João Fernando Gomes de Oliveira and Jorge Almeida Guimarães

Introduction

The Brazilian Enterprise for Research and Industrial Innovation (EMBRAPII) was founded in 2014 by a group of stakeholders from academia and industry with the goal of accelerating industrial innovation in Brazil. At the time, the National Confederation of Industry (CNI), the federal government, and many of the largest Brazilian companies were concerned about the slow pace of innovation in the country and the perception that investments in research were very risky. It was necessary to build trust in industrial innovation.

Beyond that, there was recognition that Brazilian companies often lacked the necessary knowledge or competencies to bring new products to the market and engage with external partners. Crucially, there was also little support for translational research. The creation of EMBRAPII constituted an attempt to fill these gaps and add greater dynamism to the Brazilian innovation system. Financially supported by CNI, Brazil’s Ministry of Science, Technology, Innovation, and Communications (MCTIC), and the Ministry of Education (MEC), EMBRAPII began operating in 2015, in the midst of a deep economic crisis. Despite this context, the organization has made impressive progress, receiving excellent evaluations from its industrial and research partners. This chapter discusses the main characteristics of the EMBRAPII system, summarizes its track record over the last three years, and explores how the EMBRAPII model might contribute to the mission of building trust in industrial innovation in Brazil.

This chapter is structured as follows: we begin by articulating the importance of collaboration with external partners in applied research. Firms do not have all the knowledge or competencies required to bring an idea to market and often need to engage with research institutes, other companies, and universities to accelerate the innovation process. The initial section thus provides a brief overview of the Brazilian innovation ecosystem and highlights the gaps that EMBRAPII has sought to fill to facilitate research collaborations. Subsequent sections outline the main features of the EMBRAPII system, highlighting the network’s evolution over time and its results to date, and focusing on the ways that EMBRAPII has changed the culture of innovation in Brazil, both in the research organizations, or “units,” that are part of the system and in firms that co-invest with these units in research and development (R&D) activities.

The need for an open approach to industrial innovation

Basic research and applied research are fundamentally different endeavors: the former is open ended and flexible; the latter is problem-driven and goal-oriented. When the objective is to push the limits of human knowledge, or to explain a phenomenon, the process is difficult but relatively flexible. Any novel, validated finding has the potential to be a valuable scientific contribution. In basic research, scientists are the key decision makers. They determine what their own professional mission is, and pursue open-ended sources of funding that allow them to develop their desired line(s) of research. In this sense, researchers and their teams have near exclusive ownership of and responsibility for selecting research topics, defining objectives, and producing results. Changes to a project’s objectives are common in fundamental research, and are considered part of the learning process. Such learning may lead to the identification of new questions and new frontiers to be explored.

Applied research involves a different approach, since the value of the new insights it generates is defined by the ability to solve specific problems. Industry-driven applied research needs to be constantly evaluated for commercial viability. A research finding that advances the frontier of science but has limited commercial relevance may not be examined further. Alternatively, a finding may produce a breakthrough that could “explode” as a market success. The applied research process requires constant evaluation (and potentially, new value propositions) in regard to the utility of what has been discovered. When conducted in collaboration with companies, discussions regarding commercial as well as technical and scientific viability should be merged to decide whether or not to continue supporting a given research program. Innovation needs to occur at a certain pace or speed in the research process, and researchers need to find the critical paths for making a product or business viable within the right marketing time frame. Applied research projects also demand good managerial skills to set and implement deadlines that match with other planning activities. Project changes are inevitable and expected, but must be rapidly delivered.

In this sense, commercially oriented research does not afford researchers the time for a passionate but open-ended pursuit of scientific discovery. Even if driven by a public rather than commercial interest, such research needs to be oriented towards concrete business or social applications in order to be pursued. Combining basic and applied research is arguably the best approach for creating an optimized innovation system. At most research institutions and universities in Brazil, the research agenda is led by an individual researcher’s interest in pushing forward the frontier of science. Only a few institutions work in a more planned fashion and attempt to balance basic and applied research. Our contention is that the Brazilian innovation ecosystem skews too heavily towards basic research at the expense of applied, innovation-oriented research. This lack of balance was one of the reasons for the creation of EMBRAPII, which aims to promote a greater balance between basic and applied R&D at Brazilian research and technology organizations (RTOs).

It is almost impossible for any organization to have all the knowledge and competencies necessary to develop innovative products or processes. Thus, it is often necessary, for a variety of reasons, for organizations to engage with partners in the innovation ecosystem. For example, a company may lack experience with some specific production/development procedures for which little information is available. These procedures may require experienced people who need to be brought in from outside. In other cases, a new product may incorporate elements that require new or deeper knowledge that is not readily available within the firm. Sometimes companies need new competencies to bridge the chasm between product conception and commercialization in areas such as development management and business model design, or to address specific technical issues related to the product use or assistance system, such as maintenance, product updates, or retrofitting.

In fact, new product or process development often requires knowledge or competencies that are not present in the internal team. In these cases, companies can engage in incumbent workforce training to upskill their employees, hire new people with the knowledge or capabilities required, or find a partner able to deliver the needed information or assistance in the right time frame and with the required quality and focus. Companies most often engage external partners in cases where the scope of knowledge they require is not part of the core technology they are developing. For example, a company that is developing a new battery technology needs a minimum set of competencies in electrochemistry and materials, but to bring a new product to market it may need to buy competencies on side topics such as fixtures, controls, etc. The need to engage with external partners is particularly acute in a country like Brazil, where companies spend relatively little on R&D. Fostering partnerships between companies and strong research organizations, such as universities and research institutes, is critical to accelerating innovation processes.

The context for launching EMBRAPII

In Brazil, more often than not, strong research universities with the capacity to contribute to industrial innovation are federally or state funded. Some of these institutions still take an unfavorable view of working with private companies. However, this is changing. Several good engineering research universities are beginning to engage more fruitfully with companies, including the University of São Paulo, the State University of Campinas, the Federal Universities of Rio de Janeiro, Minas Gerais, Rio Grande do Sul, and Pernambuco, and the Rio de Janeiro Catholic University. Despite progress, the formal process of linking universities and companies in joint research activities can be quite complex and unclear. Other chapters in this volume explore the specific challenges associated with university/industry research collaboration in Brazil (see especially chapters by Brito Cruz and by Reynolds and De Negri).

Beyond universities, several public and private research institutes in Brazil are dedicated to supporting industrial innovation. Some of the private non-profit RTOs were created by companies to receive tax incentives in exchange for external R&D spending. These tax incentives are available for companies in sectors like electronics and telecommunications. SENAI (Serviço Nacional de Aprendizagem Industrial, or National Service for Industrial Training), a national network of professional schools maintained by CNI, has also created “innovation institutes” (ISIs), whose mission is to support industrial innovation. Examples of private and non-profit RTOs include the Eldorado Institute, the Lactec Institute, and Center for Research and Development in Telecommunications (CPqD). Examples of SENAI institutes include CIMATEC and SENAI-Polymers, among several others. More information about the RTO landscape in Brazil in general is provided by Zylberberg’s chapter in this volume, while the chapter by Piore and Cardoso examines key SENAI-related institutes in greater depth. Much like universities, public RTOs deal with unclear and complex processes to set up R&D collaborations with companies. They also deal with administrative inefficiencies caused by the need to follow detailed “corruption prevention procedures.” Because of these legal requirements, contracts or purchases can take several months to be approved. Examples of public RTOs include the Institute for Technological Research (IPT) and the National Institute of Technology (INT).

The Brazilian research environment is quite diversified with highly competent scientific research teams in public universities and RTOs. However, the public funding system typically supports only investments in infrastructure, equipment, or scholarships for students. Since most do not have students, RTOs have a hard time getting funding to train their researchers. Several major grant programs in Brazil are specifically focused on innovation:

- The FUNTEC program of the Brazilian National Development Bank (BNDES) provided financing for projects in selected areas of technology innovation. This program is now on hold, and BNDES has not opened calls for new projects.

- A grant program from the Funding Authority for Studies and Projects (FINEP) aims to support research projects by institutions for industrial innovation.

- The São Paulo Research Foundation (FAPESP) has two programs, PIPE and PITE, that are specifically designed to fund projects undertaken by small enterprises and collaborations between research institutions and companies, respectively.

A common feature of these programs is that they fund only projects (not action plans) proposed by researchers. Thus, each submission involves an individual project that must be evaluated, selected, approved, and funded. Additionally, the selection process is often slow and subject to rigid guidelines regarding the scope of projects and the items that can be supported through the conventional public funding process. The main evaluation occurs prior to the beginning of a proposed project. Details of the project schedule and budget are defined at this point. Any eventual changes in budget allocation during the research process – for example, due to new market requirements or new findings – have to be re-evaluated and approved by the funding agencies, leading to a high volume of requests, reviews, authorizations, etc. These processes can be frustrating for companies and research institutions, which hope to move fast to capture markets for a new product or service but instead are faced with bureaucratic delays.

In Brazil, several public programs exist to fund collaborative R&D between research institutions and companies. Companies, however, have often been frustrated by the pace and results of such projects and may hesitate to work with “academic people,” whom they see as being unable to deliver quick results. The inverse also happens: researchers avoid working with companies because, in their view, companies lack understanding of the research process and do not appreciate the time required to conduct good research. Furthermore, academic researchers may find working with private-sector partners to be problematic if companies do not know exactly what they want and change direction too often.

Even when the funding for a research project comes exclusively from industry, most Brazilian public institutions have difficulty dealing with contracts, purchases, payments, rights to intellectual property (IP), etc. This is because private funding, when it flows to a public institution, becomes public money. In many cases, the better approach is for the public institution to handle these processes externally, with private foundation support. Obviously, there is also a contrast between public and industrial R&D cultures. In that context, one solution is to start working together and learning from each other.

Another critical point is that conventional research funding processes in Brazil place greater emphasis on ex ante evaluation. That is, they mainly take into consideration the quality of the research proposal and the scientific competence of the research team. Funders rarely pay attention to the track record of past projects pursued by the same team, and they rarely follow projects as they progress to assess partial results, researchers’ agility in making adjustments, or projects’ potential impacts on society or business. Once a project is approved and receives funding, evaluations normally take the form of technical reports that are submitted by the research team at intervals of a year or more.

Finally, good information is lacking on which research organizations have the skills to be good industrial partners. Companies often perceive that they are taking a risk when selecting a research organization to partner with. Even the Brazilian Lattes system, a comprehensive, government-maintained database that contains information on Brazilian researchers and research institutions, does not track the success of finished R&D projects with industry partners, making it hard for companies to find knowledgeable and efficient research organizations to work with.

Thus, the main challenges to accelerating innovation within firms can be traced to the difficulty of efficiently engaging in a complex and fast-moving process of constant joint evaluation of market opportunities, research priorities, cooperative synergies, and potential solutions. Addressing these challenges requires a focused team, managed by competent people with apt project tools. It also requires collaboration with trusted and reliable research partners. The difficulty of identifying such partners is one of the main reasons for a poor track record of innovation performance, among Brazilian firms and in the Brazilian economy as a whole.

CNI, MCTIC, and MEC came together to launch EMBRAPII in an effort to meet the need for highly competent and well-managed research organizations that could act as reliable and effective partners with industry to promote innovation. To that end, EMBRAPII devised a new process for selecting and funding research projects and for following up with organizations to confirm their ability to develop and quickly produce high-quality research with innovative industrial applications. The next section of this chapter delves into the EMBRAPII model, focusing particularly on the use of select, trained units to ensure sound project management and effective deployment of resources in support of innovation.

The EMBRAPII “system”

Main features

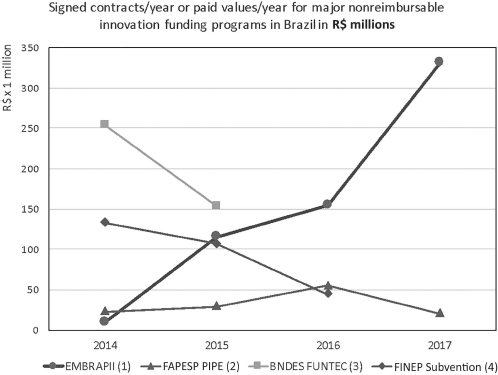

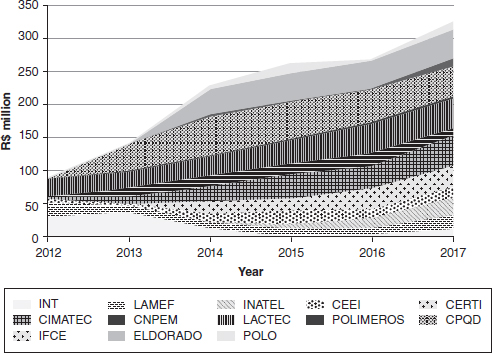

Figure 10.1 shows the progress of the EMBRAPII system – in funds provided (or contracts signed) for nonreimbursable innovation programs – since its creation in 2014. The figure also shows funds provided under programs specifically sponsored by FINEP, BNDES, and FAPESP. EMBRAPII was first implemented, and its first partner institutions were selected, in 2014. EMBRAPII research units started operating in 2015 – thus it took only three years for EMBRAPII to become the fastest and most consistently growing R&D program in Brazil.

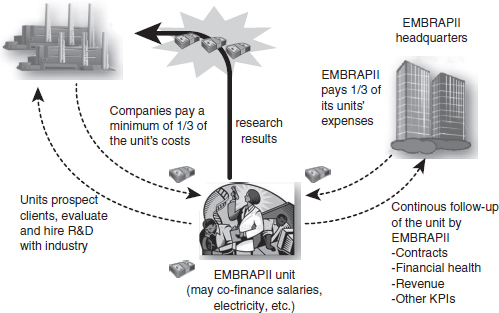

It is important to point out that EMBRAPII provides the smallest share of the funds for R&D projects with an industrial co-sponsor – typically only 33% of the total cost of its units. By contrast, FAPESP PIPE pays 100% of the project, while FINEP and FUNTEC cover around 80% of the project and thus require only a small company investment. Figure 10.1 shows the total invested value of EMBRAPII projects; of this total, EMBRAPII provides roughly one-third.

Figure 10.1 reflects the only public information available, but it is known that funding for the FINEP and BNDES FUNTEC programs has declined considerably over the last three years. Neither FINEP Subvention nor BNDES FUNTEC has opened calls for proposals since 2016. The FAPESP PIPE program remains active and has been stable for almost 20 years, since its creation. PIPE is dedicated to small companies and startups. For older programs, funds paid are close to funds contracted, since these programs are in steady state.

The fast growth illustrated by Figure 10.1 raises the question of how an innovation funding system could grow so rapidly during one of Brazil’s deepest economic crises. Several characteristics of the EMBRAPII system and of individual EMBRAPII units help to provide an answer:

- Planning – To be an EMBRAPII unit, research organizations must present a six-year action plan that clearly identifies competencies, research focus, market potential for research results, possible partners, excellence in management, and plans for expanding research projects with companies.

- Agility – Once approved as an EMBRAPII unit, the research organization has autonomy to negotiate contracts with companies, disburse funds, and change research scope without prior authorization by EMBRAPII headquarters.

- Emphasis on growth – The approval of a new EMBRAPII unit requires a track record demonstrating capacity to attract industrial funding (minimum of one-third of the unit’s total cost) and support from other institutions or sources. The expectation is that industry investment over a three-year period should exceed R$5 million. EMBRAPII expects continued growth in its R&D portfolio due to its agile funding and evaluation system.

- Attention to market prospects – EMBRAPII units are responsible for visiting potential partner companies and offering research proposals to support their innovation processes. Unit performance takes into account number of visits, proposals sent, contracts signed, and the relationship among these three activities. Numerous visits but few contracts suggest a lack of knowledge about the market.

- Budget flexibility – EMBRAPII pays a maximum of one-third of a unit’s operational costs to develop industrial projects. The funds are deposited in advance in units’ accounts so that they can be accessed quickly to launch projects with companies. Individual EMBRAPII units decide on the level of cost sharing to be applied to different projects or contracts; EMBRAPII headquarters only checks that contract terms are reasonable and to ensure that the EMBRAPII contribution does not exceed 33% of total funds contracted overall. This flexibility means that EMBRAPII can provide half the funding for a specific project that needs more public support, while providing only a quarter of the funding for another project that is able to attract more industry support. At the unit level, however, EMBRAPII’s share is limited to one-third.

- Ability to leverage existing infrastructure – EMBRAPII units are existing institutes or laboratories that already have their own developed infrastructure, recognized technological identity, and the ability to provide support to a relevant group of companies. Units can operate as public or private entities provided they have the world-class technological competencies to help develop competitive innovations for the global market. Funding for major investments in equipment is generally expected to come from other sources, though contracts with companies can include some budget for minor infrastructure investments.

- Management excellence – The EMBRAPII system includes a specific focus on promoting excellence in R&D management for innovation. To that end, EMBRAPII has developed a manual that outlines best practices for prospecting R&D opportunities with companies, negotiating IP, and managing contracts. EMBRAPII also sponsors meetings to showcase best practices in R&D project administration and management.

- Ability to pay salaries – Unlike other funding programs, most of EMBRAPII’s financial support goes to human resources and salaries. This allows EMBRAPII units to hire and maintain teams of competent people to deliver research support.

- Continuous evaluation – EMBRAPII units have to agree to continuously provide detailed technical and project management information to a web-based project management system. This allows EMBRAPII headquarters to closely track proposals sent to clients and the performance of projects in progress. Several technical committees, comprising leading researchers from academia and industry who serve as EMBRAPII consultants, monitor the quality of the research being developed by EMBRAPII units.

- Transparency – The selection and monitoring of EMBRAPII units is handled in a clear and transparent fashion, with readily available information and public access to non-proprietary data.

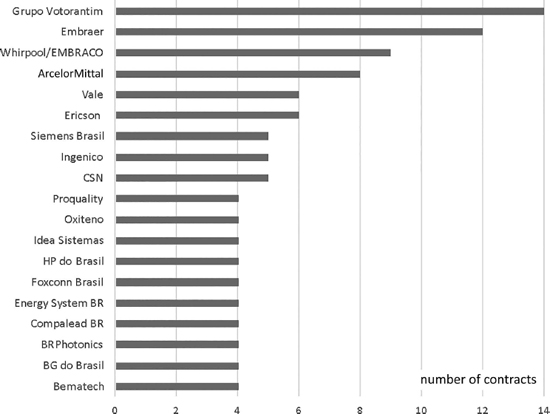

The best measure of customer satisfaction is whether the client returns. This maxim applies here also – thus, it is instructive to see if partner companies pursue new contracts after a first experience with EMBRAPII. Figure 10.2 shows companies that have engaged in four or more EMBRAPII projects. Good examples are the Votorantim Group and Embraer, which have entered into 14 and 12 different contracts, respectively, with various EMBRAPII units. Both companies have stated that EMBRAPII has created a new paradigm for public/private cooperation in technology R&D in Brazil.

It is important to note that this number of contracts occurred in just the three years that EMBRAPII has been operating. In the case of Votorantim and Embraer, this represents a pace of three or more contracts per year.

Many other companies have negotiated multiple contracts with an EMBRAPII unit. Specifically, 14 companies have undertaken three or more contracts, and 29 companies have undertaken at least two contracts.

A notable development to date has been Embraer’s decision to establish a new research center in Florianópolis (in the south of Brazil) in 2017. This commitment was mostly motivated by a large contract with one of EMBRAPII’s Florianópolis units – Fundação CERTI – to pursue research in avionics.

Several articles in major Brazilian news outlets have reported on the satisfaction of companies using the EMBRAPII system and on the fast growth of demand for EMBRAPII support.1 Most of these articles have commented positively on the responsiveness of EMBRAPII units and on the quality of the research they are producing.

A growing network

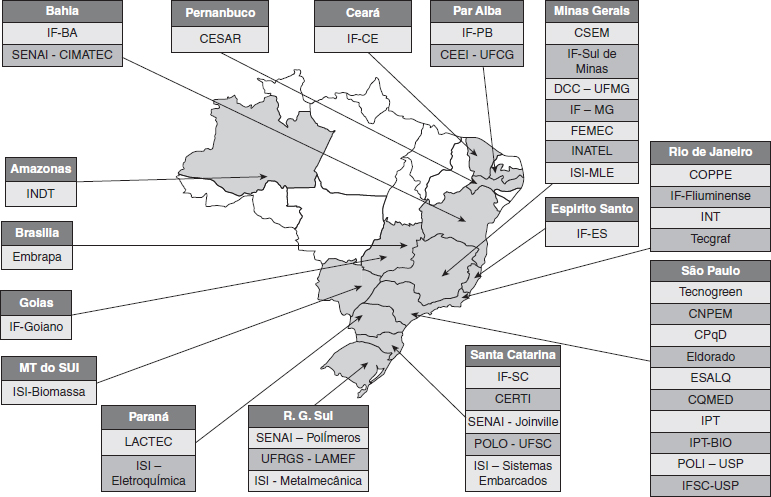

EMBRAPII has already issued five calls for additional research organizations to become part of its system. New additions will join the system in one of two formats: EMBRAPII “units” (the main program) and EMBRAPII “hubs,” which are being formed in cooperation with MEC for the Federal Technological Institutes. Figure 10.3 shows the geographic distribution of EMBRAPII’s 42 currently active units and hubs. Some of the research organizations shown in Figure 10.3 were recently added, at the end of 2017, and are still starting their activities.

Institutional structure and relationship to federal government

EMBRAPII is a non-profit organization founded by researchers, scientists, and industry representatives.2 Its aim is to accelerate innovation in Brazil. Brazilian federal law allows non-profit organizations to be hired to provide services or conduct research to advance innovation culture and other public interests. Non-profit organizations are required by law to follow certain guidelines and rules and must be recognized by the president of Brazil as an “organização social” (social organization) or just “OS.”

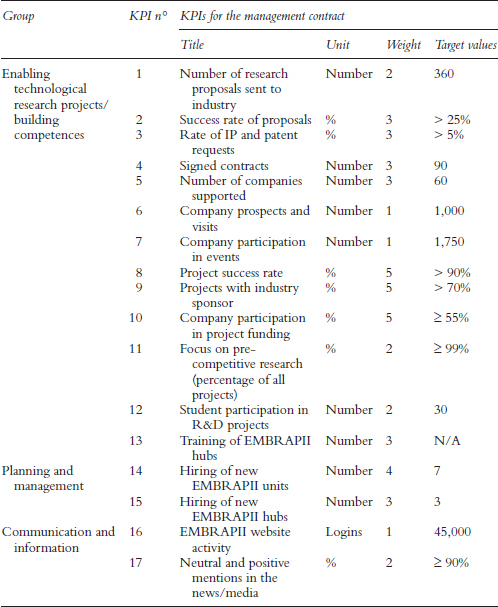

EMBRAPII was recognized as an OS and hired by MCTIC and MEC to plan and execute research programs dedicated to innovation in industry. This type of contract, called a “management contract,” includes a set of performance indicators that are negotiated and evaluated annually by a specially designated, independent committee of experts. The committee monitors EMBRAPII twice per year.

Table 10.1 shows the key performance indicators (KPIs) used to evaluate EMBRAPII. The first group of KPIs relates to the process of enabling research projects and building competencies. KPIs 1–12 target a mix of process indicators and expected results. Examples of process indicators include company prospects and visits (KPI 6), number of research proposals (KPI 1), success rate of proposals (KPI 2), and organization and participation in events (KPI 7). KPIs 2, 4, 5, 8, 9, 10, and 11 focus on results.

The second group of KPIs includes indicators of success in planning and management and focuses on the number of new units or hubs that join the EMBRAPII network. The third group of indicators focuses on communications.

The link between performance indicators and financial support

The performance expectations and values that apply to EMBRAPII as a whole also apply to its individual research units. Thus, the management team at EMBRAPII headquarters has an obligation to ensure that its units deliver desired results and can be properly evaluated by the government’s expert committee. Accordingly, contracts between EMBRAPII and its research units include a list of performance indicators that specify each unit’s performance targets for the next six years.

This represents a significant change in the country’s innovation culture, since Brazilian R&D institutions are not used to planning for a six-year period. Also, planning at the institutional level has generally been lacking at Brazilian universities and research labs, which have more often operated according to a collection of individual plans from researchers with little interaction between teams and limited emphasis on cooperation to reach well defined objectives.

When EMBRAPII issues a call for new research units (each of these calls to date has elicited more than 100 proposals), responding institutions are induced to undertake a planning effort to prepare the required action plans. After three years, this has already changed the planning culture at EMBRAPII research units and led to a greater focus on several specific aspects of their operations:

- Planning the connection with customers – Units must show how they plan to approach industrial partners in visits, meetings, and events. This is a new process for most research institutions, which often displayed a passive attitude regarding their relationships with industry in the past.

- Learning industry’s needs – Units also have to plan for the number of proposals they intend to present to industry and the rate of approval they expect. To support this type of planning, units must have confidence that their proposals are relevant to the businesses they are targeting. Simply visiting companies is not enough – units must develop a relevant agenda for each visit in order to put forward research proposals that have a realistic likelihood of success.

- Managing performance – EMBRAPII headquarters tracks the amount of time that elapses between when an EMBRAPII unit sends a proposal and when a contract is signed. The expectation is that this process should take about one month. Longer processes have to be explained, and units have to show that they are taking steps to minimize bureaucratic hurdles.

- Planning industrial revenue – EMBRAPII units have to plan for number of projects and expected industrial revenues from those projects for a period of six years. Revenue shortfalls could jeopardize the contract between EMBRAPII and the federal government, so headquarter officers are quite attentive to these indicators.

- Linking results to consequences – EMBRAPII can cancel its contracts with units if units do not deliver on minimum expectations for processes or results. Two units have so far had their financial support canceled due to a lack of projects and contracts.

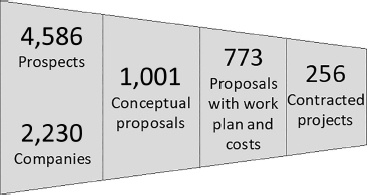

In the past, there was a culture in the Brazilian research environment of maximizing funding requests for projects with the expectation that “the government will make cuts anyway.” This has changed in the EMBRAPII system. Since the organization’s public funding is tied to the amount of funds it expects to receive from industry, maximizing proposed budgets means an obligation to get more contracts and funding from private companies. This in turn means more visits, more proposals, and more work to do. Figure 10.4 shows the volume of company prospects, proposals, and contracted projects amassed by the EMBRAPII system as a whole since 2015.

Based on EMBRAPII’s first three years of experience, every 20 visits with prospective clients may yield one contract with a company. This means that units that propose to increase their project budgets are effectively proposing to increase their outreach to prospective clients 20-fold. Units that overcommit risk underperforming and triggering a canceled contract. Meanwhile, the six-year planning time frame provides a strong incentive to deliver results and sign contracts with companies in a timely fashion.

Contracts between EMBRAPII and its units may be canceled only after EMBRAPII requests a re-planning and subsequent evaluation period. Several units have had to re-plan their activities and are now under evaluation. This represents an enormous change in the research management culture in Brazil, which featured little or nonexistent follow-up or continuous progress evaluation in the past.

Selection and operation of EMBRAPII units

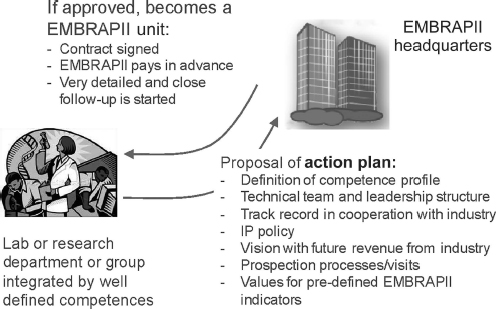

Figure 10.5 shows a simple representation of the selection and hiring process for EMBRAPII units or hubs. It starts with the submission of an action plan by candidate organizations (labs, research departments, or groups) under the rules of an EMBRAPII call for proposals.

Action plan proposals should identify the competencies, infrastructure, research team, and IP policy of the submitting organization and, most important, a market evaluation and a description of the research and innovation revenues to be developed in the next six years. Proposals must also demonstrate the submitting organization’s track record and show a minimum level of industrial research revenue in the last three years. This criterion is designed to reduce the risk that public funds will be expended on projects that fail to meet expectations. Submitting organizations must also complete a table of KPIs for each year of the six-year period, indicating performance targets for number of industrial visits, proposals, contracts, industrial revenue, etc.

After a pre-selection process conducted by EMBRAPII’s technical staff – in which, for example, formal aspects of the proposal and the declared track record of the submitting organization are checked – a meeting is organized with consultants from academia, government, and industry. The committee selects the best proposals to continue to the next phase of the selection process, in which consultants and EMBRAPII directors and staff visit candidate organizations. During these visits, the organization’s recent revenues and the quality of its research contracts are evaluated. The action plan is discussed, and EMBRAPII’s staff and consultants may propose modifications.

A final evaluation round is made after the visits, and a proposal for new EMBRAPII units is submitted to the EMBRAPII board for approval. Once contracts are signed, units begin operating as part of the EMBRAPII system, as pictured in Figure 10.6.

EMBRAPII units prospect for research projects with industry partners using a similar process of market evaluation, visits, meetings, events, proposals, contracts, etc. As noted previously, units have immediate access to EMBRAPII funds (up to a specified fraction of their overall budget) to begin undertaking these outreach activities. The process of continuous follow-up and evaluation also starts at this point.

Follow-up, continuous performance evaluation, and excellence in operation

One of the main features of the EMBRAPII system is that units are allowed to decide on research content, budget terms, contract conditions, IP distribution, etc. for individual projects. All project aspects are periodically monitored by EMBRAPII staff and consultants with a particular focus on project quality, unit competence, budget adequacy, management efficiency, and the satisfaction of industry partners. Potential problems are flagged for correction; repeated performance failures can lead to contract cancelation and exclusion from the system. This type of follow-up typically occurs on a monthly basis.

Continuous ex-post evaluation inverts the conventional system for research funding and is designed to foster faster processes and accountability.

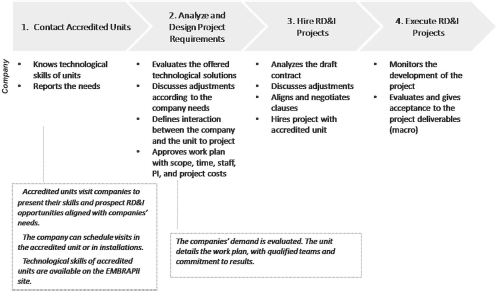

After three years of operation the EMBRAPII system is becoming popular among companies interested in R&D and innovation. Companies can access the system by identifying which EMBRAPII units offer a competence profile that fits their R&D needs. This can be done through the EMBRAPII website (www.embrapii.org.br) or by contacting EMBRAPII staff and asking for a visit. The process from industry’s perspective is detailed in Figure 10.7.

EMBRAPII headquarters works continuously with its units to develop their competencies through training programs and meetings where best practices are shared. EMBRAPII also offers manuals, such as the Operation Excellence System (OES), which is similar to an industrial excellence standard such as ISO 9000, but was specifically developed for EMBRAPII research units. The OES manuals contain examples of business models and references that research units can use to increase the uniformity and performance of their management systems/processes. The models are based on standard functions and responsibilities related to basic activities, such as prospecting, institutional learning, and management. The idea is that EMBRAPII units will have standard governance structures – with positions such as unit general director, research director, etc., and related responsibilities (for example, the marketing manager would be in charge of the prospecting agenda). OES was developed by experts from the University of São Paulo; please see Ronsom and Amaral (2017) and Ronsom (2015) for its main characteristics and objectives.

Main achievements

Increasing R&D in partnership with industry in Brazil

Table 10.2 shows data on the first years of the EMBRAPII system. With a total of 386 contracts involving 266 companies and R$612,300,000 committed, these results show that there was demand for greater public/private R&D cooperation that was not being met by previous funding programs. Even with a match requirement that limits EMBRAPII’s share to one-third of total costs, the program is growing faster than other programs that covered as much as 50–100% of research expenses. Based on interviews with industry leaders in R&D (program clients, in other words), several features of the EMBRAPII system account for this success:

- A proactive approach – EMBRAPII’s units have to learn about the market, relate their competence to client needs, visit companies, and offer R&D support.

- Agility – EMBRAPII is capable of signing a contract in a matter of days (some contracts are signed in 20 days), and funding is immediately available to be deployed by its units.

- Low risk – Due to a rigorous selection process that includes evaluation of track record, EMBRAPII projects have a high success rate, which increases industry confidence in the program.

- Quality work with flexibility – EMBRAPII has the best industrially oriented labs in Brazil. Its units deliver high-quality research and are quite rigorous with deadlines. Project objectives are constantly reviewed, and needed changes are implemented rapidly.

- Funding capacity – Figure 10.8 shows the number of researchers that are being paid through EMBRAPII contracts. Since EMBRAPII is the only public R&D funding system that can pay salaries in Brazil and since most R&D institutions have difficulty hiring research personnel, the expectation from the outset was that the program would significantly expand Brazil’s research capacities. At present, EMBRAPII projects are paying the salaries of about 1,600 researchers. By comparison, Germany’s Fraunhofer system employed about 24,000 researchers after 60 years in operation. EMBRAPII has been in full operation for a total of three years (following an initial three-year pilot phase with just three units), thus it is growing at a similar rate to the German program.

Impact on partner institutions’ profile, culture, and R&D revenues

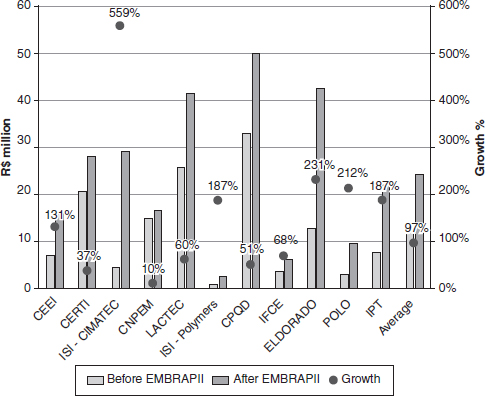

Figure 10.9 shows the annual value of contracts for industrial R&D for 13 selected EMBRAPII units that operated from July 2014 (the start of EMBRAPII system) to May 2016. Newer units are not included because they have had less time to operate. The figure shows that most of the 13 units experienced significant growth in R&D revenues during their years as part of the EMBRAPII system.

Figure 10.10 provides a clearer picture of the impact of the EMBRAPII system on the industrial R&D capacity of its first units, showing average annual R&D contracts and percent growth in R&D contracts before (two-year average) and after (two-year average) joining the EMBRAPII system. Of the 13 units included in Figure 10.9, only two – the National Institute of Technology (INT) and the Physical Metallurgy Laboratory (LAMEF) – failed to show growth. In fact, these two institutions experienced a reduction in their combined R&D revenues of about 17% over the period studied. Both units are very focused in the oil exploration technology area, which explains their experience. Up to 2013, this industry had generated a great number of contracts – mostly related to investments in equipment and infrastructure – using funds from the National Agency for Oil (ANP), hired at the request of Petrobras. INT and LAMEF already had big contracts in 2012 and 2013. Today, funding from ANP is not available as before, and the EMBRAPII commitment has helped these institutions to, at least, reduce the impact of the Petrobras crisis on their revenues.

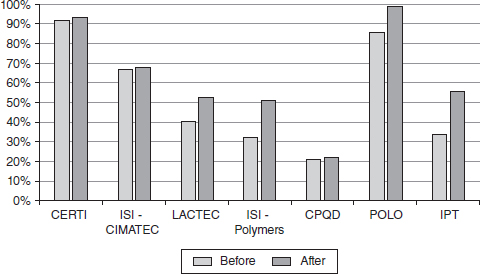

Besides increasing the R&D capacity of its partner institutions, EMPRAPII has also had an influence on their profile and culture. Some of the EMBRAPII units included in Figure 10.8 also provide technology services (e.g., product testing, calibration, etc.). Revenue from such services is normally more stable; it is also often easier to get costumers/clients for these services. By contrast, many public R&D institutions have had difficulty maintaining a large share of their total revenues from R&D contracts. Figure 10.11 shows R&D contracts as a percentage of total revenues for those EMBRAPII units that offered information on their service revenues, before and after entering the EMBRAPII system. (Note that the numbers shown were generated by averaging available financial information for the years before and after joining EMBRAPII. Because R&D revenue grew so quickly for some of the organizations over the three years of participation in EMBRAPII, this averaging may somewhat mask the magnitude of the actual change that has occurred.) Several units (e.g., IPT, ISI – Polymers, LACTEC, and POLO) show a fairly dramatic increase in R&D activity as a percentage of their overall revenues after entering the EMBRAPII system.

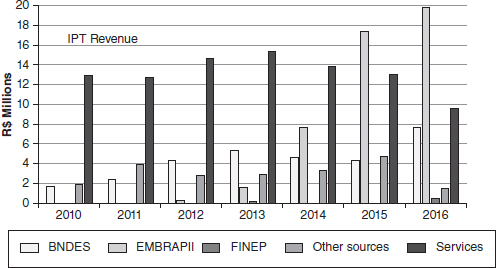

For a deeper analysis, Figure 10.12 examines EMBRAPII’s impact on the revenues of the Institute for Technological Research (IPT), one of the first three EMBRAPII units. EMBRAPII is only part of IPT’s operation. The institute employs about 1,000 people in different areas of biology, chemistry, computer science, engineering, geology, materials science, nanotechnology, and metrology. Only the materials science and nanotechnology areas of IPT’s operation have participated in EMBRAPII since the launch of the EMBRAPII system. Other research units at IPT were historically strong users of BNDES FUNTEC.

Today IPT is developing research in quite innovative areas. For example, it is working in nanocosmetics with major Brazilian cosmetic companies, developing new painting and coating technologies to address special corrosion resistance requirements in deep-sea oil exploration, and exploring new processes for the local production of rare-earth magnets, among other topics. In the past, IPT was mainly focused on testing innovations that were developed by others. As part of the EMBRAPII framework, IPT is itself proposing product and process concepts to be developed in partnership with industry, and is integrating development and testing in a much more efficient manner.

In the area of materials, to give another example. IPT has excellent infrastructure for developing steel alloys that can be used in special metallurgical applications. This was one area where joint R&D between IPT and industry was already moving at a good pace, but IPT’s role was limited to a more traditional scope. Since IPT became an EMBRAPII unit, it has been able to respond more effectively to industry’s R&D demands and deploy its research infrastructure and people in other areas of materials science. The same team is now developing new niobium-titanium-zirconia alloys that can be applied in 3D printing for human implants.5 The research team is exploring a wider set of R&D challenges and potential applications in health and, using new additive processing capabilities, is leveraging cooperation across different areas (rheology, 3D printing, biology, etc.) to achieve results. This shift occurred when more intense cooperation with industry in strategic areas became part of IPT’s institutional mission, as required under its EMBRAPII action plan. EMBRAPII projects are now the main source of IPT’s revenue and have fostered a planning culture that is spreading to other parts of the institution. In sum, IPT became more competent in research and increased its potential to support industrial innovation as a result of its association with EMBRAPII.

As can be observed in Figure 10.12, IPT’s main revenues used to come from technology services, not R&D. With the EMBRAPII contract, IPT created a different planning culture – one that is more focused on research, has clearer objectives, and is full of internal joint projects looking at bigger and multidisciplinary problems.

As already noted, a focus on continuous evaluation and on consequences for poor performance is an important feature of the EMBRAPII system. This fosters a culture of accountability that affects other aspects of participating units’ activities. Another relevant feature of the program is quick access to funds even before EMBRAPII units have identified individual R&D projects. This combination of flexibility and fast response is valued by researchers and by industry partners. By way of contrasting EMBRAPII to previous funding programs, the FUNTEC/FAPESP/Embraer contract for IPT’s light structures R&D program took more than two years to be evaluated and signed by all partners. An additional three months were required to access the funds. EMBRAPII’s contract for a similar project with Embraer took less than two months to be get underway, with funds that were already in EMBRAPII’s account. Some EMBRAPII contracts are signed in a matter of three weeks from initial discussion. Under the older BNDES FUNTEC program, changes to contracts also entailed considerable bureaucracy and time. In the EMBRAPII system, project scope is negotiated between the company and the EMBRAPII unit, and changes can be made more efficiently.

As shown in Figure 10.11, an increase in revenues from R&D has occurred at other EMBRAPII units where a new R&D culture is likewise emerging. This is among the most important impacts of the EMBRAPII program. As a result, Brazilian research institutions are planning more activities targeted to industry, and their revenues from these activities are growing quite quickly.

The outlook for EMBRAPII

The main concern about EMBRAPII’s future concerns its funding stability. Since the system works with advance deposits and since government payments can be slow, EMBRAPII needs a reserve fund to be able to support rapid system growth. However, the existence of a reserve fund during Brazil’s current period of fiscal crisis can be wrongly perceived by the federal government as justifying “low priority” for payment. So far the government has continued to fund EMBRAPII, but if this changes and affects deposits to EMBRAPII units’ accounts, it could be quite damaging to the program’s credibility.

Conclusion

EMBRAPII was founded to build a new, more effective system for supporting innovation in Brazil through R&D partnerships with industry. It was launched during a challenging period of economic crisis and lack of trust between industry and academia with respect to joint research work. This chapter has attempted to evaluate the EMBRAPII experience and to draw lessons from its main results and characteristics, which include a greater emphasis on efficiency, responsiveness, flexibility, planning and accountability, performance indicators, transparency, and reliability.

Worth noting, as an indicator of EMBRAPII’s efficiency, is the fact that its entire headquarters staff is composed of only 25 people; moreover, all headquarters expenses are covered by financial revenues from the system’s reserve fund.

Overall, EMBRAPII has achieved impressive results after only three years of effective operation, and there are strong grounds for concluding that it is having a significant positive impact on Brazil’s innovation ecosystem. Other critical aspects of that ecosystem, however, still need to be addressed. Though not the subject of this chapter, further diagnosis of Brazil’s innovation challenges and of opportunities to use legal and other mechanisms to overcome these challenges will help guarantee EMBRAPII’s success, and the success of future innovation efforts in Brazil more broadly.

Notes

References

8° Termo Aditivo EMBRAPII Contrato de Gestão. (2017). Available from: http://embrapii.org.br/wp-content/uploads/2016/01/embrapii_8o_termo_aditivo_do_contrato_de_gestao.pdf.

Associados fundadores da EMBRAPII. (2016). Available from: http://embrapii.org.br/wp-content/uploads/2016/01/embrapii_membros-fundadores-da-assembleia-geral-ordinaria-da-embrapii.pdf.

IPT Annual Report. (2017). Available from: www.ipt.br/download.php?filename=1544-Relatorio_Anual_2016.pdf.

Pipe 20 anos. (2017). Fapesp. Available from: www.fapesp.br/publicacoes/2017/pipe20anos.pdf.

Prestação de contas 2016. (2016). Finep. Available from: www.finep.gov.br/acesso-a-informacao-externo/transparencia/114-relatorios/relatorios-de-gestao/5470-prestacao-de-contas-2016.

Relatório de Execução do Contrato de Gestão 1o semester. (2017). EMBRAPII, 2017. Available from: http://embrapii.org.br/wp-content/uploads/2017/11/embrapii_relatorio-do-1o-semestre-de-2017-cacg.pdf.

Ronsom, S. (2015). Proposta de padrão para sistema de gestão da inovação: a experiência EMBRAPII para a melhoria de um Sistema Nacional de Inovação. Master’s degree dissertation, USP, São Carlos. Available from: www.teses.usp.br/teses/disponiveis/18/18156/tde-24092015-090652/pt-br.php.

Ronsom, S., & Amaral, D.C. (2017, July/September). Gestão & Produção 24(3). São Carlos. Available from: http://dx.doi.org/10.1590/0104-530x2512-16.

Souza, E., et al. (2016, June). Avaliação do BNDES Funtec: uma análise sistêmica de efetividade. Revista do BNDES 45: 67–97.