CHAPTER 15

PROCUREMENT AUDITS, CONTRACT AUDITS, AND GRANT AUDITS

CONTRACT AUDITS

Contract expenditures are some of the most significant expenditures within the Federal Government, with obligations totaling in the trillions of dollars in any given year and individual contracts often reaching into the billions of dollars. Funds are expended under Federal contracts to purchase or support a wide variety of services, purchases of equipment, and real and consumer-type properties. For many agencies, amounts spent under contracts greatly exceed amounts spent on other items in their budgets.

Contracts Defined

Contracts are the legal obligations of the Federal Government, generally in writing, which obligate the government to an expenditure of money upon delivery of goods or performance of services. Federal Government contracting is a preferred form of acquiring services, products, capital assets, real properties, supplies, and materials from non-Federal sources for military and civilian purposes and for use domestically or internationally.

Contract Types

The types of Federal contracts vary but may be grouped into six general categories, with variations in each grouping:

1. Fixed price

2. Cost reimbursement

3. Incentive

4. Indefinite delivery

5. Time-and-materials, labor-hour, and letter contracts

6. Agreements

Fixed-price contracts establish a negotiated price for goods and services when the government can clearly define the outcomes, services, and/or goods. The contractor is responsible for all costs incurred, whether in excess of the negotiated price or not, as long as the scope defined in the contract is consistent with the contract. If the contractor performs the contract for less cost, the contractor remains entitled for the entire contract amount. These types of contracts provide the government with less risk of cost overruns and costs that are more predictable. Several variations of fixed-price contracts include:

- Firm fixed-price contracts. These contracts entitle the contractor to the full amount of the contract at the completion of work defined in the contract scope and acceptance by the government. Typically, contracts define payment schedules for partial payments throughout the period of performance. Absent an authorized change in contract scope, the contractor may collect only the fixed contract price regardless of the cost incurred to perform. The full financial risk is with the contractor.

- Fixed-price contracts with economic price adjustments. These contracts provide for upward and downward price adjustments based on established prices, actual costs, or cost indexes established in the contract. These types of contracts exist to compensate for market conditions over extended periods and industry-wide contingencies outside contractor control, such as commodity prices.

- Fixed-price incentive contracts. These contracts provide contractors with incentives for adjusting profits based upon an established formula. These contracts establish incentives based upon performance to improve the quality and efficiency of the goods or services provided. The predefined formula established in the contract may increase or decrease the contractor’s fees based upon surpassing or missing the performance measures, respectively.

- Fixed-price contracts with prospective price redetermination. These contracts provide a fixed price for the initial period of performance or deliveries with a stated redetermination time to adjust the price for services and/or goods that were uncertain at the initiation of the contract.

- Fixed-ceiling-price contracts with retroactive price redetermination. These contracts are specific to research and development (R&D) contracts estimated at $150,000 or less when established and the use of other contract types is impractical. These contracts contain ceiling prices that may be adjusted based upon stated circumstances.

- Firm-fixed-price, level-of-effort term contracts. These contracts specify a level of effort at a negotiated fixed price equal to or less than $150,000.

Cost-reimbursement contracts are used when the Federal Agency and contractor are not able to define the required scope of work in sufficiently definite terms, or when there is no valid basis for predicting results or performance. Also, with cost-reimbursement contracts, the financial risks are borne primarily by the governmental entity. Various types of cost-reimbursement contracts are discussed next.

- Cost contracts. These contracts reimburse the contractor for allowable costs without any fee or profit. These types of contracts are typically used for R&D-type work through nonprofit entities.

- Cost-sharing contracts. These contracts reimburse the contractor for an agreed-to portion of allowable costs; no fee/profit is negotiated into the contract amount since the contractor anticipates to mutually benefit from performing the scope of work.

- Cost-plus-incentive-fee contracts. These contracts reimburse the contractor for allowable costs, plus a variable fee adjusted by a formula based upon a relationship of the total allowable costs to total target costs. These contracts may also include incentives based on technical performance. The intention of these contracts is to provide the contractor with incentives to effectively manage the contract and its related costs.

- Cost-plus-award-fee contracts. These contracts reimburse the contractor for allowable costs, plus a negotiated fixed fee as well as an award fee based on meeting contract performance goals. The intention of these contracts is to provide motivation to the contractor to manage costs, schedule, and technical performance.

- Cost-plus-fixed-fee contracts. These contracts reimburse the contractor for allowable costs, plus a negotiated fixed fee. The government bears the performance and cost risks because it does not provide incentives to the contractor for effectively managing performance or costs. Use of these contracts is primarily for research, preliminary exploration, or studies where the level of effort is unknown.

Other types of contracts provide for obtaining goods and services based upon established labor rates and contracts of last resort. These other contract types include:

- Time-and-materials contracts. These contracts reimburse the contractor for labor and the cost of materials in a negotiated composite rate for each hour of labor worked; the rate is all-inclusive of labor costs, overhead costs, and profit. Because the contractor has no positive incentive to maintain cost controls, the government should effectively monitor contractor performance. Use of these contracts is appropriate when the extent of the work is uncertain or cannot be reasonably predicted.

- Labor-hour contracts. These contracts are similar to time-and-materials contracts except there are no provisions for materials. These contracts reimburse the contractor on the basis of a fixed hourly labor rate that includes the cost of labor, overhead, and a profit factor; the only variable is the number of hours provided under the contract.

- Letter contracts. These contracts authorize contractors to immediately manufacture supplies or perform services when no other contract is suitable. These contracts require clauses limiting the government’s liability.

- Indefinite-delivery contracts. These contracts allow for the purchase of goods and services through the use of multiple delivery orders and task orders. These are open contracts that do not have a predefined level or quantity of services.

Under the rules set forth in the simplified acquisition methods, agencies may obtain goods and services through purchase orders, blanket purchase agreements (BPAs), imprest funds, third-party drafts, and Standard Form (SF) 44, “Purchase Order–Invoice–Voucher.”

- Purchase orders specify a fixed price for the quantity of goods and/or scope of services, with specified delivery dates and period of performance.

- BPAs provide a simplified purchasing method to fill anticipated repetitive needs for supplies and services through qualified sources of suppliers by which orders can be placed.

- Imprest funds and third-party drafts are similar to petty cash used in the commercial sector. These transactions are usually limited to $500 and $2,500 for imprest funds and third-party drafts, respectively. However, agency heads may approve different limitation levels based on agency needs and policy documentation.

- SF 44 is designed to authorize the purchase of goods and/or services when one is away from the administrative office and services and/or goods are needed. It is used rarely.

Responsibility for Contracts

Several organizations in the Federal Government’s legislative and executive branches have the authority or responsibility for financing, negotiating, awarding, funding, administering, and settling Federal contracts. The nature of authority or responsibilities exercised by these various organizations is briefly outlined next.

Congress

Congress, through its authorization and appropriation committees, has the ultimate authority and responsibility for overall Federal procurement and grant policies. These policies appear in laws having government-wide applicability, and, at times, specific legislation applies to a single particularly significant procurement.

Cost Accounting Standards Board

The Cost Accounting Standards Board (CASB), part of the Office of Federal Procurement Policy within the Office of Management and Budget (OMB), issues standards to achieve uniformity and consistency in the cost accounting principles adhered to by Federal contractors and subcontractors.

Government Accountability Office

GAO is authorized to audit the expenditures of Federal monies spent under contracts, including reviews of agency procurement systems. These reviews are made internally at the Federal entity or externally at a contractor’s location. GAO also has the legal authority to render binding decisions on Federal entities with respect to procurement actions, but a contractor may appeal these decisions in the courts.

General Services Administration

The General Services Administration (GSA) is responsible for publishing and overseeing the Federal Acquisition Regulations (FAR) that describe the terms and conditions of Federal procurements. FAR is a government-wide procurement policy. Agencies such as the Department of Defense (DoD) and the National Aeronautics and Space Administration (NASA) may monitor contracts pursuant to a tailored version of procurement regulations, but these tailored regulations are almost identical to the FAR published by GSA.

Office of Management and Budget

OMB issues government-wide regulations relating to Federal procurements, the most notable of which are the OMB cost circulars that, along with provisions of various titles of the U.S. Code, define types of allowable costs, unallowable costs, and indirect or overhead costs permitted or prohibited under Federal contracts and grants.

Defense Contract Audit Agency

The Defense Contract Audit Agency (DCAA), with over 4,000 auditors at more than 300 field audit offices throughout the United States, Europe, and the Pacific, is responsible for performing all contract audits for the DoD as well as several hundred Federal grants. These audits could include:

- Reviews of contractor and grantee cost estimates and price proposals.

- Audits of contractor or grantee costs for compliance with Federal allowable, unallowable, and indirect costs regulations.

- Reviews of contractor and grantee compliance with Federal cost accounting standards and other costing criteria, such as the OMB allowable and unallowable cost circulars.

DCAA may decline audit requests from the cognizant agency (the agency responsible for auditing the contractors). In these cases, the cognizant agency may contract with others to obtain the audit services.

Individual Contracting Agencies

Pursuant to the Budget and Accounting Procedures Act of 1950 and later laws, Federal Agencies must have in place procurement policies, procedures, and systems for: the solicitation and evaluation of contract proposals; to negotiate, award, and administer contracts; and to account for contract performance. An agency’s systems of controls, accounting, and reporting must be sufficiently precise to permit monitoring of contract obligations, liquidation of these obligations, and the costing and disbursement of contract funds. The cognizant agency is held responsible for having the necessary audits performed.

FEDERAL PROCUREMENTS

Selected salient features of Federal procurement include the responsibilities, requirements, and processes discussed in the next sections.

Players

Not all contract award tasks or activities are resident within a single unit or function of a Federal Agency. The successful completion of a procurement action requires the collaboration and coordination of several various agency units. Some of these are outlined next.

Program Office or Allottee

The initiation or determination of need for contractor services generally originates with the responsible program management office, although functional offices (e.g., accounting, budget, data processing, human resources, and even the contracts office) might require contracted services or support. The originating office is expected to:

- Prepare a preliminary estimate of costs.

- Identify potential sources of supply.

- Prepare the formal procurement request.

- Monitor performance and accept delivery under the contract.

- At contract completion, recommend that the contractor be paid.

Contracts Office or Procurement Section

Actual contracting activities are generally centralized in the agency’s contracts function. This function often is responsible for:

- Identifying prospective contractors.

- Issuing requests for proposals (RFPs) and invitations for bids (IFBs).

- Conducting negotiations with prospective contractors.

- Executing and awarding contracts.

- Administering the contracts.

- Settlement and close-out upon contract completion.

Accounting Section

The accounting section must confirm the availability of agency appropriations money for the contract in advance of procurement request (PR) approval. Additionally, this function:

- Formally obligates agency funds upon notification of contract award.

- Examines invoices related to contract terms and performance.

- Conducts prepayment “audits” of contractor invoices.

- Initiates formal accounting transactions to obligate, liquidate the obligations, expenditures, and payables, and provide ultimate payment related to each awarded contract.

- Compiles internal and external financial reports on awarded contracts.

- Prepare the schedule to request issuance of checks by the Treasury Department to the contractor.

- Perform the fiscal and budgetary accounting during and after expiration of the agency’s appropriations.

Contractor or Vendor

The contractor or vendor must first submit a proposal or bid in response to the RFP or IFB. If successful, it negotiates contract terms and conditions and executes a contract with the Federal Agency. The contractor or vendor must then:

- Perform the agreed-upon services or deliver the contracted goods.

- Complete and file end-of-contract financial, property, and performance reports for final contract settlement.

Treasury Department

Actual checks or electronic fund transfers (EFTs) in payment of invoices submitted by contractors are issued by the Treasury Department upon receiving a request from the contracting agency to initiate payment to a contractor, unless the contracting agency has disbursing authority. In that case, the agency issues the payments to submitted invoices.

Process

As noted, many Federal Agencies have the authority to issue and require adherence to their policies and regulations relating to Federal contracts. However, the design of a system of controls to meet the criteria of these agencies and to adequately protect the government with respect to procurements is the sole responsibility of the individual operating Federal Agency that issues the contract. Although the specific steps or details vary, most Federal entities have established procedures requiring:

- Preparation and approval of a procurement request or authorization, approved by the responsible program official and annotated to show that unobligated funds exist to meet the estimated amount of the intended procurement, all of which is done before prospective contractor sources can be contacted. For agencies that use commitment accounting, this results in an accounting entry to reserve the funds as a commitment.

- Determination as to whether a procurement is to be awarded from a competitive selection and whether the contract is ultimately awarded through advertising or negotiation. Competition may be obtained from a variety of Federal sources, including electronic media (e.g., Federal Business Opportunities [FedBizOpps]).

- A formal review process for the objective evaluation of all proposals, solicited and unsolicited, received by the agency to ensure compliance to prescribed negotiation practices.

- Conduct of a survey or review of contractor accounting and management controls systems through on-site examinations of the contractors and consulting with other Federal entities with which the contractor has done business.

- The formal execution and issuance of the contract, with the timely notification to the agency fiscal function to permit prompt obligation of funds in an amount equal to the funded value of contracts.

- Reporting, on a periodic basis, of the rate of expenditures by the contractor as well as the quality and timeliness of contractor performance or deliveries, which often includes positive confirmation of the receipt and satisfaction of service or performance.

- Prepayment audits of invoices to ensure that:

- Amounts, performance, and deliveries are consistent with negotiated contract terms.

- Prompt and accurate payment is made of properly rendered invoices.

- There is timely processing of all procurement transactions.

- Final settlement or contract closeout of any advanced money, government-furnished equipment, and property in a manner consistent with agency policy or contract conditions, and a final assessment of contractor compliance.

- Collection of an objective report on contractor performance during each performance period to be used in source selection evaluations, often stored in an automated Contractor Performance Assessment Reporting System (CPARS).

Accounting

OMB has prescribed certain agency accounting criteria for the obligation, accrued expenditure, and applied cost of contract transactions relating to the acquisition of services and goods. Except when precluded by law, the contract accounting of Federal Agencies must be conducted in accordance with concepts set forth in OMB Circular A-11, Preparation, Submission, and Execution of the Budget.

Obligations Incurred

An agency’s reporting of contracted obligations incurred for contracted services or support must comply with Section 1311 of the Supplemental Appropriations Act, which requires the existence of legal evidence of binding agreements, orders, or other legal liabilities prior to the recording and reporting of a contract obligation. OMB Circular A-11 sets forth the formal criteria for recognizing legal obligations. According to OMB, internal administrative commitments of funds and invitations to bid sent to prospective contractors must not be included in amounts the agency reports as obligations. These types of activities fail to meet the criteria of Section 1311 for valid obligations.

Accrued Expenditures

Expenditures for printing and reproduction, contractual services, supplies and materials, and equipment will accrue when a contractor, vendor, or other party performs the service or incurs costs. Tests of performance may be a physical receipt, passing of title, or constructive delivery. The constructive receipt criteria would apply when products or services are being provided according to the Federal entity specifications and the product or service is a nonstock item.

Accrued Costs

The reporting of accrued costs related to contracts, orders, and agreements is similar to the reporting of accrued expenditures, with some exceptions. For instance, according to OMB:

- Applied costs include depreciation and unfunded liabilities when such amounts are provided in the accounts of the agency.

- A net increase in inventories is an accrued expenditure but would not be an applied cost until that inventory is used.

- Conversely, a net decrease in inventories is an applied cost but not an accrued expenditure.

- For operating programs, a change in capital assets is not an applied cost, even though it is an accrued expenditure; the use or consumption (by depreciation or amortization) is the cost of a capital asset.

Key Forms

Within a Federal entity, several forms are required to document a valid contract action. The more common forms encountered are identified next.

Procurement Request and Authorization

The PR represents the initiating document for a procurement. This record is completed by the program office determining that a need exists that cannot be met with the Federal entity’s existing resources. (No accounting entry results from the preparation or issuance of a PR unless agencies use commitment accounting.)

Request for Proposal or Bids or Quotes

An RFP or IFB should identify or describe the following:

- Scope of work

- Period of performance

- Estimated level of resources required to conduct or perform the scope of work

- Type of contract to be awarded

- Special and general conditions applicable to the contract

- On some occasions, the estimated amount budgeted by the entity for the specific contract action (no accounting entry results from the preparation or issuance of an RFP/RFB/RFQ)

- Information required to be in the offeror’s proposal

- Factors and significant subfactors that will be used to evaluate the proposal, and the relative importance of each

Submitted Proposals or Bids

Interested organizations respond to the RFP/RFB/RFQ by submitting proposals or bids describing how they would undertake to perform the scope of work, the type of resources that would be required to complete the work satisfactorily, and the amount of money required to provide the goods or services. (No accounting entry results from this phase of the contractual process.)

Contract Document

The award of a contract constitutes the legal binding obligation of the Federal entity. The contract, signed by the contractor and agency executives, describes:

- Negotiated scope of work.

- Performance period.

- Terms and conditions.

- Amount of the contract.

- Amount funded.

(A formal accounting entry is made to obligate a portion of an agency’s appropriation balance for the amount of the contract or the funded amount, whichever is less.) When the amount of the contract is significantly in excess of the amount funded, the contract is said to be incrementally funded, limiting its liability to only the funded amount.

Financial Expenditure Reports and Invoices

Most Federal entities provide for progress or partial payments through the duration of the contract, with the amount of the payment dependent on the rate of incurred expenditures shown on periodic financial reports or invoices submitted by the contractor. (These documents are generally subjected to a prepayment audit and are the basis for supporting an accounting entry to liquidate the earlier obligation and record the accrued expense or costs of the contract.)

Cash Advances

Certain contractors (usually nonprofit organizations and non-Federal Government entities) receive an advance of funds. Advances can take one of two forms: (1) lump-sum or periodic advances, given to the contractor to cover operations for a specified time period, such as 30 or 60 days, and (2) letter-of-credit drawdowns. The letter-of-credit process is also a periodic funding that requires the existence of certain forms:

- An authorized signature card identifying the contractor’s certifying officer, which is placed on file with the Treasury Department and the contractor’s commercial bank or other designated disbursing organization.

- A letter of credit completed by the government entity and forwarded to the Treasury Department:

- Identifying the Federal Reserve Bank or Treasury disbursing agent.

- Identifying the contractor.

- Establishing the total amount of the letter of credit and the periodic withdrawal limits.

- Defining the time period for which the letter of credit will be available.

- A request for payment on the letter of credit prepared by the contractor, consistent with the letter of credit, to withdraw funds to finance the contract scope of work. This form requires a reconciliation of balances, withdrawals, and other letter-of-credit transactions and an identification of the program or contract for which funds are being withdrawn.

- The issuance of an advance at the time of contract award or the release of funds pursuant to the submission of a request for payment on a letter of credit constitutes a disbursement of funds, which is an advance that must be posted as an accounts receivable due the Federal entity. These advances are a reduction in the agency’s fund balance with the Treasury.

Schedule and Voucher of Payments

The schedule and voucher of payments, whether a hard-copy form or an electronic facsimile, is the formal request by an agency to the Treasury Department to make payment (by checks, EFTs, or direct deposits) for specific amounts to identified contractors. The Treasury Department makes no distinction between payments made for services or for advances. This accounting is a responsibility of the individual entity, and the schedule represents the documentation in support of an agency’s cash disbursements accounting entry.

PROCUREMENT AUDITS

A distinction generally exists between internal audits made of a Federal Agency’s procurement functions and external audits made of the agency’s contracts awarded to its contractors.

Audits of an agency’s procurement functions (i.e., internal audits) could entail an examination of the policies, procedures, and practices by which the agency advertises, negotiates, awards, manages, monitors, finances, accounts, and ultimately closes out or settles contracts. Periodic audits of the procurement functions would more likely be made by Federal Inspectors General (IGs) or agency internal audit staffs, but such reviews and examinations could also be outsourced to independent consulting and accounting firms.

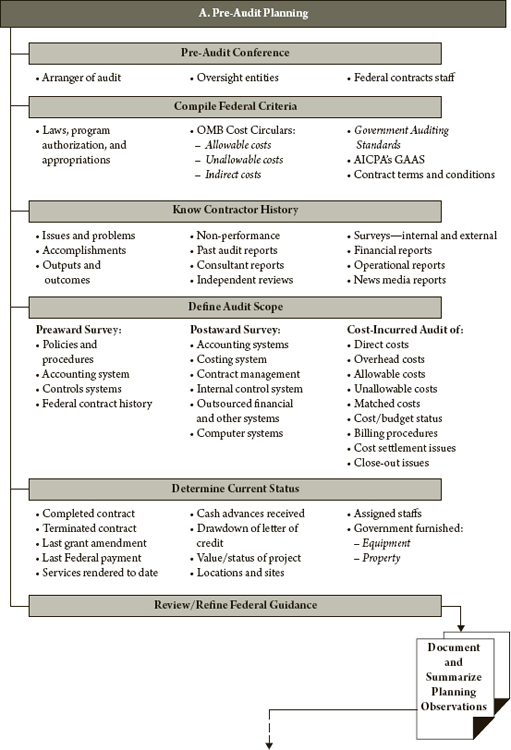

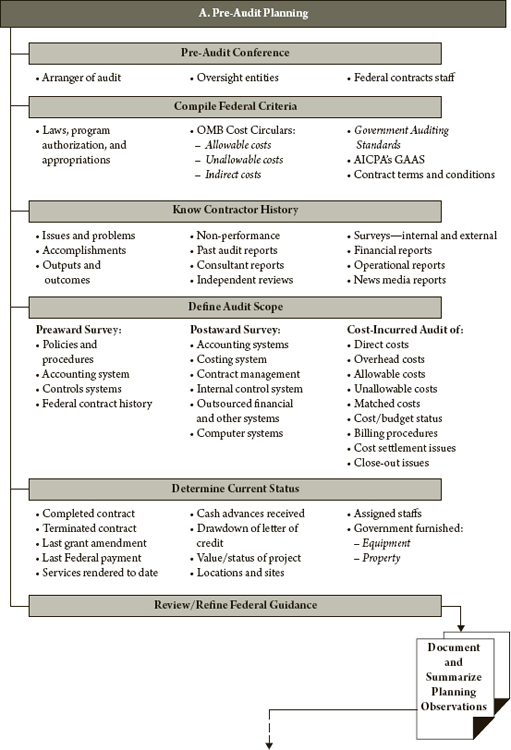

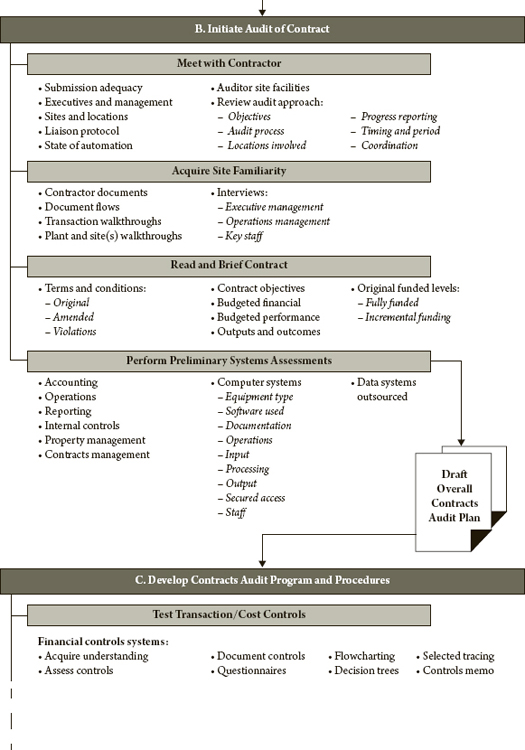

Exhibit 15.1 is a partial listing of the factors to consider in planning an audit of a Federal contractor or contract. Specific conditions and circumstances related to individual Federal contracts and grants may dictate that alternative tests be considered. If circumstances do not permit performance of the tests, the auditor must reflect this fact in the audit opinion.

Audits of Procurement Process

An agency’s procurement process is subject to periodic internal audits to determine whether its program managers and contracting personnel are procuring the right services and goods at fair prices in accordance with agency policy and procedures and pursuant to the Federal acquisition regulations and other laws and OMB regulations.

Audits with Varied Scopes

No uniform scope exists for internal audits of a Federal Agency’s procurement process. Each audit is tailored to achieve the unique objectives and address the particular needs of that agency. The scope of an internal audit of a Federal Agency’s procurement process could be broad and all-encompassing, blending aspects of a compliance audit, financial-related audit, and a performance audit; or the audit scope could be limited, concentrating on a single subject or area. Most likely, the audit will concentrate on one or a few issues that concern agency management, possibly including tests of one or more of these activities to:

- Assess the effectiveness of decisions reached in determining an agency’s need for services, supplies, equipment, or property.

- Examine the manner and thoroughness with which lists of prospective contractors are compiled, vetted, and solicited.

- Ensure adherence to practices that will result in the maximum competition of competent, prospective contractors resulting in goods and services being procured at a competitive price.

- Test the relative completeness of bid and proposal evaluations and weightings applied in selecting the successful contractor.

- Assess the thoroughness of bid and proposal pricing reviews and cost analysis techniques.

- Review contract administration activity, including tasks to monitor contractor performance, contractor progress reports, invoice preaudits and payment approvals, controls over government-furnished properties (GFPs), contract closeouts, and final settlement practices.

- Assess adherence to regulations relating to contracting by small purchase orders, with particular emphasis on compliance with adherence to the dollar ceilings and repetitive award of such contracts to a single vendor.

An internal audit of a procurement process could appropriately be focused on nonfinancial administrative and management issues. Another internal audit could, with merit, be an examination of the contracting, financial, administrative, and monitoring systems that support an agency’s contract activities. The dollar significance of government-furnished equipment (GFE) or government-furnished property (GFP) in a contractor’s possession could warrant an audit of the manner in which the GFE or GFP is procured, acquired, stored, controlled, used, and disposed of.

Internal audits are often made at the procurement function’s central location, but field and site visits are not uncommon to verify or confirm the existence of a condition, possibly involving the contractor’s bid, performance, or financial activities.

External Contract Audits

Audits and reviews executed in connection with Federal procurements generally encompass the activities discussed next.

Contract Audits

In addition to audits of an agency’s procurement process (i.e., internal audits), audits are also made of non-Federal contractors (i.e., external audits). Although these audits are typically made by Federal IGs, internal audit staffs, and the DCAA, a significant number of these audits are also performed by independent accounting firms under contract to Federal and other governmental agencies usually the cognizant agency.

Contract audits are made of proposals and bids from prospective contractors who desire to compete for fixed-price and cost-reimbursement–type contracts. Contract cost audits are made to test the allowability or possible unallowability of costs claimed under cost-reimbursement contracts. These audits are typically focused on assessing the adequacy of a contractor’s cost accounting systems and billing procedures, and appropriateness of its cost allocations to Federal and non-Federal activities.

Many audits are made of a contractor as an entity, but considerably more audits are made of individual contracts, particularly those of dollar significance, with performance scheduled over more than a single year. These Federal audits could be made by agency auditors who actually reside at the contractor’s location or by a traveling Federal audit team that periodically visits the contractor. The reasons for contract audits vary but include issues such as these:

- Many contracts are awarded by negotiation, often without the benefit of competition, and result in somewhat less than a marketplace price determination.

- Cost-reimbursement contracts are audited to ensure that the contractor is reimbursed for only actual allowable and relevant costs and to identify and restrain incurrence and billing for exorbitant costs.

- The Federal Agency cannot audit the basic price of fixed-price contracts, but such contracts often contain terms that permit reviews of price adjustments, cost escalation readjustments, and incentive compensation.

- The quality of a contractor’s property accountability policies and practices with respect to GFE may be assessed to ensure that Federal property is adequately safeguarded and applied only for purposes approved by the Federal Agency.

The authenticity of cost or pricing data submitted by a contractor must meet the requirements of the Truth in Negotiations Act.

Types of Contract Audits

Contract audits may be detailed, transactional-type financial audits of costs incurred and charged to a Federal contract. At times, the term contract audits more broadly includes pricing reviews, preaward surveys, postaward surveys, and detailed audits of costs of one or more contracts.

Pricing Reviews

After proposals are received from prospective contractors, an agency may elect to have its auditors conduct a pricing review of elements of the proposed costs or price. A detailed pricing review might well include verification of the bidders’ proposed costs for material, labor, other direct costs (i.e., travel, relocation, special equipment, computers, and so on), overhead burden, and general and administrative costs. Equally as important would be a validation of the bidders’ bases for such estimates and, if possible, relating the proposed price to the bidders’ performance on similar efforts.

Preaward Surveys

Should a Federal Agency have limited experience with a prospective contractor who is otherwise deemed to be responsive and responsible, its auditors might make a preaward survey to generally assess the prospective contractor’s systems of financial accounting, cost accounting, internal controls, and project/contract management policies and procedures. Inquiries could also be made of the experiences of other Federal Agencies in relation to the prospective contractor.

Postaward Surveys

A postaward survey, if one is conducted, would occur within 90 days of contract award to a new contractor to ensure that the contractor has in place financial, administrative, and operational policies and procedures and that desired practices are employed for the contract.

Audits of Direct and Other Contract Costs

Contract audits are made at the conclusion of shorter-term contracts and are made periodically of significant contracts requiring performance over more than one year. These audits would blend audit tests to assess compliance with general contract terms and conditions as well as performance and financial terms. Although the objectives of these audits are dependent on the type of contract experience and issues or problems encountered, such audits often include audit tests of these areas:

- Costs incurred, charged to, and later billed to the contract

- Support documents and other evidence of compliance with performance and financial terms and conditions of the contract

- Reasonableness of costs claimed in relation to the expired contract period and desired or expected contract outputs and outcomes

- Appropriateness of cost accounting and cost allocations applied to the Federal contract in comparison to that employed for a contractor’s non-Federal business and activities

- Comparison of proposed costs, to negotiated costs and to incurred costs to assess the overall efficacy of prices being paid by the Federal Agency.

OMB’S COMPLIANCE AUDIT SUPPLEMENT

OMB’s Compliance Audit Supplement (the Supplement) provides guidance for audits of Federal contracts as well as grants and cooperative agreements.1 Prior to the issuance of the Supplement, auditors of Federal contracts were required to search numerous sections of the Code of Federal Regulations (CFR), OMB circulars, the Federal acquisition regulations, and their agency’s own procurement and contract policies in an effort to distill the Federal contract compliance concerns into an audit program. An analysis of several OMB circulars and bulletins covering contract policies, Federal laws, and regulations (the FAR, particularly) affecting the government’s procurement of goods and services and the contracting policies and procedures of individual Federal Agencies reveals considerable similarity, duplication, and overlap. The OMB Supplement is an excellent single source for identifying Federal contracting policies, concerns, and issues insofar as they relate to contract audits.

OMB has stated that application of the Supplement will constitute a “safe harbor” for auditors with respect to the nature (i.e., what to audit) of audit procedures to apply. However, the timing (i.e., which months, periods, or accounts to test) and the extent (i.e., how much will be tested) depend on the auditor’s judgment and on circumstances unique to the contractor or contract undergoing audit.

AUDIT ISSUES

This section focuses on audits of Federal contractors and individual contracts awarded to non-Federal entities, including state and local governments, corporate entities, academic institutions, utilities and authorities, and subsidiaries. Concurrent with its Federal activities, a non-Federal contractor may also provide services under contract to non-Federal activities.

These conditions, relationships, and circumstances may present difficulties when undertaking an audit of individual Federal contracts that could restrict the audit scope or be the basis for a qualified audit opinion. Some of these audit issues are outlined next.

Allowable, Unallowable, Indirect Costs

Uniform Federal policy defines what the Federal Government has determined to be allowable, unallowable, and appropriate indirect costs. While OMB issued circulars to define these requirements, the circulars have been relocated to the CFR to provide a common and comprehensive location for Federal regulations. The circulars and the relocation citations include:

- OMB A-21, Cost Principles for Educational Institutions, relocated to 2 CFR Part 220

- OMB A-87, Cost Principles for State, Local, and Indian Tribal Governments, relocated to 2 CFR Part 225

- OMB A-122, Cost Principles for Non-Profit Organizations, relocated to 2 CFR Part 230

- 48 CFR Part 31, Contract Cost Principles and Procedures

These circulars describe selected cost items, allowable and unallowable costs, and standard methodologies for calculating and allocating the indirect costs of non-Federal contractors. These cost policies are limitations on the amounts that may be reimbursed or recovered under a Federal contract. The cost principles articulated in each of these circulars are substantially similar, but some differences do exist, due mainly to the nature of the recipient organization, the nature of programs administered, and the breadth of services and operations of some grantees but not others. Further, the policies closely parallel the cost provisions in the government’s FAR.

A general policy relating to charges, reimbursements, billings, or payments to non-Federal contractors is that these costs must “be determined in accordance with GAAP [generally accepted accounting principles], except as otherwise provided for in CFR.” The emphasis on the word except is of particular significance to auditors of Federal contract and grant programs because there are many significant exceptions.

Characterization of costs as allowable or unallowable does not imply that such costs are unnecessary, unreasonable, or illegal. The terms allowable or unallowable mean only that the cost does not meet the government’s criteria for allowability. In most instances, the contractor could not function without the activities supported by the so-called unallowable costs.

Several policy statements (laws, regulations, OMB circulars, agency rules) detail categories of costs necessary to operate the non-Federal entity that are considered to be unallowable as a matter of declared Federal policy. Some examples of costs declared as unallowable include those listed next.

- Costs unallowed per public policy: Write-off of uncollectible receivables; accrued cost for contingent liabilities; state and local government taxes; advertising cost; cost of idle facilities; lobbying costs; financing costs; donations; and contributions. The accounting and reporting of these costs are mandated and appropriate under GAAP but are classified as unallowable by the Federal Government for charges to its contracts.

- Costs unallowed unless “funded” in advance of billing to the Federal Government: All pension costs of government employees; postretirement health and other benefit costs due to Government employees; and self-insured liabilities and costs are deemed unallowable until actually funded. The accounting and reporting of these incurred but not paid costs are required by and appropriate under GAAP but are classified as unallowable by the Federal Government as charges to its contracts.

- Costs unallowed unless approved in advance: Cash drawdown in excess of three days; employee relocation costs; recruiting costs; subscriptions costs; professional membership fees; and purchase of capital assets. The accounting and reporting of these costs are mandated and appropriate under GAAP but are classified as unallowable by the Federal Government for charges to its contracts, unless advance approval was obtained.

Unallowable costs may not be charged to, claimed under, or billed directly or indirectly to any Federal contract, grant, or other program of Federal assistance. If so done, such costs would be an audit finding reportable as a questioned cost by the auditor.

ALLOWABLE/UNALLOWABLE COST CRITERIA

The audit tests to assess compliance with Federal procurement policy and Federal allowable cost criteria require the auditor to test direct and indirect costs charged to or claimed under a Federal contract and to verify that the cost elements meet each of several allowability cost factors.

To be allowable under Federal costing criteria, direct and indirect costs charged or claimed by a contractor must meet each of these ten criteria:

1. Be

necessary and reasonable for the proper and efficient performance and administration of Federal awards.

Necessary costs are costs required, implicitly or explicitly, by law, regulations, and the Federal contract agreement to support the program outlined in the Federal contract. Necessary cost criteria should be assessed from the view of the purpose, timing, amount, authorization and approval, and the ultimate accounting of charged costs in relation to the performance period of the contract.

Reasonable costs are costs that are reasonable if, in nature and amount, they do not exceed that which would be incurred by a prudent person under circumstances prevailing at the time the decision was made to incur the cost. Determination as to the reasonableness of costs must give consideration to the following questions:

- Do the claimed costs exceed the type generally recognized as ordinary and necessary for the operation of the contractor or attainment of the performance or objectives outlined in the executed Federal contract?

- Do the claimed costs exceed restraints on spending or cost requirements imposed by sound business practices, presence of arm’s-length bargaining, terms of Federal and other laws, regulations, and terms, or as conditions of the Federal contract?

- Do the claimed costs exceed market prices for comparable goods or services?

- Do the claimed costs significantly deviate from established practices in a manner that unjustifiably increases the cost to the Federal contract?

2. Be

allocable to Federal awards under the provisions of FAR cost principles.

Allocable costs are costs that are allocable if the cost is directly allocable to a particular cost objective or if the goods and services involved are chargeable or assignable to such cost objectives in accordance with relative benefits received. OMB requires that determination of allocability of costs give consideration to:

- All activities that benefit from a unit’s indirect cost, including unallowable activities and services donated by third parties, receive an appropriate allocation of indirect costs.

- Unless otherwise permitted in writing, any cost allocable to a particular Federal contract or cost objective may not be charged to other Federal awards to overcome fund deficiencies, to avoid restrictions imposed by law or terms of Federal awards, or for other reasons.

- Where an accumulation of indirect costs will ultimately result in charges to a Federal contract, a cost allocation plan will be required, similar to those outlined in CASB standards or the appropriate OMB cost circulars.

3. Be authorized and not otherwise prohibited under any Federal, state, or local laws or regulations.

4. Comply with any limitations or exclusions set forth in the FAR, cost principles in OMB circulars, terms and conditions unique to the Federal contract, or other governing regulations regarding types, amounts, or limits on cost items.

5. Be in conformance with policies, regulations, and procedures that apply uniformly to both Federal and non-Federal contracts and awards and to Federal and non-Federal activities of the non-Federal entity receiving assistance under a Federal contract.

6. Be accorded consistent cost accounting treatment.

Consistent cost accounting treatment means that costs may not be assigned to a Federal award as a direct or indirect cost if any other cost has been incurred for the same purpose, in like circumstances, and has been allocated to the Federal award directly or, in part, indirectly. The consistency requirement relates to the uniform accounting and charging of costs to both Federal and non-Federal activities of a contractor between fiscal reporting periods.

7. Be determined in accordance with GAAP, except as otherwise provided for in OMB cost circulars.

8. Be not included as a cost or used to meet cost sharing or matching requirements of any other Federal award in either the current or prior period, except as specifically provided by Federal law or regulation. This restriction prohibits a contractor from claiming direct or indirect costs that were charged to the Federal Government under one Federal agreement to meet a cost-sharing or cost-matching cost requirement of another Federal agreement.

9. Be net of all applicable credits.

Net of applicable credits refers to receipts or the reduction of expenditure-type transactions that offset or reduce expense of items charged to Federal contracts as direct or indirect costs (e.g., purchase discounts, rebates or allowances, recoveries or indemnities on losses, insurance refunds or rebate, or other price adjustments). In applying costs net of applicable credits, the allocability of net costs must give consideration to:

- The extent that such credits relate to allowable costs, the credits must be applied to the Federal award as a cost reduction or cash refund, as appropriate.

- Amounts of any credits should be recognized in determining indirect cost rates or amounts to be charged to Federal awards.

10. Be adequately

documented.

Audits of direct and indirect costs and matching contributions claimed or charged must be tested to support documentation that identifies or relates to the amount, timing, and purpose of transactions to the specific Federal contract. For example, the timing of the transaction must be within the contract period. In most instances, transactions preceding or following contract award are not allowable in the absence of specific approval by the Federal Agency.

Supportive documentation, as defined in literature of GAO and the AICPA, includes:

- Accounting records of original entry. Examples include journals, registers, ledgers, manuals, worksheets, and support for cost allocations. Alone, though, these types of accounting data are not sufficient supporting documentation.

- Corroborating evidence. Examples include canceled checks, invoices, contracts, grants, minutes of meetings, confirmations, and other written statements by knowledgeable personnel, information obtained by auditor inquiry, observation, inspection, personal examination, and other information developed by, or available to, the auditor.

- Independent tests must be made by the auditor of underlying data and records and include analyses, reviews, retracing procedural steps of the financial process, auditor recalculations, and performance of reconciliations of any cost allocations.

In audits of Federal contracts, the auditor must question and report to the Federal Agency for resolution claims or charges to the contract that are not sufficiently documented or supported or about which the auditor is unable to satisfy him- or herself by other evidential means as to the propriety and allowability of costs.

The OMB Supplement identifies ten procurement compliance regulations, noncompliance with which could have a direct and material effect on the accounting, charging, and billings to Federal contracts. If the contract is materially significant to the contractor, noncompliance under a Federal contract might well affect the contractor’s overall financial statements. The compliance policies associated with individual contracts and of importance to contract audits are listed next.

1.

Costs charged to government: allowable, unallowable, direct, and indirect costs. Dating to the middle of the last century, it has been Federal Government policy that the government will permit only certain direct and indirect costs to be claimed by and reimbursed under Federal contracts. Federal money may not be claimed or paid for any direct or indirect costs defined as unallowable by Federal policy. OMB has provided these definitions of direct and indirect costs:

- Direct costs are those that can be identified specifically with a particular final cost objective. Typical direct costs chargeable to Federal contracts include employee compensation, cost of materials, equipment if specifically approved, and travel expenses subject to Federal limits.

- Indirect costs are those (a) incurred for a common or joint purpose benefiting more than one cost objective and (b) are not readily assignable to the cost objectives specifically benefited, without an effort that is disproportionate to the results achieved. To facilitate equitable distribution of indirect expenses to the cost objectives served, it may be necessary to establish a number of pools of indirect costs within the contractor. Indirect cost pools should be distributed to benefited cost objectives on bases that will produce an equitable result in consideration of relative benefits derived. Any direct cost of a minor amount may be treated as an indirect cost for reasons of practicality, where such accounting treatment for that item of cost is consistently applied to all cost objectives.

2. Equipment, real property. The title to equipment acquired by non-Federal entities with Federal monies could remain with the non-Federal entity or with the Federal Government. Here, equipment is defined as tangible, nonexpendable property with a useful life of more than one year and an acquisition cost of $5,000 or more per unit.

3. Matching contributions. Matching requirements, in kind or other, often require examination of the terms and conditions of the individual contract. Matching requirements are often specific as to the amount, type, timing, and purpose of match that is permissible. For example, if the agreed-upon match was to be cash, donated labor, or any other type of contribution, free or paid, it would be unallowable. Also, there may be a requirement that the match be provided within a certain time period; compliance in a later period would have to be reported.

4. Availability of program funds. Legislation for all Federal appropriations and other financial assistance places limits on the amount of funds being provided, the purpose for which the funds are provided, and a time period (or use period) after which the authority to spend the Federal monies lapses. (OMB Circular A-102, Grants and Cooperative Agreements With State and Local Governments (10/07/1994) (further amended 08/29/1997), the “common rule,” should be consulted for additional guidance on this compliance requirement.)

5. Procurement, suspension, debarment. Presidential executive orders and Federal regulations prohibit Federal Agencies from contracting with or subcontracting to parties that have been suspended or debarred or whose principals are suspended or debarred.

6. Program income. Program income is the gross income directly generated by the Federal project during the contract period (e.g., fees earned for services, rental income, sale of commodities or items fabricated under the program, payment of principal, and interest on loans made from Federal funds). Unless otherwise specified by the Federal Agency, program income shall be deducted from program outlays.

7. Reporting. Recipients of Federal contracts must use prescribed standard forms for financial, performance, and special reporting. Auditors must confirm that controls have been implemented to ensure that reports, claims for advances, and reimbursements are supported by the same books and records from which the entity’s financial statements were prepared. Tests must be made ensure submitted reports, claims for advances, and reimbursements are supported by underlying documentation and appropriate corroborating evidence.

8. Special tests and provisions. Laws, regulations, provisions of contracts, and grants contain requirements for special tests. The auditor must review the specific terms and conditions of the contract since the contract could contain conditions warranting special examination. The axiom of the legal profession applies equally to contract audits: When all else fails, read the contract. There is no substitute for examining the terms and conditions of specific contracts, bond covenants, terms of loans, loan guarantees, and so on under which money or financial assistance is provided to support contracts to non-Federal entities.

9. Activities: Allowable, unallowable. Public monies may be used only for those activities allowed by law or regulation. Congress determines that certain organizations, groups, or individuals are to be beneficiaries of funding provided under particular Federal legislation. The law will also define the qualifying conditions and the benefits to be conferred. Permitted and prohibited activities must be identified, and audit tests made, to ensure that Federal monies are used to support only those activities permitted by law or regulation. Audit tests must be made to ensure that Federal monies were used to support only those activities permitted law or regulation.

10. Cash management: advance funding of government programs. For some contractors, forms of advance funding exist (e.g., lump-sum or total advance of required Federal funding; advances made at designated points during the contract period; or periodic drawdowns under a prearranged letter-of-credit procedure arranged between the contractor, the U.S. Treasury, and a local commercial bank). Under the Cash Management Act, a contractor’s procedures for drawing down Federal funds must minimize the time elapsing between the transfer of funds from the U.S. Treasury and disbursement by the contractor. Historically, the cash balance could not be in excess of three business days.

When deciding whether to test a compliance requirement, the auditor must conclude whether (1) the requirement does or does not apply to the contract and (2) noncompliance with the requirement could or could not have a material effect on the contract. Chapter 7 of Government Auditing Standards (Yellow Book), “Reporting Standards for Performance Audits,” provides guidance for the desired narrative-type audit reports and should be consulted before undertaking an audit of Federal contracts. Further, the guidance in Chapter 7 is part of the criteria used by Federal IGs and GAO in assessing the adequacy of the contract audit.

GRANT AUDITS

For the Federal Government, expenditures under grants-in-aid are very significant. Funds are expended by grants to purchase or support a wide variety of services, including purchases of equipment, real and consumer-type properties, supplies, and conduct of research, to mention a few of the purposes for which grants are issued. Amounts spent under grants greatly exceed amounts spent on other items in the budgets of many agencies. Congress monitors major grant programs closely, agencies track financing and operations under grant instruments, and, at times, the print and other news media provide extensive and detailed coverage of grants, particularly if there is a hint of fraud, waste, or abuses.

Grants Defined

Since the 1960s, the definition or nature of the Federal grant has evolved from an endowment or outright gift of monies, to today, where many recipients of Federal grants operate programs, perform services, and render technical assistance on behalf of the Federal Government. Generally, a Federal grant may be defined as:

money or property in lieu of money paid or furnished by the Federal Government to a grantee under a program that provides financial assistance to the grantee or through the grantee to a constituency defined in law by Congress. Not included in this definition would be other types of Federal financial assistance, such as loans, loan guarantees, revenue sharing, and forms of insurances.

Grant Types

In practice, the terms and conditions of grants may be indistinguishable from those of Federal contracts, as both contracts and grants are legally binding instruments between the Federal Agency and its contractors and grantees. At times, an instrument considered to be a contract by one Federal Agency may be accounted for as a grant by another. A variety of descriptors are applied to grants; some of the more common classifications are discussed next.

- Formula grants, by law, have a mandated funding level for identified types of grantees only, with little or no discretion being exercised by the Federal grantor. Formula grants could include allocations of money to states and their subdivisions for activities of a continuing nature, not confined to a specific project.

- Project grants resemble contracts because Federal grantors agree to pay the grantee for services, performance, or the completion of a project. These grants for projects with fixed or known periods could include research and training grants, planning and demonstration grants, technical assistance grants, and construction grants.

- Block grants, which are intended to consolidate funds for broad purposes into a single funding action, are typically issued to state or local governments with minimal or less expenditure restrictions from the Federal grantor.

- Noncompetitive grants may be awarded to all applicants meeting specified legal or other congressional criteria.

- Competitive grants may be awarded to a selected number of grantees having similar qualifying characteristics after an evaluation of proposals, in a manner similar to that used for competitive contract awards.

- Recovery grants, which are a result of grants issued under the American Recovery and Reinvestment Act of 2009 (Recovery Act), are unique in that they require Federal Agencies to implement certain activities for awarding and overseeing funds to enhance accountability and transparency of the funds issued under the Recovery Act.

As is evident from these definitions, the categorization of grants by groups is not a mutually exclusive ranking, nor are the descriptors applied uniformly across Federal Agencies. In practice, a grant award could conceivably fall within two or more of these categories.

Responsibility for Grants

Several organizations share the responsibility for award, administration, and settlement of Federal grants. The nature of authority or responsibilities exercised by these organizations is outlined next.

Congress

Congress, through its authorization and appropriation committees, has the ultimate authority and responsibility for Federal grant policies. These policies appear in laws having government-wide applicability as well as in specific legislation applicable to individual granting agencies. Legislation applicable to individual agencies contains specific congressional policy and, at times, procedural directions concerning the award and administration of a grants program.

Government Accountability Office

GAO is authorized to audit the expenditures of Federal monies spent under grants. In the exercise of this authority, GAO may review systems of Federal Agencies relating to grants award and administration and the accounting and internal controls in support of these types of agreements. These grant reviews are made both at the Federal entity level and at contractor and grantee locations.

Office of Management and Budget

OMB issues government-wide regulations relating to grant awards. For the past several years, OMB has relocated many of the OMB circulars related to grants to Title 2 in the Code of Federal Regulations (2 CFR), subtitle A, chapter II parts to provide a central location for Federal Government policies on grants. The CFR defines types of allowable and unallowable costs and indirect or overhead costs that are permitted or prohibited. The remaining circular, OMB Circular A-133, Audits of States, Local Governments and Non-Profit Organizations defines requirements for the audits of grant recipients. Applicable 2 CFR and circulars are listed next.

- 2 CFR Parts 215 and 220, Cost Principles for Educational Institutions (OMB Circular A-21), sets forth the allowable, unallowable, and indirect cost principles for contracts with educational institutions.

- 2 CFR Part 225, Cost Principles for State, Local, and Indian Tribal Governments (OMB Circular A-87), sets forth the allowable, unallowable, and indirect cost principles applicable to state, local, and Indian tribal governments.

- 2 CFR Part 230, Cost Principles for Non-Profit Organizations (OMB Circular A-122), sets forth the allowable, unallowable, and indirect cost principles for nonprofit organizations.

- OMB Circular A-133 sets forth requirements for Federal Agencies to perform audits of Federal grant award recipients to promote consistency.

OMB has issued specific guidance to Federal Agencies issuing recovery grants to enhance the accountability and transparency of the Recovery Act funds. OMB Memorandum M-09-15, Updated Implementing Guidance for the American Recovery and Reinvestment Act of 2009, provides guidance to Federal Agencies to facilitate accountability and transparency objectives of the Recovery Act. OMB provides guidance for merit-based decision making in awarding funds and issuing funds for projects that provide long-term public benefit and economic growth in line with policy.

Individual Federal Grantor Agencies

The Budget and Accounting Procedures Act of 1950 and later laws require the head of each Federal entity to establish and maintain an adequate system of accounting and internal controls over grant assistance programs. Pursuant to the act and other legislation, Federal entities have designed procedures relating to the solicitation and evaluation of grant proposals; negotiation, award, and administration of grants; and accounting for all phases of grant performance. It is critical that an agency’s systems of controls, accounting, and reporting be sufficiently precise to permit: monitoring of grant obligations, liquidation of these obligations, and the costing and disbursement of funds under these agreements. The systems of controls, accounting, and reporting for contract and grant awards generally require the coordination of numerous organizations of the awarding Federal Agency. In addition, the Recovery Act establishes enhancements to the requirements for awarding and overseeing the funds, including awarding grants and required reporting for jobs and fund use.

Controls for Grants-in-Aid

Federal organizations such as GAO, OMB, and GSA have some authority and responsibility to issue and require adherence to their government-wide policies and regulations relating to contracts and grants. However, the actual design of systems of controls, accounting, and reporting to protect the government is the sole responsibility of individual Federal granting agencies. The details vary, but most Federal entities have established operating policies and procedures requiring that:

- A grant authorization is to be approved by the responsible agency official and annotated, in advance, to show that sufficient appropriated funds exist to meet the estimated amount of the anticipated grant.

- If grants may be competitively awarded, a formal review process will exist for the objective evaluation and ranking of grant proposals received by the agency, both solicited and unsolicited.

- The issuance of a grant with the timely notification to the fiscal function permits prompt obligation of funds in an amount equal to the funded value of the grant.

- Periodic reporting of expenditures and performance must be made to grantees, with formal agency acknowledgment of grantee performance.

- Settlement by grantees of advances of money and drawdowns under letters of credit must comply with Federal policy and the individual grant conditions.

- There exists periodic assessment of the extent to which the purpose or objective of the grant is being achieved and that the required accounting and management control systems are in place and operating effectively.

- There is compliance with specific conditions and provisions for required matching or cost sharing or in-kind contributions by grantee recipients.

- There is timely payment of grant liabilities, prompt settlement and close-out, final accounting, and reporting at the conclusion or termination of the grant program.

- A final audit of the grantee must take place, with the Federal Agency retaining the right to recover appropriate amounts after considering audit recommendations and questioned or disallowed costs identified during the audit.

Grants-in-Aid Process

For Federal Agencies with the authority to operate grants-in-aid programs, the grants management process requires formal authorizations and approvals for anticipated grant awards, the execution of specific forms to document the grants award process, establishment of the controls, and performance of the accounting for each grant awarded. Identification of the types and purposes of various support documentation is essential to auditing an agency’s grants-in-aid program. For example:

- An agency’s grantor program office establishes operating policies and procedures to implement a grants-in-aid program to provide assistance to the eligible recipient constituency cited by Congress in the authorization and appropriation legislation for the program.

- The agency’s grants director, possibly a designated allottee, possesses budgetary authority to approve and fund grantee selections and later execute grants.

- The responsible Federal Agency might issue a notification to the public in the Federal Register, grants.gov, and other announcements describing the grants program, the eligible constituency, and the procedures for applying for the assistance to solicit applications for grants. (Some grant-in-aid processes may forgo the formal application phase, depending on the program’s enabling legislation.)

- Applications for grants assistance, if required, are reviewed on receipt, critiqued for compliance with law, and approved, and a formal grant agreement is executed with grantees that is legally binding between an agency and its grantees, pursuant to Section 1311 of the Supplemental Appropriations Act.

- The receipt and acceptance of services, goods, or assistance by a grantee often must be formally monitored and acknowledged by the appropriate agency personnel.

- Financial expenditure and operational reports are provided by the grantee for reimbursement of expenses or in support of earlier advances or letter-of-credit drawdowns provided in anticipation of the reported expenditures.

- There are prepayment audits of invoices to ensure that amounts, performance, and deliveries are consistent with negotiated grant terms; prompt and accurate payment is made of properly rendered invoices; and there is timely processing of all procurement transactions.

- There is final settlement or grant closeout of any advanced money, government-furnished equipment, and property in a manner consistent with agency policy or grant conditions, and a final assessment of grantee compliance.

Not all grant award tasks or activities are resident within a single unit, function, or activity of a Federal Agency. Rather, the completion of a grant action requires collaboration and coordination between:

- Grantor program office and allottee. For new programs, the Federal grantor’s program office is responsible for informing the congressionally targeted constituency of the Federal assistance program. This office is often responsible for conducting negotiations, when required, with prospective grantees; executing and awarding the grants; administering the grant; monitoring periodic financial and performance reports; and settlement and closeout at completion of the grant.

- A grant management office may exist outside of the grantor program office to maintain a separation of duties from the program office by providing policy and procedure development, award file management, financial oversight, and close-out support.

- Accounting section. This section must confirm the availability of agency appropriations money for grants in advance of grants approval. Additionally, this function performs the agency’s accounting to record a commitment to reserve the available funds obligated for each grant awarded, liquidate the obligation when services are performed; and process the expenditures, payables, and ultimate disbursement transactions related to each grant. The accounting section might also: compile internal and external financial reports on grants; prepare the schedule to request issuance of checks by the Treasury Department to grantees; and perform the fiscal and budgetary accounting during and after expiration of the agency’s appropriations.

- Grantee. The grantee may have to prepare and submit a grant application, negotiate terms and conditions of the prospective grant, and execute a legally binding grant with the Federal Agency. Federal grants could be funded by periodic advances of cash to the grantee, permitting the grantee to draw down cash under a Federal letter of credit, or reimbursing the grantee on the basis of reports reporting the expenditures incurred for the Federal grant program. Each grantee must perform services or operate the agreed-to grant program; periodically complete and submit financial and performance reports to the Federal grantor; and compile end-of-grant financial, property, and performance reports to formally settle and close out the grant.

- Treasury Department. Actual checks or other types of funds transfer in payment for a grantee performance are issued by the Treasury Department upon receiving a request from the Federal grantor agency that a check be issued or direct deposit made to a named grantee unless the issuing agency is authorized to make disbursements, as DoD is.

Events Requiring Accounting Entries

OMB has prescribed certain criteria for the incurring of financial obligations for awarded grants, the accruing of expenditures reported by grantees, and the accounting for costs of grant transactions. The accounting of grants-in-aid by Federal Agencies must be in accordance with the concepts set forth in OMB Circular A-11.

- Record only valid obligations. An agency’s reporting of obligations incurred for Federal grants-in-aid programs, according to Section 1311 of the Supplemental Appropriations Act, requires that there be legal evidence of a binding agreement prior to the recording and reporting of obligations for grants. OMB Circular A-11 sets forth the formal criteria for recognizing formal grants-in-aid obligations. According to OMB, internal administrative commitments of agency funds and invitations to apply for Federal assistance sent to prospective grantees are not legally valid obligations. These and other type activities fail to meet the criteria of Section 1311.

- Accrue grant expenditures regardless of when paid. Expenditures for grants accrue when the grantee reports performance in accordance with the terms and conditions of the grant program. The expenditures accrue and a liability to the grantee is created by the grantee’s performance. The accounting for the cash disbursed in payment or reimbursement to the grantee may delay performance by weeks or even months, unless the grantee has received an advance or has withdrawn funds under a letter of credit.

The more common forms used by Federal Agencies when awarding and administering grant programs include several of those identified next.

Grants Authorization

The program authorization is a formal authorization for the grants program and approval to incur obligations on behalf of the Federal Government. Within the Federal Agency, this form may be executed by the head of the agency or, more often, by an official, frequently the agency’s designated program allottee. The grants program authorization serves as the basis to allot a portion of the agency’s appropriation to the grants-in-aid program.

Grant Applications

Repeat grantees of continuing grants-in-aid programs may be permitted to simultaneously submit an operating budget with the next year’s financial plan, which, if approved, becomes the grantee’s funding application for that year. A new grants-in-aid program might be required to request grants applications from the constituency identified by Congress in the programs authorization and appropriation legislation. Grant applications typically identify or describe these areas:

- Nature of the grants program

- Number and type of constituents to be serviced

- Period of performance

- Budget or estimated level of financial and other resources required to operate the grant program

- General and special conditions applicable to the grants-in-aid program or the individual grant.

No accounting entry results from receipt of a grants application.

Grant Agreement

The award of a grant constitutes the legally binding obligation of a Federal entity. The grant agreement typically signed by a grantee and the designated agency executive describes the scope of the grant services, performance period, terms and conditions, the amount of the grant, and the amount funded. When the face amount of the grant is in excess of the amount funded by the Federal Agency, the contract is said to be incrementally funded. An incremental funding limits the Federal Agency’s liability to the funded amount. (At this stage, an accounting entry is made to formally obligate a portion of an agency’s appropriation balance for the lesser of the face amount of the grant or the incrementally funded amount.)

Expenditure Reports

Most grants-in-aid programs require that grantees submit periodic progress reports (financial and/or performance) to document grant funds received earlier as advances, letter-of-credit drawdowns, or requests for reimbursement of grant expenditures. (These reports are generally subjected to a prepayment audit and are the basis to support an accounting entry to liquidate earlier obligated amounts and record the program’s accrued expense.)

Cash Advances

Most Federal grantees, usually nonprofit organizations and non-Federal Government entities, receive an advance of grant funds. Advances can be made in two forms: lump-sum or periodic advances given to the grantee to cover operations for a specified time period or letter-of-credit drawdowns. The letter-of-credit process is a periodic funding process that requires the existence of certain forms, including:

- An authorized signature card identifying the grantee’s certifying officer that is placed on file with the Treasury and the grantee’s commercial bank or other designated disbursing organization.

- A letter of credit, completed by the government entity and forwarded to the Treasury, identifying the Federal Reserve Bank or Treasury disbursing agent and the grantee, establishing the total amount of the letter of credit and the periodic withdrawal limits, and defining the time period for which the letter of credit will be available.

- A request for payment on letter of credit is prepared by the grantee, consistent with the letter of credit, to withdraw funds to finance grantee performance. The form requires the reconciliation of balances, withdrawals, and other letter of credit transactions and an identification of the associated grant program or grant for which funds are withdrawn.

- The issuance of an advance at the time of grant award or the release of funds pursuant to the submission of a request for payment on a letter of credit constitutes a disbursement of funds, which is an advance that must be posted as an accounts receivable due the Federal entity.

Schedule and Voucher of Payments

The voucher and schedule of payments, whether a hard-copy form or an electronic facsimile, is the formal request by the Federal grantor agency to the Treasury Department to make payment (by checks, EFTs, or direct deposits) in specified amounts to identified grantees. The Treasury makes no distinction between payments made for performance or for advances. This accounting is a responsibility of the Federal entity, and the schedule merely represents the documentation in support of an agency’s accounting entry for its cash disbursements.

Cooperative Agreements