CHAPTER 41

OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Post-Trade Execution Events – Credit Events

Recommendation to Readers: as the subject of credit events relates directly to credit default swaps (CDS), it is recommended that readers that are not familiar with CDS should read Chapter 17 ‘OTC Derivatives and Collateral – Transaction Types – Credit Default Swaps’ prior to reading this chapter.

41.1 INTRODUCTION

Where a firm has a live/current OTC derivative trade, specifically a credit default swap (CDS), at any point during its lifetime that trade may be subject to a credit event.

The term ‘credit event’ is a generic label given to a qualifying event of default by, for example, a bond issuer who, by the terms and conditions of the bond issue, must pay interest (coupon) to investors on scheduled dates and (typically) at a predetermined rate of interest, and who should repay capital to investors no later than the bond’s maturity date. Should the bond issuer fail to make such payments, a credit event is deemed to have occurred, which triggers payout by the protection seller to the protection buyer, and immediate termination of the CDS trade.

When a CDS trade is executed, the particular events that will qualify as credit events are agreed between the two trading parties; amongst others, these typically include the bond issuer’s:

- bankruptcy

- failure to pay, and

- debt restructuring.

Note that ISDA allows for a limited predefined set of credit events to be included within the contract.

At the outset of the CDS contract, there is no guarantee that a credit event will (or will not) occur, although the cost of protection (payable as a premium by the protection buyer to the protection seller) reflects the perceived likelihood of issuer default.

Should any one of the credit events listed within a particular trade actually occur during the lifetime of the CDS contract, the protection seller is required to settle the notional principal with the protection buyer.

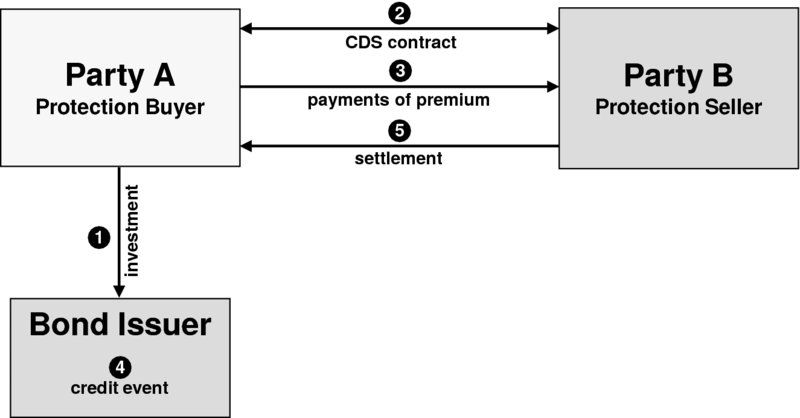

Once settlement has occurred following a credit event, the CDS contract will automatically cease, and neither of the parties to the contract will suffer any ongoing exposure. This situation is depicted in Figure 41.1, which shows both the pre-credit event and post-credit event situation:

- Step 1: Party A invests in a bond

- Step 2: Party A decides to seek protection against default by the bond issuer (known as the reference entity in a CDS) by choosing to enter into a credit default swap contract, and has become the protection buyer. Party B decides to provide protection to Party A, and has become the protection seller

- Step 3: Party A remits premium payments (the cost of protection) to Party B periodically

- Step 4: If the bond issuer undergoes a credit event, settlement of the CDS contract will be triggered

- Step 5: The CDS contract is settled by the protection seller paying 100% of the notional principal, less an agreed recovery amount, to the protection buyer, at which point the contract is terminated with no ongoing exposure to either the protection buyer or protection seller. The recovery amount is derived from a recovery percentage which is set by an auction process; the recovery percentage reflects the market’s expectation of how much a physical investor in a senior unsecured bond would likely receive after the issuer’s bankruptcy process takes place.

FIGURE 41.1 Credit default swap: pre- and post-credit event situation

Note: although the above-mentioned diagram and description depicts Party A having an investment in a bond which leads to a decision to execute a CDS contract, there is usually no requirement (legal, regulatory or otherwise) to be invested in a bond to become a party to a CDS contract. For example, Party B is providing protection to Party A and may choose to enter into an equal and opposite contract with a different counterparty where Party B becomes a protection buyer, thereby hedging their position. Under these circumstances, Party B has two CDS trades, but has no investment in the underlying bond issuer.

Events such as novation, unwind and offset are triggered by one party to a contract wishing to exit that contract. Conversely, credit events are triggered by, for example, the bankruptcy or default of an obligor (e.g. a bond issuer or reference entity) rather than by parties to the CDS contract.

Historically, disputes have arisen between protection buyer and protection seller, as to whether a qualifying credit event had in fact occurred, or not. During 2009, an ISDA protocol was introduced whereby regional determination committees (RDCs) were empowered to ascertain whether a credit event had occurred, or not. The RDC’s decision is binding on all parties that have signed up to the protocol.

Following a credit event, the fact that there will be no ongoing exposure with the counterparty will result in there being no requirement to either mark-to-market the trade or to receive or to deliver collateral.

Credit events will impact the total notional principal of a contract; as a credit event impacts all outstanding CDS contracts (relating to the particular bond issuer or reference entity), no partial quantities will remain following a credit event.

41.2 IMPACT OF CREDIT EVENTS ON BOOKS & RECORDS

Should a credit event occur, both protection buyer and protection seller will be impacted:

- for the firm that has purchased protection, once they have received the settlement amount the contract and exposure with its counterparty must cease

- for the firm that has sold protection, once they have remitted payment of the settlement amount the contract and exposure with its counterparty must cease.

The result of a credit event, from the perspective of each of the parties, is summarised in Table 41.1

TABLE 41.1 Result of credit event

| Result of Credit Event | |||

| Party | Ongoing Exposure? | Exposure With? | |

| Original Counterparty | New Counterparty | ||

| Party A | X | not applicable | not applicable |

| Party B | X | not applicable | not applicable |

Following a credit event, and once the protection seller has remitted payment to the protection buyer, both parties must ensure their books & records no longer show the trade as being live and valid.

41.3 IMPACT OF CREDIT EVENTS ON COLLATERAL MANAGEMENT

As the result of a credit event is that counterparty exposure no longer exists, and providing the books & records of both parties have been updated correctly and in a timely fashion, the Collateral Departments within each firm will be aware of the updated situation and should begin the daily collateral process accordingly.

The process of portfolio reconciliation at the very start of the daily collateral lifecycle is intended to reveal whether the firm’s trade population is the same or different from the counterparty’s records. This topic is covered within Chapter 31 ‘OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Portfolio Reconciliation’.

41.4 CONCLUSION

Collateral management personnel should remain aware of the possibility of credit events on current credit default swap contracts, and the impact of credit events on ongoing counterparty exposures.