Budgeting Your Living Costs

In This Chapter

- Why nobody likes a budget

- Accepting that a budget is the way to go

- Knowing what to include in your budget

- Deciding whether you need to earn more or spend less

- Staying on budget with websites and apps

The good news, according to T. Rowe Price’s 2015 Retirement Saving and Spending Study, is that the majority of millennials pay attention to how much they spend and are concerned about budgeting their money—more so than their baby boomer counterparts. The bad news is that boomers didn’t set the bar all that high, and millennials still could be doing better regarding spending and saving.

The need for budgeting is rarely a popular topic. Mention the word budget when you’re with a group of people, and you’re likely to hear a collective groan. Used as either a noun or a verb, the B word is not a favorite in most people’s vocabularies. Making a budget or sticking to one probably ranks right up there with going to the dentist or buying a new transmission for your car.

Most people understand the need to figure out how much money they have and how they’ll spend it, yet they remain reluctant to work out a budget and commit to sticking to it. Why is that? Businesses use budgets. Schools use budgets. Governments use budgets (or at least claim to). It’s clear that budgets are sensible, necessary things to have. We’ll even go a step further and say budgets are desirable because they keep us out of trouble, if used properly.

Why Budgets Have Such a Bad Rep

A budget is simply a schedule of income and expenses. It’s a way of keeping track of the money you earn and planning how you spend it. See, that’s not so bad, is it?

Definition

A budget is a schedule of income and expenses, usually broken into monthly intervals and covering a 1-year period.

If budgets are sensible, necessary, and even desirable, why do they have such a bad reputation? The reason is that making a budget, or working within one, implies having to use restraint or, worse yet, having to do without. As a society, restraint and denial are things we have a lot of trouble dealing with.

As mentioned previously, marketers and advertisers have been bombarding you since you were old enough to understand them, telling you what you want and what you need. And although many millennials seem to be less enamored with stuff than those of other generations, that doesn’t mean it’s not easy to spend more money than you should, especially if you see something you like and have a couple credit cards in your wallet.

Working within a budget at the very least holds you accountable for what you earn and what you spend. A good budget tells you to the dollar how much you can spend on things such as food, restaurants, clothes, makeup, drinks with friends, movies, and more.

And although it sometimes will be difficult to stick to a budget, in the long run, it’s the smartest thing you can do.

To avoid the traps so many people fall into—too much debt, too little savings, too much spending—you’ve got to have a budget. A budget helps you live within your means while also saving for your long-term goals.

It takes a little time to set up a good budget that’s comfortable for you to use, but it’s well worth it to get a clear picture of your financial situation. You can use the sample budget we’ve included in the next section, or adapt it for your own purposes, but know that there’s no one way to set up a perfect budget. It depends on your needs and how detailed you want your budget to be.

Pocket Change

About 1.5 million Americans file for bankruptcy each year, according to U.S. bankruptcy court statistics. Among those filings, almost 97 percent are made by individuals, not businesses. The most-cited reasons for filing include medical expenses, job loss, credit card debt, divorce, and reduced income.

What Your Budget Should Include

You can start your budget simply by identifying spending categories and listing all the money you spend in each category each month, either estimated or exact. Try to include everything you spend money on, right down to toothpaste and coffee.

Chances are you’ll use an app or budget software to track your income and expenses, but take a look at the following sample budget worksheet. It can help you think about your categories of spending and see just where your money goes. Feel free to revise it to best suit your needs.

Once you’ve gotten all the numbers in front of you, you can start working with an app that lets you manage a budget from your smartphone.

Housing |

Estimated Cost |

Amount/Worth |

Mortgage/rent |

||

Phone |

||

Cable |

||

Internet |

||

Electric |

||

Utilities |

||

Heat |

||

Furniture |

||

Appliances |

||

Maintenance |

||

Housing Subtotal: |

||

Transportation |

Estimated Cost |

Amount/Worth |

Gas/maintenance |

||

Tolls |

||

License/taxes |

||

Public transportation, taxis, car services |

||

Transportation Subtotal: |

||

Taxes |

Estimated Cost |

Amount/Worth |

Federal |

||

State |

||

Local |

||

Social Security |

||

Luxury |

||

Taxes Subtotal: |

||

Estimated Cost |

Amount/Worth |

|

Credit card |

||

Car loans |

||

Student loans |

||

Personal loans |

||

Line of credit |

||

Debt Subtotal: |

||

Entertainment |

Estimated Cost |

Amount/Worth |

Movies, concerts, theater, etc. |

||

Vacations |

||

Hobbies |

||

Pets |

||

Magazines and books |

||

Streaming services |

||

Restaurants |

||

Entertainment Subtotal: |

||

Personal |

Estimated Cost |

Amount/Worth |

Food |

||

Gifts |

||

Clothes |

||

Shoes |

||

Jewelry |

||

Dry cleaning/laundry |

||

Hair/makeup |

||

Health club |

||

Other |

||

Personal Subtotal: |

||

Estimated Cost |

Amount/Worth |

|

Copayments |

||

Prescriptions |

||

Doctor visits (including eye doctors) |

||

Dental visits |

||

Health Care Subtotal: |

||

Insurance |

Estimated Cost |

Amount/Worth |

Car |

||

Home/renter’s |

||

Disability |

||

Life |

||

Health |

||

Insurance Subtotal: |

||

Children |

Estimated Cost |

Amount/Worth |

Day care |

||

Babysitters |

||

Toys |

||

Clothes |

||

Children |

Estimated Cost |

Amount/Worth |

Other |

||

Children Subtotal: |

||

Charity |

Estimated Cost |

Amount/Worth |

Donations |

||

Charity Subtotal: |

||

Total: |

Although certain things, such as your rent, groceries, and clothes, will be obvious expenditures as you start preparing your budget, be sure you include a category of less-obvious expenses. Christmas or Hanukkah gifts, the birthday party you want to give your boyfriend in May, the $100 you contributed to the Red Cross to aid hurricane disaster victims, and wedding and baby gifts are all known as nonroutine expenses. They aren’t exactly unexpected—sure, Christmas and Hanukkah do roll around every year—but they’re not expenditures that come up each month, so you’re more apt to overlook them.

Definition

Nonroutine expenses are expenditures often overlooked because you don’t have to pay them regularly.

Car repairs also are nonroutine expenses. If you don’t budget for them, they can be devastating financial news. It’s hard to anticipate when your muffler is going to fall off onto the highway, but when it does, you must have some money budgeted for a new one.

Or what if you’ve budgeted money for routine dental checkups but learn during one of those checkups that you have a loose filling in your back tooth that needs to be replaced? A little procedure like that could set you back more than $200 and wreck your monthly budget.

The best way to anticipate nonroutine expenses is to figure out all you’ve had in the past year. Include car repair bills, big gifts, unexpected medical bills, the weekend at the ski resort that came up unexpectedly, and any others you can think of. Add the cost of all those things, and divide the total by 12. That’s how much you should set aside each month for nonroutine expenses.

Routine Expenses

The first items to list are known as routine expenses. You’ll need to have the following in your budget:

Definition

Routine expenses include the more obvious expenditures such as rent, insurance, food, and entertainment.

Housing Your rent or mortgage makes up the biggest chunk of your housing expenses, but don’t forget the other things you pay for, too. How about your utilities bill, and the sofa and loveseat you bought? Consider the set of dishes you got at IKEA and the washer and dryer. How about your cable, phone, and internet bills? If you’re paying costs for upkeep, such as having the carpets cleaned, windows washed, or painting done, be sure to include that, too.

Debt This is probably another big expense category, unless you’ve been very frugal or very lucky. Include in the debt category everything for which you owe money: your student loans, your car, your credit cards, and so on. Do you have a line of credit opened anywhere? What about personal loans? If your dad loaned you $1,500 for a security deposit and the first month’s rent on your apartment, include that in your debt category. Include both principal and interest payments.

Insurance Include any insurance you pay for in this category: auto, health (don’t forget your copayment if you’re partially insured by your employer), renter’s, and so on.

Taxes If you don’t own property, you probably don’t pay many taxes other than sales taxes and those deducted from your paycheck. If you do own property, you’ll need to include your local property taxes, even if you put money in escrow and your mortgage company makes the payment for you. Also include the taxes deducted from your paycheck: federal, state, Social Security, occupational privilege, and any others.

Transportation If you don’t own a car, your expenses in this category will be what you spend on public transportation, taxis, and car services. If you own a car, include routine maintenance costs such as oil changes and what you spend on gas and car insurance. Don’t forget the expenses for your license and car registration. If you pay tolls regularly when driving, include those, too.

Health care Hopefully, these costs are minimal. But don’t forget to budget for dental costs if your insurance doesn’t cover them, as well as eye exams, glasses, prescriptions, and routine doctor visits.

Entertainment and vacations If you’re like most people in their 20s and 30s, this category contains considerable expenses. Be sure you include everything because unfortunately this is one of the first areas we look to when cutting costs. This category covers a variety of expenses such as vacations; restaurants (even fast food); and the cost of drinks if you go to bars, clubs, or coffeehouses. Think about movies, concerts, museums, cover charges, and any costs associated with your hobbies (golf, bowling, skiing, or whatever).

Don’t forget pet costs; magazines and books; video rentals; the money you spend on streaming services for music, video, and books; and any other expenses related to entertainment. Don’t forget the money you spend in the office football pool and on the trip to the casino.

Be honest when you list expenses in this category. Many people don’t realize how much money they spend on entertainment until they sit down and add it all up.

Personal This category includes food; clothing; shoes; jewelry; laundry and dry-cleaning costs; your health club fees; all fitness expenses; and money spent on hair stylists, manicures, makeup, and toiletries.

Children If you have kids, you already know they’re expensive. If you don’t have kids but plan to someday, it doesn’t hurt to know what costs are involved. Include expenses incurred for babysitters and day care, toys, clothes, food, diapers, and shoes.

Giving List money you contribute to your church, synagogue, or charities.

After you’ve listed your expenses, tally them. Think about any categories you might have to add that aren’t listed here, and don’t forget to include the nonroutine expenses mentioned earlier.

Dollars and Sense

When you put together a budget, you can set aside your savings in one of two ways. Either include the money you’ll save each month in your routine expenses, or deduct it from your income before you start making your budget. Paying yourself first pays off greatly down the road.

Trimming the Fat: Analyzing Your Expenses

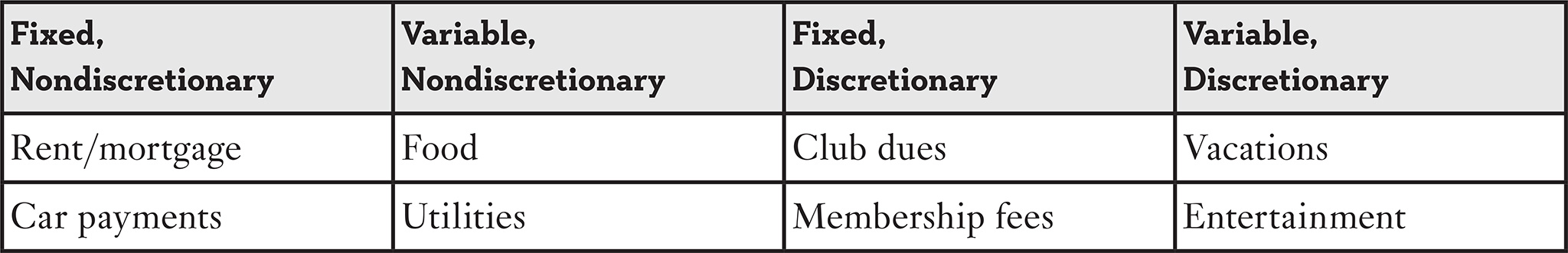

You already have your expenses organized into spending categories, so you now can break them down further into fixed expenses and variable expenses, and nondiscretionary expenses and discretionary expenses. When you have all your expenses categorized, it’ll be easier to see how you can control your budget. Analyzing different ratios within your budget also helps you determine where you should be cutting back your expenses.

Definition

You can break down your expenses into fixed expenses, such as rent and car payments, and variable expenses, such as food and entertainment. These categories can be further broken down into nondiscretionary expenses, which are things you can’t do without such as food and rent, and discretionary expenses, which you can do without like vacations and entertainment.

Fixed Versus Variable Expenses

Some of your expenses are fixed, and others are variable. Fixed expenses include the following:

- Rent

- Car payments

- Any other payments that don’t vary in amount such as dues or club membership fees

- Your mortgage, if you have one

These expenses might be necessary, like rent or mortgage payments, but they often can be scaled down. If your rent is more than you can afford, you might have to move to a smaller place or get a roommate. Or perhaps you could refinance your mortgage for a lower interest rate. (Be sure to consider the expenses involved in refinancing before deciding to go ahead.) You might really like the club you’ve joined, but if the membership fees are too high, you may have to consider dropping out. And don’t forget the varying expenses of car ownership (see Chapter 15).

Variable expenses include the following:

- Food

- Utilities

- Entertainment

- Vacations

It’s probably easier to cut back on variable expenses such as these than on fixed expenses. Utilities can be adjusted to save money, and you can pass up the pricey lobster tails and eat more affordable chicken instead.

Nondiscretionary Versus Discretionary Expenses

After you break down your expenses into variable or fixed, you can add another category: nondiscretionary or discretionary.

Nondiscretionary expenses are things you must pay for or buy, including the following:

- Food

- Rent or mortgage

- Car payments

- Utilities

Nondiscretionary expenses can’t be avoided, but you might be able to control them, as discussed earlier.

Discretionary expenses, on the other hand, are those that aren’t necessary, including the following:

- Vacations

- Entertainment

- Club memberships

These expenses are the most obvious ones to curtail if you’re trying to cut back on expenses. Now you can organize your expenses by how they fit into both sets of categories.

Expenses

Basically, there are two ways to use this information to save money: you can control your discretionary expenses (skip the vacation this year, for example), or limit your nondiscretionary expenses (maybe find a roommate or move into a smaller apartment).

Spending Ratios

When it comes to figuring out where you need to cut expenses, spending ratios are useful tools. A spending ratio is simply the percentage of money, as it relates to your gross income, you use for a particular area, such as housing or entertainment. If one area of expense becomes too great, you’ll see that ratio is too high and begin to cut back.

To figure out your housing payment ratio, which is one kind of spending ratio, add up all your housing costs (rent or mortgage, insurance, property taxes, and so on), and compare that number to your total income. If your housing costs are more than 28 percent of your gross income, you’re paying too much for housing and should look for ways to cut your costs.

To calculate your total debt ratio, add all your monthly payments (car, credit cards, rent, and so on), and compare that number to your total income. If it’s more than 36 percent of your income, these expenses are too high and you should look for ways to cut them.

Finally, you can figure out your savings ratio, which is the percentage of your gross income you save. Compare the amount of money you save each week or month to your income for that period. Aim for 8 percent a year. If you’re not saving that much, you should look for ways to cut expenses and save more.

Definition

Spending ratios are used to determine the amount of your gross income that goes toward a particular expenditure area. They can be used as tools in cutting expenses. Your savings ratio is the opposite of your spending ratio. It is the percentage of your gross income you’re able to save within a given time.

There are other ratios, too, but these are good ones to start with. Don’t get too hung up on these ratios. If your housing costs are 29 or 30 percent instead of 28 percent, you don’t have to immediately sublet your apartment and move back home with Mom and Dad. But if you find your ratio is up to 35 or 40 percent, you ought to think about downsizing.

One Job, Two Jobs, Three Jobs, Four …

After you’ve figured out how much you’re spending, you’ll know exactly how much money you need to pay for that spending. You’ll also have a clear picture of what you spend your money on.

Take a good, hard look at how you’re doing. If you’re able to meet all your expenses, make regular payments on student loans and any other debt you have, save a portion of your income, and have some money left over for discretionary purposes, good for you! You’re in good financial shape.

If, however, you’re spending everything you earn and not saving anything, or if you’re spending more than you earn, you’ve got to change your ways. If you have credit card debt that never gets paid off, if you’re having trouble keeping up with student loans, or you’re in over your head with car loans or other debt, your financial condition is shaky.

There are two ways to handle this situation: you can either spend less or earn more. Those who are in a real financial bind may very well need to do both of those things. For many people, it’s easier to change their mind-set and cut down their spending, and that usually makes the most sense. Some hard-core spenders, however, would rather try to earn more than spend less.

If you fall into the hard-core spender category and you don’t see a big raise in your future anytime soon, you need to figure out a way to get more money. You can play the lottery every night, but statistically, your chances of getting ahead that way are pretty slim. You can hope for a big inheritance or some other windfall, but you’ll probably wait a long, long time. If you can’t cut down on spending, you’ll need to get another job. There’s no getting around it.

It’s a bitter pill to swallow, but American workers have been working harder and earning less for years. The U.S. Bureau of Labor Statistics reported that real output per person increased nearly 2.5 percent per year between 2000 and 2011 while incomes fell. When adjusted for inflation, incomes in 2014 were about $2,100 lower than when President Barack Obama took office in 2009 and $3,600 lower than when President George W. Bush was sworn in in 2001.

You’d probably be much better off if you cut your spending rather than get another job to pay for it, but working two jobs is better than racking up big debt with no way to pay for it. Many people take a second job when they’re trying to earn money for a specific expense, such as a wedding or college tuition. That’s fine, as long as they’re careful to put the extra money in savings so they’ll have it when the expense occurs. It’s easy to lose sight of a long-term goal when you suddenly have extra money to spend.

If you do decide to take a second job, consider carefully what it will do to your life. What activities would you have to give up? How much less time would you have to spend with family and friends? Keep in mind, too, that many relationships have failed because one person becomes unavailable or unapproachable when he or she works too much. When working becomes (or appears to become) more important than the relationship, you can bet there will be trouble. It’s a personal decision, but being able to buy a lot of things is less than ideal if you don’t have time to enjoy them.

Money Pit

If you think you need a second job, look carefully at what you’ll make and the possible expenses you’ll incur because of the job. If you’ll be earning $12 an hour on a second job but spending more money on transportation costs and clothes for the job, and eating dinner out every night because you’re too tired or don’t have time to make something at home, it just might not be worth your time and effort.

Sticking with It

After you have your budget prepared, you need to keep track of how you’re doing compared to the budget. Many people have drafted great budgets only to give up on them after a few months. But your spending habits aren’t the same every month, so you need to keep track of your expenses for several years to get an accurate picture of what you’re spending over the long term. An app that’s easy to use and lets you link all your accounts in a centralized place can help you track what you spend over time.

Many people who neglect to budget for nonroutine expenses get discouraged and quit using their budgets when they’re hit with a car repair or other major expense. That’s why it’s important to include money for those types of expenses when you first draft your budget.

If you slip up one month and overspend, don’t be too hard on yourself, and don’t give up on the budget. It’s like when you’re trying to lose some weight. Just because you overeat one day doesn’t mean you should quit the diet and eat whatever you want the next day, too. Go back to the plan, and you’ll reach your goals.

Budgeting Websites

Websites that offer advice on setting up budgets and handling other financial matters are plentiful. Check out the following sites to start.

America Saves (americasaves.org) America Saves provides tips for savings and resources to help you prepare a budget, along with the stories of people who have committed to and succeeded at saving more.

Dollarbird (dollarbird.co) Dollarbird employs a calendar-view approach that lets you easily see how much you spend and on what every day of the month.

Bankrate (bankrate.com) Bankrate offers much useful information. Its budgeting calculator, for example, helps you start your own budget and provides lots of tips and suggestions. You can access it at bankrate.com/calculators/smart-spending/home-budget-plan-calculator.aspx.

Budgeting Apps

Many good apps can help you with your budget. Here are some highly rated free apps for 2016.

Personal Capital (personalcapital.com) Personal Capital lets you link all your accounts in a centralized place and has some valuable tools that help you easily see where your money is and better understand cash flow. You can use it with your iPhone, iPad, or computer.

Level Money (levelmoney.com) Easy to use, Level Money shows you how much money you’ve got available for the month, week, and even day. You can use it on an iPhone or Android phone.

Mint (mint.com) Mint’s app lets you use your iPhone, Android, or Windows phone to link to and track all activity on bank, credit card, loan, and investments accounts. You also can set up alerts for bills that come due and create a budget with detailed categories.

LearnVest (learnvest.com) In addition to budgeting tools, LearnVest gives you access to information relevant to your personal finances.

BillGuard (billguard.com) BillGuard automatically tracks your spending without you having to enter expenditures. It also notifies you of any suspicious activity with your accounts.

Regardless of what tools you use, the most important ingredients of successful budgeting are a willingness to make a budget and to stick to it after it’s made.

Dollars and Sense

Keep all your receipts, either as paper copies or digitally. This lets you see everything you’ve purchased at the end of the month and holds you accountable if you overspend.

The Least You Need to Know

- Most people don’t like to think about budgeting, much less do it, but you can and should.

- After you have a handle on what you have and what you need, you can assess your financial condition.

- If your earnings aren’t greater than your expenditures, you’ve got to earn more or spend less.

- If you’re tempted to take a second job to earn more money so you can spend more, consider cutting expenses instead.

- Regardless of what budgeting tools you use, you should have a budget to know exactly how you spend your money and how you’re implementing your plan.