CHAPTER 4

The Physical Impacts of Climate Change on the Evolution of Carbon Finance

Economic activities whose greenhouse gases (GHGs) are already subject to regulation (as discussed in the previous chapter) will be referred to as carbon-regulated. However, many other economic sectors, which do not face the imminent prospect of having their GHG emissions regulated, will still be closely involved in the evolution of climate change and the evolution of carbon markets. Some sectors—specifically forestry and agriculture—could become important suppliers of carbon credits. Others may seek to protect themselves from adverse weather by buying weather derivatives, the price of which will also be influenced by the price of carbon credits. (The linkage between these markets—the weather market and the carbon market—is discussed in Chapter 8.) In the European Union (EU), any company can register as a trading entity in the carbon market. Thus, although this chapter is mainly concerned with the physical impacts of climate change on various sectors of the economy, it also serves to assess the effect of these impacts on the evolution of carbon finance. The world of carbon finance is a world in which many economic sectors are trying to adjust to climate change, even if they do not necessarily make use of the new products directly associated with the trading of carbon credits.

Obviously, this chapter is only indicative of the impacts that have either been observed already or are expected to occur. It is not possible in a work of this scope to make an exhaustive assessment of the economic impacts of climate change. For a more comprehensive survey, reference should be made to the latest output from the Intergovernmental Panel on Climate Change (IPCC 2001, 2005b).

At this point we should add that the physical impacts of climate change may damage the adaptive and mitigative measures we may take to reduce those various impacts. For example, hurricanes may damage wind farms, while drought will reduce the effectiveness of biomass sequestration of carbon through forestry and agricultural change. These physical impacts could therefore reduce the effectiveness of carbon trading as a strategy for slowing the pace of climate change.

The order in which various sectors are assessed in this chapter is based on the magnitude of their direct physical vulnerability to climate change, beginning with water, food, and fiber, which are sensitive even to small shifts in temperature and precipitation. Next, we assess the vulnerability of physical property, such as housing, production facilities, the tourist industry, and infrastructure. Finally, the chapter analyzes the ramifications of these vulnerabilities for the financial services sector, focusing on banking, investment, and insurance. This is by no means an order that reflects the importance of climate change and carbon finance for these various sectors. In a sense, we have saved the most affected sector for the last in this sequence, as the insurance industry absorbs a large percentage of the accumulated losses suffered by all the other sectors. Furthermore, the insurance industry has a major role to play in the development of carbon markets, both as an insurer of this new trading activity (such as counterparty risk) and as an investor in the assets (such as carbon credits) produced by carbon markets.

Other accumulators of these various impacts are human health and security. Because of the fundamental nature of this concern, we have devoted Chapter 7 to the topic.

PHYSICAL IMPACTS ON UNREGULATED SECTORS

Water Supply and Treatment

It could be argued that the water supply and treatment industry is the human activity most immediately affected by climate change, given its direct dependence for its raw material on everyday experience of precipitation and temperature. In their response to the Third Carbon Disclosure Project, the directors of RWE, the utilities conglomerate, stated:

For our water business, adaptation to climate change is a major challenge. More uneven distribution (of water) together with a rise in temperatures will lead to serious concern over availability of sufficient water supplies. If the expectation of society to achieve progressively higher quality standards is maintained, this could lead to additional use of energy and higher emissions, notwithstanding that technology success might be able to reach higher efficiency gains. (Kiernan and Dickinson 2005)

One thing that is certain about climate change is that it will inject a great deal of uncertainty into our lives, especially those whose lives relate to the production of weather-dependent products, like drinking water. In the water supply business—if customers expect the same degree of reliability that they have enjoyed in the past (admittedly only in the richer, industrialized economies)—then that expectation translates directly into additional investment in water supply infrastructure, beginning with storage capacity and including loss reduction in distribution. One of the most predictable consequences of living in a carbon-constrained world will be ongoing heavy investment in water supply and treatment.

For example, Britain enjoys a temperate climate with prevailing westerly winds bringing a constant stream of moist air from the cool waters of the North Atlantic. Yet even Britain is experiencing uncertainties and shortages of water supply, as evidenced by the unexpected drought in Yorkshire in 1995 (Bakker 2000). At the time, the leading hydrologists and meteorologists in Britain were reluctant to link this unusual event to climate change. As Yorkshire Water Services had recently been privatized and the company had returned millions of pounds of profit to its parent holding company (Yorkshire Water plc.), public opinion preferred to blame the new management for the shortage, for which the regulators had provided plenty of warning.

Whatever the rights and wrongs of this particular case there is already greater uncertainty for water supply—even in a temperate country like Britain—and that uncertainty will require substantial, ongoing investment in the decades ahead. An interesting example of the degree to which the situation has changed is provided by the proposal to build a water desalination plant to meet the future needs of London! Note: This is not a proposal for Bahrain or Malta. Thames Water plc. tabled the proposal in the summer of 2005 as an essential part of their plan to meet the anticipated needs of the projected increase in population in the region known as the Thames Gateway, the lands downstream of London, adjacent to the Thames. Even before the government water regulators could respond to the proposal, the Mayor of London, Ken Livingstone, dismissed it completely, proclaiming it to be “the wrong way to go,” because the days of supply-side management were over, and the future lay in “demand-management,” that is, conservation and reduction in water use.

Thus, it seems very likely that increasingly we will be living in a water-constrained world, as well as a carbon-constrained world. Companies that might prosper under these conditions will be low-carbon companies and will use water and energy as efficiently as technology allows. If the future also sees the gradual removal of subsidies and the freer play of market forces, it is likely that prices for water, energy, land, and other commodities will rise, at least in the short term.

Agriculture

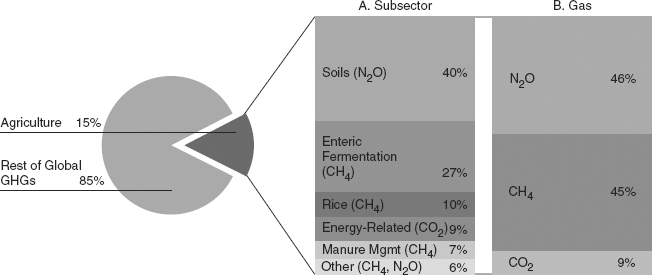

GHG emissions from agricultural activities account for approximately 15 percent of global GHG emissions (Figure 4.1), but with a different emissions profile than other sectors. Methane (CH4) and nitrous oxide (N2O) make up about 90 percent of agricultural GHGs, with CO2 from burning fossil fuels and electricity use contributing the remaining amount. Agriculture also contributes CO2 to the atmosphere through the clearing of land and the burning of biomass. On the economic front, agriculture accounts for between 15 and 23 percent of gross domestic product (GDP) and over half the workforce in countries such as China, India, and Indonesia, while contributing only between 1 and 4 percent of GDP and employment in industrialized countries. Thus, considerations of carbon finance play an important role in the agricultural sector, above all in developing countries. From the operational perspective, the public in the richer countries tend to take their agricultural water supply for granted because it has been provided cheaply and reliably for many decades. The same public, however, is acutely aware of the vulnerability of agriculture to climate uncertainty because the impacts are more visible, even if those impacts can be circumvented by consumers by seeking alternative sources of supply.

FIGURE 4.1 GHGs from agriculture

Source: Baumert, K., T. Herzog, and J. Pershing 2005. Navigating the Numbers: Greenhouse Gas Data and International Climate Policy, World Resource Institute, available at www.wri.org.

Under climate change scenarios the greatest impacts that agricultural practices contribute are the greenhouse gases emitted from crop production and soil management. Physically, the greatest risks arise from heat waves and the attendant drought. Among weather-related disasters, this hazard produces the biggest financial losses in the rich countries and the greatest loss of life in the poor countries. A worsening trend should be assumed under climate change. Even those regions that may appear to benefit from higher rainfall are likely to be net losers, as higher temperatures will increase the rate of evaporation from the soil.

How will carbon finance affect this situation? First, there is a great opportunity for some farmers to benefit by changing their agricultural practices, in order to reduce emissions. This can be achieved by shifting to minimal tillage of arable land, or by changing their crop lands to pasture or forestry (crop switching). Several American states, such as Nebraska, have passed legislation to encourage this transition (Baumert, Herzog, and Pershing 2005).

Farmers may also benefit by selling or renting their land to wind farms, which are highly compatible with retaining the land in pasture, as the footprint of a wind turbine requires less than 5 percent of the land it occupies. Like carbon sequestration, this transition requires the encouragement of legislation, such as the Renewable Energy Requirement in Texas, which “required 2,000 MW of new renewable energy to be built in the state by 2009” (Pew Center on Global Climate Change 2005a). It is hoped that carbon credits and renewable energy credits will become fully exchangeable (or fungible) as the carbon markets mature, thus providing greater liquidity and opportunities to embrace an integrated carbon strategy, rather than pursuing a single operation.

The development of weather derivative markets also provides an opportunity for transferring some of the weather risk from farmers to the capital markets at an affordable cost. The three main challenges associated with this development of weather derivatives in low-income countries are: Lack of weather data, lack of a local insurance market to provide the commercial infrastructure and assume the risk, and the basic risk inherent in using an index as a proxy for actual loss incurred. These problems are being tackled in experimental projects funded by the World Bank.

The agricultural sector is typified by its decentralized nature, comprising many loosely organized individuals, small firms, and a few multinational corporations. In addition, agricultural practices vary, not only by crop and livestock type, but by soil quality and ecosystem characteristics. Thus, one problem in understanding the actual and potential role of the agriculture in carbon finance is the lack of uniform information found in corporate strategies of other sectors, which is comparable to the data provided by FT500 to the Carbon Disclosure Project. Since farming in many countries is quintessentially small enterprise, it is unlikely ever to enter the FT500. Also, some global agricultural companies, such as Cargill, are privately held and therefore not publicly traded.

Forestry

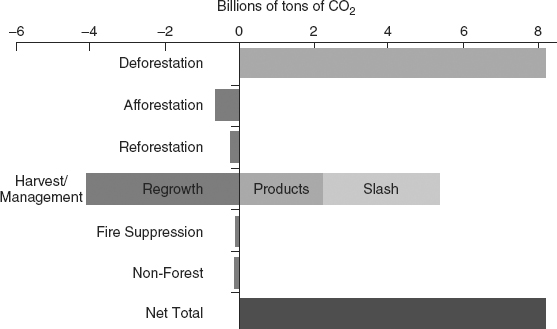

Like agriculture, the forestry sector is local in nature yet subject to global forces of demand and trade. Forest products, such as timber, rubber, bamboo, and palm oil, are estimated to contribute about 1.2 percent of world GDP (Baumert, Herzog, and Pershing 2005). Land-use change within the forestry sector, which creates a flux of greenhouse gases (Figure 4.2), is difficult to characterize at the global level.

FIGURE 4.2 Annual emissions and absorptions from land-use change in forestry

Source: Baumert, K., T. Herzog, and J. Pershing. 2005. Navigating the Numbers: Greenhouse Gas Data and International Climate Policy, World Resource Institute, available at www.wri.org.

Physically, although the greatest losses from heat and drought fall on agriculture, the most dramatic losses—through fire—occur in forestry. The natural role of fire in producing a healthy forest has long been acknowledged, although this is a difficult process to simulate and control. Instead, in the richer countries, the usual policy is to suppress fires whenever possible, once they threaten human settlements. In some rich regions, like southeast Australia, western Canada, and the western United States, this appears to be a growing problem, although the role of climate change is still not entirely clear. The forest fire risk in southern Europe is also a serious concern.

Several factors have coalesced to increase the fire risk in forests. The first—as in many growing risks—is attributable to the human desire to live in scenic places, such as steep, forested slopes. A second factor is the impact of warmer weather on the spread of pests, such as the pine beetle, which kill trees and thereby provide significantly more readily combustible material. Arson and accidental ignition (cigarettes, camping fires) are frequently cited as important contributors to the risk. During the recent (December 2005) bush fires in southeast Australia, even suburban barbecues were banned.

In addition to the fire risk, the heightened windstorm experience in northern Europe has also led to very significant losses in forestry. In January 2005, for example, a weekend storm, bringing winds of 145 kph, uprooted 60 million cubic meters of wood in Sweden—the equivalent of four years’ harvest. The forests of Latvia and Estonia were seriously damaged by the same storm. The sudden availability of this quantity of wood on the market depressed prices abruptly.

The role of forestry in carbon finance is pivotal. The trend in many rich countries has been toward reforestation in the past few decades, from the nadir in Europe in the nineteenth century when entire regions were deforested to provide construction material (including shipbuilding) and fuel. The reversal of this situation in countries like Britain, France, and the United States was one of the few large-scale, positive environmental trends in the twentieth century, although it is an inadequate counterbalance to the ongoing massive deforestation in tropical countries. Sadly, this positive trend is threatened by the fire and windstorm risks associated with climate change. Meanwhile, at the first COP/MOP meeting in Montreal, a group of tropical companies proposed that they should be compensated by richer countries for not exploiting their forest reserves.

There is the potential for reforestation and appropriate harvesting regimes to sequester additional carbon in forests. This could create an additional revenue stream for forestry companies and forest dwellers, thereby providing an incentive to encourage careful management of the forest resource and hence outweighing other incentives which encourage neglect or short-term, destructive exploitation.

During the negotiations leading up to the adoption of the Kyoto Protocol, the Canadian delegation pushed hard for the inclusion of carbon sequestration credits in the agreement, confident that Canada could claim a positive contribution, and thereby would need to do less on the carbon reduction side of the equation. However, with the spread of beetles and the ever-present danger of more forest fires in a warmer world, the outcome is no longer apparent.

Forestry suffers the same dilemma of measurement uncertainties and lack of comparable data as does agriculture. The flux between absorption and emission of CO2 in forestry creates a lack of permanence of claimed emission reductions, and poses both uncertainties and technical challenges to policy makers. The forestry sector could, then, become a net contributor to the carbon balance—that is, become a contributor to the carbon overload in the atmosphere. In the emerging carbon-constrained world, then, the role that forestry will play in carbon finance hangs in the balance.

Fisheries

The fisheries sector might appear to have little relevance to carbon finance, other than its minor contribution to GHG emissions through fuel for boats, processing, and distribution. Although it is a relatively low-carbon means of food production, the fisheries sector is, however, vulnerable to climate change. Climate change will produce warmer waters which will affect breeding and maturation, and—in turn—food quality. This threat is additional to that of stratospheric ozone depletion, which reduces phytoplankton availability for the fish. These effects add to the vulnerabilities that fisheries already exhibits, both from overfishing and from the difficulties encountered in trying to establish international control regimes to protect its stock. Fish farming is making up an increasing amount of the gap between supply and demand, but that activity is also contributing to alarm because of the escape of farmed fish into the wild population and the spread of disease.

Fish are a major source of protein and essential diet throughout the world, especially in low-income countries that have few arable options for food production. If the fish stock continues to decline, then pressure will increase on land-based food such as cereals and livestock, and these, in turn, will reduce the opportunities of converting agriculture to a carbon-sequestering future. Thus, although fish may appear to have little to do with the price of carbon, any decline in the availability of fish will put pressure on the price of carbon, as more demand comes to bear on land-based food systems to make up the dietary deficiency.

Real Property and Production Facilities

Real property and production facilities are a sitting target for extreme weather events, especially windstorms and flooding. Most of the insured losses attributed to extreme weather are damage to physical property—homes and businesses, including losses due to business interruption. The connection between these losses and carbon finance is indirect because the owners of the property, unlike agriculture and forestry, have no carbon sequestration potential. Some of the production facilities, including electric power utilities, coke ovens, and cement plants, are already regulated under the European Union emissions trading scheme (EU ETS) and the Kyoto Protocol, as discussed in the previous chapter. Some companies may purchase weather derivatives to hedge their exposure to adverse weather.

Although the owners of these assets (with the above exceptions) are unlikely to become players in the carbon markets, they will be negatively affected in a carbon-constrained world as the losses from extreme weather mount. It is almost inevitable that insurance premiums will rise, deductibles will rise, limits on policies will be lowered, and exclusions will proliferate for the most vulnerable properties, such as those in floodplains and on coastal locations. Property is a very important asset class for investors, including institutional investors, so this vulnerability must reduce the value of the assets, even if this impact is masked by high demand in many regions such as southeast England.

Transportation

Like housing and production facilities, the transportation sector is very vulnerable physically to extreme weather events, in terms of both actual damage and disruptions to operating schedules. As fossil fuels are used ubiquitously throughout the sector, their prices are a key to operating profit. Some parts of the sector are more carbon intensive than others—road transport more than rail, and aviation most of all. For multimodal shippers like UPS there are several strategies available to help the company move toward a lower-carbon future.

Although the sector has not yet been regulated for GHGs, that day will come, with aviation becoming the first industry within the transportation sector to be included, beginning in the EU ETS. Some airlines are already positioning themselves by offering carbon-neutral travel, in which the passenger’s share of the carbon can be offset by a contribution to a reforestation project. Two Japanese automobile companies, Mitsui and Mitsubishi, have formed partnerships with emissions brokers (CO2e.com and Natsource, respectively) to develop a capacity for emissions trading, while both are also investing in carbon funds. Ground transportation must simultaneously count the financial costs of time lost through routine congestion as well as time lost from disruptions following extreme weather events.

Tourism

The prosperity of the tourism sector is almost as dependent on favorable weather as agriculture and water supply. Indeed, much of the demand for tourism is driven by a desire to access better weather than the tourist expects to experience at home, whether this be more sunshine, less rainfall, warmer seas, or more snow. If these expectations are not met then the sector will suffer. Prime destinations in a hurricane zone—like Cozumel and Acapulco—are clearly very vulnerable to this kind of physical risk and the associated reputational fallout. As the Mediterranean region warms, it may become much less attractive to tourists and less able to support their needs, such as water for golf courses and swimming pools. Many small island states in the Caribbean, Indian Ocean, and South Pacific are heavily dependent on international tourism, as well as being the most immediately vulnerable to climate change and sea-level rise.

In addition to the direct physical impacts, carbon finance will impinge on tourism in other ways. Getting there is usually a significant part of the cost, and this can be expected to rise as the cost of fossil-fuel consumption gradually absorbs the full cost of GHG emissions. Aviation-based mass tourism cannot escape untouched. There are proposals to bring back hydrogen airships, but it difficult to see descendants of the Hindenburg replacing Boeing and Airbus soon.

A portion of the weather risks for tourism can be hedged with weather derivatives, and for some businesses this may be the only way to survive, or at least prolong the activity for a while. Warmer weather is already affecting skiing worldwide, although the lack of natural snow can be compensated by making snow, albeit with significant energy implications. For major weather events, such as hurricanes, catastrophe bonds may be available for the largest operators. On the positive side, warmer weather may be beneficial for places currently considered too cold for a vacation, while the increased cost of travel will favor local destinations.

Municipalities

Although the Kyoto Protocol and the EU ETS have been negotiated by national governments, a great deal of emission reduction activity has been carried out by municipalities and other local governments. This is the case even in the United States and Australia, both of which withdrew from the Protocol. For instance, Melbourne, the second largest city in Australia, has established a goal of zero net emissions of GHGs by 2020 (Bulleid 2004–2005). In California, San Diego has set a target of reducing CO2 emissions to 15 percent below 1990 levels by the year 2010.

In addition, in the United States, 165 cities belong to the U.S. Mayors’ Climate Protection Agreement, while 147 American cities support the Cities for Climate Protection Campaign organized by the International Council for Local Environmental Initiatives (ICLEI).1 Their climate protection strategies include methane capture from landfills, renewable energy (solar and wind), improving energy efficiency in buildings, fueling bus fleets with compressed natural gas and buying hybrid electric vehicles (Bulleid 2004–2005).

In 2003, Transport for London introduced a £5 daily charge for automobiles entering central London (Box 4.1) in order to reduce congestion and pollutants in the downtown core. Both the charge and the area, to which it applies, are to be increased over the years.

BOX 4.1 LONDON, U.K.: TRAFFIC CONGESTION CHARGE

In February 2003, Transport for London—London’s traffic management body—introduced a £5 daily charge for automobiles entering central London. Predictably, motorists driving in the zone and shopkeepers located there opposed the charge and they felt that it would never work because so many people would refuse to pay.

However, more than three years later, the scheme has achieved many of its objectives and the dire predictions did not come to pass. Very quickly, the number of cars entering the zone—and the associated congestion—was reduced by about 30 percent with concomitant reductions in particulate matter, nitrogen oxides, and carbon dioxide. Bus travel times were reduced, bus ridership increased, and accidents went down.

In 2004–2005, revenues from the Congestion Charge contributed 9 percent of the total earnings of Transport for London, all of which (by law) has to be invested in improving the bus system to make it increasingly competitive with the use of the automobile. Transport for London purchases 20 percent of its electricity from green sources, further reducing the transport system’s contribution to carbon dioxide emissions.

The London Chamber of Commerce reports a retailers’ survey as saying that they still think the charge has a negative impact of sales, and no motorists have reported enjoying paying the charge. On the positive side, the system has achieved its objectives, including a rare reversal in the modal split, taking people out of their cars and into public transport, taxis, walking, and cycling. The charge was increased to £8 in July 2005 and the zone will be doubled in size in February 2007. The scheme is being used as a model for extending road pricing to the entire country to reverse the hitherto inexorable growth in traffic on the roads.

Source: Transport for London. 2005. Annual Report 2004/05. Available at http://www.tfl.gov.uk/tfl/pdfdocs/annrep-04-05.pdf.

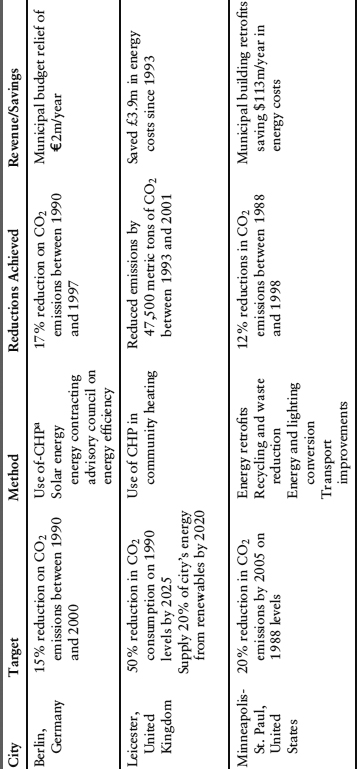

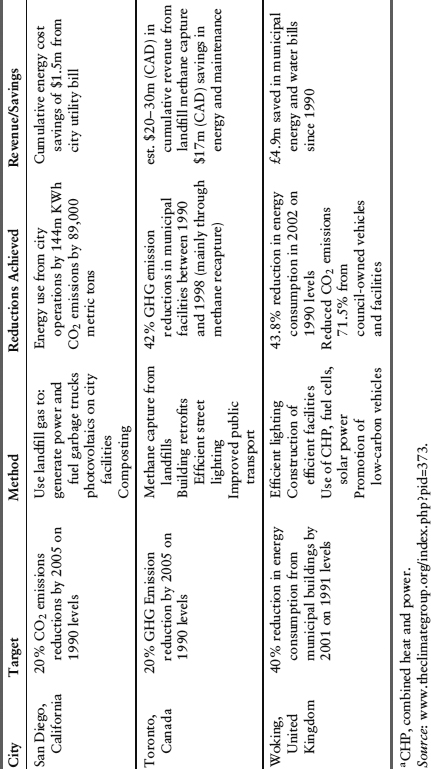

A similar range of activities can be found in other parts of Europe, Canada, and elsewhere (Table 4.1). In many cases, targets that have been taken on by cities exceed those of their national governments.

TABLE 4.1 Targets and Reductions made by Leading Cities

Although municipalities have been excluded from the international climate change negotiations they are very well positioned to become important carbon players. Now that emission reductions are being monetized they should be able to benefit from their conservation measures by selling their reduction credits. Some cities (Chicago, Boulder, Oakland, and Berkeley) are members of the Chicago Climate Exchange and are already doing so. The monetary benefits from conservation are well documented, as evidenced by ICLEI’s estimate that its Campaign for Climate Protection members reduced CO2 emissions by 22 million metric tonnes between 1994 and 2004, saving the cities $600 million.

There are multiple side benefits from municipal emissions reduction programs apart from the cost savings and the potential sale of carbon credits. Energy conservation, and a shift to renewables, directly improve air quality from reduced fuel consumption, and indirectly if they reduce traffic congestion, as has been demonstrated from the operation of the London Congestion Charge since 2003. Furthermore, by taking action now municipalities are reducing their exposure to the rising cost of fossil fuels.

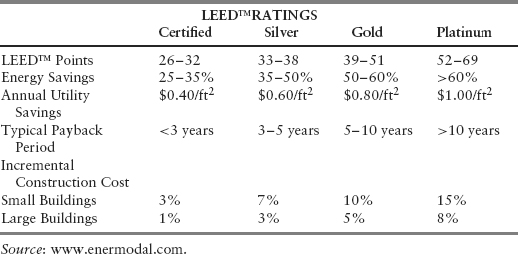

The Built Environment

In North America, a number of initiatives have spawned the drive for green building standards for the construction industry. The LEED™ (Leadership in Energy and Environmental Design) building rating system was developed by the U.S. Green Building Council to provide a recognized standard by which to assess the environmental sustainability of building designs. The point-based rating system grades buildings in six areas, including water and energy consumption, indoor air quality, and the use of renewable materials, to provide four performance ratings (see Table 4.2). The standard has also gained acceptance from the Canada Green Building Council (www.cagbc.org).

TABLE 4.2 LEED™ Green Building Rating System

Examples of LEED-certified projects abound, as architects and developers strive to meet LEED requirements. In Canada, the new offices of the Vancouver Port Authority won a LEED Gold designation for its reduction of lighting (20 percent), energy (36 percent), and water (39 percent) required, as well as its use of recycled materials (70 percent) (Lazarus 2006). In the United States, two new towers in Manhattan have also qualified for the LEED Gold rating. Features of the Seven World Center tower include: large, low-iron glass areas that maximize daylight and visibility, thus reducing the need for artificial lighting while minimizing heat; 100 percent of core and shell electricity coming from renewable energy; and rain collection on the roof for cooling the tower and irrigating a nearby park (Pogrebin 2006).

In 2006, the U.K. building regulations were modified to increase the energy efficiency standards for both new and refurbished buildings. In response to this change, the Carbon Trust launched its Low-Carbon Building Accelerator, aimed at accelerating the adoption of cost-effective, low-carbon initiatives in nonresidential building projects (Carbon Trust 2006).

PHYSICAL IMPACTS ON CARBON-REGULATED SECTORS

Electric Power

It may seem ironic that major producers of GHG emissions have themselves become victims of the extreme weather associated with climate change, although perhaps it is no more ironic than the fact that this major disturbance of human occupancy of the planet is solely the product of human ingenuity. Whatever the judgment, the last few years have seen significant impacts on the electric power sector from the heat wave/drought conditions mentioned at the beginning of this chapter. The same weather that spells trouble for agriculture and forestry also has immediate negative consequences for the electric power sector.

First, a drought deprives hydroelectric power (HEP) producers of their source of power. Then, the higher temperatures increase evaporation losses from the reservoirs behind the dams. For the Scandinavian and Alpine countries, which are heavily dependent on HEP, this can have grave consequences—as was experienced in the European heat wave of 2003. Their power shortages have a knock-on effect throughout the European power network, obliging producers to burn more fossil fuels to increase supply at the margin.

Nuclear and fossil-fuel power producers are not immune to the threat because they too need water for cooling their turbines. In the 2003 European heat wave, nuclear plants were shut down in France, as were coal-fired plants in northern Italy, because of water shortages. The problem soon escalates because higher temperatures raise demand for power to support air-conditioning. Since Europe is still much less dependent than the United States on air-conditioning, this is not yet as serious when it will be in the future, as the demand for air-conditioning will spread through Europe, spurred on by warmer summers. The same conditions will increase the demand for water for irrigation.

Electric power utilities will become central to the evolution of carbon finance because of the regulations that require them to reduce emissions. While some will have surplus credits to sell, others will be buyers. Some will also be significant buyers for weather derivatives to hedge their exposure to heat waves and droughts. In order to meet the needs of HEP utilities, derivatives have also been designed based on stream flow in the rivers that power their turbines.

For electric power producers, the interplay between the carbon markets and weather derivatives is particularly important. Droughts that are prolonged enough to affect HEP utilities will force the power producers to burn more fossil fuels, which will drive up the price of carbon credits. This, in turn, will drive up the price of the weather derivatives that are sold to hedge this risk. In addition to the drought and water problem, electric power producers’ infrastructures are also vulnerable to direct physical impacts from extreme weather events such as windstorms, hurricanes, and flooding.

Oil and Gas Producers

This sector’s vulnerability to direct physical impacts from extreme weather events was dramatically exposed by the 2005 hurricane season in the Gulf of Mexico. However, shutdowns of oil rigs as a storm approached and damage inflicted as the storm hit, have been a recurrent pattern in the Gulf of Mexico for several years. Similar impacts have occurred in the North Sea from winter storms. Rising sea levels add to the vulnerability of oil rigs and oil storage platforms which were designed in the 1960s, long before the impacts of climate change became a serious concern.

The temporary shortage of oil products as a result of extreme weather events adds upward pressure to their price, just at the time when producers of oil products are having to factor in carbon regulation compliance costs. The hurricanes in the Gulf of Mexico in the fall of 2005 demonstrated the paradox whereby oil and gas companies are making record profit from higher prices at the same time as they are suffering heavy damage from the changing climate to which they are contributing. Thus, a newspaper captured the paradox in the title “Platform snag mars bumper BP profits” when one of its major oil platforms was heavily damaged by hurricane Katrina (The Independent, October 20, 2005). At the same time, Munich Re increased insurance rates on oil rigs by 400 percent (Aon Risk Bulletin #94, November 10, 2005, p. 14).

It seems likely that these forces will jointly push the cost of crude oil and oil products steadily upward. To date, there is no carbon finance solution that can alter this upward trend in these prices. What carbon finance can contribute is to make the choices available explicit—now that emissions have been monetized. Individuals, corporations, and governments will have to develop low-carbon strategies if they are to remain viable.

Banking

All of these varied sectoral concerns eventually pass through the filter of the financial services sector—for commercial bank loans, trading of company shares on the world’s exchanges, initial public offerings (IPOs) for new companies, and insurance. The response of the financial services sector to the first alarms over climate change was extremely varied, even from the same sort of company in the same country. Such intercompany differences are still apparent in the results from the third run of the Carbon Disclosure Project (Chapter 5) (Kiernan and Dickinson 2005).

In the 1990s some commercial bankers appeared to believe that climate change either did not exist or, even if it did, that it was not their problem. They looked at the “green housekeeping” issues, did a bit of energy conservation, reviewed corporate travel, and promoted recycling. Very few were prepared to look at the wider picture and ask how they were using their capital, and whether their strategy was in the shareholders’—or the planet’s—long-term interest. For some commercial banks, such a review was unthinkable because important clients who were major emitters of GHGs had directors on the bank’s board.

Gradually, some banks broke the ranks and acknowledged their key role in shaping the global response to the climate change challenge. Twelve such banks (and diversified financials) are recognised in the CDP’s Climate Leadership Index for 2005—the largest sectoral representation. In addition, many have become signatories to the Equator Principles that govern project financing (see Chapter 5).

Investment

Investment banks and major institutional investors, such as pension funds and mutual funds, were equally slow to awaken to a risk that had been publicly identified since the 1970s and 1980s. (See Chapter 5 for a further assessment of the role of institutional investors.) They generally saw climate change as very uncertain and very marginal to their traditional criteria for screens for investment. This attitude is still prevalent in some quarters of the financial services sector today. However, as scientific opinion on the reality of climate change has become almost unanimous, major investors have had to reconsider their position. In addition, institutional investors have been pushed by legislative changes, such as the Pension Disclosure Regulation (2000) in the United Kingdom, and the U.S. proxy voting rules in 2004, which help redefine environmental issues, including climate change, in terms of fiduciary responsibility.

As will be discussed further in Chapter 5, the Sarbanes-Oxley Bill (2002) in the United States has tightened all reporting standards in the wake of the Enron and WorldCom scandals, which were aimed primarily at fraud. Environmental issues, including climate change, rode in on the coattails of this bill. In Canada, it was determined that if climate change might have a material impact on earnings, then such a judgment should be reported in the Management’s Discussion and Analysis (MD&A), which is prepared quarterly by publicly listed companies. Similar legislation was brought forward in the United Kingdom and France. Suddenly, almost by accident, a fringe issue was on center stage for investment houses.

Insurance

The implications of all of the physical impacts of climate change end up on the insurers’ desk. Almost all of the real property losses for homeowners, automobile owners, and businesses are insured, plus the losses from business interruption. Major events will also spill over into life insurance, health insurance, and workers’ compensation. Unlike many of their clients, insurers are not as physically exposed to risk from climate change—unless their offices are located in a hurricane zone. Their assets are financial rather than physical plant and inventory. The insurers’ own operations are not really at risk, because the major players have established back-up office operations in case a particular office is threatened by an extreme weather event. However, some insurers—unlike most bankers and investment houses—realized from the very beginning that the exposure and losses of their clients would be affected by climate change. Thus, insurers are very much at grave risk to climate change through their clients who are physically exposed and through their investments, sometimes in those same clients. It had long been held to be axiomatic that the risk on the underwriting side was uncorrelated with risk in the investment portfolio. However, the September 2001 attack on the World Trade Center disproved this assumption, as the insurers were tallying their clients’ claims the stock market took a dive. Since then, extreme weather events—such as a hurricanes Katrina, Rita, and Wilma—have eclipsed even their World Trade Center loss.

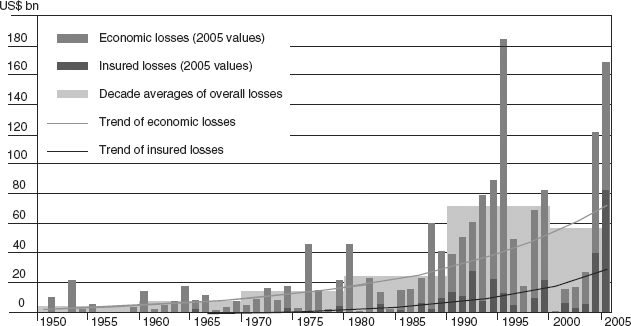

There is no question that both economic and insured losses have been rising exponentially over the past 15 years (Figure 4.3). Drivers of this increase in losses include several elements, including higher insurance density in exposed areas, such as Japan, the coastal United States, and northern Europe. The insurance industry, led by the reinsurers, has long recognized this growing exposure and has championed proactive responses, including the enforcement of building codes and land use zoning to deter new development from hazardous (especially coastal and flood-prone) areas.

FIGURE 4.3 Great Natural Disasters 1950–2005: Insured and Economic Losses

Source: Munich Re. 2006. Topics Geo Annual review: Natural Catastrophes 2005. Munich.

How does this evident concern about physical impacts relate to carbon finance? First, as major institutional investors, insurance companies are in a unique position to manage their investment portfolios to reflect the risks that they themselves are experiencing first hand, as insurers meeting claims. Strangely, their investment and underwriting arms seem to be slow to make this connection (Silver and Dlugolecki 2006). Insurance companies—as major institutional investors—are in a unique position to develop and manage carbon finance markets. Secondly, as insurers, they are developing new products to insure the complex counterparty risk for carbon finance transactions. The viability of our economic system, as a whole, relies heavily on the insurance sector to develop appropriate instruments for the transfer of risk to meet the new conditions.

There is a diminishing number of skeptics left in the corporate world who are willing to bet that climate change is not happening now—and will not happen ever. Even if there are those who doubt the computer-based simulations of future climates, there are few who could deny that the climate has already begun to change—the temperature record alone illustrates the trend. The physical impacts of climate change are having an effect on most sectors of the world economy—rich and poor, agricultural, industrial, and services.

Carbon finance is a new type of endeavor that helps corporations and governments to respond to the risk posed by climate change. The centerpiece of this new field is the trading of GHG emission reduction credits, known as the carbon market. Those companies whose GHG emissions are already regulated have begun making their emissions inventories, assessing their marginal abatement costs, and deciding whether to participate in the carbon market. The market is also being used by investors and speculative traders for whom carbon is fast becoming just another commodity.

The weather market is developing in parallel with the carbon market, as corporations assess the need to hedge the weather risks associated with a changing—and hence more uncertain—climate. The sectors most directly affected by extreme and adverse weather are oil and gas, electric power, agriculture, forestry, water supply and treatment, construction, and tourism. Weather derivative products are being developed to meet their diverse needs. This market is described in more detail in Chapter 8.

Banking and investment have been slow to respond to the challenge of climate change compared to the proactive insurance companies, some of which have been monitoring a deteriorating loss experience for more than a decade. Insurers have had to reassess their entire industry as the climatic changes have become more apparent. This reassessment is ongoing, leading to changing policy conditions, demanding higher standards of risk management from their clients, and developing new products, such as counterparty risk for carbon trading.

Although new products and conditions may help to redistribute the risks associated with climate change, there is only one sure way to slow the rate at which the climate changes, and that is to change our patterns of energy use in order to reduce the emissions of carbon dioxide, the principal GHG. No country, corporation, or individual is exempt from this risk. Chapter 5 examines in more detail the critical importance of the deepening engagement of institutional investors in the response to climate change.

1. The International Council for Local Environmental Initiatives (ICLEI) has now been renamed Local Governments for Sustainability.