Tribe vs. market segment

Tribe vs. market segmentBased on what it takes to become a more Hyper-Social organization, as described in the earlier chapters of this book, you can now begin to measure how Hyper-Social your company really is. In fact, the concepts introduced in the earlier chapters enable you to benchmark your Hyper-Sociality against that of your competitors, or that of one part of your organization against that of another part.

This benchmark, which we call the Hyper-Sociality Index (HSI), is a framework that companies can use to evaluate how well positioned they are to take advantage of the Hyper-Social shift, and where they lie on the migration curve. After calculating their HSI, organizations will better appreciate their Hyper-Social weak points, be better positioned to compare themselves to the competition, and be able to better define those steps that will move them toward Hyper-Sociality.

The HSI is built around the Four Pillars of Hyper-Sociality:

Tribe vs. market segment

Tribe vs. market segment

Human-centricity vs. company-centricity

Human-centricity vs. company-centricity

Network vs. channel

Network vs. channel

Social messiness vs. process and hierarchy

Social messiness vs. process and hierarchy

As we consider the Four Pillars of Hyper-Sociality, you will see that we have included in the framework specific questions that suggest or highlight practices that we have seen successfully employed by companies that participated in the Tribalization of Business Study. These questions have been carefully selected to raise the relevant issues for each pillar that will help you to “grade” a company on that specific pillar.

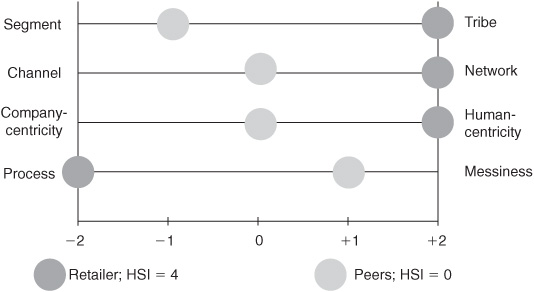

As part of the Tribalization of Business Study, we have surveyed more than 500 companies, and interviewed many of them, to begin ranking them relative to their peers. By assigning simple relative scores (−2 for significantly behind its peers, −1 for slightly behind its peers, 0 for on a par with its peers, +1 for slightly ahead of its peers, and +2 for significantly ahead of its peers’ progress), company management can generate an accurate and consistent assessment of a company’s location on the Hyper-Social shift.

First, a word on measuring your HSI score against those of your competitors effectively. Looking at the organizations that your constituents (employees, members, customers, or business partners) would consider to be your competitors, compare your outward behavior, as seen by the market, with your competitors’ outward actions and expressed attitudes. For instance, although it is encouraging that your organization may have recently realized that it needs to pay greater attention to its tribes, without overt actions in the furtherance of this pillar, you shouldn’t give your organization credit for only this newfound awareness in calculating its HSI. Hyper-Social behavior requires overt actions that are visible to the people that matter (customers, members, employees, and business partners), not just corporate resolutions or internal memos avowing greater human-centricity. Talk is cheap, and talk alone shouldn’t be allowed to influence an HSI score.

Figure 9-1 is an actual HSI that was calculated for a large retailer. The company has stood well above its peers in the recent past in identifying and interacting with its tribes (notably, women looking for bargains because their families are on tight budgets). As the company learned by listening to this tribe, these women don’t want to brag about buying luxury products cheaply—that is a different tribe. These women are much more interested in sharing tips with their tribe on how to stretch a budget and how to prepare nutritious, but economical meals.

Figure 9-1 Example: HSI of Retailer

After discerning what the passion of the tribe revolved around (helping one another to find bargains and to make ends meet), the company did a great job of speaking to the tribe as a tribe, not as single individuals. The company took a minor role in the community (as it should) and allowed a network of people to educate it and one another on how and why they bought what they did. It was not primarily a disguised marketing campaign or just another channel for distribution of press releases.

Could the company’s performance in helping this community find value around its passion be improved? Absolutely—look at the weakness around process. If the company eased up a little on how it managed the somewhat rigid application process, and used different sorts of incentives to keep people engaged, it might develop an even more powerful and sustainable discussion forum, with even more people participating for longer periods. In other words, if the company made this even less of a marketing program than it already is, we suspect that it would become an even more vibrant and ultimately sustainable community than it is now.

At the highest level, developing an HSI allows one to easily see where a company risks running into trouble dealing with Hyper-Social consumers and employees. Think of a package shipping company, for instance, that focused 100 percent on a conventional market segment, small businesses, and missed the important tribes within that segment. Not surprisingly, the company’s product innovation community effort failed. Thankfully, it was a small failure, and many lessons were learned. Here, the company clearly failed to satisfy the pillar that requires organizing to interact with tribes, instead of with more standard market segments.

Or think of a mobile handset company that acquired a gaming community to better codevelop and comarket the company’s mobile gaming platforms. The new product development process in the larger mobile handset company was so rigid and lengthy that people in the community felt that they were not being heard and started to desert the community, forcing the company to redesign a new product development platform centered around the community. Here again, the company had to try twice before it embraced the reality that Hyper-Sociality can be a messy business that is not easily shoehorned into a legacy corporate process.

Now, not all cases are as black and white as the ones we just described (where the companies would likely have scored a –2 in the categories of tribe vs. segment and messiness vs. process, respectively), and we need to add some measure of degree to the various pillars that we use to determine the HSI. An effective way of doing this is to develop a series of questions that, when answered honestly, help you to assign scores to the various pillars as they are practiced at your company and at your competitors’ organizations.

And in addition to honesty, we find that having a broad functional perspective improves the process as well. For that reason, we encourage you to include people from across the company when you are assessing your HSI. It is tempting for the sponsoring group or business function (often marketing) to have all of the members of the HSI-measuring group be from that function. As we will see from the analysis involved, however, you will be better served if you include representatives from marketing, product development, talent, knowledge management, sales, and any other function that shows interest and insight. You should also include a representative from the legal department so that you can understand the reasons why some practices and attitudes may exist, and the steps you would have to undertake to reform or change those processes that appear to be having a negative impact on your HSI.

So as you embark on the HSI journey, consider which specific aspects of the company’s Hyper-Sociality you will initially focus on, and who your target stakeholder will be. Perhaps you will examine how the company interacts with customers, or perhaps with business partners or with employees. Since at this point, you may well have different organizational levels of Hyper-Sociality for dealing with these different stakeholders, consider which would profit most from the Hyper-Social shift, and focus on that group as your target stakeholder. As Hyper-Sociality is adopted across the company, you will, of course, be aiming for a consistently Hyper-Social relationship with all of your stakeholders.

Let’s jump into it. Let’s look at how we would approach developing an HSI in the following example. The company being measured, whose target stakeholder is the consumer, should ask questions like these when assessing its score along the Four Pillars of Hyper-Sociality.

Have you identified tribes that are consumers of your products, but that differ from your legacy segmentation understanding of your customers?

Have you identified tribes that are consumers of your products, but that differ from your legacy segmentation understanding of your customers?

What is your relative rank as against your competitors? (Give yourself the following points: −2 for significantly behind your competitors, −1 for slightly behind your competitors, 0 for on a par with your competitors, +1 for slightly ahead of your competitors, and +2 for significantly ahead of your competitors’ progress.)

What is your relative rank as against your competitors? (Give yourself the following points: −2 for significantly behind your competitors, −1 for slightly behind your competitors, 0 for on a par with your competitors, +1 for slightly ahead of your competitors, and +2 for significantly ahead of your competitors’ progress.)

Have you discovered the existence of tribes on social networks or online communities that you have identified as viable target customers?

Have you discovered the existence of tribes on social networks or online communities that you have identified as viable target customers?

Have you increased your understanding of the collective passion that causes these people to participate in these online communities?

Have you increased your understanding of the collective passion that causes these people to participate in these online communities?

Have you developed a “win story” that you’ve circulated within your organization about interacting with a previously identified or unidentified tribe in the past six months?

Have you developed a “win story” that you’ve circulated within your organization about interacting with a previously identified or unidentified tribe in the past six months?

Have you implemented features that permit members of your target tribe to help one another and enhance their status with one another?

Have you implemented features that permit members of your target tribe to help one another and enhance their status with one another?

Do members of your tribe seem to trust your authenticity?

Do members of your tribe seem to trust your authenticity?

Have you added offline or real-world activities that allow the members of your tribes to interact with one another (e.g., conferences, Webcasts, and conference calls)?

Have you added offline or real-world activities that allow the members of your tribes to interact with one another (e.g., conferences, Webcasts, and conference calls)?

Can the tribes discuss discomforting things, such as what they like about the competition or what prices they are paying to whom?

Can the tribes discuss discomforting things, such as what they like about the competition or what prices they are paying to whom?

Are the people who communicate with your tribes on the front line chosen for their special skills, their level of interest, or their rapport with the community, or are they given that job as a part-time role, or because they are not fully utilized elsewhere?

Are the people who communicate with your tribes on the front line chosen for their special skills, their level of interest, or their rapport with the community, or are they given that job as a part-time role, or because they are not fully utilized elsewhere?

Are competitors and detractors allowed to join the conversation?

Are competitors and detractors allowed to join the conversation?

Are there social media tools that are not being used, compared to what other active Hyper-Social companies are using?

Are there social media tools that are not being used, compared to what other active Hyper-Social companies are using?

Were customers and employees included in the drafting of the terms of service?

Were customers and employees included in the drafting of the terms of service?

Have you deployed a social Q&A system that permits users to ask one another questions and to draw upon your knowledge databases?

Have you deployed a social Q&A system that permits users to ask one another questions and to draw upon your knowledge databases?

Do you listen to all of the methods that your tribes use to communicate and to receive information? (Receive higher scores for the degree to which the answer is yes, and negative scores for failing to listen to the tribes through disparate channels such as Twitter, blogs, phone, e-mail, and text messages.)

Do you listen to all of the methods that your tribes use to communicate and to receive information? (Receive higher scores for the degree to which the answer is yes, and negative scores for failing to listen to the tribes through disparate channels such as Twitter, blogs, phone, e-mail, and text messages.)

Do you use technologies to listen in real time to the conversations about your company, your brands, your products, your executives, and your employees that are taking place in the social media?

Do you use technologies to listen in real time to the conversations about your company, your brands, your products, your executives, and your employees that are taking place in the social media?

Do you share information gleaned from conversations with your tribes between internal functions such as sales, customer support, marketing, and product development in a nearly real-time fashion?

Do you share information gleaned from conversations with your tribes between internal functions such as sales, customer support, marketing, and product development in a nearly real-time fashion?

Have you implemented a customer experience system that tracks all customer touch points (both direct and indirect) with your company?

Have you implemented a customer experience system that tracks all customer touch points (both direct and indirect) with your company?

Is the bias toward responding to tribe communications, or toward thinking about and analyzing how to respond?

Is the bias toward responding to tribe communications, or toward thinking about and analyzing how to respond?

Is there a formal workflow or process that requires more than one person to approve responding to an inbound communication?

Is there a formal workflow or process that requires more than one person to approve responding to an inbound communication?

Do you have a process in place that ensures that all incoming communications from the tribes, as well as references to your companies, brands, and executives, are responded to immediately?

Do you have a process in place that ensures that all incoming communications from the tribes, as well as references to your companies, brands, and executives, are responded to immediately?

Are there processes in place for determining whether a communication should be engaged with?

Are there processes in place for determining whether a communication should be engaged with?

Do you respond to both explicit communications and informal “chatter” from your tribes?

Do you respond to both explicit communications and informal “chatter” from your tribes?

Have you given your people who communicate with the tribes explicit abilities to move that information around your company and to seek assistance from places outside of their function within the company?

Have you given your people who communicate with the tribes explicit abilities to move that information around your company and to seek assistance from places outside of their function within the company?

Have you included representatives from all divisions of your company in the group that hears what the tribes are saying? Is this cross-pollination effective and casual, or is it involved and lengthy?

Have you included representatives from all divisions of your company in the group that hears what the tribes are saying? Is this cross-pollination effective and casual, or is it involved and lengthy?

Have you ever been surprised by information being communicated to you about your tribes that didn’t come from your tribes directly? For instance, did you hear about what your tribes were saying as a result of a news story, not from the tribes themselves?

Have you ever been surprised by information being communicated to you about your tribes that didn’t come from your tribes directly? For instance, did you hear about what your tribes were saying as a result of a news story, not from the tribes themselves?

Are registrations required for users to join the conversations with the tribe?

Are registrations required for users to join the conversations with the tribe?

Are negative tribe comments broadcast as widely to management as the positive comments are?

Are negative tribe comments broadcast as widely to management as the positive comments are?

Are employees across the company able to see what’s being said by the tribes?

Are employees across the company able to see what’s being said by the tribes?

Does content have to be approved before it is posted where the tribe can see it?

Does content have to be approved before it is posted where the tribe can see it?

Can the tribes link to information on their own and post their own comments (without censorship for impermissible hate speech, and so on)?

Can the tribes link to information on their own and post their own comments (without censorship for impermissible hate speech, and so on)?

Has a Google Labs–like beta feature been created that permits users to vote on new products and innovations that they like?

Has a Google Labs–like beta feature been created that permits users to vote on new products and innovations that they like?

Are small innovation experiments that are expected to fail and that are expected to only create learning or customer satisfaction encouraged?

Are small innovation experiments that are expected to fail and that are expected to only create learning or customer satisfaction encouraged?

Do you permit negative reviews of your products or positive reviews of your competitors’ products?

Do you permit negative reviews of your products or positive reviews of your competitors’ products?

Will you go to where your tribes are already assembling, or do you try to bring them to your online properties?

Will you go to where your tribes are already assembling, or do you try to bring them to your online properties?

This is by no means an exhaustive list of the questions that companies should develop to assess their location on the continuum that exists for each of the four pillars, but it does identify the sort of thinking that will assist you in scoring yourself on the four pillars, and that will lead to accurate determination of your company’s HSI. Indeed, there is no end to the questions that you should and will develop as you begin to think within the Four Pillars of Hyper-Sociality, and as your company becomes increasingly Hyper-Social. As you become more familiar with the four pillars, you will soon identify specific issues that you are struggling with as a company—for instance, should we allow our competitors’ thought leadership materials to be posted on our site? This is a significant human-centricity vs. company-centricity question, and it would be a terrific issue to track over time, and to see how your organizational resistance or acceptance changes over time.

Ensuring that employees from different functions are involved in the process, and different generations of employees as well, will yield better and richer questions. As a result, you will be able to engage in a robust, eye-opening discussion as your organization tallies up its scores. We say scores because you are likely to develop several HSIs as part of the process: one number that is your overall calculation of your HSI, others comparing you with each of your competitors, and perhaps others for specific business functions within your company. As you consider the questions given previously, you will undoubtedly realize that you probably cannot answer some of the questions for your competitors or your peers, as the information that the answer requires is not the sort of information that is broadcast externally or shared widely. It is fine to exclude those questions from your calculations of your HSI for purposes of comparison.

This should be a flexible tool that you can adjust for the idiosyncrasies of your industry—both the companies and the consumers. The compass to follow as you go through the analysis is to keep returning to the Four Pillars of Hyper-Sociality; any question posed that gets you closer to advancement on those four fronts will be useful and should be considered.

We should also stress that since expectations and social media advance so quickly, it is advisable that you benchmark yourself every six months to ensure that you are not losing ground to rivals and that different business functions within your organization are not falling behind relative to one another. As we’ve shown, humans will flow to the companies that interact with them Hyper-Socially; you cannot rest on your laurels, as other companies will be moving forward on their Hyper-Social shifts. You can be sure that the interested tribes will broadcast any changes that they perceive as being important to their interests. Indeed, tribes will often follow online community terms of use closely, and carefully scrutinize any changes; if your organization begins to depart from what the community expects in terms of Hyper-Sociality, you are likely to hear about it promptly. The same is true if you fail to adopt a technology platform that the tribe has adopted for communication.

Also, we must note that severe underperformance on any one pillar can have a disproportionately higher impact on your progress along other pillars. For instance, failing to be human-centric can outweigh a terrific understanding of who your tribes are and how well you manage the social messiness. The tribes will eventually see through the veiled attempt to extract undue benefit from them, and will go to another organization that they trust to provide them with greater value and to respect their interests.

In addition to comparing yourself to your peers and tracking your migration to Hyper-Sociality, the HSI may provide other valuable insights. For instance, select a key operating metric, and determine which identifiable factors affect it. If it is customer churn, for instance, identify the best thinking on what is likely to be causing the churn. If you suspect that it is poor customer service, try Hyper-Socializing customer support, and then carefully track both the change in HSI in that area and the change in churn (if any). Such an experiment not only helps you improve your measurement and management of the HSI of the customer support function, but also provides you with a possible validation of your Hyper-Sociality efforts.

We also encourage you to compare the data you use to compose your HSI with the Tribalization of Business Study findings that we regularly update and publish at www.hypersocialorg.com. These results provide updated cross-industry data on how companies are performing across the four pillars, and provide trend information to show where the changes have been greatest. It is a terrific way to determine where you stand in relation to the larger population of Hyper-Social companies, and where you might improve.

The HSI can also be used to identify and develop business functions or areas that need to be improved, to set a goal to strive for, to identify possible reasons that competitors are moving ahead or falling behind, and to detect that if a competitor has increased its HSI, it may be targeting Hyper-Sociality. Since it is our observation that an HSI score rarely rises on its own without management support and direction, a rising HSI score at a competitor indicates that that competitor may be actively trying to raise its HSI. Not only does this have strategic implications, but it also provides a learning opportunity for your organization. Indeed, whenever you identify a competitor that has increased its overall HSI or its HSI in a particular function, track performance in that area. You can learn much about your weak spots that way.

To improve an organization’s Hyper-Sociality effectively, managers must be able to measure their organization’s Hyper-Sociality accurately. The Hyper-Social Index is a straightforward way of measuring an organization’s performance across the Four Pillars of Hyper-Sociality, one that yields a numerical rating that can be used to gauge progress and to compare one organization’s Hyper-Sociality with others’. By answering a series of questions, managers can identify areas of strength and areas that require improvement.