11. WHAT THE HELL IS A RANDOM WALK?

Charting is as old as papyrus; the “random-walk” thesis has ancient origins but, properly worked out, is as new as computers. Charting seeks to find some order in what has happened; the random-walk thesis maintains there is no order. If the random-walk people are right, the Chartists are out of business and all the security analysts are in trouble.

The random-walk people are university professors in business schools and economics departments. They have had a lot of advanced mathematics and they delight in using it, and in fact, most random-walk papers by these academics must be arcane and filled with symbols so that their colleagues will be impressed. If you want to read some of these, try a journal called Kyklos; it has published a number of them. The material in our glimpse at the attack is covered there; also in The Random Character of Stock Market Prices published by the Massachusetts Institute of Technology, edited by Professor Paul Cootner; and in paper number 16 of the Selected Papers of the Graduate School of Business of the University of Chicago, “Random Walks in Stock Market Prices,” by Professor Eugene Fama.

What is a random walk? I can’t understand half the papers on the subject, since my fluency in Boolean algebra is limited and in stochastic series is nil. But after a number of conversations with random-walk lads, it occured to me that the whole thing could be defined in one sentence, and Professor Cootner later told a friend of mine this was an okay definition, so without any equations, Σs, or Δs, here it is:

Prices have no memory, and yesterday has nothing to do with tomorrow. Every day starts out fifty-fifty. Yesterday’s price discounted everything yesterday. To quote Professor Fama, “the past history of the series (of stock price changes) cannot be used to predict the future in any meaningful way. The future path of the price level or a security is no more predictable than the path of a series of cumulated random numbers.”

Randomness as a way of beating the market is not limited to academics, of course. Senator Thomas J. McIntyre, Democrat of New Hampshire and a member of the powerful Senate Banking Committee, brought his dart board in one day. Senator McIntyre had tacked the stock market page onto his dart board and thrown darts at it, and the portfolio picked by his darts outperformed almost all the mutual funds. (Senator McIntyre’s darts thus supported the random-walk testimony of Professors Paul Samuelson of MIT and Henry Wallich of Yale, given when the Senate was considering mutual-fund legislation.)

If big guns like Professors Samuelson and Wallich and the Senate Banking Committee are taking the random walk seriously, everybody had better gird up, because if the random walk is indeed Truth, then all charts and most investment advice have the value of zero, and that is going to affect the rules of the Game.

The first premise of the random walk is that the market—say the New York Stock Exchange—is an “efficient” market, that is, a market where numbers of rational, profit-maximizing investors are competing, with roughly equal access to information, in trying to predict the future course of prices.

The second premise is that stocks do have an intrinsic value, an equilibrium price in economists’ language, and that at any point in time the price of a stock will be a good estimate of its intrinsic value, the intrinsic value depending on the earning power of the stock. But since no one is exactly sure what the intrinsic value is, “the actions of the many competing participants should cause the actual price of a security to wander randomly about its intrinsic value.” (Fama speaking.)

The random-walk fellows have gone about testing their theory on “empirical evidence,” and the purpose of this research is to show mathematically that successive price changes are independent. Here is a sample test, just to scare you. This one is by William Steiger of MIT, from The Random Character of Stock Market Prices.

The test is based on a sampling distribution of a statistic pertinent to pure random walks which I have derived in another place. Letting t be the ratio (a random variable) of the range of deviations from the line joining the first and last observations of a segment of a continuous random walk to the sample standard deviation of the increments, the distribution denotes the probability, Pt, that t is less than or equal to any t.

Consider the following continuous stochastic process.

Let

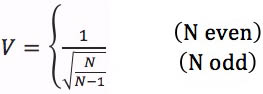

describe a pure random walk in the segment from m to n where m, integers and t vary continuously in m ≤ t ≤ n. Let

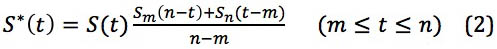

We transform a realization of S(t) in the segment from m to n to one which has a mean increment of zero as follows. Put

the deviations from the line joining (m, Sm to (n, Sn) and

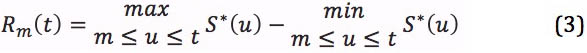

let the range of deviations of the segment (m, n) at time t.

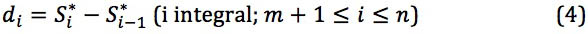

Putting the increments

we define

the standard deviation of the increments, at integral times, in the segment.

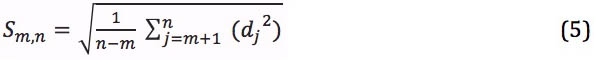

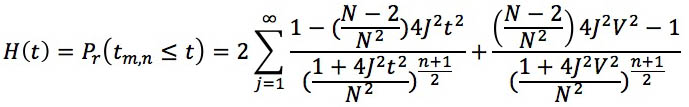

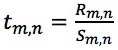

Finally letting the random variable

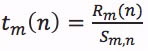

we have the sampling distribution function for

where

and

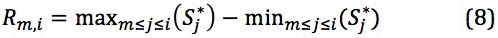

Equation (7) has two interpretations in sampling segments of random walks. Since one can only sample S*i, i integral, for the segment of the continuous random walk S(t) in ≤ t ≤ n, one is not able to sample Rm(t) in (3), but instead can only sample

and thus sample only

In some cases Rm, i may equal Rm (i) and then and only then is (7) interpreted as an exact sampling distribution function for tm(n).

In general Rm, i ≤ Rm(i) and it is shown elsewhere that equality is attained with probability 1, for i → ∞, m fixed.

These are, in case you didn’t know, serial correlation coefficients, and they give me the same feeling they give you. Another approach is to test different mechanical trading rules to see whether they provide gains better than simply buying and holding. Professor Sidney Alexander of MIT, for example, tested all kinds of filters, inferring from the results what would happen if other mechanical trading rules were followed.

(A filter of 5 percent would work this way: If the stock moves up 5 percent on any day, buy it and hold it until the price moves down 5 percent from a subsequent high, at which time sell it and go short. Maintain the short until the daily closing price rises at least 5 percent over the low, at which time cover and buy.)

You can see that the filter is indeed related to trend analysis or the measurement of price moves. Professor Alexander reported on tests of filters from one to 50 percent (“Price Movements in Speculative Markets: Trends or Random Walks”) and buying and holding consistently beat the filter.

Hence the random-walk people would say to the premise that a stock in a trend will more likely than not follow the trend, that that is nonsense, the chances of the stock following the trend are fifty-fifty.

You could say the same thing about flipping nickels. If you flip a nickel five times in a row and it comes up heads, what are the chances of its coming up heads the sixth time? If you flip a nickel a hundred times in a row and it comes up heads a hundred times, what are the chances of heads coming up the 101st time? Fifty-fifty either way.

“If the random-walk model is a valid description of reality,” says Professor Fama, “the work of the chartist, like that of the astrologer, is of no real value.”

The random-walk fellows seem particularly out to get the Chartists. As I said, one random-walk professor choked on his dessert at my house at the very suggestion that charts could be taken seriously. (We now have a rule at my house that all random-walk professors must finish their desserts before the subject of charts is brought up.) Another random-walk professor of my acquaintance had his graduate students flip nickels, assigning a plus to heads and a minus to tails, and they filled an x in the chart up for heads and down for tails, and sure enough, it made a beautiful point-and-figure chart, complete with line formations, heads and shoulders, reversals, double tops, and the whole thing.

But the random-walk fellows are not stopping with the Chartists. They are also going to bring the security analysts up on their toes. And that reasoning runs this way:

There are discrepancies between the actual price and the true intrinsic value of a stock. The analyst gathers all his information, applies his training and insight, and plumps for a purchase or sale accordingly. His action helps to close the gap between the price and the intrinsic value. The better the analysts are, the more sophisticated analysts there are, the more they become self-neutralizing, i.e., the more “efficient” the market becomes. An “efficient” market closely conforms to the random-walk model, in which the price reflects the true discount of intrinsic value.

Now obviously an analyst who is one step ahead is going to beat the average of analysts in an efficient market, but of course all analysts think they are better than average. An analyst’s insights must be consistently better than a randomly chosen portfolio of the same general flavor, because every analyst has a 50 percent chance of doing better than a random selection, even if he is a complete idiot or uses darts and a dartboard instead of a slide rule.

It is a cold, austere world, the world of the random walk, and a negative one. The random walkers do believe in the intrinsic value of a stock, but they have not much help for us on that because a stock only sells for its intrinsic value—whatever that is—whenever the market rushes past it either optimistically or pessimistically, so that intrinsic value is right like a stopped clock is right twice a day.

There are, as we know, sixteen thousand security analysts, and there are certainly thousands of Chartists. The Chartists will not believe in the random walk, because that would make what they were doing meaningless, and no one wants to feel that a dartboard selection will do as well as one with effort. As for the analysts, they will feel the random walk is irrelevant because their insights and information put them ahead. None of them will really follow the mathematical proofs of randomness. If they did, and believed them, they might take a salary cut and switch to teaching at a business school, and no exodus has yet been spotted.

In support of the skeptics we can only look again at the premise, that the market is reasonably “efficient,” that it is a market where numbers of rational, profit-maximizing investors are competing. It may just be that investors—even cold, austere, professional money managers—are not rational, or are not 100 percent rational. It may be that they would rather have some profit and a feeling of company than a maximum profit and a feeling of anxiety. The investor in the random-walk model is suspiciously Homo economicus, and we did wander among some thought that Homo is not economicus. “There is nothing so disastrous,” said Lord Keynes, “as a rational investment policy in an irrational world.”

No one has yet learned how to put emotions into serial correlation coefficients and analyses of runs. It is absolutely true that statistically the price of a stock has no relation tomorrow to what it was yesterday. But people—the Crowd—do have a memory that extends from day to day. You do notice one thing about the random-walk world and the chart world: There are no people in them. The prices are there, the coefficients are there, the past is there (or not there, depending on whether you are charting or random walking). Bishop Berkeley’s tree has fallen in the forest, and it has made an awesome noise even though no one has heard it fall.

If the market is truly a Game, it would be possible to have the Game without any intrinsic values at all. If part of the Game is that Bishop Berkeley’s tree is down when everyone decides it is down, then there need not even be a tree. If the printers will print stock certificates, the New York Stock Exchange will stay open, and the banks will print out occasional dividends, we can have the whole Game even though all the steel plants and warehouses and railroads have mysteriously disappeared, as long as no one knows they have disappeared.

The random-walk people are taking to their computers for more complex proof of their thesis, and they are going to have a big influence. The Technicians are also taking to their computers, and they are running samples and filters and runs not only of price changes but of advances and declines, moving averages, upticks and downticks, and any other serial relationship they can think of. People program computers; the computers do not reason by themselves. So the same computers will come up with varying proofs. The first challenge in mathematical language to the random walkers was in Robert Levy’s Relative Strength Concept; an answer, in the same language, is probably simmering somewhere even now.

The influence of the random walkers must by definition be good because it will make everyone test results and performance instead of accepting myth and generalities. Meanwhile—not that it means anything—there are few rich random walkers, and few rich Chartists. But there are some quite successful investors around who have no particular system. Perhaps they are the lucky holders of serial runs, perhaps they are more rational or have better access to information, and perhaps—something not taken into account in the austere statistical worlds—they are better students of psychology.

Random walkers do not unanimously insist that the market is a random walk. It is not a random walk, some of them admit, only because the market strays from the “perfect” or the “efficient”; in short, there are people in it. “My model,” says Professor Cootner, “is perfectly compatible with much of what I interpret Wall Street chart reading to be all about. Like the Indian folk doctors who discovered tranquilizers, the Wall Street witch doctors, without benefit of the scientific method, have produced something with their magic, even if they can’t tell you what it is or how it works.” Professor Alexander concludes a paper with this statement: “In speculative markets price changes appear to follow a random walk over time, but a move, once initiated, tends to persist.”

You could make a chart out of a move tending to persist. (“The statisticians’ findings of a random walk over the time dimension is quite consistent with nonrandom trends in the move dimension,” says Professor Alexander.)

To be honest, you must apply the biases recited in the Confessions of Bias in this book to both charts and the random walk. Charts we have only glimpsed, and technical work can cover factors other than price changes (volume, advances and declines, and so on), which charts demonstrate most readily. The bias confessed in the love for those happily compounding earnings comes under the old Fundamentalist concept called The Discounted Present Value of Future Earnings, only one step removed from classic Fundamentalism, The Present Value of Future Dividends. Admittedly, there is the idea of Intrinsic Value woven into these accelerating earnings, but it can all be played as a Game even if there is Intrinsic Value there. And if the market is a Game, then the statisticians’ destruction of charting may not be as important as it sounds. Enough Chartists acting together become a market force themselves. Perhaps the Chartists simply belong to the irrational, as yet unmeasured, Australopithecus side of the market.

There is still one other bias extant toward the academics, which should be recorded, and that is the lecture in the language which the listener does not speak, i.e., quadratic equations. “There is a special paradox in the relationship between mathematics and investment attitudes on common stocks,” wrote Benjamin Graham, the dean of all security analysts, in The Intelligent Investor:

Mathematics is ordinarily considered as producing precise and dependable results; but in the stock market the more elaborate and abstruse the mathematics the more uncertain and speculative are the conclusions we draw therefrom. In 44 years of Wall Street experience and study I have never seen dependable calculations made about common stock values, or related investment policies, that went beyond simple arithmetic or the most elementary algebra. Whenever calculus is brought in, or higher algebra, you could take it as a warning signal that the operator was trying to substitute theory for experience.

As you would expect from my own confession of bias, I find it hard not to agree with the dean of analysts. I suspect that even if the random walkers announced a perfect mathematic proof of randomness, I would go on believing that in the long run future earnings influence present value, and that in the short run the dominant factor is the elusive Australopithecus, the temper of the crowd.

CAN INTUITION BE PROGRAMED?

In 1881 G. W. Carleton & Company published How to Win in Wall Street by a Successful Operator. The Successful Operator’s adventures in the Erie and in streetcar companies need not concern us. There is the ring of authenticity about Successful Operator’s story, but Successful as he was, Operator was far outdone by the great trader Keane. After he spent some time watching the great Keane in his brilliant maneuvers, Successful Operator approached Keane and asked if he had any rules about buying or selling. “Sir,” said the great Keane, “I do not. I buy or sell much as a woman would, by intuition.”

Intuition is still with us, even though it cannot be programed into a computer. Almost everything else can be programed, and my friend Albert the chartmeister is one of the leading computer handlers. Albert had never heard of a random walk until I told him about it, so you see a computer can be used on both sides.

Albert called me one day, excited as a nine-year-old boy who has just been given a 320 cc Black Madonna Beauty Queen cycle, just like the Hell’s Angels ride. “Come and see the new computer,” he said.

Albert is what the downtown folks call a Technician. Technicians believe the only thing you have to know about the market is supply and demand; never mind earnings, dividends, business outlook—that is all for the Fundamentalists. Supply and demand show up in price and volume and other statistics which the Technicians marshal onto pieces of paper, the charts. Just as the natural enemy of the baboon is the leopard, the Technicians have a natural enemy—not the Fundamentalists, who can always be tolerated, but the Anti-Technicians, the random walkers we have just met. But as you know, no random-walk theoretician has managed to write a complete paper in English yet, and most Wall Streeters cannot read those little Greek symbols lying on their sides inside the square-root symbols.

Anyway, Albert was so excited that I zipped over to see the new computer. Albert works for an Institution, a large fund of hungry money. When Albert first went to work there, he sat in a little cubbyhole drawing his charts and nobody paid much attention. I knew the Institution was paying more attention to Albert when they gave him a whole room. The Policy People who make the dignified noises at the top of the Institution still pay little attention to Albert, but now Albert’s War Room, as it is called, is becoming a popular place for the salesmen and the analysts to drop in with their mid-morning coffee.

I have been to Albert’s War Room before, and it always reminds me of a battalion headquarters. There are charts all over the walls, and there are charts on stands in the middle of the room. You expect a light colonel to come out with a pointer and say, “Gentlemen, Intelligence says Charlie is here [tap tap] in Zone E, so we will mount a helicopter assault here [tap tap], and cut him off before he gets to the Laotian border. Ginsberg, O’Reilly, and Alberghetti will take their companies here …” and so on.

Usually when I want to find out what the Technicians think of the market I go over and Albert walks me through the whole market. “Here we see,” he says, as we walk, “that the odd-lotters are still selling. Good. And here we see they are still selling short. Good. Now, on the south wall, the two-hundred-day and twenty-one-day moving averages, we see line A is still above line B. Good. Now”—and we stroll along, like art collectors in a gallery, walking by the portrait of the advance-decline ratios, and the portrait of Lowry’s differentials, and all the other portraits in Albert’s gallery.

Albert is one man I know who is really happy in his work. I think when he was a small boy he classified and half memorized all the batting averages in both major leagues, and then rated them against errors and putouts and what have you. When he got out of business school—not The Business School, which is Harvard—he was working as an accountant, not chartered yet, at a ball-bearing factory. A vice-president of the ball-bearing company was playing the commodity market and kept charts, and pretty soon Albert was keeping the commodity charts. The vice-president did so well that he got Albert off to one side in the plant and Albert studied charting on his own. For a year he read everything that had been published and he experimented with every kind of chart. Charting is still a kind of eighteenth-century science, all empirical, and it isn’t really taught. It is learned by apprenticeship and trial and error. Albert was the first man at the plant in the morning and the last to leave at night, and he was happy, and the vice-president was happy, and the commodity broker was happy.

Meanwhile, the ball-bearing sales were going to hell, as you would expect when the vice-president is worrying about May Wheat and October Mercury; but by the time they booted the vice-president—and Albert in the process—Albert had a pretty good grip on his charts. The vice-president had made so much money that he bought a thousand-acre lime grove in Florida. He shook Albert’s hand warmly and wished him well, and Albert went out to look for a job as a Chartist, having found his life’s work.

Anyway, Albert’s Institution is still not really among the most technically oriented, because the top-level people aren’t. But there is an Underground of younger people, analysts and what have you, and Albert’s reputation as a chartmeister is such that they always check in with him. And, of course, Albert is now plotting his new computer statistics on charts.

There were two analysts in with him when I arrived. One was looking at a chart with Albert and the other one was pacing back and forth in front of Lowry’s differential, waiting his turn.

“I have just been to see this company,” says the analyst, “and the profit margins are expanding, sales will be up twenty percent.…”

Albert holds up his hand. “Don’t tell me these things,” he says. “I don’t want to know them.” Albert stares intently at the chart, the analyst waiting with bated breath for the wizard to make something out of the eye of newt and toe of frog.

“Is that a head and shoulders?” asks the analyst, nervously pointing to a formation on the chart. Albert looks at him contemptuously. Albert is very nice and very modest, but it annoys him when laymen attempt to breathe life into a chart. It isn’t the chart, it’s the man who reads the chart, Albert says, and I have to believe it, since if you take two Chartists and show them the same chart they will give-you opposite opinions half the time.

“It’s got another leg to go,” Albert says finally, “maybe seventeen, eighteen points.”

“But when the earnings come out …” protests the analyst.

“Discounted,” says Albert, and the next analyst is stepping up. This analyst has found a real mid-sixties company called Alphanumeric with a new printing device. Profits are some way away but the stock has gone from 7 to 200. Consequently the Alphanumeric chart is one inch long at the bottom and then goes straight up for three feet. In fact, they have had to glue two more pieces of chart paper together to let it go straight up for three feet. The analyst is very optimistic but he wants to know the risks. He points to a little area around 170 on the chart and wants to know if Albert thinks buying will come in there if the stock goes down.

“No,” Albert says. Albert does not waste words.

“Where would you say there is solid support?” asks the analyst.

Albert points to the one-inch line at the bottom. “I’d say at seven, but you never can tell,” he says, because he is not really taking the Alphanumeric seriously. It is way out there in the blue, on its own, and practically unchartable. Now visiting hours are over and the patients leave, and I have the chartmeister to myself.

“Look,” Albert says. On a table in the middle of the War Room is something that looks like a television set. This is the display device. In front of the display device are keys, like typewriter or calculator keys.

I can’t see what all the fuss is about. Albert and computers are not strangers to each other; he has been using one in a time-sharing program before, and I have sat with him while he circles in red little numbers on the green-and-white computer print-out sheet.

“On line, real time,” Albert says. On line is just what it sounds like, the information is all there on the same system. Real time is practically instantaneous. This means the system works like one of those airline computers which scans all the seats on all the planes and tells you if there is a seat on flight number 1 on Christmas Eve. Maybe the analogy is not right, and I think even Albert was wrong, and in order for this computer to know what is going on, the trade actually has to happen and be printed and recorded. Anyway, let’s just say this is a smart young computer; Albert worked on the program himself. Albert seats himself at the keyboard like Van Cliburn or Glenn Gould—more like Glenn Gould, wrists at the ready, shirt cuffs out.

“Momentum by groups!” Albert cries, and goes tappety-tappety-tap. The display device lights up.

1 AIRLINES

2 ELECTRONICS

3 AEROSPACE

says the computer. This is what is moving. Motion is what the random-walk people deny.

“Which airlines?” I ask. Albert goes tappety-tappety-tap.

TRUNKLINES

says the smart computer.

“Thanks a lot,” I say. “I could have figured that myself.”

“Airlines, trunklines, weighted,” Albert says, tappety-tappety-tap.

1 EAL

2 TWA

3 NWA

The computer says Eastern is moving well.

“Now watch,” Albert says. “Eastern relative to the group. Eastern relative to the market.”

EAL

1 :4 17 :5 4 × 1 × 3

“It just lost me,” I say. “What are those other numbers?”

“That’s my own system,” Albert says. “These are parameters. Don’t worry about it.”

Just my luck. I don’t know anything about computers, and when I am around them all they say is stupid things like 01001100100101101.

“Now here is Eastern, relative to previous days and weeks, weighted on a current basis,” Albert says, and tappety-tappety-tap, the screen lights up with

EAL

99 :97

3 × 4 × 1

“More buyers than sellers at the moment,” Albert says.

I lean over and press the symbol of another airline, and then the same keys Albert has pressed.

ERROR

“This machine is a one-man dog,” I said. “It’s no use unless you personally are sitting at it. It knows its master’s hands.”

Albert grins. We sit there for another quarter of an hour, playing tappety-tappety-tap. You can see the final fulfillment of a boyhood dream, all the batting averages of all the players, ranked by height of player, weight of player, number of years in the majors, whether he does better against right- or left-handed pitchers, whether he does better to right or left field, on cloudy days or on clear days.

“I can see that this gizmo processes a great deal of information,” I say. “But on any given day, the whole thing could turn around.”

“The whole thing could,” Albert says, “but the mix of odds would show up.”

“Great,” say I. “Now all you have to tell me is why, with all the sophisticated tools, the Chartists were bullish in July and bearish in September at the bottom.”

“Somebody has to make the first move,” Albert says. “Not us.”

“The new toy is pretty, but it doesn’t do anything you weren’t really already doing,” I say. “I grant you, you can scan more stocks faster. You can rank everything that happened up to an hour ago. But it’s the same game: What Is Everybody Else Doing?”

Albert grins. “That’s the name of the game,” he says. He jerks his thumb skyward. “They are impressed,” he says. They are the people up on the floor where everybody has carpeting, where the policies are made.

Now suddenly I see what the whole game is about. To anyone who has grown up under the Stern Calvinist Dictum of the Prudent Man, securities are Quality or Not, and Quality means in business a long time, and generally big. To these people, the Chartist was an odd little fellow with carbon on his fingers, sitting on a three-legged stool at a drawing board. But now he is a Technician with a Computer, and here is mystery indeed, for who will thumb his nose at the Computer? Does it not calculate the payroll ever so fast? So I see why Albert is so happy. It isn’t just a bright new toy, although there is a lot of fun in that, especially when you make a simulated stock market and play with the model. What makes Albert happy is a new status. The computer is going to sanctify charting. The Chartists are on their way.

Of course, we have had Chartists for years, and there are very few rich Chartists, so there is no need to be terrified. In the end, a pair of human eyes has to read the numbers, and the brain behind them will either be smart or not, and that spectrum will be no different. Meanwhile, let us be happy for Albert.

You do see the possibilities. All we have to do to make money in the market is to find out what the Computer-sanctified Charts would like to do. There is already a crude version of this afoot, not so different from some of the beautiful pictures painted on the tape in the 1920s, when there were some very artistic tape-painters around.

The crude version I will call Fourth and One, Let’s Go for It. This means the stock is on its own forty-five-yard line, fourth and one to go, and it has been moving well. If it crosses the Upside Breakout line on the charts, it gets a first and ten. Let us say, for laughs, that we have Brunswick at 12.

We are sitting at our computer, and all the Theys are sitting at theirs. The name of the game is: What Is Everybody Else Doing? The computer has shortened the time span and improved communication. The telephone need not be used at all. Everyone can see immediately that if Brunswick crosses 12½, Upside Breakout on all the published charts, it gets a first and ten.

You can almost hear the crowd begin to roar. There is a feeling in the air, Fourth and One, Let’s Go for It. The ball is snapped: 12, 12⅛, 12¼, 12½, 12⅝! First and ten! No need even to bring out the measuring chains. No need to worry about a sudden retreat back to 7. The old Breakout line is now a defense line, a little consolidation, a quiet off-tackle play, and we are ready for the Bomb, the crowd-winning touchdown pass.

I can see where this is all going to lead. Somebody will not be content with a good thing. Here we are with a very comfortable maxim, a stock is going up as long as it’s going up, a very serene way to be in the market. And since we are all watching each other, it is very comfy. This is called a Trend. And if we all stay with the Trend, then we have only to worry about how we will all get out when the Trend reverses, but maybe we can get the public enlisted for that.

But one night a maintenance man is going to walk into Albert’s office. I visualize him wearing a cap like Railroad Bill, and carrying an oil can with a long spout. In his pockets are screwdrivers and little wrenches and what have you, so nobody questions him if they run across him. They assume he is there to stop the fluorescent light from flickering in the hallway. Railroad Bill looks around, and steps quickly into Albert’s War Room.

Aha, you are ahead of me: You know he is not Railroad Bill at all. Anyway, he goes up to the computer. A few quick turns of a screwdriver and some panels come out. From an inside pocket appear some odd swatches of tape. Railroad Bill works swiftly as a safe-cracker. A few more taps, the pocket flashlight goes off. Footsteps in the hallway. Railroad Bill steals out, then strokes his chin, looking at the flickering light.

The next morning Albert comes to work. He confers with an analyst; they hold up a chart, like surgeons looking at an x-ray. Then Albert sits down to play, the cuffs shoot out, the first crashing chords of the cadenza echo forth.

“Greatest momentum of all stocks,” Albert asks this current-day Jeep. (Everyone has forgotten that before the Jeep was a car it was a little animal that could only tell the truth.) And the latter-day Jeep lights up and says:

MURGATROYD BONBON

“Murgatroyd Bonbon?” questions Albert. “Never heard of it.”

The analysts race for their manuals. There it is, a tiny little company that would interest no one.

“Oh, well,” Albert will say. “A fluke.” Then Albert will ask for the leader in percentage strength.

MURGATROYD BONBON

The crowd around Albert is growing. “Ask it the resistance level,” cry the voices. “Ask it how far it can go.” The crowd senses history, fortune in the making.

Tappety-tappety-tap, goes Albert, asking what stock of all stocks is going to go up most.

MURGATROYD BONBON

“I’d say we have to buy a little, just on the technical action,” one wise man will say. And a progressive, forward-looking fund manager will take a little plunge, just enough to get his toes wet.

Meanwhile, in a small furnished room on the other side of town, Railroad Bill will be waiting for nightfall, polishing his tools, checking his list.

And that night, and that night …