CHAPTER 46

OTC Derivatives and Collateral – Regulatory Change and the Future of Collateral – Introduction

46.1 INTRODUCTION

The Global Financial Crisis in the autumn of 2008 highlighted the need for far greater levels of regulation than had been the case previously, regarding the trading of and ongoing management of OTC derivative trades.

During 2009, the G20 (the Group of Twenty Finance Ministers and Central Bank governors representing the world’s 20 major economies) agreed a set of target measures designed to bring far greater structure and transparency to the OTC derivative marketplace.

The regulatory reforms are being spearheaded in Europe under the banner of the European Market Infrastructure Regulation (EMIR), and in the US by Title VII of the wide-ranging Dodd-Frank Act. Similar reforms are occurring in other regions including Australia, China, Hong Kong, Japan, Republic of Korea and Singapore.

This chapter introduces the most significant of such regulatory measures. It is important to note that the implications of those measures are so far reaching on collateral management that this chapter contains information at an overview level only. The two chapters that follow this chapter will delve into significantly greater detail on the implications on collateral management.

46.2 THE NEED FOR REGULATORY CHANGE

The background to and the reasons for these highly significant regulatory changes are stated within the following two communications, namely the European Commission’s press release in September 2010 and the summary of measures issued by the US Senate in July 2010.

46.3 REGULATORY CHANGES: INTRODUCTION

The regulatory authorities have introduced the concept of standardised OTC derivative trades. This means that it has been determined, by an appointed authority, which component parts of (for example) an interest rate swap (IRS) trade, or a credit default swap (CDS) trade, are considered to be the most common, and hence ‘standard’. The execution of standardised trades provides a number of benefits to trading firms, including the multilateral netting of trades; please refer to Section 46.5 ‘Central Clearing: Overview’ within this chapter, and Chapter 47 ‘OTC Derivatives and Collateral – Regulatory Change and the Future of Collateral – Centrally Cleared Trades’.

The ‘headline’ objectives of the regulatory authorities relating to standardised OTC derivative trades are that they should be:

- traded on exchanges or electronic trading platforms

- centrally cleared via central counterparties, and

- reported to trade repositories.

It will continue to be possible to execute trades that do not conform to the standardised model; these are known as non-centrally cleared trades, and the regulatory objectives for such trades are that they should be subject to rigorous collateral and capital requirements.

Note: subsequent to this chapter:

- Chapter 47 ‘OTC Derivatives and Collateral – Regulatory Change and the Future of Collateral – Centrally Cleared Trades’, describes the collateral-related implications of standardised trades with central counterparties, and

- Chapter 48 ‘OTC Derivatives and Collateral – Regulatory Change and the Future of Collateral – Non-Centrally Cleared Trades’ describes the regulatory requirements relating to collateral management of trades which have (for example) non- standardised features and are therefore executed on a bilateral basis.

46.4 EXCHANGES AND ELECTRONIC TRADING PLATFORMS: OVERVIEW

This section refers solely to the act of trade execution pertaining to OTC derivative trades, under the regulatory initiative.

Prior to the new regulations, all OTC derivative trades were privately negotiated and were traded bilaterally, meaning directly between the two trading parties; in all cases such trades were tailored to suit the needs of the involved parties. Usually, the details of each trade were held (throughout the trade’s lifetime) only by the two trading parties, with no other party being aware of the trade, including regulatory authorities.

Conversely, other types of derivative products such as futures and options have had a standardised structure and therefore lend themselves to being traded on exchanges (‘Exchange-Traded Derivatives’ (ETD)). Within derivative exchanges, members of the exchange place orders (electronically) to execute trades in standardised products, directly with the exchange; the exchange attempts to find a match of that order with opposing orders received from other exchange members. If a match is found, the order has been fulfilled and a trade has been executed. (Similar concepts are applicable at many electronic stock exchanges.) The standardised nature of ETD products facilitates speedy and transparent trade execution between members of the exchange.

The historic tailoring of OTC derivative trades to suit the needs of the two involved parties has not been conducive to standardisation and has been a barrier to achieving trading of such products within derivative exchanges.

Today, standardisation of certain types of OTC derivative products does exist; examples of this are single name credit default swaps (SN-CDS) and fixed/floating interest rate swaps. For instance, within a year of autumn 2008, major steps had been taken to standardise SN-CDS via the Big Bang Protocol, leading to a range of benefits enjoyed by buyers, sellers (and regulators) throughout the trade’s lifetime; a key change was the introduction of fixed coupons which facilitates portfolio compression, whereby multiple gross trades are compressed resulting in a net position which represents the original pre-compressed trades. Such net positions result in both counterparty risk being reduced, and position maintenance costs being lowered. (For further details, please refer to Chapter 30 ‘OTC Derivatives and Collateral – The Collateral Lifecycle – Post-Trading – Trade/Portfolio Netting’.)

As for the new trading measures being required by regulators in the US and in Europe, recent years have seen a considerable expansion in the labels given to electronic trading platforms; for example, ‘swap execution facility’ is just one of a range of labels given to sites where trade execution occurs.

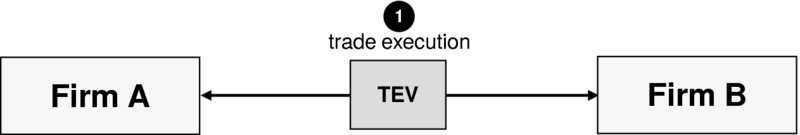

The common theme and primary regulatory requirement amongst all TEVs is that they bring together electronically parties that wish to execute trades, as per Figure 46.1

FIGURE 46.1 Trade execution via a trade execution venue

The types of firm permitted to participate directly with TEVs are banks (sell-side firms) and institutional investors (buy-side firms). As in the past, trades will continue to be executed:

- between sell-side firm and buy-side firm (dealer to client)

- between sell-side firm and sell-side firm (dealer to dealer).

Where a firm has executed an OTC derivative trade via a TEV, at trade execution the firm’s counterparty will be, in some cases, a normal (bilateral) counterparty. In other cases, trades are executed via a TEV anonymously where, at trade execution, the firm’s counterparty will be the TEV itself. Under the new measures, both trade execution methods will result in a trading firm’s counterparty becoming the central counterparty; see Section 46.5 ‘Central Clearing: Overview’.

Not all OTC derivative products are likely to be suited to electronic trading. The regulatory authorities (e.g. under EMIR, the European Securities and Markets Authority (ESMA)) must determine which OTC derivative types are subject to the mandatory trading requirement.

As trading is at the very start of the trade lifecycle, other measures being introduced such as central clearing and use of trade repositories should provide both pre-and post-trade transparency (and therefore a full audit trail) throughout the trade’s lifetime, as required by the regulatory authorities.

46.5 CENTRAL CLEARING: OVERVIEW

Generically speaking, clearing is the process of managing exposures throughout the various steps through which a trade passes, from post-trade execution to pre-settlement, relating to trades in all financial products.

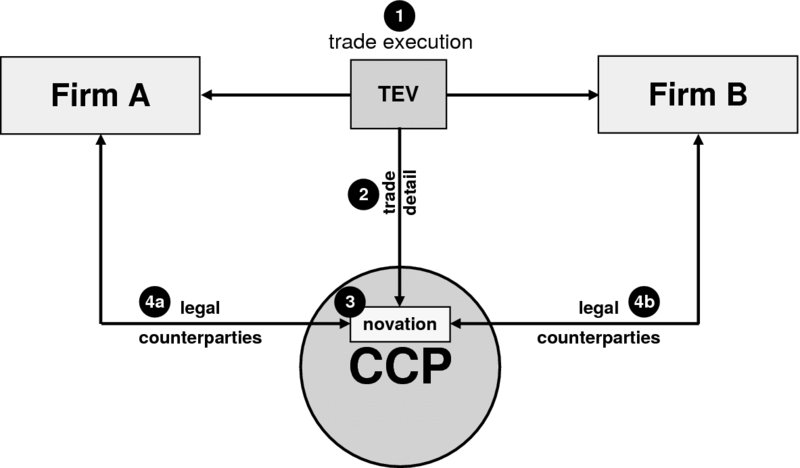

In the context of OTC derivative products, firstly central clearing pertains only to OTC derivative trades that are eligible for central clearing, whereby such trades executed via a trade execution venue (TEV) are of a standardised nature and are subsequently assigned to a central counterparty via the legal process of novation, as depicted in Figure 46.2

FIGURE 46.2 Post-execution, post-novation

The steps in the diagram are explained as follows:

- Step 1: trade execution has occurred between two trading parties, via a TEV

- Step 2: the TEV forwards the trade details to the appropriate CCP

- Step 3: the CCP assesses the trade details and clearing limits, and (if accepted) the trade is novated

- Step 4: novation results in two trades: 1) CCP versus Firm A, and 2) CCP versus Firm B.

This results in Firm A’s counterparty being updated from ‘Firm B’ to the ‘central counterparty’ (CCP), meaning that the firm’s ongoing exposure for the particular trade is with the CCP and not with Firm B.

(Note that, in addition to the OTC derivative product being subject to the clearing obligation, for a trade to be accepted by the CCP both the original trading parties must be subject to the clearing obligation under EMIR; this is described within Chapter 47 ‘OTC Derivatives and Collateral – Regulatory Change and the Future of Collateral – Centrally Cleared Trades’. If a party is not subject to the clearing obligation, the trade will not be centrally cleared unless that party voluntarily chooses to centrally clear the trade; otherwise the trade must be bilaterally cleared.)

Novation occurs from the perspective of both original trading parties; therefore, the ongoing counterparty from the perspective of Firm B is the same CCP. The CCP therefore interposes itself between the original trading parties; it becomes the seller to every buyer, and the buyer to every seller, thus eliminating traditional bilateral counterparty exposures.

It is important to note that before a trade is executed, a TEV must ensure that the trade is able to be cleared 1) by a particular CCP, and 2) on behalf of both parties to the trade. For this to occur, each party to the trade must:

- be a holder of a direct account at the particular CCP, namely

- a ‘clearing member’, or

- have use of client clearing services provided by a clearing member at the particular CCP, namely

- a ‘non-clearing member’ (sometimes referred to as ‘indirect clearing member’).

Following novation, central clearing involves the CCP managing trades, positions, collateral and the elimination of all risks. The CCP must remain market risk neutral at all times, meaning it must never take a position in an OTC derivative product for its own account, as, although the CCP will become counterparty in many thousands of trades, each pair of trades is offsetting, thereby leaving the CCP with a zero position.

A particular CCP is the focal point for many (if not all) eligible trades in a particular OTC derivative product; consequently one of the primary benefits of central clearing is that a firm that executes multiple buy and sell trades is likely to benefit from multilateral netting. Historically, if Firm T executed two purchases and one sale in the same OTC derivative product, with each of the three trades being executed with different bilateral counterparties, the netting of trades would not have been an option (as netting is achievable only with the same counterparty). Given the same three trades under a central clearing environment, Firm T’s sole counterparty will be the CCP, and as such the CCP is in a position to see both sides of each trade it processes, meaning that Firm T could benefit greatly through the three individual trades being represented by a single (net) trade.

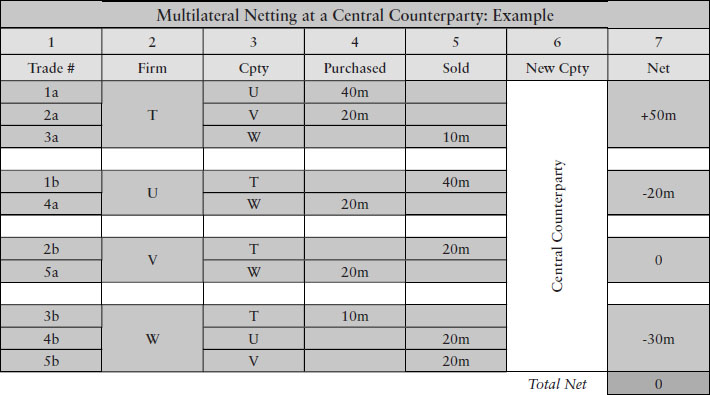

To extend those three example trades executed by Firm T, in the following table four parties execute a total of five trades bilaterally (refer to columns 1 to 5), followed by the effect of multilateral netting as would occur at a CCP (refer to columns 6 and 7):

TABLE 46.1 Multilateral netting at a central counterparty

Explanation of the table’s content: following novation to the CCP, the CCP’s multilateral netting process results in three firms each having a net position with the CCP, while the fourth firm (Firm V) has a zero net position. The CCP maintains a ‘matched book’ of offsetting trades resulting in the CCP having a post-netting position of zero, thereby remaining market risk neutral.

To take the CCP multilateral netting concept to a more detailed level, in the case (for example) of credit default swaps (CDS), an individual firm’s trades would need to meet the following criteria in order for netting to occur on such trades:

- trades must belong to the same trading entity (e.g. Firm T), and

- trades must relate to the same reference entity (e.g. France Telecom), and

- trades must have the same scheduled maturity date (e.g. 20th June 2030), and

- trades must have the same fixed coupon (e.g. 100 bppa).

For a description of CDS, please refer to Chapter 17 ‘OTC Derivatives and Collateral – Transaction Types – Credit Default Swaps’.

Central counterparties are companies (not government utilities) which must be authorised to act in the role of CCP. It is therefore possible that for a particular OTC derivative product (e.g. interest rate swaps), two or more CCPs may be providing central clearing services in a particular geographic region. It is also possible that a single CCP may choose to focus on particular types of OTC derivative product (e.g. credit default swaps), but not other types (e.g. cross-currency swaps).

In summary, central clearing of OTC derivatives mitigates the traditional bilateral counterparty risk whilst reinforcing integrity of the market for investors and other participants. Additionally, centrally managed trade processing and collateral processing throughout the trade’s lifetime is regarded as a benefit for all concerned. Furthermore, such high levels of transparency provide regulators with the ability to closely monitor new trades and existing positions.

Significantly greater detail of central clearing is provided within Chapter 47 ‘OTC Derivatives and Collateral – Regulatory Change and the Future of Collateral – Centrally Cleared Trades’.

46.6 TRADE REPOSITORIES: INTRODUCTION

A trade repository (TR) is in essence an electronic ‘warehouse’ for the storage and safekeeping of the details (terms) of individual OTC derivative trades and positions. TRs maintain details of trades reported to them by, or on behalf of, the parties to the trade. Regulatory authorities will access such trade information held by TRs in order to carry out their regulatory oversight responsibilities.

46.6.1 Reporting of Centrally Cleared Trades

Where trades have been novated to a CCP, the parties to each trade are 1) the CCP, and 2) one of the original parties to the trade. Trade details include both individual trades (not netted) and net positions resulting from multilateral netting by CCPs. As OTC derivative trades may have a tenor of (for example) up to 50 years, the ongoing maintenance of accurate and formal trade records is paramount.

As a party to a centrally cleared OTC derivative trade, the CCP has a reporting obligation. The CCP’s counterparty (e.g. Firm A) also has a reporting obligation. Firm A is able to choose the method by which its trade is reported to the TR; Firm A may report directly to the TR or delegate the reporting task to the CCP. However, Firm A remains responsible for ensuring its trade details are received by the TR.

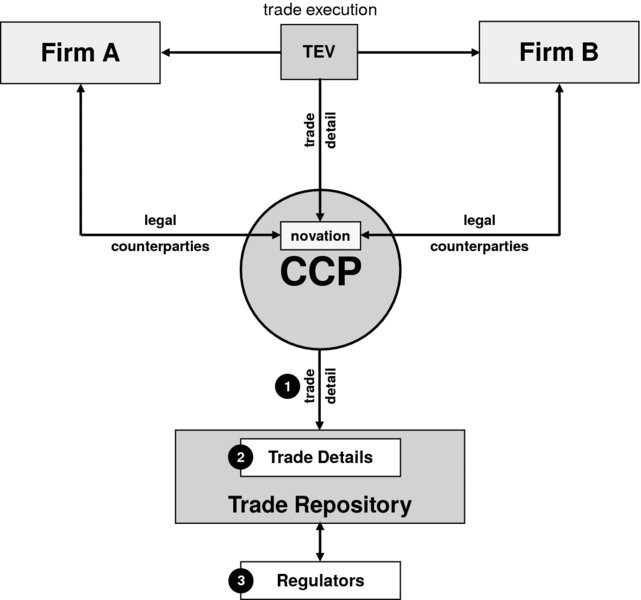

The flow of information by which a TR receives details of centrally cleared OTC derivative trades in which Firm A has delegated reporting to the CCP is depicted in Figure 46.3

FIGURE 46.3 Central clearing and trade repositories

The steps in the diagram are explained as follows:

- Step 1: the CCP sends a single electronic message containing trade details (for itself and for Firm A) to the TR

- Step 2: the trade repository stores trade details using electronic records

- Step 3: for regulatory oversight purposes, trade details are accessed by regulatory authorities.

In order to maintain direct control over reporting of trades, many of the larger trading (typically sell-side) firms that execute OTC derivative trades in greater volumes than other firms have developed their own reporting software systems. Firms executing lower volumes of CCP-eligible trades are more likely to delegate reporting to the CCP.

Similar to central counterparties, trade repositories are companies (not government utilities) which must be authorised to act in the role of TR. It is possible that a single TR receives trade details from one or more CCPs.

46.6.2 Reporting of Non-Centrally Cleared Trades

Where a firm executes a trade directly with a traditional counterparty (and the trade is not novated to a CCP), such trades are labelled ‘non-centrally cleared’ or ‘bilaterally cleared’.

(Note: the reasons why some trades are not centrally cleared are described within Chapter 48 ‘OTC Derivatives and Collateral – Regulatory Change and the Future of Collateral – Non-Centrally Cleared Trades’ and include reasons such as the trade components being non-standard.)

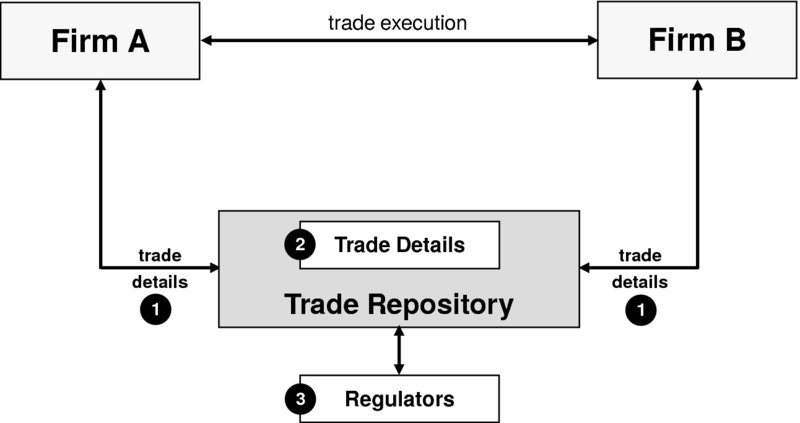

For all such bilaterally cleared trades, the responsibility for reporting of trade details to the TR remains with each trading firm, and this direct reporting situation is depicted in Figure 46.4

FIGURE 46.4 Bilateral clearing and trade repositories

It is important to note that both parties to a bilaterally cleared trade are responsible for ensuring that the details of each executed trade reach the TR. For example, a trade executed and cleared bilaterally between an investment bank and an institutional investor requires both the sell-side firm and the buy-side firm to report their trades to the TR. If the buy-side firm does not have the necessary infrastructure to action the reporting itself, that firm may enter into an arrangement whereby reporting is delegated to the sell-side firm, who would then report to the TR for both parties.

One of the most important regulatory measures is the requirement for regulators to have direct access to OTC derivative trade information, from a market transparency and oversight perspective. Through the integrity of their trade records, TRs will provide such information or make it available for retrieval by regulators.

Note: it must be re-emphasised that a trading firm is ultimately responsible for ensuring that the details of 100% of trades it executes are reported to a TR. As mentioned earlier, for trades which are centrally cleared, the CCP will pass gross or net trade details to the TR, on behalf of (and if required by) the trading firm. For trades which are not subject to central clearing (‘non-centrally cleared’ trades), it remains the responsibility of the trading firm to ensure trade details are sent to the TR; this may be achieved by direct reporting for which transmission options are available, including trade reporting services offered by some consulting firms.

At the time of writing, the reporting process within buy-side and sell-side firms is relatively new and will be improved by the future introduction of reconciliations to ensure the trade/position data reported to TRs is complete.

46.7 CENTRALLY CLEARED AND NON-CENTRALLY CLEARED TRADES

Under the regulatory initiative, each OTC derivative trade must be either centrally cleared via a central counterparty or be treated as non-centrally cleared with a traditional (bilateral) counterparty (see Figure 46.5).

FIGURE 46.5 Centrally cleared and non-centrally cleared trades

The following two chapters describe:

- for centrally cleared trades (see Chapter 47):

- the typical structure of CCPs and regulatory requirements pertaining to firms as both clearing members and non-clearing members

- for non-centrally cleared trades (Chapter 48):

- the regulatory requirements for firms having trades with traditional bilateral counterparties.