CHAPTER 10

Securities Lending & Borrowing and Collateral – Principles of SL&B

10.1 PRINCIPLES OF SECURITIES LENDING

The particular circumstances giving rise to securities lending include:

- increasing the return on investment

- reducing the cost of holding securities, and

- reducing taxation through arbitrage strategies.

It is important to remember that throughout the period of any SL&B trade, the securities lender retains an investment (or economic) interest in the particular security; consequently, the securities lender remains exposed to fluctuations in price and value (despite the fact that the security is no longer in the possession of the securities lender).

10.1.1 Increasing Return on Investment

Having purchased equity and bonds, the holder could choose to keep their securities safely and securely in the hands of the central securities depository (CSD) or custodian. By so doing, the investor can benefit from 1) increases in price (capital growth), 2) receipt of income payments, and 3) receipts of advantageous forms of corporate action.

Should the investor be prepared to lend some or all of its securities, beneficial ownership is retained by the securities lender; this means that capital growth, income and corporate actions are also retained by the lending investor.

But in addition, the securities lender earns fees for lending its securities.

When securities are lent, under normal circumstances the securities are delivered to the securities borrower and are therefore no longer under the direct control of the investor, although beneficial ownership is retained by the securities lender. Some investors contemplating the lending of their securities may feel that losing direct control of their assets is too much of a risk; however, potential lenders should consider the fact that it is standard practice for the securities borrower to provide collateral, the value of which covers the market value of the lent securities, plus an agreed margin percentage. Furthermore, common practice is for the securities lender and the securities borrower to sign legal documentation, designed to protect the interests of both parties; once signed, all individual securities lending & borrowing (SL&B) trades fall under the terms and conditions of the legal documentation.

In summary, the key motivation for a firm to lend its securities is to optimise the return on its existing assets.

10.1.2 Reducing the Cost of Holding Securities

When purchased securities are settled, the securities are held on behalf of the investor either 1) directly at a CSD, or 2) at a custodian. Whilst such shareholdings or bondholdings exist, the CSD or custodian will charge the investor securities safekeeping fees.

Such fees can become significant, and can be based upon a range of factors, including:

- asset type: whether equity or bonds, and

- average value of holdings.

Because lent securities are usually delivered to the securities borrower, safekeeping fees will be reduced and the securities lender will therefore benefit financially.

In summary, although such safekeeping fee reductions may not be a key factor in an investor’s decision whether to lend its securities or not, the investor does gain some benefit through avoiding safekeeping costs.

10.1.3 Arbitrage Strategies

In generic terms, arbitrage is the simultaneous purchase and sale of an asset in order to profit from price differences that exist in different markets.

Two examples of arbitrage strategies are:

- dividend reinvestment plan arbitrage, and

- dividend tax arbitrage.

Dividend Reinvestment Plan Arbitrage

A dividend reinvestment plan (DRiP) is a type of dividend that is paid by an equity issuer, to registered shareholders, in the form of cash or securities. This is known as an optional corporate action, in which the shareholder can choose whether to take cash or securities; normally, the shareholder will be given the default outcome of cash, unless the shareholder opts for securities. If the shareholder opts for securities, the cash value of the dividend (share quantity x dividend rate per share) is used by the issuer to supply the resultant shares to the investor at a discount to the current market price.

Some types of investor may be required to accept cash in a DRiP, as they are prevented from opting for securities. For example, index tracking funds cannot deviate from defined securities weightings as their holdings would become greater than their investment guidelines permit and are therefore restricted to taking cash in a DRiP; the index tracking fund must therefore miss out on the opportunity to opt for the securities. However, such funds have an obligation to maximise returns for their investors.

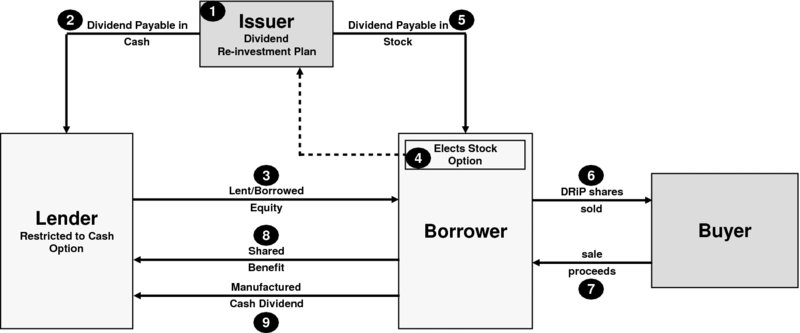

A dividend reinvestment plan arbitrage involves the lending of securities by the beneficial owner, to a borrower that is able to accept the securities offered in a DRiP. By executing such an SL&B trade, both the securities lender and the securities borrower gain a benefit. Providing the borrower takes possession of the borrowed securities prior to the record date of the dividend, the borrower will opt for securities and the resultant shares will then be sold in the open market. The benefit gained from this overall transaction is the difference between the cash value of the DRiP and the proceeds from the sale of the shares acquired through the DRiP; the benefit is shared between the securities lender and the securities borrower. This series of steps is illustrated in Figure 10.1:

FIGURE 10.1 Dividend reinvestment plan arbitrage

The steps in the diagram are explained as follows:

- Step 1: the issuer announces a dividend in the form of a DRiP

- Step 2: the existing holder is restricted to taking cash only

- Step 3: the existing holder lends the equity to a borrower – delivery needs to occur prior to the record date of the dividend

- Step 4: the borrower communicates to the issuer that it wishes to take the stock option (rather than the cash option)

- Step 5: the issuer provides stock to the borrower

- Step 6: the borrower sells the stock arising from the DRiP

- Step 7: the borrower delivers the DRiP shares to the buyer and receives the sale proceeds from the buyer

- Step 8: the benefit derived (the difference between the cash value of the DRiP and the proceeds from the sale of the shares acquired through the DRiP) is shared between borrower and lender

- Step 9: the cash dividend amount is ‘manufactured’ by the borrower and is paid to the lender – the lender thereby receives the dividend as originally expected, plus their share of the benefit.

Note: unlike the usual reason for borrowing securities (to fulfil a delivery commitment) in which the borrower on-delivers the borrowed securities, this strategy results in the borrower holding the borrowed securities, albeit temporarily.

Dividend Tax Arbitrage

Income payable on most equity (as dividends) and some bonds (as coupon) is subject to withholding tax (WHT). The tax authority within the issuer’s country demands that the issuer deducts WHT from payments to investors at the appropriate rate, the choice of which can be:

- the statutory rate, for example 25%:

- this is the basic rate of WHT deductible from income payable to investors that do not fall within either of the following two categories

- also known as the ‘non-treaty rate’

- the treaty rate, for example 15%:

- governments of many countries enter into double taxation agreements (also known as ‘treaties’) with other national governments. When income is paid by an issuer to an investor resident in a treaty country, the applicable rate of WHT is the ‘treaty rate’, a lower rate of WHT compared with the ‘non-treaty rate’

- the exempt rate, that is 0%:

- some countries allow shareholders that are qualified pension funds and charities which are resident in other countries to be exempt from WHT.

Note that where WHT is applicable, the WHT is deducted (withheld) from income payments made by the issuer; the investor is therefore credited with the net proceeds of the income. The issuer must remit the WHT to its national tax authority.

Dividend tax arbitrage is the lending/borrowing of securities on which income is payable imminently, in order for both lender and borrower to benefit financially, where a difference exists in the withholding tax rates payable by the securities lender and the securities borrower. It is the practice of temporarily exploiting the differences in WHT rates between the issuer’s country and the countries of residence of investors.

In situations where the shareholder’s or bondholder’s rate of withholding tax is the non-treaty rate (for example 25%), the holder may choose to lend the relevant security to a borrower that is resident in a treaty country and whose applicable withholding tax rate is considerably lower (for example 15%). Once the SL&B trade has been executed, the transfer of the lent/borrowed security must occur no later than the record date of the income payment, to facilitate the lower rate of WHT being deducted from the payment made by the issuer to the securities borrower. The differential (in the above example 10%) is shared between the securities lender and the securities borrower. Figure 10.2 represents the sequence of steps.

FIGURE 10.2 Dividend tax arbitrage

Explanation of diagram:

- Step 1: the existing holder is subject to 25% WHT on the income due

- Step 2: the security is lent to a borrower that is subject to a lower WHT rate (e.g. 15%)

- Step 3: the issuer pays the borrower after deduction of the lower WHT rate

- Step 4: lender and borrower share the benefit gained (in this case 10%).

Note: unlike the usual reason for borrowing securities (to fulfil a delivery commitment) in which the borrower on-delivers the borrowed securities, this strategy results in the borrower holding the borrowed securities, albeit temporarily.

10.2 PRINCIPLES OF SECURITIES BORROWING

The particular circumstances giving rise to securities borrowing include the need:

- to fulfil a delivery commitment

- to deliver high quality collateral.

10.2.1 Fulfilling Delivery Commitments

Typically, the reasons why some firms borrow securities when they have an obligation to deliver securities is due to 1) a technical short position, and 2) short selling.

When a firm sells securities, the following motivating factors are normally at play:

- receiving the sale proceeds at the earliest opportunity:

- the earliest opportunity is the value date of the sale, and

- in order to receive the sale proceeds, the seller must deliver the securities to the buyer, assuming the settlement method is delivery versus payment (DvP)

- settling the client’s purchase on value date:

- where an investment bank has sold securities to a buy-side counterparty, the buyer expects the securities to be delivered on value date

- from a client service perspective, it is important that such deliveries are made on time

- avoiding the buyer enforcing settlement:

- if the buyer is in urgent need of the securities, the ultimate measure that the buyer can take is to enforce settlement by invoking the market’s buy-in procedure.

Technical Short

A firm may purchase securities and immediately sell them. If settlement of the firm’s purchase occurs on its due date (value date), then it is expected that the firm’s sale will also settle on its value date; if this is the case, there is no requirement to borrow the securities. This is because the timely settlement of a firm’s purchase will facilitate settlement of the firm’s sale.

However, the failure to settle a purchase on its due date provides the firm with the opportunity to settle its sale before the purchase, and to benefit financially. (The settlement failure of a firm’s purchase is usually due to the seller having an insufficient quantity of securities available for delivery.)

Assume the firm XYZ Securities has executed a purchase with one counterparty, and an equal and opposite sale with a different counterparty; also assume that all components of the two trades are identical, as listed in Table 10.1:

TABLE 10.1 Executed trades

| Trades Executed by XYZ Securities | ||

| 001 | Trade Number | 002 |

| Party D | Counterparty | Party K |

| Buy* | Operation | Sell* |

| 5th June | Trade Date | 5th June |

| 7th June | Value Date | 7th June |

| 1,000,000 | Quantity | 1,000,000 |

| M&S Shares | Security | M&S Shares |

| GBP 3.26 | Price | GBP 3.26 |

| DvP | Settlement Method | DvP |

* Note: ‘Buy’ means that XYZ Securities buys from the counterparty, and ‘sell’ means that XYZ Securities sells to the counterparty

Both the purchase and sale by XYZ Securities are due to settle on a delivery versus payment (DvP) basis.

If on value date Party D is able to deliver the securities to XYZ Securities and XYZ Securities makes payment to Party D, that will in turn allow XYZ Securities to deliver the securities to Party K and to receive the sale proceeds. This means that both trades have successfully settled on value date; consequently, there is no opportunity for XYZ Securities to make profit through securities borrowing.

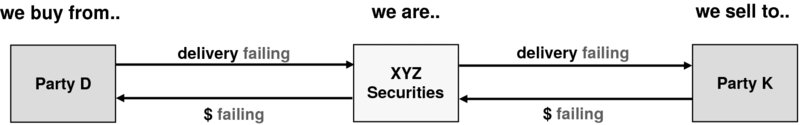

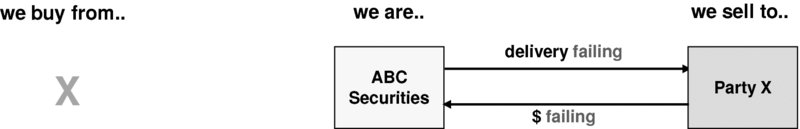

Instead, when value date is reached, if Party D fails to deliver the securities, then this will prevent XYZ Securities from settling its sale and receiving its sale proceeds at the earliest opportunity, as depicted in Figure 10.3.

FIGURE 10.3 Technical short situation, due to settlement failure of the purchase

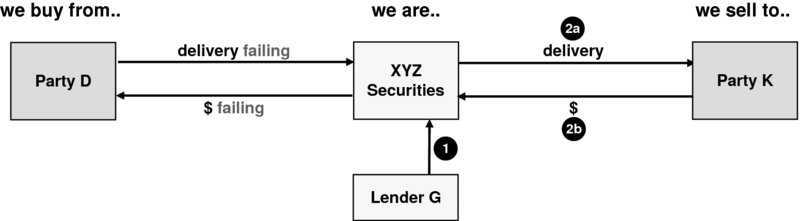

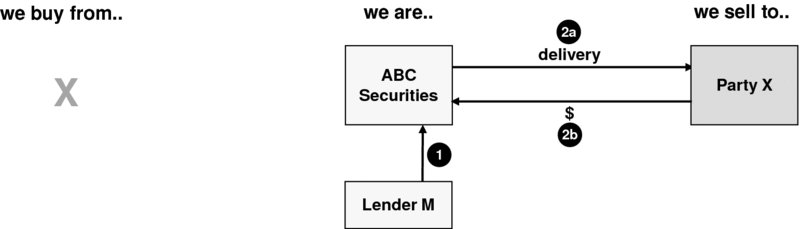

However, under the circumstances in which Party D cannot deliver the securities to XYZ Securities on value date, XYZ Securities may choose to borrow securities in order to settle its sale and thereby receive its sale proceeds (before having paid Party D), as depicted in Figure 10.4.

FIGURE 10.4 Technical short situation, post-borrowing

Following settlement failure on value date of its purchase:

- Step 1: XYZ Securities executes a securities borrowing trade with Lender G, on an ‘open’ basis, resulting in Lender G delivering the securities to XYZ Securities

- Step 2a: XYZ Securities now delivers the borrowed securities to Party K, on a DvP basis

- Step 2b: simultaneously, XYZ Securities receives the sale proceeds from Party K.

Note: the borrowing of securities by XYZ Securities from Lender G was executed on an ‘open’ basis, which contractually permits XYZ Securities to close the trade with Lender G at any time.

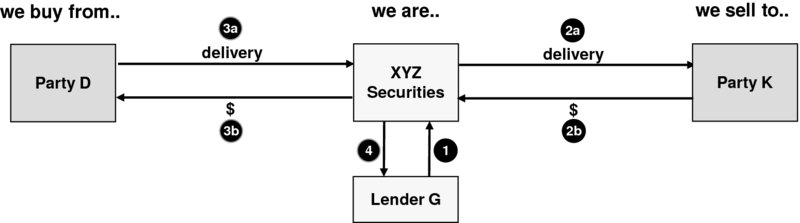

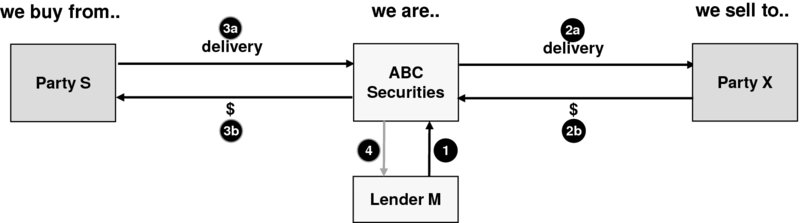

At a later point in time (potentially days or weeks later), Party D delivers the securities it sold to XYZ Securities. The securities received by XYZ Securities should now be returned to Lender G and to close the securities borrowing trade, as depicted in Figure 10.5:

FIGURE 10.5 Technical short situation, post-settlement of purchase

- Steps 1, 2a and 2b are as per Figure 10.4 above

- Steps 3a and 3b: at a later date, Party D delivers its sold securities to XYZ Securities, on a DvP basis

- Step 4: the securities received by XYZ Securities from its purchase are now used to reimburse the securities lender (Lender G), following which the securities borrowing trade has been closed.

Under the circumstances described above, in summary, the buyer with a failing purchase may choose to borrow the securities in order to settle its sale, thereby 1) receiving the sale proceeds at the earliest opportunity, 2) keeping the client happy (where the buyer is a buy-side firm), and 3) avoiding a buy-in.

Short Selling

The sale of a security that the seller does not own is said to be a short sale, meaning that the first trade executed by a firm in a particular security is a sale (rather than a purchase); another way of representing this situation is that the seller has taken a negative trading position. Such trades are executed by a firm’s trader in the expectation and hope that the security’s price will fall in the coming days or weeks or months. If the trader’s initial decision proves to be correct, the securities will be purchased at a lower price at a later date, thereby generating profit for the trader and the firm.

Historically, a trader may have executed a short sale without first ensuring the securities can be borrowed; this is known as a naked short which is no longer allowed by regulation (at least in some markets). Conversely, a short sale executed only after the trader ensures the securities can be borrowed, is said to be a covered short; in some markets today, regulation permits this type of short selling of equity and government bonds.

Figure 10.6 depicts the situation for a firm that has executed a short sale, prior to borrowing:

FIGURE 10.6 Short selling situation, pre-borrowing

The diagram illustrates that firm ABC Securities cannot deliver the securities to settle its sale, as it owns none of the particular securities and it has not (yet) purchased such securities; consequently, ABC Securities will suffer a delay in the receipt of the sale proceeds, if no action is taken.

ABC Securities now borrows the securities to settle its sale; Figure 10.7 illustrates this situation:

FIGURE 10.7 Short selling situation, post-borrowing

- Step 1: ABC Securities executes a securities borrowing transaction with Lender M, resulting in Lender M delivering the securities to ABC Securities

- Step 2a: ABC Securities now delivers the borrowed securities to Party X on a DvP basis

- Step 2b: simultaneously, ABC Securities receives the sale proceeds from Party X.

At a later point in time, ABC Securities purchases the securities in the marketplace resulting in ABC Securities receiving delivery of the securities, in turn facilitating the closure of the securities borrowing transaction, as depicted in Figure 10.8:

- Steps 1, 2a and 2b are as per Figure 10.7 above

- Steps 3a and 3b: at a later date, ABC Securities purchases the securities from Party S who then delivers the securities to ABC Securities, on a DvP basis

- Step 4: the securities received by ABC Securities from its purchase are now used to reimburse the securities lender (Lender M), following which the securities borrowing trade has been closed.

FIGURE 10.8 Short selling situation, post-purchase

In a short selling situation, in summary, the seller is usually obliged to arrange the borrowing of securities prior to execution of a short sale, following which that sale will be settled, thereby 1) receiving the sale proceeds at the earliest opportunity, 2) keeping the client happy (where the buyer is a buy-side firm), and 3) avoiding a buy-in.

Delivering High Quality Collateral

The 2008 Global Financial Crisis triggered regulators to demand the mitigation of firms’ risks in financial transactions, through the provision of collateral. Such regulatory requirements are most noticeable in relation to the mitigation of exposures associated with trades in OTC derivatives; the regulation in Europe is known as the European Market Infrastructure Regulation (EMIR), and in the USA is the Dodd-Frank Act.

Mitigation of exposures in OTC derivative trades is usually achieved by the giving or taking of cash collateral or of highly rated government bonds; the latter is known as high quality liquid assets (HQLA). However, the choice of giving either cash collateral or HQLA is not always available to the collateral giver. This is because the introduction of mandatory central clearing (via central counterparties – CCPs) of standardised OTC derivative trades brings with it strict regulation as to the type of collateral that may be provided to CCPs in order to mitigate exposures.

For some organisations that engage in OTC derivative trades, the nature of their business means that they do not necessarily possess the (collateral) asset types that are CCP-eligible. This situation means that such organisations need to borrow HQLA so as to comply with margin calls received from CCPs.

This topic is described further within Part 4c ‘OTC Derivatives and Collateral: Regulatory Change and The Future of Collateral’.

10.3 LENDABLE AND BORROWABLE ASSETS

The types of securities that are typically required by securities borrowers (and are therefore lendable by securities lenders) include:

- equity:

- global equity

- American Depository Receipts (ADRs)

- Global Depository Receipts (GDRs)

- Exchange-Traded Funds(ETFs)

- bonds, issued by:

- central governments

- supranational entities

- agencies

- corporations

- other types of security:

- mortgage-backed securities.

10.4 PARTICIPANTS IN THE SECURITIES LENDING & BORROWING MARKETPLACE: INTRODUCTION

The typical parties that are involved in the lending and borrowing of securities are primarily the following.

10.4.1 Securities Lenders

The types of organisation that are active in securities lending are those that are classified as institutional investors, many of which have significant assets provided by their underlying members or investors. Such organisations have the nickname of ‘buy-side’, because they are often long-term investors in equity and bonds; consequently, they are ideally suited to enhance their returns through their preparedness to lend the securities they own.

The following types of firm are amongst the buy-side community:

- pension funds

- mutual funds

- investment funds

- exchange-traded funds

- sovereign wealth funds

- endowment funds

- private foundations

- insurance companies.

Some types of fund operate within very competitive environments, where their investment performance is compared against their rivals; therefore having a means to increase their returns (via securities lending) becomes a critical component of their ongoing performance. Other buy-side firms may view securities lending revenues as a means of reducing their costs, such as securities safekeeping fees charged by CSDs and custodians.

Some of the larger buy-side firms may choose to manage their securities lending activity by themselves, where the parties to an SL&B trade are the securities lender and the securities borrower, with no intermediary involved.

Conversely, many buy-side firms utilise the securities lending services provided by intermediary firms, some of which are known as lending agents; see ‘Intermediaries’ later in this section of this chapter.

10.4.2 Securities Borrowers

The normal borrowers of securities include the following:

Broker-Dealers

- market makers form part of the Securities Trading Department of investment banks or broker-dealers, and are required to quote prices at which they are prepared to buy and to sell specific securities for which they choose to make a market; as market makers, they are obliged to execute purchases and sales of such securities, at their quoted prices

- when a market maker sells, they may or may not own the share quantity they are selling. In situations in which the market maker is selling short (i.e. taking a negative trading position), their ability to borrow securities in order to effect delivery of such sales is of paramount importance in fulfilling their role as a market maker.

- the Trading Department of broker-dealers (which includes market making) buy and sell equity and bonds. On many occasions, the broker-dealer’s ability to settle their sale on the value date of the trade is dependent upon their purchase settling first

- where settlement of the broker-dealer’s purchase is delayed (i.e. settlement failure), it is in the broker-dealer’s interest to settle the sale without delay; borrowing securities under such circumstances enables the broker-dealer to effect the delivery to the buyer, thereby:

- receiving the sale proceeds at the earliest opportunity

- satisfying the securities delivery required by buy-side buyers, and

- avoiding a buy-in (enforcement of settlement) by the buyer.

- where settlement of the broker-dealer’s purchase is delayed (i.e. settlement failure), it is in the broker-dealer’s interest to settle the sale without delay; borrowing securities under such circumstances enables the broker-dealer to effect the delivery to the buyer, thereby:

Hedge Funds

- amongst a variety of trading strategies employed by hedge funds, such firms utilise short selling; consequently, there is a need for securities borrowing in order to settle such short sales. Many hedge funds utilise various services provided by prime brokers, including facilitating the borrowing of securities to settle short sales executed by hedge funds.

In general terms, as time passes there is an increasing need for firms of all types to provide collateral for their various financial transactions. For example, a firm:

- may have borrowed equity or a bond, for which the securities lender requires high quality securities collateral

- may have executed a repo trade in which the firm wishes to borrow cash and needs to provide high quality securities collateral to the cash lender

- may have executed an OTC derivative trade in which the central counterparty (under EMIR or Dodd-Frank) is calling the firm to provide high quality securities collateral

- in all three cases above, if the firm does not possess the necessary securities collateral, it is likely that the firm will choose to borrow the securities.

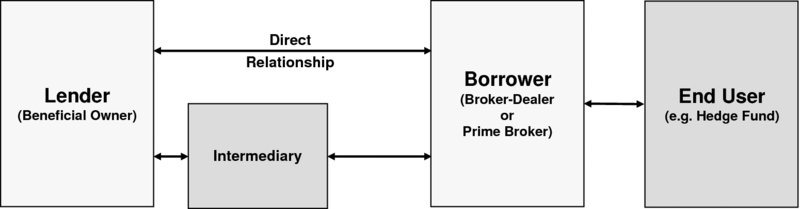

10.4.3 Intermediaries

As mentioned earlier, some of the larger buy-side firms choose to lend their securities directly to borrowers, whereas other buy-side firms opt to utilise the services provided by securities lending & borrowing intermediaries.

Amongst the types of firm that fall within the category of intermediary are:

- international central securities depositories

- global custodians

- trading platforms and associated central counterparties, and

- non-custodial lending agents.

The role that intermediaries play is depicted in Figure 10.9:

FIGURE 10.9 The role of the intermediary in securities lending & borrowing

International Central Securities Depositories

A central securities depository (CSD) is the ultimate storage location of securities within a financial centre, in which securities are held by the CSD in safe custody and on behalf of the securities holder, within one or more securities accounts; similarly, cash accounts are maintained.

The record of ownership is typically maintained electronically, and the settlement of trades is usually conducted by electronic book-entry on a delivery versus payment (DvP) basis or on a free of payment (FoP) basis.

Today, CSDs are present in most (if not all) major financial centres around the globe, usually on a per-country basis; these are known as national central securities depositories (NCSDs). Commonly, within a country one NCSD exists for domestic equity and bonds, although in some cases separate NCSDs exist for (say) equity as opposed to government bonds. At the time of writing, in China three NCSDs exist; one for equity, another for government bonds, and a third for corporate bonds.

In addition to numerous NCSDs globally, two international central securities depositories (ICSDs) exist, namely Clearstream International (Luxembourg) and Euroclear Bank (Brussels). Both ICSDs manage 1) international securities as well as 2) domestic securities, the latter usually being achieved via electronic links with certain NCSDs. Furthermore, both ICSDs are multi-currency environments, in which currency balances can be held overnight (as opposed to being zeroised each day as occurs in some NCSDs).

Both ICSDs offer automated and anonymous securities lending and securities borrowing programmes to their members. For further details as to the role of ICSDs in securities lending & borrowing, please refer to Chapter 12 ‘Securities Lending & Borrowing and Collateral – Accessing the SL&B Marketplace’.

Note: Target2 Securities (T2S) is a pan-European project in which trade settlement (which has historically been actioned within the relevant NCSDs) will instead be actioned within the T2S settlement platform, in central bank money.

Global Custodians

Generically speaking, custodians are organisations that provide services to securities holders that do not have direct accounts at NCSDs or ICSDs. Many buy-side firms choose not to become direct members of CSDs, and instead become clients of either a local custodian in a particular marketplace, or of a global custodian that provides access to multiple markets around the globe.

The custodian usually has one or more accounts at the relevant CSD, in which their various clients’ securities are held. Note that the clients of such custodian organisations have a relationship directly with the custodian, and not with the CSD.

Global custodians (GCs) usually operate a network of sub-custodians that hold such assets on behalf of the GC; in turn the GC holds the securities on behalf of its client. The benefit in a firm utilising the services provided by global custodians is that it is a single point of contact for multiple markets around the globe.

A number of global custodians offer securities lending & borrowing services to their members.

For further details as to the securities lending & borrowing services provided by global custodians, please refer to Chapter 12 ‘Securities Lending & Borrowing and Collateral – Accessing the SL&B Marketplace’.

Central Counterparties

Trading platforms are software systems which facilitate the act of trade execution between two members of the system.

Central counterparties (CCPs) are firms that are situated between a buyer and a seller; the CCP is the buyer to every seller and the seller to every buyer. CCPs minimise counterparty risk, as the bilateral counterparty does not apply. The CCP becomes a party to a trade by one of two routes, either:

- immediately upon trade execution, where trading is anonymous and where the counterparty to both the end-buyer and end-seller is the CCP, or

- trade execution occurs directly between the two member firms and is subsequently assigned to the CCP by the process of novation.

Eurex is a Germany-based organisation which offers both trade execution capability and CCP services via its clearing house Eurex Clearing. Amongst its various services, securities lending & borrowing trades are executed bilaterally, then novated to Eurex Clearing as CCP.

For further details as to the role of CCPs in securities lending & borrowing, please refer to Chapter 12 ‘Securities Lending & Borrowing and Collateral – Accessing the SL&B Marketplace’.

Non-Custodial Third Party Lending Agents

Many buy-side firms choose to lend their securities via non-custodial lending agents, whereby the beneficial owner uses the lending agent as the conduit to securities borrowers.

The primary role of third party lending agents is to negotiate the terms of securities lending with borrowers, and to manage such arrangements on an ongoing basis, on behalf of the beneficial owner of the securities. ‘Non-custodial’ refers to this type of lending agent being a firm that does not have direct possession of the beneficial owner’s securities assets (unlike a CSD or global custodian).

For further details as to the role of non-custodial third party lending agents, please refer to Chapter 12 ‘Securities Lending & Borrowing and Collateral – Accessing the SL&B Marketplace’.

10.5 SECURITIES LENDING & BORROWING: LEGAL DOCUMENTATION

Because a securities lending & borrowing (SL&B) trade is executed over a period of time, risks and exposures arise for both lender and borrower.

In parallel with other types of collateralised transaction (e.g. repo and OTC derivatives), before a firm executes an SL&B trade, for its own protection (and that of its counterparty) it is essential that an appropriate legal agreement is signed between the two trading parties. Once the legal agreement is in place, each individual SL&B trade is then executed between the two parties with reference to and under the protection of the legal agreement.

10.5.1 Background

Over a number of years, as the style and content of trades were shaped amongst the SL&B trading community, a common standard for the content of SL&B legal agreements was developed.

Today, that standard legal agreement is entitled the ‘Global Master Securities Lending Agreement’ and is commonly known as the GMSLA. Various versions of the GMSLA have been produced over the years, the latest of which is the 2010 version (at the time of writing).

10.5.2 GMSLA: Overview

In essence, the purpose of legal agreements such as the GMSLA is to clearly state contractual rights for both parties, and their contractual obligations.

One very important feature of the GMSLA is clearly defined events of default; if a firm’s counterparty has defaulted (or becomes insolvent), the agreement permits obligations relating to all open trades falling under the agreement to be immediately terminated and set off against each other, and settled on a net basis. The right of set-off is invaluable to a firm, as without such a right 1) all payment obligations of a firm may be required to be made, without 2) simultaneous receipt of obligations due to the firm. In an insolvency situation, the latter can take an inordinate length of time, in some cases months or years. Due to over-collateralisation given by the securities borrower over and above the market value of the lent security, it is expected that the securities lender normally holds adequate collateral to repurchase the lent securities in the market, via utilisation of cash collateral held or by selling securities collateral held.

The GMSLA additionally contains terms and conditions covering areas such as:

- the beneficial owner and legal owner of the lent/borrowed security

- the beneficial owner and legal owner of securities collateral

- the value of collateral that must be given relative to the value of the lent/borrowed securities

- whether a margin is to be applied

- the method of settlement of the opening and closing legs

- the procedure for closing ‘open’ trades

- conditions under which margin calls can be made

- collateral substitution conditions

- the treatment of income payments (e.g. coupons and dividends)

- the securities that must be returned upon trade closure.

Between two parties that intend executing SL&B trades with one another, the wording within the GMSLA is typically not altered. Any specific arrangements between the two parties are documented within the Schedule to the GMSLA.

10.5.3 Ownership and Reuse of Securities

Specifically, regarding ownership of the lent/borrowed security and of securities collateral:

- the lent/borrowed security:

- legal ownership of the lent securities is transferred from the securities lender to the securities borrower for the duration of the SL&B trade. From an operational standpoint, however, the lender has not sold the lent security, and as such retains beneficial rights. Whilst the securities borrower is the legal owner, the securities lender is the beneficial owner. Legal ownership is transferred because, under the GMSLA, the legal basis on which the securities are lent/borrowed is title transfer

- securities collateral:

- in parallel with the above, legal ownership of securities collateral is transferred from the securities borrower (collateral giver) to the securities lender (collateral taker) for the duration of the SL&B trade. From an operational standpoint, however, the securities borrower has not sold the securities collateral, and as such retains beneficial rights. Whilst the securities lender (collateral taker) is the legal owner of the securities collateral, the securities borrower (collateral giver) is the beneficial owner. Legal ownership is transferred because, under the GMSLA, the legal basis on which securities collateral is given/taken is title transfer.

The method of transfer of a securities purchase and sale is also title transfer, therefore the securities borrower and the securities collateral taker in an SL&B trade have the same unlimited rights to the securities as if those parties had instead purchased the securities. Consequently, both parties are free to choose whatever they wish to do with the securities, including:

- for the securities borrower:

- on-delivering in order to fulfil a delivery commitment, or

- holding the securities safely within the borrower’s account at its custodian (where the securities have been borrowed for a different purpose than on- delivering)

- for the securities lender (collateral taker):

- holding the securities collateral safely within the lender’s account at its custodian, or

- reusing the securities collateral in one (or more) of the following ways: selling it, repoing it, lending it, or delivering it to satisfy a margin call in (for example) an OTC derivative transaction.

Note that, due to title transfer, neither the securities lender nor the securities borrower (collateral giver) has the legal right to prevent its counterparty from reusing the collateral. However, at the close of the SL&B trade, each party is obliged to return to its counterparty the equivalent security or the equivalent collateral (as appropriate). Each party must remain aware of this fact, particularly if:

- the securities borrower has chosen to on-deliver the borrowed securities, or

- the securities lender has chosen to reuse the securities collateral.

10.5.4 Uniqueness of Legal Documentation

Specifically, from a collateral management perspective, it is important to note that each set of legal documents (i.e. the GMSLA plus the Schedule) a firm has with each of its SL&B counterparties is likely to contain different terms and conditions and unique characteristics.

It is therefore imperative that the SL&B operations personnel carry out their day-by-day responsibilities according to the legal terms defined with each of their counterparties in the appropriate legal documents. If there is a failure to do so, the firm is likely to be at risk as, for example, the firm’s exposures with counterparties may not be fully mitigated, and/or counterparty’s exposures may be over-collateralised.

In order to view the content of the current GMSLA, the complete 2010 version can be found in Chapter 13 ‘Securities Lending & Borrowing and Collateral – The Global Master Securities Lending Agreement’.

10.6 SECURITIES LENDING & BORROWING AND COLLATERAL

10.6.1 Risks and Risk Mitigation

Upon delivery of the lent securities to the borrower, the lender has a definite and immediate risk: the risk that the borrower will fail to return the lent securities. The following mitigating actions are usually taken by the securities lender:

- a securities lending & borrowing legal agreement (GMSLA) should be signed

- trades are executed on an ‘open’ (as opposed to ‘term’) basis, thereby allowing the securities lender to recall the lent securities at any time and at very short notice

- collateral must be provided by the securities borrower to the securities lender

- collateral must be of an adequate value* so as to cover the repurchase cost of the lent securities, in the event of the securities borrower’s insolvency

- collateral acceptable to the securities lender is defined so as to make certain that only liquid securities are eligible

- the required value of collateral incorporates a margin (over-collateralisation) given by the securities borrower.

Similarly, the borrower is at risk of not having its collateral returned by the securities lender. The GMSLA is designed to protect the interests of both parties.

10.6.2 Purpose and Use of Collateral

Following execution of a securities lending & borrowing (SL&B) trade, the lender will deliver the securities to the borrower. The lender of securities bears the risk that the borrower will fail to return the lender’s securities.

In order to mitigate that risk, it is common practice for the lender to receive collateral from the borrower. The form of collateral acceptable to the lender is agreed prior to executing a securities lending & borrowing trade, within a legal agreement.

If the lender is to avoid going on-risk and having an exposure, the value of collateral given by the securities borrower must be no less than the market value of the lent securities, plus the applicable margin, throughout the lifetime of the securities loan. Because the value of the lent securities will fluctuate and does not remain static, both securities lender and borrower must recalculate the value of the lent securities at the agreed frequency, normally on a daily basis. During the lifetime of the SL&B trade and on a day-to-day basis, this may result in the need for the borrower to provide further collateral, or for the securities lender to return some of the existing collateral; such activity is the result of margin calls which are made by the party with the current exposure.

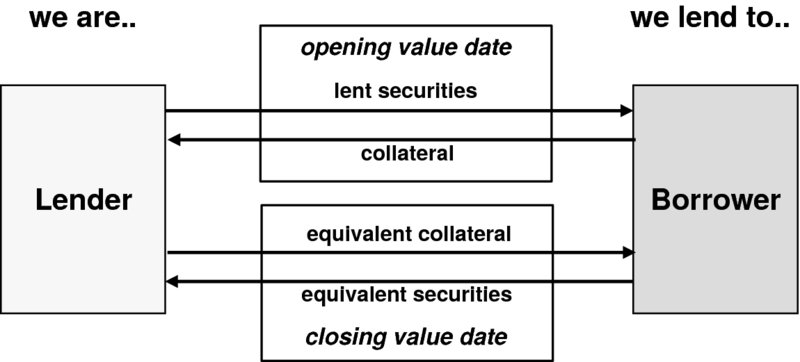

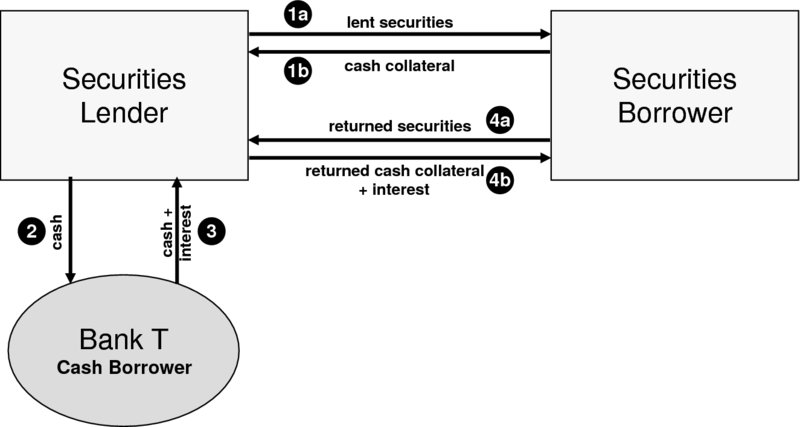

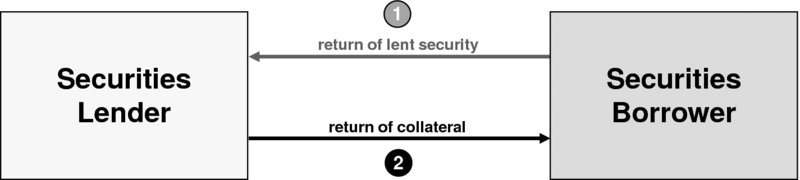

When the lender delivers the lent security, in order to mitigate the lender’s risk (of not having their asset returned) the borrower is required to provide collateral simultaneously. Likewise, at the close of the trade, when the borrowed securities are returned to the lender the collateral must be returned to the borrower simultaneously. This is illustrated in Figure 10.10:

FIGURE 10.10 Securities lending trade structure, including collateral

Because (under normal circumstances) a securities borrower executes a borrowing trade due to a delivery commitment that it cannot otherwise fulfil, a securities borrower will take possession of the borrowed securities from the lender and immediately on-deliver the borrowed securities to another party. Any delay between the receipt of the borrowed securities and the on-delivery is likely to result in the securities borrower incurring unnecessary borrowing costs. This, therefore, means that (under normal circumstances) the borrower does not have possession of the borrowed securities throughout the lifetime of the borrowing, although it does have a legal commitment to return to the lender equivalent securities; the word ‘equivalent’ is used in recognition of the possibility that, during the lifetime of the SL&B trade, the original lent/borrowed security could be cancelled and replaced by a new ISIN (as a result of a corporate action event). If no such event has occurred, the borrower is required to return to the lender the same quantity of the same ISIN, upon closure of the SL&B trade.

10.6.3 Eligible Collateral

The form of collateral eligible (acceptable) to the lender must be documented within the legal documentation.

Typically, and per trade, eligible collateral will be either cash (in one or more specified currencies) or securities. Where securities are eligible, it must also be stated whether, for example, equity is eligible. Bonds are usually acceptable, providing they are issued by highly rated governments, government agencies, supranational organisations and corporations.

As mentioned earlier in this chapter (within Section 10.2 ‘Principles of Securities Borrowing’), high quality liquid assets (HQLA) are in great demand as collateral relating to, for example, OTC derivative exposures; consequently, securities borrowers are seeking to utilise other collateral assets wherever possible for their SL&B trades, thereby saving HQLA for when they are the only form of collateral acceptable to a counterparty.

Whether cash or securities collateral, the securities lender must have certainty that, should the securities borrower fail to return the lent security, the market value of its lent security is recoverable by liquidating the collateral it holds. This means 1) for cash collateral, becoming the owner of the cash it holds, and 2) for securities collateral, selling the securities and taking ownership of the sale proceeds.

Whether cash or securities collateral, it is common practice for a margin to be applied over and above the current value of the lent/borrowed security; ‘margin’ is the terminology used in SL&B for a valuation percentage. To clarify, margin has the effect of increasing the current market value of a lent/borrowed security in order to derive the required value of collateral which the borrower must provide to mitigate the securities lender’s risk; in other words, the borrower is required to over-collateralise. This is depicted in Table 10.2:

TABLE 10.2 Required collateral value

| Required Collateral Value | |||

| Trade # | Lent Security Current Market Value | Margin | Required Collateral Value |

| 1 | EUR 20,000,000.00 | 2% | EUR 20,400,000.00 |

| 2 | USD 16,000,000.00 | 5% | USD 16,800,000.00 |

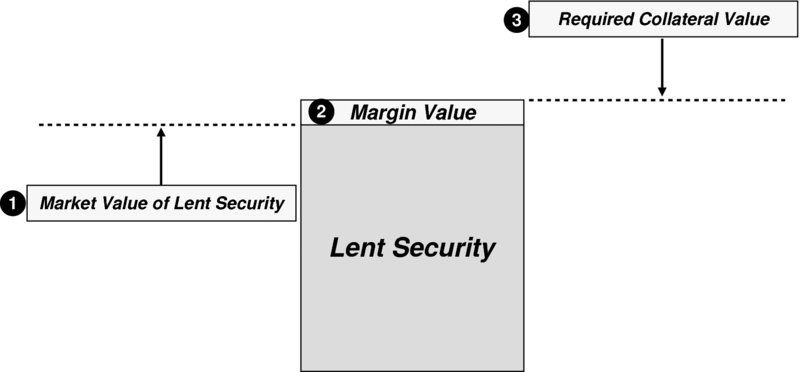

10.6.4 Over-Collateralisation (Margin)

In SL&B trades, it is common practice to apply a risk adjusted value over and above the market value of the lent/borrowed security; this risk adjusted value is expressed in percentage terms and is known as ‘margin’ (the equivalent of ‘haircut’ in a repo trade).

Margin provides an additional cushion of value to the securities lender, its purpose being to mitigate the risk of adverse movements in the value of collateral relative to the value of the lent security.

The value of collateral required by the securities lender is the sum of 1) the market value of the lent security, and 2) the value of the margin percentage. The margin therefore denotes the extent to which the securities borrower is required to over-collateralise the value of the borrowed securities. This is represented in Figure 10.11:

FIGURE 10.11 Deriving the required collateral value

Table 10.3 provides a monetary example:

TABLE 10.3 Calculation of required collateral value

| Currency | Cash Value | |

| Market Value of Lent Securities | EUR | 7,500,000.00 |

| Margin Value (2%) | EUR | 150,000.00 |

| Required Collateral Value (102%) | EUR | 7,650,000.00 |

Margin impacts the securities lender positively, as they will receive a greater value of collateral than the market value of the lent security. However, the securities borrower is impacted negatively, for the same reason.

It is important to note that margin is applicable not only to settlement of the opening leg, but it must be maintained throughout the lifetime of the SL&B trade as part of daily exposure management.

For reasons of standardisation and to facilitate automation, in the past it has been market practice to apply standard margin percentages of:

- 102%, where the lent security and collateral are in the same currency

- 105%, where the currencies of the lent security and collateral are different, and

- c.110%, where equity collateral is used.

Although such fixed percentages can still be applied today, a recent trend has been for firms to negotiate margin percentages according to factors including the particular parties involved and the specific type of collateral provided.

Whatever are the agreed margin percentages between two firms, they are documented within the schedule to the GMSLA.

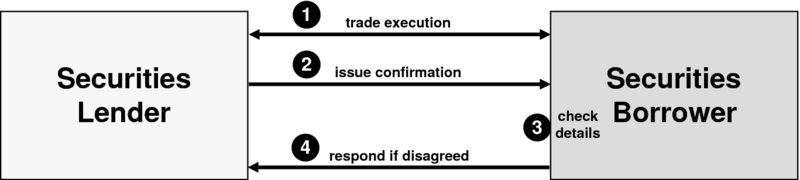

10.6.5 Trade Confirmation

Where any form of financial transaction is executed on an over-the-counter (OTC) basis and directly between two parties, including securities lending & borrowing, the risk exists that a misunderstanding has occurred between the two parties, and/or that transaction details are recorded incorrectly by one of the parties. Such discrepancies may well lead to settlement failure or incorrect settlement, potentially causing financial loss to one or both parties.

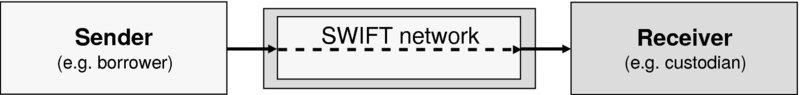

Consequently, it is essential for all parties involved in OTC trading to adopt procedures that identify that details of an individual trade are either agreed or disagreed. Generically, the trade confirmation process is used to communicate the trade details captured by one party, to its counterparty. Upon receipt of a trade confirmation, it is essential that the details are compared to the equivalent trade within the recipient’s own records. If details are found to be different, it is imperative that this is investigated and resolved without delay. This is depicted in Figure 10.12:

FIGURE 10.12 Steps in confirming OTC trades

- Step 1: the SL&B trade is executed directly between securities lender and borrower

- Step 2: one (or both) parties issues the terms of the trade to its counterparty

- Step 3: without delay, the recipient of the trade confirmation should compare its details against internal records

- Step 4: if there is any aspect that disagrees, the recipient must contact the counterparty immediately, in order to investigate and resolve the discrepancy without delay.

Trade confirmations should include, as a minimum, all basic trade details. Ideally, full trade cash values (including their line-by-line breakdown), plus the firm’s and its counterparty’s standing settlement instructions (SSIs) should also be included.

10.6.6 Giving and Taking Collateral

Where there is a choice of eligible collateral, the securities borrower must communicate to the securities lender the collateral it proposes to provide, in order to secure the lender’s exposure. The collateral must fall within the specific terms of the agreement between the two parties concerned, in terms of its eligibility and any margin calculations. It is therefore important for both lenders and borrowers to have direct access to their respective SL&B agreements database, for each of their respective counterparties.

From the securities lender’s perspective, they will be exposed if the lent security is delivered to the borrower without simultaneous receipt (from the borrower) of an asset of at least equivalent collateral value. Similarly, the securities borrower would be exposed if they provided collateral to the lender without simultaneous receipt of the borrowed security.

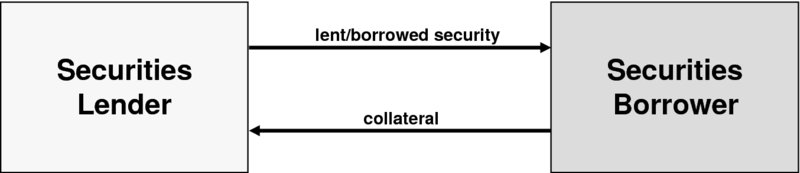

The delivery of a lent security can be made against receipt of collateral in the form of cash or securities, according to the legal agreement between the two parties. This is depicted in Figure 10.13:

FIGURE 10.13 Initial exchange of lent/borrowed security and collateral

Whichever form of collateral is provided by the securities borrower to the securities lender, neither party wishes to part with its asset without simultaneous receipt of the counterparty’s asset. But whether simultaneous exchange is achievable is dependent upon 1) the capability of the CSD to provide simultaneous exchange of the assets involved, and 2) the form of collateral.

Delivery versus payment (DvP) is the standard procedure used in order to mitigate securities delivery risk and cash payment risk in settlement of the purchase and sale of securities. The alternative to DvP is free of payment (FoP) settlement, which is in common use for delivering the lent/borrowed security FoP, and the securities collateral FoP, entirely independently of one another. It should be noted that under FoP, both securities lender and securities borrower are at risk of making a delivery of a security without simultaneous receipt of the counterparty’s asset, unless one of the parties agrees to going on-risk by delivering or paying their asset first (known as pre-delivery and pre-pay respectively).

Cash Collateral

Where the securities borrower chooses to provide collateral in the form of cash, the exchange (on the opening value date) of the lent/borrowed security and the cash collateral is normally achieved simultaneously by DvP. Note: truly simultaneous exchange of assets is achievable only if the CSD practices true DvP settlement; that is, with no delay between the movement of one asset (i.e. the lent securities) and the movement of the contra asset (i.e. the cash collateral).

If DvP settlement is not available or applicable (for whatever reason), the securities borrower is usually required to go on-risk and to make payment of the cash prior to receipt of the borrowed security (known as ‘pre-pay’).

Party L refers to its SL&B database to discover that the cash collateral proposed by Party B does fall within the agreement’s collateral eligibility criteria, and that the value of the collateral is acceptable taking into account the margin requirement.

Prior to the opening value date (ideally on trade date), each party issues a DvP settlement instruction, the lender requesting delivery of the 2,000,000 Issuer P shares, against receipt of EUR 31,354,800.00, with a value date of the trade’s opening value date, on a DvP basis. The borrower instructs for the receipt of the same. The instructions must match (at the CSD) prior to settlement occurring.

Securities Collateral

Where the securities borrower chooses to provide collateral in the form of securities (typically bonds), the exchange (on the opening value date) of the lent/borrowed security and the securities collateral is achieved on a non-simultaneous basis, by FoP. This means that 1) the lender is required to deliver the lent securities on the opening value date without knowing whether the collateral will be received at the same time; similarly, 2) the borrower is required to deliver the securities collateral on the opening value date without knowing whether the borrowed securities will be received at the same time. Historically, simultaneous exchange of securities (i.e. delivery versus delivery, or DvD) has generally not been available within CSDs, consequently two-way FoP settlement has been necessary, although not without risk to both parties. Note: Effective DvD is available within Target2 Securities.

Under some circumstances, the securities borrower may be required to provide securities collateral one day in advance of the opening value date; should the collateral fail to arrive, the lender has time to cancel the delivery of the lent security and avoid going on-risk. This can occur in a daylight exposure situation where the lent security is to be delivered in one time zone (e.g. European), and the collateral is to be delivered in a different time zone (e.g. American).

In order to effect delivery of the lent/borrowed security and the collateral security, settlement instructions must be issued by each party to their respective CSD or custodian. It is important to note that all CSDs and custodians publicise deadlines for the receipt of instructions, relative to value date. If deadlines are missed, exposures will not be mitigated at the earliest opportunity.

Securities settlement instructions can be issued using various methods, but amongst the most popular is S.W.I.F.T. due to its inbuilt security levels and structured message formats. Use of S.W.I.F.T. requires subscription by both message sender and receiver. Security of settlement instructions is paramount for both lender and borrower if fraud is to be prevented. Other secure methods are the CSD’s or custodian’s proprietary systems. Fax is an alternative but is not recommended as it is generally considered to be insufficiently secure. Figure 10.14 represents how one party (in this example the securities borrower) communicates its settlement instruction via S.W.I.F.T.:

FIGURE 10.14 Issuance of settlement instructions via S.W.I.F.T.

Note: S.W.I.F.T. has a defined set of messages specifically for collateral purposes.

Party B2 communicates that it wishes to provide a quantity of USD 18,000,000 US Treasury 4.5% bonds, maturing 15th August 2030, currently priced at 97.55%. The current market value of this bond is shown in Table 10.4:

TABLE 10.4 Collateral value calculation

| Example Securities (Bond) Collateral Value Calculation | ||

| Component | Calculation | Cash Value |

| Principal | USD 18,000,000 × 97.55% | USD 17,559,000.00 |

| Accrued Interest | USD 18,000,000.00 × 4.5% / 368 × 133 days | USD 292,744.56 |

| Current Market Value | USD 17,851,744.56 | |

As can be seen from the table, the current market value of this bond is not less than the market value of the lent security, plus the margin.

It is important to note that, for interest-bearing bonds, the bond’s current market value and current collateral value must include the current value of accrued interest. Failure to take account of accrued interest will mean that the collateral giver is in danger of undervaluing the collateral, thereby over-collateralising and delivering collateral with a true value greater than the giver has calculated. The topic of accrued interest is explained fully within this author’s book, Securities Operations: A Guide to Trade and Position Management (ISBN 0471497584). Bond prices can be quoted in two ways, namely:

- ‘clean’ price:

- this price type requires the current value of accrued interest to be added in order to derive the full current market value of the bond

- in the example trade above, the price of 97.55% is a clean price

- ‘dirty’ price:

- this price type is an ‘all-in’ price, in which the current value of accrued interest is incorporated within the price

- in the example trade above, the dirty price is 99.17635% (current market value divided by bond quantity).

Party L2 refers to its SL&B database to discover that the collateral proposed by Party B2 does fall within the agreement’s eligibility criteria, and that the current market value of the collateral is acceptable, taking into account the margin requirement.

Each party inputs two settlement instructions (1 × delivery, 1 × receipt) for the movement of the lent/borrowed securities and of the securities collateral, on an FoP basis; each instruction is required to be matched prior to settlement occurring (but with no dependency between the two sets of instructions). Once 1) the instructions are matched, and 2) the opening value date has been reached, the lent/borrowed security is transferred at the CSD between the accounts of the two involved parties; similarly, on the same date, the securities collateral is transferred in the opposite direction. Party L2 receives a settlement advice from its custodian, which reflects delivery of the lent securities, and receipt of the securities collateral. Likewise, Party B2’s custodian issues a settlement advice to Party B2 reflecting the receipt of the borrowed securities, and the outgoing delivery of the securities collateral. Furthermore, the resultant securities balances are reflected within depot statements issued by the custodians of both firms, which then facilitates depot reconciliation by both firms.

10.6.7 Interest on Cash Collateral

Collateral given in the form of cash is usually subject to interest payable by the collateral taker (i.e. the securities lender) to the securities borrower. The interest rate is agreed between securities lender and borrower at trade execution; this rate is commonly known as a rebate rate.

An important aspect of securities lending is that the lender should profit from cash collateral received, and that the collateral giver earns a return on its cash. It is common practice for the securities lender to reinvest the cash collateral in the money market for the duration of the transaction, in order to earn interest at a greater rate than the rebate rate; this interest rate is known as the reinvestment rate. It is in the securities lender’s interest to negotiate as high an interest rate as possible when placing the cash in the money market, as the rebate rate agreed with the collateral giver must be deducted from the reinvestment rate earned by the securities lender.

Following the close of the SL&B transaction, the agreed rate is paid to the securities borrower, whilst the remainder is retained by the securities lender, as illustrated in Figure 10.15:

FIGURE 10.15 Treatment of cash collateral and rebate interest

- Step 1a: on the opening leg of an SL&B transaction, the securities lender delivers the lent security to the securities borrower

- Step 1b: the securities borrower provides cash collateral to the securities lender

- Step 2: the securities lender lends the cash collateral to a bank, at an agreed interest rate.

- At the close of the SL&B transaction:

- Step 3: the cash loan is terminated with the bank; both the capital sum lent and the interest due is paid by the bank to the securities lender

- Step 4a: the lent securities are returned to the securities lender by the securities borrower

- Step 4b: capital plus rebate interest is remitted by the securities lender to the securities borrower.

Reinvestment of cash collateral is a risk for the securities lender, as they have entered into a contractual agreement to pay the securities borrower the rebate rate regardless of the rate at which the securities lender reinvests. Should money market interest rates fall below the rebate rate, the securities lender is at risk of suffering a loss on the securities loan trade. Similarly, if instead of reinvesting the cash in the money market, the securities lender invests the cash collateral in a financial product which is subject to price fluctuation (for example, mortgage-backed securities), the risk of loss remains.

Note: if the lent/borrowed security is in short supply but high demand (sometimes referred to as a ‘special’), the rebate rate negotiated between the two parties can go negative, resulting in the securities borrower (collateral giver) paying the rebate to the securities lender. Under such circumstances, the securities lender will earn rebate income as well as reinvestment income.

10.6.8 Exposure Management During the Lifetime of the Trade

Following the initial exchange of lent securities and collateral on the opening value date, both parties to the trade remain at risk. If, during the lifetime of the trade, the fluctuating value of the lent security plus margin:

- is greater than the current collateral value:

- the securities lender is at risk as they are holding an insufficient value of collateral

- is less than the current collateral value:

- the securities borrower is at risk due to excess collateral being held by the securities lender.

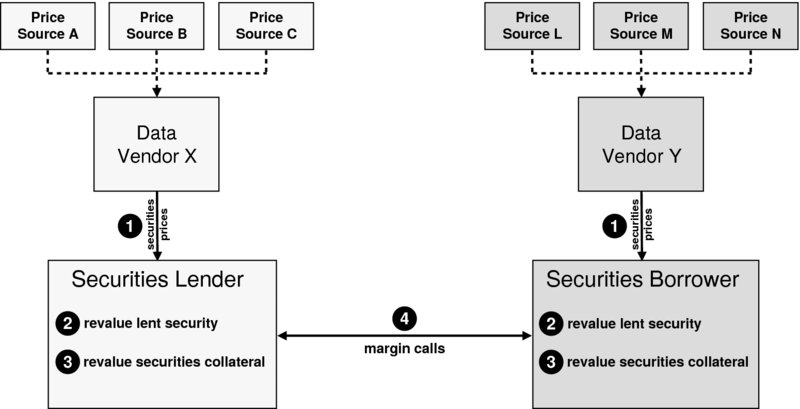

Usually every day during the lifetime of the SL&B trade, in order to determine 1) whether any exposure exists, 2) the value of such exposure, and 3) which party (securities lender or securities borrower) is exposed, it is necessary to revalue via the mark-to-market process.

Marking-to-market (MTM or M2M) is a generic term used throughout the financial services industry for a variety of revaluation purposes. MTM is the act of gathering the current market price of an asset from an external source, and applying that price to current trades and positions, including securities lent/borrowed and to securities collateral; it is essential that the price source is truly independent in order to prevent valuation inaccuracies.

Under any circumstances, the lent/borrowed security (whether equity or bond) is very likely to fluctuate in value, consequently it must be marked-to-market. Whether the collateral needs to be marked-to-market is dependent upon the nature of the collateral:

- if cash collateral:

- cash retains 100% of its value from one day to the next (unless devaluation occurs)

- as cash does not fluctuate in value, there is no requirement to mark-to-market

- if securities collateral:

- as per the lent/borrowed security, securities collateral will fluctuate in value and must therefore be marked-to-market.

Consequently, the following situations can arise. Where cash collateral applies, the current market value of the lent/borrowed security can rise or fall or remain the same relative to the (static) value of cash collateral. Where securities collateral applies, it is possible that the current market value of the collateral and of the lent/borrowed security rise together (but unlikely to rise by the same value), or one asset rises in value while the other asset falls in value, or both assets fall in value (albeit unlikely to fall by the same value). In summary, numerous possibilities exist as to how exposures can arise in SL&B trades.

In terms of timing, mark-to-market is conducted following the close of business on the business day prior to the exposure calculation day; in other words, for ‘today’s’ valuation, mark-to-market is performed as at close of business ‘yesterday’, providing that day is a business day.

Today, it is very common for the larger sell-side and buy-side firms to have externally sourced prices fed to them electronically by subscription to data vendors, with such prices updating various internal systems (for a variety of purposes) electronically, including collateral systems. Data vendors typically collect prices from a variety of sources.

Marking-to-market is depicted in Figure 10.16, where each party may well be subscribing to different data vendors:

FIGURE 10.16 Marking-to-market

- Step 1: independently, the securities lender and the securities borrower gather prices from their respective data vendors

- Step 2: the lent/borrowed security is revalued by both parties

- Step 3: the securities collateral is revalued by both parties (not applicable to cash collateral)

- Step 4: the party with the exposure makes the margin call.

Note: it is possible that the securities lender and the securities borrower will agree to obtain current market prices from the same external source; this is designed to ensure that margin call disputes are minimised.

Should the current collateral value fall short of the current value of the lent security, the securities lender will make a margin call on the securities borrower for additional collateral to be posted. Conversely, if the current collateral value exceeds the current market value of the lent security, the securities borrower would make the margin call and request the return of the excess collateral.

However, there is a difference in treatment dependent upon the type of collateral.

Cash Collateral

Assume a securities loan is made, and the current market value of the lent securities is USD 25,000,000.00 at the outset of the transaction. Also assume the securities lender is given cash collateral of USD 25,500,000.00 which covers the lender’s exposure, including a 2% margin.

The nature of equities and bonds means that the lent security will fluctuate in value; however, the value of cash collateral remains static and will not fluctuate. Therefore, when cash collateral has been given or taken, only the increasing and decreasing value of the lent security gives rise to margin calls.

10.6.9 Portfolio Reconciliation

When a firm determines that it has an exposure and then issues a margin call to its counterparty, there is no guarantee that the counterparty will agree either 1) the direction of the exposure (whether the firm or the counterparty is exposed), or 2) the size of the exposure.

Such disagreements between a firm and its counterparty can be caused by differences in the trade population; for example, a firm has correctly excluded from its lists of trades an SL&B trade that had a closing value date of ‘yesterday’, whereas the counterparty continues to list that trade as remaining live ‘today’.

The possibility of such discrepancies is minimised if a proactive comparison of trades is made between firms, prior to margin calls being issued. A third party portfolio reconciliation service exists that automatically compares files of SL&B trades received from a firm with the equivalent from its various counterparties. That service is triOptima’s triResolve system.

10.6.10 Securities Collateral: Holding and Reuse

As described earlier in this chapter (within Section 10.5 ‘Securities Lending & Borrowing: Legal Documentation’), under the GMSLA, the legal basis on which securities collateral is given/taken is title transfer, which means that the securities lender (collateral taker) has the legal right to do with the securities collateral whatever it chooses.

The choices for the securities collateral taker are to:

- hold the securities collateral safely within the securities lender’s account at its custodian, or

- reuse the securities collateral in one (or more) of the following ways: selling it, repoing it, lending it or delivering it to satisfy a margin call in (for example) an OTC derivative transaction.

Holding the Securities Collateral

If the securities lender (collateral taker) chooses to act cautiously and to not reuse the securities collateral, such securities will need to be held within the collateral taker’s account at the relevant CSD or at its custodian.

However, the collateral taker must decide whether 1) to commingle the securities collateral within its account containing its own securities, or 2) to hold the securities collateral within a segregated and dedicated ‘incoming collateral’ (or similarly named) account.

The risk in holding the securities collateral in a commingled manner is that the securities lender may apply insufficient internal control to prevent accidental reuse. Conversely, the advantage in the collateral taker adopting the segregated account method is that when it becomes time to return the securities collateral to the securities borrower at the close of the SL&B trade, the securities should definitely be available.

Reusing the Securities Collateral

Should the collateral taker choose to reuse the securities collateral, whether the collateral taker is able to return the securities collateral to the securities borrower on the closing value date of the SL&B trade is dependent upon the nature of the (reuse) trade executed by the securities lender:

- if the securities lender has sold the securities collateral, there will be no return (to the securities lender) of the security by the buyer

- this situation will require the securities lender to source the securities elsewhere in order to return the securities collateral to the securities borrower on the closing value date of the SL&B trade, in order to avoid settlement failure

- if instead the securities lender has lent, repo’d or delivered the securities collateral to satisfy another collateral delivery obligation, there will be a return of the security by the counterparty

- this situation will require the securities lender to ensure that the closing value date of such a trade is no later than the closing value date of the original SL&B trade, in order to avoid settlement failure.

In summary, at the close of the SL&B trade, the securities lender (collateral taker) must ensure that it is able to return the securities collateral (described as equivalent collateral within the GMSLA) to the securities borrower (collateral giver).

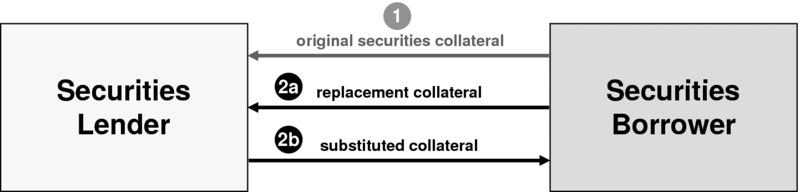

10.6.11 Collateral Substitution

Where securities collateral has been given, in the event that the securities borrower (collateral giver):

- sells the securities collateral that is currently in the possession of the securities lender, or

- requires the securities collateral for delivery within a different transaction (e.g. repo), or

- wishes to avoid processing difficulties associated with income events or corporate action events on the securities collateral

the existing collateral should be substituted for replacement collateral. This is depicted in Figure 10.17:

FIGURE 10.17 Collateral substitution

- Step 1: the original securities collateral is delivered to the securities lender

- Step 2: the replacement collateral is provided to the securities lender

- Step 3: the substituted collateral is returned to the securities borrower.

Note: collateral substitution is applicable only to collateral given in the form of securities; it is not applicable to the lent/borrowed security (as for the lender to request substitution of the lent security would completely defeat the borrower’s objective in taking delivery of the particular ISIN).

The GMSLA states that collateral may be substituted, providing the replacement collateral meets the eligibility criteria. However, the need for collateral substitution may or may not arise during the lifetime of a securities loan.

The securities lender must ensure it does not become exposed within the collateral substitution process; exposure will occur if the original (now substituted) collateral is returned to the securities borrower prior to receipt of the replacement collateral.

It is possible that the securities borrower will substitute one piece of securities collateral with two or more pieces, or give cash collateral instead.

Due to a lack of delivery versus delivery (DvD) capability within CSDs, substitution of securities collateral has historically been achieved by two-way free of payment (FoP) deliveries; that is 1) the delivery of the replacement collateral by the securities borrower on an FoP basis, and 2) the return of the original collateral by the securities lender on an FoP basis. The 2 × FoP settlements have not been linked historically, therefore simultaneous exchange has not been possible; consequently, the delivery of one of the securities can occur whilst delivery of the opposing security fails, thereby leaving one of the parties exposed. The ideal method of settling a collateral substitution is by DvD, meaning the simultaneous exchange will occur providing both securities are available for delivery, and therefore settlement is prevented unless both securities are available for delivery. However, effective DvD is available within Target2 Securities.

Following the transmission of FoP settlement instructions to their respective custodians, and subsequent matching, on the agreed date the replacement collateral in the form of the UK Government bonds is delivered to Party L2’s custodian account, and the original US Treasury collateral is returned to the custodian account of Party B2. In this case a current GBP/USD exchange rate will need to be used to calculate collateral values in USD.

From this point forward until the closure of the trade, as part of the mark-to-market process, the value of the new collateral will be calculated and compared against the value of the lent/borrowed security (unless a further collateral substitution occurs).

10.6.12 Treatment of Income

Income on securities is regarded as being dividends on equity and coupon payments on bonds.

In general terms:

- dividend payments on equity are not predictable in advance and are announced by the issuer, following a decision by the issuer’s board of directors

- coupon payments on bonds are predictable as their payment dates and amounts are known at the time of issue launch (with the exception of floating rate notes), and can be found in the issue prospectus.

Income payments may or may not arise during the lifetime of a securities lending/borrowing trade.

Income on Lent/Borrowed Securities

Should an income payment fall due on the lent/borrowed security during the lifetime of an SL&B trade, the securities borrower must make an equivalent payment to the securities lender, so the lender suffers no financial disadvantage and therefore receives the income as though the securities had never been lent.

It is expected that, in most (but not all) situations the securities borrower will have on-delivered the borrowed securities in order to satisfy a delivery commitment; under such circumstances, as the borrower is not holding the security in its account at its custodian as at record date, the borrower will therefore not receive the income from the issuer. However, the borrower must then make the equivalent income payment to the securities lender, from its own funds; such payments are commonly known as a manufactured dividend or a manufactured coupon. The exception to this rule arises where the securities borrower is able to validly claim the income from the counterparty to whom it on-delivered the securities, but this is achievable only where the securities borrower has itself lent the securities or has used the securities as collateral.

Conversely, in a situation in which the securities borrower is holding the borrowed securities in its account at a CSD or custodian (as is likely to occur in an arbitrage situation such as those described in this chapter within Sub-section 10.1.3 ‘Arbitrage Strategies’), the borrower will be credited with the income by their CSD or custodian. The borrower is then required to make the equivalent payment to the securities lender. Note: such a scenario does not involve a manufactured dividend or manufactured coupon, as the securities borrower receives the payment and then remits the equivalent value to the securities lender. In other words, there is no requirement to manufacture a payment.

Income on Securities Collateral

Income payments may or may not arise on securities collateral during the lifetime of an SL&B trade.

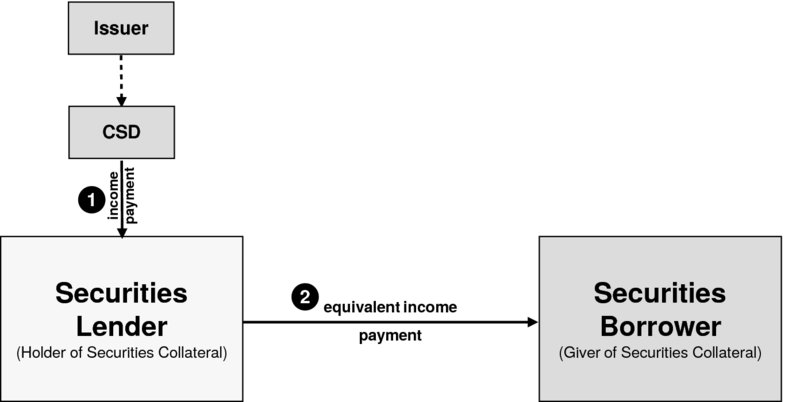

If an income payment falls due on the securities collateral whilst in the possession of the securities lender, the securities lender must make an equivalent payment to the securities borrower, so the securities borrower receives the income as though the securities collateral had never left the possession of the securities borrower. This situation is depicted in Figure 10.18:

FIGURE 10.18 Treatment of income on securities collateral