19

Brother, Can You Paradigm?

Jeffrey S. Kuhn

Jeffrey S. Kuhn, EdD, is a distinguished thinker, author, strategy advisor, educator, and speaker with expertise positioned at the intersection of strategy, innovation, growth, and organizational renewal. His work centers on helping senior business leaders develop the capacity to think and lead strategically in dynamic market environments that are undergoing profound change. He holds a doctorate from Columbia University, and has served on the faculty of Columbia Business School and Teachers College, Columbia University. He is a founding member of the London-based Strategic Management Forum and is a Fellow at the Royal Society of Arts. In 2017, Dr. Kuhn was inducted into Marshall Goldsmith’s 100 Coaches.

■ ■ ■

I recently wrote an article for a business journal titled, “Strategic Leadership: A Simple Cure for Short-Termism,”1 which explored Peter Drucker’s concept of looking out the window to see what is visible, but not yet seen as an underlying theme.

In the opening section of that article, I drew a parallel between the worldwide myopia epidemic in school-age children, stemming from excessive time spent indoors tethered to computers or mobile devices, and the strategic myopia epidemic that is raging in boardrooms around the world – an organizational pathology in which executives fixate on maximizing near-term profits at the expense of long-term strategic thinking that bolsters the value-creating capacity of the firm.

The simple cures for both forms of myopia are remarkably similar. For children, researchers recommend spending ample time outside in natural light, away from books and computers, gazing into the distance. A similar prescription can be written for business leaders: spending ample time outside the mental confines of the organization, away from spreadsheets and detailed quarterly reports, gazing into the distant future, to identify the weak signals of change (the subtle cues that are visible, but not yet seen) that portend profound market shifts.

I examined the various causes of strategic myopia, from growing investor pressure to deliver short-term gains to growing competitive intensity that tends to drive reactive, one-off thinking – the corporate equivalent of whack-a-mole. Drawing on my research in cognitive development and pattern recognition, I suggested that there is an underlying cognitive dimension to the strategic myopia epidemic in senior leaders. After all, perception occurs in the mind. I argued that years of eking out slow, single-digit growth in mature markets has conditioned leaders to think in safe, incremental terms to protect short-term profits, producing generations of denominator managers who are adept at slashing, delayering, rationalizing, reorganizing, offshoring, and nearshoring, but who lack the cognitive capacity – foresight, curiosity, and imagination – to see the exciting growth platforms of tomorrow in their minds’ eyes.

Taking a page from Professor Drucker, I concluded the article by saying, “The next time you are bleary-eyed from reading reams of quarterly reports and have a difficult time thinking beyond the demands of today, let alone the next ten years, walk over to your window and take a look outside. You might be surprised by what you see.”

Prior to submitting the article for publication, I emailed the manuscript to my trusty editor Ethan for a final review. The next morning, I found the marked-up manuscript in my inbox. Most of the edits were minor fixes that I didn’t quibble with. But as I scrolled to the bottom of the last page, I was baffled by a question he posed in the right-hand margin next to the very last sentence: “How exactly do we look out the window?” I’ve been working closely with editors for more than two decades and have had my share of off-the-wall comments, but this one took the cake. Dumbfounded, I stared at my computer screen, shaking my head in disbelief, and thought, You don’t literally look out the window. The window is a metaphor for our minds. Looking out the window means looking at the tangle of socioeconomic trends and emerging technologies that create and shape markets.

Nevertheless, the journal welcomed my metaphorical musings and published the article without substantive changes. But I continued to ruminate on my editor’s question until it dawned on me that the point he was endeavoring to make, as odd as it sounds, was that many leaders don’t know how to look out the window, meaning they don’t know how to scan the broad market landscape to identify intersecting socioeconomic trends and such. They’re not wired that way. They’re wired to keep the organizational engine humming and execute quarterly performance targets. If by chance they do peek out the window, they’re not sure what to look at, let alone how.

Paradigm’s Lost

If we were to turn back the clock 100 years and look out the window, our minds would construct (i.e., see) a much different world – a mechanistic, Newtonian world that gave rise to the organization-as-machine management paradigm epitomized by Frederick Taylor’s scientific management.

Back then, there was little need to look out the window. The external environment was relatively stable and, to a degree, predictable. Industries were composed of a handful of dominant players competing with a familiar set of rules in highly structured sectors that evolved incrementally and linearly. Competition was a clash of the titans, a game of size and structural advantage. In the event that you did look out the window, your mind would have construed an orderly, immutable universe that ran with clocklike precision, in which inputs equaled outputs, actions produced reactions, and big problems could be broken into small pieces that could be analyzed in isolation.

With the dawn of the Information Age in the 1950s, a seismic shift began to rumble. The mechanistic worldview of the Industrial Era had outlived its usefulness as the business landscape became increasingly dynamic and uncertain. Over time, the orderly universe of Newton was displaced by paradigm-busting findings in quantum physics and complexity theory. Organizations shape-shifted from well-oiled machines into dynamic organisms that were part of a larger ecosystem. Firms no longer competed in insulated provincial markets but in unstructured global arenas with new players and new rules. Facing growing market complexity and competitive intensity, leaders began to look out the window more frequently and engage in more fluid modes of thinking and being.

Today, the twin forces of globalization and technological acceleration have created a short-cycle world that has quickened commoditization cycles and shortened corporate life spans to where they can now be measured in dog years. Low-cost digital technologies have lowered barriers to entry, giving rise to new types of competitors and business models, and creating an amorphous business landscape characterized by deep complexity, high uncertainty, and transient competitive advantage.2 The future bears little resemblance to the past.

In a short-cycle, commoditizing world, the ability to identify the weak signals of change earlier and better than competitors has become a critical organizational capability. The more dynamic and uncertain the market environment, the greater the need to scan the horizon on a systematic basis to spot emerging trends and engage in strategic reflection and dialogue. Few leaders disagree with this on a conceptual level, but in the tooth-and-nail world of business, the idea of slowing down, reflecting, and thinking conceptually about the shifting contours of the market landscape is anathema to high-strung managers who pride themselves on delivering the goods each quarter. The annals of business history are littered with examples of storied firms that were too busy minding the store and got blindsided by stealthy newcomers from outside the industry. As Kodak and Blackberry can attest, failure to acknowledge profound shifts in the external environment and ask unvarnished, uncomfortable questions concerning the strategic health of the enterprise can have grave consequences.

The mechanistic worldview of the Industrial Era continues to cast a long shadow over the way we think and lead our organizations. Scientific management’s tenets of efficiency and control have been etched into the minds of generations of business leaders. When thrust into strategic roles, operationally oriented managers often struggle with broad, imaginative thinking. They can speak at length concerning asset intensity and inventory turns (concrete modes of thinking) but lose their intellectual footing when asked to think and lead with a long-term, external perspective rather than from the short-term, internal purview of operations.

However, it’s my belief that, with the right developmental experiences, leaders can develop their strategic eye – the cognitive capacity to look out the window and see what is visible yet not seen – with a high degree of perceptual acuity.

Developing Your Strategic Eye

To illustrate, let’s imagine that you are a senior business leader at General Motors, and the executive team has asked you to speak at the next board meeting concerning the transformation of the auto industry and where future growth opportunities lie.

Your mind shifts into overdrive. What should I look at? How will I recognize intersecting trends and patterns? How will I translate what I see in my mind’s eye into a set of strategic insights to share with the board?

You are not alone. Many leaders struggle with strategic thinking and regard it as an inborn trait possessed by members of the lucky gene club rather than a cognitive capability – a mind-set and muscle – that can be developed. This raises an important point: Strategic thinkers think in the form of questions. The better you are at framing strategic questions, the better you will be at strategic thinking. As my editor intimated, you don’t just gaze out the window hoping for divine revelation. Rather, you scan the market landscape with a series of broad questions to open your mental aperture. Broadly framed questions such as, What are the key socioeconomic and technological trends in the market landscape, and how do they intersect? provide an excellent jumping-off point to guide your journey. This is a significantly different, more sophisticated way of thinking than typical execution-oriented questions such as, How can we crush our competitors and sell more cars?

As a seasoned auto executive, the first thing that you will notice when you look out the window is that the industry is in a state of entrepreneurial flux, much like it was in the early 1900s, when there were 241 auto manufacturers registered in the United States alone, and steam- and electric-powered vehicles vied with the internal combustion engine to be the dominant design. Today, a constellation of Silicon Valley tech giants, venture-backed start-ups, universities, and incumbent auto manufacturers are pioneering novel forms of hybrid vehicles, electric vehicles, and self-driving cars; new vehicle concepts such as two-, three-, and four-wheeled city cars; and innovative business models such as ride sharing (think Uber and Lyft), luxury subscription services, and fractional models in which multiple parties own or lease a vehicle.

This insight leads you to a deeper set of questions: What’s creating this entrepreneurial flux? How will the industry landscape likely evolve? How will customer and economic value be created in the future? How do we get ahead of the curve so that we don’t get elbowed out of our own business? How quickly will the future arrive?

Intrigued, you dig deeper into the broad market landscape and identify five strategic megatrends that are reshaping the contours of the auto industry: environmental concerns with CO2 emissions; urbanization and the rapid growth of megacities with high population density; demographic shifts such as the growth of the global middle class and the coming of age of the millennials; emerging technologies such as new energy sources and autonomous vehicles; and seismic consumer shifts, in particular, a growing preference for access over vehicle ownership. You examine the interrelationships among these trends and it becomes abundantly clear that they are converging and creating a new mobility landscape in which fewer people own cars and mobility is consumed as a service.

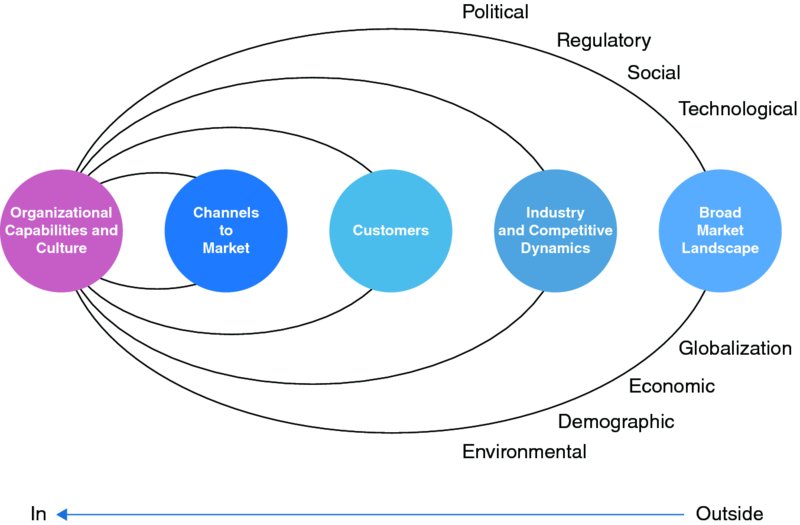

From a cognitive standpoint, you would have failed to see these trends if you had looked at the market landscape through the narrow prism of your current core business of making and selling cars to customers who own and drive them. To develop a broad perspective of where the future lies, you must look at the world from outside in – not through the prism of existing products and services – and beyond immediate customer needs and near-term competitive dynamics, to the broad market landscape (see Figure 19.1).

Figure 19.1 Strategic Lenses

As an organization matures from fledgling start-up to industry stalwart, the field of vision often narrows, and the organization finds itself peering at the outside world through a peephole. Individuals undergo similar life-cycle changes as they grow and mature from starry-eyed children with boundless curiosity and imagination to buttoned-up executives who interpret the future through the prism of past experiences. Left unchecked, these perceptual filters become self-limiting and self-sustaining, suppressing the long-term imaginative thinking that is essential to sustained value creation. This explains why, in incumbent firms, most growth opportunities are hidden in plain sight.

For senior leaders, spotting intersecting trends and emerging growth opportunities requires the ability to wipe one’s mental windshield clean to overcome organizational orthodoxy and inertial forces that impede divergent thinking and stifle imagination. An ecological lens is also key. Expert trend spotters are like seasoned biologists who study dynamic interactions of flora and fauna in a rain forest. Markets are no different. They are based on the same principles as natural ecosystems – interdependency, dynamism, and emergence.

Help Wanted: Strategic Leaders

Drucker’s dictum, while simple in form, requires an array of sophisticated cognitive capabilities to scan the market landscape and pick up subtle cues that are visible but not yet seen. Further complicating matters is a host of organizational pathologies and immune systems that function as an invisible hand influencing what we see and how we see it.

Over 20 years ago, strategy expert C.K. Prahalad3 suggested that established firms were not resource-bound, but imagination-bound, meaning that imagination was the scarce resource. Organizations are slowly waking up to these new market realities and finding themselves in short supply of dynamic, strategic leaders with the curiosity, imagination, and entrepreneurial verve to look out the window and conceive the markets, businesses, and industries of tomorrow.

The socioeconomic trends creating the new market landscape are as structural as they are paradigmatic. Market shifts are so pervasive and subtle that they are difficult to perceive. But one thing is certain: You won’t be able to see what is visible, but not yet seen if your field of focus is limited to the current quarter, or to fighting over a quarter point of market share with an archrival.

The leaders I’ve worked with through the years recognize the importance of looking out the window on a systematic basis; they just aren’t sure how to make sense of what they see. But as management guru Tom Peters recently declared, “If you’re not confused, you’re not paying attention.”4 So, just as I suggested to readers in my article, “Strategic Leadership: A Simple Cure for Short-Termism,”5 put down your spreadsheets and walk over to your window and look outside. You will be amazed at what you can see when you wipe the residue of industrial-era paradigms and past experiences from your lens and scan the market landscape with the curiosity and imagination of a five-year-old. Subtle cues that are invisible to the naked eye will become crystal clear when you develop your strategic eye.

Reflection Questions

- Why is looking out the window such an important, yet unnatural, act in established firms?

- What systems and processes does your organization have in place for monitoring the external environment? How important is this capability in your particular industry?

- What trends in the broad market landscape should your organization be monitoring? What strategic questions should your executive team be asking?

- In a given week, how much time do you spend looking out the window to identify market trends? Based on your role, how much time should you spend doing so?

- What are some ways that you can sharpen your strategic eye to recognize emerging threats and opportunities in the broad market landscape?