Figure 10.1 How Is the Government Going to Take Your Money?

Over the course of our deliberations, the urgency of our mission has become all the more apparent. The contagion of debt that began in Greece and continues to sweep through Europe shows us clearly that no economy will be immune. If the U.S. does not put its house in order, the reckoning will be sure and the devastation severe.

—National Commission on Fiscal Responsibility and Reform, “The Moment of Truth,” Debt Commission Report, The White House, December 2010

Blessed are the young for they shall inherit the national debt.

—Herbert Hoover Address to the Nebraska Republican Conference, Lincoln, Nebraska, January 16, 1936

I once asked my economics professor if the United States could go bankrupt. He said, “No, because the government can tax you for everything you have.” The answer has remained in my mind for 40 years. As I consider the question again, I know the government would create a political upheaval if they taxed away everyone’s wealth to pay off the nation’s debt. But maybe we can just take it away from the rich, those that make over $400,000. One question: Who pays if the rich don’t have enough wealth to pay off the debt?

Today, federal debt is out of control because of continual annual overspending by the federal government. Everyone knows it. The nation’s enormous debt is the single most serious security threat to the United States, and consequently it is a financial threat to every U.S. citizen who holds anything of value that is denominated in U.S. dollars—savings, bonds, mutual funds, and many stocks. The threat is real, and it is only due to lucky financial developments elsewhere in world that the U.S. government’s debts have not created a financial disaster. It is important to determine the financial losses a debt bomb can create for you. In this chapter, we will try to find ways to mitigate your financial losses as events unfold.

In a first step, the size of the federal debt needs to be put into perspective. Deficit spending contributes to the nation’s debt burden. A deficit is created anytime more money is spent than is earned during a one year period, and excluding two past years, the federal government has been spending more than its income every year since 1960.1 In order to fund the excess spending, the government must borrow money. Consequently, more and more debt is owed to those who buy government IOUs and fund governmental programs. The selling of U.S. bonds is the means the government uses borrow money. The U.S. Treasury prints those bonds and sells them to China, Japan, individuals, banks, and investment firms. In order to pay off maturing bonds, the government can sell more bonds to pay off its old bonds or it can just print money. Our governmental debt will continue into perpetuity as long as there is someone willing to buy bonds. The federal government has a lot of debt, and it is going up so fast any “current” debt estimate is quickly outdated. With that caveat, the federal debt as of December 21, 2012, was $16,336,217,360,826 or a bit over $16 trillion, and the interest rate on the debt averages around 2.8 percent, resulting in around $360 billion in annual interest payments.2 The debt has continued to increase at close to $4 billion per day since 2007.3 For the normal wage earner these amounts are unfathomable, but to put it in perspective, as of November 2012 to pay off the debt each person in the United States owes the government $53,378.4 So get out your checkbook and pay off your share of the debt. It is our debt because it arises from government expenditures for innumerable social transfer payments, defense spending, payments to prop up foreign governments, special tax provisions for solar companies, subsidiaries to agriculture, tax loopholes for everyone, and interest payments for funding the debt. When we vote, we vote for these expenditures.

Is anyone in the United States willing to hand over $53,378 to the government? Even if the government were willing to increase everyone’s tax to pay off the debt or if each American citizen felt a patriotic obligation to voluntary send in a check for that amount to the government, the results would be catastrophic to the economy. In an economy largely based on consumer spending, the withdrawal of this money from consumers would result in a business contraction that would rival the Great Depression of the 1930s. For individuals, the result would be substantially more losses than $53,378 per person and the recovery would take generations. Currently, the federal government is between the edges of two cliffs. At this point in the story federal officials have little wiggle room to get out of the situation that has been developing over the past 50 years.

Right now, the government has experienced a short-term reprieve from economic chaos due to interest rates being manipulated to historical lows by the Federal Reserve and the fact that the United States remains a safe haven for overseas investment. Currently, the interest rate on the federal debt is approximately 2.8 percent, which makes the interest paid on the debt only $360 billion annually. Should the interest rate on bonds increase, debt serving will become more difficult. If the interest rate should rise by threefold to 9 percent, then the annual interest payments will rise in parallel to an annual interest payment of over $1 trillion. These payments would largely be sent overseas. A 9 percent interest rate is not without precedent. In January 1980, the benchmark interest rate was 20 percent as the Federal Reserve attempted to reduce inflation.5 With little complication, the federal government can find itself in a situation where the interest on U.S. debt is so high the ability of the U.S. Treasury to pay it may be questioned. Only so much money can be printed before investors devalue our dollars. These interest rates may begin to increase because foreign investors who buy our debt require a higher rate in order to continue to fund the U.S. government’s operations or because the Federal Reserve has raised interest rates to fight runaway inflation.

The choices to deal with an unmanageable debt are limited, and some choices are infeasible. The basic four choices are shown in Figure 10.1, which begins with the debt’s ultimate effect on your net worth and financial prospects. Without careful planning, a loss of wealth is guaranteed no matter which road the government selects. Figure 10.1 shows that the results are the same; the only variation is how your wealth is going to be taken. The methods are different, as some are not a direct-in-your-face approach, such as personal tax increase or transfer payment reduction, but they are just as effective at appropriating your wealth.

Figure 10.1 How Is the Government Going to Take Your Money?

Of course, these methods could be used in combination with one another. The nations in the European Union have raised taxes on their citizens while at the same time cutting government benefits from pensions to food support, laying off government workers, and cutting the salaries of government employees who remain. Right now, in Europe the conventional economic wisdom is to use tax increases along with austerity measures. In the United States, none of these measures have been agreed upon as a means to control the financial viability of the country.

Regardless of the outcome of the tax debates in Congress, tax increases cannot raise revenues enough to eliminate annual overspending and contribute to a pay-down of our debt. The new taxes that are needed to cover deficit spending cannot be instituted without creating political unrest in the United States. Additionally, when new taxes are instituted, they are already allocated for a specific purpose. For example, the new tax on investment income (above a specific criteria) is allocated to the Obama Health Care Law; federal fuel taxes are designated for road infrastructure; even general tax revenues are committed to other causes before they can be used to reduce the country’s debt burden. The underlying purpose of many tax schemes is to redistribute the wealth from those who are better off to those who have less.

Social arguments for redistributing wealth by increasing taxes can take lawmakers to strange places. Is it financially fair for those who are well off to receive more Social Security payments than those who earned less during their working years? Does it also seem financially fair that those who followed a healthy lifestyle and may live longer may therefore collect more money from Social Security than those who followed a lifestyle predicated upon immediate satisfaction? All these differences could be considered reasons for changing the distribution of Social Security payments. Regardless of the side arguments about taxation, any choice is not going to stem the tide of annual deficit spending unless you first pay your share toward the reduction of the nation’s debt now at $53,378.

Austerity measures are substantially different than tax increases, debt default, or inflation growth. The latter three methods target all Americans, causing equal suffering among everyone. With expenditure cutbacks (i.e., transfer payments), particular programs are targeted, and those specific programs and individuals receiving benefits endure the brunt of the cuts.

Today, so many people are dependent on one form or another of transfer payments, austerity or cutbacks in government spending is also an unlikely congressional choice. It is estimated that over 50 percent of U.S. households receive some form of benefit from the government.6 Many U.S. citizens have been collecting money from the U.S. government for decades. These constituents and their government administrators have developed a symbiotic relationship. As more U.S. citizens receive transfer payments, the programs and those administering the programs become more important to our way of life. Can you imagine the result of these programs becoming successful and stopping their constituents’ dependencies? One of the first steps would be a loss of jobs for the administrators of these programs. The governmental system encourages expansion, not corrections. Without the direst financial conditions, such as those currently experienced by Greece, austerity measures will not be instituted in the United States.

The government will not take your wealth and money through large increases in taxes, and they will not take away coveted transfer payments with austerity measures. The political costs for a democratically elected Congress are too great. Taking such actions results in senators and congressmen losing their seats in Congress. For the past 50 years, no Congress has voted to face that alternative, and it is unexpected that a new Congress would vote for such changes before a financial crisis hits the United States. At this point, minimum changes are not enough to make a difference in the debt story. The remaining two governmental choices, as shown in Figure 10.1, are debt default and inflation.

Debt default occurs when a government cannot pay the interest on its debt or its maturing debt, and consequently it requires a restructuring of its debt and its interest payments.7 Debt repudiation, an unlikely event, takes place when a national government declares it will not pay its debt obligations. With a debt default, holders of the government debt can expect to only be repaid cents on each dollar owed them, as well as losing interest payments. A national government can always print more money, so default is likely to occur when no creditor will take the printed money because it is close to worthless. There have been 48 countries that have defaulted on their national debt over the 1971–1997 time period.8

The objective of a default is to eliminate debts the government finds so large that they will experience unacceptable austerity measures. In Europe, banks holding bond debt from national governments such as Greece and Italy have had to accept a reduction in the number of euros owed them. When this occurs, borrowed amounts are paid back at one tenth the original borrowing, for example, but the government does not repudiate its entire debt obligation. Thus, the government has only gone partially bankrupt. For the country, there are likely to be increases in all interest rates, devaluation of the countries’ currency, inability to make international contracts, a contraction of the country’s economy, and loss of purchasing power as all imported goods, from bananas to cars, become more costly.9 If the United States were to take this approach, it would also mean that the dollar would no longer be considered the reserve currency of the world and further crash the value of the dollars as holders of U.S. dollars traded their holdings for other currencies. This approach will not be taken in the United States.

When government-caused inflation is instituted to order to use cheap dollars to pay off its debt, it is called monetization.10 During the 2010–2012 period, the Federal Reserve instituted an interest rate policy to make people spend their money rather than save it.11 During this period, interest rates were kept so low that those who saved money lost money. They lost their purchasing power because the rate of inflation, although low, was higher than the rate of interest savers received on their bank deposits. So each year that money was kept in an account, purchasing power was lost, and savers found themselves in worse financial shape. The Federal Reserve instituted this policy to force consumers, in a consumer economy, to spend their cash to help revive the stagnant economy. If the Federal Reserve has the ability to institute a policy to force Americans to spend money, the Fed can also institute a policy to create inflation in the economy. In fact, the current Federal Reserve policy is to focus on lowering unemployment levels and allow inflation to increase above previous rates as a way to stimulate the economy.

The basic purpose of allowing inflation to increase is to be able to pay off debt with cheaper dollars. Such a policy means dollars will buy fewer goods and debtors profit while creditors lose. For example, with a fixed-rate home mortgage of $200,000, you considered your ability to make monthly payments based on your current earnings at the time you made the purchase; that is Point 1. Assume hyperinflation rages for two years and your employer has matched inflation rates with raises in your salary. You are not receiving raises because you are promoted, due to seniority, or higher productivity. Now a $4 hamburger costs $12. At Point 2, you look at your mortgage and you see how you can pay it off with cheaper dollars. After two years, you now owe $198,000. Your balance and your interest rate have been unaffected by inflation. Your salary, however, has doubled or tripled and you are now making $198,000. You decide to pay off your home mortgage. Creditors, the bank or loan company, holding the mortgage get paid off in cheaper dollars, which are worth less than the dollars they loaned. The Federal Reserve can create this situation so the government does not have to default on its debt or cut its expenditures, but instead pays off debt with cheap dollars. This government policy is called the monetization of the debt. It is a more sneaky policy than visibly cutting program expenditures, raising taxes, or defaulting on the nation’s debt, but it is still a conscious step toward debt repayment.

If the federal government decides to monetize its debt, it allows elected officials to say they did not raise taxes on the public or cut expenditures on the poor, but the overall effect will be the same. It allows politicians to say “we are on your side” as the deceptive effect of inflation creates a crisis for everyone on a fixed income or anyone owed money.

A debt default would have immediate international retaliatory effects, but increasing U.S. inflation does not create the outrage of a debt default. Yet defaults create similar losses among U.S. citizens as does inflation; except it gives the government an excuse to say “we are on your side.” If expenditure cuts are made to government programs, it will create a huge outcry from the constituents of these programs and from members of Congress. Yet if inflation eats into the ability of these programs to provide services to their constituents, it is another matter. No programs were cut, but the same objective is achieved through rising inflation and it allows the government to say it is fighting inflation so that full services can be restored—that is, “we are on your side.” Therefore, inflation is the only viable alternative for the federal government to alleviate its debt problem.

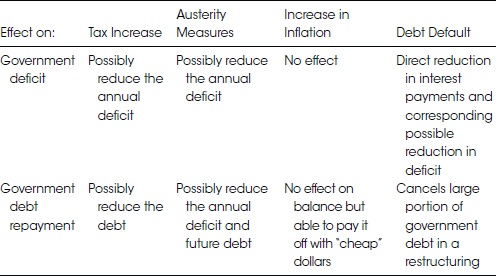

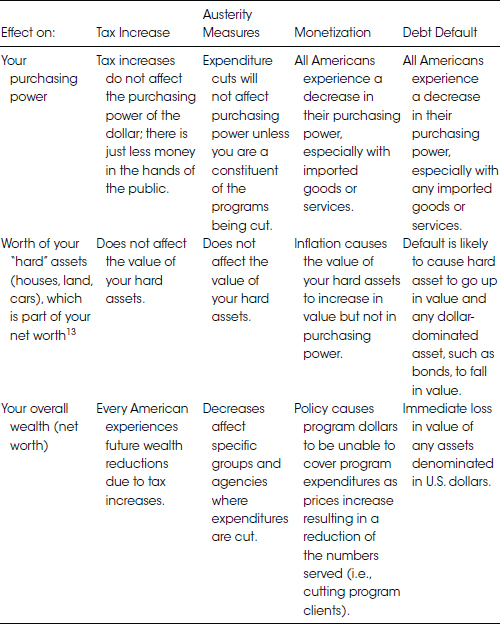

The specific effects of these policies are noted in Table 10.1. In Table 10.1, tax increases, austerity, increased inflation, and debt default are viewed from their immediate effects on the deficit and debt repayment. The direct consequences of these policies are shown in Table 10.2, but no changes in the economy are that simple. For example, as has been indicated a debt default creates all sorts of currency, bond, and foreign exchange turmoil for a country. Several effects in Table 10.1 are qualified with the word “possible.” The reason is because the immediate effect may be a reduction in the deficit, but it depends on whether governmental spending increases, for example.

Table 10.1 Policy Choices and Their Effect on Deficits and Debt

Table 10.2 Policy Side Effects and Me

Many of the effects of government policies to reduce the debt and deficit financial have been mentioned. Table 10.2 summarizes those effects on an individual’s net worth, purchasing power, and value of their “hard” assets.12 As has been stated, the most likely government plan to avert an immediate financial crisis is the monetization of its debt, so that is the policy scheme that needs to be investigated.

As monetization of the debt is the most likely policy scenario for the federal government to try to squeeze out of its financial situation, it is worthwhile to see how monetization affects different groups in the United States. The groups that will be considered here are the retired, salaried workers, bond and stock investors, the unemployed and disabled, and single small-business proprietors. These groups are not mutually exclusive from each other.

After the Soviet Union collapsed in the 1990s, its workers’ welfare system collapsed. Good comrades who had served communism and retired still received their pension payments, but the pensions did not buy much, and it was common to see news footage of these retired workers begging in the streets of Moscow. What happens to the retired if their pensions cannot increase to keep up with the rate of inflation?

All those living on fixed incomes or incomes that do not keep pace with the rate of inflation will suffer if monetization of debt becomes a government policy used to generate cheap dollars. If the retired own bonds, they will see the average interest rates on their bond portfolio rise, but their purchasing power from those payments cannot keep up with inflation. Consequently, they will lose their economic foothold just as they are losing it now with negative interest rates.14

My personal example of a loss of purchasing power relates to my mother and the amount she received when she retired. At the time she retired, her annual pension payments were just slightly lower than the salary I was earning. At the end of her life, her pension was so low she qualified for Medicaid. Quite a fate for someone who worked from the time she was 16, became an author, and retired as a university professor. At least she didn’t have to use a tin cup on the sidewalk. God bless the U.S. government.

The government does not have to institute a tax increase to take your money to pay off its debt. Instead, the Federal Reserve can create inflation at a level that allows for all creditors to pay off their debts with dollars that are worth less.

Okay, now suppose you are a working stiff. When inflation becomes rampant, what are you going to ask for in order to keep up with the level of inflation? Raises.

Will you get them? Probably, yes. Unfortunately, increased raises contribute to a never-ending increase in inflation through new price increases for products and services as employers raise their prices to cover their increases in cost, like your raise. Prices increase for everything, and they accelerate at a rate where wage increases cannot keep up with them. The inflationary spiral has started. Wage earners eventually find themselves in the same situation as retirees, except it will take them slightly longer to get there, but coming in second is not much fun either. If such a scenario occurs, it means the Federal Reserve has lost control of the economy. In our past financial history, this situation existed when Jimmy Carter was president and interest rates were raised to 20 percent to subdue inflation and regain control of the economy.

Under an inflationary environment, it makes less and less sense to save money as the dollars saved eventually will lose their purchasing power. In this environment, no one is saving and everyone is spending their earnings as fast as they can to buy goods before the prices go up again.

Investors are represented by three different groups. They are bond investors, stock investors, or a combination of these two groups. Here, we will consider the differential effects of inflation on bond investors and stock investors. As an investor in bonds that are not indexed to the rate of inflation (interest payments increase with inflation), you will suffer a loss in purchasing power as debtors pay you back with dollars that are not worth the dollars you loaned them in the first place. Although you may think it is possible to sell your bonds to someone else and not have to continue to receive interest payments that are worth less each day, it may be impossible to unload the bonds as no one else wants to buy them except at a steep discount. Investors in any sort of fixed-rate bond would experience significant losses in an inflationary climate.

Stock investors would fare better but would still lose purchasing power as the dividends they received would purchase less and less. The market price of a specific stock is likely to vary depending on the industry. Gold manufacturing companies are likely to see their stock price rise in the face of inflation. With other companies, the picture is more varied. Some companies are going to face constant cost increases as inflation continues to ravage their bottom lines. Those companies will see decreases in their share prices other things being equal. Other companies able to maintain profits in an inflationary economy or whose profits are denominated in currencies other than the U.S. dollar, such as oil companies, are going to see their stock price rise more than the rate of inflation.

During an inflationary economy, those companies with largely robotic operations and few manual workers will be better able to keep their costs down. The question about their operations that is important to answer is whether anyone will be interested in buying their products. For example, if you maintain a robotic manufacturing process to produce HD TVs that’s good, but consumers do not need to buy your product during inflationary periods. However, with a robotic electric utility or a pharmaceutical manufacturer using robotic facilities, manufacturing cost increases are more limited and demand from consumers are not as likely to drop. Consumers need your product. High rates of inflation may lead to more speculation in stocks as it did during Germany’s hyperinflation, but it depends on whether investors have any money remaining after paying an inflated price for necessitates.15 Yet no one may benefit from the increase in the market price of stocks as investors hesitate to sell their shares due to the high taxes they would pay on inflated gains. Consequently, there is no easy answer as to the inflationary effects on stock investors as there is for bond investors.

Additionally, the inflationary effects on companies’ financial statements that investors rely on to make stock investments will become distorted. The financial reports based on the assumption of a constant dollar will have to be adjusted in an arbitrary manner to take the effects of inflationary prices into account. In the past, this has been performed with price-adjusted financial reports.

In this scenario, it is assumed that the Federal Reserve is not taking any actions to decrease inflation by raising interest rates. It is assumed that the Federal Reserve is following a policy that allows rising inflation to purposefully allow the government to pay its debts with cheap money.

The unemployed will have difficulty paying for such basics as food and housing. Their transfer payments will buy less and less in an inflationary economy. The unemployed will face the same fate as the retired who are also essentially receiving transfer payments through their Social Security payments. The disabled will find no one willing to provide the services they need for the price they can pay. Or they will find that “free” charity services will handle fewer and fewer cases. The agencies providing services to the disabled will have to cut their roles in order to provide a minimum level of service to the remaining people enrolled in their programs. No politician can be accused of cutting services to the needy under these circumstances, but the result is the same as if program expenditures were cut. Who is to blame?

Proprietors are those individuals or families who run a retail, manufacturing or service business. Proprietors do not include the large public companies such as General Motors or IBM. These are small companies, usually run by families, and they do not issue stock.

Inflationary effects on small business will vary, but general effects may result in speculation as managers concentrate less on their core business activities and try to secure inflationary gains. Thus, the efficiency of operations may begin to suffer as proprietors turn more to speculating on increasing prices of their production facilities. Or they may begin to make immediate purchase decisions they would otherwise delay. Purchases would be hedged in other currencies not affected by strong inflation. Hedging is done to guarantee the purchase price in constant dollars in an attempt to control price increases and anticipated future costs of operations. Profits on inventories would begin to become higher than profits on their core business operations.

The small businesses that will do best in this environment are the ones that provide essential services that must be purchased by consumers.

Other issues aside, the inflation winners are those who owe money because they can pay off their debts with cheap dollars. The losers are those who have loaned money prior to the beginning of an inflationary period. So become a debtor before anticipated inflation is incorporated into a loan with higher interest rate.

Further, do not expect survival in an inflationary environment to come from wage increases. Survival cannot be dependent on the interest earned on bond investments. It has to depend on a product or services that can earn a profit when inflationary pressures are creating chaos in the economy. Although all “hard” assets owned by consumers such as houses, land, and cars will increase in value and give a false sense of wealth, the selling of these assets will not bring wealth, as the money received will not be enough to purchase a new asset. This is the “California effect,” where Californians have held on to their houses for decades and have seen the price of their homes skyrocket in value, making them believe they are wealthy. When they sell their homes, they cannot repurchase another house in the same area and must move, usually out of state to a lower-priced area, in order to find a comparable home.

The characteristic of a truly profitable inflationary product or service is one that must be purchased by consumers, and can be provided without the continual business cost increases for raw materials, labor, or wholesale goods that drive up its own business costs. Such a product is one that is not subject to the full effect of inflationary pressures because those effects are delayed, or they do not seriously affect a product or service.

As an example, consider the services provided in a dental office with one dentist who owns his office (or has a mortgage), and therefore is not subject to inflationary rent increases. The number of patients coming in for a cleaning may drop as inflationary pressures cause consumers to spend on necessitates. Yet the fixing of a decayed or loose tooth is going to bring consumers into the dental office. The cost of materials used in tooth repair will rise along with other inflationary pressures, but it is a minor portion of the revenue earned by the dentist from repairing the tooth. The main cost component for the repair is the dentist’s labor hours. Thus, the added inflationary revenue for the repair is not for materials, and it goes into the dentist’s pocket. The largest portion of increased charge to the patient is paid to the dentist, and the dentist does not have to pay it out to anyone else in cost increases. Compare this situation with a grocery store, which also represents a product, food, which must be purchased by consumers. For the grocery store owner, the largest cost component is the wholesale cost of goods, whereas labor represents a smaller portion of operational costs than with the dentist. For that reason, the grocer owner does not get to keep the increase in inflationary revenues, as they must be paid to vendors supplying the goods used to stock grocery store shelves. Essentially, the grocery store owner does not keep increased inflationary revenues but the dentist does as it is an inflationary charge for his labor services. Consequently, the dentist is advancing his financial position during an inflationary period, and the grocer is staying constant at best.

Consider the example of rentals or leasing as a business where inflationary pressures do not drive up the cost of doing business in direct proportion to inflation. Housing is a necessity just as are dental services. In the normal rental, the utilities are paid by the tenants. Therefore, the cost of running the rental is not affected by inflation and if the landlord has a mortgage, he can pay it off with cheap dollars as he raises the rents. The landlord can increase the rents in response to inflationary pressures without suffering an increase in operating costs that the grocery store owner faces. The landlord, like the dentist, is able to advance his financial position during an inflationary period.

The dentist and the landlord can independently raise their salaries or rents and keep the inflationary revenue increases for themselves. For that reason, their real return becomes proportionally larger than it was prior to the beginning of the inflation period. They do not have to match the inflationary cost increases dollar for dollar with their revenue increases. They are able to keep a larger portion of their revenues than before inflation occurred. The characteristic of an inflationary-protected organization is its ability to increase its revenues by raising its prices and not have these added revenues siphoned off by an equivalent inflationary increase in the cost of its operations.

Organizations providing professional services mitigate the effects of inflation. Rental and leasing operations, where purchase of new assets can be delayed, are examples of business operations that have the best opportunity of avoiding the damaging effects of inflationary cycles in the economy.

It is going to be difficult to improve one’s finances during an inflationary period. Many of the strategies that are written about in the financial press are used to maintain a financial position but not improve it. Much of this advice deals with the purchase of hard assets such as gold or other precious commodities. These purchases will maintain your financial position in the economy when the value of the dollar is falling, but such techniques will not advance your financial position. In order to advance your position during an inflationary period, it is necessary to invest in a company or small business that does not face the full inflationary pressures on its cost structure. The objective is not just to maintain your finances but to improve them. One factor overlying all businesses is to focus on products or services that are a consumer necessity.

Individual survival tips:

1. See historical tables at www.whitehouse.gov/omb/budget/Historicals.

2. See TreasuryDirect at www.treasurydirect.gov/NP/BPDLogin?application=np.

3. See National Debt Clock at http://www.brillig.com/debt_clock/.

4. The Weekly Standard blog at www.weeklystandard.com/blogs/us-person-debt-now-35-percent-higher-greece_660409.html. It should be noted that in Greece the amount owed by each person is $39,384.

5. Trading economics: www.tradingeconomics.com/united-states/interest-rate.

6. Nicholas Eberstadt, A Nation of Takers: America’s Entitlement Epidemic (West Conshohocken, PA: Templeton Press, 2012), 31.

7. For the United States, the debt limit has to be continually raised by Congress to keep the country borrowing more money so that it can pay its old debt off and keep spending.

8. Countries on this list include Chile, Czech Republic, India, Poland, and Turkey. Sebastian M. Saiegh, “Coalition Governments and Sovereign Debt Crises,” January 2008, available at SSRN: http://ssrn.com/abstract=1017147 or http://dx.doi.org/10.2139/ssrn.1017147.

9. Purchasing power is the amount of goods that can be purchased with a U.S. dollar. If the value of the dollar goes down on international monetary exchanges, the amount that can be purchased is decreased and it is called a loss of purchasing power. Over the past 20 years, the purchasing power of one dollar has decreased. For example, a cup of coffee used to cost 25 cents, not $4.

10. “Debt monetization occurs when a government does not tax its citizens to repay the debt it incurs but instead prints money—or, in the modern equivalent, its central bank creates banking reserves by buying securities issued by its treasury department. The result is a larger amount of money chasing an unchanged amount of goods, which is a textbook explanation of inflation.” Jerry H. Tempelman, “Will the Federal Reserve Monetize U.S. Government Debt?” Financial Analysts Journal (November/December 2009): 24. www.jerrytempelman.com/Jerry%27s%20website/Publications/01.%20Monetary%20Policy/01.%20Fed%20and%20Debt%20Monetization.pdf.

11. The Federal Reserve System is composed of 12 regional banks and a Board of Governors in Washington, D.C. The Federal Reserve sets monetary policy in the United States by changing interest rates and using other policies that affect monetary transactions.

12. Hard assets are sometimes called real assets. They are physical assets that have a value in and of themselves such as inventory and buildings. They do not have a value that is derived from the value of another valuation source such as most financial instruments.

13. Net worth is the difference between all your assets and all the money you owe.

14. Negative interest rates occur when interest on your investments is lower than the inflation rate.

15. Joe Weisenthal, “Here’s What Happened to Stocks during the German Hyperinflation,” http://articles.businessinsider.com/2011-11-26/markets/30443754_1_stock-market-speculative-mania-stock-exchange.

16. In a normal economy, prices cannot be raised above competitive marketplace prices, but in a highly inflationary economy accompanied by rapidly changing prices, a competitive marketplace price becomes harder to identify. Thus, the marketplace for professional services or rentals does not act as such a deterrent to price increases as it would in a stable economy.