It’s a sad truth that many elderly people slip into poverty as they grow older. One of the most important reasons is rising medical costs and the need for increasingly expensive procedures designed to keep them alive. Another factor is that people underestimate how long they’ll live, and they outlive their savings. This situation is particularly difficult for people who took early Social Security benefits, thus permanently reducing the size of those benefits. They often discover that it is difficult to subsist on a small sum from Social Security with no other streams of income.

The two best ways to avoid falling into this trap are, first, to increase your savings, which will provide another source of retirement income, and, second, to increase the size of your benefits. To do either or both of these may involve some sacrifice now. You’re putting money away for the future, not spending it now on stuff you want. You will have to decide that a secure future is worth a frugal present, and then take steps to make that future a reality.

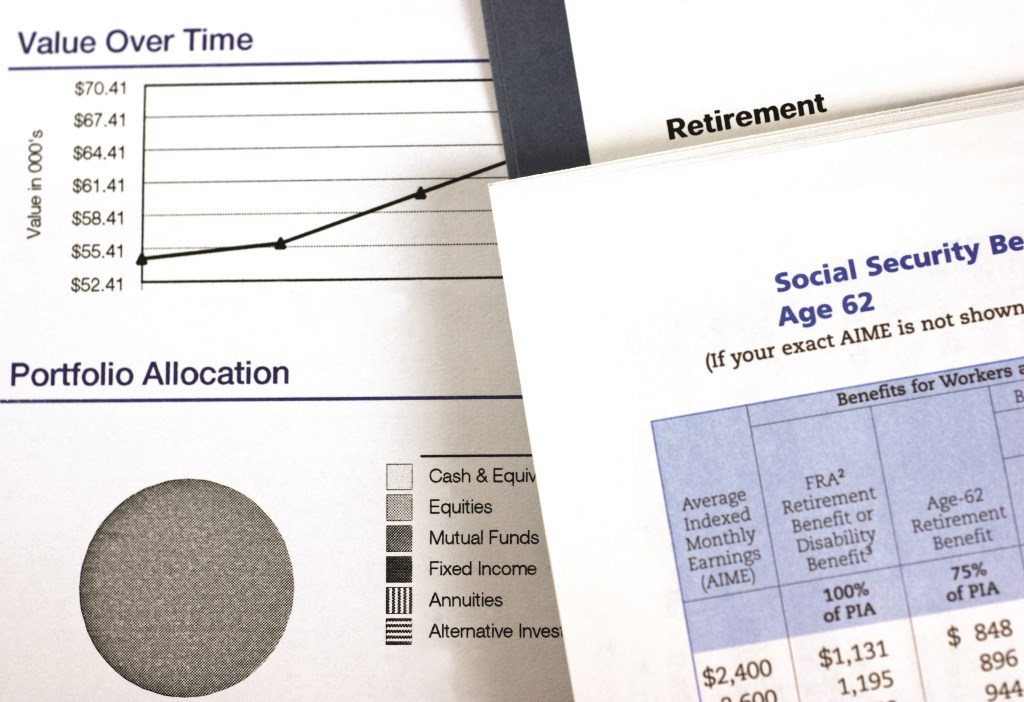

The difference in taking your benefits at full retirement age and taking them at age seventy may be striking. For each year you work past your full retirement age, the government gives you a credit worth 8 percent of your benefit. In other words, if your retirement age is sixty-seven and you work three years past it to age seventy, your benefit grows by 24 percent.

One of the most common tools to determine whether or not you should take benefits early or wait it out is called a break-even analysis.

As said earlier, a lot of factors go into determining life expectancy. One of these factors has to do with how the life expectancy tables themselves are calculated. The basic calculation of life expectancy averages a cross-sample of males and females. This includes people who die when they’re very young as well as very old. If you’re a man, your expected lifespan is seventy-five. But if you live to be sixty-two, your life expectancy increases to eighty-two. For women who live to sixty-two, life expectancy increases from eighty-one to eighty-five.

Essentially, a break-even analysis tells you how long you need to take benefits to receive the monetary value you’d get if you took them earlier or later. Keep in mind the way benefits work: If you claim them before reaching your full retirement age, you get more checks, but they’re smaller. If you claim at or after your full retirement age, there are fewer checks, but they’re bigger.

Let’s look at an example. Mark, who has just turned sixty-two, decides to claim his benefit of $750 per month. Linda, who is the same age, determines that she’ll wait until her full retirement age of sixty-six, at which point her benefit will be $1,000. Neal, also turning sixty-two, decides to wait to claim until he turns seventy, when he’ll claim $1,320 per month. The following table shows the cumulative amount of money they’ve received from Social Security.

| Break-Even Analysis for Mark, Linda, and Neal (Annual Benefits) | |||

|---|---|---|---|

| Age | Mark | Linda | Neal |

62 | $9,000 | $0 | $0 |

63 | $18,000 | $0 | $0 |

64 | $27,000 | $0 | $0 |

65 | $36,000 | $0 | $0 |

66 | $45,000 | $12,000 | $0 |

67 | $54,000 | $24,000 | $0 |

68 | $63,000 | $36,000 | $0 |

69 | $72,000 | $48,000 | $0 |

70 | $81,000 | $60,000 | $15,840 |

71 | $90,000 | $72,000 | $31,680 |

72 | $99,000 | $84,000 | $47,520 |

73 | $108,000 | $96,000 | $63,360 |

74 | $117,000 | $108,000 | $79,200 |

75 | $126,000 | $120,000 | $95,040 |

76 | $135,000 | $132,000 | $110,880 |

77 | $144,000 | $144,000 | $126,720 |

78 | $153,000 | $156,000 | $142,560 |

79 | $162,000 | $168,000 | $158,400 |

80 | $171,000 | $180,000 | $174,240 |

81 | $180,000 | $192,000 | $190,080 |

82 | $189,000 | $204,000 | $205,920 |

Notice that even though Mark got money in years when Linda and Neal didn’t, their totals caught up to his and surpassed it. In Neal’s case, this happened quite quickly—by age eighty, after he’d been taking benefits for ten years. So Neal’s and Mark’s break-even point is eighty, while Linda’s and Mark’s is seventy-seven. Neal’s and Linda’s is eighty-two. Another way of putting this is that for Mark to justify his decision to collect benefits before waiting until his retirement age, he’ll have to live until at least age seventy-seven. Linda, to justify her decision not to wait until age seventy as Neal did, will have to live to age eighty-two.

“Social Security is based on a principle. It’s based on the principle that you care about other people. You care whether the widow across town, a disabled widow, is going to be able to have food to eat.”

—Noam Chomsky, American linguist

However, it’s worth noting that the Social Security Administration no longer uses break-even analyses when it advises people on benefits. The reason is that the analysis leaves out too much: What about the health, habits, and family histories of each individual? What about their stress levels? What about the physical environments in which they work? (Someone who works in a building that contains asbestos fibers isn’t likely to have a long life expectancy, no matter what the family history!)

The amount of your monthly benefit increases over time provided to delay taking Social Security until at least when you reach your full retirement age.

© iStockphoto.com/Laura Young

We come back to the point made earlier. Unless there’s a specific reason to do so, it’s best not to take your benefits earlier than your full retirement age. In fact, it’s generally best to wait until age seventy before taking them.

Consider the preceding example that compares Mark, Linda, and Neal. By the time they reach age eighty-five, Mark’s total has reached $216,000, Linda’s $240,000, and Neal’s has totaled a whopping $253,440. That’s more than $37,000 more than Mark. And that amount increases exponentially as the years advance. By age ninety, Mark’s accumulated Social Security benefits amount to $261,000 but Neal by that time has benefits of $332,640. Now he’s more than $71,600 ahead of Mark.

The system of retirement benefits down under dates to 1992 and is called a Superannuation Guarantee. Unlike most social insurance systems, employees don’t have to contribute to the fund, although they are encouraged to do so. Employers’ contributions amount to 9.5 percent (between 2021 and 2025, this percentage will gradually grow to 12 percent). Funds are divided into three types:

All of this assumes—and this can’t be stressed enough—that you’ve evaluated your probable life expectancy and all the factors that go into it. If there is a reasonable probability of you living until your full retirement age and beyond, it makes eminent sense to delay taking benefits and enjoy the larger sums when they start.