17. |

Japan property gets Olympics push

13 March 2014, The Business Times |

A year is not considered a long time in real estate markets. This is especially so for a well-established and mature economy such as Japan, where during the ‘Two Lost Decades’, real estate prices remained flat after the property bubble burst.

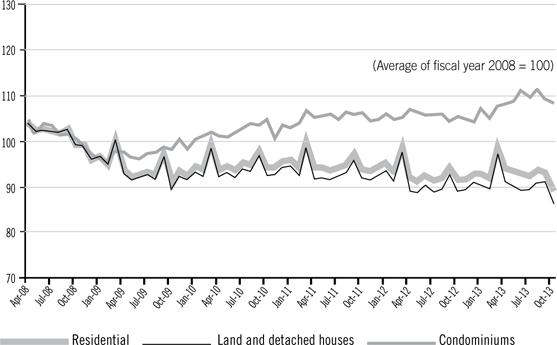

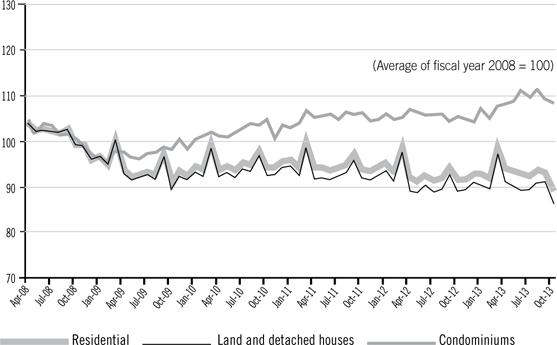

Figure 1: Japan Residential Property Price Index. The value of condominiums have gone up, gradually appreciating about 10 per cent from January 2010 to October 2013. (Published 29 January 2014)

Source: Ministry of Land, Infrastructure, Transport and Tourism, Japan

Since deflation ruled Japan’s economy from the mid-nineties till after the Lehman crisis, Japanese real estate was rarely ever considered for capital gains.

In the past twelve months, however, the tides have turned. Twenty years of stagnation in the real estate market was stirred up after Prime Minister Shinzo Abe won the election in December 2012. He kept to his campaign promises of high government spending and money printing to reflate the economy from its slumber.

Several things took place in quick succession within months of Abenomics being introduced, the majority of which have made Japanese real estate very attractive.

Unprecedented money printing weakened the Japanese yen relative to most of the major currencies in the world. In January 2013, $1 could buy 72 yen. In February 2014, the rate was 80 yen, a drop of over 10 per cent. For example, a luxury apartment in Central Tokyo which was priced at 200 million yen in January 2013 (equivalent to about $2.78 million), can be had for about $2.63 million today despite its price appreciation to 210 million yen in February 2014. This is a reason that foreign investors are more positive about Japan’s real estate market than Japanese investors themselves. Foreign investors also expect to profit from the eventual strengthening of the yen when they divest in five to ten years time.

A weak yen will increase the costs of imported goods, raising construction costs. Most property developers are forced to price in a 20 per cent premium for their new project launches to account for higher imported costs. New launch property prices are leading the real estate index on an upwards trend.

Higher imported costs will lead to inflation, and Mr Abe’s objective is to achieve a small and sustainable rate of inflation by keeping the yen weak. The past six months of official data has shown inflation at a positive 1 to 1.5 per cent. Since we generally expect that rentals and capital values should rise in tandem with inflation, investing in real estate will provide one’s portfolio with a natural hedge against inflation.

Most investors getting into Japanese properties today are expecting to reap rewards from rental income (current rental yields of about 4 to 6 per cent in Tokyo are expected to rise with inflation as tenants renew leases), price appreciation and hopefully foreign exchange gains.

The scenario above can describe any other country with a weak currency and positive inflation. But Japan has something more — in the form of euphoria, much like what Singapore’s economy experienced in 2005 to 2006, following the announcement of two multi-billion dollar integrated resort projects.

Since taking office, Mr Abe has invested time, effort and trillions of yen in many emerging markets, particularly around Southeast Asia. In countries such as Indonesia and Myanmar, Japanese conglomerates are expected to benefit from the large infrastructure projects that will be built from funds provided by the government’s yen printing press. Japanese firms will earn US dollar income and report their corporate results in a weakening yen, therefore pushing up corporate returns and share prices.

By September 2013, we saw the early fruits of investments reaped by the Abe government in the form of votes for Tokyo to host the 2020 Olympic Games. This single massive project provides the green light for the government to print even more yen as infrastructure and facilities for the Olympics at Tokyo Bay would need to be built. In turn, this would spur jobs and employment, bring about increased tourism revenue, add foreign income from tourists and push up consumption.

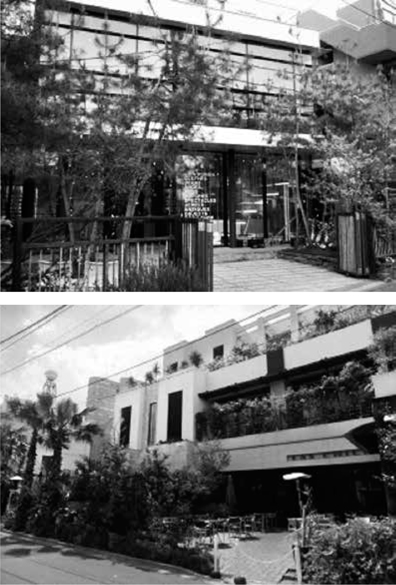

Mixed strata apartments with retail shops on the lower floors in the upmarket Shibuya district.

For such a large and beautiful country with 127 million population, Japan’s annual tourist arrivals stand at a paltry 10 million, lower than the 14 million people who visited Singapore last year. Lots of upside for tourism can be expected from now till the 2020 Olympics, especially if visa requirements for foreigners are further relaxed.

Given the many positive factors, most investors are focused on Tokyo’s hotel assets and residential assets. Those who search for yields of over 6 per cent and larger headroom for capital appreciation (or yield compression) may consider other major cities such as Nagoya, or the Kyoto-Osaka-Kobe region or the many varying locations in Hokkaido.

Here are some pointers for first-time investors:

• Almost all land titles in Japan are freehold.

• Generally there are no restrictions to foreigners buying land and properties except that since the Lehman crisis, mortgages from Japanese banks are restrictive. Those who might secure mortgages in Japan will enjoy relatively low loan rates at below 1 per cent per annum. There are also Singapore banks that give loans for prime Tokyo residential properties but the interest rates are relatively high at above 3 per cent per annum and TDSR rules apply. Compared against a property yield of 3 to 5 per cent per annum for prime properties, these packages are not attractive.

• For investments of say, above $2 to $3 million, it might be cost effective to set up a Japanese company to purchase the property.

• Japanese taxes and stamp duties might seem complicated but they are not as complex as Singapore’s recent introductions of multiple types of duties and tiered taxes. A typical apartment of about $1 million might require the buyer to pay the following one-off taxes: Registration Licence Tax and Real Estate Acquisition Tax, both of which are on the value of the land as well as the value of the apartment/house, in addition to a Consumption Tax on the value of the apartment/house. These three taxes add up to no more than 6 per cent of the purchase price. (Consumption Tax is at 5 per cent and will be raised to 8 per cent from 1 April 2014, and to 10 per cent from 1 April 2015.)

• Owners also make annual payments for Fixed Asset Tax and City Planning Tax, totalling about 0.3 per cent of the property’s value.

• Capital Gains Tax varies depending on the length of time that the property has been held, whether or not it has been used as a place of residence, and what the taxable profits are. The basic calculation is 39 per cent if the property is sold within five years, and 20 per cent if it is sold after five years. As there will be deductions and other mitigating cost factors, I usually advise clients to speak with a Japan-registered tax accountant for filing taxes.

• Unless purchasing directly from developers, buyers are required to pay a commission of up to 3 per cent of the transacted price to the real estate broker representing them.

Investors have highlighted their concerns about natural disasters and the seemingly high cost of business in Japan. But such is the nature of investing: risks versus rewards. My advice to investors is that it is more important for them to do their homework thoroughly, get themselves familiar with the rules, the good locations, the reliable brokers, accountants and property managers.

In my view, aided by the hindsight of the London and Sydney Olympics, Tokyo real estate is worth a much closer look. But we need to move fast, as droves of investors have already started their search across Japan.

Nishishinjuku Park Tower with apartments on the left, next to a shrine; most investors getting into Japanese properties today are expecting to reap rewards from rental income. (Photo by Masahiko Yoshino)