Getting Started

You have made the decision. You are going into business for yourself as a landscaper, nursery owner, lawn service provider, or maybe all three. The next step is to prepare a business plan. You know where you want to go; now you must propose how to get there. This plan is your map. If you were traveling from Baltimore to Denver, you would not just head west and hope you run into Denver. You would look at a map and plan your trip. You would find your route number and have a schedule of where you want to be at various times on your journey. It is no different with your business. This is the key to your future as a successful owner of an outdoor business. “I want to be rich” may be an attractive answer, but it is not a business plan.

In the previous section, you examined the options for landscaping, nursery operations, and yard maintenance. You know what kind of business you would like to run. You probably already have a picture in mind of what your entry point into this business will be. If you have chosen lawn maintenance, are you going to begin by collecting residential customers? Do you plan on being aggressive and going after a few commercial customers as well? If you are considering landscaping or a nursery operation, lay out your options. Outline what your company will look like during the first month — then the second, third, and so on. Draft a one-year vision for your business, then a vision for two or three years out.

Stay as close to reality as you can, while remaining positive about your potential. Unless you already have a background in this field, it is not realistic to assume you will be a big player right away. It is realistic to assume that you can:

1. Survey your market

2. Analyze the potential for business

3. Learn what your competitors are charging

4. Determine what equipment you will need and how much it costs

5. Forecast your business expenses

6. Determine your personal financial needs (how much you need from this business to pay your own bills)

Business Planning

Here is the step-by-step process you will need to get your business going:

1. Organize. Ask yourself, what is your business all about? Write down a short, clear mission statement. For example, “Lance’s Lawns offers high-quality lawn and garden care to residential and commercials customers. Our customer service is the best in the business. We stick by our word.” This is a broad statement, giving you latitude in determining the kinds of services and products you can eventually offer, but it also commits you to high business standards.

2. Define. What specific services will you offer right away? Write down if you will specialize in lawn mowing, edging, driveway cleaning, mulching, trimming, or if you will engage in more extensive landscaping services. If you are operating a nursery, describe what types of products you will grow and sell.

3. Ownership. Who owns the business? Only you, or do you have partners?

4. Structure. What is your business structure? Are you a sole proprietorship, an S corporation, or a limited liability company (LLC)? Structure types are discussed later in this chapter. Business consultants suggest that you do not operate your business as an individual or proprietorship because of liability and other risks.

5. Credibility. If you are going to borrow money to get your business going, you will need to write out a complete background report on yourself, explaining how and why you are qualified to operate this business successfully.

6. Forecast. What are your long-range plans for the business? Will you eventually offer walkways, ponds, stone walls, or commercial landscape development? When and how do you plan to do that?

7. Research. What is your market? Have you surveyed the market in your area so you know what the demand is and how much customers are willing to pay for such services? Hint: If you have a lawn care company doing your own lawn, how much are you paying? What do your neighbors pay? Call a couple of real estate agents and ask them what the going rate is for typical residential yards. Maybe they have some thoughts about commercial jobs as well.

8. Competition. Who are your competitors? Is there one company that comes to mind when you think about landscaping services? Market impact is also known as “footprint.” Does anyone have a big footprint in your area? Check the yellow pages to see who has invested in large advertisements. Go online to search for landscape companies in your area. Call them and learn if they will give you free estimates. The more information you can get during your planning phase, the better. Remember, it helps to know all you can find out about their pricing structure, and to get a feel for the people who work for them.

9. Marketing. What type of marketing will you do? If you have a business phone you will automatically be listed in the yellow pages. However, display ads cost extra. Think carefully before investing in a large display ad to start. A well-designed flyer may work better, either mailed or dropped on doorsteps in your target neighborhoods. Visit your printer to have business cards designed and printed. Join professional organizations such as builders and real estate associations, and business groups such as Business Network International and the Chamber of Commerce.

10. Pricing. How will you determine what you will charge for your services? Again, the basic market research will help you learn pricing for each of your services. Do not assume you must be the cheapest guy in town. Playing the price game can be the road to failure. Know your costs and work with a reasonable margin. More details on how to price your services are found in Chapter 8.

11. Equipment. What will you need and how much does it cost? We will discuss equipment in Chapter 11.

12. Vehicle. Let us assume you will need only one in the beginning. You will probably need a full-size pickup, not necessarily new, and possibly a trailer to haul your equipment.

You must list all startup costs, including equipment, vehicles, tools, and other hard, capital expenses. You may need to rent a storage space for these things. Then, list marketing and advertising expenses, along with all other budget items for the first 6 to 12 months.

You also must forecast business income. How many customers do you think you can handle? Be realistic. You personally will not be able to cut 40 lawns a day. If you plan to hire someone, you must add that person’s costs to your numbers. You may want to hold off on hiring anyone until you are situated. Slow and steady growth is preferable to a large financial commitment in a new business.

Before photo: This is a typical front yard.

After photo: Note how dramatic this same yard appears with terracing and professional landscaping.

Photos by Tom Hamm, Green Gardens, Inc.

Here are two examples of creative uses of lawn space.

Becoming a Small Business

A small business is a company with fewer than 500 employees. You will be joining more than 26 million other small businesses in the United States, according to the Small Business Administration. Small companies represent 99.7 percent of all employer firms in the country and contribute more than 45 percent of the total U.S. private payroll. More than half are home-based. Franchises make up two percent.

Of those 26 million small U.S. businesses, the SBA states that 649,700 new companies first opened for business in 2006. During the same period, 564,900 of the 26 million total closed shop. However, two-thirds of newly opened companies remain in business after two years and 44 percent after four years. The odds are with startups. Just keep in mind that virtually every one of the companies that survive do so because the owners are working hard and care about their company.

Basic business structures

Your state’s business Web site may be the best place to start, but here is a brief description of business structures you might consider.

Sole proprietorship

This is the simplest, cheapest way to go into business. As a sole proprietor, you set up shop as yourself: “Hi, I am Lance and I cut lawns.” Under this structure, the owner is personally liable for all business debts and other potential liabilities. You will be driving a truck, hauling equipment, and working in other people’s yards and businesses. You may have other people working for you. If you or your employees cause damage or injury, your assets are seriously exposed. Many jurisdictions assume that sole proprietors will operate under their names. If you chose this form of business and are not going to use your name, you will likely be required to file the business name as a DBA (short for “doing business as”) and may need state or municipal approval. As with all decisions regarding business structure, talk to an attorney who specializes in small business issues. He or she will be familiar with the laws and regulations you will be subject to and can advise you on ways to protect yourself.

Partnerships

This is similar to the sole proprietorship but involves more than one person. Profits, losses, and liabilities are shared. Management also may be shared. Naming the company is the same as the sole proprietorship, and may require the filing of a DBA. One caution here: Be sure you like your partner. If you choose to go into business with your best friend, realize the risk that doing business together could undermine or destroy your friendship. If you are considering a partnership, ask your partner if you can each be responsible for separate duties to avoid conflict.

A partnership may be a good idea if you do not feel strongly about running everything exactly your way. If you like being part of a team, you and your partner may find the shared experience of running a business a positive aspect of the work.

Be sure you have an attorney (you and your partner may wish to have separate attorneys) to set up the agreements that will cover what happens if you have a falling out, if one of you passes away, or if other contingencies occur.

Limited liability company (LLC)

This is more formal than the two structures outlined above, but not as formal as corporations. An LLC has advantages that limit your personal liability and offers certain tax benefits. You probably will have to file your LLC’s name with the secretary of state, along with other documents. You will want to have an attorney involved in any of the business structures that go beyond a sole proprietorship.

C corporation

This is the most expensive and complicated way to go into business. You will be creating a legal entity separate from you and any others who may be involved. Some states require more paperwork, licensing, and taxes. For example, the corporation’s profits will be taxed at the corporate level, and again when they are distributed to shareholders. Your accounting bill may be higher if you choose this structure; so will your legal bills. You also will have to issue stock certificates, hold annual meetings, elect officers, and all of the other formalities associated with corporations.

S corporation (sub chapter S)

This is similar to the C corporation, but it offers tax benefits to the owners. It will be taxed like a partnership, meaning there is no double taxation. Profits flow directly to the shareholders and are taxed as ordinary income. You are not required to have multiple shareholders. You can be the only one.

Again, discuss these issues with an attorney who specializes in small business matters. Also, find a reputable, certified public accountant (CPA) who specializes in small businesses. Talk to other small-business owners for referrals. Do not use your brother-in-law who took a tax course two years ago. A competent attorney and CPA will cost some money up-front, but are worth their expertise.

After you have made these decisions, you must meet your state and local requirements for conducting a legal business and obtain the necessary licenses, tax certificates, and other legalities of being in business. You must obtain a federal tax number, under which you will conduct your business and address tax issues such as payrolls and Federal Insurance Contributions Act (FICA). FICA is mandated by the federal government, and requires a portion of employers and employees paychecks to go towards funding Social Security and Medicare. Your federal tax number is easy to obtain, often with just a phone call. Be prepared to tell the person on the other end all the details of your business. This is another topic to discuss with your lawyer and accountant.

Once you have determined a structure for your enterprise, put a business plan together. For this example, we will call your company “Lance’s Lawn Care and Nursery.”

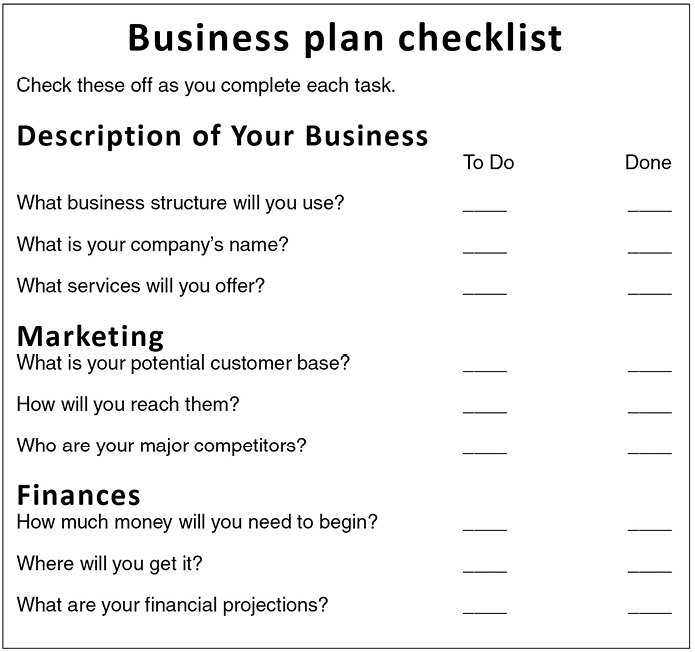

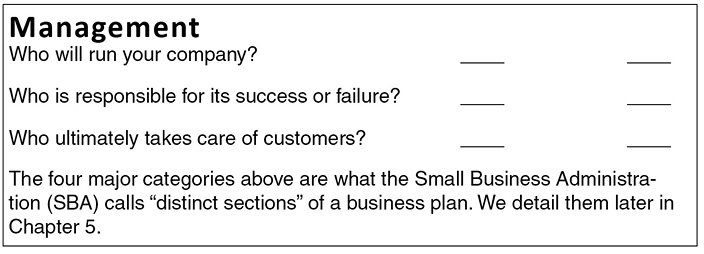

Parts of Your Business Plan

Essential elements:

1. Executive summary

2. Market analysis

3. Company description

4. Organization and management

5. Marketing and sales management

6. Services and products to be offered

7. Financials

8. Funding requests (if asking for loan)

We will make some assumptions as we work through this example plan, such as your structure, financials, equipment needs, and so on. Your specific plan must reflect your needs, marketing conditions, funding, and the advice you receive from your attorney and accountant.

Executive summary

Lance’s Lawn Care and Nursery is a residential and commercial landscaping service offering basic-to-advanced lawn services, gardening, and landscape design to homeowners, property managers, and developers. Lance’s Lawn Care and Nursery will target upper-income homeowners and upscale commercial areas, which need and can afford quality services of this nature. Real estate prices in this area have remained strong, despite the turnout in other sections of the country, and demand remains high, thus offering growth opportunities.

Lance’s Lawn Care and Nursery will begin as a limited liability company, LLC, owned entirely by Lance Lingering. Lance has worked as a lawn care and gardening specialist for the past eight years, as supervisor for Bob’s Yards and Patios, and more recently as a master nursery supervisor at Elaine’s Plants and Patios. Lance is a certified lawn maintenance quality-control specialist.

Lance’s will open for business at the beginning of the region’s lawn care season, which typically runs for seven months — April through October. During that time, Lance will hire one part-time helper to work up to 20 hours per week. Lance estimates his own workweek at 60 to 80 hours. If business warrants, Lance will hire a second, part-time worker.

Lance forecasts initial business at 20 to 30 residential customers requiring weekly yard maintenance, plus spring and fall services such as cleanup, mulching, and trimming. The average lawn maintenance fee will be $50, with some being higher or lower depending on yard size and services required. Spring and fall services will be in the $100 to $300 range. Anticipated monthly revenues during the first season from residential customers are expected to be $6,000, plus an additional $2,000 to $3,000 per month in April, May, and October from yard cleanup and preparation. We do not anticipate significant commercial contracts during the first season of business; however, we will market aggressively for commercial work for the following season, using the first year as a period of development and networking. Our first-year revenues are forecast at $49,500.

The above numbers are imaginary, but you get the idea. The summary explains the thinking that justifies the company and its future.

Market analysis

Lance’s service area has experienced strong, sustained growth in population and property values over the past decade, even during recent setbacks in the real estate industry nationally. The growth of upper-income homes has been pronounced in communities with large lots. These homeowners a) have the financial resources to pay for first-class landscaping and b) little desire to do this type of work themselves. County planners expect more than 300 such homes to be sold and occupied in the coming 12 months, adding to the more than 1,000 such homes now occupied. Lance will target all of these residences so our estimate of 30 customers is modest. We expect to exceed that number quickly.

In addition, several retirement communities are under construction and Lance will market to the developers and management companies that oversee landscaping and maintenance. Lance has joined several professional groups that network decision makers in this segment.

Again, the idea here is to explain the market you intend

to pursue.

Company description

Here you will formally explain the business structure you have selected. You are, for the purpose of this example, a limited liability corporation, LLC. In your specific case, you may elect something else. In this portion of your business plan, you would explain it, stating your officers, managers, and so on.

Organization and management

This is where you will be specific about how your company will be operated. Lance will be owner and general manager. If he plans to hire his wife or sister to do some daily bookkeeping, mention it here. If Lance’s office will be at home, list it here. Where will equipment be stored? Will Lance need a storage facility? Be specific. Personnel and sales goals can also be mentioned here, and will be expanded upon later in this plan.

Marketing and sales management

Lance’s Lawn Care and Nursery, LLC, will rely primarily on door-to-door marketing during its first quarter. We will distribute fliers at each home in our target area once a week for four weeks, approximately 4,000 fliers during the first month of operation. Each home will receive the flier at least twice. Two of our target communities permit solicitors to knock on doors, and Lance will personally knock on these doors on Saturday mornings for two hours each week to help him establish personal contact with potential customers and to offer on-the-spot consultations and estimates to build the initial customer base. Lance’s initial marketing will focus on spring cleanup special offers.

Lance will also pass out business cards to developers, property managers, and other potential commercial customers, establishing potential relationships in the commercial arena.

This is where the plan meets the real world. Think this through and understand that this is the key part of your plan to make your business successful. All of your research and planning will focus on sales and marketing. Explain an entire year’s worth of market planning — canvassing, networking, yellow pages, professional organizations, and any other advertising you plan to use.

Do not expect miracles from your marketing. Fliers generate 1 to 2 percent responses. Out of every 100 fliers you put out, you will get one or two calls. You should close more than half of these responses. The response rate goes up with frequency. Each time a potential customer sees your flier, the higher the likelihood that person will respond. Everything you do will add up to a total marketing strategy that will bring customers to your business.

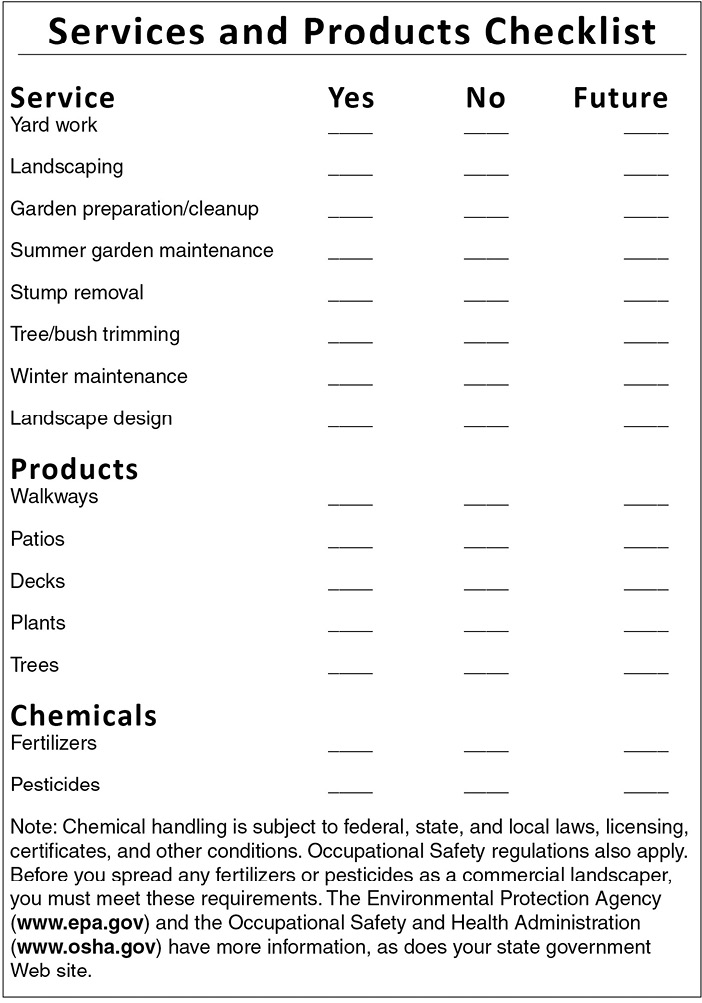

Services and products

Here you expand on what you will do for your customers — lawn care, patios, walkways, tree trimming, and so on. If you live in an area with a short lawn season and a long, snowy winter, you may want to provide snow removal in the cold months. You need to determine how much income you can project for your services given the number of customers you can realistically anticipate in your first six months or year.

All of your services must be researched. You need to be aware of your competition, their prices, and the market. Do you plan to operate a nursery to sell plants and related products to the general public, in addition to landscaping or yard maintenance? If so, you will need a separate business plan for that, including a commercial site, permits, and products.

Financials

Here is where you make your financial projections for your first three years. These are estimates based on solid information and market conditions but, as with all business activities, nothing is guaranteed. Nevertheless, this is a financial blueprint.

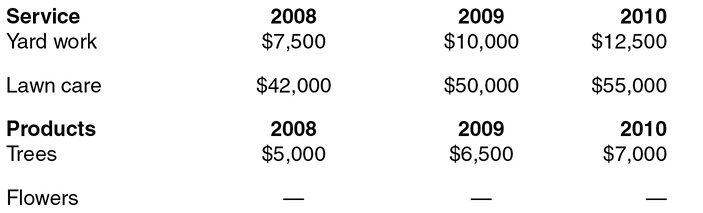

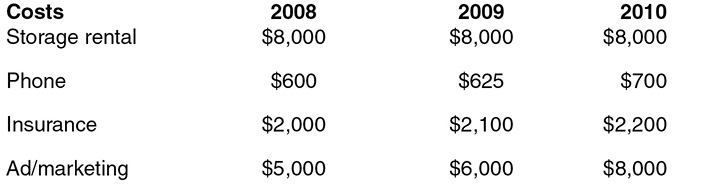

First, make a column of all of the services you plan to offer and forecast sales for them.

List all of your services and products and what you reasonably expect them to bill.

Next, list your costs. These would include cost of goods (not equipment, which is a capital expense), rent, phone, marketing, insurance, fuel, equipment maintenance, and other costs of doing business.

It is important that you make a good faith effort at predicting your costs. Your actual expenses may be higher or lower than your initial projections so track your expenses monthly to allow for adjustments. For instance, you may increase or decrease your marketing expenses according to projected costs versus actual expenses.

Labor

Here is where you list your labor expenses. How much are you going to pay yourself and your part-time employee(s)? If you have employees, you must pay unemployment insurance, workers’ compensation insurance, and possibly other fees, depending on your state’s laws.

Startup costs

List here what you anticipate the cost of opening your business will be — equipment, vehicles, tools, trailers, fees, licenses, computer, software, and all of the other costs associated with starting a business. If you are planning a small lawn cutting and mulching operation for the first few months or a year, your expenses will be lower. On the other hand, if you want to begin as a full-service company offering a wide range of lawn care and nursery services, you will need substantial start-up capital.

You will need a vehicle to haul your equipment to job sites. A full-sized pickup truck is a reasonable option, although you may choose a van. Remember, these are work trucks —you will not want or need leather seats, heated drink holders, or a premium sound system. You will need a vehicle you can beat up, so stay away from anything that needs to be pampered. You may want to consider a used truck; something that is mechanically sound, physically acceptable, with low mileage, and low cost. Avoid purchasing a vehicle that has major dents or other cosmetic problems because your company’s name will be on it and customers (and potential customers) will judge your company by the condition of your truck. That does not mean it has to be spotless, but you do not want yourself or your company associated with a beat-up wreck. You want to portray confidence and a quality image in everything you do.

Look around on the Internet and in area dealer lots, then price and compare. There will be a healthy cost difference between a new truck and a two-year-old model. Larger, more-established companies sometimes have a policy of replacing their vehicles every two or three years, so look out for deals.

Professional-grade equipment such as mowers and tractors can also be purchased used. Tools such as shovels, rakes, hoes, hoses, and other common yard implements should be purchased new and at top grade. You do not want to get bargain tools for a professional landscaping business, as they will not hold up to the heavy-duty work you will be doing.

Funding requests

If you are going to borrow the money needed to start the business, you must provide a detailed financial statement in addition to the information you already have in your business plan. This is the same information you would provide for any substantial loan from a bank or other financial institution. You must provide assurance that you can and will pay back the loan and offer a form of security. This might be your home or other assets such as savings, stocks, or real estate. Your business and its assets will be part of the security package. We will cover more details about funding your business in Chapter 7.

If you are purchasing a franchise, you likely will not be able to use the franchise as collateral because franchisors typically retain sole rights to award franchises, and therefore may not honor any claims against the franchise. This means if you put your business up as collateral and default on the loan, the lender cannot take over your franchise, so it is useless as collateral.

If you are considering the purchase of a landscaping or lawn service franchise, the law requires that the franchisor provide you with a detailed report explaining every aspect of the business. This is a requirement of the Federal Trade Commission (FTC), which advises all prospective franchisees to read these reports carefully. A meticulous review will protect yourself and your investment. It is suggested that you employ a lawyer or CPA who is aware of FTC regulations to double-check these documents for potential problems.

You may have noticed the words “lawyer” and “accountant” again. As stressed earlier, these two professionals can save you from trouble and losing money. One more option many startup companies have used, especially in the past: credit cards. If you have good personal credit and a high enough limit, you may be able to borrow the money from yourself. Be wary of high interest rates, and be sure you will be able to pay the monthly fees. Talk to your accountant and your banker about loan details. If you lend money to your company, you may be entitled to interest on the loan, as well as repayment.

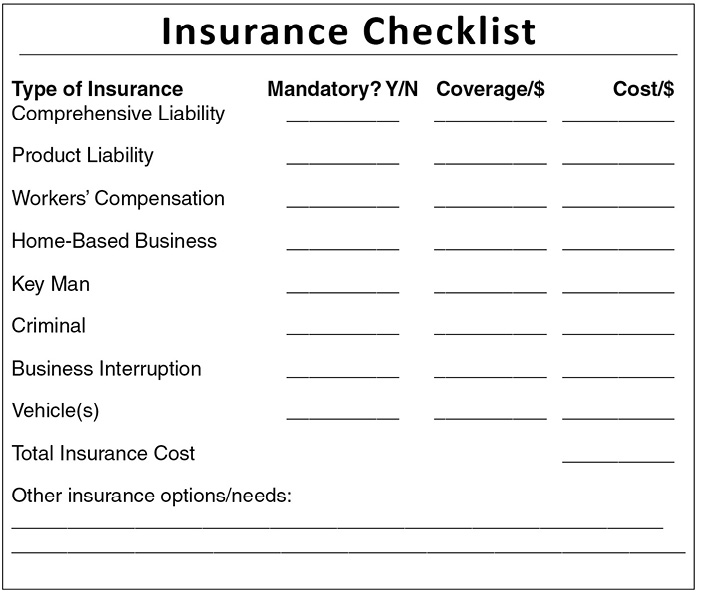

Insurance

Insurance is a necessary expense, and in some jurisdictions, an absolute requirement for doing business. No matter how careful you are accidents will happen so insurance is your protection.

As the owner of a landscaping business you have many assets to protect, the most important of which is the business itself. Unless a corporate shield protects you, your personal assets are also at risk and could be lost in a lawsuit if you do not have the proper insurance protections.

Types of insurance

Insurance is not a one-size-fits-all solution. Laws vary by state, so some states will have higher premiums, based on a number of factors, including the number of claims filed overall. If you are licensed to use chemicals, you may find that your insurance costs for that category of service are higher than for other services you provide. Insurance companies may consider lawn chemicals as a higher risk because misuse or accidents with them could lead to serious claims by people who were affected.

A prospective insurer will examine the list of services you provide, your vehicle(s), equipment, and the number of employees you have on the payroll to help determine your premiums. These basic business facts will also help you determine what types of insurance you need. Ask yourself “What can I afford to lose?” in the event of a catastrophic claim by a customer, subcontractor, or vendor.

Environmental damage is another serious risk for landscaping businesses. If a large canister of pesticides overturns, polluting a stream, your business may face civil suits and hefty government fines. Defense attorneys and court actions are expensive. You do not want to find yourself trying to scrape up the money to cover such extraordinary costs.

Many states have minimum business insurance standards. A description of some common types of insurance follows:

Comprehensive general liability insurance

General liability insurance may be required in your state. This type of insurance will cover your business against unexpected accidents and injuries. Review the policy for exclusions that might leave you vulnerable to exposure under certain circumstances. Read the fine print — do not ignore it or skim over it. For example, if your policy excludes damage caused by drunken employees, the insurance company may not help you if an inebriated employee loses control of your company truck.

Know what you need and what coverage an insurance company is providing. Talk to a number of providers. Better yet, ask other business owners for referrals to reputable insurance brokers who deal with a range of insurance companies. He or she will shop around for the coverage you need at the lowest cost. The most important part of this process is obtaining the proper coverage. A lower premium is not worth much if you find yourself without the insurance protection you need.

How much liability coverage is enough? $1 million sounds like a lot, but in today’s world that amount may not be enough. $2 million is probably a minimum; $3 million is safer. If you can afford it, go higher. You will find that insurance companies price this type of insurance reasonably, assuming you do not have a history of claims and judgments, and premiums are not based on a dollar-for-dollar fee schedule. $2 million in coverage is less than twice the cost of $1 million, and so on. An insurance broker who specializes in small business coverage can help you determine what you need. Be honest with him or her and do not mislead them, or yourself, about what you will be doing in your business — whether it is outlining the services you provide, or the products you are offering. Ask questions, write down the coverage you need and any promises regarding coverage from the provider or the broker, and check these items against the actual insurance policy.

Bonding

If you already have general liability insurance, do you also need to have company and employees bonded? The answer is—sometimes, yes. Liability insurance covers accidental property damage or injury caused by you, the contractor, to your customer’s property or people on the site, but it does not compensate for construction defects or poor workmanship. A surety bond is an agreement the contractor arranges with a bonding company, to pay awards to the consumer if the contractor is judged at fault, by arbitration or legal action, if a job is not completed to the customer’s satisfaction. State laws differ but it is common for states to require contractors to carry surety bonds of a certain level, depending on their license category. Bonding is usually a requirement for jobs with the government or large commercial jobs.

Although it is expensive to carry both liability insurance and a surety bond, it helps attract and keep customers who understand that their property and investment will be protected, no matter what. Plus, you can then charge premium rates, because not every person with an outdoor service business carries this coverage. You can find a bond provider who works with businesses in your state at the National Association of Surety Bond Producers: www.nasbp.org/AM/Template.cfm?Section=Find_a_Producer_in_your_State&Template=/CM/HTMLDisplay.cfm&ContentID=1844

Employee bonding is a different matter. Employee dishonesty bonds are surety bonds that guarantee compensation if your employee steals property or is otherwise negligent on the job. You may want this coverage because, frankly, you never know what another person is thinking. Talk to your insurance agent to see if it is necessary.

Product liability insurance

Product liability insurance is a separate category that provides protection from problems arising from the products you sell. Patios may sink, walkways may crack and trip someone, or some other product could fail. Be sure your business is covered against this type of risk.

Workers’ compensation insurance

Worker’s Comp, as it is commonly called, is required in every state. However, the structure of the insurance varies by state. Private insurance companies offer this coverage based on the number of employees on the payroll, the roles each individual performs, and the type of business you are operating. However, some states require that such coverage be obtained from the state government or one of its agencies. This insurance pays medical expenses and lost wages for workers who are injured on the job. There are exclusions for certain categories, such as independent contractors and volunteers, but, again, check your state’s laws. Business owners are generally exempt in most cases.

Home-Based business insurance

Home-based insurance will be required if you are working out of an office in your home. Homeowners’ policies rarely cover business losses. If you are operating from your home or garage, check with your insurance agent to see if anything in your office is covered. The typical homeowner’s policy specifically excludes home-based business losses, including equipment, theft, loss of data, and personal injury. Unfortunately, many companies that provide homeowner’s insurance do not offer business coverage, so you may need to have two insurance companies covering different areas of your home.

Criminal insurance

Criminal insurance covers you in the event of an employee committing a crime. General liability insurance may not cover theft or other criminal acts by employees. If someone is on your payroll, you may be held responsible for his or her actions in a customer’s home, including the yard. Should that person steal something, vandalize that home, or deliberately harm a resident, the homeowner will expect you to assume responsibility. This type of coverage can also protect you in the event of employee embezzlement. Depending on your general liability coverage, you may want to consider this category of insurance.

Surety bonds

Surety bonds are performance guarantees that fall under the insurance category. This is a way to assure a client or customer that your company will complete work as stated in a contract. Small customers, such as homeowners, probably will not ask for this guarantee (at least not in this form) but large commercial customers will want to know you have the financial resources to get the work done. If you have bid on a $1 million project that involves labor and material, you must have some way to pay your expenses, and cash flow for small businesses can be a deal breaker. Surety bonds (also called performance bonds) are available from insurance companies. If you cannot get such coverage on the commercial market, the Small Business Administration has a Surety Bond Program that may be available to you — but, as with all government programs, be prepared for paperwork.

Key man insurance

Key man insurance may be required by lenders who provide capital for businesses. This coverage applies to the person whose absence from the company would cause it to fail. Most likely, that person would be you or your partner. If you have borrowed money to start or operate your business, the lender may require such insurance as a guarantee of payment if anything were to happen to you.

Business interruption insurance

Business interruption insurance covers your expenses if you are shut down by fire, natural disaster, or other catastrophe. Landscaping businesses are not as vulnerable to this as other types of businesses, so look carefully at your other coverage. Assuming your equipment and vehicles are already covered, you may not want to duplicate coverage. Discuss this with your provider or broker.

Vehicle insurance

Vehicle insurance is the commercial version of the insurance you have on your private vehicle. The same price considerations apply: type of vehicle, history of claims, mileage, location, and drivers. If you have employees who will drive your vehicles, their driving records will be considered in the rate you pay, along with yours.

Insurance Review

Insurance is not an option — it is protection that is required both by law and good sense. There is no single standard for business insurance because laws, rates, and requirements vary by state.

At a minimum, you will need comprehensive general liability insurance, vehicle insurance, workers’ compensation insurance, and probably home-based business insurance. You may also consider product liability and criminal insurance policies. Your lender may require key man insurance if you have borrowed money for your business.

Ask other small business owners in your area for referrals to a reputable business insurance broker and review your options and requirements with her or him to determine the best coverage for business and to find the best rates.

Have your insurance coverage in place before you mow your first lawn or provide any business service to customers.

Case study: St. Louis Lawn Care, Tim Jenkerson

St. Louis Lawn Care

3524 Glen Arbor Dr

St. Louis, MO 63125

314-974-5911

www.STLLawnCare.com

The roots of St. Louis Lawn Care go back to 1995, when Tim Jenkerson’s father started a lawn care business in the off hours from his jobs as a police officer and a fireman. He started with a small commercial lawnmower and a little truck, and Jenkerson and his brother Nick helped him throughout high school and college.

At the time, the Internet was gaining popularity, and Jenkerson had a college friend who was involved in high-tech search engine optimization and Web sites. Jenkerson picked his friend’s brain, did some research of his own, and built his dad a Web site. It brought in so much business that “he couldn’t handle it,” said Jenkerson.

Jenkerson graduated with an accounting degree and worked for a while in that field, but decided to put his phone number on the Web site to see if he could get some lawn care business for extra money. It worked so well that Jenkerson opened St. Louis Lawn Care. He and his father operated separately for a year, but recently combined the two businesses under the St. Louis Lawn Care name.

Jenkerson, his father (who remains a police officer), and his brother are all working partners in the business, which includes one full-time and two part-time employees. The business is home-based. Services include mowing, trimming, mulching, fertilizer applications (organic and standard), overseeding, sod, leaf removal, and snow plowing. They also perform light landscaping services and build retaining walls. Ninety percent of their business is residential, with ten percent commercial.

The Web site is their primary marketing tool. It features a lawn care blog, as well as a complete description of services. The company also offers a referral program that rewards residential customers who refer a friend with a free fertilizer application or grass cutting when their friend signs a yearly agreement. Annual contracts carry over year to year, unless a customer cancels.

They do their own equipment maintenance such as oil changes and blade sharpening, but if anything major goes wrong, they take it to a service shop. They have a couple backup mowers in place to use if one goes out.

“It’s not super expensive to start a lawn business,” Jenkerson said, “but there are startup costs with everything you do. I got lucky. Since my Dad had all the equipment, I just used his to start with, and then bought my own eventually.”

What do new business people need to know? “It helps to know how the equipment operates, and lawn maintenance skills,” he said. Jenkerson advises to cut grass 2’ to 2.5’ high in the cool season, then raise it up to 3’-3.5’ in the summer. They price each lawn individually, factoring in both market price and time. “It’s basically experience.”