CHAPTER 5

FEDERAL FINANCIAL STATEMENTS

INTRODUCTION TO FEDERAL FINANCIAL STATEMENTS

The financial statements issued by component entities of the Federal Government differ significantly from the statements issued by commercial entities, not-for-profit organizations, or state and local government entities. In addition, the requirements for Federal Government financial statements and their requisite form and content also differ between the three branches of the Federal Government.

HISTORICAL EMPHASIS OF FEDERAL FINANCIAL REPORTING

Historically, within the Federal Government, considerable effort was expended to meet only legally required reporting mandates of Congress. While such reports were important, these requirements were not the reporting information most needed by Federal entity executives to manage activities and operations properly. As a result, significant changes and improved financial reporting requirements were implemented by the Federal Government in the 1990s.

For the prior 200 years, Congress and executives of Federal entities were almost exclusively concerned with appropriated amounts, the status of apportioned budget authority, and the rate of obligation and expenditure. So long as the obligated and expended amounts remained below the amounts appropriated by Congress, few expressed any concern about the absence of other types of data. Information presented by Federal entities for both external and internal uses were essentially the dollar values of obligated balances and cash expenditure amounts.

In the 1940s and 1950s, Congress, the Government Accountability Office (GAO), the Office of Management and Budget (OMB), Federal executives, and two Hoover Commissions recognized the limitations of obligation and expenditure accounting and reporting. This type of stewardship reporting was not sufficient to meet the scope of the financial management needs of the government. In the 1960s and 1970s, Congress became concerned that Federal entities were not managing programs to ensure that the rates of expenditures were consistent with program plans and desired economic thrusts and were not reflective of promised accomplishments or results. As a result, laws imposed fiscal and performance restrictions on programs. Time limitations were placed on the period for obligation of appropriated funds and on the time periods by which the Federal monies had to be fully expended. If both time limitations were not met, the entity’s funding authority might lapse.

HIERARCHY OF ACCOUNTING PRINCIPLES FOR FEDERAL ENTITIES

For the 200 years preceding passage of the Chief Financial Officers Act of 1990 (CFO Act), Congress did not require, nor did Federal entities apply, consistent and uniform accounting and reporting standards, prepare annual agency financial statements, or have independent audits performed over financial statements. This changed with the CFO Act. Also in 1990, the newly established Federal Accounting Standards Advisory Board (FASAB) set forth a basic objective that Federal accounting and financial reporting should assist in fulfilling the government’s duty to be publicly accountable for monies raised through taxes and for reporting that Federal expenditures were made in accordance with appropriations laws.

FASAB suggested that there could be several levels of accountability: policy, program, performance, processes and procedural, and legal. In its statement of objective, FASAB noted that this accountability must have utility to a variety of users, which FASAB categorized into four groups:

1. Individual citizens (e.g., taxpayers, voters, or service recipients of Federal assistance)

2. Congress (individual members, committees, plus legislative agencies with budget and other Federal financial responsibilities, such as the Congressional Budget Office [CBO] and GAO)

3. Federal executives and those with oversight responsibilities (including the President and those acting as the President’s agents)

4. Program managers (i.e., those Federal entity executives responsible for operating plans, program operations, and budget execution).

1

To meet the needs of this myriad of users, FASAB recommended that financial statements and reports be issued for individual Federal entities and for all entities, in total, government-wide.

FEDERAL GOVERNMENT’S ACCOUNTING HIERARCHY

The hierarchy of accounting for Federal entities is established by the American Institute of Certified Public Accountants (AICPA) Code of Professional Conduct Rule 203, Accounting Principles. The interpretation under Rule 203 designates FASAB as the body to establish accounting principles for Federal Government entities through the insurance of Statements of Federal Accounting Standards (SFFAS). SFFAS 34, The Hierarchy of Generally Accepted Accounting Principles, Including the Application Standards Issued by the Financial Accounting Standards Board, established the hierarchy as follows:

1. Officially established accounting principles consist of FASAB SFFAS and interpretations. FASAB standards and interpretations will be periodically incorporated in a publication by the FASAB

2. FASAB technical bulletins and, if specifically made applicable to Federal reporting entities by the AICPA and cleared by the FASAB, AICPA Industry Audit and Accounting Guides

3. Technical releases of the Accounting and Auditing Policy Committee of the FASAB

4. Implementation guides published by the FASAB staff as well as practices that are widely recognized and prevalent in the Federal Government

In the absence of guidance provided by the preceding hierarchy, the auditor of a Federal Government entity may consider other accounting literature, including:

- FASAB concept statements

- The pronouncements referred to in the second category above when not specifically made applicable to Federal reporting entities by the FASAB

- The pronouncements of other accounting and financial reporting standards-setting bodies, such as the Financial Accounting Standards Board (FASB), Governmental Accounting Standards Board, International Accounting Standards Board, and International Public Sector Accounting Standards Board; professional associations or regulatory agencies; and accounting textbooks, handbooks, and articles

FEDERAL REPORTING ENTITY

There is only one overall economic entity: the Federal Government as a whole. But, on a daily basis, the Federal Government operates as a network of somewhat autonomous entities: departments, agencies, subdepartments and subagencies, commissions, and other Federally funded or Federally assisted organizations. Each entity manages activities, can legally obligate the government, and is authorized by Congress to spend Federal monies.

Until the 1990s, there had been no uniform resolution of what constituted a Federal accounting and reporting entity. The individual congressional appropriations were viewed by most as the “accountable” entity, while the departments and operating agencies were viewed as the “reporting” entities. This distinction was an impediment to implementing consistent, uniform cost-based, accrual financial reporting within Federal departments and agencies, between these and other entities of the government, and for the government as a whole. Others, with different responsibilities, believed that the budget accounts or Treasury accounts (and these do not provide for the same accounting) provided the more accurate and revealing financial disclosures. Still others thought the primary reporting entity should be special funds and trusts established by various laws. Further complicating Federal accountability was the fact that congressional appropriations and other forms of spending authority were not clearly or neatly aligned by Federal departments and agencies. A final void in the Federal reporting was that no financial statements were prepared to report on the operations of the Federal Government as a whole.

Limitations of Appropriation, Cash Basis Accounting

Historically, Federal accounting and reporting for some departments and agencies was based on congressional legislation that provided a single appropriation to a single Federal Agency as the primary financing resource for operations, which considerably simplified accounting and reporting. However, this was not the norm, particularly for the larger Federal departments, which frequently had responsibility for two or more congressional appropriations. When a single department or agency is responsible for multiple appropriations, these appropriations supported a variety of operations and usually a combination of programs; each appropriation was separately reported. Then, at its discretion, Congress might opt to not provide funding through an appropriation at all but rather through another form of spending authority whereby the agency is authorized to first spend Federal money and then report to Congress for “reimbursement.” In other instances, an agency’s operations are supported by none of these funding devices but rather through a congressionally mandated “allocation” of money from another agency’s appropriation, raising the issue as to which agency should report what amounts and how. Financial information on individual Federal entities and programs arrayed only by appropriation or budget authority was of limited value to Federal executives and managers in operating the day-to-day activities. These macro-level reports and statements on appropriation balances, essentially a cash-basis reporting, provided few clues to the economy, efficiency, or relative effectiveness of Federal operations.

Resolution of this accountability and reporting conundrum of 200 years began in earnest with passage of the CFO Act that mandated Federal Agencies to annually prepare entity-wide financial statements for all resources for which they were responsible, using the uniformly applicable accounting standards for Federal Agencies, and that these financial statements be independently audited. By 1994, FASAB recommended Federal departments and agencies to report on all of their stewardship responsibilities in a single set of financial statements, and not separately, by individual appropriations and funding sources. FASAB, in its accounting concepts, stated that a basic postulate of accounting is that accounting information pertains to entities (meaning a Federal Agency or organization) and that, therefore, reporting should be performed by the organization regardless of the numerous and distinct devices used to fund the organization.

Breadth of Federal Entity Accountability

Federal entities must provide financial data on a variety of reporting bases, often for differing time periods and by many organizational structures (e.g., individual departments and agencies, subordinate offices, bureaus, branches). Reporting details must include an accounting by appropriations of related financial positions, obligations, expenditures, cash disbursements, and costs of authorized programs, products, activities, and services managed. Also, systems of Federal entities are expected to provide a ready and accurate reporting by every congressional district in America for an entity’s programs that could impact tens of thousands of states, counties, cities, towns, and other governmental units receiving Federal financial assistance. Not to be overlooked, several agencies make payments directly to tens of millions of individual citizens, each requiring an individual “account” and requiring some type of reporting. Such an accounting and financial reporting has no counterpart in or out of government.

This chapter describes the form and content of the Federal Government’s financial statements for both individual Federal entities and for the consolidated reporting of the U.S. government as a whole.

REPORTING BY DEPARTMENTS, AGENCIES, AND THE GOVERNMENT AS A WHOLE

Executive branch agencies subject to the requirements of the CFO Act, as amended by the Federal Financial Management Act of 1994, Federal Financial Management Improvement Act of 1996, Reports Consolidation Act of 2000, or Accountability of Tax Dollars Act of 2002, prepare their financial statements in accordance with the policies prescribed by OMB. The latest guidance issued by OMB is Circular A-136, Financial Reporting Requirements.2 Several of the components of the legislative branch of government have elected to prepare their financial statements based on the guidance contained in this bulletin, but are not required to comply with all of its provisions. To date, the judicial branch of government has elected not to issue financial statements. The majority of the following discussion will focus on financial statements prepared in accordance with OMB Circular A-136.

Performance and Accountability Reports

Each agency subject to the CFO Act or Accountability of Tax Dollars Act is required to annually submit their audited financial statements in a Performance and Accountability Report (PAR), which combines performance and financial reporting into a single document. In addition to the base financial statements, the PAR will include a management’s discussion and analysis (MD&A), a performance section (where the agency will discuss its strategic goals), the Independent Auditor’s Reports, the Required Supplementary Stewardship Information, and other information, such as Improper Payments Information Act of 2002 reporting details. In conducting an audit of a Federal Agency, the auditor is responsible for forming an opinion on the basic financial statements taken as a whole. The MD&A and other information that are not parts of the basic financial statements, but are required by FASAB and OMB Circular A-136, are subjected only to certain limited procedures. The auditor does not opine on the information presented outside of the basic statements. The remainder of this chapter focuses on the six financial statements on which the auditor will opine:

1. Statement of financial position or balance sheet (

Exhibit 5.1)

EXHIBIT 5.1 Balance Sheet

The accompanying notes are an integral part of these statements.

|

Department/Agency/Reporting entity

CONSOLIDATED BALANCE SHEET

As of September 30, 2XXX (CY) and 2XXX (PY)

(in dollars/thousands/millions) |

| Assets (Note 2): |

2XXX

(CY) |

2XXX

(PY) |

| Intragovernmental: |

|

|

| 1. Fund balance with Treasury (Note 3) |

$ xxx |

$ xxx |

| 2. Investments (Note 5) |

xxx |

xxx |

| 3. Accounts receivable (Note 6) |

xxx |

xxx |

| 4. Loans receivable |

xxx |

xxx |

| 5. Other (Note 12) |

xxx |

xxx |

| 6. Total intragovernmental |

xxx |

xxx |

| 7. Cash and other monetary assets (Note 4) |

xxx |

xxx |

| 8. Investments (Note 5) |

xxx |

xxx |

| 9. Accounts receivable, net (Note 6) |

xxx |

xxx |

| 10. Taxes receivable, net (Note 7) |

xxx |

xxx |

| 11. Direct loan and loan guarantees, net (Note 8) |

xxx |

xxx |

| 12. Inventory and related property, net (Note 9) |

xxx |

xxx |

| 13. General property, plant and equipment, net (Note 10) |

xxx |

xxx |

| 14. Other (Note 11) |

xxx |

xxx |

| 15. Total assets |

$ x,xxx |

x,xxx |

| 16. Stewardship PP&E (Note 11) |

|

|

| Liabilities (Note 13): |

|

|

| Intragovernmental: |

|

|

| 17. Accounts payable |

$ xxx |

$ xxx |

| 18. Debt (Note 13) |

xxx |

xxx |

| 19. Other (Notes 15, 16, and 17) |

xxx |

xxx |

| 20. Total intragovernmental |

xxx |

xxx |

| 21. Accounts payable |

xxx |

xxx |

| 22. Loan guarantee liability (Note 8) |

xxx |

xxx |

| 23. Debt held by the public (Note 14) |

xxx |

xxx |

| 24. Federal employee and veteran benefits (Note 15) |

xxx |

xxx |

| 25. Environmental and disposal liabilities (Note 16) |

xxx |

xxx |

| 26. Benefits due and payable |

xxx |

xxx |

| 27. Other (Notes 15, 16, 17, 18 and 19) |

xxx |

xxx |

| 28. Total liabilities |

x,xxx |

x,xxx |

| 29. Commitments and contingencies (Note 20) |

|

|

| Net position: |

|

|

| 30. Unexpended appropriations—earmarked funds (Note 21) |

xxx |

xxx |

| 31. Unexpended appropriations—other funds |

xxx |

xxx |

| 32. Cumulative results of operations—earmarked funds (Note 21) |

xxx |

xxx |

| 33. Cumulative results of operations—other funds |

xxx |

xxx |

| 34. Total net position |

$ x,xxx |

$ x,xxx |

| 35. Total liabilities and net position |

$ x,xxx |

$ x,xxx |

2. Statement of net cost (

Exhibit 5.2)

EXHIBIT 5.2 Statement of Net Cost

The accompanying notes are an integral part of these statements.

|

Department/Agency/Reporting Entity

STATEMENT OF NET COST

For the years ended September 30, 2XXX (CY) and 2XXX (PY)

(in dollars/thousands/millions) |

|

2XXX

(CY) |

2XXX

(PY) |

| Gross Program costs: |

|

|

| Program A: |

|

|

| Gross costs (Note 22) |

$ xxx |

$ xxx |

| Less: earned revenue |

−xxx |

−xxx |

| Net program costs: |

$ xxx |

$ xxx |

| Other Programs: |

|

|

| Program B: |

xxx |

xxx |

| Program C: |

xxx |

xxx |

| Program D: |

xxx |

xxx |

| Program E: |

xxx |

xxx |

| Other programs: |

xxx |

xxx |

| Less: earned revenue |

−xxx |

−xxx |

| Net other program costs: |

$ x,xxx |

$ x,xxx |

| (Gain)/Loss on pension, ORB, or OPEB |

|

|

| Assumption changes (Note 15) |

$ −xxx |

$ −xxx |

| Net program costs including |

|

|

| Assumption changes: |

$ x,xxx |

$ −x,xxx |

| Cost not assigned to programs |

xxx |

xxx |

| Less: earned revenues not attributed to programs |

−xxx |

−xxx |

| Net cost of operations |

$ x,xxx |

$ x,xxx |

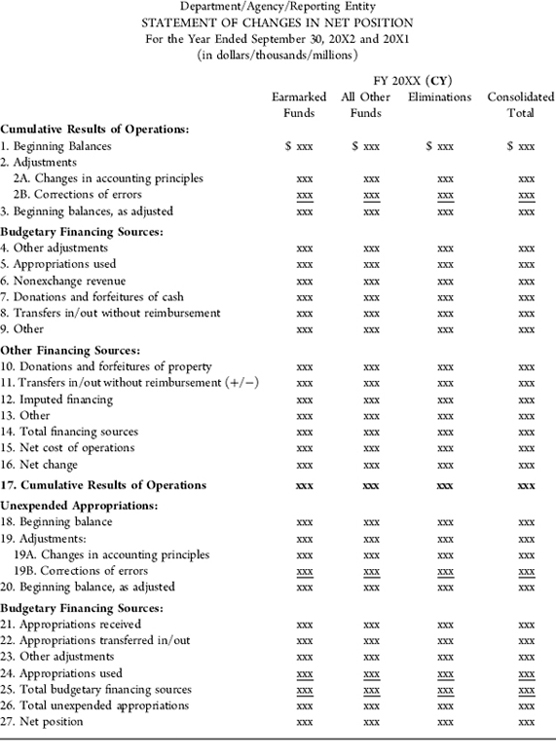

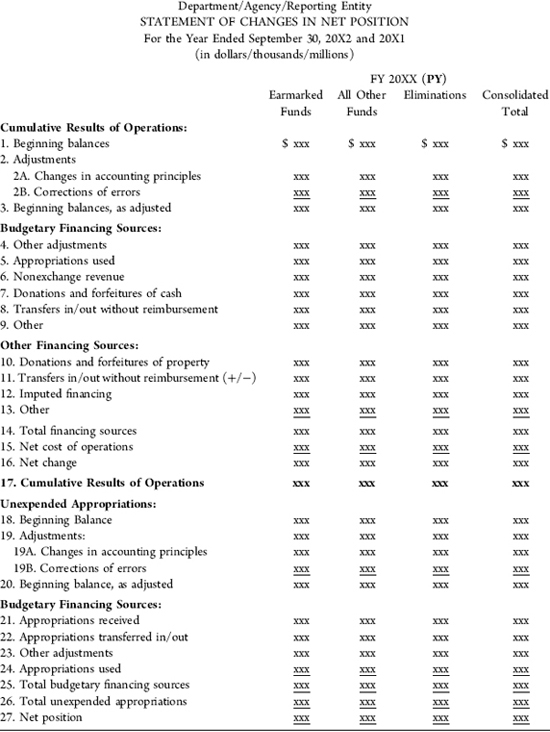

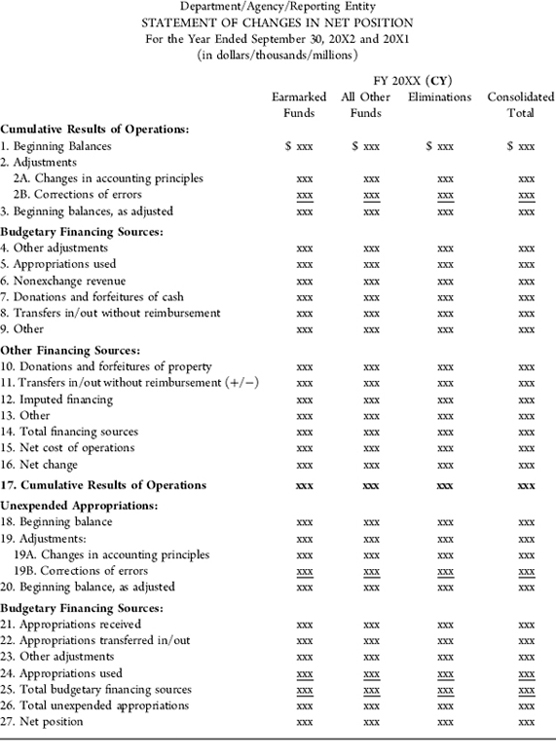

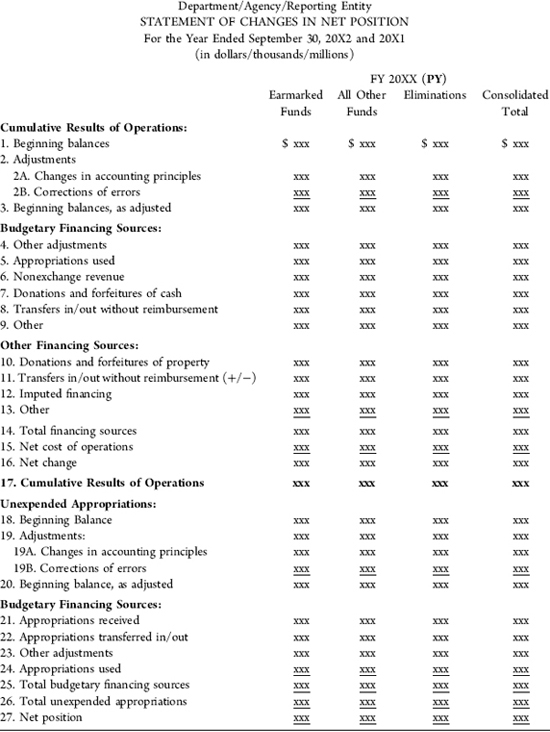

3. Statement of changes in net position (

Exhibit 5.3)

EXHIBIT 5.3 Statement of Changes in Net Position

The accompanying notes are an integral part of these statements.

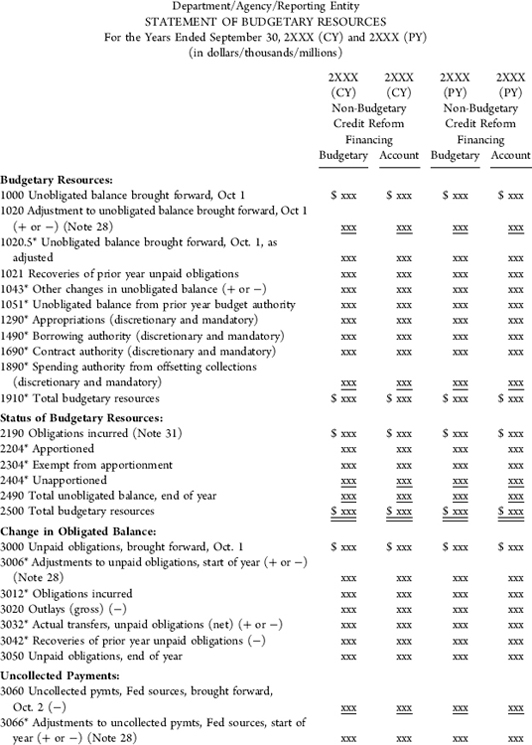

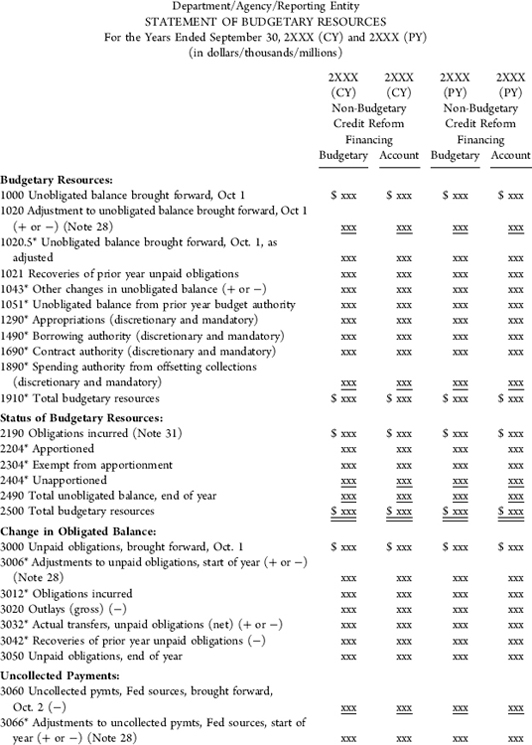

4. Statement of budgetary resources (

Exhibit 5.4)

EXHIBIT 5.4 Statement of Budgetary Resources

The accompanying notes are an integral part of these statements.

5. Statement of custodial activity (

Exhibit 5.5)

Exhibit 5.5 Statement of Custodial Activity

The accompanying notes are an integral part of these statements.

|

Department/Agency/Reporting Entity

STATEMENT OF CUSTODIAL ACTIVITY

For the Years Ended September 30, 2XXX (CY) and 2XXX (PY)

(in dollars/thousands/millions) |

|

2XXX |

2XXX |

| Revenue Activity: |

|

|

| Sources of Cash Collections: |

|

|

| 1. Individual Income and FICA/SECA Taxes |

$ xxx |

xxx |

| 2. Corporate Income Taxes |

xxx |

xxx |

| 3. Excise taxes |

xxx |

xxx |

| 4. Estate and Gift Taxes |

xxx |

xxx |

| 5. Federal Unemployment Taxes |

xxx |

xxx |

| 6. Customs Duties |

xxx |

xxx |

| 7. Miscellaneous |

xxx |

xxx |

| 8. Total Cash Collections |

x,xxx |

x,xxx |

| 9. Accrual Adjustments (+/−) |

xxx |

xxx |

| 10. Total Custodial Revenue |

x,xxx |

x,xxx |

| Disposition of Collections: |

|

|

| 11. Transferred to Others (by Recipient): |

|

|

| Recipient A |

xxx |

xxx |

| Recipient B |

xxx |

xxx |

| Recipient C |

xxx |

xxx |

| 12. (Increase)/Decrease in Amounts Yet to Be Transferred (+/−) |

xxx |

xxx |

| 13. Refunds and Other Payments |

xxx |

xxx |

| 14. Retained by Reporting Entity |

xxx |

xxx |

| 15. Total Disposition of Collections |

xxx |

xxx |

| 16. Net Custodial Activity |

$ 0 |

$ 0 |

6. Statement of social insurance (SOSI) and statement of changes in social insurance amounts (SSCSIA) (

Exhibit 5.6)

EXHIBIT 5.6 Illustrative Statement of Social Insurance

Government Corporations

The financial statements of Federal departments, agencies, and other entities must comply with 31 U.S.C. 3515 and other legal criteria for presenting the financial position and results of operations of Federal entities. The OMB circulars and bulletins prescribing the form and content of Federal financial statements essentially incorporate the Federal financial accounting concepts and standards researched and recommended by FASAB. OMB Circular A-136 does, however, also mention government corporations (GCs). GCs are not responsible for complying with 31 U.S.C. 3515 but instead must comply with 31 U.S.C. 9101 through 9110.

GCs are subject to the Government Corporation Control Act (GCCA) of 1945. The GCCA was intended to make GCs more accountable to Congress while allowing the freedom to pursue commercial activities. The CFO Act of 1990 amended the GCCA to strengthen the audit and management reporting requirements, but it did not include a definition nor did it include classification criteria for GCs.

There are two types of GCs: mixed ownership corporations and wholly owned GCs. Examples of mixed ownership GCs are listed next.

- Federal Deposit Insurance Corporation

- Federal Home Loan Banks

- National Credit Union Administration

- Resolution Trust Corporation

Examples of wholly owned GCs are listed next.

- Commodity Credit Corporation

- Community Development Financial Institutions Fund

- Export-Import Bank of the United States

- Government National Mortgage Association

According to 31 U.S.C. 9109, “Exclusion of a Wholly Owned Government Corporation from This Chapter,” when the President of the United States considers it practicable and in the public interest, the President may include in the budget submitted to Congress under 31 U.S.C. 1105, “Budget Contents and Submission to Congress,” a recommendation that a wholly owned GC be deemed an agency for fiscal matters. If approved, the corporation is deemed to be an agency under Chapter 11 and for fiscal matters for fiscal years beginning after the year of approval.

Very similar to Federal Agencies, GCs are required to submit their reports to OMB, GAO, and Congress no later than 45 days after the end of the fiscal year (unless they have registered equity securities with the Securities and Exchange Commission, at which point they are exempt from the accelerated dates). The 45-day deadline is a permanent requirement for all GCs regardless of fiscal year.

Unlike Federal Agencies, however, there is no requirement that a GC follow FASAB accounting. GCs may elect to follow FASB accounting or any other accounting they deem appropriate for their purposes. Prior to the amendment to the GCCA in 1990 by the CFO Act, the GCCA required audits to be reviewed for consistency with commercial accounting practices.

Per statute, a GC must submit an “Annual Management Report” to Congress no later than 180 days after the end of the fiscal year. The report includes the following financial statements:

- Statement of financial position

- Statement of operations

- Statement of cash flows

- Reconciliation to the budget report of the GC, if applicable

- Statement on internal accounting and administrative control systems

- Audit report

FEDERAL FINANCIAL STATEMENTS

The six principal financial statements required of Federal entities discussed in this chapter include:

1. Statement of financial position or balance sheet (

Exhibit 5.1)

To be complete, a Federal entity’s financial statement must also include several required footnotes, plus other notes necessary to describe the financial and other activity of the specific Federal entity. Additionally, the prescribed Federal financial statements must contain other information including:

- Supplementary stewardship information relating to property, plant, and equipment (PP&E); entity investments; and program-related risks

- Supplementary information, including a statement on budgetary resources, custodial activity, and segment-related information, where appropriate

- Other accompanying information, which would include data on performance measures and forgone Federal revenues, on subjects such as tax burden and tax gaps, as appropriate for specific entities

These OMB-prescribed financial statements reflect summarized financial information contained in 2,000 ledger, subledger, and subsidiary accounts of the Federal Government’s standard general ledger. In addition to providing meaningful reporting to citizens, the data in these entity-level financial statements form the basis for the consolidated financial statements of the U.S. government, which are also required by the CFO Act. Entity financial statements are rolled up by the Treasury Department when compiling the government-wide consolidated statements.

Currently, Federal entities are required to submit a quarterly financial statement package to OMB that consists of their balance sheet, statement of net cost, and statement of budgetary resources. A complete audited set of financial statements, including all required statements and note disclosures, is required at year-end. Included in this set are the financial statements that must, for each entity and for the government as a whole, annually undergo an independent audit.

Balance Sheet (Statement of Financial Position)

The balance sheet is the component of the Federal financial statement that most closely resembles the corresponding statement of a commercial enterprise. The balance sheet presents the assets, liabilities, and net position of a Federal entity as of a specific time. The example presented in Exhibit 5.1 illustrates the prescribed format reflected in OMB Circular A-136. The key elements of a Federal Agency’s balance sheet include:

- Intragovernmental assets and liabilities (i.e., assets and liabilities arising from transactions among Federal entities) being shown separately from assets and liabilities arising from transactions with non-Federal entities.

- Net position broken down between unexpended appropriation (the portion of an entity’s appropriation represented by undelivered orders and unobligated balances) and cumulative results of operation3 (the net results of operations since inception plus the cumulative amount of prior period adjustments; this includes the cumulative amount of donations and transfers of assets in and out without reimbursement). Unexpended appropriations and cumulative results of operations are further subdivided into earmarked funds (and referred to as funds from dedicated collections) and other. As defined by FASAB, funds from dedicated collections are financed by specifically identified revenues, often supplemented by other financing sources, which remain available over time.

Classifications in a Federal Balance Sheet

An entity’s balance sheet presents data as of a specific moment in time; a Federal balance sheet could present the financial position of a Federal entity as of the end of a month, quarter, or fiscal year.

Exhibit 5.1 is a generic example of the classified balance sheet required of Federal entities by OMB. OMB’s form and content guidelines prescribes a classified balance sheet for Federal entities. Due to differing missions and programs of Federal entities, not all necessarily issue a balance sheet with this illustrated content or format.4

Congress is the ultimate determinant of what a Federal entity must report on and how. It is Congress that authorizes certain Federal entities to operate certain programs and not others. Congress designates which constituencies a Federal entity must serve and how (e.g., large corporations with big contracts; small businesses by subsidized loans and set-aside programs; nonprofit and educational institutions by grants; the young, old, hungry, and homeless by grants and direct subsidies; or others by loan and loan guarantee programs for education, health, economic development, natural disasters, etc.).

Accounting for Assets

Assets are defined as tangible or intangible items owned by the Federal Government that could have probable economic benefits that can be obtained or controlled by the Federal entity.5 These assets include cash, investments, real and personal properties, and also claims of the Federal entity against non-Federal entities or parties (e.g., accounts receivable, interest receivable, and amounts due from Federal advances and advances or prepayments to these non-Federal entities or parties). With some exceptions, assets are initially recorded as purchased costs or donated values.

Accounting for Liabilities

FASAB and OMB define a Federal liability as a “probable and measurable future outflow of resources arising from past transactions or events.” The liabilities grouping of accounts include an enormity of transactions and events, such as accounts payables, end-of-period accrual liabilities, Federal commitments and guarantees legally assumed or entered into, contingencies, damages from litigious proceedings, and others. Liabilities are measured and recorded in a Federal entity’s accounts in the period incurred and removed from the accounts in the period liquidated or paid. Also, liabilities represent amounts owed and are not dependent upon receipt of an invoice or request for payment. Liabilities must be reported irrespective of whether Federal funds are available or authorized for their payment.

Federal liabilities arise in four ways:

1. Exchange transactions (i.e., for services rendered)

2. Government-related events

3. Government-acknowledged events (i.e., voluntary assumption of debts, risks, or costs of others)

4. Nonexchange transactions (i.e., debts and amounts due the sovereign government, as taxes)

Any advance payments and prepayments from other entities for goods or services yet to be delivered by a Federal entity must also be recorded as other current liabilities.

Accounting for the Net Position of a Federal Entity

Net Federal or entity position is defined by FASAB as the “unexpended appropriations and the cumulative result or residual balance” resulting from (1) the initial investment to commence a Federal operation; (2) the cumulative results of the operation’s revenues or resources and expenses; and (3) donations, collections, or transfers of funds or other property by or to a Federal entity, as permitted by Congress.

- Unexpended appropriations are appropriations not yet obligated or expended, and undelivered orders.

- Cumulative results of operations include amounts accumulated over the years by an entity from its financing sources less expenses and losses, including donated capital and transfers in the net investment of the government account and the entity’s liabilities (for accrued leave, credit reform, and actuarial liabilities not covered by available budgetary resources).

- Residual balance is comprised of appropriated capital provided by Congress; invested capitalized assets or expended appropriations for purchased goods and property; or receivables due for loaned or advanced Federal monies. The net position investment could relate to a single appropriation, several appropriations, or other congressional budgetary authority accounts.

In addition to the information presented on the face of the balance sheet, certain information related to the assets and liabilities of a Federal entity is required to be disclosed in the notes to the financial statements, per the provisions of OMB Circular A-136. Some disclosure requirements unique to the Federal environment include these:

- Nonentity assets. Nonentity assets are those assets that are held by the entity but are not available to the entity. Examples of nonentity assets include customs duty receivables that the Customs Service collects for the U.S. government but do not have the authority to spend, the Federal income tax receivable that the Internal Revenue Service (IRS) collects, and the regulatory fees collected by the Federal Communications Commission. In each case, the Federal entity holding the asset does not possess the authority to spend the funds. Further disclosure is required to show intragovernmental nonentity assets. Also, the agency must provide other information needed to understand the nature of nonentity assets.

- Fund balance with Treasury. The composition of fund balance with Treasury (i.e., amounts representing trust, revolving, appropriated, and other fund types) is required to be disclosed along with the status of the fund balance (i.e., amounts unobligated and available, obligated and unavailable, disbursed or not yet disbursed).

- Cash and other monetary assets. The balance is required to be divided into cash, foreign currency, and other monetary assets (i.e., gold, special drawing rights, U.S. Reserves in the International Monetary Fund). In addition, the entity is required to disclose any restrictions on cash.

- Investments. The cost, unamortized premium or discount, amortization method, net investment, other adjustments, and market value of all material investments of a Federal entity are required to be disclosed. In addition, any information relative to understanding the nature of reported investments, such as permanent impairments, should be disclosed.

- Direct loans and loan guarantees. Considerable additional disclosure is required for Federal Agencies subject to the provisions of the Federal Credit Reform Act. See SFFAS 2, Accounting for Direct Loans and Loan Guarantees as well as OMB Circular A-136 for discussion and formatting of the required disclosures.

- Liabilities not covered by budgetary resources. These are liabilities for which congressional action is needed before budgetary resources can be provided. These disclosures should report intragovernmental and other liabilities separately. The distinction between funded and unfunded liabilities is as follows:

- Federally funded liabilities would be liabilities covered by budgetary resources. That is, the Federal entity has available to it congressionally approved expenditure authority, through an appropriation law or other budgetary or contract authority that permits the entity to recognize and pay these liabilities.

- Federal unfunded liabilities would be those liabilities recognized by a Federal entity that are considered to be liabilities not covered by budgetary resources, as defined in the above paragraph. Payables and liabilities not covered by budgetary resources are unfunded and should be separately disclosed and segregated from payables or liabilities that are covered by budgetary resources.

- Federal Employee and Veterans Benefits. Entities that are responsible for administering pensions, retirement benefits, and other postemployment benefits should calculate and report these liabilities and related expenses in accordance with SFFAS 5, Accounting for Liabilities of the Federal Government.

In addition, the normal required disclosures under generally accepted accounting principles (GAAP) for areas such as accounts receivable, inventory, PP&E, debt, leases, and commitments and contingencies are also required for Federal entities.

Statement of Net Cost

The statement of net cost is designed to separately show the components of the net cost of the reporting entity’s operations for the period. The net cost of operations is the gross cost incurred less any exchange revenue earned from its activities. The gross cost of a program consists of the full costs of the outputs produced by the program, plus any nonproduction costs that can be identified and assigned to the program. Exchange revenue arises when a government entity provides goods or services to the public or another government entity for a price. Exchange revenue is synonymous with earned revenue. This statement should be presented in responsibility segments that align directly with the major goals and outputs described in the entity’s strategic and performance plans, as required by the Government Performance and Results Act.

In 1995, FASAB, in its recommended accounting standard related to entity and display, viewed the statement of net cost as specifically meeting the Federal reporting objective to “provide information that helps the reader determine the costs of providing specific programs and activities and the composition of, and changes in, these costs.”

The primary purpose of the statement of net cost is to display, in clear terms, the net cost (i.e., total costs less all revenues attributed to a program and permitted to be offset against program costs) by an entity’s suborganizations and of its programs and other costs (i.e., administrative and other costs not allocated to specific programs). Exhibit 5.2 is an illustration of the statement of net cost.

Occasionally, the structure and operations of an entity are so complex that in order to fully display the major programs and activities of all of their suborganizations, additional supporting schedules are required. These schedules should be presented in the notes to the financial statements. Other note disclosures required for the statement of net cost include:

- Intragovernmental cost

- Cost of stewardship property, plant, and equipment

- Stewardship assets acquired through transfer or donation

- Exchange revenue

- Gross cost and earned revenue by budget functional classification

Statement of Changes in Net Position

The statement of changes in net position reports changes in the two components of a Federal entity’s net position (cumulative results of operations and unexpended appropriations). The statement format was designed in a manner to show each component separately. See Exhibit 5.3.

The statement of changes in net position ties together several amounts from the other component statements of a Federal financial statement. Both components of net position are reflected as line items on the balance sheet. Budgetary appropriations received on the statement of changes in net position must agree with line 1 of the statement of budgetary resources. The “Other Financing Sources” section of the statement must agree with the statement of financing. The net cost of operations on the statement of changes in net position must agree to the statement of net cost.

The purpose of a Federal entity’s statement of changes in net position is to identify all financing sources available or used by a Federal entity to support its net cost of operations and the net effect or change in the entity’s financial position. As illustrated in Exhibit 5.3, these financial data are arrayed by the same organizational components and responsibility segments as appeared in the statement of net costs.

Classifications of Financing Sources

Since the purpose of this statement is to identify changes in the net position, or how an entity’s costs were financed, OMB has prescribed specific data classifications to be used. These classifications must be identified, whether shown in a statement of changes in net position or combined with the statement of net cost.

- Appropriation used represents amounts of congressional budget authority, including all transfers of budget authority from other entities that may be used by Federal entities to finance mandated operations.

- Nonexchange revenues include all receipts of taxes and non-exchange revenues such as dedicated taxes, fines, and other revenues the Federal Government demands in its role as a sovereign power.

Once collected, these major funds then become monies to be appropriated by Congress. The collection function involves only a few Federal entities (e.g., the IRS for personal and business taxes; Customs Service for import fees and duties). These entities are not authorized to use all collections for their operations; rather they serve as collecting agencies and custodians of cash received and turned over to the Treasury Department. (For these entities, a statement of custodial activities, discussed later, would be appropriate.)

For all other Federal entities, nonexchange revenues collected would be shown on this statement.

- Donations are monies and materials given by private persons and organizations to the Federal Government without receiving anything in exchange. Not all Federal entities are authorized to accept donations or contributions; specific authority must be provided by Congress.

- Imputed financing sources are costs incurred by a Federal entity that are financed by another Federal entity. This classification must include costs attributable to the reporting Federal entity’s activities but that do not require a direct cash payment in the reporting period (e.g., interest cost associated with carrying inventory or investing in physical assets). For example, Congress provides a direct appropriation of funds to the central Office of Personnel Management to pay retirement and other post-retirement costs to former Federal employees, most of whom were employed by Federal entities other than OPM.

- Transfers in are amounts of cash or other capitalized assets received by one Federal entity from another Federal entity without reimbursement. Transfers out are amounts of cash or other capitalized assets provided by one Federal entity to another Federal entity without reimbursement. If exchange revenue, included in calculating an entity’s net cost of operations, is transferred to the Treasury Department or another Federal entity, the amount transferred is recognized as a transfer out and not netted against the entity’s cost of operations. If the cash or book value is not known for these transferred amounts, the recorded value is the estimated fair value of the asset at transfer date.

- Cost of operations must be the same amount as reported on the statement of net cost and on the entity’s statement of changes in net position for the same fiscal period.

- Prior-period adjustments are corrections or adjustments to data reported for operations in a prior fiscal period. These adjustments are limited to the correction of errors and accounting changes having a retroactive effect that impacts the reported net position of the Federal entity. OMB does not require that statements of changes in net position of prior periods be restated for prior-period adjustments.

- Unexpended appropriations and budgetary authority will exist at the end of any fiscal period. The increase or decrease in this amount affects the net position of a Federal entity but does not affect the reported net cost for that period. These unexpended appropriation amounts may become the costs reported for some future period.

- Ending balance (net position at the end of the period) is equal to the total unexpended appropriations and the cumulative results of operations of the Federal entity and would also be reported in the entity’s statement of financial condition (i.e., the entity’s balance sheet). The end-of-period balance becomes the beginning balance of unexpended appropriations for the next fiscal period.

The “Beginning Balances” section of the statement of changes in net position must agree to the amounts reported as net position on the prior years’ balance sheets. The prior-period adjustment amounts would be limited to the items defined as prior period adjustments in SFFAS 21, Reporting Corrections of Errors and Changes in Accounting Principles.

The “Budgetary Financing Sources” section reflects financing sources and nonexchange revenue that are also budgetary resources, or adjustments to those resources as reported on the statement of budgetary resources and defined as such by OMB Circular A-11. The “Other Financing Sources” section reflects financing sources and nonexchange revenues that do not represent budgetary resources as reported on the statement of budgetary resources and as defined by OMB Circular A-11.

Effective for fiscal year 2006, SFFAS 27, Identifying and Reporting Funds from Dedicated Collections, requires Federal component entities to show earmarked nonexchange revenue and other financing sources, including appropriations and net costs of operations. separately on the statement of changes in net position. It should be noted here that this statement does not use the term “earmarked” as it is sometimes used to refer to set-asides of appropriations for specific purposes, but rather, the Board intends that the term earmarked fund be applied based on the substance of the statute and consistent with the three criteria set forth in the standard.

Statement of Budgetary Resources

The statement of budgetary resources and related disclosures provide information regarding how budgetary resources were made available and the status of those resources at the end of the reporting period. The statement of budgetary resources is the statement most unique to the Federal entity. It is the only statement prepared exclusively from the entity’s budgetary general ledger and in accordance with budgetary accounting rules that have been incorporated into GAAP for Federal entities.

The statement of budgetary resources is particularly meaningful since data are provided on how a Federal entity obtained its budgetary resources and the status or remaining balances of these resources at the end of the reporting period. This statement, illustrated in Exhibit 5.4, is prepared by Federal entities whose financing comes wholly or partially from congressional appropriations and borrowing, spending, and contract authority.

The basis for accounting and reporting on this statement is prescribed by OMB in its long-standing and regularly updated Circular A-11, Preparation, Submission and Execution of the Budget. The statement of budgetary resources is required to be classified into four major sections or groupings.

1. The “Budgetary Resources” section presents the total obligational and nonbudgetary resources (generally from congressional appropriations and budgetary and contract authority) under the stewardship of a Federal entity. These accountable resources could include new budget authority, unobligated balances at the beginning of a period and those transferred in and out during the period, recoveries of prior-year obligations, and any adjustments made to an entity’s budgetary resources. The calculated total for budgetary resources is the total amount made available to the Federal entity for the fiscal period.

2. The “Status of Budgetary Resources” section of the statement provides an analysis of the status of budgetary resources by such specific components as obligations incurred, unobligated balances of available budget authority, and unobligated balances that are unavailable except to adjust or liquidate obligations charged to a prior year’s appropriations. The total of this section, “Total Status of Budgetary Resources,” is equal to the budgetary resources still available to the Federal entity as of the reporting date.

3. The “Change in Obligated Balance” section displays the change in obligated balances during the reporting period.

4. The “Budget Authority and Outlays, Net” section shows gross budget authority and the net outlays or cash disbursements by a Federal entity for the fiscal period. Budget authority consists of appropriations, borrowing authority, contract authority, and spending authority from offsetting collections and reduced by the offsets displayed in

Exhibit 5.4. Net outlays would be the total of disbursement requests made to the Treasury Department for the period reduced by actual offsetting collections.

Data appearing on the statement of budgetary resources is, in condensed form, the same data reported by Federal entities to OMB on the report of budget execution (i.e., the government’s Standard Form [SF] 133, Report on Budget Execution and Budgetary Resources) pursuant to OMB Circular A-11. Also, these data are reported government-wide in the Treasury Department’s monthly Treasury statement and its annual report, as well as in the President’s budget request annually submitted to Congress.

An important consideration for preparers and auditors of the statement of budgetary resources is that the statement should be consistent with the budget execution information reported in SF-133 and with information reported in the Budget of the United States Government for the entity. The statement of budgetary resources is an agency-wide report that aggregates account-level information reported in the SF-133. Any material differences between the information reported must be disclosed in the notes to the financial statements.

Consistent with the SF-133 and the general ledger for budgetary accounting, the statement of budgetary resources tracks budgetary resources and their status independently. The total of budgetary resources and the status of budgetary resources must always be in balance, just as total assets must always equal total liabilities plus net position. The “Budgetary Resources” section presents the total budgetary resources available to the reporting entity. Budgetary resources include new budget authority, unobligated balances at the beginning of the period, spending authority from offsetting collections, recoveries of prior-year obligations, and any adjustments to these resources. The “Status of Budgetary Resources” section displays information about where in the budgetary process the resources are (i.e., their status). It consists of:

- Obligations incurred.

- Unobligated balances at the end of the period that remain available.

- Unobligated balances at the end of the period that are unavailable.

- Unobligated balance at the end of the period that is not available, except to adjust or liquidate prior-year obligations.

The final section of the statement of budgetary resources displays the relationship between obligations incurred and outlays during the reporting period. Outlays consist of disbursements net of offsetting collections. The net outlays reported on the statement of budgetary resources must agree with the total outlays reported in the budget of the United States, the aggregate outlays reported on the year-end SF-133 for all budget accounts, and the net total of all disbursements and collections reported to the U.S. Treasury on a monthly basis on the statement of transactions (SF-224) for the reporting period.

Additional financial statement disclosure related to the statement of budgetary resources includes:

- Apportionment categories of obligations incurred. The reporting entity is required to disclose the amount of direct and reimbursable obligations incurred against amounts apportioned under Category A, B, and exempt from apportionment. The disclosure must agree with the aggregate information on the entity’s year-end SF-133 and lines 8a and 8b of the statement of budgetary resources. The apportionment categories are determined in accordance with the provisions of OMB Circular A-11.

- Adjustments to beginning balances of budgetary resources.

- Legal arrangements affecting use of unobligated balances.

- Explanation of differences between the statement of budgetary resources and the budget of the U.S. government. Differences between the statement of budgetary resources and the amounts reported in the budget do not always indicate a reporting error. Legitimate reasons for such differences can exist. The note disclosure should list and explain the reasons for all differences.

Statement of Custodial Activity

The statement of custodial activity is not required for all Federal entities, only for those agencies that collect nonexchange revenue for the general fund of the Treasury, a trust fund, or other recipient entities. An additional exception to the preparation of the statement of custodial activity is made for entities whose custodial collections are immaterial and incidental to their primary mission. In these instances, the collections are identified in the footnotes to the entity’s financial statements. In addition, entities preparing a statement of custodial activity for nonexchange revenue should disclose:

- Basis of accounting.

- Factors affecting the collectability and timing of the nonexchange revenue.

- Cash collections and refunds.

Agencies required to prepare a statement of custodial activity include the IRS, U.S. Customs and Border Protection, and the Federal Communications Commission.

To account for custodial activity, the collecting entities do not recognize as revenue those collections that have been, or should be, transferred to others as revenue. Instead, the collection and disbursement of funds is reported on the statement of custodial activity. If some of the nonexchange revenue is transferred to others and some is retained by the collecting entity to offset the cost of collections, both amounts are reported on the statement of custodial activity, and the amounts retained are also reported on the statement of net cost. See Exhibit 5.5. In all cases, the “Total Sources of Collections” section (total revenue) must equal the “Total of the Disposition of Collections” section (total disposition of revenue). The net custodial activity must always be zero.

These requirements are described in SFFAS 7, Accounting for Revenue and Other Financing Sources.

Statement of Social Insurance and Statement of Changes in Social Insurance Amounts

Like the statement of custodial activity, not all agencies are required to report a an SOSI (see Exhibit 5.6) and an SCSIA. An SOSI is required for these programs:6

- Old-Age, Survivors, and Disability Insurance (OASDI or Social Security)

- Hospital insurance (HI) and supplementary medical insurance (SMI), collectively known as Medicare

- Railroad retirement benefits

- Black lung benefits

These programs are housed in the agencies listed next.

- The Social Security Administration (SSA) administers the Old-Age, Survivors, and Disability Insurance (OASDI, or the Social Security program).

- The Centers for Medicare and Medicaid Services (CMS) as housed in the Health and Human Services (HHS) administers HI and SMI, collectively known as the Medicare program.

- The Railroad Retirement Board administers the railroad retirement benefits program.

- The Department of Labor administers the black lung benefits program.

The programs collectively are known as social insurance. The SOSI presents the actuarial present value of two figures:

1. Contributions and income to the program

2. Scheduled expenditures

3. Difference between figures 1 and 2

The SOSI must include a summary section that details assets that are held by the programs and the total unfunded obligation to date of the program as of the date of the reporting period. Entities required to present a SOSI must also present a SCSIA.

The purpose of the SOSI is to present the present value position of the funding of the program. The point of the SCSIA is to detail the line item changes by amount to the total funded or unfunded position over the last reporting period.

SFFAS 17, Accounting for Social Insurance; SFFAS 25, Reclassification of Stewardship Responsibilities and Eliminating the Current Services Assessment; SFFAS 26, Presentation of Significant Assumptions for the Statement of Social Insurance: Amending SFFAS 25; and SFFAS 37, Social Insurance: Additional Requirements for Management’s Discussion and Analysis and Basic Financial Statements provide further detailed information about these statements.

Management’s Discussion and Analysis

Every agency’s general purpose financial report must include a section devoted to an MD&A of the financial statements and related information. The MD&A section is designed to help readers better understand the entity’s financial position and operating results and to answer questions more directly related to a Federal entity’s activities. Examples include:

- What is the entity’s financial position and condition, and how did these occur?

- What were the significant variations from prior years, from the budget, from performance plans in addition to the budget?

- What is the potential effect of these factors, of changed circumstances, and of expected future trends?

- Will future financial position, condition, and results, as reflected in future financial statements, probably be different from this year’s, and if yes, why?

- Are the systems of accounting and internal administrative controls adequate to ensure transactions are executed in accordance with budgetary and financial laws, assets are properly acquired and used, and performance measurement information is adequately supported?

The content of the MD&A is the responsibility of management. Its preparation should be a joint effort of both the chief financial officer and the program offices. The MD&A should be a fair and balanced presentation of information. It should include both positive and negative performance information, as necessary, to accurately portray the results of the agency. The information presented should be consistent with information presented in the performance plans and reports and the budget information. The auditor will not opine on the information presented in the MD&A, but certain limited procedures need to be performed. The procedures consist principally of inquiries of the agency’s management regarding the methods of measurement and presentation of the information.

In 1998, FASAB recommended that the MD&A be treated as required supplementary information to Federal financial statements.7 FASAB desired that the MD&A section of Federal financial statements section address an entity’s:

- Mission and organizational structure.

- Performance goals and results.

- Financial statements.

- Systems and controls.

- Possible future effect on the entity’s current demands, risks, uncertainties, events, conditions, and trends.

Current revisions of the guidance can be found in OMB Circular A-136.

FASAB states that the subjects in the MD&A could be based on information in other sections of the entity’s general-purpose financial report or other reports that may be separate from the general-purpose financial report.

Required Supplementary Stewardship Information

Some Federal entities are entrusted with responsibilities for stewardship assets. These assets include:

- Stewardship PP&E (e.g., heritage assets—monuments, memorials, historical, cultural); mission PP&E (defense and space); and stewardship land (not for, or in connection with, general PP&E).

- Stewardship investments.

- Other stewardship responsibilities.

The reporting and disclosure of these assets may be in terms of physical units rather than cost, fair value, or other monetary values.

GOVERNMENT-WIDE FINANCIAL STATEMENTS

In spring 1998, the first consolidated and audited financial statements were issued for the U.S. government covering its fiscal year ended September 30, 1997. Robert Rubin, Secretary of the Treasury at the time, in the introduction to the 1997 Consolidated Financial Statements of the United States Government, wrote “never before has the United States Government attempted to assemble comprehensive financial statements covering all of its myriad activities and to subject those financial statements to an audit.”

Format of Consolidated U.S. Statements

The consolidated government-wide financial statements differ somewhat from those prescribed and used by individual Federal entities in order to reflect the different reporting perspective for the entire government. The 2011 government-wide consolidated statements were comprised of these items:

- A message from the Secretary of the Treasury

- A Citizen’s Guide Summary of the financial report

- An MD&A section

- A disclaimer of audit opinion on the government-wide consolidated financial statements

- A report on internal controls

- A report on compliance with laws and regulations related to financial reporting

- Other information transmitted by GAO

- A consolidated statement of net cost for the U.S. government

- A consolidated statement of changes in net position for the U.S. government

- Reconciliations of net operating cost and unified budget deficit

- Statements of changes in cash balance from unified budget deficit and other activities

- A consolidated balance sheet for the U.S. government

- A consolidated statement of social insurance

- A consolidated statement of changes in social insurance amounts

- Notes to these financial statements

- A consolidated supplemental information for the U.S. government

- A consolidated stewardship reporting for the U.S. government

Content of Consolidated U.S. Statements

As stated in Note 1 of the Summary of Significant Accounting Policies to the 2012 financial statements of the U.S. government, the consolidated financial statements of the United States generally include the financial activities of the executive, legislative, and judiciary branches, with the following exceptions (or deviations from GAAP):

- The Senate and the House of Representatives report on the cash basis.

- The judiciary branch reports on a limited basis (this branch is not required by law to submit financial statements to the Department of the Treasury) and what is reported is reported on the cash basis.

- Government-sponsored enterprises (i.e., Fannie Mae, Freddie Mac) are not included.

- Entities with activities not included in the Federal budget’s total are also excluded. Examples include the Board of Governors of the Federal Reserve and the Thrift Savings Fund.

Basis of Accounting for U.S. Statements

The consolidated financial statements are prepared in accordance with the form and content guidance specified by OMB that incorporates the recommendations of the FASAB. Under this basis of accounting, expenses are recognized when incurred, and nonexchange revenues are recognized on a modified cash basis. Cash remittances are recognized when received, and any related receivables are recognized when measurable and legally collectible by the Federal Government. Exchange revenues are recognized when earned.

Financial Reporting Checklist

In performing the audit of a Federal entity, the auditor should complete, or have completed by the auditee, the Government Accountability Office/President’s Council on Integrity and Efficiency’s Financial Audit Manual Checklist for Reports Prepared Under the CFO Act. The checklist has been incorporated in GAO’s Financial Audit Manual (Section 2020).