20. IF ALL THE HALF DOLLARS HAVE DISAPPEARED, IS SOMETHING SINISTER GAINING ON US?

Very articulate and intelligent fellow, the Gnome of Zurich. I keep up with him from time to time. Since the conversation with the Gnome which you have just read, there have been a couple of developments. The nations of the world have gotten together and drawn up a blueprint for a kind of international currency through the International Monetary Fund. If all the congresses and parliaments ratify it, there will be special drawing rights for each country, in proportion to the deposits each country has made in this quasi-international bank. It is encouraging to see nations acting together, because together they are bigger than the speculators, or the businessmen hedging against currency problems.

But the special drawing rights are only a device which gives more time to solve the problems. The problems are still there, still unsolved. The real international currency, the dollar, still has a balance-of-payments deficit. The crisis is deepening. The devaluation of the pound late in 1967 set off some new and darker chapters. We may, if our affairs are really handled ineptly, get to the point where no American will be able to leave this country with more than $100.

Beyond this, the problem is universal. It is that governments are now held responsible for the welfare of the people. The aspirations of the people can outrun their ability to pay for them, and nobody has yet found a way to create answers to the aspirations out of thin air. What this means is that if governments have a choice between attempting full employment and defending their currencies, they will nearly always pick jobs over the worth of the currency. Currencies do not vote. In this country, the Full Employment Act of 1946 spells this out. The government is committed to full employment, and if it must pump money into the economy to achieve this, and if there isn’t enough money, it creates the money. Long-range inflation is the policy, articulated or not, of every country in the world.

The aspirations of the people are a noble thing and no one is against jobs. But it does seem easy to produce them with currency rather than productivity. Central governments soon learn the utility of a deficit. It is convenient to take the views of the economists who followed Keynes and spend money during recessions. There are even problems on that side of the equation, because even with the breadth of statistical reporting and with computer speed, this kind of economics is still inexact, and the central government can find itself pressing the wrong lever at the wrong time.

It is less convenient to put some of the grain in the silo during the fat years. You can always think of something else to do with it, to take the convenient part of Keynes without the inconvenient part. This country has been particularly inventive, based on a feeling of omnipotence and omnicompetence. (“Times of great crusades,” says the Boston Mister Johnson, “are not times of very great reality.”)

What has this to do with markets? Markets are only a tiny facet of society, but being made by mass psychology, they are a good litmus paper for what is going on. Markets only work when they believe, and this confidence is based on the idea that men can manage their affairs rationally. The longest period of prosperity in the last few hundred years came when everyone believed that the king was on the throne, that the pound was worth a pound, that God was in His Heaven, and that all these things would continue for ever and ever.

In the short run, long-range inflation must work for any kind of equity: stocks, land, antiques, real estate, works of art, and so on. If you have a $100 bond and you are getting 5 percent interest, but when the time comes to pay the principal your $100 is only worth $87, you are going to look for something else. If there is $600 billion in bonds out and $100 billion of it moves to the equity side, into stocks, the $600 billion of stocks is going to move as the incremental $100 billion swings. But as it does, capital becomes harder to raise, interest rates go up, some businesses do much worse, and some money moves back into the higher interest rates of the shorter-term bonds, and this rhythm goes on, minor eddies within the tides.

In the longer run, the actions of all the investors, individual and institutional, professional and nonprofessional, have to be based on the belief that leadership knows what it is doing and that rational men are handling the nation’s business rationally. If that belief fades, then so do the markets. They do not merely dive, they dive and then they disappear. It happened here in the blight of the spirit from 1930 to 1933, and it has happened in other countries.

Can it all come tumbling down? In a paper market, based on belief, this fear is universal, no matter how deep it is buried. Sure, it can all come tumbling down. All it takes is for belief to go away. Fear is no help to functioning in the marketplace, as some of the senior generation can tell you, so it doesn’t do to walk around with it every day. Most of the investment world, blazing its way through the trees, has little idea of the forest.

We all live by a thread anyway, so it may make no more sense to worry about financial H-bombs than plutonium ones.

There are those who look for Signs, and one such Sign, among those looking, was silver. I happened to be among those looking, and here is an anecdote which now seems longer ago than it was. The first stage of the Crisis has already happened. Silver came unpegged from the $1.29 price where it was carefully glued, and we are all still here. But there is more to come. Hear the story first.

Would you believe that some of the dollar bills in your wallet are worth more than the others, and the same with the fives? Well, would you believe the reason you haven’t seen a silver dollar or a half dollar in a long time is that somebody has collected them all and is waiting to melt them down? More important, do those dollar bills that could be worth maybe two dollars, and those half dollars that aren’t here any more, give you the feeling Satchel Paige warned against in his rules for survival when he said, “Never look behind you, somethin’ might be gainin’ on you”? Is it a sign that the Whirlwind, the Catastrophe, is that much closer? There are analysts who say simply that silver is going up, like a lot of things are going up, and then there are Prophets, who read in this event the portent that something wicked this way comes, something as wicked as 1929, the Dow-Jones average in smoldering ruins, apples on the street corners, soup kitchens.

The particular Prophet who scared me into walking over to the Fed clutching a handful of dollar bills is called James Dines. By trade Mr. Dines is a Chartist, and you know all about them. Preceding Mr. Dines’ weekly charts is a kind of commentary with a tone very close to that of the Prophets of Israel. The Prophets of Israel, as you recall, were always displeased by the cavorting they saw before them. Always were the princes and the people straying from the path and the way, and woe, said the Prophets, the indignation of the Lord shall be visited upon you. Then in would march the Assyrians or the Scythians, and as they put everything to the torch, the Prophet, from his place upon the wall of the city, would say lo, woe, the indignation of the Lord is visited upon us.

Mr. Dines has taken himself a place on the wall of the city slightly to the right of Nahum the Elkohite. He is so pessimistic he must make up adverbs—“unmeechingly”—to describe his pessimism.

What is the date of the Catastrophe? asks Mr. Dines, and let there be no doubt that the Catastrophe lies before us. In a Catastrophe, there is wailing in the streets and lamentation upon the highways; the chariots are burned up in smoke; the bank rate goes to 7 percent or even 8 percent; the Dow-Jones average crumbles to dust; we have such trouble as has not been seen in a generation and more. Why must there be such a Catastrophe? Folly, sir, the folly of the people and their government, giving away the gold and silver, the denseness and irresponsibility of politicians, monetary problems. Never in 5,000 years has there been a government that could resist debasing its currency. And thus: Exchange your paper money for silver coins, silver certificate dollar bills, gold and silver stocks. Then wait for the collapse and the new phoenix will take shape.

Every week Mr. Dines tolls the exiting gold and the disappearing silver, the approaching doom of the pound and then of the dollar, the folly of the governments. Gold and silver are immutable and will survive, and their disappearance is a sign that the prudent people are collecting them, stashing them away against the Day of Wrath. There is even some discussion between Mr. Dines and his readers as to where the Millerite pilgrims and their money might go. South Africa is mentioned as the Land of Canaan, plenty of gold beyond the sea.

Now the price of gold is a long and complicated question, but practically everybody is agreed that silver is going up. Not so long ago some mining people came to the sage and august New York Society of Security Analysts and the only questions seemed to be when and by how much, and nobody saw it as any more a sign of the Whirlwind than copper or aluminum going up. The difference is that if silver goes up, all the old coins of the United States and some of the dollar bills in your pocket become worth more than their face value. Nobody knows what the psychological effect of this will be. Perhaps none. Perhaps—if the tolling of the Prophets gets to you—the distrust of the people toward the government increases, and the silver and gold go under the mattress, and the stock market goes into a cave to wait for spring.

One day when the market was making like those Messerschmitts in Twelve O’Clock High, spiraling down and belching black smoke all the way, the words of the Prophet got to me, and I canvassed the gunslingers’ table at Oscar’s for the dollar bills that say “Silver Certificate” on them. There weren’t very many. Most ones and fives say “Federal Reserve Note” on them. There are $440 million that say “This Certifies That There Is on Deposit in the Treasury of the United States of America One Dollar [or Five Dollars] in Silver Payable to the Bearer on Demand,” so you’d think they’d turn up more often, but they don’t. With nineteen one-dollar bills I marched to the fortress—like the Federal Reserve Bank of New York. Everybody talks about the Fed, but who ever goes there? There I am, nineteen dollars in hand, saying Pay the Bearer in Silver on Demand, footsteps echoing in the money cathedral. I tell the guard I am the Bearer, ready to Demand. I want to see if the government of the United States means what it says on the dollar bills. The guard motions me downstairs.

Why shouldn’t the government Pay the Bearer on Demand? One day it won’t, because it won’t have the silver, so say the Prophets. Every year the world consumes 100 to 200 million ounces of silver more than it mines; photography, photocopying, electronics—Eastman Kodak alone uses up more than comes out of the mines. Normally with free market play the price would rise to the point of equilibrium for supply and demand. But the price of silver is maintained at an artificial price by the U.S. Treasury, which will sell its silver to all comers at $1.29 an ounce. The Treasury is feverishly minting those red-edged things for coins because if the price of silver goes over $1.38 the silver content is worth more than the face value and theoretically there aren’t any coins left; they have all gone into the neighborhood smelters; everybody will be throwing their quarters in the oven and rushing to Eastman Kodak with the lump. The Treasury still has 620 million ounces of silver, but 440 million are for the dollar bills and 165 million are for the strategic stockpile, so the mints are white-hot grinding out the nonsilver coins. At some point, the Treasury has to stop selling silver. It takes the lid off. Zap! The coinage of the United States, 1.85 billion ounces, goes into the vat, or up on the wall with a frame around it. Already you can get fifty-three cents for a half dollar, maybe more.

So I find myself standing before a window, and to my left is a cage. I can see bales of silver certificates there behind the wire. The man in front of me opens his bag, marked The Bank of Tokyo, and the clerk counts out something like $100,000 in tens. Then I step up, with my speech about the Bearer, and I say I would like nineteen silver dollars for my nineteen paper ones that say there is silver in the treasury behind them. The clerk laughs feverishly. I figured he would, because the Gov’mint is keeping the few silver dollars it has left, but I want to get my silver anyway. The clerk sends me to the Federal Assay Office on Old South Street. First I ask him what happens to all those silver certificates in the bale. We burn ’em, he says.

The Federal Assay Office is a white desert outpost, Fort Zinderneuf, on the river hard by the fish market and parking lots and pizzerias, in the very shadow of Wall Street. I explain my mission to the two guards at the door. I am the Bearer and I Demand. They look at each other: Another one of the nuts. Up to the big window, where the clerk spreads out the nineteen one-dollar bills. This time there is no nonsense. There is a big bag of white sand and scale that says: Maximum Weight 300,000 Ounces.

“Nineteen bucks,” says the clerk, “gets you just short of fifteen Troy ounces. Pure silver.”

“That’s the stuff, huh,” I say. White sand!

“That’s the stuff,” the clerk says, measuring it out like it was hamburger. “One or two of you birds in every day, don’t know what you do with it.” Classic Irony: Those closest to the Eye of the Whirlwind do not feel it. The clerk is measuring out the silver, 100 percent pure, none of your sterling, sterling is only 92.5 percent, and he is pouring it into—wait a minute—a plastic bag.

“Just a minute,” I say. “The United States Government redeems its currency in Baggies?”

“Whatsamatter with a Baggie?” says the clerk.

“If you’re going to give me this dust, at least give me a bag with an eagle on the side,” I suggest.

“They say we have to give you the silver. They don’t say we have to give you a bag,” the clerk says.

Well, for a while it is okay, walking around Wall Street with a Baggie full of silver, explaining the wisdom of getting silver at $1.29 an ounce when sometime it is going to $1.50 or $2.50 or $3. But there is no action in a Baggie full of silver. We know of our need for action because Our Lord Keynes wrote it in the original illumine. I have gone through the whimsical exercise of getting the silver, but now the dust is just sitting in the Baggie and there are threats it is going to end up in the sandbox. I decide to sell my silver, another whimsical exercise, if you will. The handiest market is Handy & Harmon, the great refining and marketing firm. Every day Handy & Harmon quotes the price of silver. The price is the same every day, $1.293, because that’s where the Treasury is maintaining it. I call Handy & Harmon and am swiftly given to a Mr. Wemple when I explain I am a seller of silver. Mr. Wemple is a director and the treasurer of this vast corporation. Mr. Wemple says he will be delighted to buy my silver. In what form is the silver, bullion?

“It’s in a Baggie,” I say. “United States Government silver, one hundred percent. Buy now, price going up soon.”

Mr. Wemple begins to slow down. “How much silver are we talking about?” he asks.

I tell him just short of fifteen ounces, and Mr. Wemple says, “Fifteen thousand ounces is a bit small for us; usually we like units of fifty thousand ounces; but—” and then I explain, fifteen ounces, in a Baggie. Now Mr. Wemple is beginning to wonder why his secretary let the call go through, but he is a good sport and says Handy & Harmon can’t buy fifteen ounces of silver—the bookkeeping costs would be greater than that—but he’s going to switch me to Mr. Jacobus. Mr. Jacobus is in the Old Silver department and they deal in smaller amounts.

Mr. Jacobus starts giving me the same thing about the bookkeeping costs for fifteen ounces of silver, how much it would cost to cast it, why don’t I save up and get 1,300 ounces of silver, that way I could have it in bar form. And what I want to know is, here I have this metal that is good as money and vice versa, and I could starve to death carrying it around in its Baggie. How do I trade it back for the money? Mr. Jacobus says Handy & Harmon usually pays sixty cents or seventy cents for old silver that people bring in; if I’ll do some other business with him he might give me one dollar an ounce. But one dollar an ounce is a loss of twenty-nine cents an ounce on the whole thing, so naturally I refuse. I warn Mr. Jacobus the Treasury is running out of silver, the price is going up.

“Going up it is, so they say.” Mr. Jacobus is quite cheerful about it. “And in India they don’t have bank accounts; they wear three ounces of silver on each wrist. When the price goes up, off comes the silver. That’s eight hundred million wrists, and I haven’t even started to talk about Mexico.”

I ask Mr. Jacobus if he isn’t worried about all the coins being melted down, and Mr. Jacobus says cheerfully that Handy & Harmon is in business to refine and market silver and the demand for silver goes up every year and he doesn’t think people will even notice when the silver is gone from the coins, except the birds who are going to make a thing of it and bid up each other’s coins. If the Whirlwind is coming, Handy & Harmon will be out there, flying a kite.

So I have a Baggie full of silver and I am waiting for the Day of Wrath, but I have stopped saving silver certificates. When the subway fare was fifteen cents, the authorities warned the public it wouldn’t do them any good to stock up on tokens; they would change the tokens if the fare went up. The fare went up and they didn’t change the tokens. Sometime the price will go up again but nobody is squirreling away tokens. The warnings about smoking go on and there are more smokers every year. The gold is exiting and the silver is disappearing, but even if the Prophets are right, it is just too much trouble to heed them, and in the end, well, Amos was banished, Jeremiah jailed, and Isaiah was sawn asunder.

I still have the Baggie full of silver. The Prophets, as you know, were right. They were right, and they were not quite right. One evening in spring, after the close of the market, the Treasury announced that it would only sell silver to qualified buyers and that no more could be exported. The next day there was such a scramble that you couldn’t buy silver anywhere; silver futures went up the limit in about ten seconds and were shut down for the day.

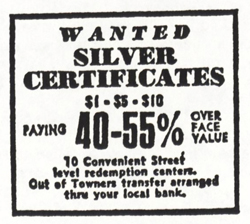

Within the next week, silver went from $1.29 to $1.50 and then to $1.75, and finally the Treasury announced it would sell all its remaining silver at auction and ads in the paper appeared like this one:

So the entire silver coinage of the United States is headed for the vat, the collector, or the museum. You don’t find silver certificates among your dollar bills any more, the silver dollars and silver half dollars are all gone, and the quarters are going. They have been replaced by nonsilver coins, and nobody seems to mind much. The Prophets were right about the price of silver, but not quite right about the reaction to it. It is only a Sign if you believe the same thing will happen to gold, and then the Catastrophe will be upon us only if the rocketing price of gold upsets everyone so much that they stop believing. The folly of governments can produce a rise in gold, and that can produce Catastrophe if the folly becomes more real than the trust in governments. If everyone continues to believe, then gold and silver can go where they will, and it will be no more significant than copper and aluminum following supply and demand, except that speculators will make money on the moves. If belief fades, it is not even necessary for gold to go up—or down.

The cause of belief isn’t helped when the United States Treasury says one thing and does another, or when it says the price of silver will hold for twenty years at $1.29 and it doesn’t. The price of gold may stay at $35 an ounce forever, but there are more skeptics than there used to be. Even the skeptics, though, hope the believers are right.