Yeon-Koo Che is the Kelvin J. Lancaster Professor of Economic Theory in the Economics Department at Columbia University. Terrence Hendershott is a tenured Associate Professor at Haas School of Business, University of California, Berkeley.

SUPER BOWL XLIII of 2009 featured one of the closest contests in Super Bowl history. If not for the miraculous catch by Santonio Holmes in the waning seconds, the Steelers might have kicked a game-tying field goal and the Super Bowl would have gone into overtime.

In a sense, however, overtimes can ruin great games, because, with all too high probability, whichever team gets the ball first wins. Instead of one of the best, the game might have been remembered as dubious, maybe even ignominious, with many “what ifs.” We propose an auction method to eliminate the coin flip’s randomness by letting the teams bid to determine the initial possession.

WHY THE CURRENT OVERTIME PROCESS STINKS

Suppose that at the end of tie games, the referee simply flipped a coin to determine who won. Everyone would scream that this was unfair, or, if unfair is the wrong word, it would certainly be silly. What would be the point of calling this winning?

And yet what happens is not so far from that. From 2000 through 2007, in 37 of the 124 overtime games, the team that won the initial coin toss won on its initial possession. Could overtime outcomes be made more “fair”—by which we mean, could randomness be reduced to increase the role skill and execution play in determining the outcome?

DIAGNOSING THE PROBLEM

Part of the issue with the current NFL overtime rule is its sudden death format; namely, that an overtime game is won by the first team to score. Sudden death, however, keeps the playing time manageable in light of the physical nature of the sport and the network’s broadcasting constraints. Also, sudden death is not unfair by itself, as before the coin flip neither team has an advantage. It is only unfair to the extent that the possession, or receiving an opening kickoff, confers a significant advantage, as it now does.

A clue to the nature of the problem and to its solution is found by asking what happened in 1994. That year, the NFL moved the kickoff spot from the 35-to the 30-yard line, where it remains today, which ensures that the receiving team gets a good field position. Field position is everything, as any watcher of football knows, and as David Romer (2006) has extensively documented.

ECONOMICS (BUT NOT ECONOMISTS) TO THE RESCUE

One lesson of economics is that markets or auctions produce fairer and less random outcomes. To minimize the impact of luck, it must be the case that the team that receives the opening possession has no real advantage. To accomplish this, why not let the teams trade on who receives the opening possession with the starting position used as currency?

Although the idea is an economic one, it came first from those who care about the problem most—not from economists. Chris Quanbeck, an electrical engineer and a Green Bay Packers fan, was the first to suggest the idea of auctioning off the possession, according to an article in Slate. According to his idea, the team offering to start at a position closest to one’s own end line would win possession at that position.

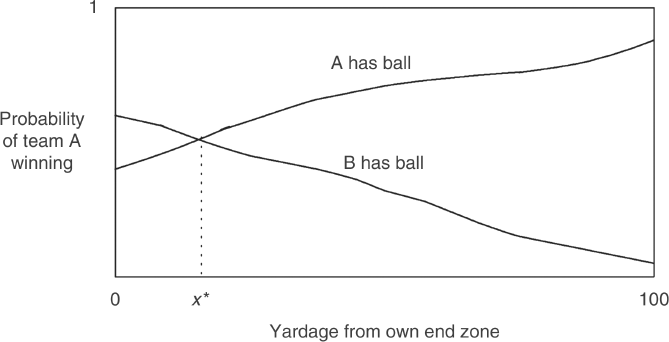

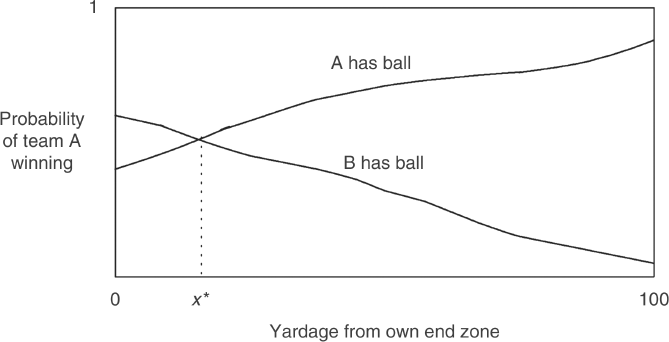

How can opening a market help make the overtime game less random and, therefore, more fair? Imagine that you offered each team the chance to have the first possession 100 yards from its own goal, ready to score. Each would grab at the chance, so it wouldn’t be fair to give it to either. What about 90 yards? Well, again, both teams would want the ball. On the other hand, neither would want the ball backed up against its own goal. So is there a distance x* in between where it wouldn’t matter to either team, whether A started with the ball x* yards from its goal line or B started with the ball x* yards from its goal line? Typically, there will be, as illustrated in Figure 32.1.

Say team A will win with probability p(x) against team B if A has possession x yards from A’s goal line, and with probability q(x) if B has possession x yards from B’s goal line; p(x) is the upward sloping line and q(x) is the downward sloping line in Figure 32.1. As x rises, p(x) will go up because it gets easier for A to score, at least from a field goal, as one gets close to the other team’s end line. Likewise, q(x) will fall with x because B too is more likely to win the farther from its own goal line it takes possession, which makes A less likely to win.

Consider the x* that equates p and q, the x* such that p(x*) = q(x*). Both teams must be indifferent to possession at x*. For example, it might be that the Steelers are just as likely to win if they get the ball at their own 18-yard line as if the Cardinals get the ball at the 18-yard line, that is, p(18) = q(18). But then the Cardinals should be indifferent to possession at precisely 18 yards, since 1 − q(18) = 1 − p(18).

But how would we find such an x*? Easy. Hold an auction.

Consider an auction in which each team is bidding for possession of the ball. The auction is descending in field position, which means that x begins at 100 yards, which means taking the ball at 100 yards from one’s own goal line. Each team would love that opportunity! Teams successively bid lower numbers, x, in an attempt to win the auction and get to start with the ball x yards from their own goal line. The lowest bid wins.

Suppose that the current bid is at x and team A is more likely to win if it starts with the ball x yards from its goal line than if B starts with the ball x yards from B’s goal line: that is p(x)> q(x). For such an x, A will lower its bid. Remarkably, team B will also want to lower its bid as well because 1 − q(x)> 1 − p(x), and 1 − q(x) is the probability that B wins if B takes the ball x yards from B’s goal line, and 1 − p(x) is the probability that B wins if A takes the ball at x yards from A’s goal line. Thus bids will go down until x falls to x*.

In fact, any standard auction could be used to achieve the same result. The point is that the auctions will force the teams to bid so that opening possession yields no real advantage. This outcome increases fairness by eliminating the randomness of the coin flip: the team losing possession at the bid of x* does not envy that possession.

Further, if two teams are equally strong or skilled, as is likely given the game is going into overtime, then they will win with the same likelihood; that is, if p(x) = 1 − q(x) for all x, then p(x*) = q(x*) = ½.

Instead of an auction, one could apply another classical idea, namely, the “divide-and-choose” method, to achieve the same outcome. One team (divider), selected by, say, coin flipping, proposes “x” and the other team (chooser) chooses between gaining and ceding possession at the chosen x. Say team A is the divider. Then, fearing that team B will choose the bigger of 1 − p(x) and 1 − q(x), thus leaving it with the “shorter end of the stick,” team A will equalize p(x) and q(x) by proposing x*.

COMPLICATIONS

The aforementioned theory is all very elegant, but it is unlikely that the teams will have a common and accurate understanding of the probabilities of each team winning starting at each position, as we have implicitly assumed. Each team presumably knows more than its opponent about the status of its own offense and defense units and, more importantly, its own kickers at the start of overtime. We (see Che and Hendershott 2008) argue in a paper in Economics Letters that in such a realistic setting, auctioning off the possession is fairer than divide and choose.

Suppose, for instance, that each team “guesses” x* with some error and that two teams’ guesses combined are more accurate than one team’s guess. In divide and choose, the divider will likely propose his best guess on x*, and this may “tip off” his information. The chooser may exploit this by acting on even better information than either team has. This means that coin flipping is again necessary to settle the imbalance, which brings us full circle.

Auctions avoid coin flipping altogether, since they treat both teams symmetrically. Standard ascending or descending auctions as well as sealed-bid auctions have this property and will do as well in aggregating guesses. They may engender strategic reactions, however. A winner’s (low bidder’s) guess on x* is likely biased below, and the loser’s guess is likely biased above, true x*. So teams may adjust their bids upward to overcome the “winner’s curse” in an ascending or first-price (low-bid) sealed-bid auction and adjust their bids downward to overcome “loser’s curse” in a descending or second-price (high-bid) auction. Such strategic reactions and possible mistakes can be minimized if the starting position is determined in a sealed-bid auction by the average of the low and high bids—our favorite proposal. To the extent that the best combined guess is close to the average of each team’s guess—a reasonable guess—each team will not gain much from strategizing and will be protected from possible mistakes in this format.

WHY NOT?

The NFL is aware of current overtime rules’ shortcomings. Prior to Super Bowl XLIII, NFL commissioner Roger Goodell suggested a new overtime format in which the team that takes the opening kickoff cannot win by a field goal on its first possession. While this would eliminate the most egregious overtime outcome, any proposal that does not take into consideration the teams and field conditions cannot fully eliminate the impact of the coin flip. The auction eliminates the coin flip and enables the teams to account for all relevant information.

Implementing an auction to begin the overtime would be a daring move for the NFL, but, as Tim Harford (2009) points out, it could be very entertaining. Imagine the opportunities for fans and commentators to second-guess coaches’ bidding strategies, saying things like, “Boy, I would have thought the Raiders would be more aggressive than that in their bidding given how well their offense is doing. One way to look at it is they are showing confidence in their defense, but given the number of points the Dolphins have scored today, that seems crazy.”

REFERENCES AND FURTHER READING

Harford, Tim. 2009. “Flipping Awful: Why the NFL Should Replace the Overtime Coin Toss with an Auction System.” Slate Magazine, January 29. Available at www.slate.com/id/2209436.