CHAPTER 18

OTC Derivatives and Collateral – Transaction Types – Foreign Exchange Swaps

18.1 DEFINITION

A foreign exchange swap (FXS) is an OTC derivative contract in which two parties exchange principal amounts in different currencies at the start of the trade (at one exchange rate), with the reverse exchange occurring at the close of the trade (at a different exchange rate).

FXS are part of a family of financial products known as currency derivatives.

FXS are also known as ‘plain vanilla foreign exchange swaps’, ‘spot/forward fx swaps’, and ‘forex swaps’.

Note: in a foreign exchange swap, because the principal amounts are paid in full, the term ‘notional’ (meaning ‘theoretical’) is not applicable, consequently the terms ‘principal’ and ‘principal amount’ are used instead.

18.2 PURPOSE

FXS are used to mitigate foreign exchange risk.

Imagine that a firm needs to borrow a particular amount of a particular currency immediately, where the firm currently holds a different currency that the firm does not need immediately. An FXS trade is a temporary (therefore two-legged) exchange of the two currencies:

- in the first leg of the trade, the firm’s existing currency known as the base currency [ccy #1] is paid to the counterparty, versus receipt of the equivalent value of the required currency or quote currency [ccy #2] – this part of the FXS is executed on trade date at the spot exchange rate

- in the second leg of the trade, the base currency [ccy #1] is repaid by the counterparty, versus payment of the equivalent value of the quote currency [ccy #2] – this part of the FXS is also executed on trade date, but at the forward exchange rate.

In order to appreciate how FXS work, it is firstly necessary to understand what is meant by ‘spot’ and ‘forward’.

18.2.1 ‘Spot’ Foreign Exchange

The execution of a normal foreign exchange trade is said to be traded for ‘on-the-spot’ settlement (hence ‘spot’), meaning the normal settlement cycle between trade date and value date.

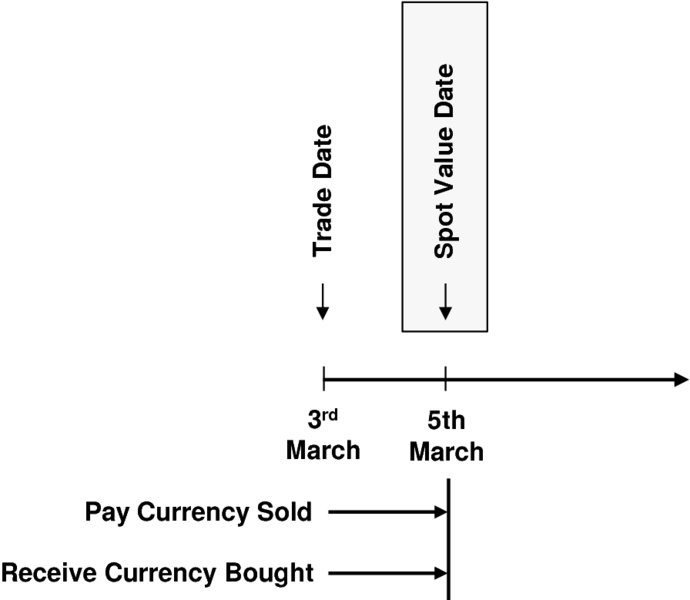

One FX trade involves each party selling one currency and buying the contra currency. This therefore involves the sale of a currency by each of the two involved parties; for the majority of the world’s currencies 2 days is the historic period of time necessary for a firm to organise the payment of a currency amount to the firm’s counterparty. This time period is due, at least in part, to time zone differences between currency banking centres. This situation is represented in Figure 18.1.

FIGURE 18.1 Profile and example of dates in a spot FX trade

Note: an exception to the 2-day rule exists for FX trades between USD/CAD, where spot is the business day following trade date.

At trade execution of an FX spot trade, an exchange rate is determined for the currency that a firm wishes to sell and the currency that firm is seeking to buy. Approximately 180 currencies exist around the globe, therefore many combinations of currencies are possible in a foreign exchange trade.

Spot FX trades involve the outright sale (not a loan) of the base currency against the outright purchase of a quote currency, at an agreed (spot) exchange rate, for settlement 2 business days following trade date. The components of a spot FX trade are as follows (written from the perspective of Party A):

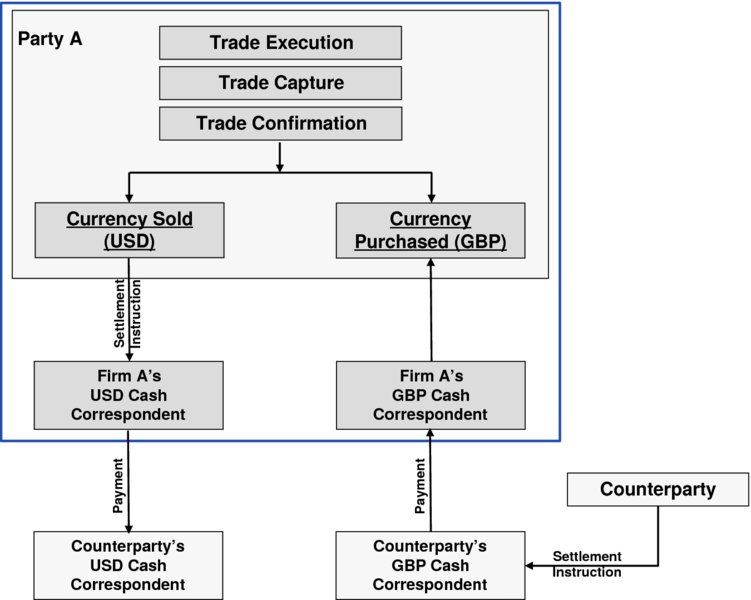

From a settlement perspective, the traditional method of settlement is for each party to the spot FX trade to issue a settlement instruction to its cash correspondent (or nostro) for the currency amount it is selling. Settlement instructions must be received by the deadline stated by each cash correspondent, relative to currency and the value date of the payment. Under the traditional settlement method, in the world of foreign exchange there is no matching of settlement instructions prior to settlement occurring. Focusing on the trade in Table 18.1, Party A needs to pay USD 20,000,000.00 to Firm B on 5th March 2017; Firm A’s cash correspondent should comply with the settlement instruction received, providing firm A has adequate cash balance or overdraft facility. Firm A’s settlement instruction must contain the account details of its counterparty, Firm B; from an operational efficiency perspective, such account details should already be held in Firm A’s internal static data repository, in the form of a standing settlement instruction.

TABLE 18.1 Example spot foreign exchange trade components

| Spot Foreign Exchange | |

| Trade Component | Example Trade Detail |

| Transaction Type | Foreign Exchange Spot |

| Counterparty | Firm B |

| Trade Date | 3rd March 2017 |

| Spot Value Date | 5th March 2017 |

| Base Currency and Amount | USD 20,000,000.00 |

| Quote Currency and Amount | GBP 16,032,064.13 |

| Spot Exchange Rate | USD 1.2475/GBP 1.00 |

| Base Currency Seller | Party A |

| Quote Currency Seller | Firm B |

Regarding the currency that Firm A is due to receive following execution of this spot FX trade, Firm B must issue a settlement instruction to its GBP cash correspondent for the payment of the GBP 16,032,064.13 to Party A. Note: Firm A’s GBP cash correspondent may require to be informed that a cash amount is due to be received. If that is the case, Firm A must issue a funds preadvice to its cash correspondent by the stated deadline, in order to ensure crediting of funds with good value (and to avoid incurring a delay in the receipt of the funds).

In this particular spot FX trade in which the currencies are GBP and USD, clearly there is a time zone difference between banking hours in London and New York; this is usually 5 hours. And, in the traditional method, settlement is free of payment, with no simultaneous exchange of the two currencies. Consequently, the party that pays first is the party that pays the more eastern currency first, and the party that takes the risk that payment of the eastern currency is made at a point in time when it is not (yet) known whether the contra currency has (or will be) received. Such a settlement risk is known as Herstatt Risk and cross-currency settlement risk.

An extreme (but realistic) example of Herstatt Risk would occur where one currency is very eastern and the other is very western, such as New Zealand dollars (NZD) versus USD; Wellington is 17 hours ahead of New York, so a seller (and payer) of NZD will not know for many hours whether the USD had been received by their USD cash correspondent.

However, Herstatt Risk can be overcome. CLS Bank began operations in 2002; it is designed to make payments from one member’s account to another member’s account on a simultaneous exchange basis, known as PvP (payment-versus-payment) – this is the cash/currency equivalent of delivery-versus-payment which is so popular for securities settlement (as described in Chapter 2 ‘The Nature and Characteristics of Collateral Types’. Note: for currencies not covered by CLS and for firms that have chosen not to use CLS, the traditional settlement method remains available for use.

Settlement of the aforementioned spot FX trade can be summarised as shown in Figure 18.2 (viewed from Party A’s perspective):

FIGURE 18.2 Settlement of a spot FX trade

18.2.2 ‘Forward’ Foreign Exchange

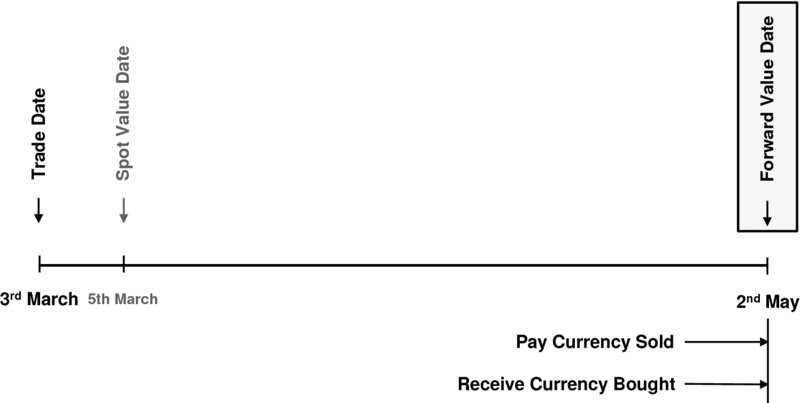

Forward FX trades are used by firms to ‘lock in’ today the sale of one currency (base currency), and the purchase of a quote currency, for settlement at an agreed future date.

For example, a Singaporean furniture manufacturer (Firm G) is due to receive EUR 5,000,000.00 in 60 days’ time, on 2nd May. If the firm takes no action and waits until the EUR payment arrives, the possibility exists that the SGD/EUR exchange rate will have moved against the firm, compared with today’s exchange rate. In order to mitigate that risk, Firm G decides to execute a forward FX trade today with Bank K, with the result that the sale of the incoming EUR 5,000,000.00 in 60 days from now will provide a fixed amount of Singapore dollars, due to execution of the trade today at today’s forward FX rate. This situation is represented in Figure 18.3.

FIGURE 18.3 Profile of and example of dates in a forward FX trade

For this particular forward FX trade, the trade components captured by Firm G would appear as shown in Table 18.2

TABLE 18.2 Example forward foreign exchange trade components

| Forward Foreign Exchange | |

| Trade Component | Example Trade Detail |

| Transaction Type | Foreign Exchange Forward |

| Counterparty | Bank K |

| Trade Date | 3rd March 2017 |

| Forward Value Date | 2nd May 2017 |

| Base Currency and Amount | EUR 5,000,000.00 |

| Quote Currency and Amount | SGD 7,661,000.00 |

| Forward Exchange Rate | EUR 1.00/SGD 1.5322 |

| Base Currency Seller | Firm G |

| Quote Currency Seller | Bank K |

The similarities and differences between a spot FX trade and a forward FX trade can be summarised as follows:

- similarities: the trade is executed on trade date, and is an outright sale of one currency (base currency) against the outright purchase of a quote currency at an agreed exchange rate

- differences: the settlement cycle is extended beyond the standard 2 days to a mutually agreed future value date, and the exchange rate is typically at a premium or discount over the spot exchange rate.

18.2.3 Foreign Exchange ‘Swaps’

As for spot and forward FX trades, foreign exchange swaps (FXS) are designed to mitigate foreign exchange risk.

But unlike spot and forward FX trades, FXS trades are used to borrow one currency against the loan of another currency, for a defined period of time; therefore, an FXS trade is not an outright sale of one currency and the purchase of another currency.

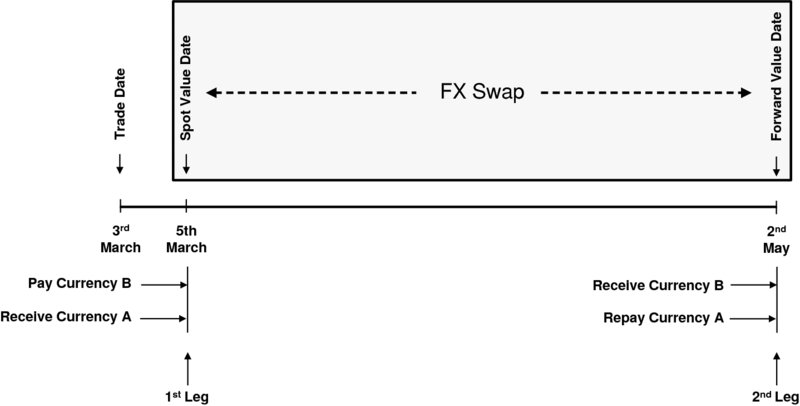

However, foreign exchange swaps incorporate the characteristics of both spot and forward FX trades, in a single transaction which has two legs:

- Leg 1 – on the spot value date:

- receive Currency A

- pay the equivalent spot value of Currency B

- Leg 2 – on the forward value date:

- repay the same amount received of Currency A

- receive the equivalent forward value of Currency B.

Note that the value of Currency A remains constant in both legs; this is known as the ‘base’ currency in a foreign exchange swap. Also note that no interest payments are applicable in a foreign exchange swap.

This situation is represented in Figure 18.4.

FIGURE 18.4 Profile and example of dates in a foreign exchange swap trade

Imagine that, for goods purchased from a US manufacturer (Manufacturer G), a European importer (Firm M) has committed to pay USD 10,000,000.00 in 2 business days from now. In turn, Firm M has contracted the goods to be onsold in 3 months’ time; upon delivery of the goods, the buyer (Buyer T) will pay USD 10,000,000.00. Whilst Firm M’s overall USD position in 3 months’ time is netted to zero, there’s a timing difference in cashflows. Firm M is therefore exposed to exchange rate movements over the 3-month period.

The following describes 1) what could occur if Firm M takes no action to mitigate the risk, and 2) what happens if an FXS is executed.

Firm M Takes No Action

f Firm M takes no action now, the exchange rate risk they face would be as follows:

- the amount of EUR Firm M will pay to Manufacturer G in 2 business days for the USD will depend on the exchange rate quoted for delivery that day

- the amount of EUR Firm M will receive in 3 months’ time relating to the receipt of USD from Buyer T will depend on the exchange rate quoted 3 months from now. That exchange rate may be advantageous or disadvantageous to Firm M.

Regarding Firm M’s payment of USD 10,000,000.00 to Manufacturer G in 2 days’ time, assume the spot exchange rate is EUR 1.00/USD 1.1108. Firm M will pay EUR 9,002,520.71 (USD 10,000,000.00 / 1.1108).

If the EUR increases in value (relative to USD) during the next 3 months, the USD will become less valuable and as a consequence, in 3 months’ time Firm M will receive a lesser amount of EUR when it comes time to exchange the USD received from Buyer T. Assume the exchange rate in 3 months’ time is EUR 1.00/USD 1.1313, Firm M will receive EUR 8,839,388.31 (USD 10,000,000.00 / 1.1313).

These circumstances will result in a loss to Firm M of EUR 163,132.40 (EUR 9,002,520.71 - EUR 8,839,388.31).

If instead, the EUR decreases in value (relative to USD) during the next 3 months, the opposite outcome will occur and Firm M will receive more EUR. Assume the exchange rate in 3 months’ time is EUR 1.00/USD 1.0896, Firm M will receive EUR 9,177,679.89 (USD 10,000,000.00 / 1.0896). This situation will result in a profit to Firm M of EUR 175,159.18 (EUR 9,002,520.71 - EUR 9,177,679.89).

As can be seen by the above example exchange rates, Firm M could make a profit if the fluctuating exchange rate falls in their favour, but equally Firm M could experience a loss if exchange rates go against them. Exchange rate fluctuations are influenced by many factors, most (if not all) of which are outside the control of Firm M. For firms that do not wish to gamble, FXS mitigate such risks.

Firm M Executes a Foreign Exchange Swap Trade

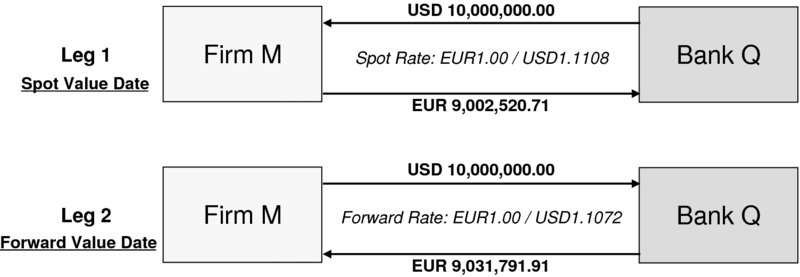

Firm M chooses not to take such a risk and executes an FXS trade with Bank Q:

- Leg 1: for spot value Firm M buys USD 10,000,000.00 (the base currency amount) with EUR 9,002,520.71, at an exchange rate of EUR 1.00/USD 1.1108, from Bank Q

- Leg 2: for forward value (3 months from now) Firm M sells USD 10,000,000.00 (the base currency amount) for EUR 9,031,791.91 at an exchange rate of EUR 1.00/USD 1.1072 to Bank Q.

The terms of the FXS are now final, meaning that Firm M has mitigated the risk and knows precisely the amounts payable and receivable over the next 3 months, regardless of the actual exchange rate in 3 months’ time – both parties to the trade have locked in to both the spot and the forward rates. One important aspect of this situation is that, by executing an FXS trade, Firm M has peace of mind and thereby avoids the nagging concern as to what the exchange rate will be in 3 months’ time. The cashflows applicable to this particular FXS trade are shown in Figure 18.5

FIGURE 18.5 Example foreign exchange swap cashflows

Note: the difference between the spot rate and the forward rate is an adjustment factor known as the ‘forward margin’; this relates to the difference in interest rates applicable to the two involved currencies. Each party has the use of a currency over the lifetime of the FXS trade, which the recipient can invest to earn a particular interest rate. The purpose of the adjustment factor is to equalise this interest rate differential and to compensate the relevant party for giving the higher interest-bearing currency.

The primary benefits in executing FXS are:

- flexibility, as firms can tailor trades to meet their specific requirements in terms of the currencies involved, start (spot) date, maturity (forward) date and duration

- certainty, as FXS trades allow firms to lock-in to exchange rates thereby removing the doubt as to how a firm will be impacted by fluctuating exchange rates.

As a technical comment, although many firms treat FX swap trades as OTC derivatives, they are not true derivatives because:

- there is no underlying product

- the full value of principal amounts is exchanged, and

- there is no payment uncertainty requiring to be managed.

18.3 TRADE COMPONENTS

Once a firm has executed an FXS trade, it must be captured without delay. The trade components that must be captured include those listed in Table 18.3 (from Firm M’s perspective):

TABLE 18.3 Example foreign exchange swap trade components

| Foreign Exchange Swap | |

| Trade Component | Example Trade Detail |

| Transaction Type | Foreign Exchange Swap |

| Counterparty | Bank Q |

| Trade Date | 30th May 2017 |

| Spot Value Date | 1st June 2017 |

| Forward Value Date | 1st September 2017 |

| Spot Payments | |

| Base Currency and Amount | USD 10,000,000.00 |

| Quote Currency and Amount | EUR 9,002,520.71 |

| Spot Exchange Rate | EUR 1.00 / USD 1.1108 |

| Base Currency Buyer | Firm M |

| Quote Currency Buyer | Bank Q |

| Forward Payments | |

| Base Currency and Amount | USD 10,000,000.00 |

| Quote Currency and Amount | EUR 9,031,791.91 |

| Forward Exchange Rate | EUR 1.00 / USD 1.1072 |

| Base Currency Buyer | Bank Q |

| Quote Currency Buyer | Firm M |

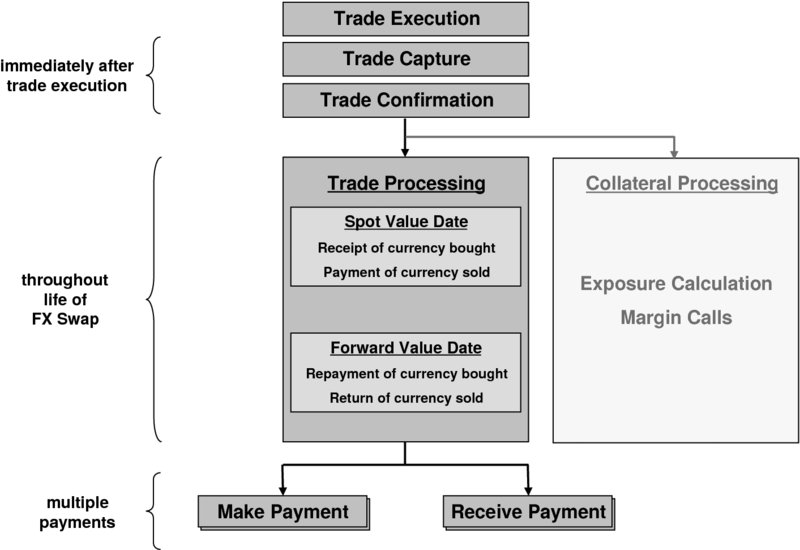

18.4 FXS OPERATIONS ACTIVITY: OVERVIEW

From an operations perspective, each party to a trade must:

- make payments of currency amounts as and when they fall due, and

- monitor receipts of currency amounts when they fall due.

These actions are represented in Figure 18.6

FIGURE 18.6 Foreign exchange swap processing actions

The trade processing operational activity for FXS is summarised in Table 18.4

TABLE 18.4 FXS trade processing operational activity

| Foreign Exchange Swaps | |

| Premium payable? | No – not applicable |

| Exchange of principal? | Yes – on both legs |

| Single/multiple currencies? | Multiple |

| Single/multiple settlements? | Multiple principal settlements |

| Payments gross or net? | Gross |

18.5 FOREIGN EXCHANGE SWAPS AND COLLATERAL MANAGEMENT

Regarding collateral management, after the FXS trade has been executed the current value of the FXS trade is calculated through the regular (normally daily) mark-to-market process.

The party having a positive mark-to-market has an exposure to its counterparty, and the non-exposed party must provide collateral (in the agreed form) to the exposed party. There are a significant number of steps in this process; please refer to Chapters 24–44, all of which fall under the heading of ‘The OTC Derivative Collateral Lifecycle’.

18.6 FOREIGN EXCHANGE SWAP VARIATIONS

18.6.1 Forward/Forward Foreign Exchange Swap

Definition: a type of FXS in which both legs are forward transactions.

For example, a ‘3/6 forward/forward swap’ means:

- Buy 3 months swap (= sell spot, buy forward)

- Sell 6 months swap (= buy spot, sell forward)

As both spot transactions offset each other (if done at same spot rate and same cash amount),

the result of both transactions will be as follows:

- buy base currency 3 months forward, and

- sell base currency 6 months forward.

Forward/forward FX swaps are also known as:

- forward swap

- forward start swap

- delayed start swap

- deferred start swap.