5. |

Picking a home for legacy planning

28 February 2013, The Business Times |

Seven rounds of cooling measures have been introduced for the residential market segment since September 2009, when it was clear that the property market was recovering. Together with a strong inflow of foreign capital (or what many pundits call ‘hot money’) and cheap home loans, the private residential segment sets new price and volume records from 2010 till 2012.

The most prudent cooling measures introduced were those that curbed excessive risk-taking by reducing borrowing limits, and encouraging investors to take a long-term view by imposing a painfully high four-year Seller Stamp Duty (SSD) and limiting the potential supply of tiny dwelling units.

With such stringent policy measures in place — along with existing investors paying down their current loans, the new investments made with higher proportions of cash equity (as opposed to CPF equity), and lower borrowings — the market will be ‘de-risked’ with each passing day. While the risk of an over supply in the mass market region remains, the risk of an over-leveraged residential market and mortgage defaults hitting our banks is reduced.

Singapore’s residential market has a strong end user demand, as evident from the vacancy rates of around 5 to 6 per cent. The high utilisation rate suggest that mortgages will get paid by the owner-occupier or the landlord letting the home out. Coupled with a low unemployment rate of under 2 per cent and cheap borrowing cost likely to last till late 2015, we can expect mortgage default risks to remain low.

For those holding cash and staying on the sidelines of the residential market, consider these points before investing:

• Even though the Population White Paper will be amended, we could reasonably expect a gradual increase in population, and therefore steady demand for housing. This is because the Economic Development Board has been successful in bringing to Singapore more than $10 billion of new investments annually the past few years — and all these investments help to generate jobs. Given the sub-2 per cent unemployment rate, most of these new jobs will have to be filled by foreigners. And they will require housing.

• The low borrowing costs today equates to low interest returns from money in the savings accounts. With inflation, our savings will steadily devalue while sitting in the banks.

• The Additional Buyer’s Stamp Duty (ABSD) may be a deterrent to current investors but this perception may change once investors are confident that residential prices will climb by say 20 per cent or more within the next five years. A 4 per cent rise per year is not inconceivable if our economy continues to chug along at 3 to 4 per cent growth and inflation remains at 2 to 4 per cent per annum. Would you prefer to buy now and suffer the ABSD or to wait for a potential reduction in the ABSD while watching the residential price index climb 20 per cent in five years?

• If the residential market hits a bad patch and prices start to weaken across the board, policy makers can unwind all seven rounds of cooling measures in one fell swoop, and money that is waiting on the sidelines, particularly those from neighbouring countries which have receded in 2012, will be encouraged to flow in again.

For those who are looking to investing in residential properties for legacy planning purposes, focus on good value buys which come with freehold — often a 999-year leasehold or equivalent titles, such as estate in perpetuity, estate in fee simple, among other such properties.

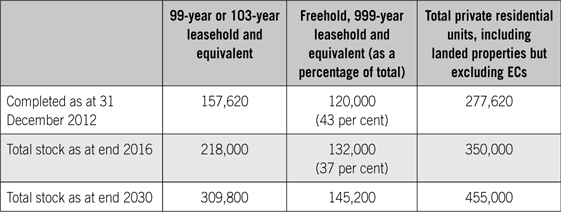

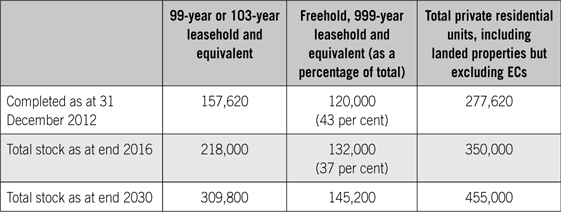

Table 1: Freehold scarcity and the Breakdown of private housing stock by tenure

Source: IPA’s estimates and forecasts

International Property Advisor (IPA) has analysed the current stock of completed private homes (excluding Executive Condominiums) in Singapore and we estimate that as at the end of 2012, about 43 per cent of the total stock of 277,620 private homes comprised of freehold or 999-year equivalent properties, with the remaining 57 per cent comprising of dwelling units on 99-year or 103-year leasehold sites.

Between the end of 2012 and the end of 2016, we forecast that the total stock of completed private homes on the island will increase by roughly 26 per cent to some 350,000, with the stock of freehold or 999-year properties rising by 10 per cent to 132,000 units — a smaller rate of increase when compared with our projected 38 per cent increase in the stock of 99-year or 103-year properties, to 218,000 units. As a result, the freehold properties’ share of total private housing stock will decline to 38 per cent by the end of 2016. We believe the trend will continue, with the freehold share of Singapore’s private housing stock shrinking to 10 per cent by the end of 2030. Why?

The proportion of freehold properties will drop because it is relatively more difficult to increase their supply compared to the 99-year leasehold segment, where the government can provide a regular source of development land through the Government Land Sales Programme. In contrast, prospects for increasing the number of freehold homes are much more limited and will prove a much slower process as the freehold supply can increase only if developers manage to clinch enbloc sale sites.

By the year 2030, if we do reach the 1.9 million total dwelling units (including HDB flats) projected in the Population White Paper and Urban Redevelopment Authority’s Land Use Plan, the 145,200 freehold residences (based on IPA’s forecast) will make up a mere 7.6 per cent of the island’s total housing stock. As at the end of last year, the 120,000 freehold homes accounted for 10 per cent of the 1.2 million total homes.

And of the stock of freehold homes at end 2012, landed properties numbered just around 50,000 units. Going ahead, their stock is unlikely to increase, making freehold landed properties even rarer. As highlighted in my previous book Building Your Real Estate Riches, the demand for landed properties, due to demographic change, will ensure that prices continue to hold up.

So with the long-term investment objectives in mind, what are some good-value buys in the various budget levels? By ‘good value’, we mean: well-constructed, with top grade materials, relatively easy to lease out and priced below new launches in the same vicinity.

• For a budget up to $2 million: It is near impossible to find freehold landed properties without having to spend a significant amount on renovations to bring it to investment grade (that is, for it to be leased out to a family immediately). For condominiums, consider two-bedroom units in Aspen Heights, Residences@Evelyn, Tanglin Park and Valley Park.

• For a budget up to $3 million: Choices open up a lot more at this budget, including good quality but not brand new terrace houses, such as those in the East Coast or Serangoon Gardens. For condominiums, in addition to the list above, add Gallop Gables, Newton One, Palm Spring and Paterson Residence.

• For a budget up to $5 million: For landed properties, include semi-detached houses in the East Coast as well as terrace houses along the prime Bukit Timah stretch. For high-rise residences, other than the projects mentioned, include Regency Park, Sommerville Grandeur and The Draycott.

• For budgets the fall between $5 and $10 million: There are several evergreen collectibles that are not to be missed. These are well-constructed with top grade material and good workmanship, and finding tenants for these apartments should not be a chore — Ardmore Park, Ardmore II, Gallop Green, Nassim Jade, Tate Residences and The Claymore. As for landed properties, consider the well-located ones in Goldhill estate, Coronation Road, Kheam Hock Road and Mount Sinai.

• For the ultra high-net-worth individuals with unconstrained budgets, long-term investment returns and wealth preservation may require different considerations. This group might invest in a top grade property for keepsake rather than for rental income. This is not dissimilar to investments of passion such as art and antiques, where no income is derived from the investment, but value is built up through value appreciation due to their rarity. A portfolio of collectibles in this category would include Ardmore Park (again), Bishopsgate Residences, Nassim Park Residences, Ritz Carlton Residences, The Marq on Paterson Hill. And don’t forget to put in at least one Good Class Bungalow in the top residential addresses of Chatsworth, Nassim and Bishopsgate.

The time is ripe, as the residential investment market is being de-risked. Those who hold a long term view of more than ten years and for those who are investing for wealth transfer or legacy planning, timing the market is secondary to finding a well-built home in a top residential precinct. Investors who try to time property market cycles generally do not perform as well as those who remain invested in the best locations over the long-term.

And while it may be a pipedream, can you imagine if what the ABSD were reduced and the cooling measures reversed or relaxed some time in the near future? Can you imagine what the upside might be?