If you have all the money you need to start your business, you can skip this section for now. But, sooner or later, you may need to find outside sources of funding to purchase equipment or supply working capital, among other possibilities. The US Small Business Administration suggests asking the following questions before seeking financial assistance:

• Do you need more capital or can you manage existing cash flow more effectively?

• How do you define your need? Do you need money to expand or as a cushion against risk?

• How urgent is your need? You can obtain the best terms when you anticipate your needs rather than looking for money under pressure.

• How great are your risks? All businesses carry risks, and the degree of risk will affect cost and available

financing alternatives.

• In what state of development is the business? Needs are most critical during transitional stages.

• For what purposes will the capital be used? Any lender will require that capital be requested for very specific needs.

• What is the state of your industry? Depressed, stable, or growth conditions require different approaches to money needs and sources. Businesses that prosper while others are in decline will often receive better funding terms.

• Is your business seasonal or cyclical? Seasonal needs for financing generally are short term.

• How strong is your management team? Management is the most important element assessed by money sources.

• Perhaps most importantly, how does your need for financing mesh with your business plan? If you do not have a business plan, make writing one your first priority. All capital sources will want to see your business plan for the start-up and growth of your business.

Financing Options

You may want to consider the two types of financing options: debt or equity. You will want to compare the amount of money you have borrowed (debt) with your personal financial investment (equity). This calculation is called the debt-to-equity ratio; in other words, the comparison between the amount of money you have borrowed and your personal financial investment in your business. The more money you have invested personally in your startup business, the easier it is to attract financing later on.

If your business has a high ratio of equity to debt, you should probably apply for a bank loan. However, if your business is already deeply in debt, you should probably seek to increase your ownership capital (equity investment).

Debt financing

There are many sources for debt financing: banks, savings and loans, commercial finance companies, and the U.S. Small Business Administration (SBA) are the most common. In recent years state and local governments have developed many programs to encourage the growth of small businesses in recognition of their positive effects on the economy. Family members, friends, and former associates are all potential sources, especially when capital requirements are smaller.

Traditionally, banks have been the major source of small business funding. Their principal role has been as a short-term lender offering demand loans, seasonal lines of credit, and single-purpose loans for machinery and equipment. Banks generally have been reluctant to offer long-term loans to small businesses. The SBA guaranteed lending program encourages banks and non-bank lenders to make long-term loans to small businesses by reducing their risk and leveraging the funds they have available. The SBA’s programs have been an integral part of the success stories of thousands of businesses nationally.

Lines of credit

A line of credit loan is designed to provide short-term funds to a company to maintain a positive cash flow. Then, as funds are generated later in the business cycle, the loan is repaid. Most commercial banks offer a revolving line of credit when a fixed amount is available.

In addition to equity considerations, lenders commonly require the borrower’s personal guarantees in case of default. This requirement provides a serious, incentive for the business owner to attend to business details and ensure loan repayment. For most borrowers this is a burden, but also a necessity.

Equity financing

Most small or growth-stage businesses use limited equity financing. As with debt financing, additional equity often comes from non-professional investors such as friends, relatives, employees, or even customers. You may put your home or other assets up for collateral, or use money obtained through a home-equity loan to underwrite certain business expenses. Discuss this sort of transaction with your accountant before you make a decision to do this, because you are literally mortgaging your home to support the enterprise. If you can see a way that the money will be readily paid back, it may be a safe way to go. If in reality you are pouring cash from your home into a serious business problem, alternatives such as soliciting an investment from a wealthy friend or family member may be a wiser decision. However, this person may insist on a stake in your company or other influence in return for the investment.

There are special sources of funding for different catergories of business owners, such as minorities. Your banker may have knowledge of such sources, or you can contact your local Small Business Development Center (SBDC). Approximately 1,000 SBDCs have been formed and partially funded by the US Small Business Administration. The SBDCs link universities, state, and local governments. They are designed to assist new and existing business owners with free consultation and low-cost training in virtually every aspect of business operation, including finding funds to continue or expand.

The SBDC member programs assist more than one million businesses every year. A large number of these businesses are just getting off the ground, but the majority are existing businesses with concerns about handling transitions, stabilizing their operation, or planning for expansion. You can access the network of Small Business Development Centers to find your closest office on the Web at http://sbdcnet.org/sbdcs-nationwide-12.php.

Professional Advisors

For many business owners who are not involved in a partnership, one of the more frustrating aspects of being the boss is not having someone to bounce ideas off of, or to ask for help. The SBDC consultants, mentioned previously, are one avenue to outside advice. Remember that while they are there to serve your needs, they are also serving the needs of dozens or hundreds of other business owners too.

You will want to create a personal network of business advisors, including those with professional credentials. The sooner you can bring experts into your business team, the better for both you and your fledgling business. Be sure to include these professionals on your short list of necessary advisors:

• A certified accountant (CPA) or someone of equal ability in accounting. You will need this person for advice and to provide services on taxes (US, state, and local), loan terms, vehicle purchases—practically anything to do with money. A competent accountant can show you how to get the most profit for each dollar of income. He or she might even have good ideas on additional sources of income you could provide. If you do not know a good accountant whom you trust, get first-hand referrals from a successful business owner or banker.

• A capable business attorney. Build a relationship with a good business attorney so you always have someone knowledgeable on hand if you need to have someone go over a contract to look out for your special interests, if you need legal advice in hiring situations, or for advising on legal forms and requirements at your state and local level. You will want someone experienced. It is not good for you to be the guinea pig for a start-up attorney, even if you are running a start-up yourself.

• A business-banking expert from your primary business bank. You want a banker who is interested in the growth of your company, who is literally “banking” on your success. A good business banker can help you network with vendors, or even find new customers. Often the business banker has a deep reservoir of business knowledge that he or she would like to share with you, so ask questions.

• A solid business insurance agent or broker. A broker may be your wisest choice since, in theory at least, they check out several different insurance companies for you and recommend only what they believe is best. Look to a professional insurance advisor to help you analyze and prepare for your business risk.

Perhaps you do not want anything to do with certain aspects of your business, but you do not want to hire employees either. Whether it is weekly bookkeeping, or laying a stone walkway, if you do not feel comfortable or competent in performing a necessary business task, it is far better to find the right service to handle it than to neglect the job or mess it up. Use your professional advisors — banker, accountant, attorney — as a starting point to find the services that will help you get your worst jobs done right.

Money Management

Business success is directly connected to sound money management—keeping careful track of the amount of money that comes in, where it comes from, how much money goes out, and who receives it. Sound money management begins with knowing your costs. Ideally, you will calculate your best estimate of operating cost before you start your business, and build in regular re-evaluations to be sure your estimates are on the mark once your business is underway.

You will want to know your basic cost of doing business — the amount you need to meet just to remain solvent — before you add on products that customers are purchasing from you. If that number is $5,000, and there are 30 days in a month, you must make an average of $167 for each day of the month just to pay your basic expenses. In other words, you do not make any money until you exceed that amount.

Start this process by estimating what it costs you to be in business for one month. Add up fixed costs, such as rent, phones, truck payments, ongoing marketing expenses, and the costs of your equipment spread out over their expected working life. For instance, if your mower costs $1,000 and you expect it to last three eight-month seasons, the mower cost is $41 per month. You can expand that to a 12-month season if you like, for a monthly cost of $28. Do not forget to add in the monthly cost of gas, oil, blades, and general maintenance. Truck, trailer, and other vehicles will be accounted for in the same manner to arrive at their monthly costs.

You will also need to figure employee wages and benefits, and many other costs. An accountant may be able to give you a more detailed approach to determine your costs. That is another benefit of working with a professional expert. The point is to have a realistic method of determining costs so you will know how to factor them into your pricing. Your cost of doing business should always be borne by the customer, not your business.

Taxes

Taxes are a critical factor in sound money management. It is essential to maintain records of all sales and expenses, down to the last penny. The Internal Revenue Service (IRS) will want to see what came in and what went out, especially if your business is ever audited. Clear, up-to-date records show that you are a responsible taxpayer, and help avoid any suspicion of shady policies. Keep your company above board and financially transparent to the parties that have a legal right to see the numbers.

Also recognize that keeping accurate books is not a favor to the government. Your financial records are an ongoing map of your business’s life. If you do not keep accurate and detailed numbers, you will not have any idea how your company is doing financially. You must have the numbers and understand them to know whether you are meeting your goals and have a decent profit margin.

You will want to make sure your federal, state, and local taxes are filed on a timely basis. In some places, you may be required to collect sales tax on products or services, and pay it to the governing body periodically. Verify these requirements by contacting your city or state tax department. They will tell you what licenses or tax filings are necessary, as well as the schedule and appropriate ways to file. Many taxing entities are converting to online tax filings for businesses. You will need to set up a special account on the related government Web site to use online filing and payment methods.

Controlling Costs

Controlling costs is the most challenging aspect of business. You are not in business as entertainment or just to occupy your time. You are in business to make money. You must accomplish two things: find customers who will pay you fairly for your services, and control your business spending to enable you to make a profit. Many small businesses, especially new ones, find that their cash flow is out of control and, even though accounts-receivable are healthy, they do not have the money on hand to pay bills or payroll on time. This is where budgeting and cost controls become critical.

Your company’s cost controls begin with the first item you pay for, whether it is a shovel, a truck, or an accountant. It is to your advantage to shop around, determine the going rate for your target purchase, and look for discounts on that rate. A small accounting firm that specializes in small businesses may offer lower rates than a large firm that demands higher rates to cover the overhead costs of a fancier office and numerous employees. You may also find the service is more personal when dealing with a small law firm or accounting practice.

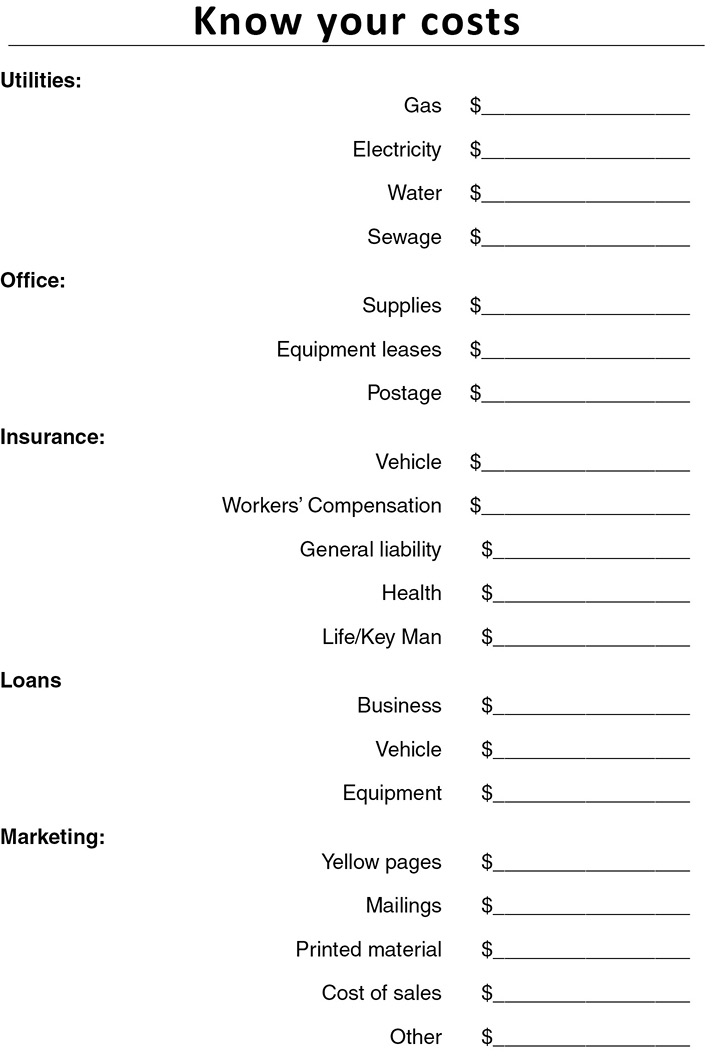

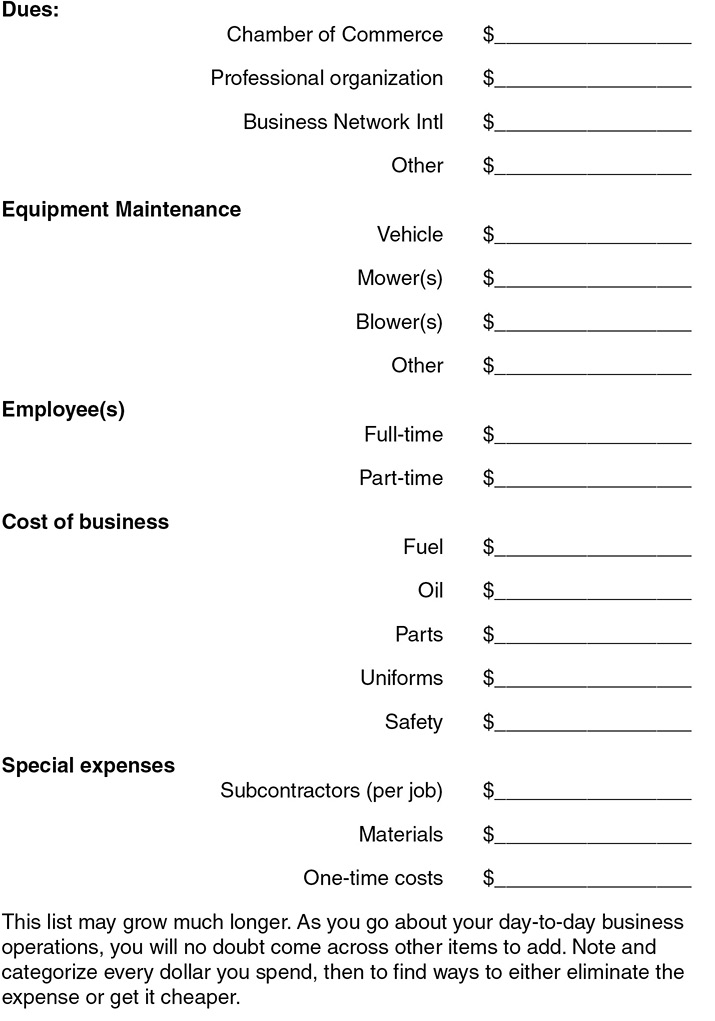

Know your costs

Never blindly accept any price. Ask yourself how any product or service can be obtained for less money. You may not get as low of a price as a chain store or big business, but you do have the ability to move to lower cost suppliers who will deliver the quality you expect. As you put together your monthly, quarterly, and annual budgets and cost estimates, plan to spend as little as possible. When you start out in business, it is wise to stick to the basics and save the luxuries for a later day. It may be tempting to be a bit extravagant here and there: a nice leather chair for your office, a fancier desk, a warehouse for your equipment, but you cannot make money if you are spending it all. Develop a frugal mind-set. Use this form to identify some of your expenses, then see what you may be able to reduce and by how much:

Utilities

With utility deregulation underway in some states, you may be able to negotiate your gas or electric rate by considering alternate suppliers. In the past, a business had to be very large or use vast amounts of energy to bargain for better rates. That is not always true today — some states even offer alternate energy suppliers for residential customers.

There are also numerous ways to reduce your consumption of gas and electricity. It may seem inconsequential to save pennies on your electricity bill, but if you start there and force similar savings on everything you do, in the long run the pennies will add up.

Low-energy light bulbs are good for the environment and use less electricity. There are many brands and options. Take advantage of them. If you have gas heat, make sure the system is working efficiently and has a clean filter. If you are working out of your home and are taking a tax deduction for your office space, be aware that basic cost efficiencies in your home will eventually translate into dollars for you. Take your utility company’s advice and perform an energy audit of your home and office.

Water should not be a major expense at your office or your home, unless you maintain a significant plant inventory and therefore must use copious amounts of water to keep them healthy. If that is the case, look into ways to conserve or recycle water, such as cisterns to capture rainwater.

Office Expenses

The office is a good place to control costs. If you can develop systems and strategies that keep your operating costs down, even a few cents at a time, it will add up in the long run.

Let us take stationery, for example. As a landscaper, nursery owner, or yard maintenance firm, your business does not need the same fancy linen stationery that would be appropriate for a major law firm. Basic paper stock is fine. A professional-looking letterhead with a single color will suffice. That may change if you begin working in high-end neighborhoods where your customers prefer that the services they purchase are top-of-the-line, but right now conserving upfront expenditures is the best strategy. Envelopes, business cards, order forms, contracts, and other forms can look crisp and professional at low cost. Some forms you can print yourself. You may buy office supplies online through a discount supplier, or buy from an office supply warehouse. Buy in bulk if you will use a lot of the product, but avoid oversupply (especially if you have limited storage in your office.

If you lease equipment for such services as credit card processing and postage, shop around for the best deal. Practice your negotiating skills on everything, and with all vendors, whether or not your target product or service is advertised on sale. You may be shocked by the price variations for the same service with the same piece of equipment. Keep in mind that every vendor you deal with has the same goals you have for your business: gaining the highest possible margins. Beware of unnecessary upgrades a company may try to sell, and keep your basic goal of quality in mind while covering the essentials.

Loans

If you borrowed money to go into business, or arranged for a line of credit to purchase equipment or smooth your cash flow, you must budget to make repayments. Seek out the lowest interest rates and the best terms for the money. Fees, closing costs, document processing can raise the cost of borrowing money, so apply the same standards here as you would apply to vendors. If your credit is good, you will discover that most lenders are happy to deal with you and are willing to negotiate. If your credit is not so good, it may mean higher interest rates, increased fees, and special charges. Do your best to improve your credit score by borrowing as little as possible, paying on time and in full. Eventually, if you maintain good financial habits, your credit score will rise and the cost of borrowing money will go down.

Marketing

Marketing is essential to your business’s well being, but it can also be a budget-buster. We will discuss marketing in detail in Chapter 13, but your annual marketing plan is likely to include the telephone book’s yellow pages and similar publications. Avoid the temptation to go for a full-page advertisement, despite what a salesperson may tell you about its benefits. You will want a yellow pages presence, but you do not need to spend big dollars. There can be a significant lag-time for such annual ads. If your business is like most start-ups, you will have a limited marketing budget. It is advisable to spread it around to get the best value. The only marketing that is worthwhile makes you money.

Dues

Your membership in organizations such as the Chamber of Commerce, Business Networking International (BNI), local or national landscaping and nursery associations, and other professional groups will bring you business, so budget money to pay your dues. Plan to spend several hundred dollars per year for these memberships, plus whatever application or initiation fees are involved. Most of these groups will have some period during the year in which they waive these fees as initiatives to increase membership.

If you find that the cost of membership in all of the groups you identify will not fit in your initial budget, determine which one or two of these organizations will be most beneficial and delay joining the others. Talk to other professionals about the groups they have joined and ask them which provide the most leads or customers. In some cases, BNI produces more residential business than the local Chamber of Commerce, but the Chamber ultimately can offer business-to-business contacts that you might otherwise miss.

There is one unavoidable fact about memberships in business groups: You must show up and be active or you will be wasting your money. Membership alone does not bring in business. You must go to the meetings, pass out your business cards, work a booth at the annual fund-raising picnic, volunteer for whatever charity your group supports, and help other members increase their businesses just as you are asking them to help yours. This requires a commitment of time, which can be in short supply for a small business owner.

Equipment maintenance

This is one area where going cheap is a mistake. Your equipment makes you money, so you must be kind to it. That means following manufacturers’ recommendations regarding maintenance and parts replacement. Keep your mowers and other equipment clean, sharp, oiled, and in good working condition. If possible, learn to fix it yourself to save labor costs. Use your downtime to sharpen blades, change oil, inspect spark plugs, and replace cords and other parts. Purchase the highest quality oil at the proper weight and keep a supply in your truck in the event oil levels drop while you are on the job.

Keep a maintenance log and note each repair or replacement of parts and oil. Note the date and frequency of blade sharpening and replacement. Note the cost of maintenance on each piece of equipment. You should be creating a fund to replace equipment when it wears out. When the cost of maintaining any given piece of equipment approaches the cost of replacing it, throw it away and get a new or reconditioned item. Proper maintenance over time will save you money because your equipment will last longer. If you have employees, train them to maintain and repair the equipment they use. If your employee can repair an expensive piece of equipment, this will save you money over time. When an employee performs an otherwise costly repair, give him or her a bonus to show your appreciation. Retention of trained employees is a key way to save money. It saves you from having to find someone else, and spend time and money on training.

Employees

If you choose to hire a full or part-time employee, be aware that the cost can be far higher than you anticipate. Basically, you have two choices to get work done: hire someone who will be employed by your company and whose taxes are deducted by your company, or sign up someone who is an independent contractor — for whom you would file a 1099 income tax form. A person working under a 1099 uses a Federal Tax ID or social security number (if a sole proprietor) and actually operates his/her own business. This type of worker is responsible for his own taxes. Individuals who provide their services to a number of small businesses prefer this arrangement. You may find yourself using this type of worker if all you need is occasional help. You will not be expected to pay benefits or social security deposits for this person, but you must be careful not to refer to independent contractors as “employees,” or to demand that they work specified hours, at specified locations, or be under your control. The IRS is aware that businesses may attempt to use contractors to avoid paying payroll taxes. You want to be sure you do not violate the rules for 1099 work. Ask your accountant for an opinion, or check the following IRS sites:

• www.irs.gov/businesses/small/article/0,,id=99921,00.html This site will help you determine the difference between employees and independent contractors.

• www.irs.gov/businesses/small/article/0,,id=179115,00.html This site will give you an example of an independent contractor’s work and compensation pattern.

An independent contractor is required to choose his or her own times to work. Now, it is possible, even likely, that a potential independent contractor will choose to work the hours you would prefer, but if the contractor wants to take a two-hour lunch break, you are not permitted to punish him or her if the work is done on schedule. If the worker is under your control, he or she is working as an employee, not a contractor. Basically, if you utilize an independent contractor, you have the right to control or direct only the result of the work, not the means and methods of accomplishing the result.

People who work as independent contractors generally charge more per hour than you would pay an employee because they must pay their entire FICA tax as well as many of their own expenses, marketing costs, and so on. Independent contractors generally work for several different firms, juggling their hours during the week to accommodate several clients. The contractor decides who to work for and when, not the businesses who request his service.

If you use an independent contractor, at tax time you will submit an IRS-approved 1099 form to the contractor, and a separate copy sent directly to the IRS, showing the total compensation that person received from you in the previous year. This is done, in part, to keep the contractor honest. Independent contractors are responsible for reporting all earnings, filing a Schedule C to deduct expenses like any other businesses, and paying all required taxes.

If you hire a full-time employee, expenses for vehicles, insurance, and so on shift to you. In addition to base pay, employers pay the social security tax for each employee (half is the employer’s responsibility, the other half is deducted from the employees gross pay), plus Worker’s Compensation Insurance, unemployment benefits, and all the other costs associated with maintaining an employee. These additional costs may amount to 24 percent or more over straight base pay. The IRS employer tax information is available in hard copy or online at www.irs.gov/publications/p15/ar02.html

A full-time employee could easily cost your business more than $40,000 per year. You also have to follow labor department guidelines for overtime and other employee-labor rules that are not germane to contractors. One or more full-time employees on your staff means you are writing paychecks every month, even when business is slow. How much business do you need to justify that kind of expense? It is a basic business assumption that employees make money for their employers, so you will have to do the math to make this work for you. This involves your level of business and profit margin. You must make enough to pay for employee salaries, and a little more to pay for gas, marketing, insurance, and all of the other costs of doing business before you break even. It is easier to add benefits than to take them away, so be cautious as you go through the hiring process. Your first responsibility is to your business. It is no good for anyone if you are forced to let someone go because you do not have the financial resources to honor your employment package.

If you only need part-time help, you may choose to hire part-time workers for your busy season. Unlike independent contractors, part-time employees are under your control. Although you are required by the government to pay taxes on the amount they earn, just as if they were full-timers, you may not be required to provide certain other benefits that are obligations for full-time help. Check with your accountant and the IRS if you are unsure of your financial responsibilities.

Cost of business

As mentioned above, it takes money just to keep the doors open for business. There will be expenses to be paid whether you have any customers or not. Your truck needs fuel and your power equipment needs oil and spark plugs. You have business cards that need to be replaced because you are passing them out to everyone you meet. There are also the costs of contracts, estimate sheets, and letterhead. Some of your tools will break and be replaced. You will need safety goggles, steel-toed boots, and possibly back braces for heavy lifting.

These and more are the day-to-day expenses of operating a business. Major equipment purchases are one-time expenses and their cost can be spread over time as you work with your accountant to categorize major expenditures, but there is no getting around the need for tight budgeting of the everyday costs you will incur. Examine each category and be tough in your budgeting. Develop driving habits that increase your gasoline mileage. Look for ways to save money and confine your spending to what your business needs, not what you want.

Products and materials

There is an old saying: “A poor man can afford only the very best.” Quality is cheaper in the long run. Just as you are advised to obtain the best tools and equipment you can afford, so must you use the best quality materials available. Whether it is concrete, mulch, or topsoil, stay away from the lowest quality. Bad concrete will crack or fall apart. Questionable topsoil may be full of weeds or be unable to grow much of anything. Even worse, it may contain toxic substances. Before you try to control your costs by cutting back on what you pay for products or materials, be sure you are evaluating only reputable vendors who will make sure that the supplies you purchase from them are as advertised. You do not want to ruin your new business by providing your customers with shoddy or harmful products and materials.

Special expenses

Not every expense can be foreseen. Some items are difficult if not impossible to budget in advance. You can, however, apply your normal tight-fisted budgeting philosophy to special projects or other unusual circumstances.

One such circumstance would be a large project for which you are taking on a subcontractor. In this case, let us assume it is a major landscaping project involving stonework and a small pond. You and your employee can handle most of the work yourselves, but you cannot re-grade or re-contour the yard, so you need to contract with someone to do that. You cannot do the intricate stonework required either, so you need to find someone to do that for you too. You have two requirements for each of these prospective subcontractors: first, are they competent enough to do a good job? Second, is their price fair and can you mark it up and still provide the customer with a project cost that is competitive?

As you budget this project, consider the qualifications of your subcontractors and who will be responsible for cost overruns, project upgrades, and other changes. This is another example of the need for detailed contracts that outline all responsibilities and thorough research of your potential partners in any project. Bear in mind that if you are the primary contractor, the customer will turn to you to resolve problems. If your subcontractors have problems getting the job completed in a satisfactory manner, your customer will turn to you for solutions, not to the subcontractor whose poor grading of the yard created drainage problems that flooded the basement.

Problems will arise. It is a natural part of business. Your contracts should assign responsibility for solving problems and spell out who must pay for what. If you have done your research in your search for subcontractors, you will be more confident that the job will be done right. Re-doing a job can sink a budget and ruin an entire business year.

We will assume that you plan to be in business for a long time and will work hard to develop a reputation as a solid landscaping business. You can only do that by building a list of satisfied customers who are eager to refer you to their friends and colleagues. Angry or disappointed homeowners will drag your business down.

Responsible budget management may mean short-term sacrifices for long-term gain. Avoid the temptation of cutting corners to achieve short-term satisfaction. You are in this for the long run so keep your expenses lean, while acknowledging that every day is an investment in your future and the health of your business.

Setting financial targets

While you are still planning to open your business, you should take the time to lay out an initial budget and do some preliminary income forecasting with your banker and accountant. Set a particular target income the first three years at a minimum. Then, work backwards to figure out how many jobs you will need to reach that income level, and what you will do to find those customers. Taking a hard look at your income potential before you start will place you in a realistic position from the beginning, so you will build and maintain a profitable business.

Evaluating your progress

Even though you have set targets and think you know where the money will be coming from, circumstances change. By reevaluating your business on a monthly or quarterly track to start, then going to an annual evaluation, you will focus on what you are doing, where you are heading, and can make the necessary course corrections. Once again, enlist your accountant in this process. He or she may be able to show you how to compare reports on your software accounting program that will give you the detail you need.

Pricing services

Pricing is the key to your success in the landscaping business. You do not need to be the cheapest in town to land customers. The cheapest lawn service or landscaper may use junk equipment, be unreliable, do shoddy work, and have no license or insurance. Many people assume that the cheapest guy offers the worst product; such people deliberately seek out the midrange or higher-priced vendor, because they believe that a higher price automatically means better quality service. So, being the cheapest game in town may actually cost you customers.

There is nothing automatic about the pricing equation. The rates you set will be justified by the service you deliver and the image you are able to build with your customers. Since you are just starting out, you need to establish some basis for determining the rates you will charge. To begin setting prices, do your homework. Learn what your competitors are charging for the services you provide. Collect information from the same general income level of customers or neighborhood that you plan to serve. You may be able to find out what others charge by phoning them, or recruit a friend or two do this for you. When a competing company sends out an estimator to quote the job, you probably would not want the competitor to come to your home to size up the yard.

In addition to asking friends or family members to do some price sleuthing for you, consider asking potential customers. When you pass a homeowner watering the grass of a beautiful yard, stop to ask if he has a lawn service. If the answer is yes, you can say innocently enough, “I bet it is expensive!” At that point, they may offer you the exact amount they pay.

Some business people also find pricing help by asking vendors, industry associations, or by calling landscaping experts in other cities who are not competitors. Keep your eyes and ears open at all times, and whenever there seems to be an opportunity to do a little industry-price investigation, do so. Odds are high that your competitors will not tell you their pricing secrets voluntarily. Think of it as market research. Be sure that specific services and products are identified in your pricing research. For instance, you will want all of the quotes friends and family members obtain from competitors to match the services your company provides: lawn mowing, edging, weeding, mulching, and so on.

Examine the quotes you obtain carefully. Look to see if your competitors are adding extra fees for sloping yards, low-hanging tree limbs, animal residue, long driveways, or other special characteristics of the yards. Are their bids broken down into hourly rates or services? Do they provide specific square footage or yard dimensions? What do their bids look like? Are they contracts or simply agreements to provide yard care? Do their bids have conditions?

By learning the policies of companies in your area, you can adapt them to your business affairs. For example, if most other companies have cancellation or change penalties, your customers will likely accept the same conditions from you. Maybe they have bad-weather policies to provide lawn and garden care within a specified amount of time in the event of rain or other weather condition that prevents service on the day of the week listed in the agreement or contract. You want to come across at least as professional and well organized as your competitors, if not more so. By adhering to the norms of your community, or offering something slightly better, you will fit comfortably into the field of competition.

Once you have collected pricing estimates from three or four competitors, you can safely price your services somewhere in the middle, at a profit margin that is fair to you. Always apply your standard overhead cost into the price you quote for your services.

What will you offer?

Take a look at a well-maintained yard and ask yourself what work went into it. The yard had to be graded to drain properly and to be visually appealing. A certain type of grass was planted, watered, fed, and mowed to a proper height for climate and other conditions. Trees and shrubs were placed and planted and cared for. Flowerbeds were designed, planted, and maintained. Perhaps there is a patio or deck, maybe even a swimming pool or fountain. Is there a stone wall or a fence? Walkways? Are they brick, stone, or gravel? Check all of the details of this and other yards and gardens you admire and ask yourself what aspects of this overall look you are capable of performing. Can you already provide this level of gardening and, perhaps, reach an even higher level?

Unless you have training, experience, and a contractor’s license, you might want to stay away from designing and grading yards. Bulldozing, installing or correcting drainage systems, land contouring, and berm construction (adding mounds of earth) may require special licensing and certainly demands a level of experience and skill that cannot be obtained entirely from book learning. Taking a job as an apprentice for an experienced landscape contractor may set you on the right path for this type of work. However, you may already feel comfortable designing flowerbeds or placing trees and bushes to create a pleasing effect. Again, if you do not have any training in this area, it might be a service you can put off until you obtain the proper credentials. Many community colleges offer landscape design courses, some for certification. Such programs are worth exploring for those in the landscape and garden industry.

The basic services most new outdoor service businesses will offer are lawn care, maintenance, and mulching. Tasks will include mowing, edging, and weeding. Most landscape companies include edging as part of the mowing price; weeding and mulching are separate services and are separately priced. Many beginners in this field offer these basic services while they build their customer base and become more comfortable with the industry and their place within it. As time passes and your customer base builds, you can begin to offer more sophisticated and expensive services such as design and construction of landscape elements. It is typical in the growth of an outdoor service business that the owner starts out with yard maintenance and moves into more challenging and lucrative landscaping over time. While it is nice to have a few $50 lawn customers, it is even nicer to have a few $5,000 landscape jobs, or even $50,000 projects that include substantial design and construction.

The key points are that you should offer the services you are comfortable doing, once you are confident that you can do them well, on time, and make a profit on your work.

You must control costs and be aware of every penny that comes in and goes out. Bidding on a $50,000 job that will cost you $51,000 is not a good business move, even though it looks good on paper from a gross volume point of view. Do not be fooled by the notion that sometimes it is good to lose a little money if you are gaining experience. You cannot take experience to the bank to pay your bills. Get your credentials through training, not through bad business management.