example of what can happen when markets turn. But it is not an isolated incident. Corrections, price changes, outside influences and a huge array of factors are constantly bombarding markets. Figure 3.3 shows the huge upward move in oil prices during 2007 as speculation became rife that the world was running out of crude oil and prices would reach well above $200 per barrel, with some so-called experts even predicting it would reach $400 per barrel. It seems somehow that they were wrong!

Trades are constantly being entered and exited on a huge variety of markets all around the globe, 24 hours per day via electronic markets and trading platforms. Everywhere are woeful tales of someone being affected by this, that or the other reason in one or more of their trades, and how such-and-such announcement or event somehow had a catastrophic impact on their position. The vast majority of these stories emanate from those with no written trading plan or set of structured rules for engaging the markets they are trading.

The best time to document your trading plan is before you begin trading. It is a task that requires discipline and commitment to complete it—not unlike trading itself. If you have the discipline to take the time to commit your trading plan to paper, the chances are much higher that you will succeed as a trader because you will be creating a disciplined and structured approach to all your trading activities.

Because it is a big task to complete a trading plan, it’s easy to put it off and say ‘I’ll do it later’, but it is a lot of information to carry around in your head. By taking this information out of your head and writing it down, you are giving your trading perspective, focus and clear guidelines. Plus, you are relieving your mind of the stress of trying to retain all that information and allowing more knowledge to come in. It is well worth the effort and you will feel much more at ease as you move forward with your trading.

It should be written before you even start trading. But most people have already traded in some way before even contemplating writing a trading plan. It is like a journey you go through. You start out just wanting to trade and wanting to get your money in the market and seeing dollar signs flashing in front of your eyes (I know I did). Then you take losses and your ego takes a beating and you either stop trading altogether or you get it together and realise you need to learn, educate yourself and write a trading plan—which I think is what happens to most people.

If you are trading and haven’t committed a plan to paper then do it now! It will unburden your mind and provide you with a degree of clarity for your trading that you may not currently have.

It is a huge feeling of relief, like a weight lifted off your shoulders, when you complete your trading plan. It is hard work and takes time to do, but it feels so good when it is complete and the benefits are endless. You will now have clear rules and guidelines to follow and have answered all the ‘what if?’s.

It also gives your trading clarity and control. You can’t control the market, it does not know you exist, but you can control how you manage your risk in the market and that is so important. Your plan should include clear risk and money management strategies and this is what will give you control over your trading.

Your trading plan will be a constantly evolving document. Like a living organism, it will grow, expand and change with you as you develop as a trader. While it is important to know exactly what your rules of engagement are, it is also important to realise that these will change over time. For example, you may move from trading shares to trading futures. Changes to some markets or regulatory controls imposed by ill-informed rule makers may force you to adjust the markets you trade or the instruments you use to trade these markets. Your lifestyle may change as a result of shifting family circumstances, such as children entering your life. Life is a constant state of ebb and flow as a huge variety of external forces effect the way we trade, the time and capital we have available, and the markets we can or want to trade. This flexibility is just as important as the discipline of writing down your trading plan. The most important thing to do is recognise and document these changes in your trading plan so you know exactly what it is you are doing all of the time.

Anybody who plans to invest money in the market needs a trading plan. Think about it, if you were to buy a business, would you buy it without analysing it and understanding its costs, profit potential, drawdowns, worst-case scenarios and working out a plan to market it? Trading is no different and should be treated the same way.

When you trade the markets, you are putting money at risk with the goal of achieving a profit, just like any small business. So you need to treat it like a business and have a plan that sets out how you are going to manage it.

The only way you can be successful in the markets is to develop a trading plan that suits your personality. It is up to you to lay the foundations yourself and develop your plan to blend with your lifestyle and personality.

In this chapter, Justine Pollard, a successful private trader and author, shared her thoughts on creating and documenting a trading plan.

Justine is a trader and author of Smart Trading Plans. Her book steers you through the process of developing and implementing your own personal trading plan to increase your chances of success in the market.

Visit <www.smarttrading.com.au> for more information and to download your free special report, 10 Tips to Smarter Trading.