Figure 13.1 Electricity supply in Brazil, by source, in 2016

Source: EPE (2017).

Renewable energy has grown significantly relative to traditional sources of energy in recent decades. According to the International Energy Agency (IEA), the proportion of total primary energy supply contributed by renewable sources has been rising since 1990. Countries around the world have invested heavily to increase renewable energy production for a variety of reasons, including mitigating climate change, bolstering domestic energy security, and improving human health, among others. Moreover, several countries have enacted policies and programs aimed at developing the technologies and manufacturing industries necessary to create energy from renewable sources (Lewis & Wiser, 2007). This chapter focuses on Brazil’s effort to remain a leader in the production and utilization of energy from renewable sources, and makes the case for a forward-looking innovation agenda aimed at strengthening second-generation (2G) ethanol production capacity.

Few policies have been as successful as Brazil’s Proálcool program, which began in the 1970s in response to the first oil crisis, and quickly transformed Brazil into one of the largest ethanol producers and exporters in the world (Goldemberg, 2007). The rapid expansion of the country’s ethanol production capacity necessitated complementary efforts to drive demand, which came in the form of steadily increasing minimum requirements for ethanol blending. The program led to various downstream innovations such as the flex fuel engine, which utilizes sensors and software to optimize engine performance when variable blends of gasoline and ethanol – including up to 100% ethanol – are used (Nascimento et al., 2009). The Proálcool program of the 1970s is seen as one of the few cases in Brazil’s history where the country as a whole adopted a mission-oriented approach to technology development, employing big science to solve a big problem (Mazzucato, 2011).

Although the program is largely viewed as a success, there have been concerns through the years about the cost of subsidizing the domestic ethanol industry for such an extended period (see chapter by Limoeiro and Schneider in this volume), as well as concerns about the program’s environmental and social aspects (Goldemberg et al., 2008; Macedo, 2005; Martinelli & Filoso, 2008). Critiques notwithstanding, Proálcool is largely perceived as a success because it built on the country’s comparative advantage in the selection, modification, and cultivation of sugarcane, forged over the course of more than four centuries and embedded in institutions like the Agronomic Institute of Campinas (IAC) and the Brazilian Agricultural Research Corporation (Embrapa). Furthermore, the program was a product of control and necessity: it was created during the military dictatorship, in large part because the world oil crisis of 1973 had raised the price of imported oil dramatically, consuming half the country’s hard currency from exports (Goldemberg, 2007).

Although circumstances today are certainly different than they were in the 1970s, many have called for a return to the same degree of urgency and focus to revitalize Brazil’s ailing ethanol industry and forge ahead in the development of 2G ethanol. This chapter examines the opportunities and challenges associated with crafting and enacting a new mission-oriented agenda for 2G ethanol in Brazil. We begin by providing an overview of Brazil’s existing energy system, outlining the country’s strength in the production of several forms of renewable energy and briefly commenting on aspects of technology development in this context. We conclude by outlining a mission-oriented agenda for developing 2G ethanol that can continue to build on Brazil’s historical strength in the area of ethanol production and low-carbon technology.

The Brazilian energy system is large, diversified, and integrated. It brings together thousands of production units, converting different forms of primary energy into energy carriers that are suitable for end use and that are made available to millions of consumers through large systems of transportation, storage, and distribution, covering virtually the entire national territory. As the IEA has pointed out, Brazil’s energy sector has two distinguishing features: “almost all Brazilian households now have access to electricity, and the expansion of the energy system to support a rapidly growing economy has been achieved, to a remarkable degree, thanks to renewable energy resources” (IEA, 2013).

Indeed, the country has an extensive and diversified base of renewable energy resources. Hydropower has historically been the primary source of electricity supply, and fossil fuels have represented a relatively small share of power generation capacity. Figure 13.1 depicts the contribution of different energy sources to Brazil’s electricity supply, which totaled 620 terawatt-hours (TWh) in 2016. In this figure, biomass includes firewood, sugarcane bagasse, black-liquor, and other primary sources and hydro includes electricity imports, essentially generated by hydropower plants in neighboring countries. Although they make up a negligible portion of Brazil’s total energy supply today, growth in wind and solar power has outpaced growth in a number of traditional energy sources. In 2016, wind and solar power plants were responsible for 26.3% of the increase in installed generating capacity in the national grid (EPE, 2017).

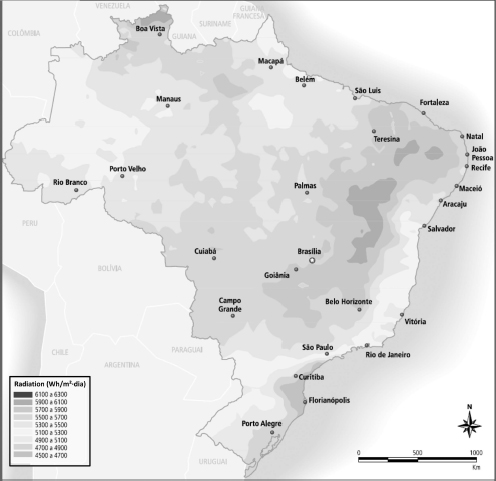

The solar energy potential indicated in Figure 13.2 is considered “world class,” especially in the northeastern region of Brazil. In the country as a whole, electricity-generating systems using photovoltaic cells have expanded notably in recent years, deployed by independent power producers or self-producers, mostly connected to the grid. Although it is still the case that the direct conversion of solar energy represents a small contribution to the Brazilian electricity matrix at present, projections indicate that the solar contribution should reach more than 4% of national demand by 2024 and more than 8% by 2030, with an installed capacity of around 30 gigawatts (GW) (Sauaia, 2016).

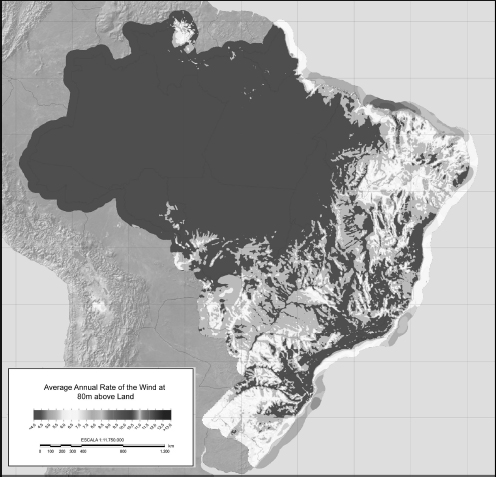

Brazil’s wind resources, indicated in Figure 13.3, are also very good, representing a total potential of 143.5 GW, much of it concentrated along the Atlantic coastline, where winds are steady and often blow at high velocity. Although the deployment of wind power began more recently in Brazil compared to solar energy, it has evolved faster. In December 2016, electricity production from wind reached a milestone in Brazil: more than 10 GW of installed generating capacity, distributed in 400 wind parks and utilizing about 5,200 wind turbines. Considering the wind capacity that is already installed and operating, plus plants for which contracts (power purchase agreements) were obtained in recent auctions and that are still under construction, total wind generating capacity will reach 17.8 GW in 2019. Some forecasts are very optimistic, estimating that Brazil’s wind power potential – taking into account the latest technological developments – amounts to 500 GW (ABEEolica, 2017).

Figure 13.2 Solar energy potential in Brazil, based on annual average radiation

Source: ANEEL. (2002). Atlas de Energia Elétrica do Brasil. Agência Nacional de Energia Elétrica – ANEEL, Brasilia, DF.

Although Brazil counts on strong solar and wind energy resources, the country has largely been unable to capitalize on its assets. Furthermore, it has been unable to successfully foster the development of industrial capacity aimed at building the means of energy generation. Founded in 1980, Heliodinâmica manufactured solar cells for the domestic market and for export, accounting for almost 6% of world production by 1986 (Braga, 2008; Ereno & Oliveira, 2011). Nevertheless, the company’s overreliance on the market protection afforded by the Informatics Law rendered it unable to compete once it became exposed to international competition in the 1990s. Today, solar energy accounts for a negligible portion of Brazil’s energy system, and the country does not produce photovoltaic cells at scale. Nevertheless, recent developments may bode well for the future of the domestic solar industry.

Source: CEPEL (2016).

In 2006, Brazilian and Swiss investors created CSEM Brasil, an organization dedicated to developing organic photovoltaic (OPV) cell production technology. In 2015, a group of private companies and other entities – including CSEM Brasil, the National Development Bank (BNDES), and others, as well as the Minas Gerais Industry Federation (FIEMG), the Science Foundation of Minas Gerais (FAPEMIG), and the Government Minas Gerais – launched a new startup named SUNEW with the aim of producing flexible OPV cells at scale. Although SUNEW is a multiinstitutional effort that builds on leading-edge global technology, it remains to be seen if the company will be able to achieve the scale necessary to compete globally and avoid the fate of Heliodinâmica.

Wind energy accounts for a larger percentage of Brazil’s electricity-generating capacity than does solar energy. Nevertheless, manufacturers in this sector have fallen prey to some of the same challenges that Brazil’s institutional framework presents. For example, Tecsis was one of the leading wind turbine blade manufacturers in the world, second only to Denmark’s LM Wind Power. The company, which was founded by graduates of the Aeronautical Technology Institute (ITA), carved out a valuable niche in the wind turbine manufacturing industry, producing blades for leading systems integrators around the world, such as General Electric (GE). Recently, the company ran into difficulties stemming from Brazil’s volatile exchange rate, which led to increased prices for raw materials and intermediate inputs and lower margins on sales to exclusively foreign clients. Despite its abundant wind resources and local-content policies (Proinfa), Brazil counts few viable wind farms and a nearly nonexistent supply base.

The task of leveraging energy resources to build an industrial base is complex, as the experience of Brazil’s solar and wind energy industries demonstrates. This chapter delves into the case of Brazil’s ethanol industry, focusing on the opportunity to build innovation and manufacturing capacity in 2G ethanol. Although solar, wind, and biomass are decidedly different energy sources, as are the industries built to harness them, they face similar challenges insofar as the institutional environment is concerned. Developing renewable energy technologies requires a long-term vision embodied in sound policies and a stable, enabling institutional environment. The case study that follows outlines the energy challenge facing Brazil and the opportunity to accelerate innovation in 2G ethanol, a technology in which Brazil can be a global leader.

The concept of a “bioeconomy” is broad, but can best be understood as an economy in which the basic building blocks for materials, chemicals, and energy are derived from renewable biological resources. Technological advances in genetic engineering, big data, and nanoparticles have created new opportunities in agriculture, farming, pharmaceuticals, chemicals, and fuels derived from renewable biological sources. The biorefinery industry offers a means of creating a sustainable and low-carbon bioeconomy based on advances in biotechnology and the need to address climate change.

Brazil can be the world’s leader in developing a low-carbon economy because of its clean energy portfolio, highly productive agricultural sector, and fully integrated biofuel production capabilities. Biofuels are an example of how Brazil once launched and implemented a significant and bold innovation program to curb the oil shock and create a formidable, integrated R&D and agro-industrial value chain to make ethanol capable of substituting for gasoline. The Proálcool program of the 1970s made Brazil the largest and most competitive sugar and ethanol producer in the world. But leadership is an endless race. Brazil first lost its position as the world’s leading producer of bioethanol to the United States in 2007, and it now lags behind by 50%. The main reasons for this decline include poor energy policies, including the freezing of the gasoline price in 2011 to curb inflation, which impacted ethanol prices directly, and policies related to electric energy transmission (auctions) and generation, which created uncertainty for investors. Furthermore, the country’s failure to continue innovating in ethanol technology is a consequence of poor protection for intellectual property rights, a lack of clear demand (i.e., mandates for ethanol use), and a shortage of capital to renew agricultural assets and fund innovation initiatives.

For the first time ever, Brazil imported more ethanol than it exported in 2017. In 1997, Brazil was the world’s largest producer of ethanol, with annual production of 15.4 billion liters (4 billion gallons) – three times the 4.8 billion liters (1.25 billion gallons) of ethanol produced in the United States at that time. Ten years later, in 2007, following U.S. adoption of a renewable fuel standard (RFS), Brazil’s production – which had increased to 27.5 billion liters (7.3 billion gallons) – was surpassed by U.S. production, which had grown sevenfold, to 35.2 billion liters (9.3 billion gallons).

Nonetheless, Brazil remained a major producer and exporter of ethanol, exporting more than 3.5 billion liters of ethanol in 2007 and more than 5 billion liters in 2008 (at the time, Brazil had virtually no ethanol imports). In 2014, however, Brazilian exports began to decline, while its imports of U.S.-produced ethanol started to increase year after year. In 2017, Brazil exported 1.3 billion liters of ethanol and imported 1.7 billion liters from the United States, registering its first-ever trade deficit in ethanol. It is important to mention that Brazilian GDP also declined by 8% in 2016 and 2017. If the economy had grown, the ethanol deficit would have probably been billions of liters larger than what was registered since fuel consumption and car sales are directly related to GDP.

Brazil will likely eliminate its domestic fuel surplus over the course of the next five years, and may need between 15 and 25 billion additional liters of ethanol by 2030 (EPE, 2018). The same decline in export competitiveness has occurred in gasoline as well. Brazil was a net exporter of gasoline until 2009. In 2010, imports of gasoline started to increase significantly year after year, and eventually, the country became a net importer of the commodity. In 2016, Brazil imported 3 billion liters of gasoline, and, from January to November 2017, the country imported more than 4.1 billion liters, an increase of more than 35% in a single year. According to industry representatives, the sharp drop in the competitiveness of Brazil’s ethanol industry was a direct result of several factors: (a) the lack of policies that recognize the industry’s positive externalities and encourage investments in this sector; (b) the gasoline price mechanism (in particular, the lasting consequences of the gasoline price freeze and the reduction of taxes on fossil fuels instituted by the government between 2011 and 2014), as well as, more recently, a price intervention prompted by the truckers’ strike in 2018; (c) shortages of the capital needed to renew cane fields, which reduced the productivity of sugarcane growers; and (d) price volatility and the lack of a guaranteed future market for ethanol that could offer the industry some price predictability.

Brazil also faces supply security concerns with respect to fuel for spark-ignited internal combustion engines, also known as “Otto cycle” fuels, as well as diesel cycle engines. Domestic refineries have been operating near or at full capacity for years, with no additional capacity increases expected in the near future. Due to record imports of diesel, gasoline, and ethanol, liquid fuel terminals are also operating at full capacity, leaving little room for the country to expand its fuel imports. Ethanol production is stable at 27 billion liters per year, with no prospects to expand capacity in the near future for reasons that include currently low profit margins for added production, competition from other grain crops and other uses of arable land, and ongoing regulatory uncertainty. Therefore, if Brazil’s GDP growth rebounds in coming years, as both private organizations and government agencies predict, it will be only a matter of time before serious shortages of Otto cycle and diesel cycle fuels emerge.

Brazil will not be able to build enough of the oil refineries needed to make up this deficit in time, nor is it likely to be able to build the infrastructure necessary to accommodate projected fuel needs in 2030. The country currently has 18 refineries with aggregate nameplate capacity of 2.4 billion barrels of oil equivalent (BOE) per day. The only new refinery built in Brazil in the last ten years was Refinaria Abreu e Lima (RNEST) in the state of Pernambuco. This facility started operations in 2014, after ten years of construction, and currently processes 115,000 BOE/day. Based on recent productivity trends in the Brazilian construction industry and given the high cost of building complex refineries, it is not reasonable to expect that domestic refining capacity will increase and be responsive to anticipated demand in the short and medium run, despite the fact that the deep-water pre-salt layer oil development by Petrobras enabled Brazil to break its oil production and export records in 2016.

More importantly, the productivity gains that have been achieved in pre-salt wells have enabled oil production at costs below US$40/BOE. This is a formidable accomplishment that reflects Petrobras’ strong innovation capacity, but its benefits to Brazil could and should be much greater. This example points to a disturbing efficiency paradox and underscores the need for further thoughtful consideration about how innovation must be conceived as part of an ecosystem of integrated supply chains and coherent regulations and policies. Brazil should have planned for the infrastructure needs of the pre-salt oil expansion brought about by Petrobras’ innovation breakthrough. Although, in this instance, innovation was created at scale, its impact on the national economy will be restricted to exporting the nonrefined oil as a commodity, with low aggregate value, fewer jobs created, and continued risks of domestic fuel shortages.

Beyond the cost and time needed to increase refinery capacity, environmental regulation and social pressure to reduce greenhouse gas emissions will pose a challenge. In one case, the city of New York is suing big oil companies for global warming impacts and damages.1 Brazil is not facing the same type of pressure yet, but several initiatives are being implemented to cut carbon emissions and develop a low-carbon economy, including the Renovabio program (described in more detail in a later section) and the Biofuture Platform, a multi-stakeholder initiative created by 20 countries that are active or interested in the concept of developing bioeconomies. Biofuture Platform aims to enhance dialogue and collaboration among member countries with the purpose of accelerating the development and scale-up of innovative, sustainable projects to reduce carbon emissions. Carbon emissions are finally becoming an important issue in Brazil, adding to the challenges faced by conventional oil refineries.

As of 2017, more than a third of Brazilian ethanol producers were either bankrupt or in a state of severe financial distress. Brazil has 368 operating sugarcane mills and another 76 mills that have been shut down (for a total of 444 commercial plants). Of the 368 active mills, 39 are under judicial restructuring or in the midst of bankruptcy lawsuits. In other words, 115 mills, representing 25% of the country’s installed mill capacity, are bankrupt or close to bankruptcy (Silva, 2015). First-generation ethanol from sugarcane is unlikely to make up for a projected shortfall in supply. “Advanced biorefineries” that integrate 2G innovation can provide the productivity shock needed to mitigate this shortfall.

Biomass-based cellulosic ethanol holds promise as an alternative source of fuel, energy, and chemicals from non-edible biomass feedstocks, which are a vast renewable resource. Depending on the biomass source and its carbon-fixing footprint, a life-cycle assessment (LCA) – which is a commonly accepted systemic measure of carbon emissions – may even indicate a negative carbon footprint for biofuels and biochemicals derived from cellulosic sugars. Some very efficient energy crops, such as energy cane (a variety of cane with much higher fiber content that grows in semi-arid areas), have been shown to act as a sponge that absorbs carbon dioxide from the atmosphere, photosynthesizing it into biomass to be converted into non-edible sugar carbons and fixed in the plant’s rooting system. The potential biomass resource in Brazil is immense, not only from agricultural residues, but also from converting inefficient but abundant cattle grazing land into energy crops that could be integrated with flexible advanced biorefineries. Brazil has 200 million hectares of degraded land occupied by about 230 million cows – these are probably the most solitary cows in the world. GranBio calculates that economic output per hectare for these degraded lands could go from US$100 per hectare per year (for extensive cattle breeding operations) to more than US$20,000 per hectare per year if the land is used to grow energy cane for 2G ethanol and energy production.

Second-generation ethanol offers transformative potential for the Brazilian clean energy economy and for the country’s energy security. Based on the yields that could be achieved using current technology, Brazil might increase its sugarcane ethanol production by 50% without additional land needs using sugarcane straw and bagasse residues that are not currently being utilized in energy and steam cogeneration. The same calculation applies to the use of corn stover in American ethanol. However, Brazilian industry and policymakers have failed so far to deliver on the promise of this technology. Large chemical and fuel companies such as BP, Dupont, Mossi & Ghisolfi, and Abengoa, among others, have built and subsequently shut down cellulosic ethanol projects. Poet/DSM in the United States and Raizen and GranBio in Brazil are persisting and progressing.

According to McKinsey & Company, the “cellulosic ethanol (or 2G) industry faces challenges in funding, inputs and processes that work, but all can be addressed” (Alfano et al., 2016). First, commercial 2G plants must demonstrate that they are profitable and replicable, preferably beating incumbents in returns and yields (and carbon footprint). Capital is still rare due to the perceived technology and investment risk. The first plants were built with some combination of venture capital, tax credit, interest subsidies, and grants. Technology is improving, and variable costs are decreasing. Biomass supply security and an integrated value chain that has the capacity to scale are key prerequisites for investors. Other inputs, such as the bio-catalysts, bio-engineered enzymes, and yeasts needed to break cellulosic polymers into sugars and ferment non-edible sugars into ethanol, are also perceived as expensive and a barrier to cost competitiveness because of logistics and scale.

In addition to technology advances and cost-curve reductions, 2G ethanol, like any new technology, requires a stable, reliable, and predictable regulatory environment. The United States and most of Europe, Japan, and now China have advanced ethanol mandates that prioritize 2G ethanol. Brazil recently approved the Renovabio program, as explained below, which is now expected to be in force in the beginning of 2019. These mandates are motivated not only by environmental concerns but also by energy security and national security considerations. In a scenario where the United States and Brazil account for more than 80% of global ethanol production, countries that use ethanol but cannot plant corn or sugarcane at scale would be subject to an energy supply oligopoly more concentrated than OPEC. Because 2G ethanol can be made from a much wider variety of feedstocks, 2G technology enables any country – regardless of its climate conditions and other agricultural outputs – to supply its own fuel demand using renewable biomass, including from managed forests or agricultural residues, in an environmentally friendly way that is responsive to international climate commitments. In other words, the development of 2G ethanol has the potential to expand production capabilities to other continents, reducing dependence on the United States and Brazil and changing the geopolitics of biofuels.

The competitive cost of cellulosic sugar also means that it can serve as a renewable carbon source for biochemicals with already demonstrated high fermentation yields and cost competitiveness vis-à-vis chemicals made from fossil fuels. Lactic acid, succinic acid, n-butanol, isobutanol, butanodiol, and many other molecules are drop-in biochemicals that may be directly applied as an option for “greening” existing supply chains. The concept of a flexible biomass refinery (or biorefinery) that can alternate production of renewable alcohols, acids, solvents, and lignin base derivatives may soon prove attractive to large chemical corporations that are interested in transitioning their value chains to produce climate-friendly bio-based products.

With so much commercial potential and expected demand for 2G ethanol and cellulosic sugars, why has Brazil, with its vast biomass output and the largest (and still growing) ethanol car fleet in the world, been so late to accelerate innovation in this area?

Increased funding for public research and science alone will not help to scale up biorefineries to cross the gap – often called the “valley of death” – between development and successful commercialization. First, the government must enact effective tax credit policies to foster private R&D efforts and reward risk taking with time tolerance to maturity. Second, while the importance of and need for entrepreneurship, startups, and public funding are generally recognized, there is little clear incentive for sugar mill owners or new entrants to innovate and establish flexible biorefineries. Public incentives to date have been neither sustainable nor replicable, and have provided very little tolerance for eventual failure. Public loan incentives typically require demand guarantees that only strong balance sheets can offer. Innovation risks rest exclusively on the entrepreneur or the company. In this sense, it may also be risky to use public funding to drive innovation through startups in the context of Brazil’s current regulatory system.

Some of Brazil’s existing programs and initiatives to promote innovation in biorefineries have been important, but a more systemic and long-term approach is needed. Brazil tends to measure innovation by R&D expenditures, applying a “science push” model that is based on an academic research mindset. A focus on expenditures also facilitates government reporting. In this case, increased R&D investments would be the main or only source of innovation. A more effective approach would be to take a systemic view, in which R&D institutions and universities do play a very important part but companies also have a central role in driving innovation and commercialization. In this view, a network with direct and indirect links that combines public and private infrastructure, schools, the regulatory framework, capital instruments, and smart incentives is critical for enabling the necessary “culture to innovate” (Mazzucato & Penna, 2016).

It appears, from a business perspective, that Brazil’s industrial and innovation policies still reflect an old-fashioned linear paradigm. The speed of change and the increased connectivity that is now available to support collaboration have made such an approach obsolete for years. As a result, recent, well-intended policies, incentive programs, and legislative initiatives to foster innovation may seem disconnected or even contradictory because they are not part of a systemic, long-term strategic plan. Common indicators, such as labor productivity, numbers of patents filed, high-knowledge jobs created, new startups launched, and speed of product/service substitution, are part of the “dashboard,” but the performance of Brazilian companies in globally competitive markets and direct investment in Brazil by international innovative companies are also important indicators.

BNDES and the Financing Agency for Studies and Projects (FINEP) sponsored several well-intended initiatives aimed at stimulating innovation in biofuels between 2011 and 2014. In 2012, BNDES and FINEP announced a US$1.3 billion program to support innovative projects in the sugar and ethanol sectors (PAISS, Programa de Apoio à Inovação dos Setores Sucroenergético e Sucroquímico). The program provided low-interest loans (for a period of up to seven years) and/or selective small grants to more than 37 companies. It funded three 2G ethanol plants, one at demonstration scale for the Center for Sugarcane Technology (Centro de Tecnologia Canavieira or CTC), and two at commercial scale for Raizen and GranBio. Beyond loans and grants, BNDES also made equity investments in companies such as CTC and GranBio to support the construction of the first cellulosic ethanol biorefineries.

These programs have faced several major challenges: (1) they are “lonely birds” in the sense that they are isolated from a broad framework of regulations and demand mandates; (2) projects are difficult to replicate because they require very high loan guarantees, generally a surety of 2.5 times the loaned amount; and (3) equity investments in advanced biorefineries have included mechanisms to take the company public on local capital markets. Although subsidized and long-term capital is available through sectoral programs, the actual interest rates and total loan costs for accessing these programs make them comparable to private capital markets; in either case, the risk is mostly on the entrepreneur’s shoulders. This is quite different from the American and European models, where governments have provided significant grants and more systemic mandates that ensure temporary subsidized demand to first comers and stimulate competition among innovative companies. In these countries, public resources have been used to open bids for pure grants and offer tax credits on a competitive basis for the best ideas, innovations, and investments to advance new technologies with positive social externalities.

In December 2017, President Michel Temer signed legislation establishing a new national policy for biofuels in Brazil (Law no. 13,576/2017). Known as “Renovabio,” this legislation aims to stimulate efficiency and attract investments to the biofuels sector. The biofuels industry celebrated this achievement, but the program still needs to be regulated by Brazil’s Ministry of Mines and Energy (MME). According to Datagro, a consulting firm dedicated to the sugar industry, the Renovabio program may result in domestic demand for as much as 40 billion liters of ethanol by 2030, as compared to the current demand of 26 billion liters.2 It is still uncertain how domestic producers will deal with this increase in demand for ethanol, but it was time for Brazil to approve a long-term policy, similar to the renewable fuel standard (RFS) and low-carbon fuel standard (LCFS) adopted in the United States.

Renovabio is designed to stimulate energy-efficient solutions, including biofuels, to improve Brazil’s energy security and reduce its carbon footprint as part of global efforts to mitigate climate change. Brazil is the world’s most advanced country with respect to the use of biofuels: in Brazil, ethanol has substituted for more than 50% of gasoline use in recent years, according to the Brazilian Sugarcane Industry Association (UNICA). However, Brazil still does not have a stable medium-term demand and pricing policy for biofuels that reflects their carbon benefits. In addition, most commercial ethanol is sold on the spot market – thus, producers hope that Renovabio will create a stable futures market and introduce carbon-based pricing, similar to the effect of the U.S. programs. Once Renovabio is fully deployed, it may create the necessary platform for a broader and more comprehensive combination of programs and funding to support innovation in biorefinery technologies that could reach not only fuels but also biochemicals and biomaterials. In this way, Renovabio could have a transformative effect on Brazil’s push to accelerate innovation in the bioeconomy.

Given the broad range of technologies to be promoted and the limited funding available to do so, it will be necessary to define priorities, focusing on the most promising technologies that align with Brazil’s areas of comparative advantage while leaving some funding reserved for initiatives that are still in the early stages of development, but that may eventually provide the basis for advanced energy solutions in the future. In this regard, there is a crucial tension to be managed: does the government prioritize large-scale projects? Or does it spread resources among various smaller projects? In the latter scenario, lower efficiency may be compensated by greater social and human development benefits.

We offer several suggestions for accelerating innovation in advanced energy, with a focus on the sorts of interventions needed to strengthen Brazil’s 2G ethanol industry moving forward:

All of the above suggestions must be linked to a well-designed and implemented communication plan, diffusing knowledge and informing the public and stakeholders about the aims and expected impacts of these actions. Finally, one general and essential recommendation for fostering innovation in energy systems is predictability in the regulatory landscape. This is critical to reduce investors’ perception of risk associated with 2G ethanol and to make new ventures in advanced biomass energy technologies attractive as investment targets.

Brazil is not starting from ground zero in the effort to build a strong and vibrant bioeconomy – on the contrary, it has a wealth of prior experience and numerous opportunities to accelerate innovation. The country has a strong scientific community producing sound basic and applied research, emerging startups, a relevant industrial sector, the cheapest biomass in the world, and creative companies. Brazil’s economy is constrained by logistics, low competition, high capital costs, and a complex tax system; nevertheless, it is the eighth-largest economy in the world and offers a correspondingly large market for the deployment of new technologies.

But Brazil is lagging behind, and probably to a greater extent than its policymakers and citizens realize. There is no simple formula for accelerating innovation in advanced energy. The future of innovation in Brazil will depend on a sum of co-related actions that can be systematized and made coherent only through ample social debate and a sort of national pact. Brazil must first envision and agree on a pathway to modernity that enables a culture of innovation in the midst of, or even as a condition of, addressing basic priorities such as high-quality education, smart regulation, free markets, and infrastructure investment. It seems difficult to target innovation as a means or an end to public policy, except in the form of projects and limited subsidies. Innovation is a consequence, part of an overall strategy of modernization. At the sector level, the Brazilian government has promoted initiatives and programs to stimulate biofuels, and Renovabio may bring the context and long-term perspective that the sector has been missing so far.

Brazil has to define its role in the global low-carbon economy: whether it will be in the cockpit or in the main cabin. It is the most biodiverse nation on the planet, with abundant water and solar radiation, more than 200 million hectares of extensive cattle grazing land that can be converted to energy crops, and huge volumes of agricultural residues that can be converted to cellulosic ethanol using existing technology with great economic and social impact. Two of the only three commercial-scale cellulosic ethanol plants currently operating are in Brazil, and the country has the largest fleet of ethanol-fueled vehicles, offering a secure and growing source of demand for new biorefinery products. Renovabio may be the right low-carbon policy to develop a national bioeconomy.

There seems to be a misconception or lack of common understanding among Brazilian policymakers and industry leaders about the appropriate policies and factors for success to accelerate innovation in Brazil. There has also been persistent resistance within the scientific and academic community at public universities to engaging in more effective collaboration with innovative companies to transform good ideas into new Brazilian technologies. This may be due to the oversized presence of the state in the economy, the potential lack of an inventive entrepreneurial culture, or just insufficient incentives to run the risk of innovating in a somewhat protected business ecosystem. With a few heroic exceptions, Brazil is not clearly signaling to entrepreneurs, investors, or inventors that the country wants to accelerate innovation.

The renewables and clean energy sector in Brazil is going through a positive and disruptive transformation. This presents a great opportunity to build public support for environmentally friendly technologies and for striving for a global leadership role. Brazil has a certain vocation for top-down, mission-oriented programs. Clean energy can provide a structuring platform for combining Brazil’s natural resources and strength in science and technology to foster virtuous innovation.

ABEEolica. (2017). “Brasil já tem 10,6 GW de capacidade instalada de energia eólica” and “500 GW de potencial em energia eólica.” Associação Brasileira de Energia Eólica.

Alfano, S., Berruti, F., Denis, N., & Santagostino, A. (2016). The Future of Second-Generation Biomass. New York, NY: McKinsey & Company.

ANEEL. (2002). Atlas de Energia Elétrica do Brasil. Agência Nacional de Energia Elétrica – ANEEL, Brasilia, DF.

Braga, R.P. (2008). Energia solar fotovoltaica: fundamentos e aplicações. Rio de Janeiro: Universidade Federal do Rio de Janeiro.

CEPEL. (2016). Atlas Eólico Brasileiro. Rio de Janeiro: Centro de Pesquisas de Energia Elétrica.

EPE. (2018). Cenários de oferta de etanol e demanda do ciclo Otto 2018–2030. Empresa de Pesquisa Energética: Ministerio de Minas e Energia.

EPE. (2017). Anuário estatístico de energia elétrica. Empresa de Pesquisa Energética: Ministerio de Minas e Energia.

Ereno, D., & Oliveira, M. de. (2011). Electricity from the Sun. Sao Paulo, SP: FAPESP.

Goldemberg, J. (2007). Ethanol for a sustainable energy future. Science 315: 808–810. https://doi.org/10.1126/science.1137013.

Goldemberg, J., Coelho, S.T., & Guardabassi, P. (2008). The sustainability of ethanol production from sugarcane. Energy Policy 36: 2086–2097. https://doi.org/10.1016/j.enpol.2008.02.028.

IEA. (2013). World Energy Outlook 2013. Paris: OECD Publishing.

Lewis, J.I., & Wiser, R.H. (2007). Fostering a renewable energy technology industry: an international comparison of wind industry policy support mechanisms. Energy Policy 35: 1844–1857. https://doi.org/10.1016/j.enpol.2006.06.005.

Macedo, I. de C. (2005). Sugarcane’s Energy: Twelve Studies on Brazilian Sugarcane Agribusiness and Its Sustainability. Berlendis Editores, São Paulo, Brazil: UNICA.

Martinelli, L.A., & Filoso, S. (2008). Expansion of sugarcane ethanol production in Brazil: environmental and social challenges. Ecol Appl 18: 885–898.

Mazzucato, M. (2011). The Entrepreneurial State. London, UK: Demos.

Mazzucato, M., & Penna, C. (2016). The Brazilian Innovation System: A Mission-Oriented Policy Proposal. Brasilia DF: CGEE.

Nascimento, P.T., Yu, A.S.O., Nigro, F., Quinello, R., de Fatima S. Macri Russo, R., & Lima, N.C. (2009). The case of Magneti Marelli Brasil: endogenous and exogenous factors in local dominant technology development. Presented at the Management of Engineering and Technology, IEEE, Portland, pp. 3122–3132. https://doi.org/10.1109/PICMET.2009.5262268.

Sauaia, R. (2016.) Potencial técnico de energia solar no país pode chegar a 30 mil GW. Canal Energia. https://www.canalenergia.com.br/noticias/24686078/potencial-tecnico-de-energia-solar-no-pais-pode-chegar-a-30-mil-gw.

Silva, E. (2015). Crise atinge um quarto das usinas do país nos 40 anos do Proálcool. Revista Globo Rural.