The key to success when it comes to buying property is due diligence. Arming yourself with as much information as possible allows you to make an educated decision and avoid buyer’s remorse. If you haven’t researched the market, if you haven’t had contracts checked to ensure the legalities are all above board and if you haven’t ensured you have pre-approval of finance, you can add a whole extra level of stress to your purchase. In fact, you might not even know how much money you can borrow, so you will waste time looking at properties you could not possibly afford.

SORT OUT YOUR FINANCES

When you start to make your list of whys, you should also be sorting out your finances. Pre-approval for a home loan needs to be underway, so that you are ready to take action if you find the property that is right for you. Get your pre-approval in writing, so that you know exactly what your budget is once you have taken the first home owner grant (if applicable) and stamp duty into account. Make sure you also ask your financial institution or mortgage broker what the most acceptable time frame for settling (making the final payment) is. This will let you know exactly how quickly you can access the funds when it comes to settlement. This will help when you negotiate your preferred terms. There is no use in offering to pay in 30 days when the banks needs 45 days. You may end up having to pay bridging finance (an extra loan) for the shortfall of 15 days and this could be a very expensive exercise.

The Secrets of the Reserve Bank of Australia

The Reserve Bank of Australia (RBA) and how it works are not actually secrets. You will hear reporters talking about the RBA and the cash rate on a regular basis on the news, and there is a section in newspapers and their online counterparts that deals with money and business. If you are anything like the vast bulk of the population, you probably tune out or keep flicking/scrolling through to the sport section when cash rates are mentioned. But they have a major impact on the rates you will pay on your mortgage and it is worth having at least some beginner’s knowledge on how they work.

Each month except January, usually on the first Tuesday, the RBA Board reviews the cash interest rate. This is the amount banks charge one another on overnight loans, and it is inextricably linked to inflation, jobs growth (or otherwise) and the general state of the economy.

Most of the time the cash rate is the lowest interest rate going. It influences all other interest rates. That includes the interest rate on mortgages and credit cards, as well as the interest you receive on your savings.

In a broader sense, raising the cash rate is how the RBA puts the brakes on inflation and demand. Lowering the cash rate—or keeping it very low, as we have seen since mid-2016 (in 2018, the cash rate was 1.5 per cent, the same level it had been at since August 2016)—boosts economic activity. For the average punter, a change in cash rate will see a change in mortgage interest rates.

When you are about to enter the housing market, watching the movement of the cash rate can give you an indication of the way your finances might be affected. Cash rates can go up and, generally, so then will the interest rates on your mortgage. With the cash rate as low as it is, you are unlikely to see the interest rates on mortgages drop any further. It is important to take this into account when you are budgeting. If now, when the rates are low, you are worried how much money you will have left over when the mortgage comes out of your account, how are you ever going to pay it if the rate goes up?

Acquainting yourself with how the process works will help you to create the best outcomes for your finances and, I hope, come out ahead when it comes to borrowing money to buy a home.

The problem with not having your finances sorted out will become obvious if you find a place you love—and that someone else also wants to buy. You can ask for a contract with conditions. These can include, for example, a ‘subject to sale’ condition (if you first need to sell the house or apartment you are in now) or ‘subject to finance’, which is exactly what it seems—the buyer’s finance still needs to be approved. Vendors have been known to take a slightly lower offer with no conditions rather than take a chance on a higher price that is subject to finance or subject to sale. If a vendor accepts your conditions and you cannot get your loan approved, the person who offered no conditions may have gone off and found themselves another place and signed a contract, leaving the vendor back where they started.

Understanding that vendors are not always looking for the highest price, I hope, helps you realise that using strategies based on this may allow you to acquire your dream property.

Most people take out a home loan with one of three types of institutions: a bank, building society or credit union. Shop around different financial institutions to discover the ideal home loan for you: you might have had accounts with a certain bank your entire adult life but that doesn’t mean it will offer you the best deal on a home loan.

There are plenty of variations when it comes to mortgages, too, so you should look for one that suits your lifestyle and needs. Perhaps you want the option of being able to make large, lump-sum payments from time to time, or would benefit from a redraw or offset facility, which is particularly handy when it comes to making improvements on the home or coping with unplanned expenses—once you’re the homeowner, you are the one responsible when the water heater packs it in or the oven decides it has had a long enough life.

Many people use the services of a mortgage broker, who can help them negotiate the ins and outs of borrowing money, recommend the best loan structure and financial institution for their loan and assist in the application and securing of the loan. They are particularly helpful for people who may not be in ‘traditional’ employment—perhaps they work as contractors or have their own small business—and are looking to take out a low-doc loan. A broker can help you not only if you self-certify your income but also to find the lowest rates available to you. This is particularly helpful with the recent tightening of credit policies.

You can also use comparison sites to do your own research. If you take out a loan through one of them, the company receives a fee from the financial institution rather than the customer, so it can be an easy way to go if your financial situation is straightforward.

Whatever direction you decide to take, you must always be truthful in your dealings with a financial institution. Withholding information will only backfire on you. Banks are very good at discovering information about potential customers—in fact, they are much better at it than you could ever be at hiding financial inconsistencies. If you’re found to have left information off your application, the lender will decline your application and you will end up with an unnecessary enquiry on your credit file. A much better idea if your first application is turned down is to either save a bigger deposit or re-evaluate the amount you want to borrow.

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry has resulted in a recent tightening of lending standards. This means that borrowing, across the board, has become more difficult. This has had an effect on the property market across all sectors. If you are a cash buyer, however, you are now in a stronger position to make decisions quickly with less competition.

FINDING THE RIGHT HOME LOAN

Unfortunately, the reality is that nearly everyone who buys a home will have to rely on a lender for at least part of their buying funds. Here are some of the common loans available and why they might suit you. Remember, the information here is no replacement for financial advice based on your personal circumstances.

VARIABLE RATE LOANS

These loans are a very popular choice, especially when interest rates are low. They rely on the fluctuation of the cash rate set out by the RBA. It means you may be paying a certain rate of interest—and therefore a certain repayment—one month and something different the next, if the rate fluctuates. When your repayments go down, that is great; it’s not so much fun when they go up. Many homeowners choose this type of loan, especially since cash rates have been very stable, and very low, for a long time now. Variable rate loans also offer other features:

FIXED RATE LOANS

Fixed rate loans are the opposite of variable rate loans and give you a fixed interest rate—generally higher than the current variable rate—for anywhere between one and five years. This can be particularly handy if you are on a strict budget and need to know exactly how much your repayments are going to be. Unfortunately, you will not have the flexibility to make extra repayments and can be stuck with a higher interest rate if they suddenly drop.

SPLIT HOMELOANS

Just as the name suggests, this type of loan allows you to have part of your mortgage at a fixed rate and part at a variable rate. It is a compromise that allows you to have both the stability of a fixed rate of interest and the flexibility of some of the features of variable rate loans, like being able to make extra repayments. You can tell your lender how you would prefer to divide the split.

INTEREST-ONLY LOANS

Once popular with investors and young buyers on a budget, this type of loan is now rare. Banks may give you a short-term loan, where you pay interest only under financial hardship terms, but will revert back to the interest-and-principal scenario as soon as possible. It is important to remember that this arrangement, if granted, has a set term—usually one to five years—then the borrower must start paying down their principal as well. So, you either have to be ready to sell (the hope is your home will have increased significantly in value during that time) or start making much bigger payments.

SECURITY GUARANTOR LOANS

If you need to borrow more than 80 per cent of the value of the home you are purchasing, and do not want to pay high mortgage insurance, you can ask a family member—most of the time it will be your parents—to act as a security guarantor and provide their property title as a means of securing the part of the loan that is above 80 per cent. If you are in a stable job and feel confident you will not have any issues making payments, this can be a great way to get onto the property ladder. But be aware that a bank can go after your guarantor’s home if you default on your loan.

LOW-DOC LOANS

‘Low doc’ stands for low documentation, and these are loans suited to freelancers, small business owners and those who are self-employed. These types of workers often will not have pay slips or their most recent financials to show a lender, so instead will usually present BAS (business activity statements), bank statements and make an income declaration supported by a letter from their accountant. They generally have a higher interest rate and fees than full-doc loans.

NON-CONFORMING LOANS

Although they might sound similar to low-doc loans, they are very different. These are for anyone who has a bad credit history or no stable employment. Again, they will have higher fees and interest rates.

A WORD ON INVESTOR LOANS

While financing is generally a straightforward affair for the owner-occupier, it is a completely different scenario for anyone entering the market as a property investor. Engage an independent, licensed financial adviser to ensure you make sensible and informed decisions. Professional associations like the Financial Planning Association and Association of Financial Planners have websites where you can search for someone in your area.

FINDING BALANCE

While it is incredibly exciting to think that in just months you could be living in your dream home, it is also important to remain sensible. The gloss on those stone counter-tops might soon fade if you are struggling to make repayments or have sacrificed a lifestyle you were enjoying immensely. Of course, almost everyone is going to have to make sacrifices to get on the property ladder and it is worth giving up buying lunch each day or cutting out weekly trips to the cinema to make an investment that will grow your wealth. Just do not over-commit or make your life a misery.

REQUEST THE CONTRACT

Once you have had your finance pre-approved (and in writing) and have found a property you like and think it might fall within your budget, ask the selling agent for a copy of the contract. The contract, together with the information provided by the vendor, will tell you a lot about the home, including who owns it and what mortgage(s) are currently held. It will inform you of the outgoings associated with the property, if there is a lease attached and how long that is for, outlining the tenant details and how much they are currently paying if it is leased. It will tell you if there is a heritage overlay on the property, which is incredibly important if you have visions of a huge overhaul or even razing the house and rebuilding on the land. It will tell you the zoning of the property.

There is nothing quite so disappointing as finding the perfect warehouse and thinking you will remodel it to create an inviting combined loft-and-office space, only to discover it sits within a commercial or industrial zone. Some people are willing to take the risk, hoping the zoning might change, but if it does not, it can severely affect your ability to develop and and/or sell the property down the track (or at least to recoup the money you have invested in it) if it does not allow you to fulfil the plans you initially had for it.

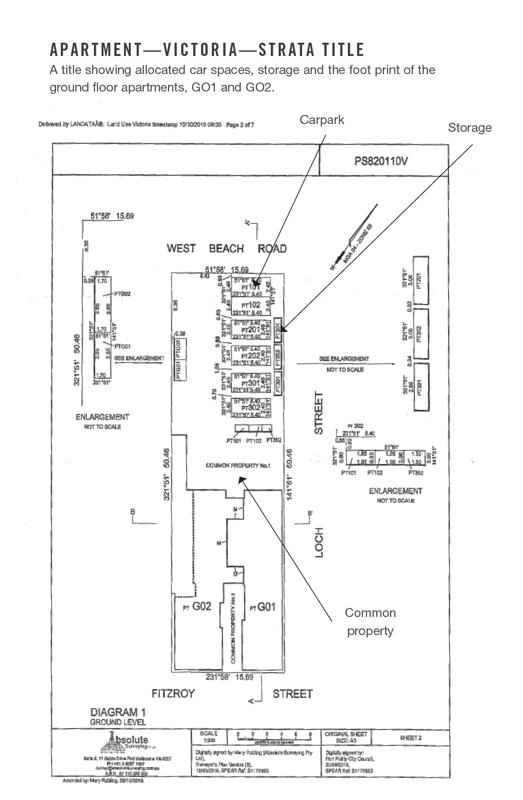

If the property is brand new, or has had work done on it in the past seven years, the contract will detail the builders’ insurance, what it covers and for how long. In the case of apartments or townhouses, the contract will tell you if it is a strata, stratum or company title property, whether there is an owners corporation and the details of that.

In short, a contract is a property’s history laid out for you. Whatever happens and regardless of how excited you are about a home, you should have an experienced solicitor or licensed conveyancer read through it and highlight any potential issues. For instance, if you want to move in to the property once it has settled, an ongoing lease will not allow you to do this. While this is something that can be solved, it is something that has to be solved before you buy the property. Knowing when you can issue a notice to vacate or aligning your settlement with vacant possession needs to be arranged beforehand so there are no surprises on settlement and so you do not waste any time.

When you ask the selling agent to supply the contract, you can also ask to see copies of the gas and electricity bills if you want to estimate how much it will cost to run the house. This is a practice that is becoming more popular with buyers, especially those looking at large homes.

STATE AND TERRITORY DIFFERENCES

In the Australian Capital Territory, vendors are legally required to provide documents prior to sale. These can include a building and compliance inspection report. This is a report that includes an asbestos assessment, any restrictions to development on the parcel of land and even a rating on the energy efficiency on the statement. These provide potential buyers with both the legal and technical details they should know about the property.

In New South Wales, residential property cannot be advertised for sale until a contract has been prepared. This must include what is called Schedule 1 Prescribed Documents, which includes a Section 149 certificate (pertaining to zoning of the land, i.e. residential or commercial), title and deed documents, a drainage diagram (where services are located), and a planning certificate issued by the local council.

In South Australia, there are also distinct disclosure requirements, which are regulated through the use of a Form 1 disclosure statement. It is the agent’s responsibility to put this statement together, but a vendor must provide the correct information so that the statement is accurate.

In Victoria, the contract of sale must include a compulsory Section 32 Vendor Statement. This document contains all the information about the property that the seller is legally required to provide to the buyer. It must be signed by the vendor and provided to the purchaser prior to signing a contract of sale. If this document is not signed, the purchaser can pull out.

In Western Australia, Queensland, Tasmania and the Northern Territory, there are no legal requirements for the vendor to disclose specific information in the contract of sale. However, the seller is legally required to disclose any material facts that may affect a buyer’s purchase decision. For example, if the seller is aware that the property has had an infestation of termites or could be stigmatised by an event such as a murder or suicide, they must legally disclose these facts.

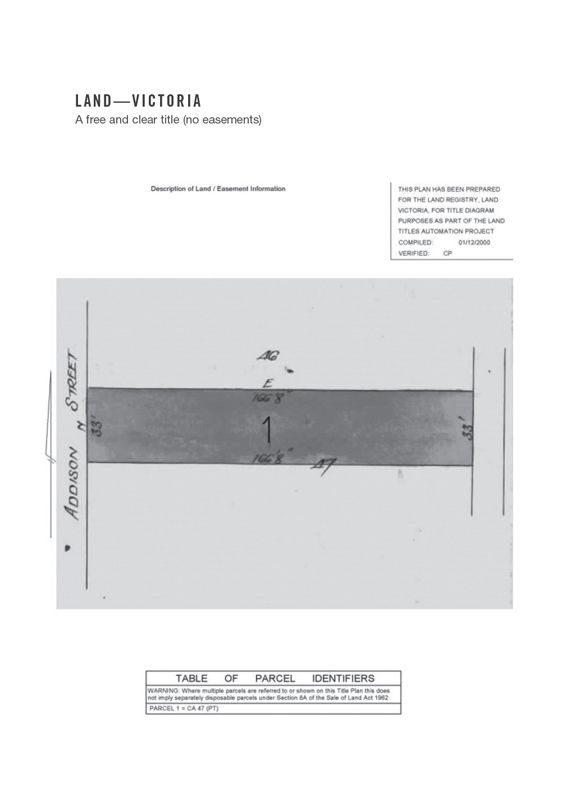

ALL ABOUT TITLES

As part of your due diligence you should be checking the title to the property. The title tells you so much about the property. The title forms part of the contract of sale, and it is where you find the details mentioned above: who owns the property, what mortgages are over it (if any), if there are any overlays, what easements (if any) the property has, what type of title it is, what accessory units there are (if buying an apartment or unit, for example). The title is the history of that property.

When you buy a property, you will be handed the title of ownership (well, the bank will hold on to it if you have a mortgage), but they are not all the same. These are the types of titles you may come across when looking at properties.

TORRENS TITLE

When you buy a house and the land it stands on, ownership is transferred to you—a state/territory creates and maintains a register of these landholdings. Your certificate of title will state you are the sole owner of the property and list any mortgages on it. The bank will hold on to the certificate until you have paid off the loan.

STRATA TITLE

If you buy an apartment, villa or townhouse, you will likely enter into a strata situation. The owners corporation—which includes everyone who owns a property in the building or complex—is a body that, by charging all owners regular levies, creates and manages a fund that is used to maintain the building and common areas, including gardens, stairwells, lifts, pools and the like. This levy comes as an extra cost to council and water rates. The owners corporation also controls the by-laws of the strata: whether or not you can have a pet, where you can park, garbage collection, and what changes you can make to your apartment. You have to consult the owners’ corp even for minor modifications like installing an air-conditioning unit.

COMPANY TITLE

Older apartment buildings, particularly those constructed in the 1920s and 1930s, may have this scheme. When you buy a company title property, you are buying a share in the company that owns the building. These types of apartments are often cheaper than strata units, but there can be more hoops to jump through when it comes to getting a loan approved for such a title. As a potential owner, you may need to pass an approval process by the company directors, and there can be restrictions on leasing the unit.

STRATUM TITLE

This type of title is less common than the others, and quite complicated, so you will need to get good legal advice before you commit. The entire property is divided into lots, and when you buy your apartment you become the proprietor of your lot. You will also hold shares in a company that owns and manages the common property.

GOVERNMENT LEASEHOLD

Occasionally, particularly in rural areas, you might purchase temporary ownership of a property, and can occupy it for an extended period of time.

SOME TERMS YOU MAY FIND ON A TITLE

Covenant A registered ‘dealing’ that restricts what can be done on the property in perpetuity. Covenants are usually designed to protect areas and values and they remain on the title until they are removed (which can be difficult). A covenant that, for example, restricts you from removing soil from the property, quarrying the land, or using it for subdivision would be considered fairly standard, and would be unlikely to cause a problem, but others can restrict development of the land or the type of building materials that can be used.

Section 173 Agreement These are quite common in Victoria and restrict what can be done on the property in perpetuity. S173 Agreements are usually designed to ensure that land developers abide by certain council guidelines when originally developing the first subdivision of land to protect future landholders. An S173 Planning Agreement might, for example, specify that you cannot alter, extend or change the property without such matters being first approved by the relevant council.

Easements These are a ‘right of way’ over part of a title plan and are generally denoted by a dotted line. Easements can be areas of land set aside for use by a government authority for sewerage and drainage purposes or even private use, such as when a neighbour has a ‘right of carriageway’ over part of the land for vehicular access purposes. Easements are very common; you are not permitted to build within 1 metre of (or over) the easement without the written consent of the relevant authority. Some owners build over easements (which we do not condone); it may not be easy to obtain a building permit to extend over the easement, and may not be at all possible in some circumstances.

GETTING THE RIGHT INSPECTIONS

Once you have checked through the contract, and are still keen to move forward, it is time to undertake building and pest inspections. Think of them like a car’s roadworthy inspection, but on a much bigger scale. A building inspection will tell you if there are any hidden issues, how serious they are and how urgently they might need to be fixed. The results will give you the information you need to get estimates on how much it will cost to correct the problems. Issues uncovered during a building inspection will not necessarily stop you from buying a property, but they will arm you with all the facts so that you can potentially negotiate the price with the vendor.

Pest inspections provide you with similar information about the state of the dwelling. Unlike a standard termite inspection, a pre-purchase pest inspection will also check for other timber pests, including borers, fungi and mould. The costs for treating any pests and remedying the damage they’ve done can also be factored into negotiations on price. It is important to remember that a building inspection is a completely different entity from a pest inspection, and a clean bill of health, so to speak, on one does not necessarily mean the other will come through clear as well.

In nearly all states and territories in Australia, both building and pest inspections will be paid for by the interested buyer and should be undertaken before the contract is signed. The only exception is the ACT, where vendors are obliged to provide a building and pest inspection report for any property they are selling. If you are eager to sign a contract, you can always make an offer that is subject to a satisfactory building and pest inspection. It is important to note that an offer made ‘subject to’ can only be made if the property is not going to auction or it is after the auction cooling-off period (for example, if the property passed in at auction and it is three business days after, you are then no longer under auction conditions). All states and territories have different cooling-off periods or none at all depending on the method of sale. Please refer to the table in Chapter 6 to see the applicable rules for your state or territory.

Always use a licensed inspector. If you like to work by recommendation, ask friends, family and colleagues for names.

Ask to see a sample report of what the inspector will cover and get a quote before engaging them. They will call the agent and organise the time to go through the property. If you would like to remain anonymous, then ask the inspector not to disclose your details. This helps if you want to keep your enthusiasm for the property under wraps from the agent.

WHAT TO EXPECT FROM BUILDING AND PEST INSPECTIONS

Before you make a booking, ask the inspector how the report will be presented and request to see reports they’ve done for other clients, so that you know how detailed the report will be and what it will cover. Although a pest inspector can only check areas to which they have access, they should spend time in the roof void and sub-flooring (if they have access), and check out buildings, timber fences and trees that are within 30 metres of the home. They will look for leaks and any issues with drainage or ventilation that might give access to termites. Some might use moisture metres, thermal imaging equipment or motion detectors to find areas of concern. One thing they cannot do is move items or open up walls to investigate concerns, but they will mention any suspicions they have on their report.

You can also ask pest and building inspectors if they’ve ever assessed this particular property before. If they have, they will be able to compare their previous report to see if structural work has been undertaken or if pests appear to have spread. It is also not a bad idea to ask the building inspector to measure the boundaries of the property so that you can check it against the title.

We coordinated a building and pest inspection on a home for clients that had been inspected by the same company two years previously. We were then able to ask what they uncovered then and had anything been done to rectify the original issues they had uncovered. The building inspection company was able to see that the vendors had indeed carried out the recommended pest fumigation, had re-pinned the foundations and had attended to the windows that had rotted previously. This was great information for our clients and spoke volumes for the upkeep of the home.

The cost of inspections will vary in different states or territories, but you should expect to pay anywhere between $500 and $1000. Never base your decision on price: ultimately, you are going to be spending hundreds of thousands of dollars, so you want to ensure the inspectors you employ are thorough. You are also well within your rights to be at the property while the inspections are taking place. Reputable building and pest inspectors will take their time completing the inspection, and the report, for you. Most will turn this around in one day, giving you no excuse as to why you cannot have one done.

If the property you are interested in is going to auction, then you must organise for the inspections to be completed before the day of the auction. Properties sold by auction cannot be bought ‘subject to’ a building and pest inspection. Once you have bid on a property and won, it is yours. If you then find out the entire home needs restumping at a cost of thousands of dollars, you have no recourse to have that cost knocked off the price. If you have spent your entire budget on the home, you will be putting yourself under financial stress before you have even moved in.

Electrical and plumbing pre-purchase inspections are also available. These are also highly recommended as building inspections will not uncover electrical wiring problems and neither are they covered for any plumbing issues that are found. Access is always the key to the report being as thorough as possible, so it can be frustrating when the report comes back with ‘no access available’.

We know of a buyer whose building and pest report was inadequate, in part due to the sheer amount of junk in the double garage of the property they wanted to buy. The vendors were not willing to move any of it (neither was the inspector), leaving this area of the home ‘unable to access’. It turned out after the property was purchased that the ‘unable to access’ area was indeed hiding water damage that had to be rectified at the buyer’s expense. In situations like this, you could ask to insert a clause in the agreement where any potential problems that are uncovered later are rectified at the vendor’s expense. Your ability to negotiate the price down is also hampered when you are unaware of these sorts of problems.

WHAT IS A STRATA REPORT?

If you are buying a property that has an owners corporation or body corporate—usually an apartment or a townhouse—you need to ensure you aren’t caught out by someone else’s financial failures. Many companies offer strata reports by licensed inspectors that will list any proposed strata expenditure, defects to the building, insurances, disputes among owners and rules that apply to the building, including in regards to pets. It is the only way to discover if you are buying into real problems that may not be apparent when you make your inspections.

A good strata report will identify these points:

You should also get, along with the report, copies of minutes from annual general meetings and extraordinary general meetings of the owners corporation. All of this, at a cost of only a few hundred dollars, will allow you to see if there are any issues you should be concerned about and may save you thousands of dollars in the future. Or a lot of drama. Imagine moving into what you think is your dream apartment only to discover that the neighbours are embroiled in a long-term battle over an issue that no-one else cares about.

A badly managed strata scheme can also affect the future resale value of your property. What you are looking for, ultimately, is a scheme that is within your budget and where owners and management work together peacefully to maintain and improve the building or complex.

VISIT THE LOCAL COUNCIL

Also high on the due-diligence checklist is consulting the planning division of the local council. They can inform you of any proposed works next to or in the vicinity of the property you are thinking of buying. Buying a beautiful home then discovering a developer has applied for or been granted permission to build a three-storey building with ten apartments next door could drastically alter whether you still want to move forward and buy. Of course, this will also affect the price you are prepared to pay for the property.

Should you wish to make changes to the property, the planning division can also talk through some of those ideas and give you an indication as to whether they will be possible. Someone there should be able to tell you what plans you need to submit and how long approval might take if you want to renovate or extend the property. There is absolutely no general rule when it comes to local councils—each and every one will have different rules and regulations. Even if you are not planning to do any work in the short term, it is worth knowing what you could do in the future. You might discover that even though the property you are interested in has room to build a garage or carport (and having undercover parking was on your list of must-haves) there could be a regulation—for instance, how close a building can be to the property line—that means you will never get council approval. The area could also be zoned with a heritage overlay and permission to build a carport or garage will never be granted.

We always speak to councils before purchasing a property for clients. A heritage overlay, for instance, does not always mean you will never be able to add to or alter a property. Working closely with the heritage planner will often allow you to achieve an addition or even change paint colours once you understand the extent of the overlay and how you can go about changing or adding so it is within the heritage guidelines. Some buyers walk a hundred miles from a property as soon as they hear the word ‘heritage’ but it is worth looking into the specific regulations in more depth before you dismiss the opportunity before you. Quite often what you want to do is achievable. But it will take planning and time, so be prepared for this.

Having these conversations with the local planning departments could definitely have helped a family I was told about who bought a property outside Hobart with two separate dwellings on the land. They had intended to convert the second dwelling into a small commercial kitchen and start a business making baked goods and preserves. Unfortunately, when they took their plans to council, the local council wouldn’t approve the commercial kitchen: the buildings were too close together and the kitchen posed a fire risk to the main dwelling. Not having a commercial kitchen meant they could not register their food business and this meant no second income. Knowing this before purchase would have saved them much stress and heartache—as it was, they had to come up with other ideas for a second income.

Historically, we’ve only ever purchased properties that we could subdivide; we’d sell the subdivided land and renovate the existing house. In this instance, you really have to do due diligence, know what zonings are in the area and whether you can actually develop the property you’re purchasing, otherwise it could be disastrous.

Georgia (Georgia and Ronnie, Series 13)

Due diligence can be time-consuming, but in the end it is absolutely worth it to ensure you buy the property that you think you are buying; if it isn’t, you can make the informed decision to move on or still go forward.

Buying off the plan

A popular option, especially in parts of a city where there is a lot of development, is to consider buying an apartment or townhouse that is either under construction or perhaps hasn’t started being built. There are potential savings on stamp duty when you buy off the plan and even buying a partially constructed building can be an excellent outcome if you are on a tight budget.

It can be hard to know where to start when it comes to buying off the plan. You may be attracted by the renders (drawings) of the finished product or the name of the architect involved in the project. While these are important, you must also do your own independent due diligence when buying off the plan.

First of all, ask if there is a display apartment you can look at. It is much easier to get a feel for size, particularly, if you can stand within a space. If there is a model of the development, ask exactly where the apartment you are considering is located on this model. Find out what other developments this particular company and/or architect and builder have been involved with. These are some useful questions to start with:

There are some important questions you need to ask before making a final decision to buy off the plan. Find out exactly how many apartments are going to be in the complex, when it is due to be finished, if there is any early indication of how many owner-occupiers will be in the building (important if you plan to live there) and the expected return if you are buying as an investment. Look very carefully at the plans and see where the external windows are in the apartment. Find out what amenities—a gym, pool, 24-hour concierge—there will be, then decide whether the cost of them makes sense when compared to how much you anticipate you will use them. If you do not feel you will really need or use them, you might be better off looking at smaller developments.

When you feel as though you may have come up with a winner, see if you can visit some of the developer’s other properties and speak to the people living there. They will let you know if they had any problems either during the build or with the finished product. Often new buildings will have issues, but the speed at which they are fixed will be an indication of how such things might go when your apartment is finished.

Always get your own solicitor to read the contract. In it, there should be a detailed list of what the outgoings will be, penalties for lateness on delivery of the property, and whether defects are covered by building insurance. Anything that you or the solicitor feels should be changed or queried has to be done before you make an offer on the apartment. Do not rely on the developer’s solicitor.

A good friend and mentor of mine, Marcus Peters, from Professionals, Whiting and Co in St Kilda, has been selling real estate for nearly thirty years and he recommends buyers look at three main things:

Checklist

Your due diligence plan

There is no harm in looking at some properties before you are ready to take the plunge, but once you have decided it is time to buy you need to be methodical in your approach. Here’s what your checklist should look like: