CHAPTER 9

Interest Rate Caps

After studying this chapter you will be able to get a grasp of the following:

- Meaning of interest rate caps

- Interest rate cap—to pay

- Interest rate cap—to receive

- Benefits of interest rate caps

- Risks of a cap instrument

- Accounting for interest rate caps

- Trade life cycle of interest rate caps

- Accounting journal entries to be recorded during the different phases of the trade life cycle

- Illustration of investments in interest rate caps

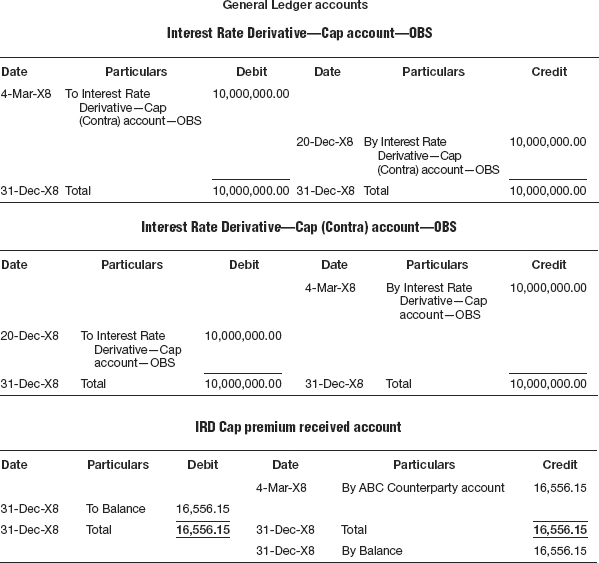

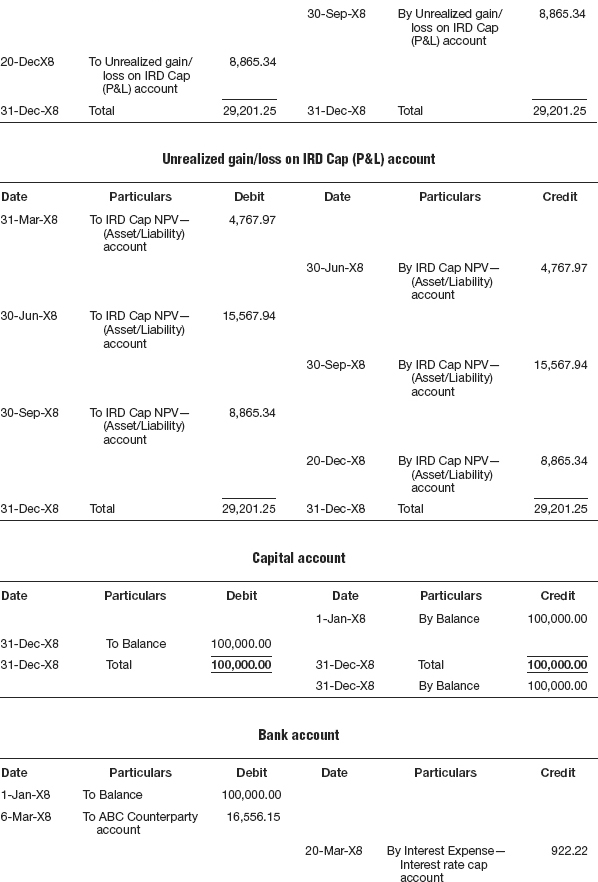

- Preparation of general ledger accounts

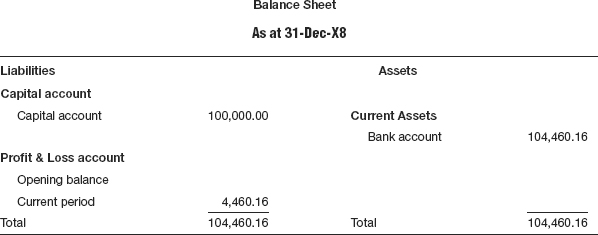

- Preparation of income statement, balance sheet after the investments in interest rate caps are made

- FX revaluation and FX translation process

- Functional currency, foreign currency and presentation currency

INTEREST RATE CAPS—DESCRIPTION OF THE PRODUCT

An interest rate cap is a form of interest rate derivative. It is also an over-the-counter interest rate derivative instrument. An interest rate cap is an interest rate management tool for an entity wanting to cap the interest commitment on its debt. It serves as a protection against increases in interest rates by limiting the maximum interest rate payable on its debt. This maximum interest rate is known as the cap rate or strike rate. In exchange for the protection of the cap instrument, the entity pays a premium. This is paid as a one-off up-front premium. If the reference interest rate rises above the cap rate then to that extent the seller of the contract would compensate the buyer. For example, if the strike rate of a cap contract is, say, 3 percent on a notional amount of say US$10 million, then if the interest rate shoots up to, say, 3.52 percent on the rate reset date, then the buyer of the cap would be compensated by the seller of the cap to the extent of the difference between the reference interest rate and the strike rate for the period starting from the rate reset date to the next interest payment date.

Interest rate cap—to pay

Interest rate caps are of two types—the first type being “to pay.” This means that for receiving an agreed premium, the buyer of this type of instrument agrees to compensate the seller of the instrument on the pay date any interest over and above the cap rate, if the benchmark interest rate is above the cap rate on the reset date. The premium is computed like any other option premium based on some mathematical model that takes into account several factors including the strike rate (cap rate), the present benchmark interest rate, the historical volatility of interest rates, the time period of the contract, among other factors. The premium received is actually a liability that represents the net present value of the contract as on the date of inception of the contract.

Interest rate cap—to receive

The second type of interest rate caps is known as “to receive.” This means that for paying an agreed premium, the seller of this type of instrument agrees to compensate the buyer of the instrument on the pay date any interest over and above the cap rate, if the benchmark interest rate is above the cap rate on the reset date. The premium paid is actually an asset that represents the net present value of the contract as on the date of inception of the contract.

Benefits of an interest rate cap instrument

- Caps provide the entity with protection against unfavorable interest rate movements above the strike rate, while allowing the entity to participate in favorable interest rate movements by paying a small premium.

- Cap contracts are flexible as they are over-the-counter products and are customized to suit the requirements of the parties to the trade. The strike rate can be positioned to reflect the level of protection sought by the buyer or willing to be written by the seller.

- Similarly, the term of the cap is also flexible and can be customized to match the term of the underlying liability to be protected.

- A cap may be used as a form of short-term interest rate protection tool in times of uncertainty.

- The cost is limited to the premium paid and theoretically like any other option contract the upward potential is unlimited.

Risks of a cap instrument

- For the buyer of the cap instrument there are no risks associated with this instrument other than the counter-party risk.

- The premium is not refundable by the seller of the contract and is a sunk cost as in any other option contract, including situations where the reference rate never exceeds the strike rate and no interest payments are ever made under the cap contract.

- If the entity’s premium has been amortized, the full amount of the premium is payable even in the case of early termination.

- The entity purchasing protection in terms of the interest rate cap will be exposed to interest rate movements if the term of the cap is shorter than that of the underlying debt obligation.

- For a seller of the cap instrument, theoretically the potential loss is unlimited as for a small premium; the risk exposure will be huge. The seller has to compensate the buyer for any increase in the reference interest rate over and above the strike cap rate.

Interest rate cap as a hedging instrument

Being a derivative instrument, an interest rate cap per se qualifies as a hedging instrument. It should be noted that in an interest rate cap, the risk reward is asymmetric and can be more or less compared to an equity options position. An interest rate cap instrument can be used to hedge primarily interest rate risk.

It should be noted that the derivative financial instrument of an interest rate cap may be designated as a hedging instrument provided it is with an external party. Intra-group derivatives do not qualify as a hedging instrument in consolidated financial statements, although they may qualify in the separate financial statements of individual entities in the group. A derivative may be designated as a hedging instrument only in its entirety or as a proportion i.e., a percentage of the notional amount.

The to pay interest rate cap is like a written option contract where a premium is received and hence cannot be designated as a hedging instrument. A written option cannot be designated as a hedging instrument because the potential loss on an option that an entity writes could be significantly greater than the potential gain in value of a related hedged item.

The to receive interest rate cap is like a purchased option contract where a premium is paid to get protection from the rising interest rate and as such can be designated as a hedging instrument.

ACCOUNTING FOR INTEREST RATE CAPS

In this chapter we will cover the accounting requirements for investments in interest rate swaps. The list of relevant accounting standards are shown in Table 9.1.

Table 9.1 Relevant accounting standards

| US GAAP Topics | IFRS |

| 220—Comprehensive Income | IFRS 7—Financial Instruments: Disclosure |

| 815—Derivatives and Hedging | IFRS 9—Financial Instruments |

| 820—Fair Value Measurements and Disclosures | IAS 21—The Effects of Changes in Foreign Exchange Rates |

| 825—Financial Instruments | IAS 32—Financial Instruments: Presentation |

| 830—Foreign Currency Matters | IAS 39—Financial Instruments: Recognition and Measurement |

| 946—Financial Services—Investment Companies |

THE TRADE LIFE CYCLE FOR INTEREST RATE CAPS

- Recording the trade—contingent

- Account for the premium on the trade

- Receive or pay the premium for the trade

- Reset the interest rate for the ensuing period

- Account for accrued interest if any on the valuation date

- Reverse the accrued interest if any on the coupon date

- Ascertain and account for the fair value on the valuation date

- Pay or receive interest on the pay date

- Termination of the trade and accounting for termination fee

- Payment or receipt of termination fee

- Maturity of the trade

- Reversal of the contingent entry on maturity/termination

- FX revaluation entries (for foreign currency trades)

- FX translation entries (for foreign currency trades)

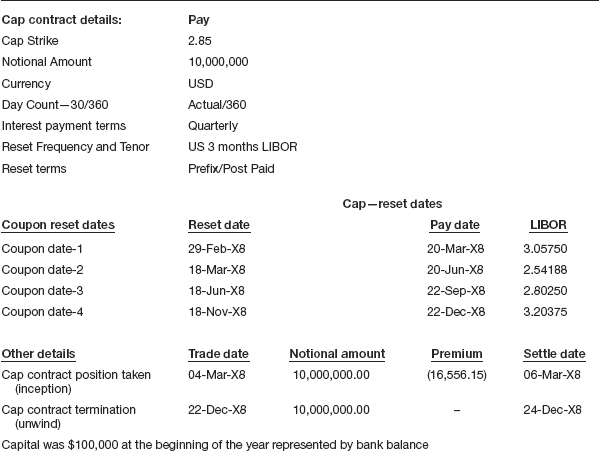

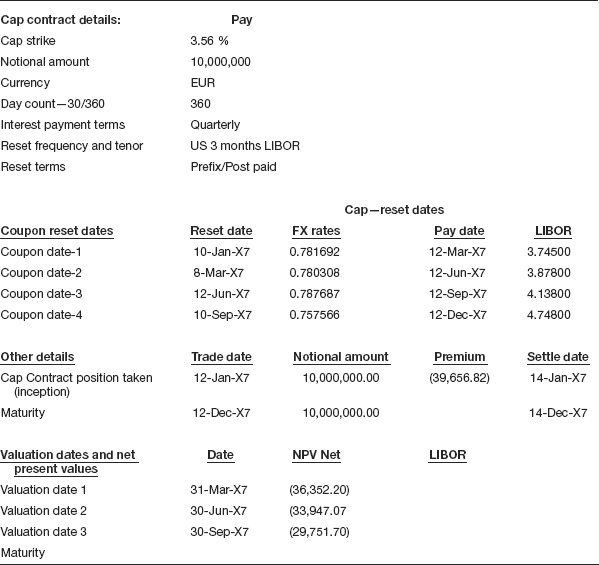

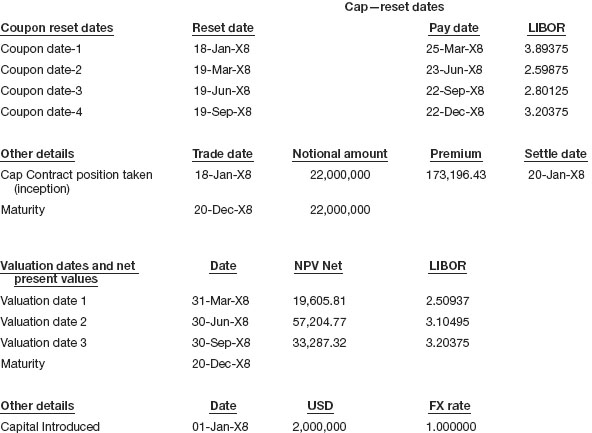

To understand the different events in the trade life cycle of an interest rate cap contract let us assume the following trade data as an illustration:

INTEREST RATE CAP INSTRUMENT—AN ILLUSTRATION

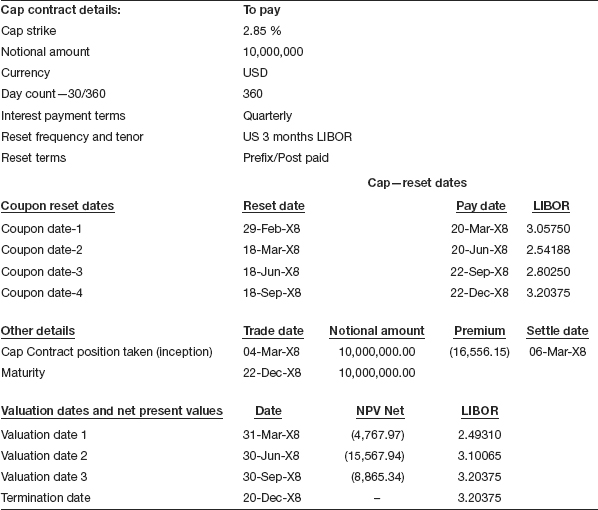

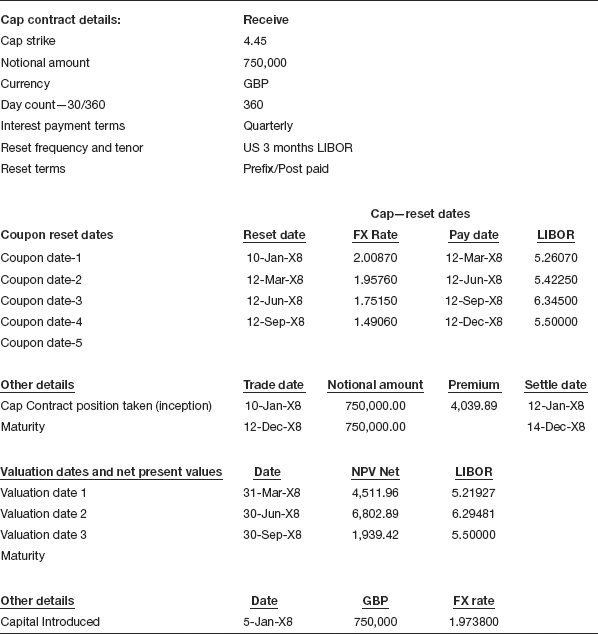

The details of the CAP instrument is shown in Table 9.2 for the purpose of this illustration.

Table 9.2 Details of the cap instrument

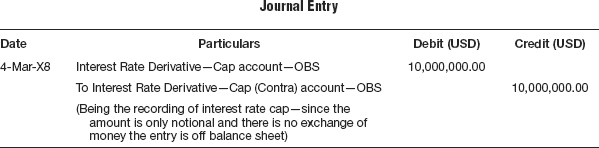

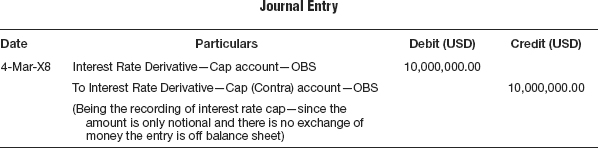

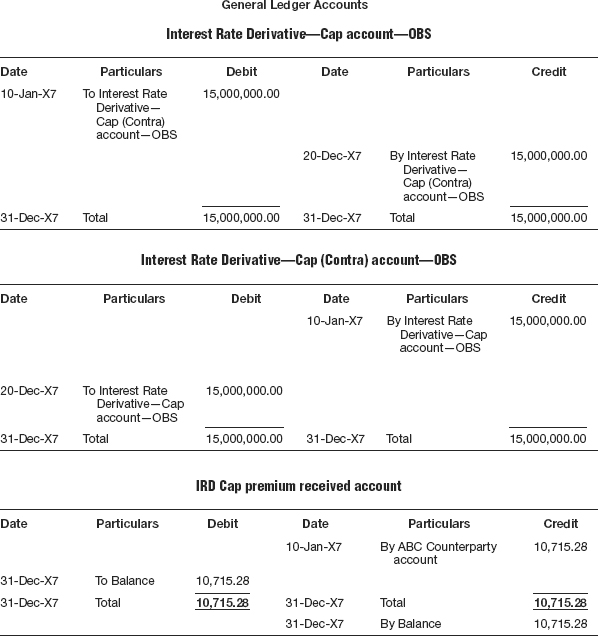

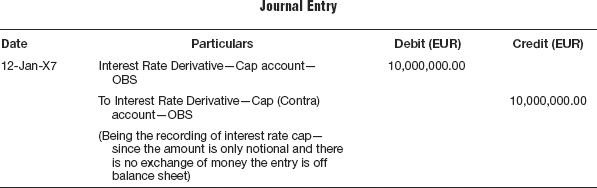

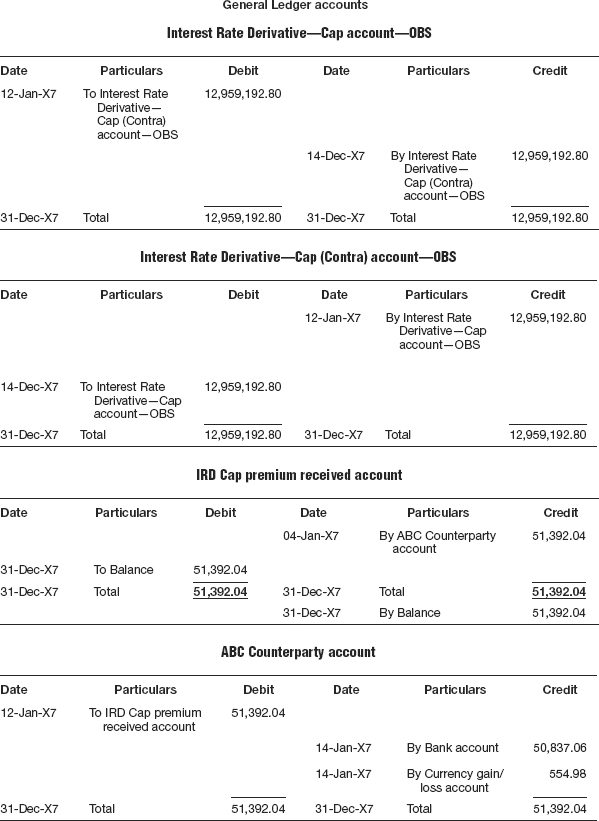

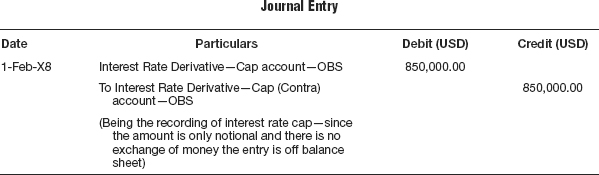

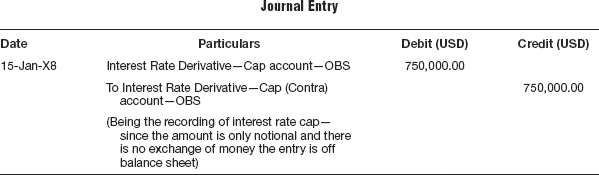

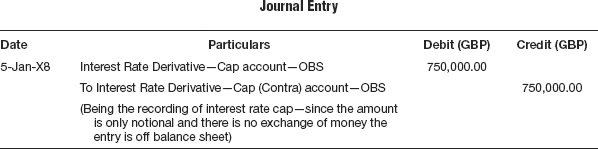

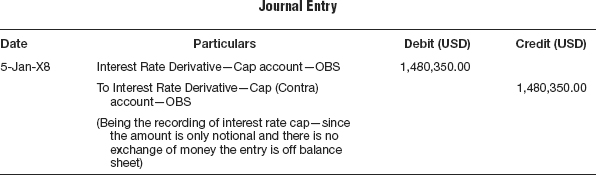

Recording the trade—contingent

Here in this contract, which is a ‘a pay’ interest rate cap, the contract is based on making a payment to the buyer of the contract when the reference rate exceeds the specified cap rate on the reset date calculated on the notional amount of the contract. However, since this is just a notional amount and no physical exchange of money takes place, the off balance sheet entry to record the transaction is made in the book of accounts, as shown in Table 9.3.

Table 9.3 At the inception of interest rate cap contract

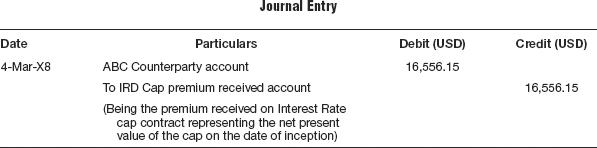

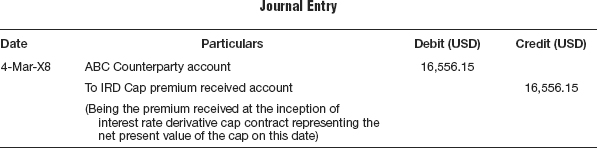

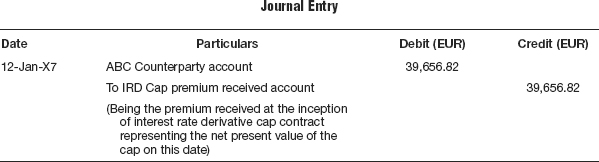

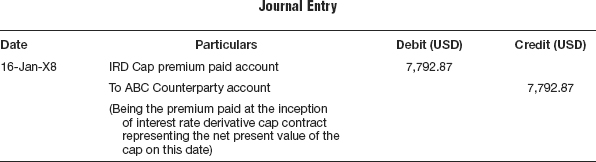

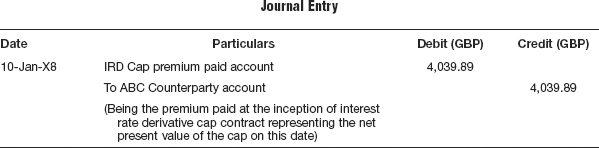

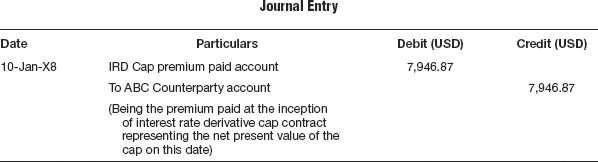

Account for the premium on the trade

In a ‘to pay’ interest rate cap trade, the buyer of the contract receives a non-refundable premium from the seller of the contract. If the interest rate rises above the cap rate, interest payment has to be made to the buyer as specified in the previous paragraph. The premium is calculated at the time the cap is established on the basis of the cap rate, the reference interest rate, the notional amount, the maturity period, and market volatility of interest rates. The premium for an interest rate cap also depends on several other factors as this type of contract is very similar to that of an option contract, where the premium is based on the strike interest rate (cap rate), current interest rate, time to maturity of the contract, volatility—both historical and implied. In the to pay contract a premium is received and the investor will have to pay interest whenever it rises above the cap rate. Similarly, in a to receive contract a premium is paid by the buyer and will receive interest whenever the interest rate rises above the cap rate.

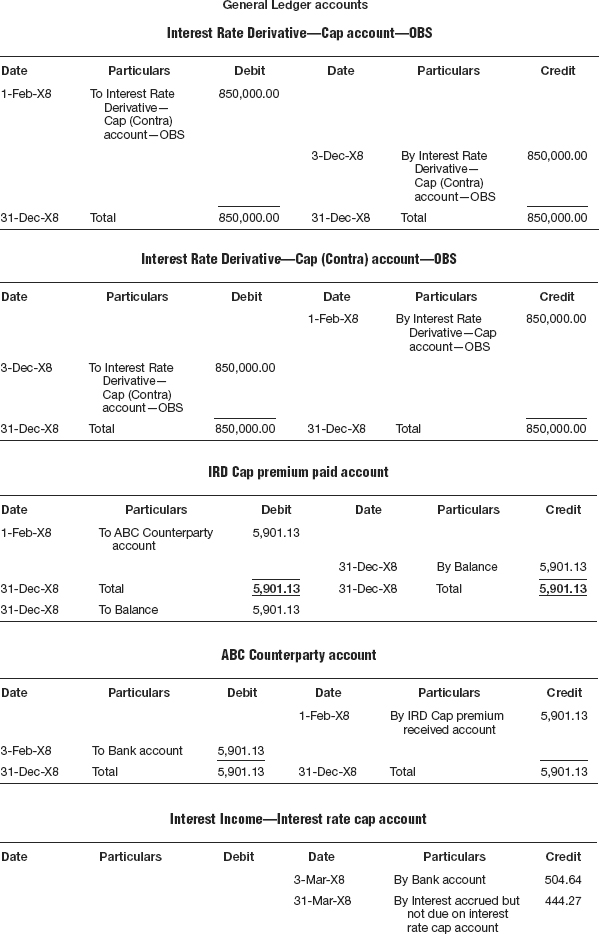

The premium received in a to pay contract actually represents a liability and this is also the net present value of the contract as at the inception of the trade. But this is treated as an income on the date of entering into the contract, and at every valuation date the actual liability or the net present value of the contract is ascertained and an unrealized gain or loss entry passed for the same. This ensures that the income statement is eventually credited only with the real profit from the contract. To illustrate with our present example, the premium of 16,556.15 is taken to the income statement at the inception of the contract. But during the next valuation date viz. 31st March, the actual liability of this trade is ascertained as amounting to 4,767.97, which is then taken to the debit side of the income statement. So the net gain from this trade for the period ending 31st March would be 16,556.15 less 4,767.97, i.e., 11,788.18. In other words, the real gain of 11,788.18 represents the reduction in the liability from 16,556.15 at the inception to 4,767.97 on the valuation date.

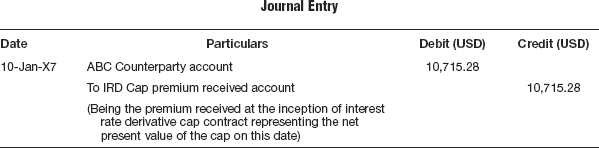

In this illustration, as this is a to pay contract the investor will receive a premium at inception of the trade. The premium is calculated as $16,556.15 and the accounting entry for recording the same is given in Table 9.4.

Table 9.4 On recording the premium received on IRD cap

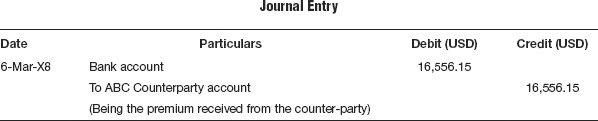

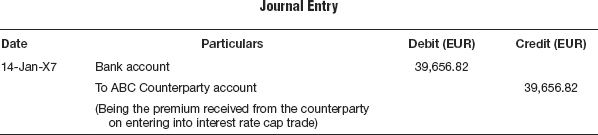

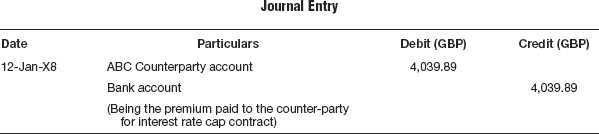

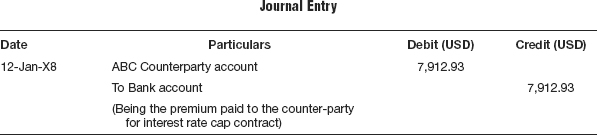

Receive/pay the premium for the trade

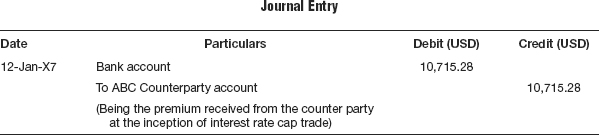

Premiums are usually paid or received within two business days of entering into the transaction. In a to pay interest rate cap, a premium is received by the buyer of the contract.

The entry that is passed to record the transaction is as shown in Table 9.5.

Table 9.5 On receipt of the premium for the trade

Reset the interest rate for the ensuing period

Interest reset dates are agreed upon between the counterparties at the inception of the trade. On the reset dates the reference rate is compared with the cap rate to determine if interest is required to be paid at all by one party to the other. If the reference interest rate is above the strike rate then interest is payable by the buyer of this cap contract. Since only reset happens, no accounting entry is passed on this date.

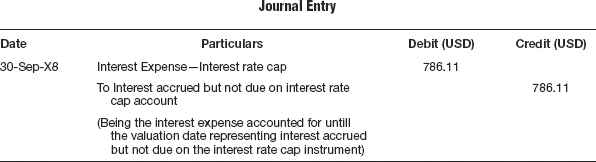

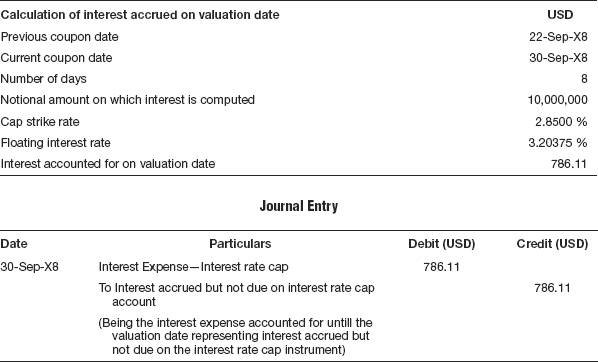

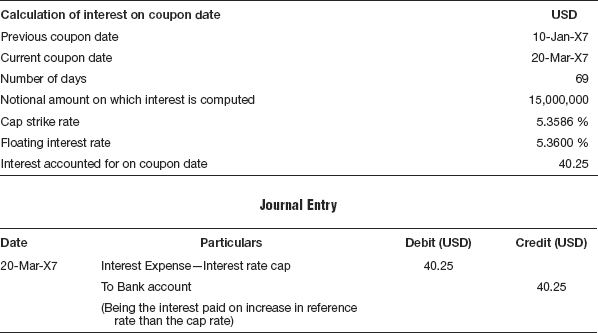

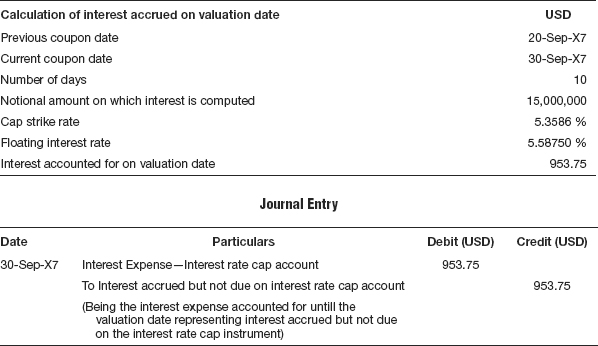

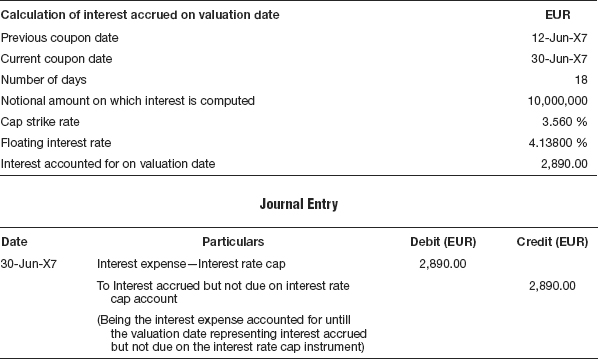

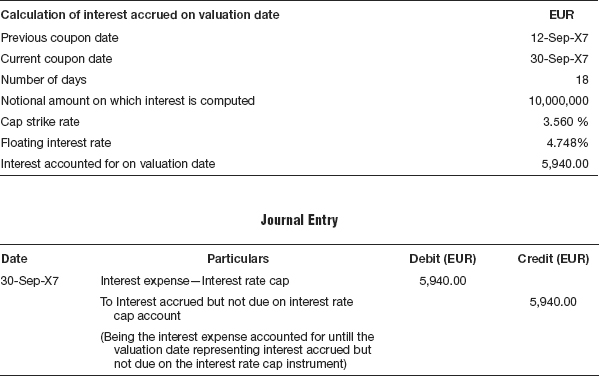

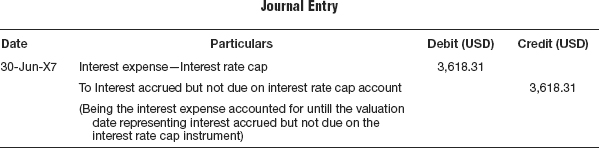

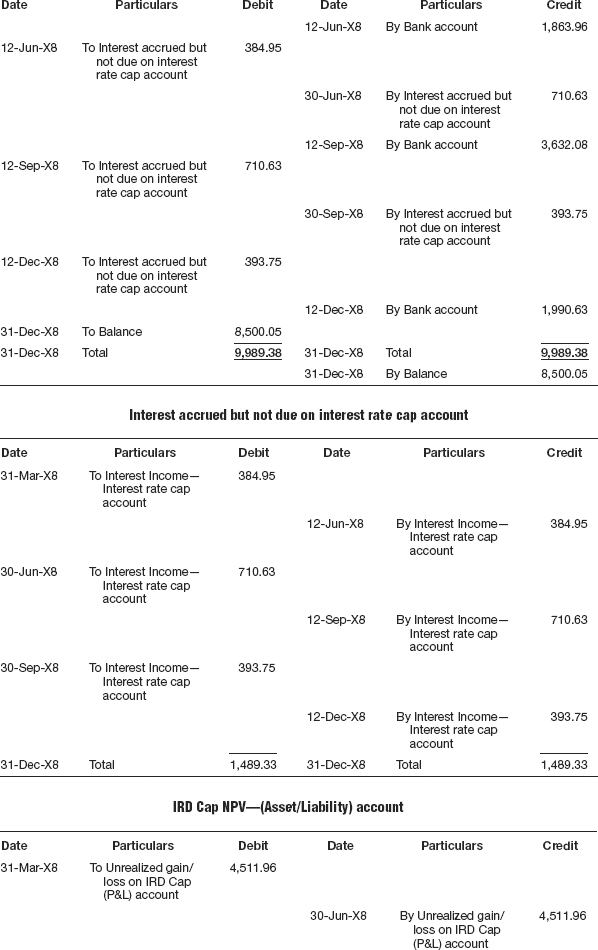

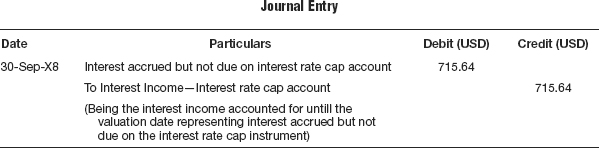

Ascertain the interest accrued—payable/receivable on cap

If the reference interest rate is above the cap rate, then the buyer of the cap instrument should compensate the seller interest calculated as per the previous paragraphs. When it is ascertained on the reset date that the reference interest rate is above the cap rate and if the valuation date occurs before the pay date then interest accrued on such cap instrument from the reset date to the valuation date should be computed and accounted for. This entry, however, will be reversed on the pay date when the actual interest calculated untill the pay date from the reset date is accounted for, as shown in Table 9.6.

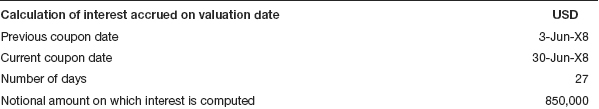

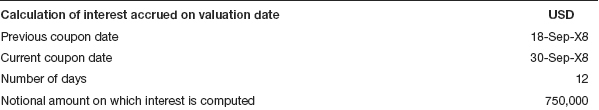

Table 9.6 Calculation of interest accrued on valuation date

| Calculation of interest accrued on valuation date | USD |

| Previous coupon date | 22-Sep-X8 |

| Current coupon date | 30-Sep-X8 |

| Number of days | 8 |

| Notional amount on which interest is computed | 10,000,000 |

| Cap strike rate | 2.8500 % |

| Floating interest rate | 3.20375 % |

| Interest accounted for on valuation date | 786.11 |

The entry for accounting the accrued interest payable on the valuation date is as shown in Table 9.7.

Table 9.7 On accounting of interest accrued on valuation date

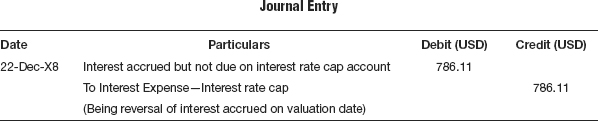

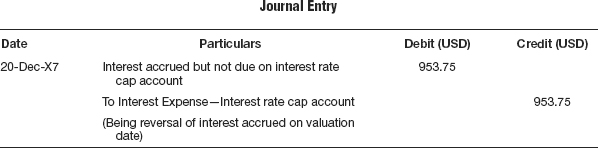

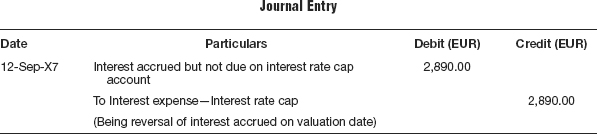

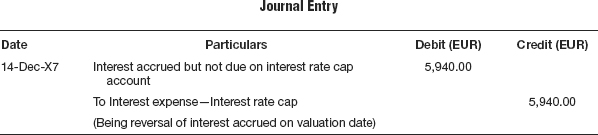

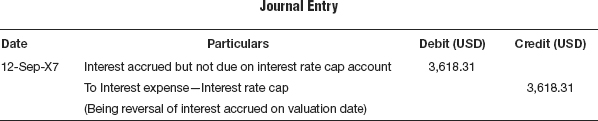

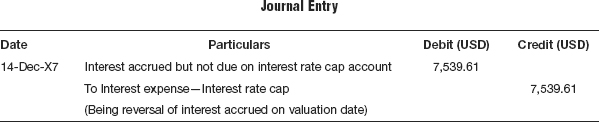

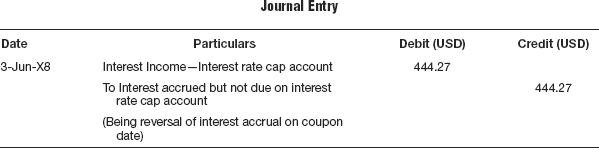

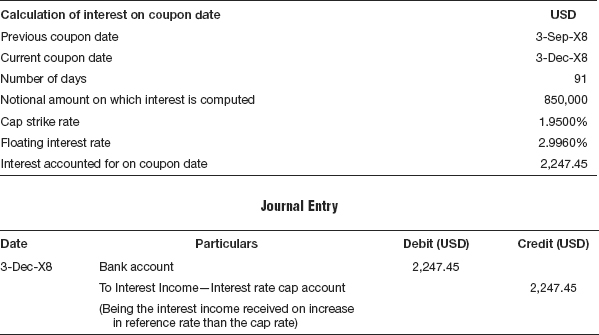

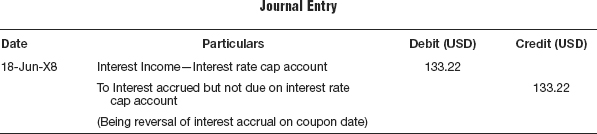

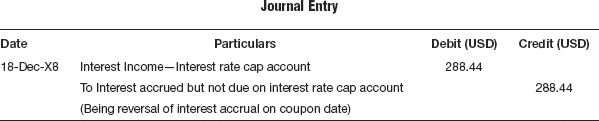

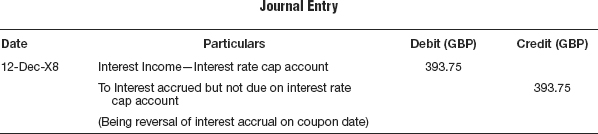

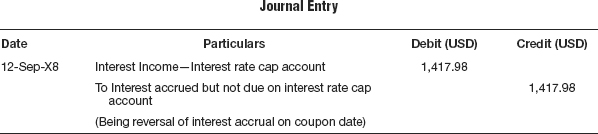

Reverse the accrued interest if any on coupon date

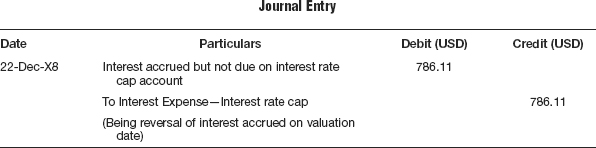

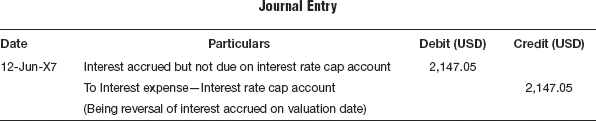

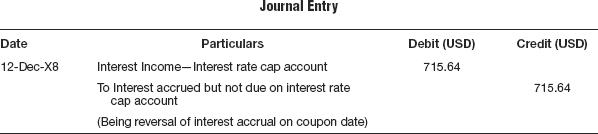

The accrued interest entry for the to pay interest rate cap contract recorded in the previous valuation date must be reversed on the next coupon date, when the actual interest untill the coupon date will be accounted for. The next coupon date subsequent to the valuation date falls on 22nd December and on that date the following entry will be recorded in the account for reversal of accrued interest, as shown in Table 9.8.

Table 9.8 On reversal of interest accrued on valuation date

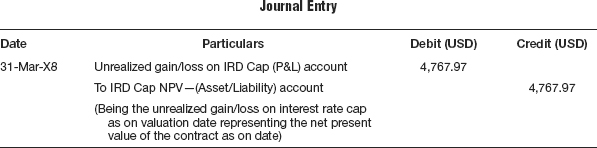

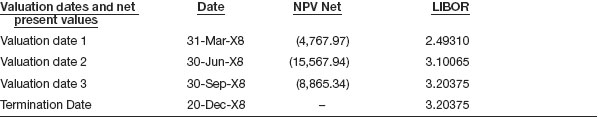

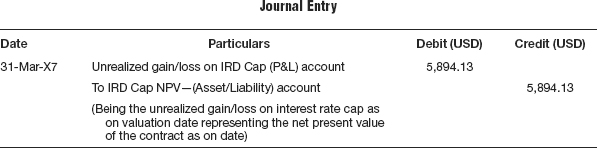

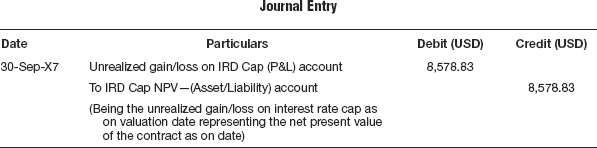

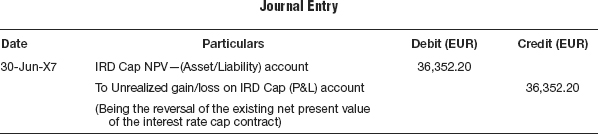

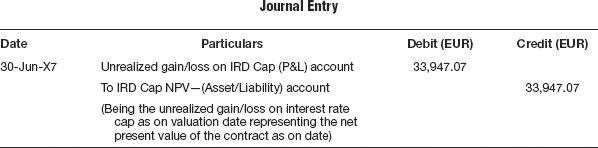

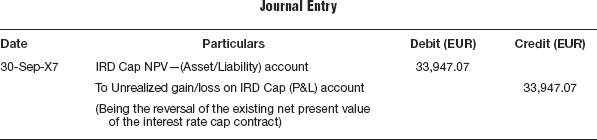

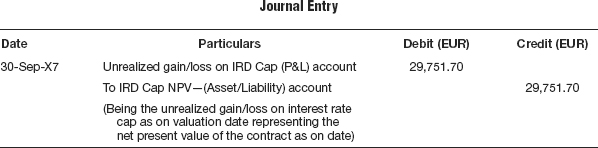

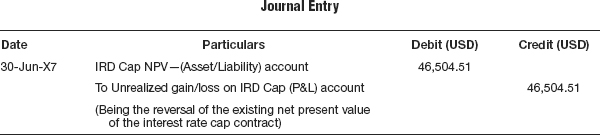

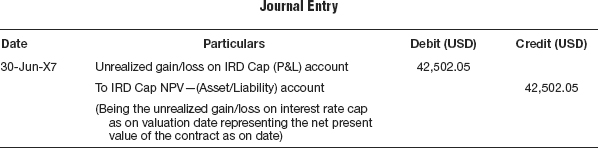

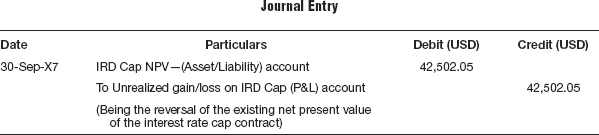

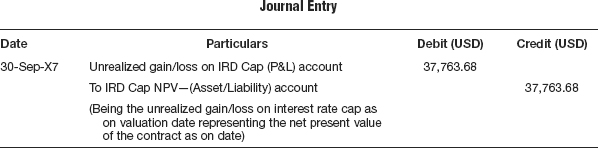

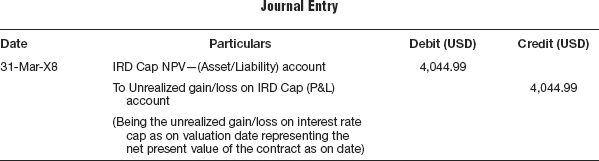

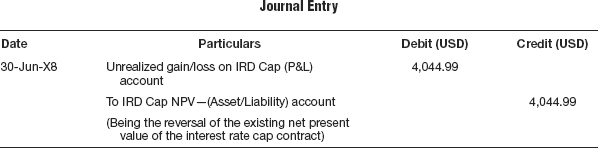

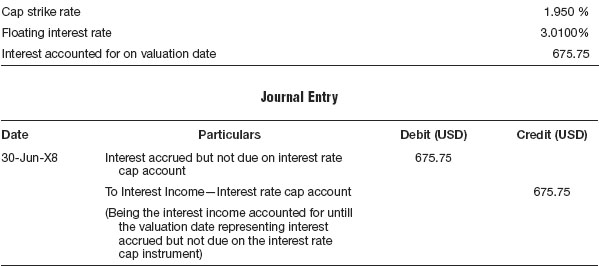

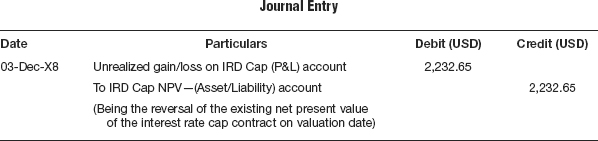

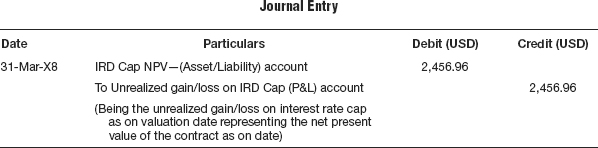

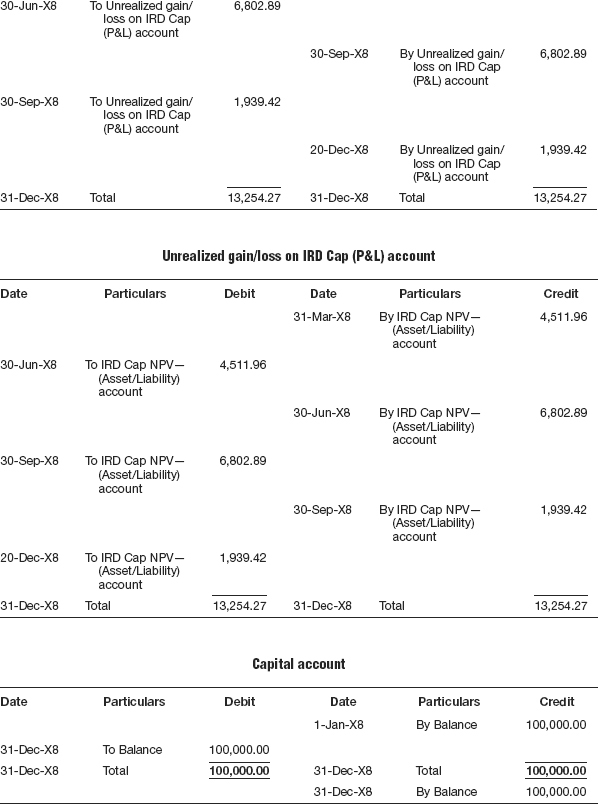

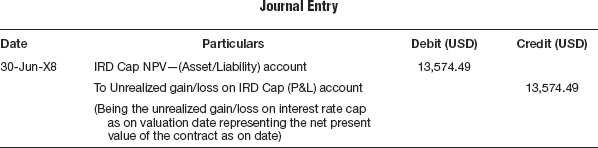

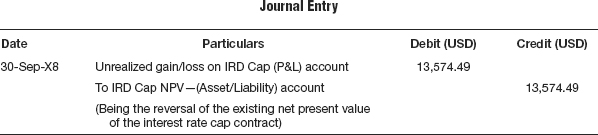

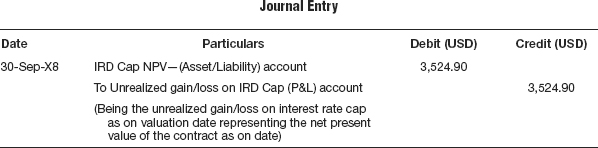

Ascertain and account for the fair value on the valuation date

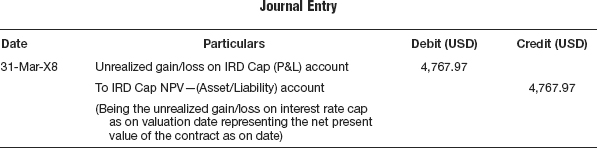

At the end of every reporting period the net present value of the cap contract is ascertained and entries recorded in the books accordingly. The net present value of the cap contract on 31st March amounts to a negative number of 4,767.97, meaning it is a liability. This is accounted for as unrealized loss on the interest rate cap instrument. Table 9.9 shows the entry is passed for the same:

Table 9.9 On valuation of interest rate cap as on date

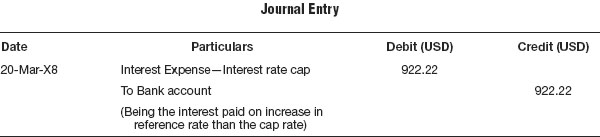

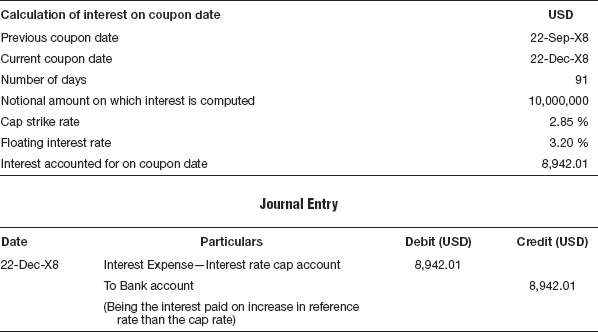

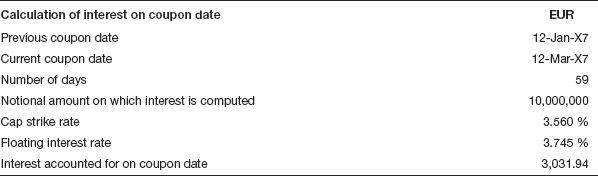

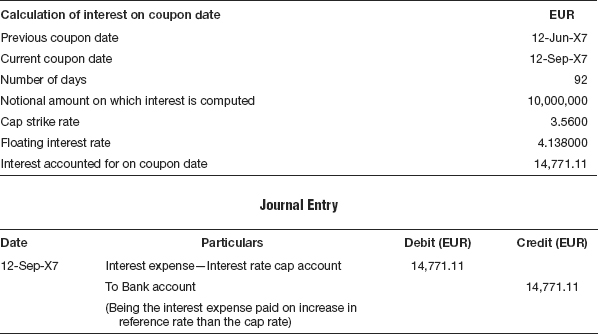

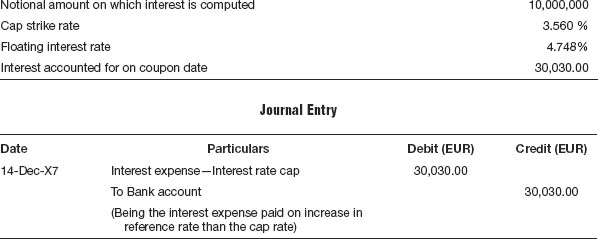

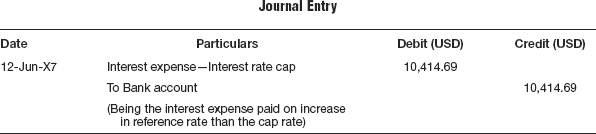

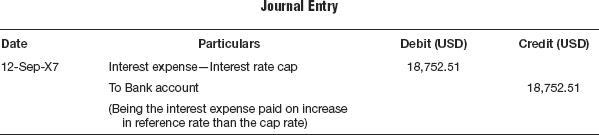

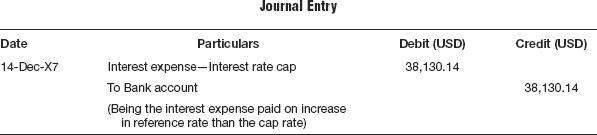

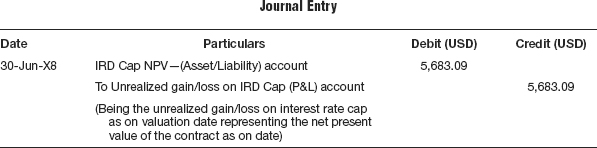

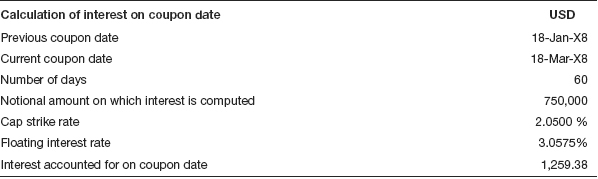

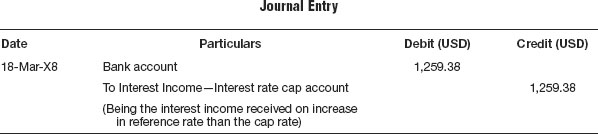

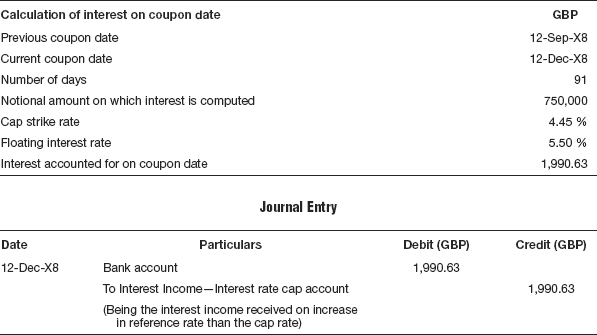

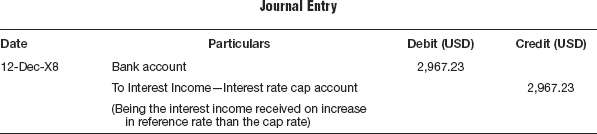

Pay/receive interest on pay date

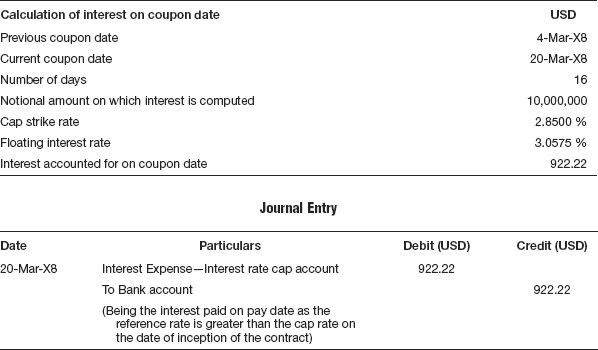

On each pay date, subsequent to the reset date, interest will be paid by the buyer of the cap contract if the prevailing reference rate exceeds the cap rate. In other words, if the reference rate is below the cap rate, then nothing is received or paid under the cap contract and no settlement takes place. At the inception of the contract, the reference rate is 3.0575 percent and since this is above the cap rate of 2.85 percent, interest is payable by the buyer of the contract on the pay date from the date of inception of the cap contract. Table 9.10 shows the calculation of interest.

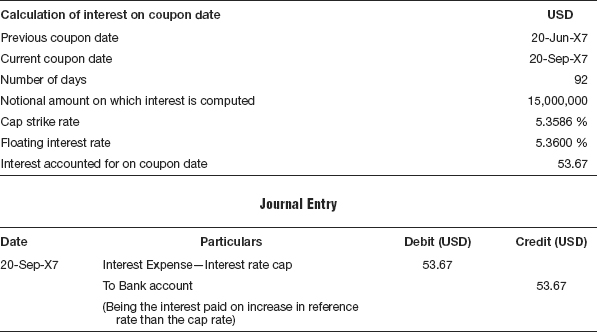

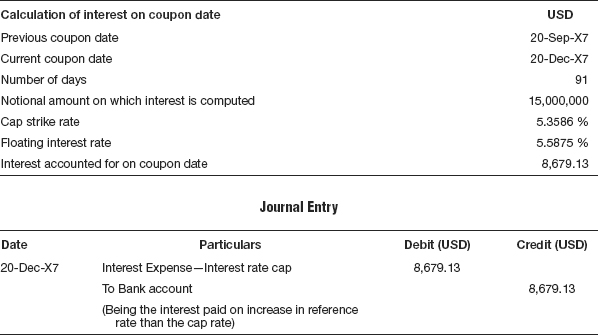

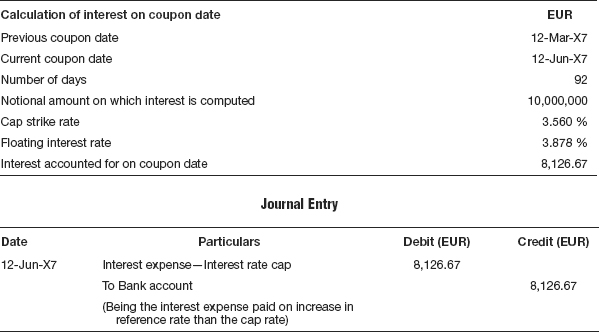

Table 9.10 Calculation of interest on coupon date

Note that on 18th March and 18th June, the next two reset dates, interest rate was below the cap rate and hence no interest is paid or received on the pay dates of 20th June and 22nd September. The interest rate on 18th September, which is the next reset date, is 3.20375 and since this rate is above the cap rate, interest is payable by the buyer of the instrument on the pay date viz. 22nd December.

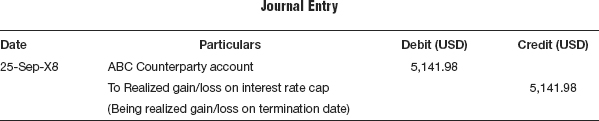

Termination of the trade and accounting for the termination fee

An interest rate cap contract can be terminated at any time by either one of the parties to contract. If the parties decide to terminate the contract, then the net present value of the contract at that point would be computed based on the net present value of the contract on such date of termination and the termination fee will be paid by one party to the other party depending upon which party stands to gain and which party stands to lose if the contract is terminated on the said date without being allowed to subsist during the remaining life of the contract. Assuming in this example the present value of the contract on the date of termination, say, 25th September, is calculated as a positive number amounting to $5,141.98 then the counterparty to the contract will have to pay this termination fee to the investor.

The accounting entry that is recorded in the books of accounts is shown in Table 9.11.

Table 9.11 On accounting for termination fee

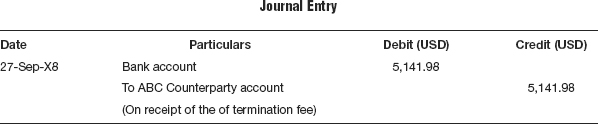

Payment or receipt of termination fee

The consideration for such termination is received on T + 2. The accounting entry that is recorded in the book of accounts is shown in Table 9.12.

Table 9.12 On settlement of termination fee

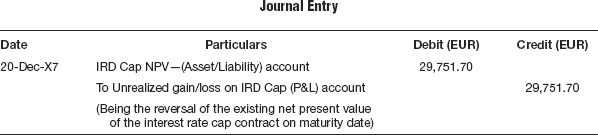

Maturity of the trade

If the trade is not terminated before the maturity date, the trade is matured automatically on the maturity date. No interest is payable or receivable after the maturity date. The net present value on the date of maturity of the interest rate cap contract would be zero as no cash flows subsist subsequent to the maturity date, unlike an early termination where subsequent to the termination date, there would be cash flows both receivable and payable. On the maturity date of the trade, the contingent entry passed at the date of inception of the trade is reversed, as mentioned in the next paragraph.

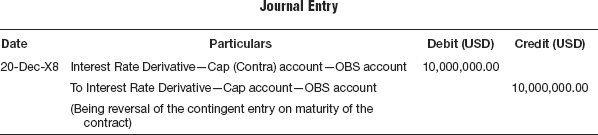

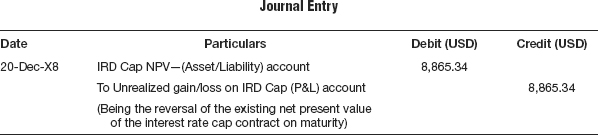

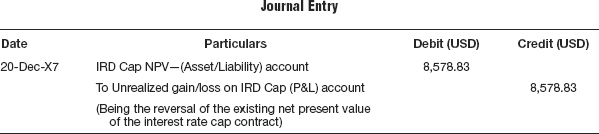

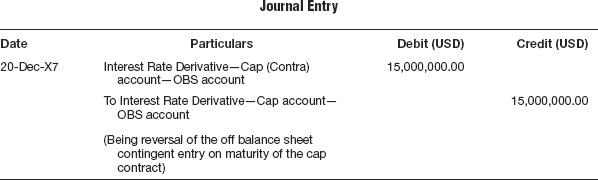

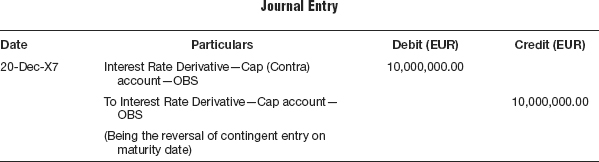

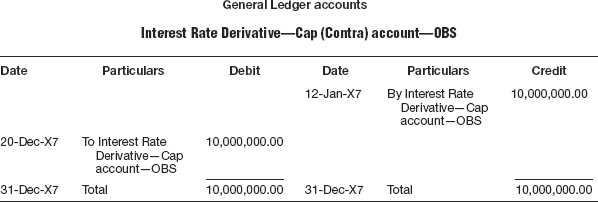

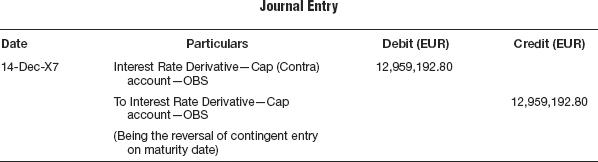

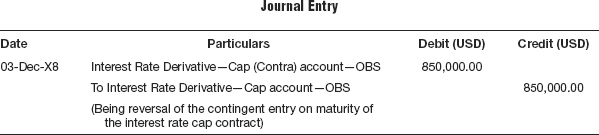

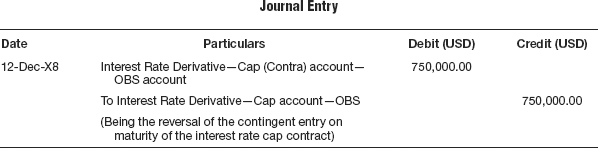

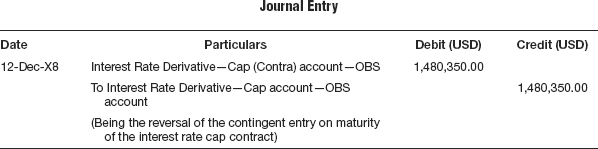

Reversal of the contingent entry on termination or maturity

The cap can be terminated anytime before the maturity date. On termination, the cap contract will be cancelled and the original off balance sheet entry passed at the time of inception of the contract is reversed. Even at the time of maturity the same entry is recorded, as shown in Table 9.13.

Table 9.13 On reversal of the contingent entry

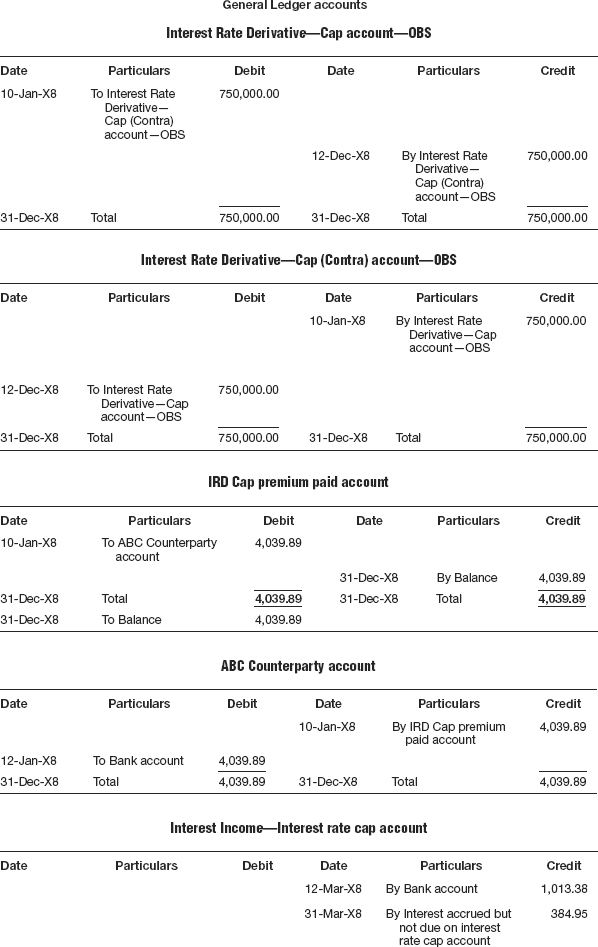

COMPLETE SOLUTION TO THE ILLUSTRATION—INTEREST RATE CAP

T-1 On recording the interest rate cap trade:

T-2 On accounting for premium on interest rate cap trade:

T-3 On accounting of receipt of the premium:

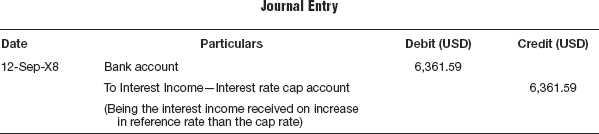

T-4 On accounting for interest payable on interest rate cap:

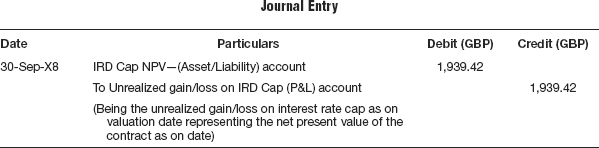

T-5 On valuation of interest rate cap as on date:

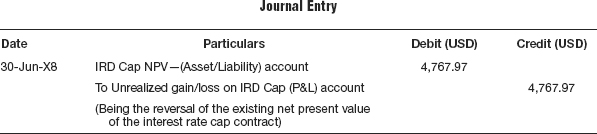

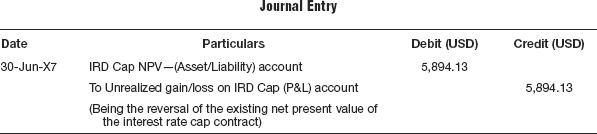

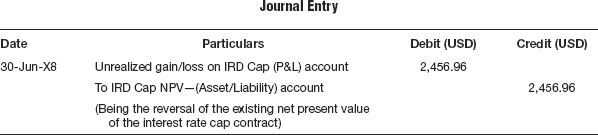

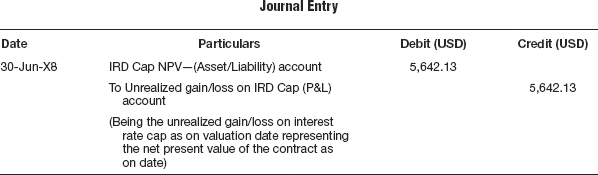

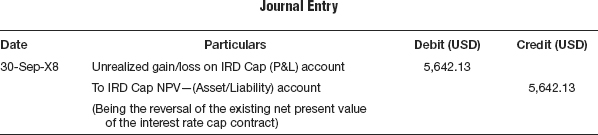

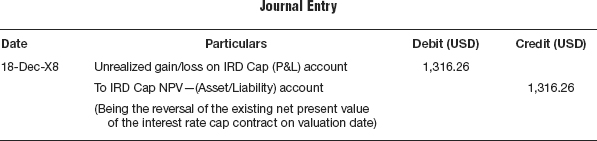

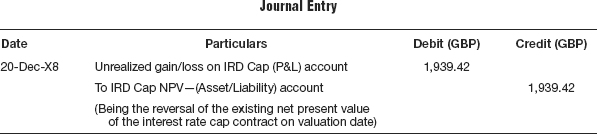

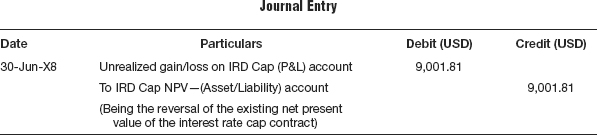

T-6 On reversal of existing net present value of interest rate cap on the next valuation date:

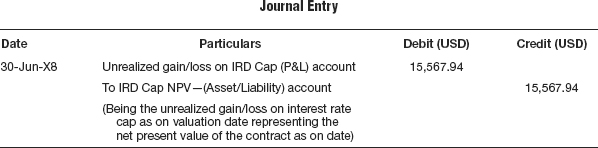

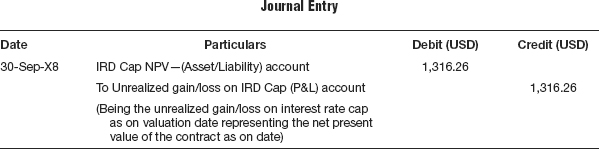

T-7 On valuation of interest rate cap as on date:

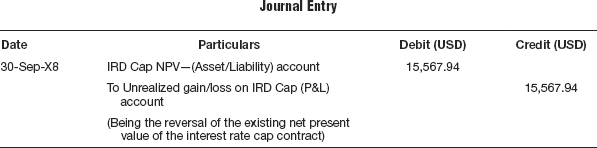

T-8 On reversal of existing net present value of interest rate cap on the next valuation date:

T-9 On valuation of interest rate cap as on date:

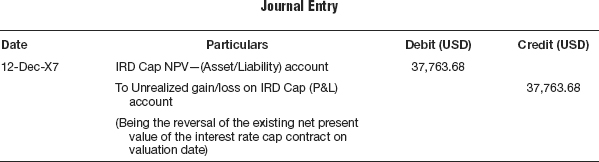

T-10 On reversal of existing net present value on maturity of cap contract:

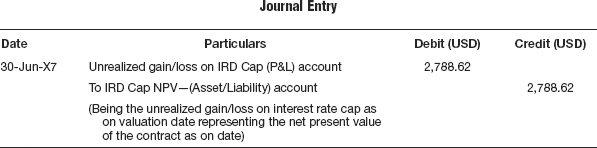

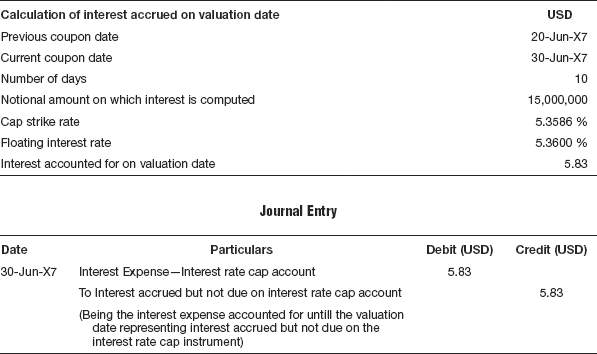

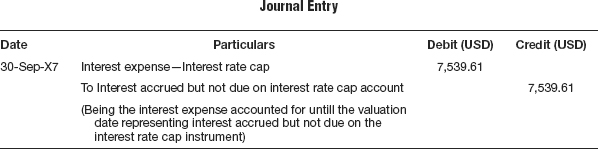

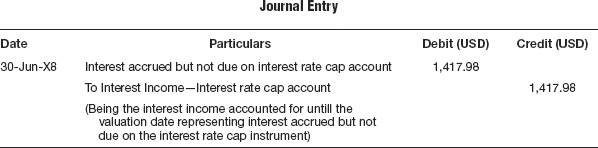

T-11 On accounting of interest accrued on valuation date:

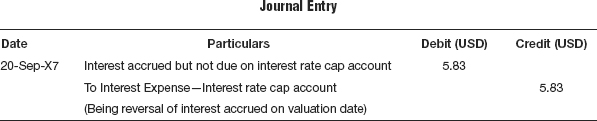

T-12 On reversal of interest accrued on valuation date:

T-13 On accounting for interest on pay date:

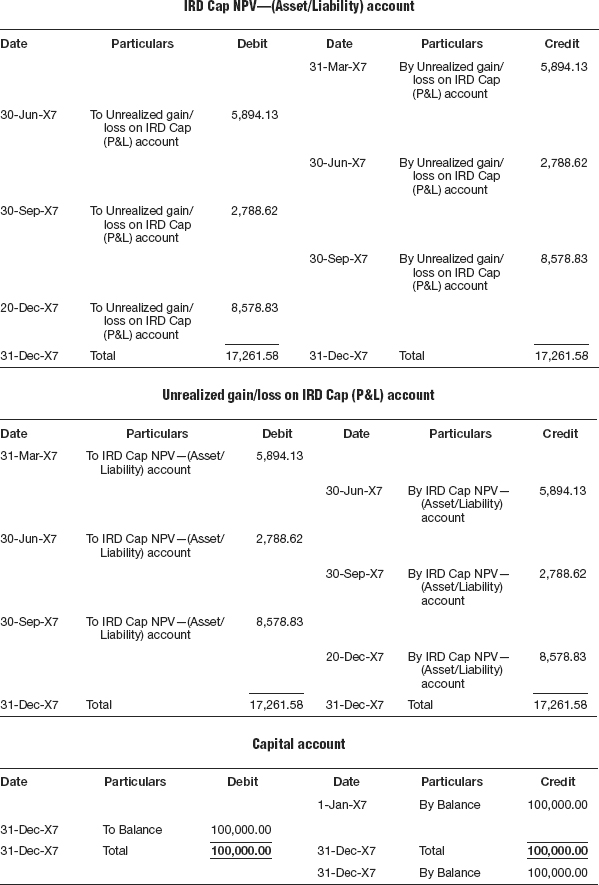

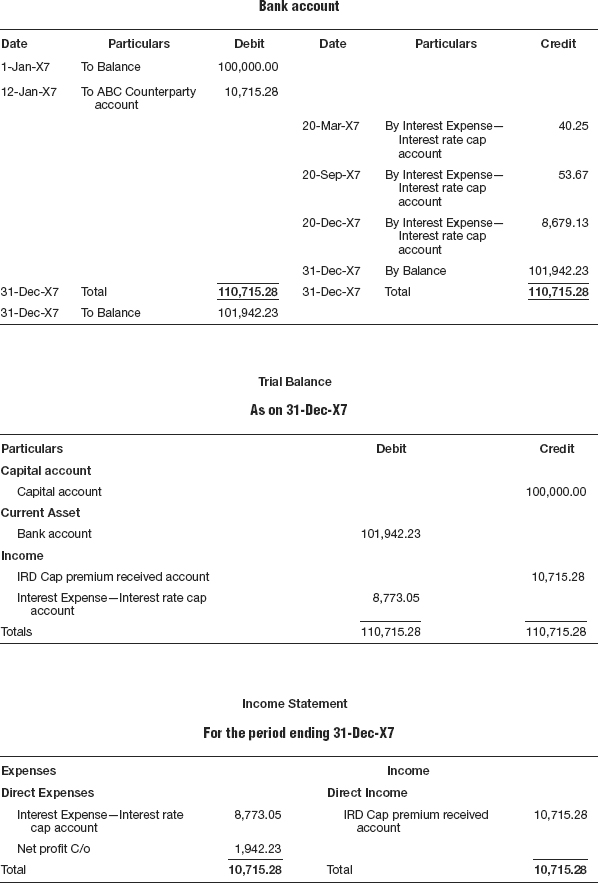

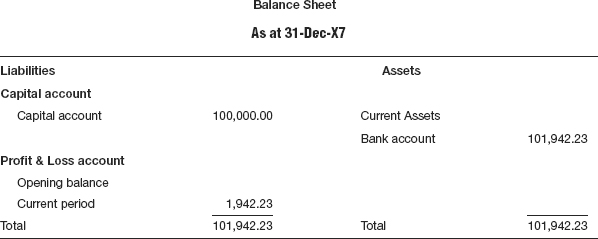

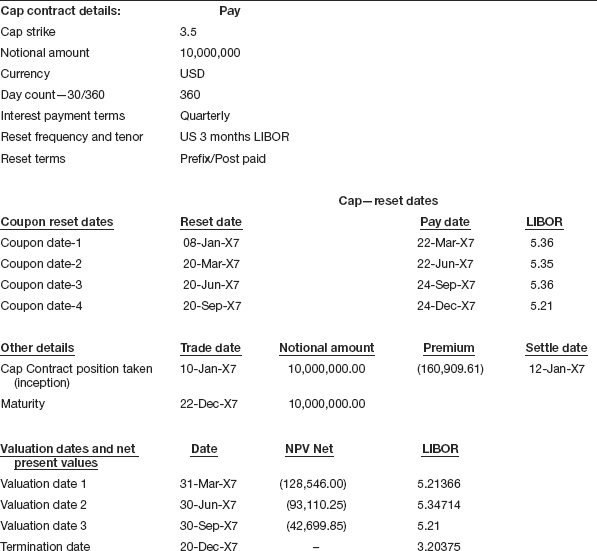

PROBLEM 1: INTEREST RATE CAP—PAY

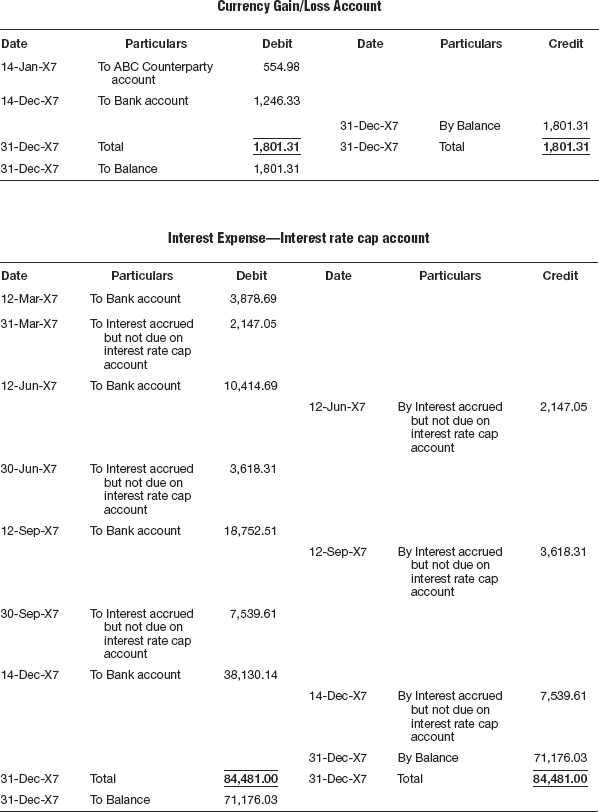

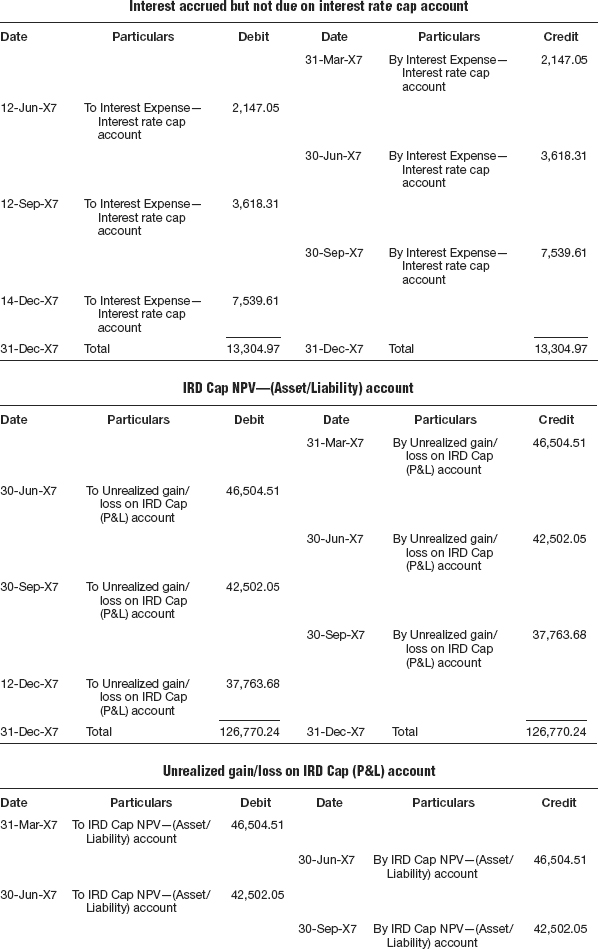

SOLUTION TO PROBLEM 1: INTEREST RATE CAP—PAY

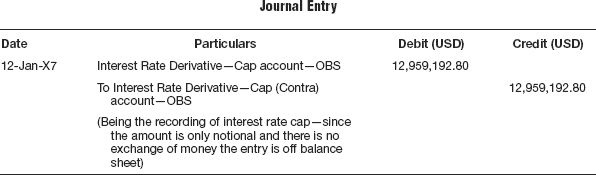

T-1 On entering into interest rate cap trade (off balance sheet entry):

T-2 On accounting for premium on interest rate cap trade:

T-3 On accounting for receipt of the premium:

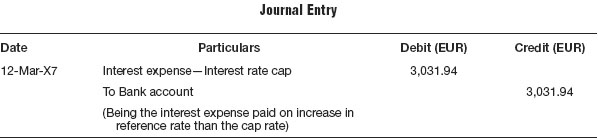

T-4 On accounting for interest payable on interest rate cap:

T-5 On valuation of interest rate cap as on date:

T-6 On reversal of existing net present value of interest rate cap on the next valuation date:

T-7 On valuation of interest rate cap as on date:

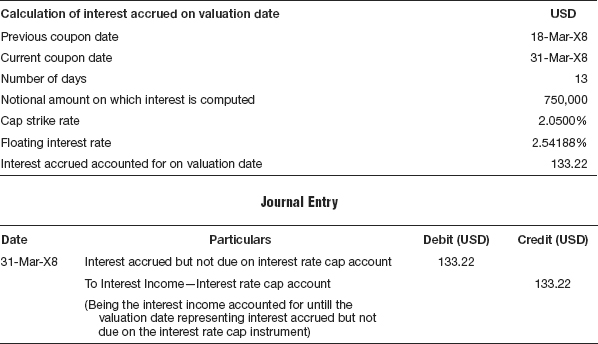

T-8 On accounting of interest accrued on valuation date:

T-9 On reversal of interest accrued on valuation date:

T-10 On accounting for interest on interest rate cap:

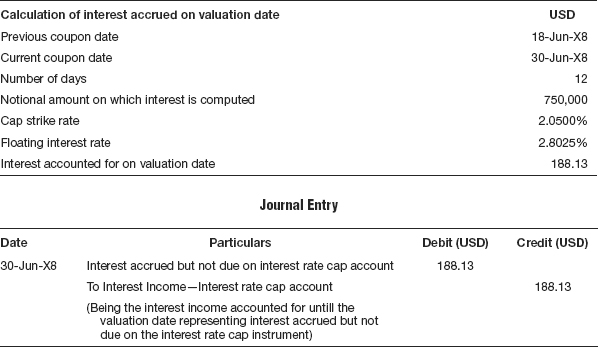

T-11 On accounting of interest accrued on valuation date:

T-12 On reversal of existing net present value of interest rate cap on the next valuation date:

T-13 On valuation of interest rate cap as on date:

T-14 On reversal of interest accrued on valuation date:

T-15 On accounting for interest on interest rate cap:

T-16 On reversal of existing net present value of interest rate cap on the next valuation date:

T-17 On reversal of the off balance sheet contingent entry on maturity of the contract:

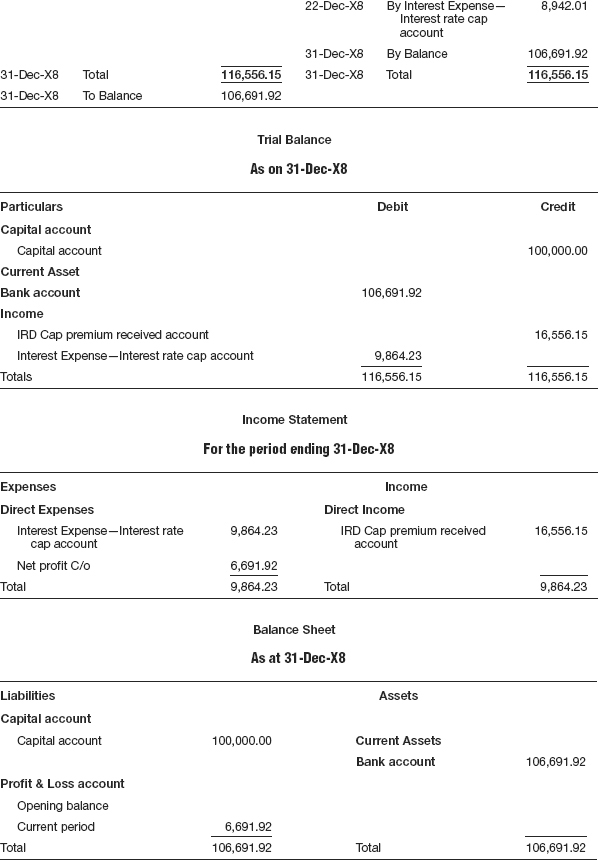

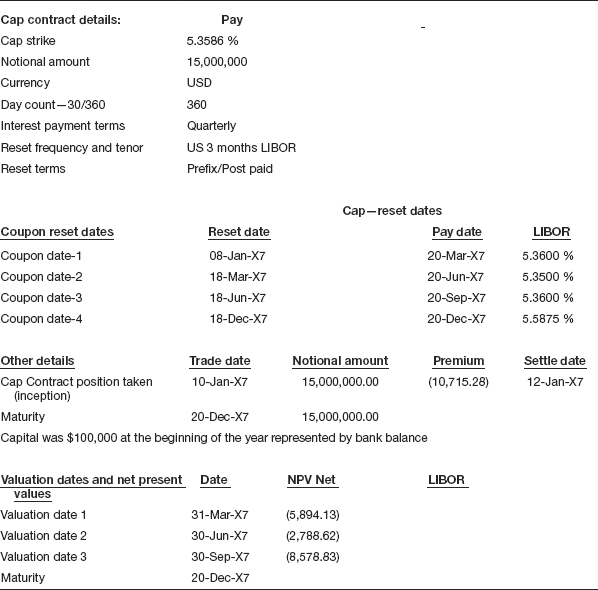

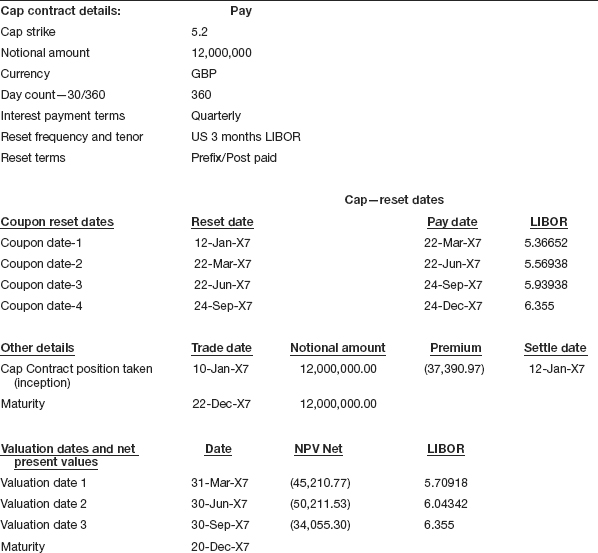

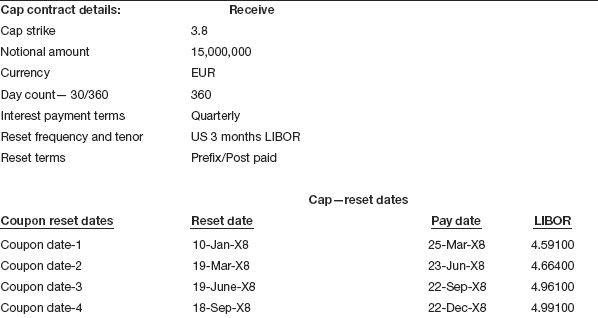

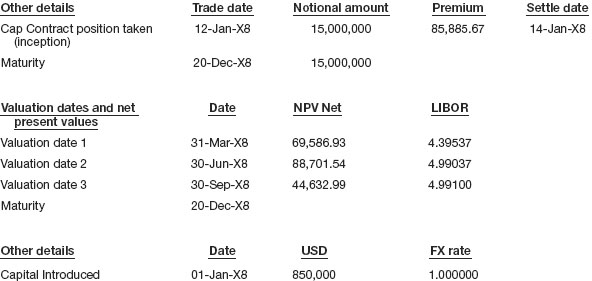

PROBLEM 2: INTEREST RATE CAP—PAY

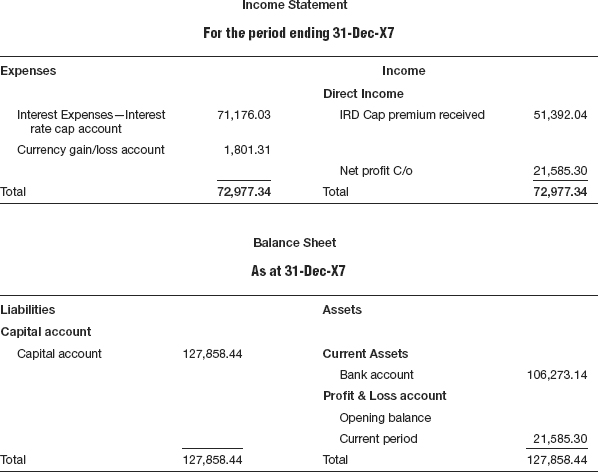

SOLUTION TO PROBLEM 2: INTEREST RATE CAP—PAY

T-1 On entering into interest rate cap trade (off balance sheet entry):

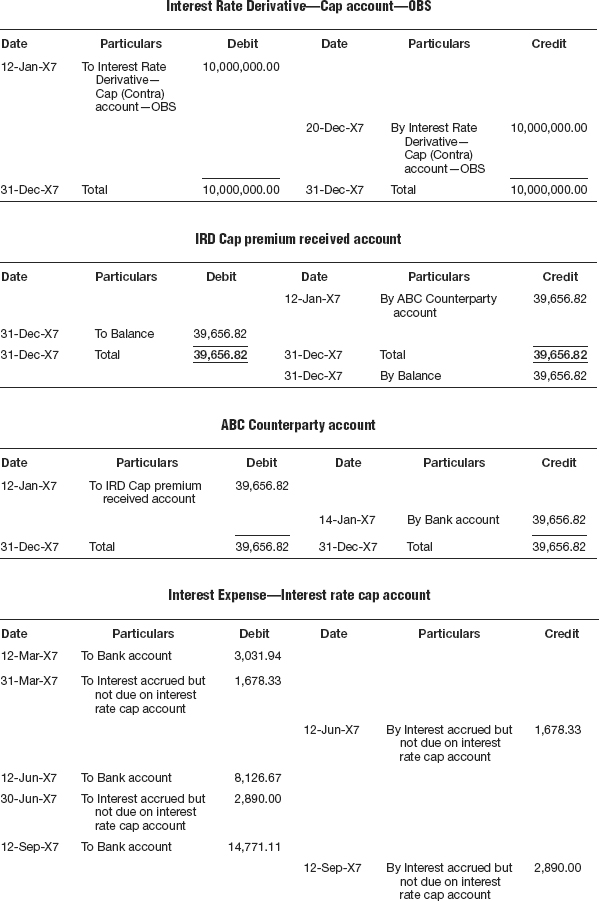

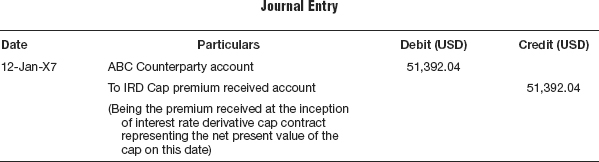

T-2 On accounting for premium received on interest rate cap trade:

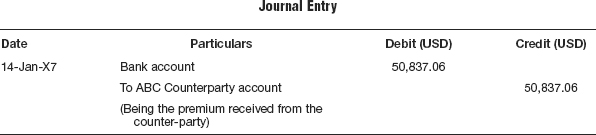

T-3 On accounting for premium received:

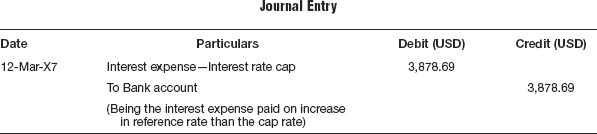

T-4 On accounting for interest expense on interest rate cap:

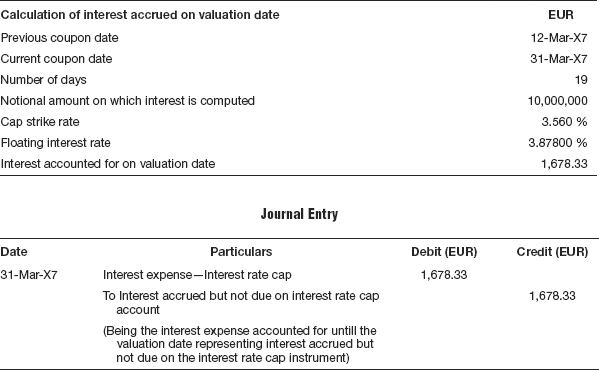

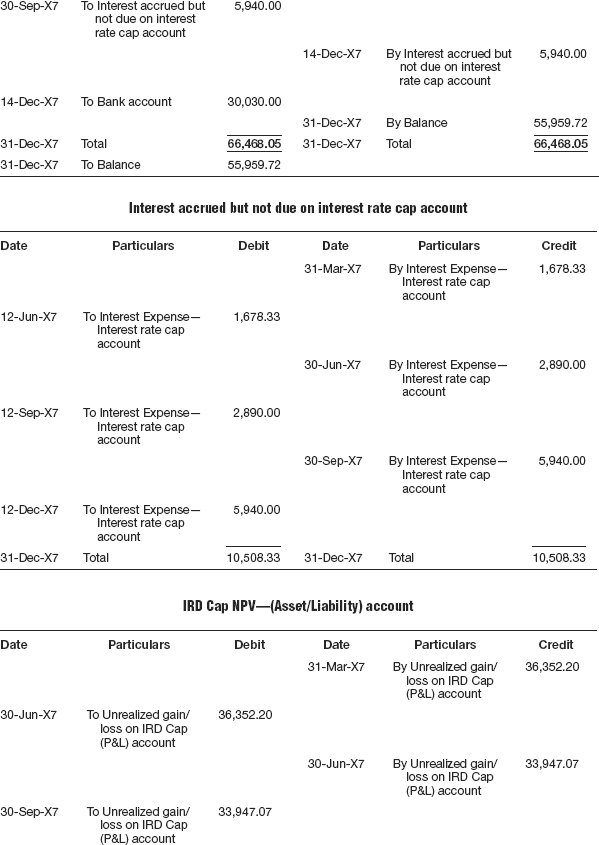

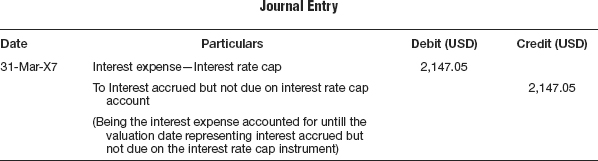

T-5 On accounting for interest accrued on valuation date on interest rate cap:

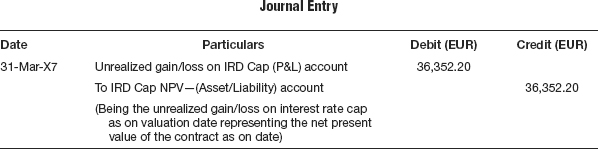

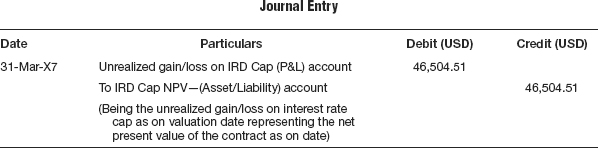

T-6 On valuation of interest rate cap as on date:

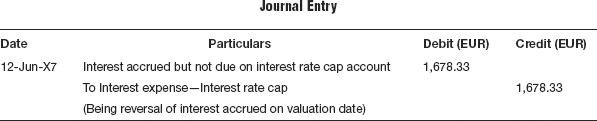

T-7 On reversal of interest accrued on valuation date:

T-8 On accounting for interest expense on interest rate cap:

T-9 On reversal of existing net present value of interest rate cap on the next valuation date:

T-10 On accounting for interest accrued on valuation date on interest rate cap:

T-11 On valuation of interest rate cap as on date:

T-12 On reversal of interest accrued on valuation date:

T-13 On accounting for interest expense on interest rate cap:

T-14 On reversal of existing net present value of interest rate cap on the next valuation date:

T-15 On accounting for interest accrued on valuation date on interest rate cap:

T-16 On valuation of interest rate cap as on date:

T-17 On reversal of interest accrued on valuation date:

T-18 On accounting for interest expense on interest rate cap:

T-19 On reversal of existing net present value of interest rate cap on the maturity date:

T-20 On reversal of contingent entry on maturity date:

ACCOUNTING ENTRIES IN FUNCTIONAL CURRENCY

F-1 On entering into interest rate cap trade (off balance sheet): (T-1 @ FX Rate: 0.7717)

F-2 On accounting for premium on interest rate cap trade: (T-2 @ FX Rate: 0.7717)

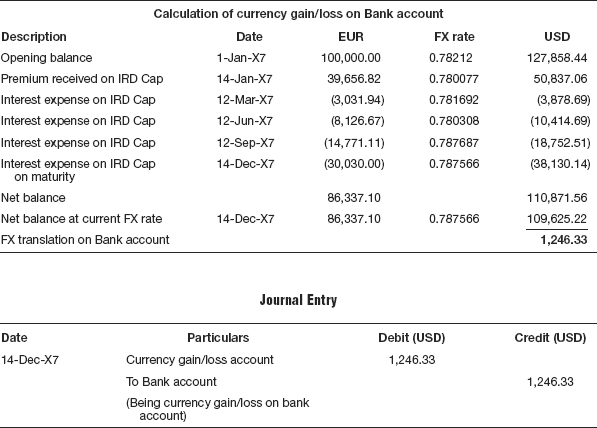

F-3 On accounting of premium received: (T-3 @ FX Rate: 0.7801)

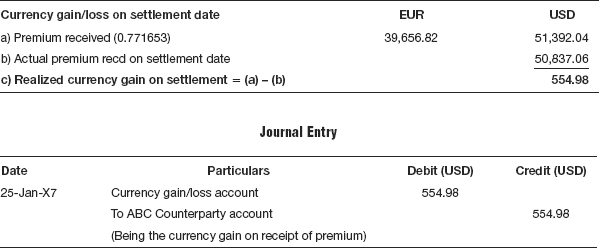

F-4 Recording the FX gain/loss amount:

F-5 On accounting for interest expense on interest rate cap: (T-4 @ FX Rate: 0.7817)

F-6 On accounting for interest accrued on interest rate cap: (T-5 @ FX Rate: 0.7817)

F-7 On valuation of interest rate cap as on date: (T-6 @ FX Rate: 0.7817)

F-8 On accounting for interest accrued on interest rate cap: (T-7 @ FX Rate: 0.7817)

F-9 On accounting for interest expense on interest rate cap: (T-8 @ FX Rate: 0.7803)

F-10 On reversal of existing net present value of interest rate cap on the next valuation date: (T-9 @ FX Rate: 0.7817)

F-11 On accounting of interest accrued on valuation date: (T-10 @ FX Rate: 0.7987)

F-12 On valuation of interest rate cap as on date: (T-11 @ FX Rate: 0.7987)

F-13 On accounting for interest accrued on interest rate cap: (T-12 @ FX Rate: 0.7987)

F-14 On accounting for interest expense on interest rate cap: (T-13 @ FX Rate: 0.7877)

F-15 On reversal of existing net present value of interest rate cap on the next valuation date: (T-14 @ FX Rate: 0.7987)

F-16 On accounting of interest accrued on valuation date: (T-15 @ FX Rate: 0.7878)

F-17 On valuation of interest rate cap as on date: (T-16 @ FX Rate: 0.7878)

F-18 On accounting for reversal of interest accrued on interest rate cap: (T-17 @ FX Rate: 0.7878)

F-19 On accounting for interest expense on interest rate cap: (T-18 @ FX Rate: 0.7876)

F-20 On reversal of existing net present value of interest rate cap on the next valuation date: (T-19 @ FX Rate: 0.7878)

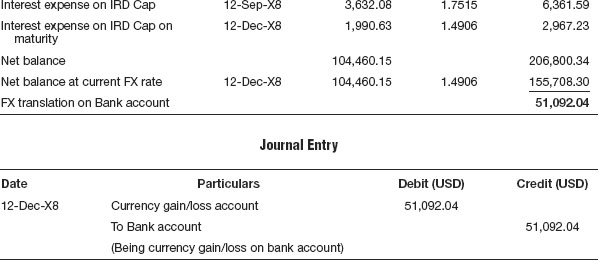

F-21 FX gain/loss:

F-22 On reversal of contingent entry on maturity date: (T-20 @ FX Rate: 0.7717)

PROBLEM 3: INTEREST RATE CAP—RECEIVE

SOLUTION TO PROBLEM 3: INTEREST RATE CAP—RECEIVE

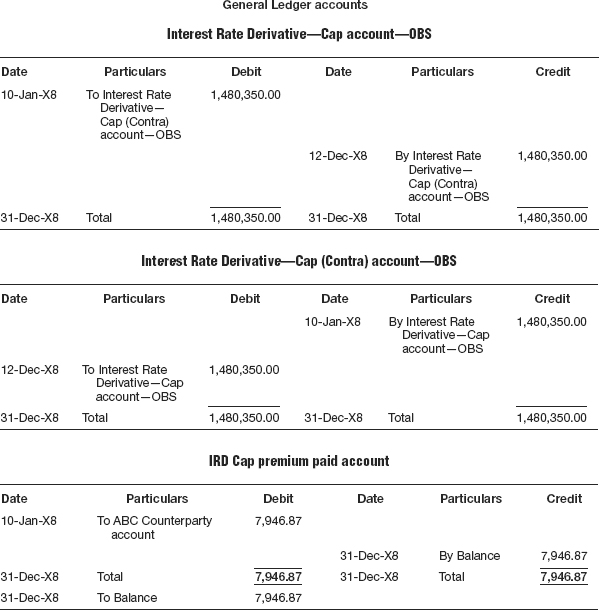

T-1 On purchase of interest rate cap trade (off balance sheet):

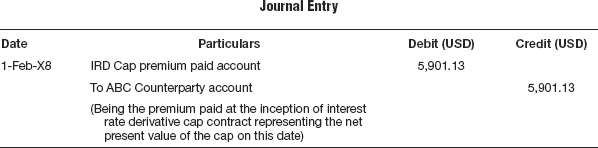

T-2 On accounting for premium on interest rate cap trade:

T-3 On payment of the premium on interest rate cap trade:

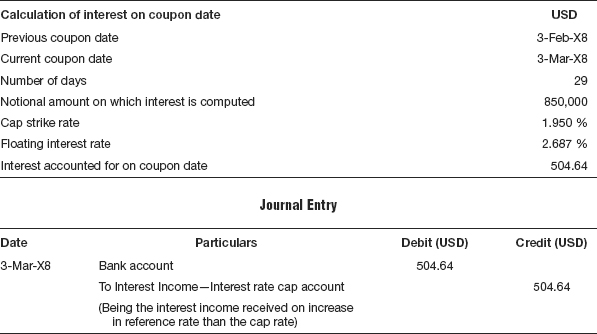

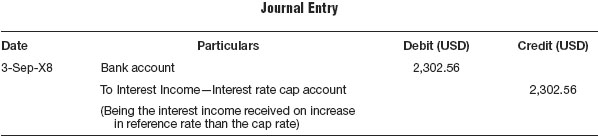

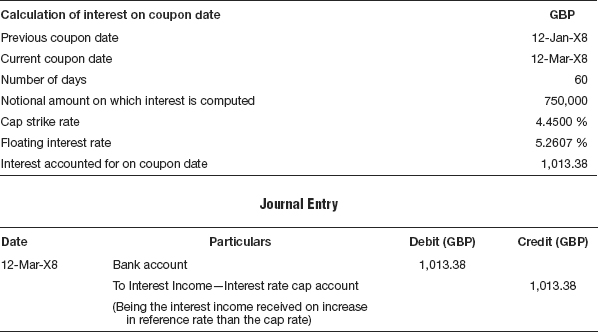

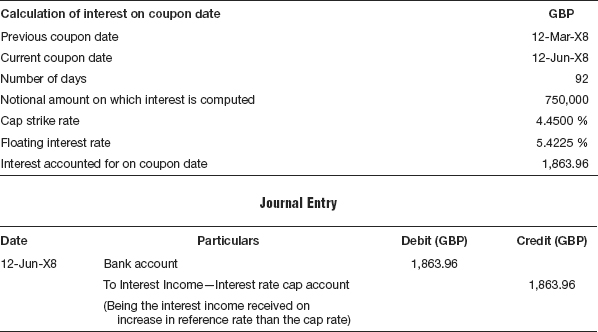

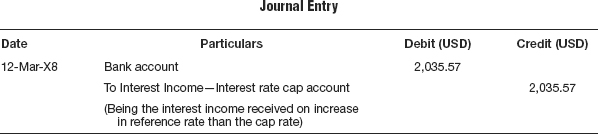

T-4 On accounting for interest income on interest rate cap:

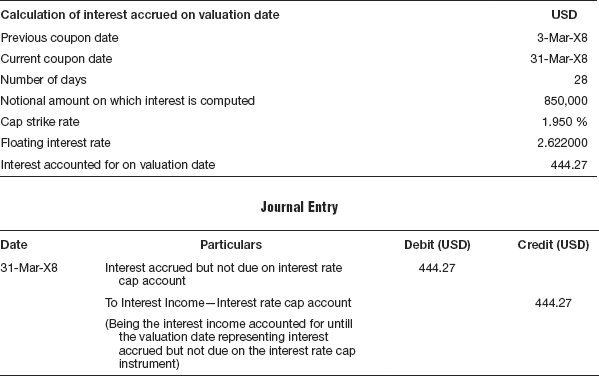

T-5 On accounting of interest accrued on valuation date:

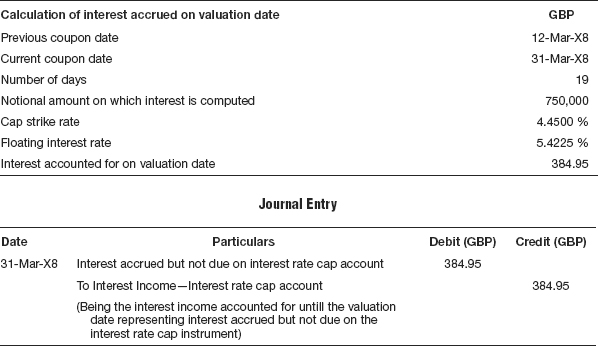

T-6 On valuation of interest rate cap as on date:

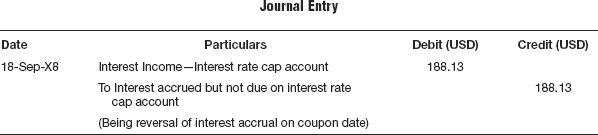

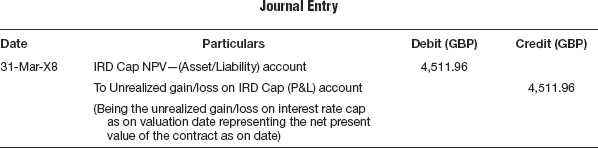

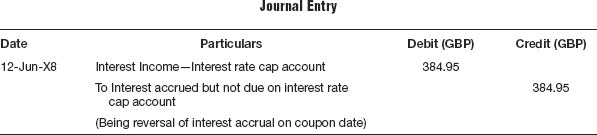

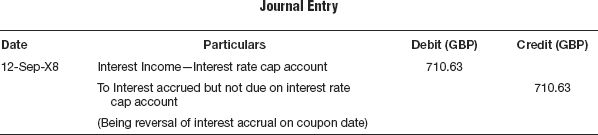

T-7 On reversal of interest accrual on coupon date:

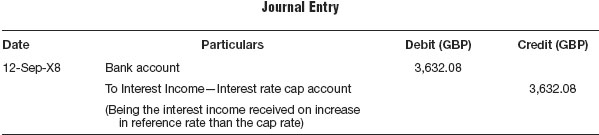

T-8 On accounting for interest income on interest rate cap:

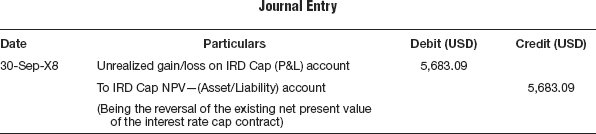

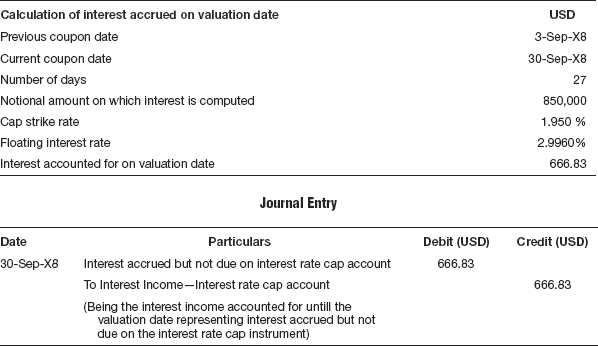

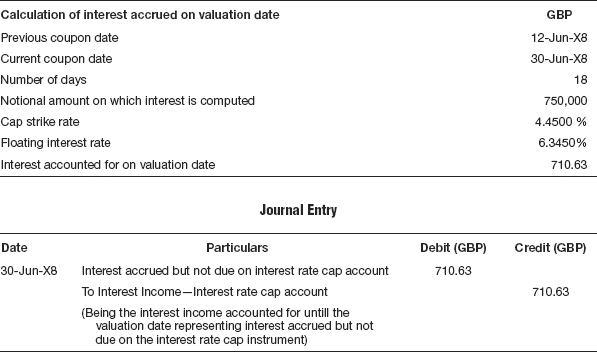

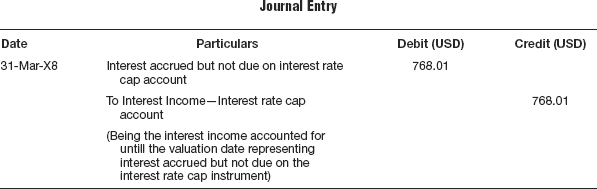

T-9 On reversal of net present value of interest rate cap contract:

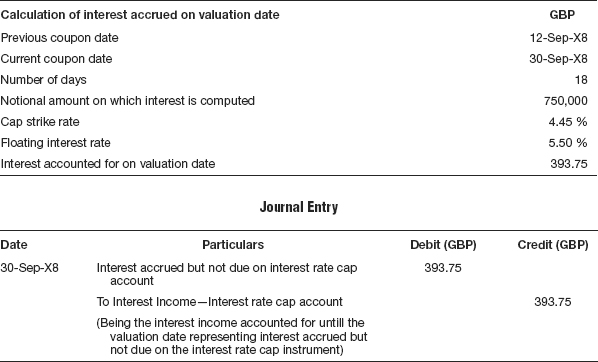

T-10 On accounting of interest accrued on valuation date:

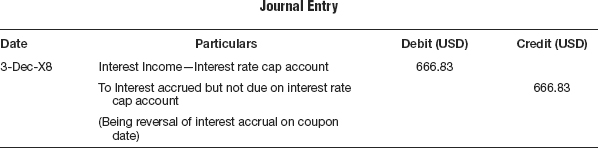

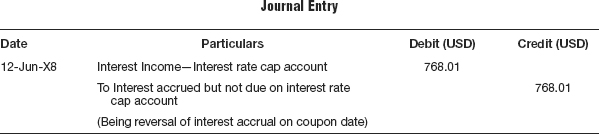

T-11 On valuation of interest rate cap as on date:

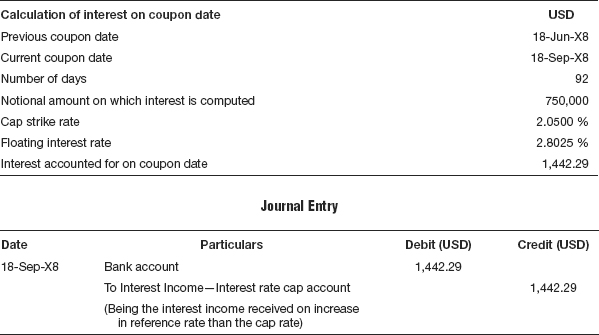

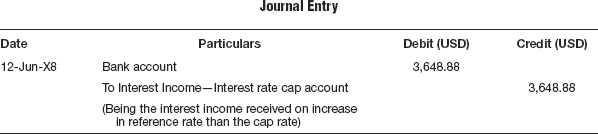

T-12 On reversal of interest accrual on coupon date:

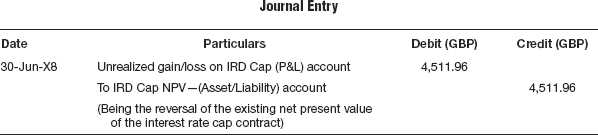

T-13 On accounting for interest income on interest rate cap:

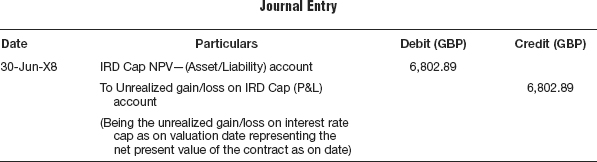

T-14 On reversal of net present value of interest rate cap contract:

T-15 On accounting of interest accrued on valuation date:

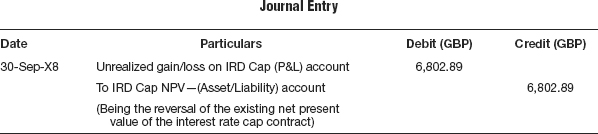

T-16 On valuation of interest rate cap as on date:

T-17 On reversal of interest accrual on coupon date:

T-18 On accounting for interest income on termination:

T-19 On reversal existing net present value on maturity:

T-20 On reversal of the contingent entry on maturity:

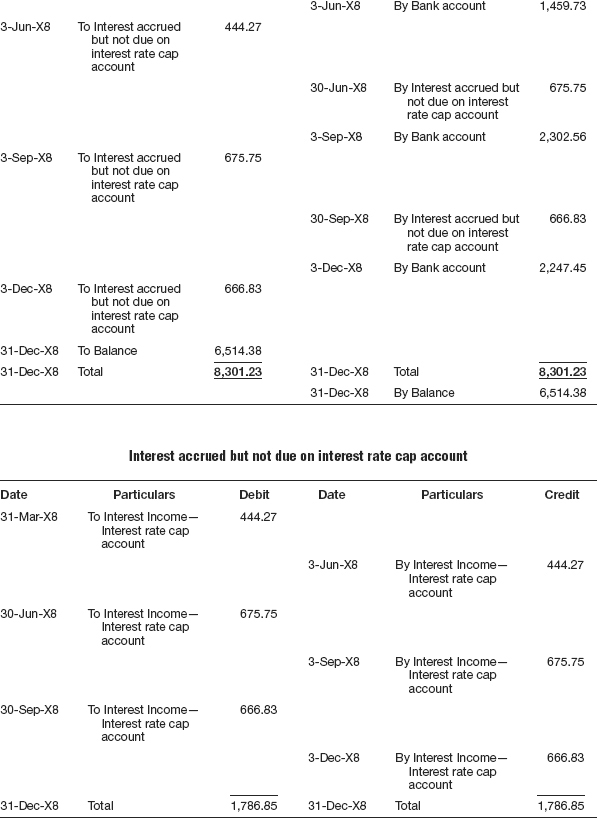

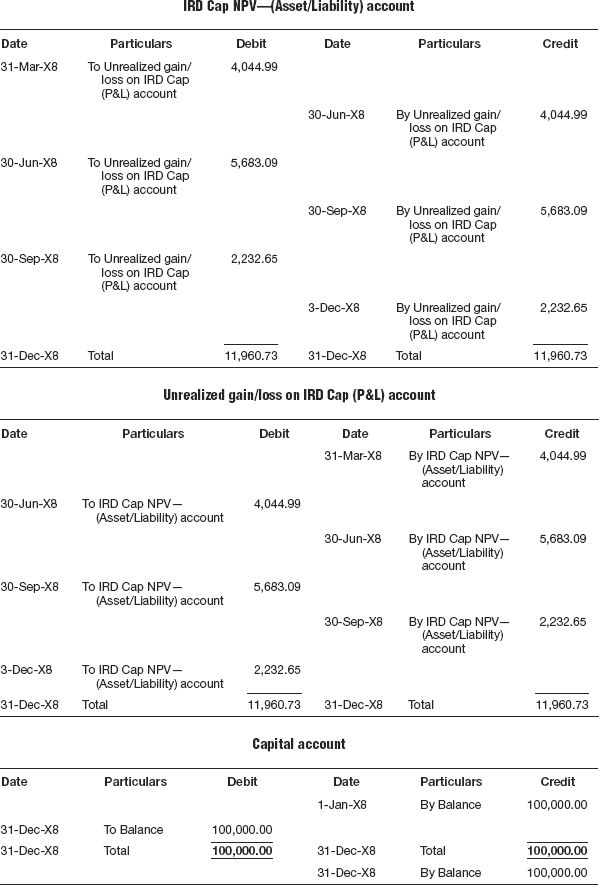

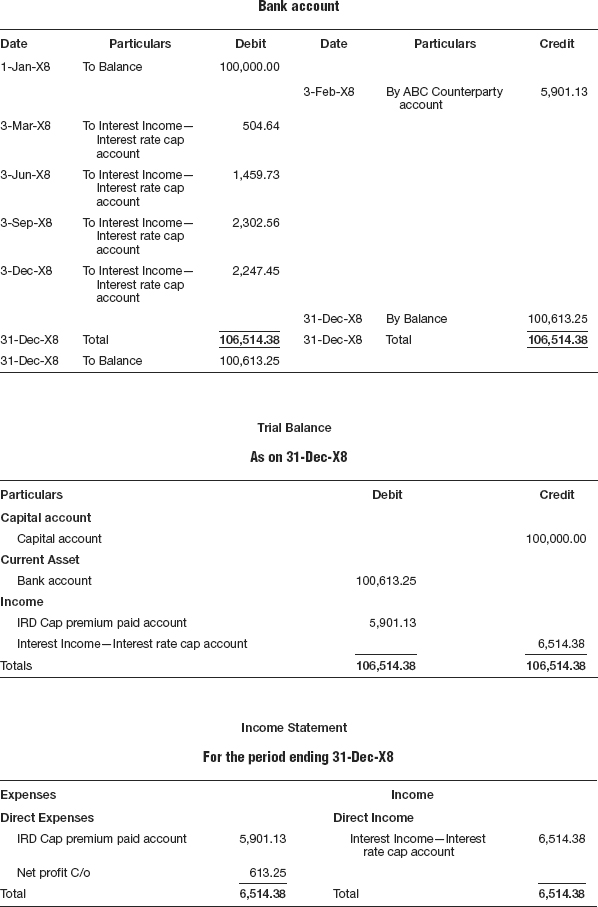

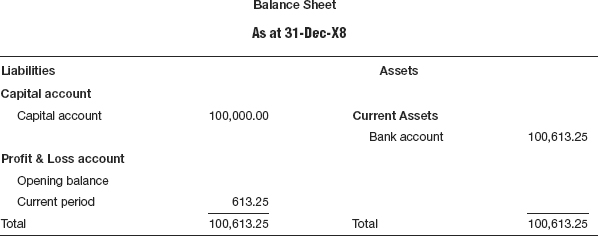

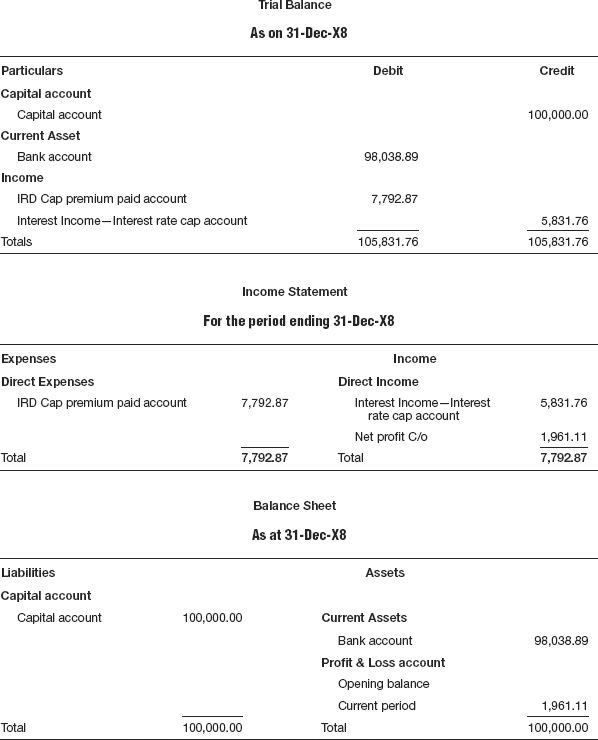

PROBLEM 4: INTEREST RATE CAP—RECEIVE

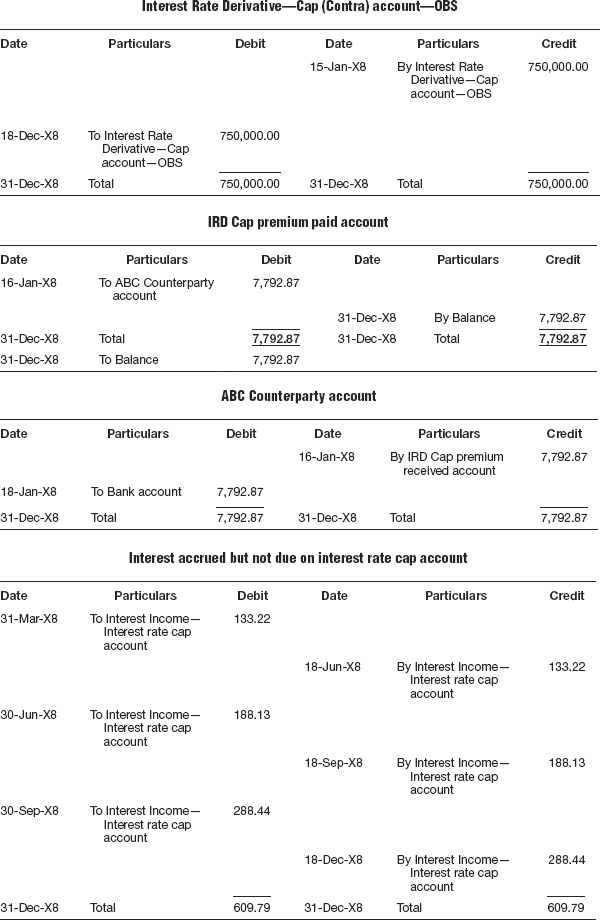

SOLUTION TO PROBLEM 4: INTEREST RATE CAP—RECEIVE

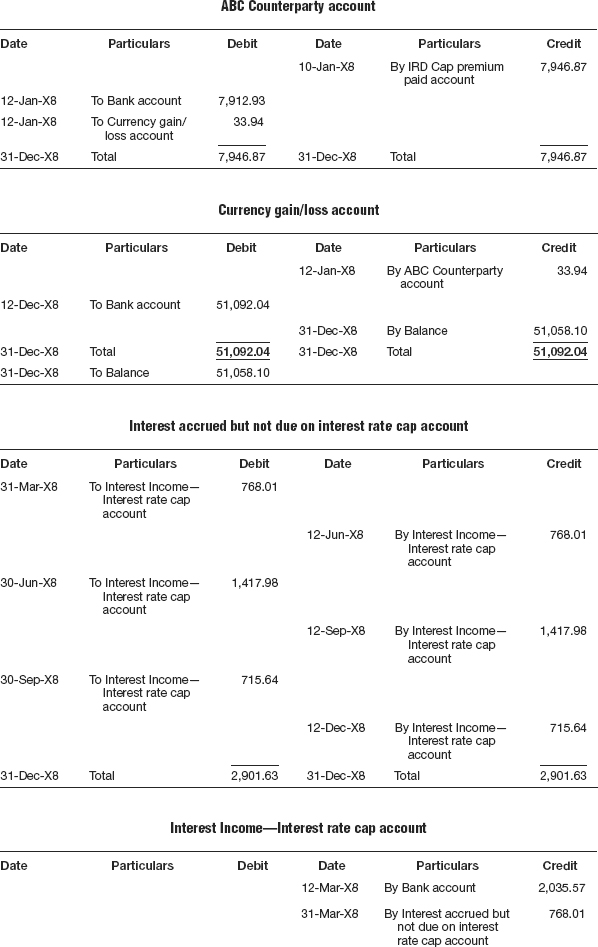

T-1 On purchase of interest rate cap trade:

T-2 On accounting for premium on interest rate cap trade:

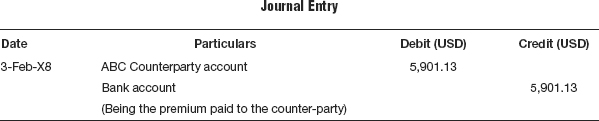

T-3 On accounting for premium paid:

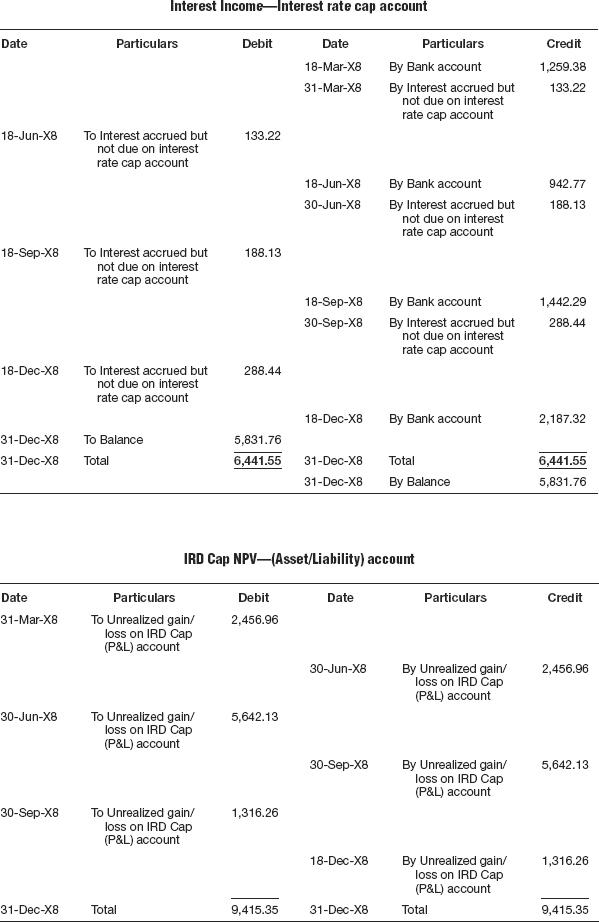

T-4 On accounting for interest income on interest rate cap:

T-5 On accounting of interest accrued on valuation date:

T-6 On valuation of interest rate cap as on date:

T-7 On reversal of interest accrual on coupon date:

T-8 On accounting for interest income on interest rate cap:

T-9 On accounting of interest accrued on valuation date:

T-10 On reversal of net present value of interest rate cap contract:

T-11 On valuation of interest rate cap as on date:

T-12 On reversal of interest accrual on coupon date:

T-13 On accounting for interest income on interest rate cap:

T-14 On accounting of interest accrued on valuation date:

T-15 On reversal of net present value of interest rate cap contract:

T-16 On valuation of interest rate cap as on date:

T-17 On reversal of interest accrual on coupon date:

T-18 On accounting for interest income on interest rate cap:

T-19 On reversal existing net present value on termination:

T-20 On reversal of the contingent entry on maturity:

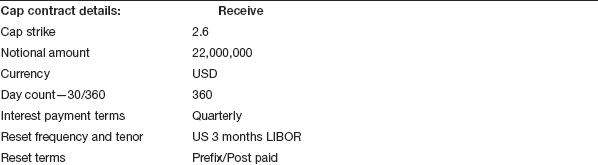

PROBLEM 5: INTEREST RATE CAP—RECEIVE

SOLUTION TO PROBLEM 5: INTEREST RATE CAP—RECEIVE

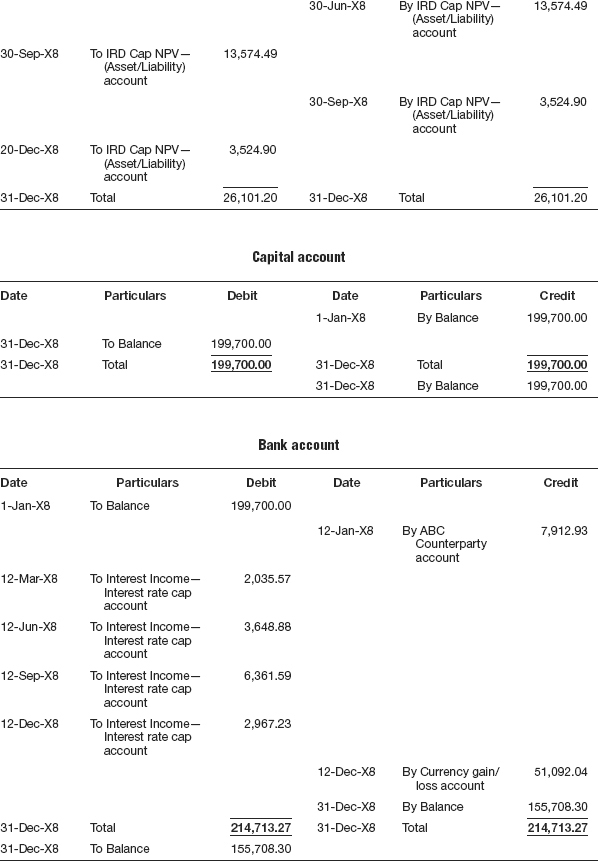

T-1 On purchase of interest rate cap trade:

T-2 On accounting for premium on purchase of interest rate cap trade:

T-3 On accounting for premium paid:

T-4 On accounting for interest income on interest rate cap:

T-5 On accounting of interest accrued on valuation date:

T-6 On valuation of interest rate cap as on date:

T-7 On reversal of interest accrual on coupon date:

T-8 On accounting for interest income on interest rate cap:

T-9 On accounting of interest accrued on valuation date:

T-10 On reversal of existing net present value of interest rate cap on the next valuation date:

T-11 On valuation of interest rate cap as on date:

T-12 On reversal of interest accrual on coupon date:

T-13 On accounting for interest income on interest rate cap:

T-14 On accounting of interest accrued on valuation date:

T-15 On reversal of existing net present value of interest rate cap on the next valuation date:

T-16 On valuation of interest rate cap as on date:

T-17 On reversal of interest accrual on coupon date:

T-18 On accounting for interest income on interest rate cap:

T-19 On reversal of existing net present value of interest rate cap on the next valuation date:

T-20 On reversal of the contingent entry on maturity:

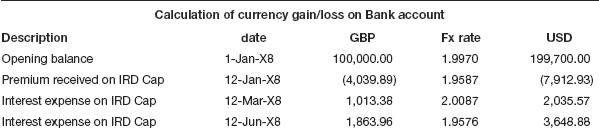

ACCOUNTING ENTRIES IN FUNCTIONAL CURRENCY

F-1 On purchase of interest rate cap trade: (T-1 @ FX Rate: 1.9738)

F-2 On accounting for premium on the interest rate cap contract: (T-2 @ FX Rate: 1.9671)

F-3 On accounting for premium paid: (T-3 @ FX Rate: 1.9587)

F-4 FX gain/loss:

F-5 On accounting for interest income on interest rate cap: (T-4 @ FX Rate: 2.0087)

F-6 On accounting of interest accrued on valuation date: (T-5 @ FX Rate: 1.9951)

F-7 On valuation of interest rate cap as on date: (T-6 @ FX Rate: 1.9951)

F-8 On reversal of interest accrual on coupon date: (T-7 @ FX Rate: 1.9951)

F-9 On accounting for interest income on interest rate cap: (T-8 @ FX Rate: 1.9576)

F-10 On accounting of interest accrued on valuation date: (T-9 @ FX Rate: 1.9954)

F-11 On reversal of existing net present value of interest rate cap on the next valuation date: (T-10 @ FX Rate: 1.9951)

F-12 On valuation of interest rate cap as on date: (T-11 @ FX Rate: 1.9954)

F-13 On reversal of interest accrual on coupon date: (T-12 @ FX Rate: 1.99541)

F-14 On accounting for interest income on interest rate cap: (T-13 @ FX Rate: 1.7515)

F-15 On accounting of interest accrued on valuation date: (T-14 @ FX Rate: 1.8175)

F-16 On reversal of existing net present value of interest rate cap on the next valuation date: (T-15 @ FX Rate: 1.9954)

F-17 On valuation of interest rate cap as on date: (T-16 @ FX Rate: 1.8175)

F-18 On reversal of interest accrual on coupon date: (T-17 @ FX Rate: 1.81750)

F-19 On accounting for interest income on interest rate cap: (T-18 @ FX Rate: 1.4906)

F-20 On reversal of existing net present value of interest rate cap on the next valuation date: (T-19 @ FX Rate: 1.8175)

F-21 On reversal of the contingent entry on maturity: (T-20 @ FX Rate: 1.97380)

F-22 FX gain/loss:

- An interest rate cap is a form of interest rate derivative. It is also an over-the-counter interest rate derivative instrument.

- An interest rate cap is an interest rate management tool for an entity wanting to cap the interest commitment on its debt. It serves as a protection against increases in interest rates by limiting the maximum interest rate payable on its debt.

- This maximum interest rate is known as the cap rate or strike rate. In exchange for the protection of the cap instrument, the entity pays a premium. This is paid as a one-off, up-front premium. If the reference interest rate rises above the cap rate then to that extent the seller of the contract would compensate the buyer.

- Interest rate caps are of two types—the first type being “to pay.” This means that for receiving an agreed premium, the buyer of this type of instrument agrees to compensate the seller of the instrument on the pay date any interest over and above the cap rate, if the benchmark interest rate is above the cap rate on the reset date.

- The premium is computed like any other option premium based on some mathematical model that takes into account several factors including the strike rate (cap rate), the present benchmark interest rate, the historical volatility of interest rates, the time period of the contract, amongst other factors.

- The second type of interest rate cap is known as “to receive.” This means that for paying an agreed premium, the seller of this type of instrument agrees to compensate the buyer of the instrument on the pay date any interest over and above the cap rate, if the benchmark interest rate is above the cap rate on the reset date.

- Caps provide the entity with protection against unfavorable interest rate movements above the strike rate, while allowing the entity to participate in favorable interest rate movements by paying a small premium.

- For the buyer of the cap instrument there are no risks associated with this instrument other than the counter-party risk.

- The premium is not refundable by the seller of the contract and is a sunk cost as in any other option contract, including situations where the reference rate never exceeds the strike rate and no interest payments are ever made under the cap contract.

- Being a derivative instrument, an interest rate cap per se qualifies as a hedging instrument. It should be noted that in an interest rate cap, the risk reward is asymmetric and can be more or less compared to an equity options position. An interest rate cap instrument can be used primarily to hedge interest rate risk.

- A to pay interest rate cap is like a written option contract where a premium is received and hence cannot be designated as a hedging instrument. A written option cannot be designated as a hedging instrument because the potential loss on an option that an entity writes could be significantly greater than the potential gain in value of a related hedged item.

- A to receive interest rate cap is like a purchased option contract where a premium is paid to get protection from the rising interest rate and as such can be designated as a hedging instrument.

Theory questions

1. What is meant by a cap on an interest rate contract?

2. Can an interest rate cap contract be terminated before maturity? If so how will the termination fees be arrived at?

3. When does an interest rate cap become “in the money” and when does it become “out of the money”?

4. What are the two types of interest rate cap contracts? Which type of contract gives the buyer protection from an interest rate hike?

5. What are the significant events in the trade life cycle of an interest rate cap contract?

6. What are the benefits of an interest rate cap contract?

7. What are the risks associated with an interest rate cap contract?

Objective questions

1. Caps provide the entity with protection against _______ interest rate movements above the strike rate.

a) Favorable

b) Unfavorable

c) Comfortable

d) None of the above

2. In an interest rate cap contract, the amount of premium payable is determined by:

a) Interest rate volatility

b) Market rate of interest

c) Strike rate

d) All of the above

3. An interest rate cap may be used as a form of ___________ interest rate protection tool in times of uncertainty.

a) Long-term

b) Short-term

c) Medium-term

d) None of the above

4. The cost is ________ to the premium paid and theoretically like any other option contract the upward potential is ___________.

a) Limited/unlimited

b) Maximum/minimum

c) Lower/higher

d) None of the above

5. In a cap, the premium is not _______ by the seller of the contract in any circumstances.

a) Non-Refundable

b) Refundable

c) Payable

d) None of the above

6. The interest rate cap agreement is based on making a payment to the buyer of the contract when the ________ exceeds the specified cap rate on the notional amount of the contract.

a) Strike rate

b) Reference rate

c) Reset rate

d) None of the above

7. To calculate the cap premium several factors are considered, including:

a) Exchange volatility

b) Market volatility

c) Interest volatility

d) None of the above

8. Caps can be cancelled any time before the _____.

a) Settlement date

b) Trade date

c) Maturity date

d) None of the above

Journal questions

1. Interest rate cap—pay

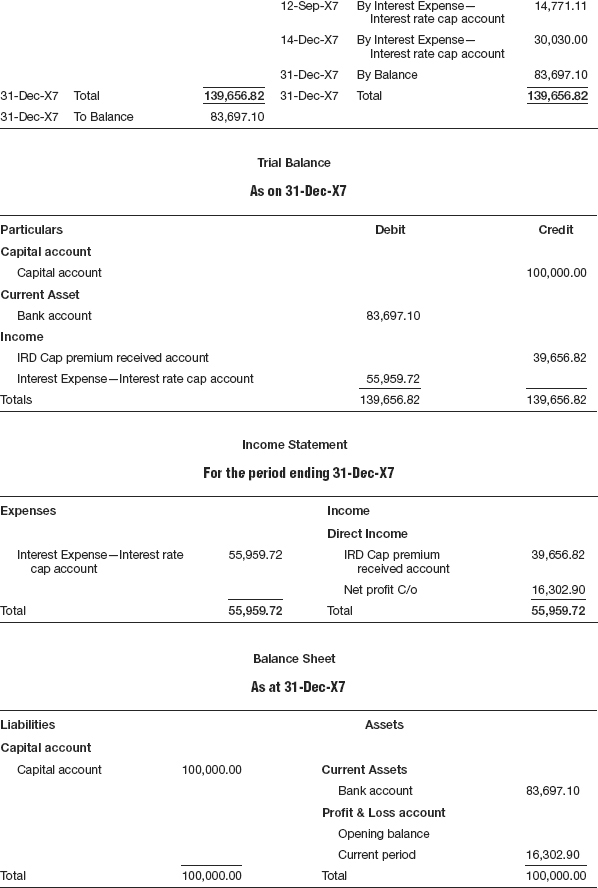

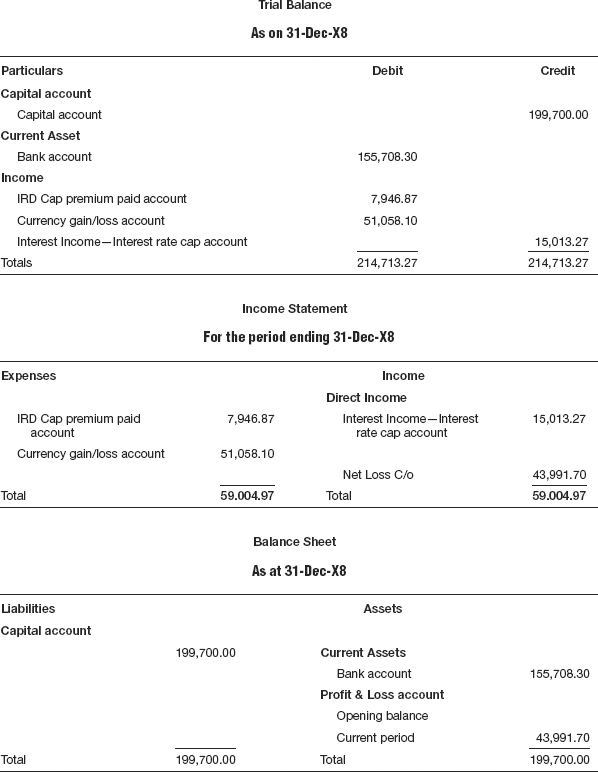

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

2. Interest rate cap—pay

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

3. Interest rate cap—receive

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

4. Interest rate cap—receive

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.