CHAPTER FIFTEEN

Passive Fixed Income Portfolio Management

The term passive means one of two things; the investors want to:

- Tie the market’s performance—and not try an outperform it. (Trying to outperform the market always entails the risk of underperforming the market.) The two most common ways to try to tie the market are through:

- Ladder portfolios

- Index matching

- Fund a liability or series of liabilities at the lowest cost possible. The three most common ways to fund specific liabilities are:

- Zero coupon portfolios

- Immunized portfolios

- Dedicated portfolios

Let’s look at how each is constructed, its advantages, disadvantages, and any special issues.

TIE THE MARKET: LADDER PORTFOLIOS

In a ladder portfolio, equal quantities of bonds are purchased that mature at set intervals along the yield curve. For example, a ladder could have $20K worth of bonds that mature each December for the next 15 years. Each year when the bonds mature, the principal is reinvested in a new 15-year bond. In effect, the portfolio is an endless conveyor belt. The variables in a ladder portfolio include:

- Length—Does the ladder go out 10, 15, 30 years? This is simply a matter of investor preference.

- Rung spacing—Do bonds mature every 6 months, 12 months, 2 years, some other interval? The more frequently they mature, the more closely the return will track the market. However, buying bonds in larger lots is usually less expensive, so there is a cost trade-off.

- Credit quality—Ladder portfolios usually are built with very high-quality bonds so that credit isn’t an issue. Any significant credit loss will distort the portfolio’s results from the markets.

The advantages of this approach include:

- It is simple to implement.

- It is very low cost because it only requires buying and holding.

- Return will equal the market return (less costs) over the long term.

The disadvantages of this approach are that it is strictly regimented. Does it really make sense to roll over maturing debt into new 30-year bonds if interest rates are at all-time lows? Probably not, but this approach offers no flexibility.

TIE THE MARKET: MIRROR INDEX

Another way to tie the market is mirror a fixed income index. The most popular index is the Barclays Capital US Aggregate Bond Index (formerly known as the Lehman Aggregate). The index is composed of more than 8,700 bond issuers, including:

- US Treasuries

- US agencies

- Insured mortgage backed

- Foreign governments issued in the United States

- Investment grade liquid corporates

Mirroring an index used to be very difficult. Today, however, any investor can mirror an index with as little as $500. This became possible with the advent of exchange-traded funds that mirror the index. Here are some examples:

BND Vanguard Total Bond Market ETF

AGG iShares Core Total US Bond Market ETF

LAG SPDR Lehman Aggregate Bond ETF

SCHZ Schwab US Aggregate Bond ETF

FUND LIABILITIES: ZERO COUPON BONDS

Regardless of whether an investor is looking to fund one liability or a large series of liabilities, one way to fund them is by funding each liability with a zero coupon bond that matures on the day the liability is due (or shortly thereafter). Because the bonds are ZCBs and the principal is spent as soon as it comes in, there is no reinvestment risk. Provided the bonds have a high credit quality, the position has little risk. The cost of funding the liabilities is known. The cash flows offset each other, and so the duration of the assets equals the duration of the liabilities.

FUND LIABILITIES: DEDICATED PORTFOLIO

A dedicated portfolio is another way to fund a set of liabilities. In a dedicated portfolio, you start by funding the longest liability with the last payment of a long-term coupon bond—not a zero coupon bond. In each of the earlier years, the bond’s coupon payments are used to partially pay an earlier liability. Thus, when the bond’s 1-year coupon is paid, it is immediately used to pay a part of a 1-year liability. When the 2-year coupon is paid, it is immediately used to pay part of a 2-year liability. When the 3-year coupon is paid . . .

By using this methodology, short-term liabilities are partially funded with long-term higher yielding assets. Then, the remaining balance of the next to longest liability is funded, and its coupons also reduce the earlier liabilities. Then, the next liability is funded until all the liabilities are funded.

An example will help illustrate.

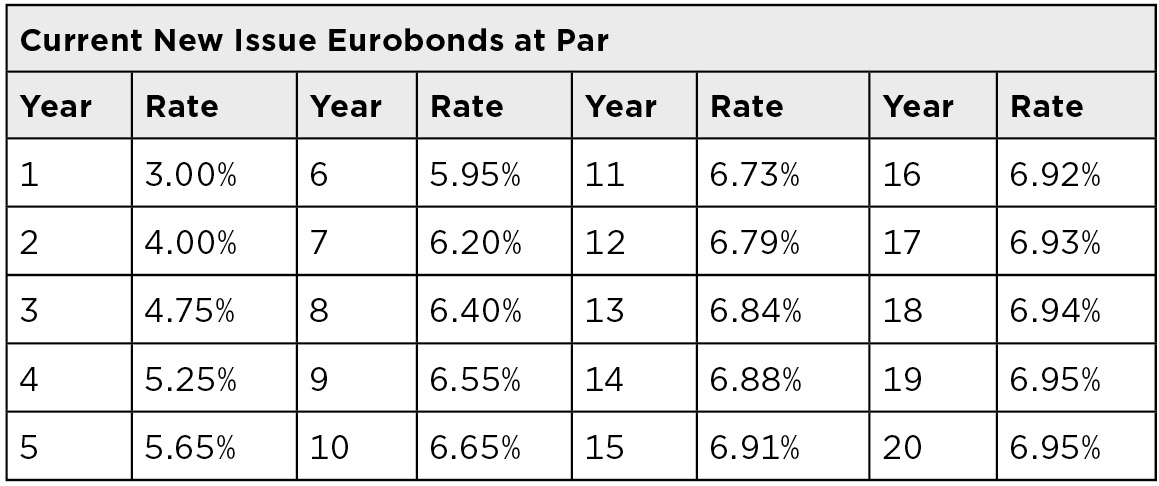

Suppose a business owner buys out his partner and agrees to pay him $1MM a year for 20 years. The business owner wants to buy a portfolio that will fund the liabilities. The current yield on eurobonds is as depicted in Figure 15.1.

FIGURE 15.1

New Issue Eurobond Yields

ANSWER:

As is usually the case, the long-term bonds yield more than the short-term bonds, so we want to use as many on longer-term bonds in funding as possible.

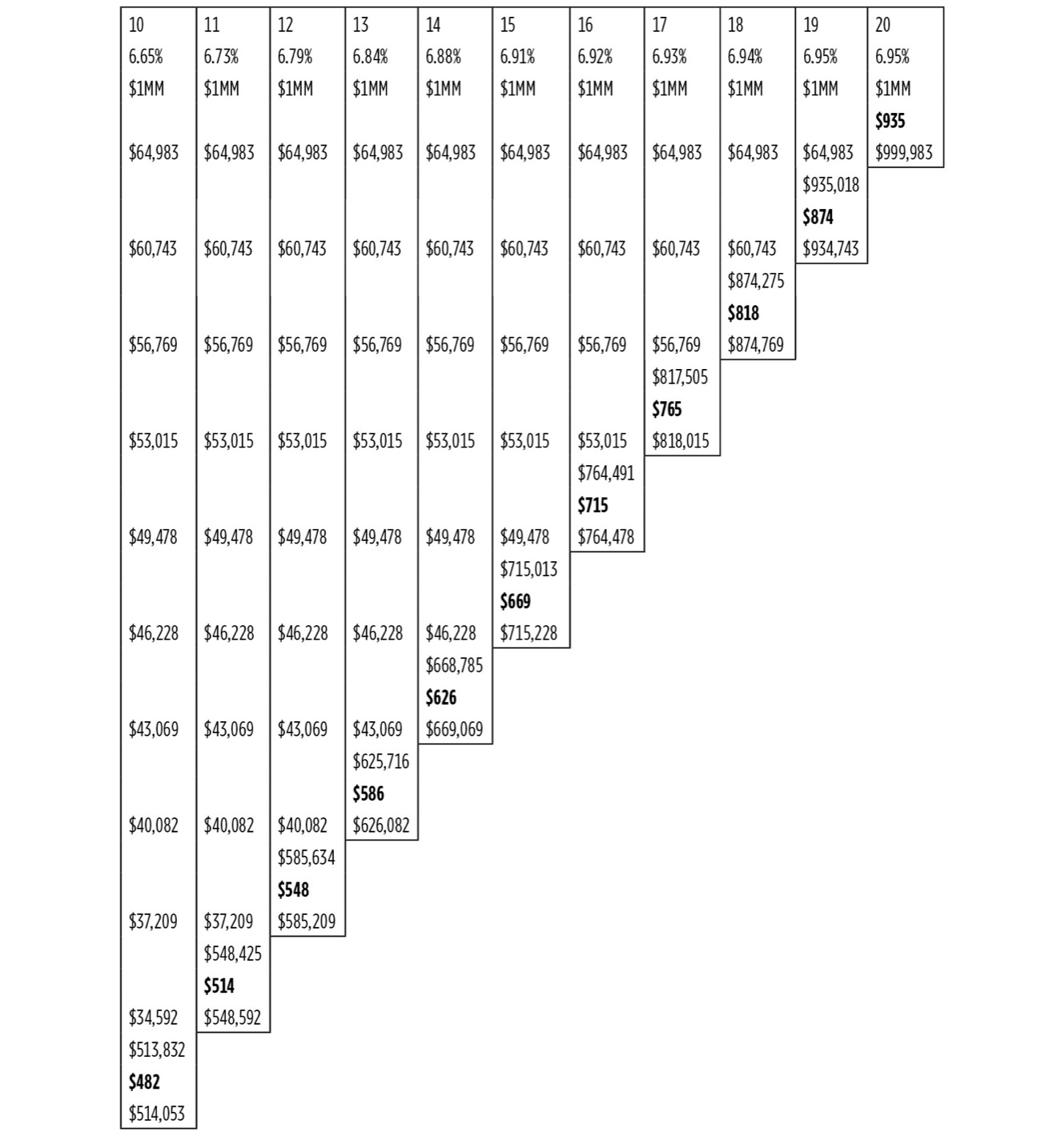

Figure 15.2 depicts the dedicated portfolio worksheet used to work through the requirements:

- The top row contains the year in which payment is due (only years 10 through 20 are shown)

- The next row is the coupon of the par eurobond with the same maturity

- The third row is the initial size of the liability each year—$1MM

- The fourth row is the number of 20-year bonds required to pay off the 20-year liability—935 bonds. Note that the answer here is not 1,000 bonds because the bonds pay interest at maturity that can also be used to pay the liability.

($935,000 Principal + ($935,000 × .0695 × 360 / 360)) = $999,983

- The fifth row is the cash flow generated by the bond: $64,983 of interest generated each year and $999,983 in year 20.

- The sixth row is the remaining liability for year 19. The remaining liability is the original $1MM liability less the interest payment generated by the 20-year bond ($64,983), which equals $935,017.

- The seventh row is the number of 19-year bonds required to retire the remainder of 19-year liability.

- The eighth row is the annual cash flows generated by the 19-year bond.

- The ninth row is the remaining 18-year liability after the interest payments from the 20-year and the 19-year bond are used to reduce it.

- The tenth row is the number of 18-year bonds required to retire the balance of the year 18-liability.

This loop continues until the first (1-year) liability is paid off.

Dedicated Portfolio Worksheet

The main issues with the construction of a dedicated portfolio are:

- Credit requirements—In this strategy, all bonds are held to maturity and a single bond might provide cash flows for 30 different annual liabilities. Therefore, if any bond develops credit issues, replacing it can be quite expensive.

- Embedded options—Bonds with embedded options should be excluded so that they don’t disturb the cash flow matches.

- Maturity mismatches—Allowable maturity mismatches include:

- Bonds that mature shortly before the liability is due are not a problem—provided that a conservative rate of return on investing the proceeds is assumed until the liability is paid.

- Bonds that mature shortly after the liability is due must either be sold just prior to maturity (taking a small amount of market risk) or require the investor to pay the liability with borrowed money—and then use the maturity proceeds to pay off the loan.

FUND LIABILITIES: IMMUNIZED PORTFOLIOS

An immunized portfolio is another passive approach to managing a portfolio. However, unlike the last two approaches, while the duration matches, the cash flows don’t. Let’s start by considering a single $10MM liability due in 10 years. As a single cash flow, the duration of the cash bond is also 10. For this example:

- Suppose 10-year bonds yield 3%

- Suppose 12-year bonds yield 3.5%

- Suppose 14-year bonds yield 4%

The easiest way to fund this liability would be with a 10-year ZCB. A 10-year ZCB has a duration of 10 years. The cash flows and durations are a match, so the funding approach works. It is, however, the most expensive way of financing the liability because the return is only 3%. Another way to fund the liability is to use longer-term, higher yielding bonds to fund the liabilities. Because the bonds will have maturities longer than 10 years, the coupons will have to be higher than 0 to keep the duration at 10. Figure 15.3 looks at three alternatives.

FIGURE 15.3

Three Alternatives for Funding a 10-Year Liability

|

Maturity |

10 Years |

12 Years |

14 Years |

|

Coupon |

0.00% |

3.50% |

6.97% |

|

Yield |

3.00% |

3.50% |

4.00% |

|

Frequency |

1 |

1 |

1 |

|

Duration |

10 |

10 |

10 |

|

Funding Cost |

$7,440,939 |

$7,089,102 |

$6,755,406 |

Funding the liabilities with the 14-year coupon bonds is the least costly of the three alternatives, but there is a catch. To illustrate the catch, let’s start by using the 10-year zero coupon bond as a funding vehicle. In this case, as of today the liability and the asset both have durations of 10 years, as shown in Figure 15.4.

FIGURE 15.4

Initial Duration of 10-Year ZCB and 10-Year Liability

As time passes, the duration of the liabilities declines in a linear manner—that is, in 1 year, the liability has a duration of 9; in 2 years, 8; in 3 years, 7; and so on. Because the asset is a zero coupon bond, its duration also declines in a linear manner. Therefore, if the liability is funded with the 10-year zero, the durations not only start out equal—but stay equal over time, as shown in Figure 15.5.

FIGURE 15.5

Duration of 10-Year ZCB and Liability over Time

If instead, the liability is funded with the 14-year coupon bond, the durations start off equal but decline at different rates as time passes. After 10 years, the liability is due, but the bond would still have 4 years to maturity and a duration of approximately 3.5, depending on the yield. Clearly, while the durations start out equal, they decline at different rates, and the hedge breaks down, as shown in Figure 15.6.

Duration of Liability and Duration of 14-Year Bond over Time

In order to use the 14-year bond as a hedge, it is necessary to periodically rebalance the hedge. This means shortening the duration of the asset so it equals the duration of the liability. There are two ways to shorten the duration: Periodically swap into lower-duration bonds or periodically add short T-note futures positions to the portfolio to lower the duration. Either will cost some money, but using the futures usually costs much less. Using the 14-year funding vehicle instead of the 10-year initially saved $685,533 ($7,440,939 − $6,755,406), as shown in Figure 15.7. If the costs of rebalancing the hedge plus the hedging error caused by a less than perfect hedge totals less than $685,533, it makes more sense to use the 14-year bond. If the costs are higher, use the 10-year.

Using the 14-Year Bond and Rebalancing