CHAPTER 11

Interest Rate Collar

After studying this chapter you will be able to get a grasp of the following:

- Meaning of interest rate collar

- Benefits and risks of interest rate collar

- Accounting for interest rate collar

- Trade life cycle of interest rate collar

- Accounting journal entries to be recorded during the different phases of the trade life cycle

- Illustration of investments in interest rate collar

- Meaning of interest rate reverse collar

- Accounting for interest rate reverse collar

- Accounting journal entries to be recorded during the different phases of the trade life cycle

- Illustration of investments in interest rate reverse collar

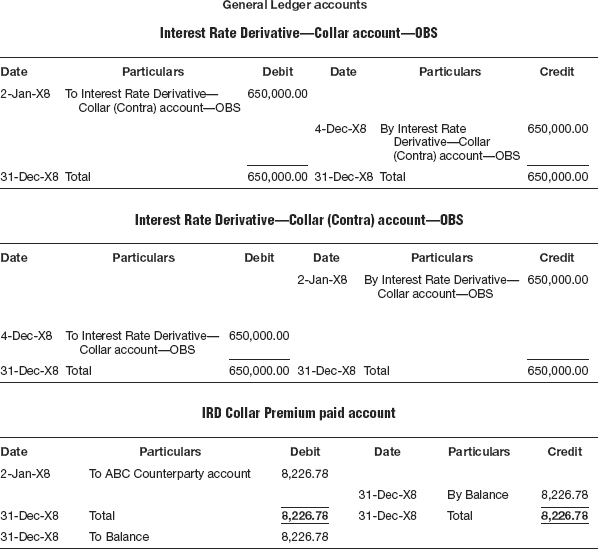

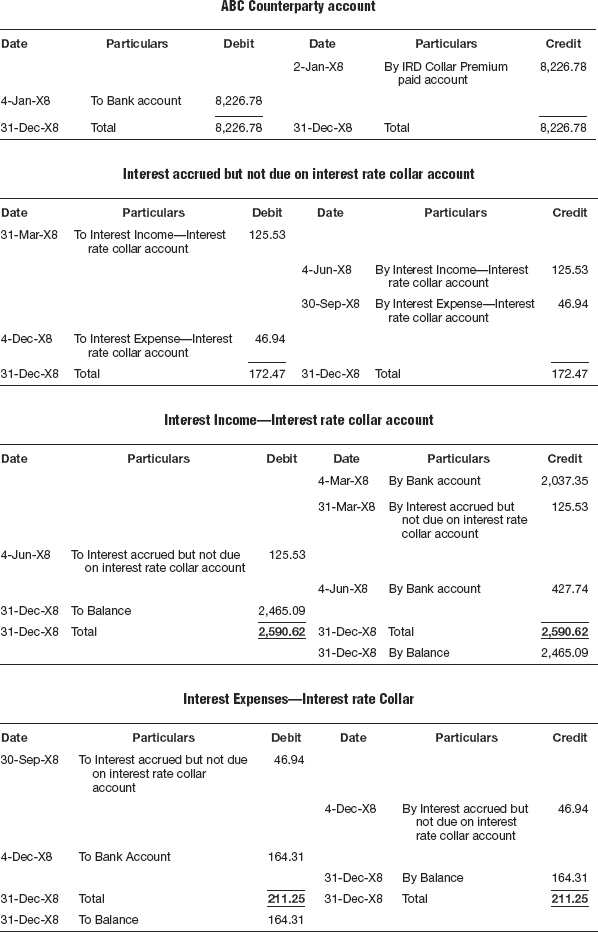

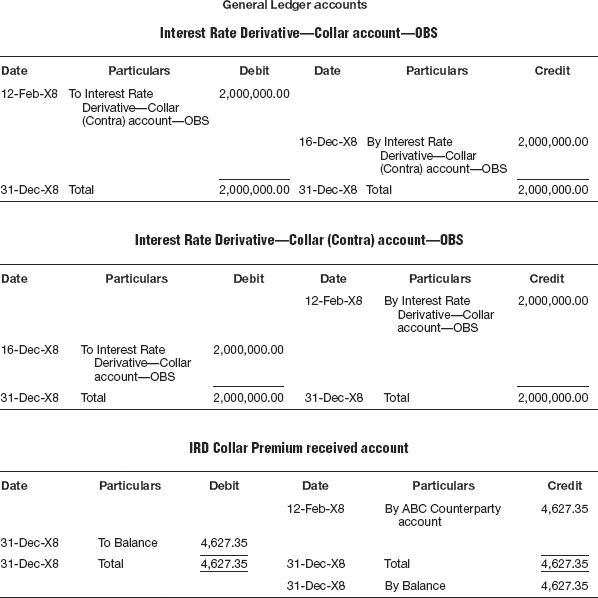

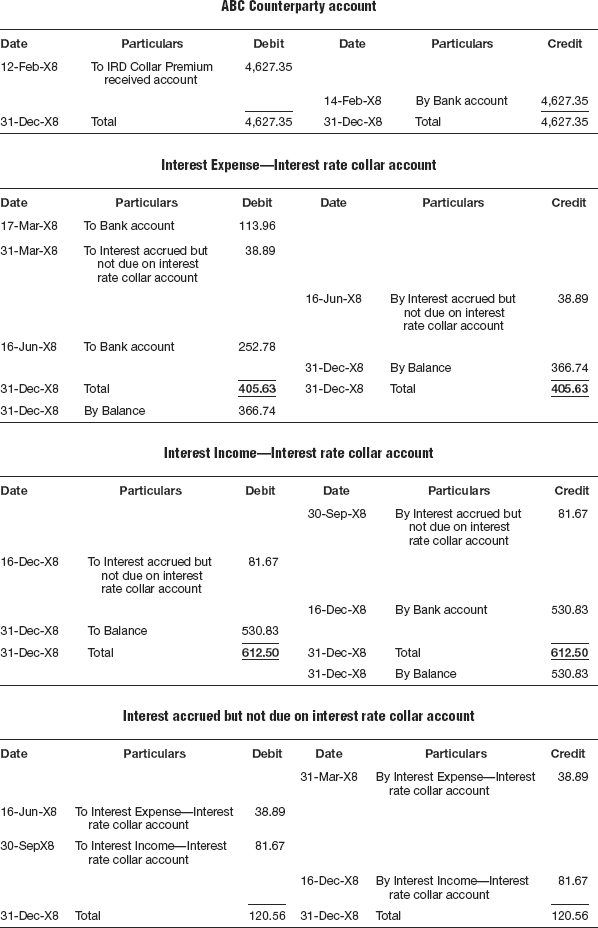

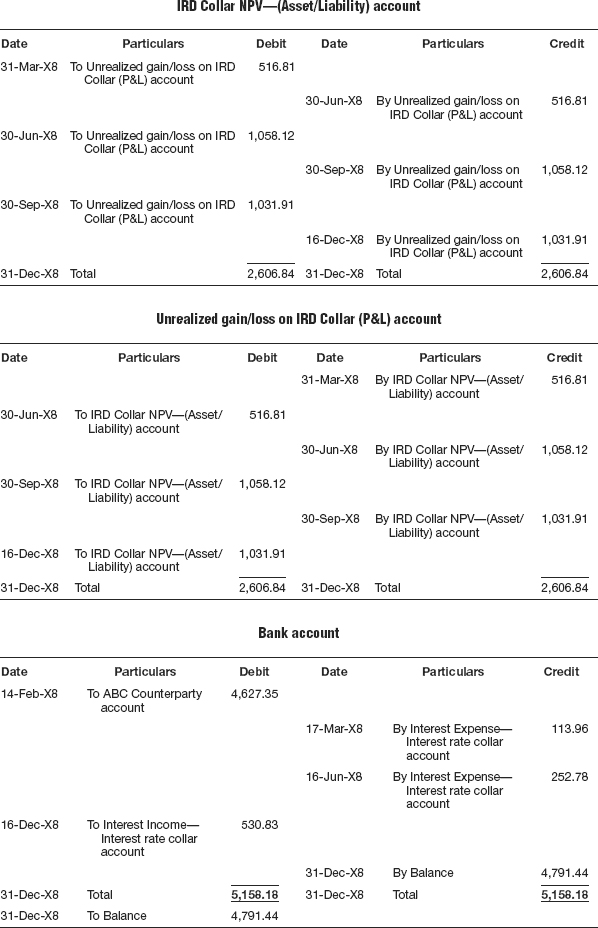

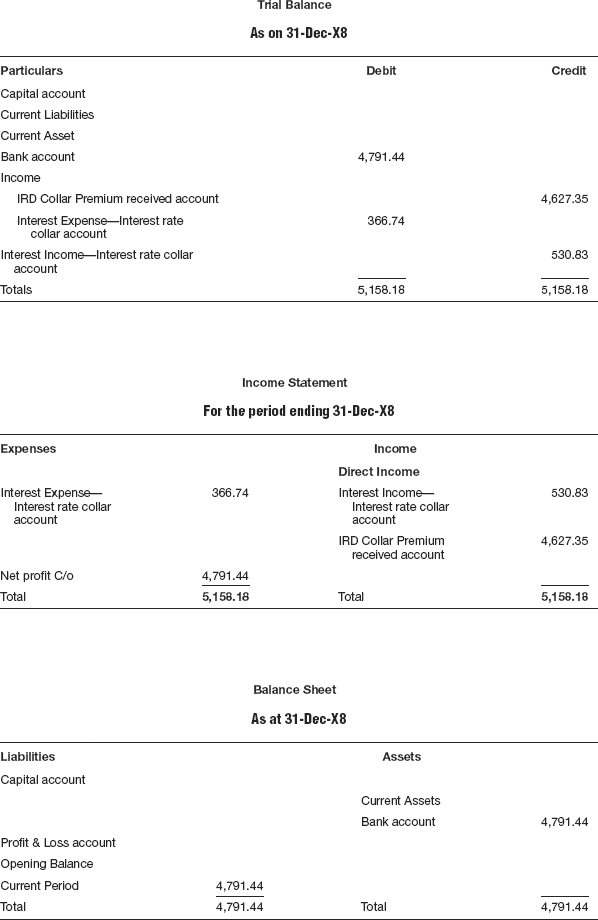

- Preparation of general ledger accounts

- Preparation of income statement, balance sheet after the investments in interest rate collar and reverse collar are made

- FX revaluation and FX translation process

- Functional currency, foreign currency and presentation currency

MEANING OF INTEREST RATE COLLAR

An interest rate collar is an instrument that combines both a cap and a floor. The cap component of the instrument gives the investor protection against rising rates by guaranteeing that the investor will never pay above a pre-agreed rate. The floor component of the collar allows the investor to take advantage of the falling interest rates until the interest rate hits a predetermined rate known as floor rate. A collar effectively creates an interest rate range with an upper and lower limit and depending upon where the cap and floor levels are set, will reduce or eliminate the requirement for a premium.

In other words, an interest rate collar protects the investor against increases in interest rates beyond a predetermined level known as the cap rate, while still allowing the investor to take advantage of falling interest rates down to a predetermined level, known as the floor rate. The investor, however, is exposed to a further fall in the interest rates below the floor rate. In a nutshell, an interest rate collar is equivalent to that of buying a cap and selling a floor.

The term collar comes from the fact that the entity’s interest cost will never be lower than the floor level and will never be greater than the cap level. Interest rate collars are a popular way of managing the interest risk of any entity having a huge debt burden.

Benefits of an interest rate collar instrument

- Since an interest rate collar includes the buying of a cap instrument, all the benefits of a cap instrument are applicable for this instrument. Caps provide the entity with protection against unfavorable interest rate movements above the strike rate. Cap contracts are flexible as they are over-the-counter products and are customized to suit the requirements of the parties to the trade. The strike rate can be positioned to reflect the level of protection sought by the buyer or willing to be written by the seller.

- The term of the collar is also flexible and can be customized to match the term of the underlying liability to be protected.

- The amount of premium is determined by the strike rate, the current reference rate of interest, and volatility of interest rates. While a premium is payable on the cap component of the collar, a premium is also receivable on the floor component of the same instrument. An investor can fix the cap and floor strike rates in such a way that the overall premium is minimized, or even reduced to zero in some cases.

Risk on collar instrument

- The investor will not benefit from a fall in rates below the pre-fixed floor rate. In fact, a fall in the rates below the floor rate forces the investor to compensate the counterparty to that extent.

- Unwinding the collar during its lifetime involves termination fees depending on the then prevailing market rates.

- The investor will still be exposed to interest rate movements if the term of the collar is shorter than that of the underling facility.

COLLAR OR REVERSE COLLAR AS A HEDGING INSTRUMENT

A written option cannot be designated as a hedging instrument because the potential loss on an option that an entity writes could be significantly greater than the potential gain in value of a related hedged item. In this background can an interest rate collar or a reverse collar be designated as a hedging instrument? A collar as mentioned above contains both a purchased option (cap) and a written option (floor). A reverse collar also contains both a purchased option (floor) and a written option (cap). So, depending upon the movement of the interest rate over the life of the contract, the entity may either have to receive interest or pay interest. Or in other words, the net present value of the instrument may oscillate between a positive and negative number theoretically. Hence the question whether a collar can be designated as a hedging instrument.

This question has been considered by both US GAAP and IFRS, the answer being the following.

An interest rate collar or other derivative instrument that includes a written option cannot be designated as a hedging instrument if it is a net written option, because the standard precludes the use of a written option as a hedging instrument unless it is designated as an offset to a purchased option. However, an interest rate collar or other derivative instrument that includes a written option may be designated as a hedging instrument if the combination is a net purchased option or zero cost collar.

To the question as to what factors indicate that an interest rate collar or other derivative instrument that combines a written option component and a purchased option component is not a net written option, the answer is very clearly given as follows.

The following factors taken together suggest that an interest rate collar or other derivative instrument that includes a written option is not a net written option.

No net premium is received either at inception or over the life of the combination of options. The distinguishing feature of a written option is the receipt of a premium to compensate the writer for the risk incurred.

Except for the strike prices, the critical terms and conditions of the written option component and the purchased option component are the same (including underlying variable or variables, currency denomination and maturity date). Also, the notional amount of the written option component is not greater than the notional amount of the purchased option component.

Obviously in the case of an interest rate collar, the notional amount, currency and the maturity are one and the same. Hence, the collar will qualify as a hedging instrument if the net present value of the instrument stays positive throughout the life of the contract and not merely at the inception of the contract. This condition will ensure that the entity will never lose on account of the hedging instrument but always has the potential to gain, which is the intention of the standard.

ACCOUNTING FOR INTEREST RATE COLLAR

In this chapter we will cover the accounting requirements for investments in interest rate swaps, as shown in Table 11.1.

Table 11.1 Relevant accounting standards

| US GAAP Topics | IFRS |

| 220—Comprehensive Income | IFRS 7—Financial Instruments: Disclosure |

| 815—Derivatives and Hedging | IFRS 9—Financial Instruments |

| 820—Fair Value Measurements and Disclosures | IAS 21—The Effects of Changes in Foreign Exchange Rates |

| 825—Financial Instruments | IAS 32—Financial Instruments: Presentation |

| 830—Foreign Currency Matters | IAS 39—Financial Instruments: Recognition and Measurement |

| 946—Financial Services—Investment Companies |

THE TRADE LIFE CYCLE FOR AN INTEREST RATE COLLAR

- Recording the trade—contingent

- Account for the premium if any on the trade

- Receive/pay the premium for the trade

- Reset the interest rate for the ensuing period

- Account for accrued interest if any on valuation date

- Reverse the accrued interest if any on coupon date

- Ascertain and account for the fair value on valuation date

- Pay/receive interest on the pay date

- Termination of the trade and accounting for termination fee

- Payment or receipt of termination fee

- Maturity of the trade

- Reversal of the contingent entry on termination or maturity

- FX revaluation entries (for foreign currency trades)

- FX translation entries (for foreign currency trades)

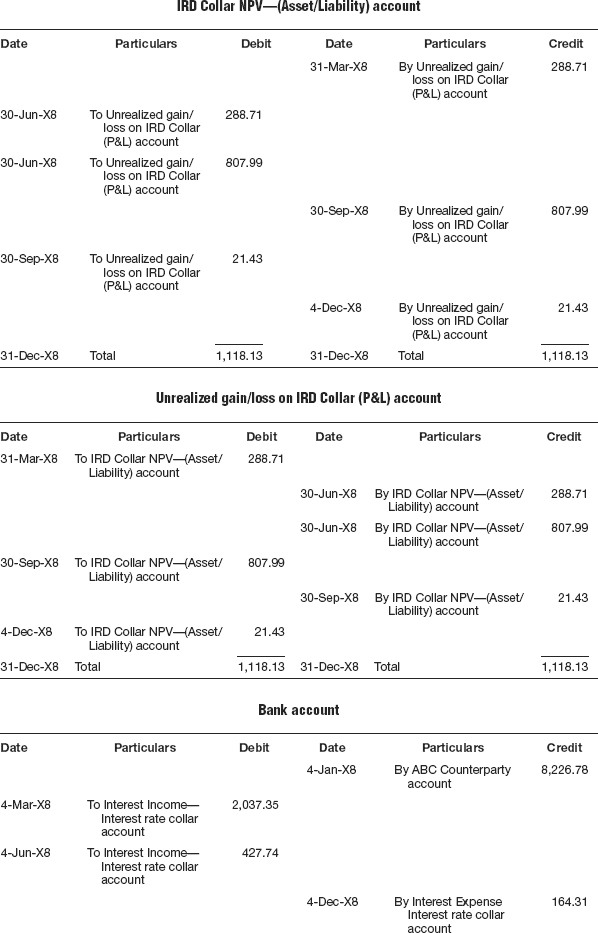

To understand the different events in the trade life cycle of an interest rate collar contract let us assume the following trade data as an illustration:

INTEREST RATE COLLAR INSTRUMENT—AN ILLUSTRATION

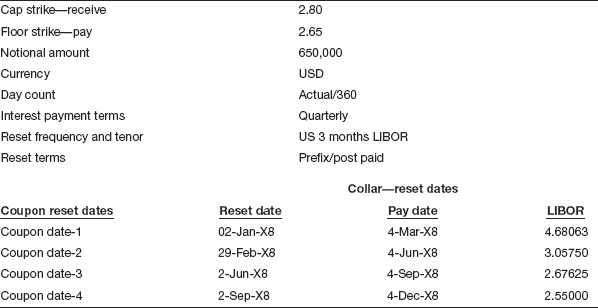

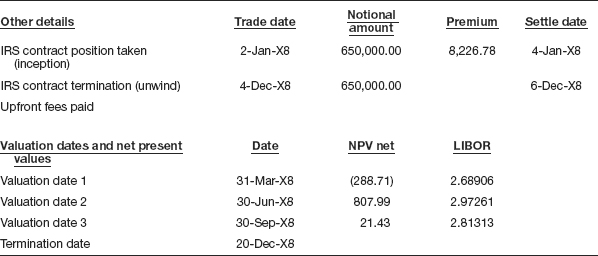

Tables 11.2 and 11.3 gives the details of interest rate collar instrument for the purpose of this illustration.

Table 11.2 Details of interest rate collar trade

Table 11.3 Other details for the interest rate collar trade

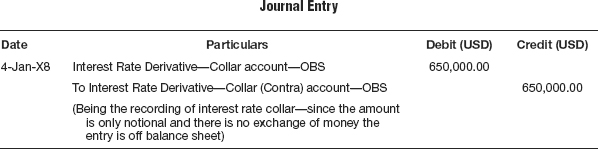

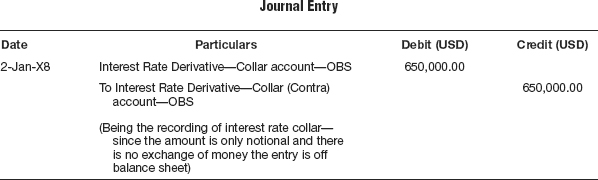

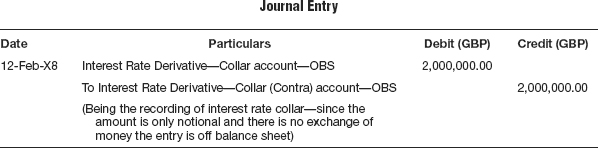

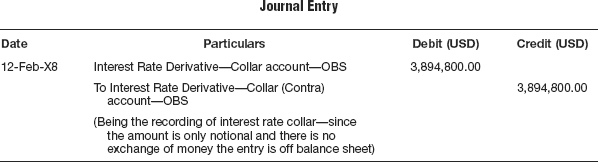

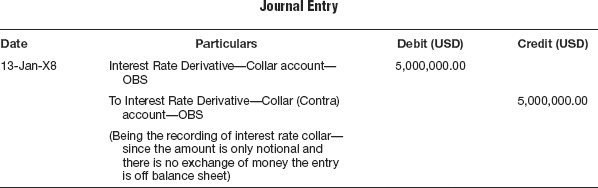

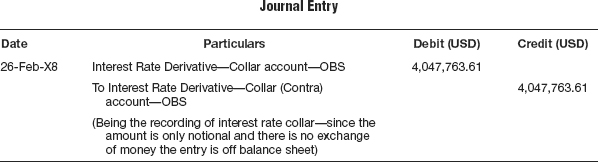

Recording the trade—contingent

This interest rate collar agreement is the simultaneous purchase of a cap and the sale of a floor for the same expiration, the length of the period and the contract’s notional amount. However, since this is just a notional amount and no physical exchange of money takes place, the off balance sheet entry to record the transaction is made in the book of accounts, as shown in Table 11.4.

Table 11.4 At the inception of the interest rate collar trade

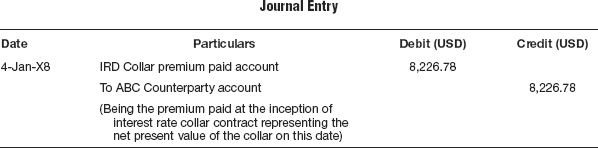

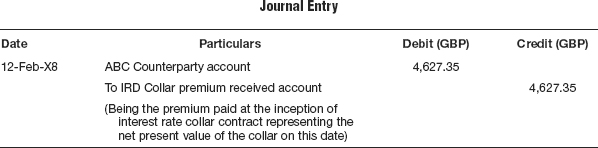

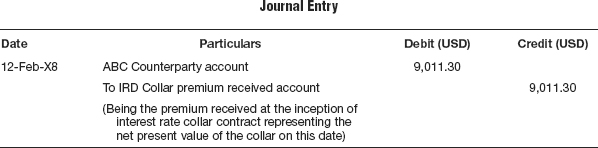

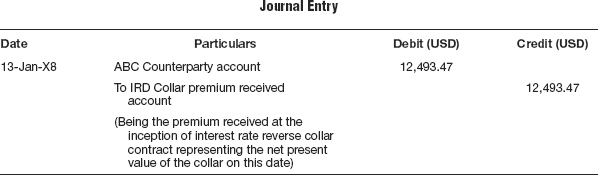

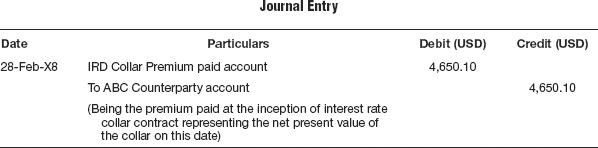

Account for the premium if any on the trade

The cost of the collar is referred to as the premium. The premium for an interest rate collar depends on the rate parameters sought as compared to current market interest rates. The net premium can be reduced to zero by choosing the strike rates that allow for the cap and floor premiums to be equal. The premium can also be in the negative, meaning that to take a collar position the buyer of the instrument may receive a premium from the seller.

The buyer of this contract pays a non-refundable premium to the seller of the collar. As for the cap component, if the interest rate rises above the cap rate the seller pays interest to the buyer. The premium is calculated at the time the cap is established on the basis of the cap rate, the reference interest rate, the notional amount, the maturity period, and market volatility of interest rates. The premium for an interest rate cap also depends on several other factors, as this type of contract is very similar to that of an option contract where the premium is based on the strike interest rate (cap rate), current interest rate, time to maturity of the contract, and volatility—both historical and implied. Similarly, for the floor component the buyer of a collar instrument has to make payment to the seller when the interest rate falls below the floor rate and for this protection, the buyer of the collar gets a premium. This floor premium goes towards reducing the cost of the collar as this is reduced from the cap premium. The instrument can be so structured that the net premium may well be zero, in which case there is no need to pay any premium at the inception of the collar contract. As mentioned before if the floor strike rate is near the market rates then it is likely the net premium may well turn out to be negative, enabling the buyer to receive a premium on buying the collar contract.

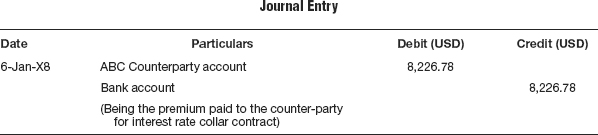

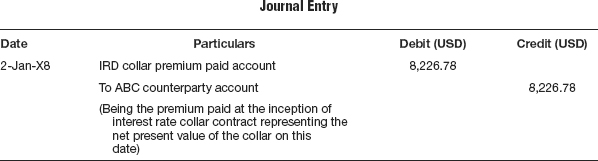

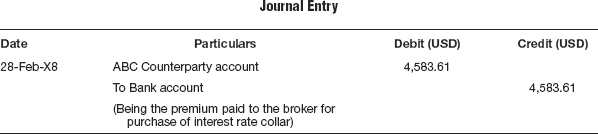

In this illustration, the entity should pay a net premium at inception of the trade amounting to $8,226.78 to buy the collar. The accounting entry for recording the same is as shown in Table 11.5.

Table 11.5 On accounting for IRD collar premium

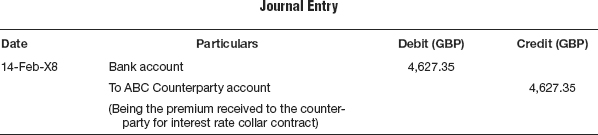

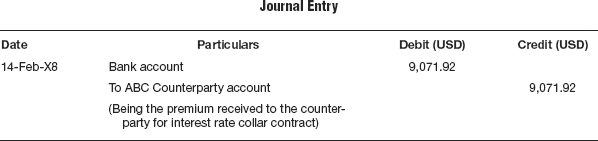

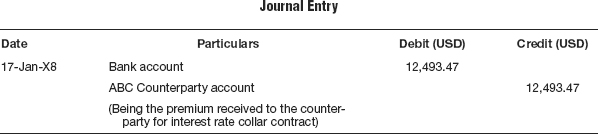

Receive/pay the premium for the trade

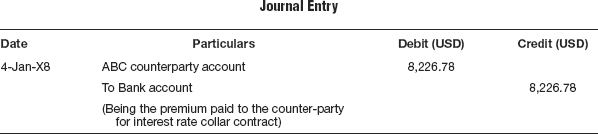

As mentioned in the previous paragraph an interest rate collar can also be structured in such a way that there is no premium for the product. This will be so when the premium on the cap component equals the premium receivable on the floor component. However, if there is any premium payable for this instrument, then such a premium must usually be paid or received within two business days of entering into the transaction. In this illustration the net premium of $8,226.78 will be paid on 6-Jan-X1 and the entry that is passed to record the transaction is as shown in Table 11.6.

Table 11.6 On payment of IRD collar premium

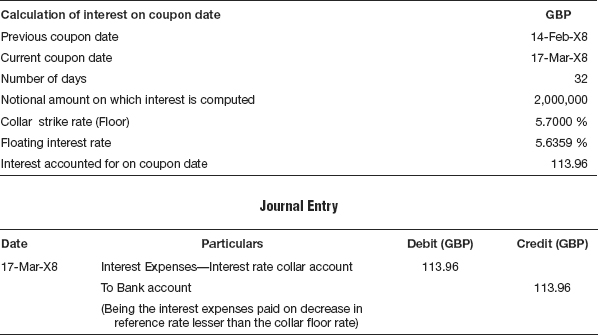

Reset the interest rate for the ensuing period

Interest reset dates are agreed upon between the counterparties at the inception of the trade. On the reset dates the reference rate is compared with the cap rate as well as the floor rate to determine if any interest is required to be paid at all by one party to the other. If the reference interest rate is above the cap rate then the interest is payable to the buyer of the collar contract. Similarly, if the reference interest rate is less than the floor rate then the buyer of the collar should pay interest to the seller on the pay date. Since only reset happens, no accounting entry is passed on this date.

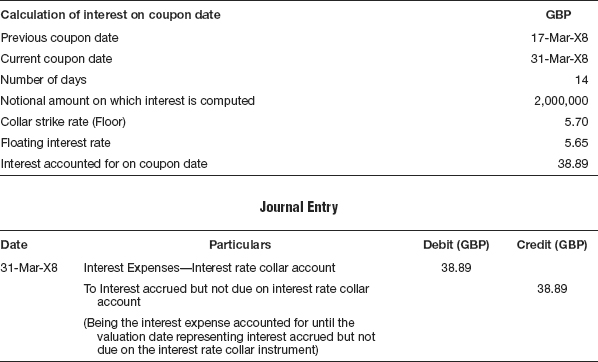

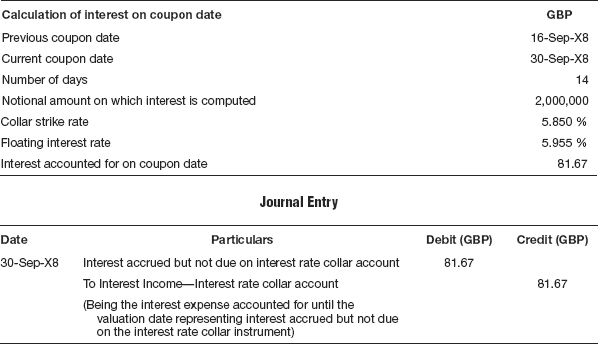

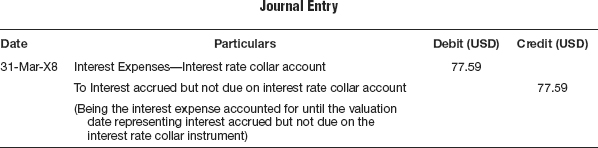

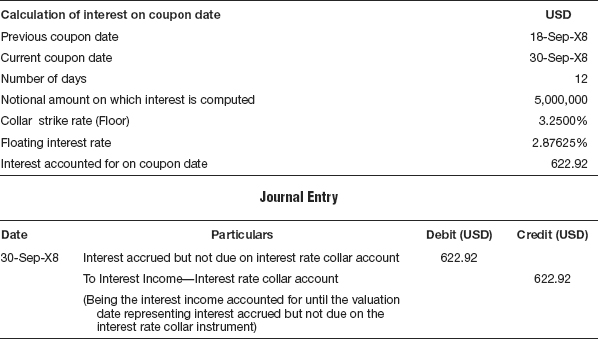

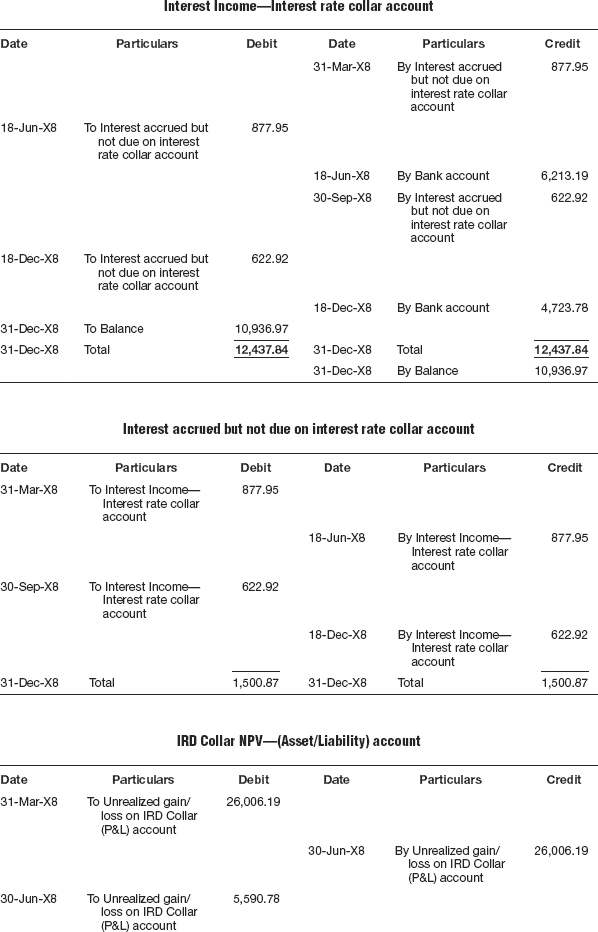

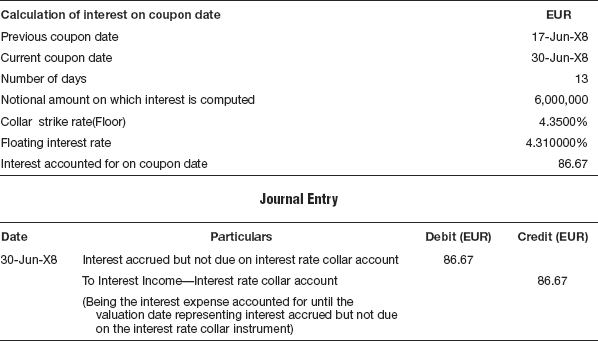

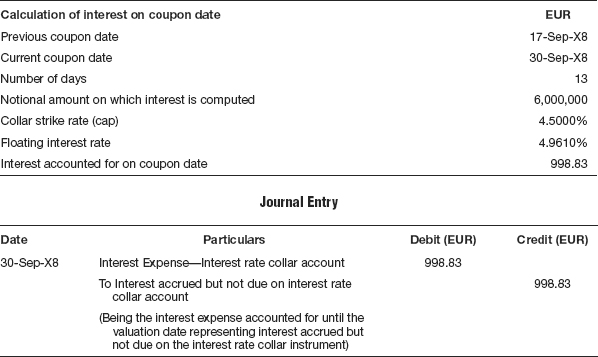

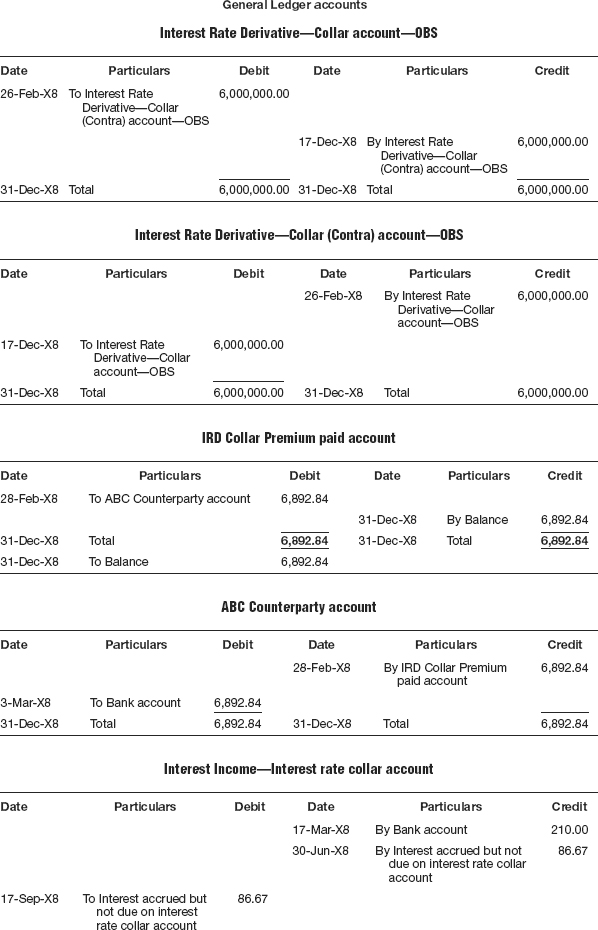

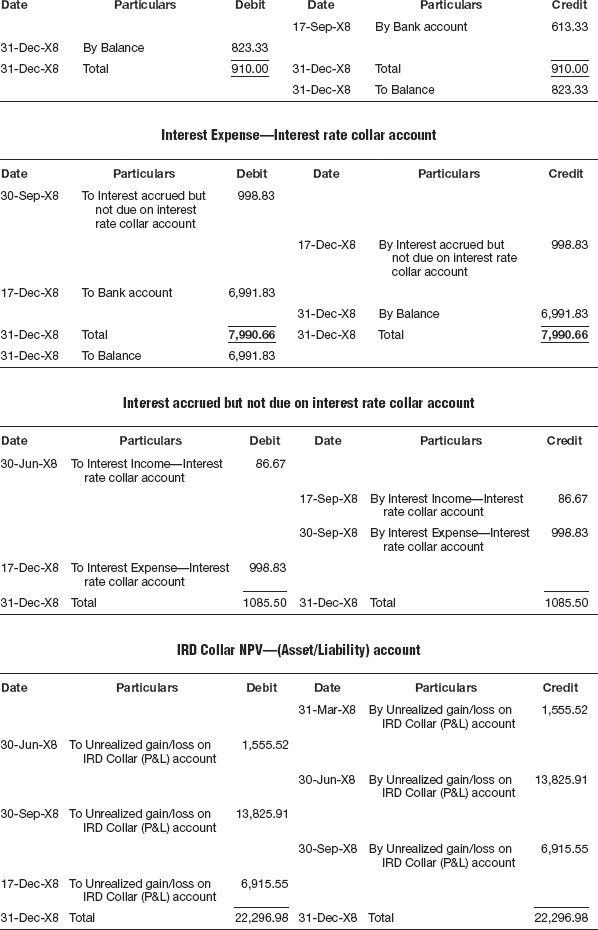

Account for the interest accrued—payable/receivable on collar on valuation date

If the reference interest rate is above the cap rate, then the buyer of the collar instrument should be compensated by the seller interest calculated as per the previous paragraphs. When it is ascertained on the reset date that the reference interest rate is above the cap rate and if the valuation date occurs before the pay date then interest accrued on such a collar instrument from the reset date to the valuation date should be computed and accounted for. This entry, however, will be reversed on the pay date when the actual interest calculated until the pay date from the reset date is accounted for.

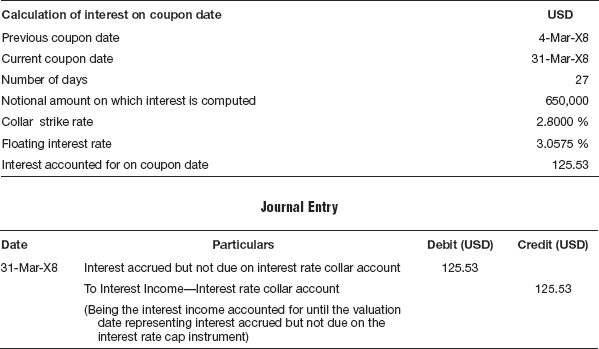

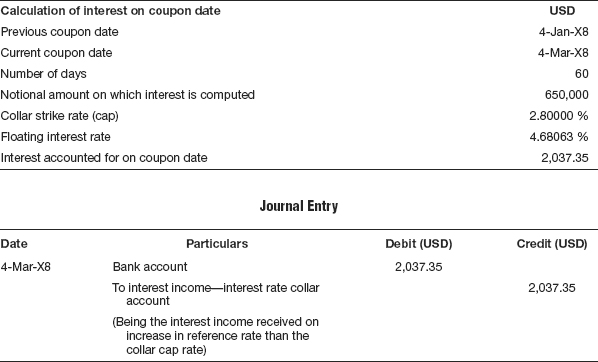

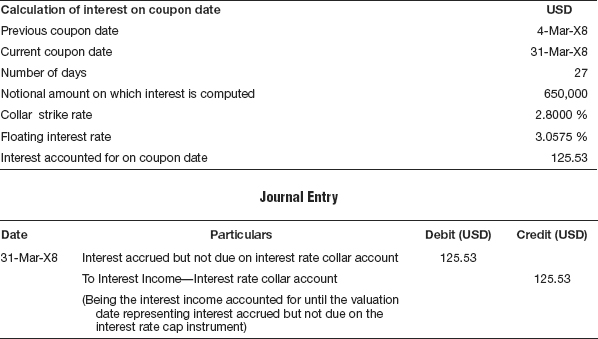

In this illustration, the cap strike rate is 2.8 percent and on the interest reset date the benchmark interest rate was 3.0575, resulting in the seller of the collar making payment to the buyer on the next pay date, viz. June 4th. Since interest is determined to be receivable, the accrued interest should be calculated on the valuation date and accounted for.

The entry for accounting the accrued interest receivable on the valuation date is as shown in Table 11.7.

Table 11.7 On accounting of interest accrued on valuation date

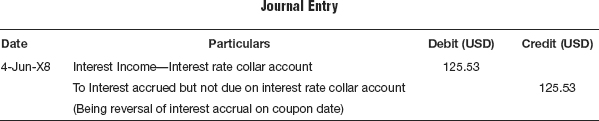

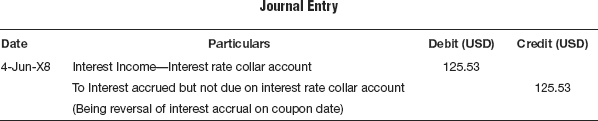

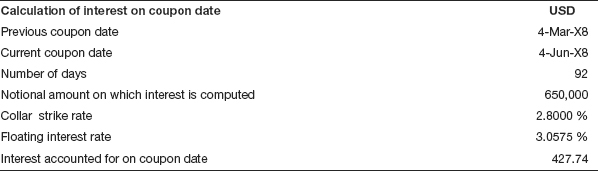

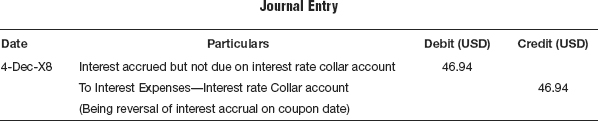

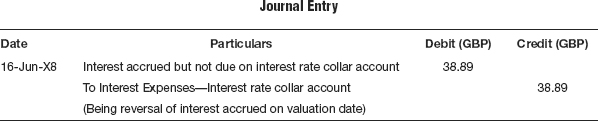

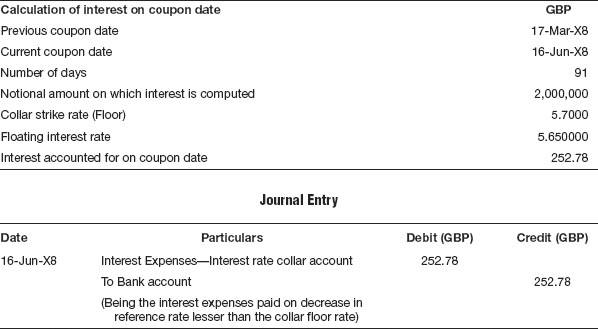

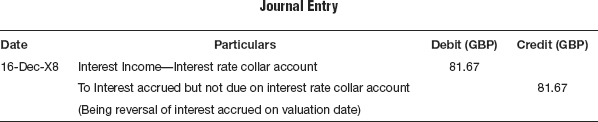

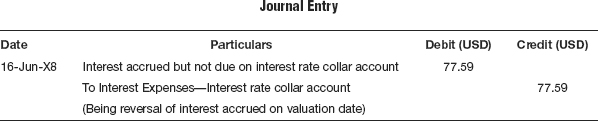

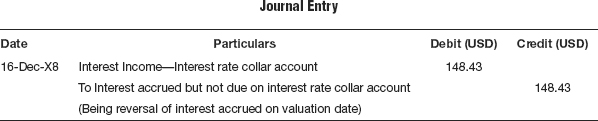

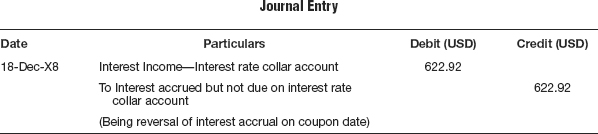

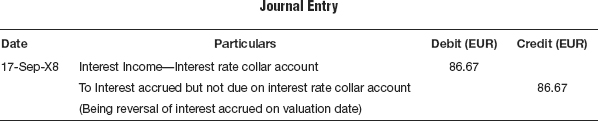

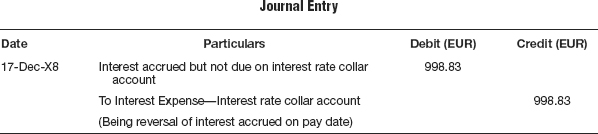

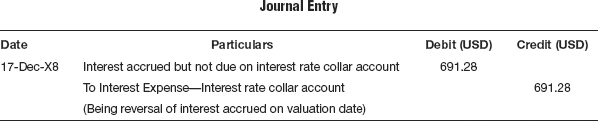

Reverse the accrued interest if any on the coupon date

The accrued interest entry for the interest rate collar contract recorded in the previous valuation date must be reversed on the next pay date, when the actual interest until the pay date will be accounted for. The next pay date subsequent to the valuation date falls on 4th June and on that date the following entry will be recorded in the book of accounts for reversal of accrued interest as given in Table 11.8.

Table 11.8 On reversal of interest accrual on coupon date

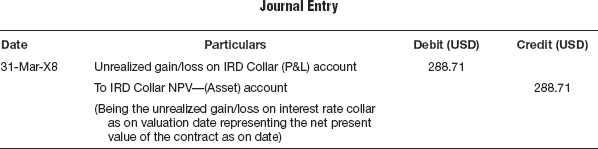

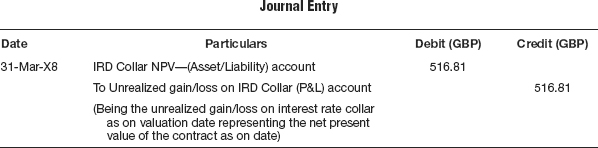

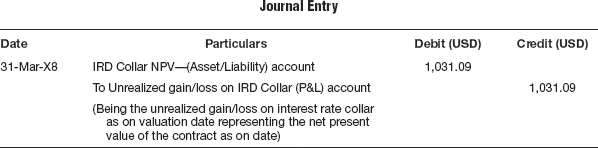

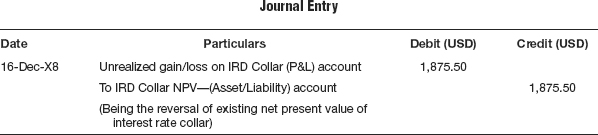

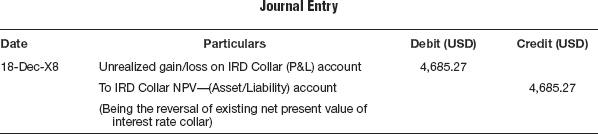

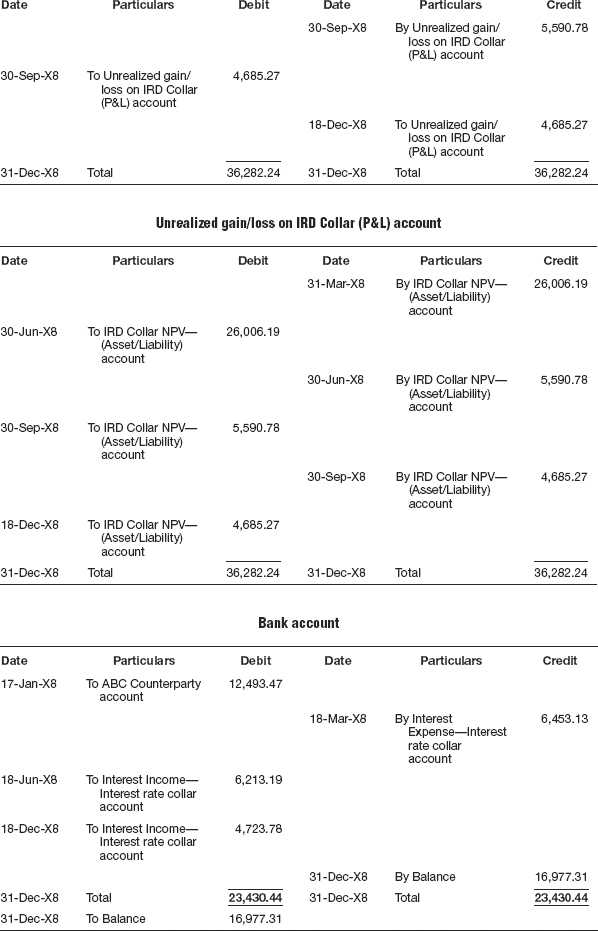

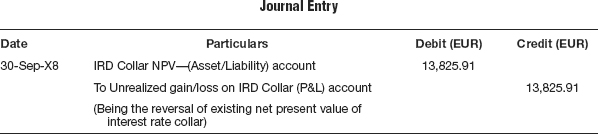

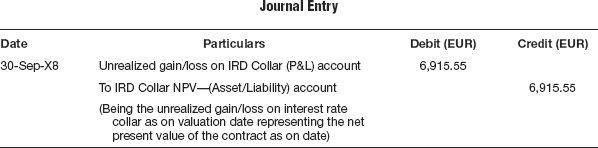

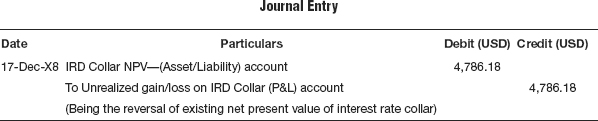

Ascertain the fair value on valuation date

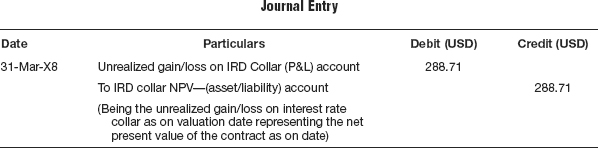

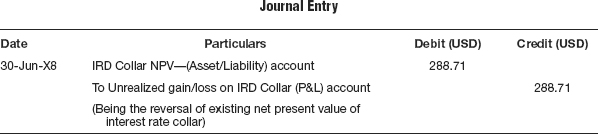

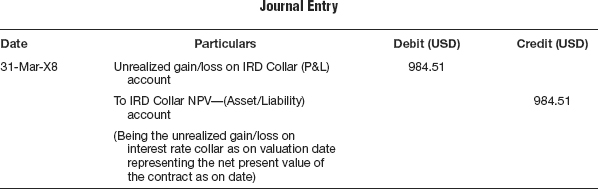

At the end of every reporting period the net present value of the collar contract is ascertained and entries recorded in the books accordingly. The net present value of the collar contract on 31st March amounts to a negative number of $288.71 and this is accounted for as unrealized gain/loss on the interest rate collar instrument. The entry as shown in Table 11.9 is passed for the same.

Table 11.9 On valuation of IRD collar

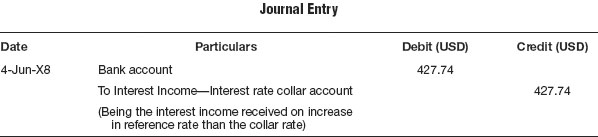

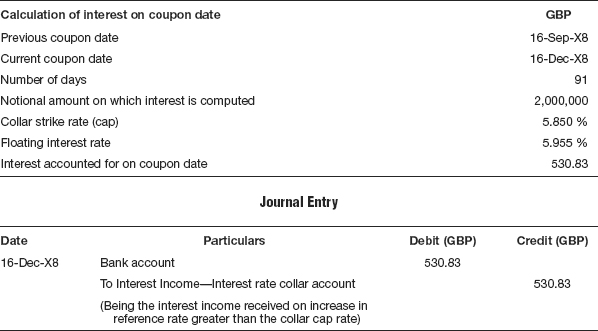

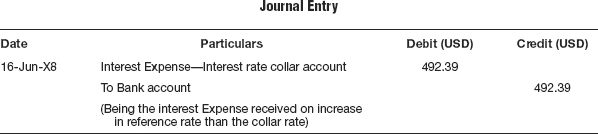

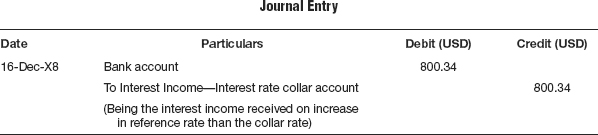

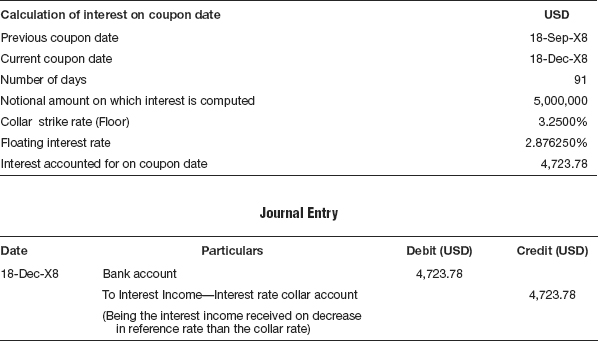

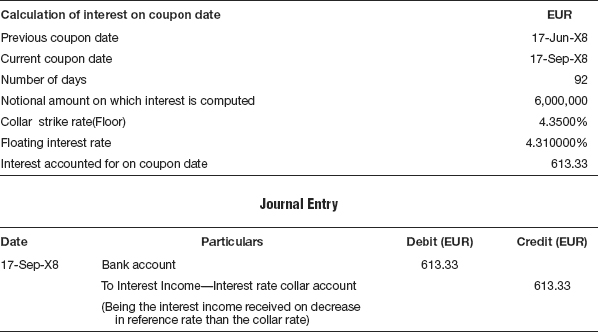

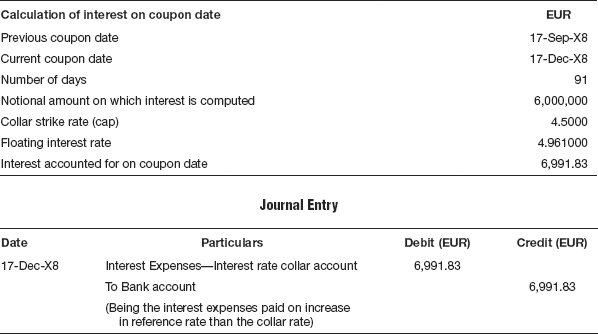

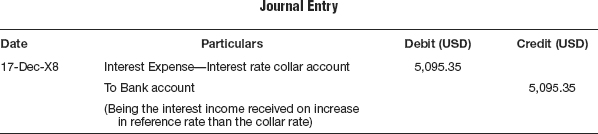

Pay/receive interest on pay date

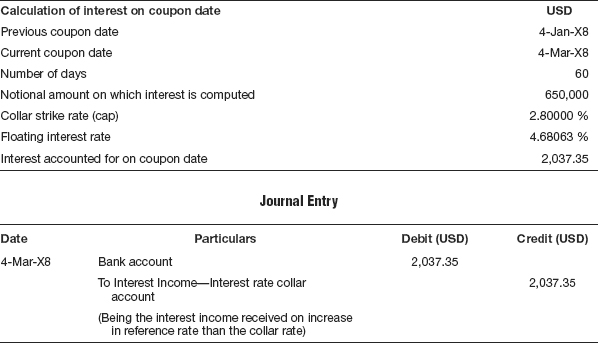

On each pay date, subsequent to the reset date, interest will be received if the prevailing reference rate rises above the cap level. If the reference rate falls below the floor rate, interest will be paid. If the reference interest rate stays between the cap rate and the floor rate then no interest is paid or received. In this illustration, since the reference interest rate on the reset date of 2nd Jan was 4.68063 percent, which is above the cap rate of 2.80 percent, interest is payable by the seller of the collar instrument amounting to $2,037.35 to the buyer of the collar. The accounting entry that is recorded in the book of accounts is as shown in Table 11.10.

Table 11.10 On accounting of interest income on interest rate collar

Note that since the reference interest rate stays above the floor rate, no interest is payable by the buyer of the collar instrument to the seller.

Termination of the trade and accounting for termination fee

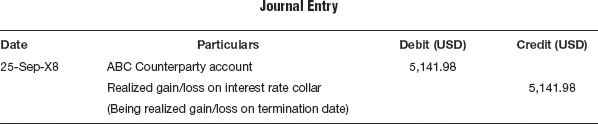

An interest rate collar contract can be terminated at any point by either party. If the parties decide to terminate the contract, then the net present value of the contract at that time would be computed based on the net present value of the contract on such date of termination and the termination fee will be paid by one party to the other party depending upon which party stands to gain and which party stands to lose if the contract is terminated on the said date without being allowed to subsist during the remaining life of the contract. In the following example the present value of the contract on the date of termination, 25th September, is calculated as a positive number amounting to $5,141.98 and the counterparty to the contract will have to pay this termination fee to the investor.

The accounting entry that is recorded in the book of accounts is as shown in Table 11.11.

Table 11.11 On accounting for termination fee

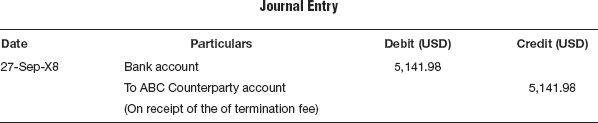

Payment or receipt of termination fee

The consideration for such termination is received on T + 2. The accounting entry that is recorded in the book of accounts is as shown in Table 11.12.

Table 11.12 On settlement of termination fee

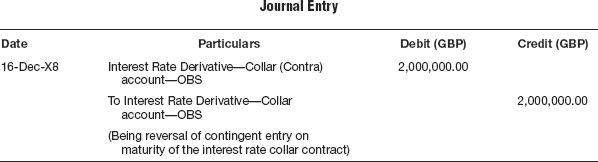

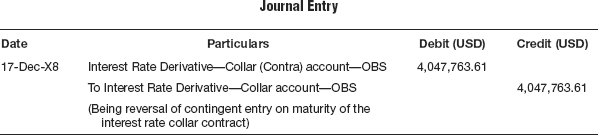

Maturity of the trade

If the trade is not terminated before the maturity date, the trade is matured automatically on the maturity date. No interest is payable or receivable after the maturity date. The net present value on the date of maturity of the interest rate collar contract would be zero as no cash flows subsist subsequent to the maturity date; unlike an early termination where subsequent to the termination date, there would be cash flows both receivable and payable. On the maturity date of the trade, the contingent entry passed at the date of inception of the trade is reversed as mentioned in the next paragraph.

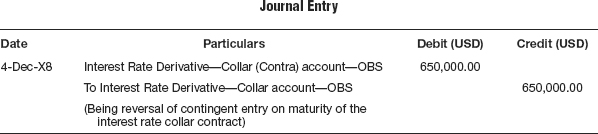

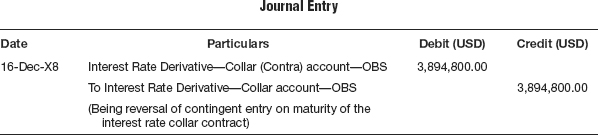

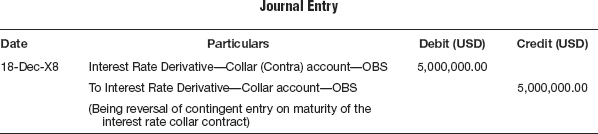

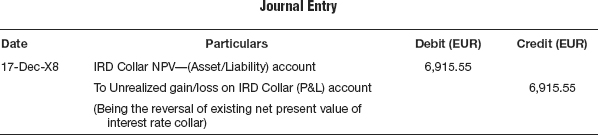

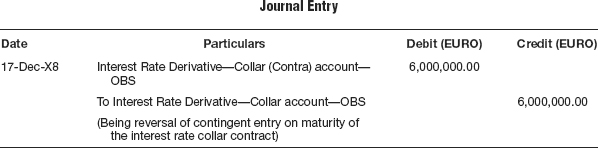

Reversal of the contingent entry on termination or maturity

A collar can be terminated anytime before the maturity date. On termination, the collar contract will be cancelled and the original off balance sheet entry passed at the time of inception of the contract is reversed. Even at the time of maturity the same entry is recorded, as sown in Table 11.13.

Table 11.13 On reversal of contingent entry

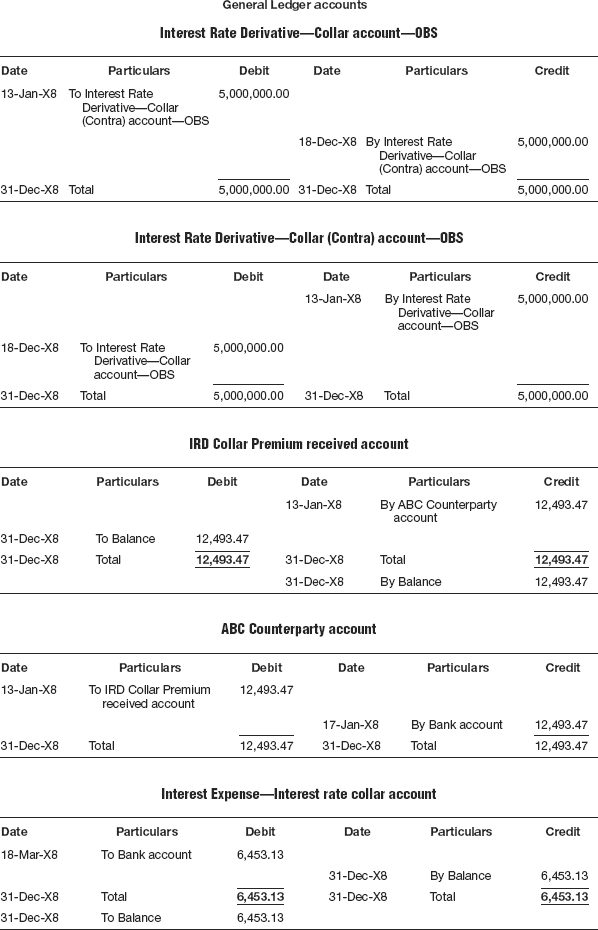

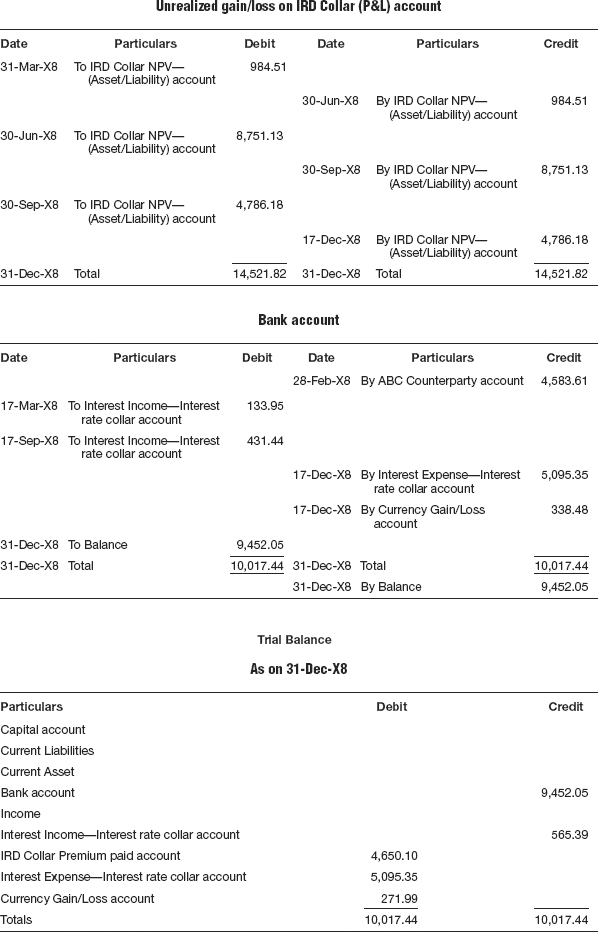

COMPLETE SOLUTION TO THE ILLUSTRATION—INTEREST RATE COLLAR

T-1 On purchase of interest rate collar trade:

T-2 On accounting for premium on purchase of interest rate collar trade:

T-3 On accounting for payment of the premium:

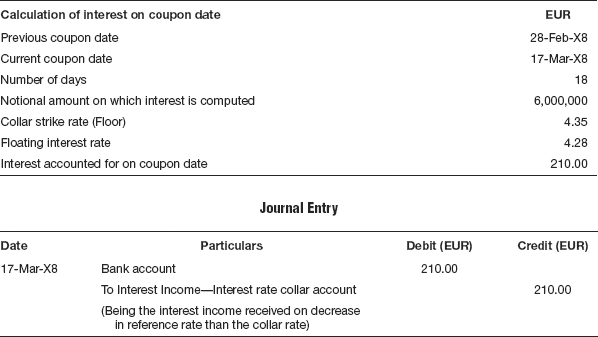

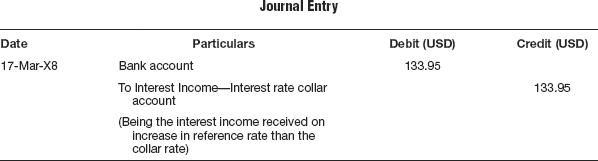

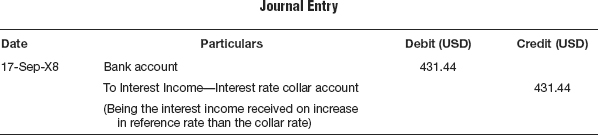

T-4 On accounting of interest income on interest rate collar:

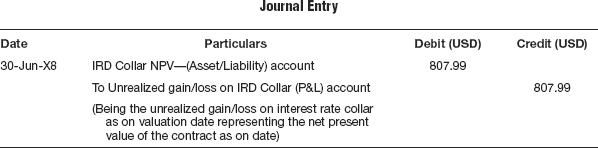

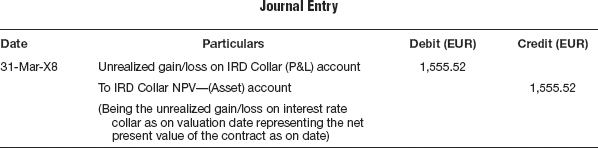

T-5 On valuation of interest rate collar as on date:

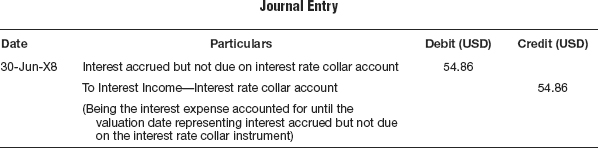

T-6 On accounting of interest accrued on valuation date:

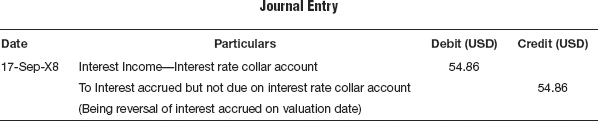

T-7 On reversal of interest accrual on coupon date:

T-8 On accounting of interest income on interest rate collar:

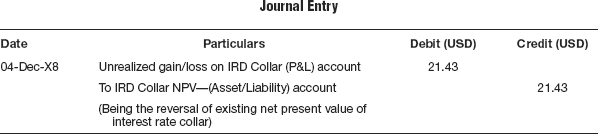

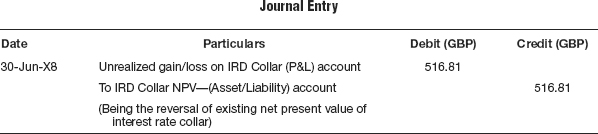

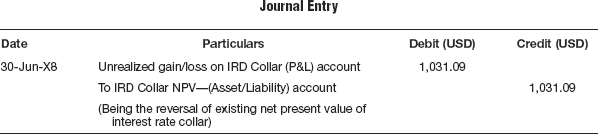

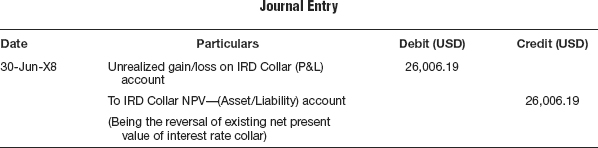

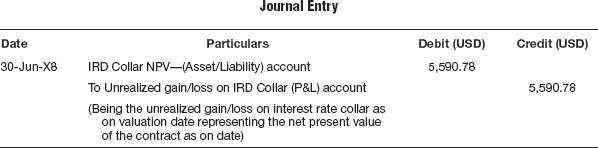

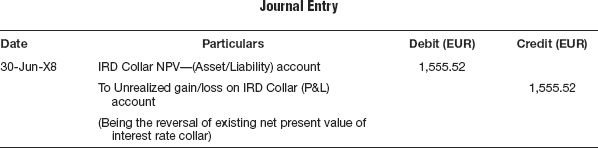

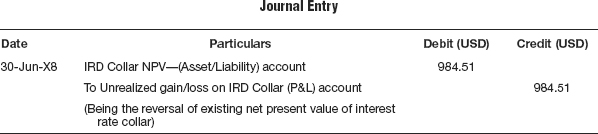

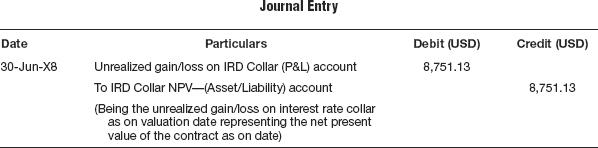

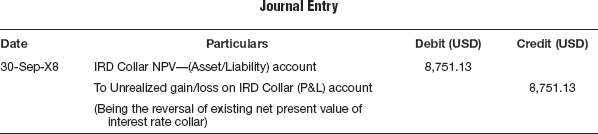

T-9 On reversal of net present value of interest rate collar:

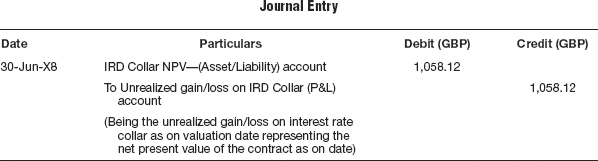

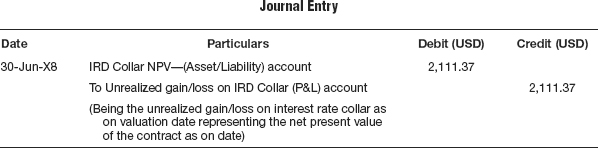

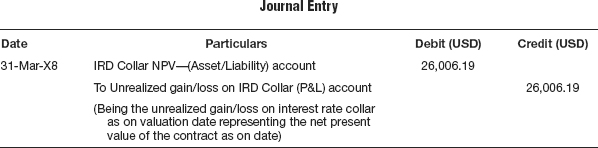

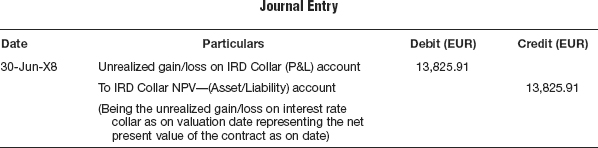

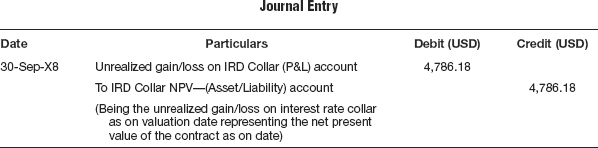

T-10 On valuation of interest rate collar as on date:

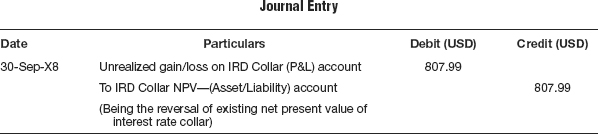

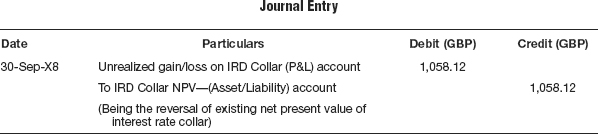

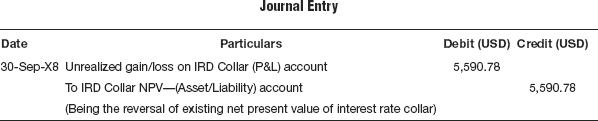

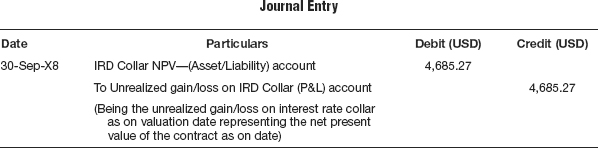

T-11 On reversal of net present value of interest rate collar:

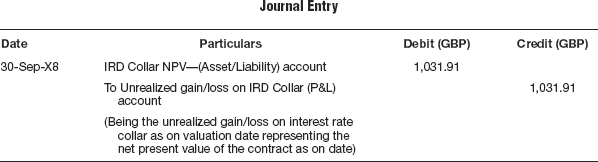

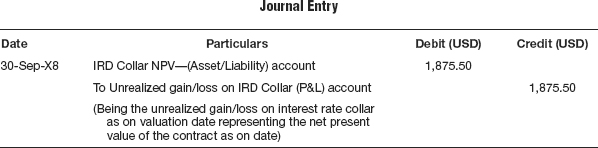

T-12 On valuation of interest rate collar as on date:

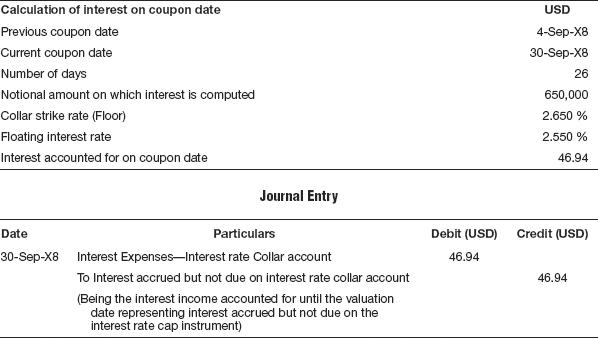

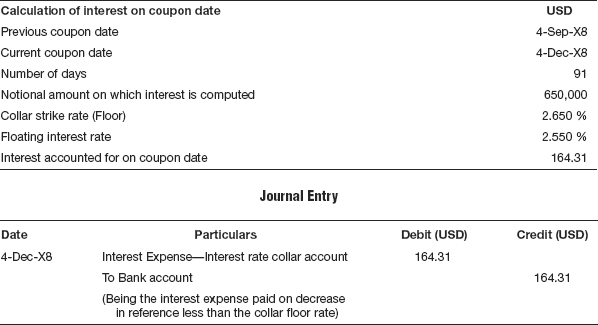

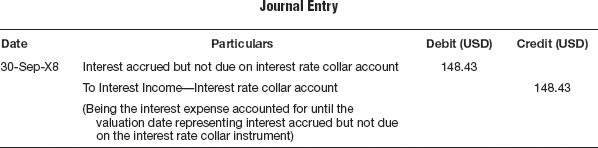

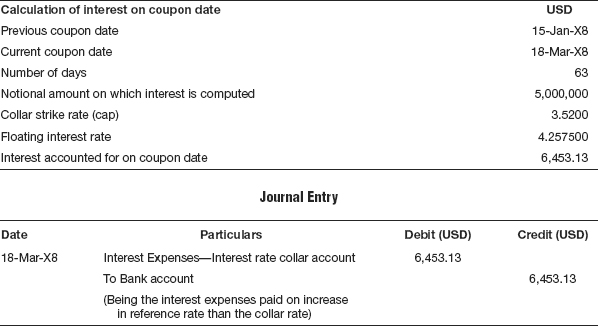

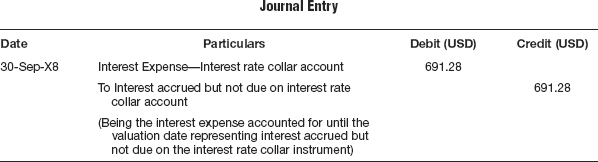

T-13 On accounting of interest expense on interest rate collar:

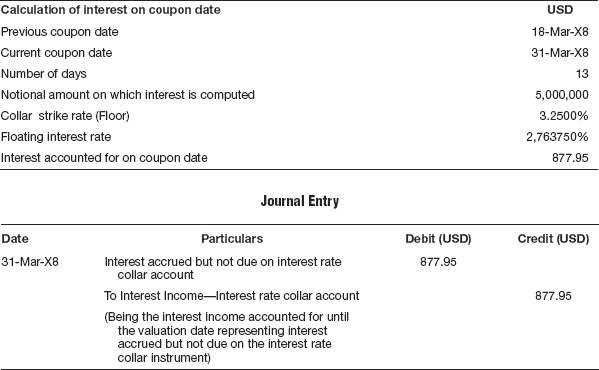

T-14 On reversal of interest accrual on coupon date:

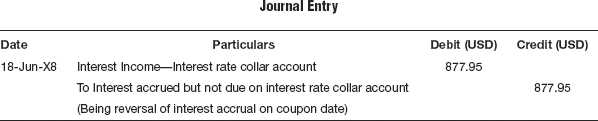

T-15 On accounting of interest expense on interest rate collar:

T-16 On reversal of net present value of interest rate collar:

T-17 On reversal of contingent entry on maturity:

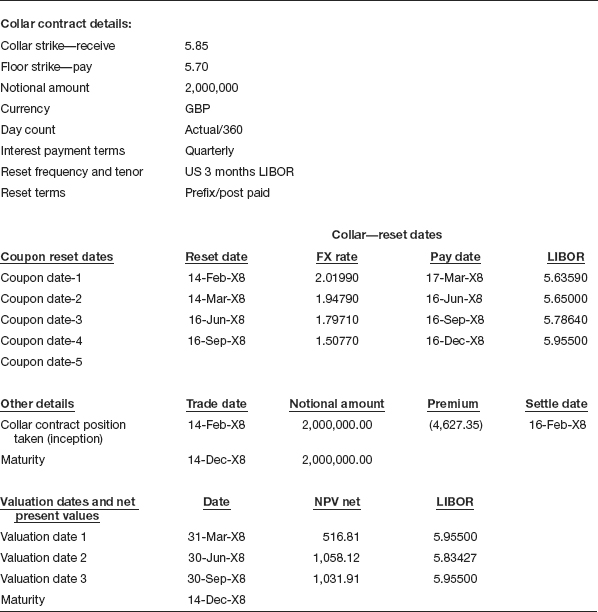

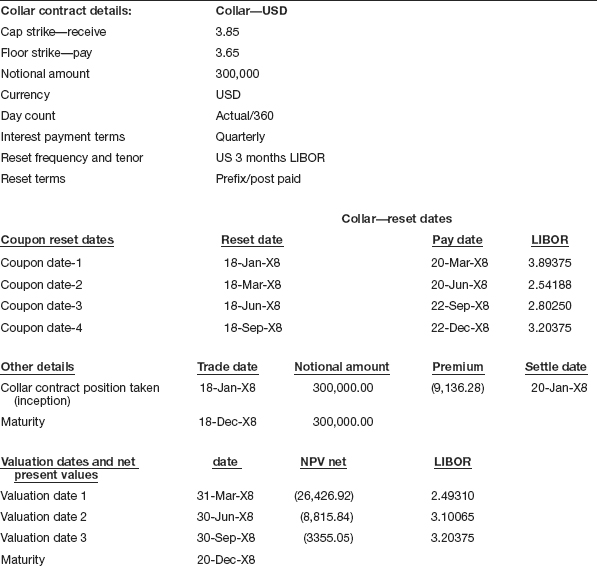

PROBLEM 1: INTEREST RATE COLLAR

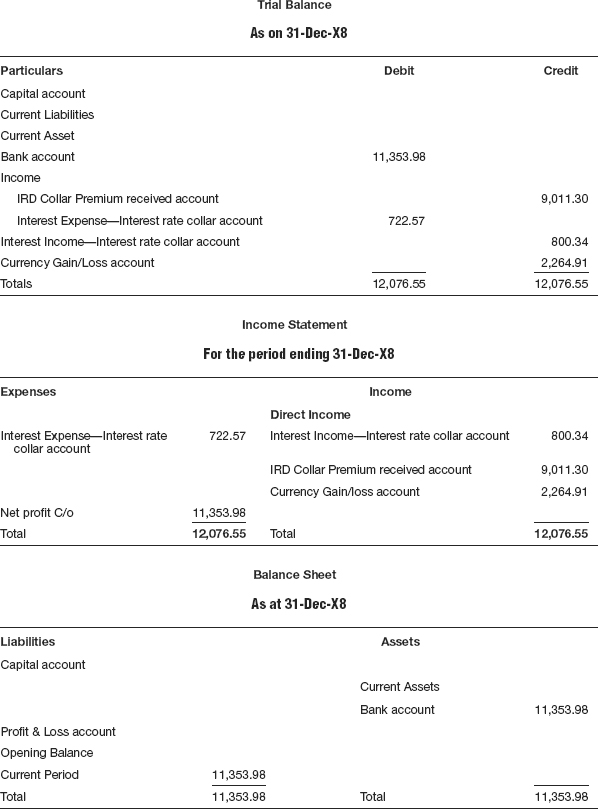

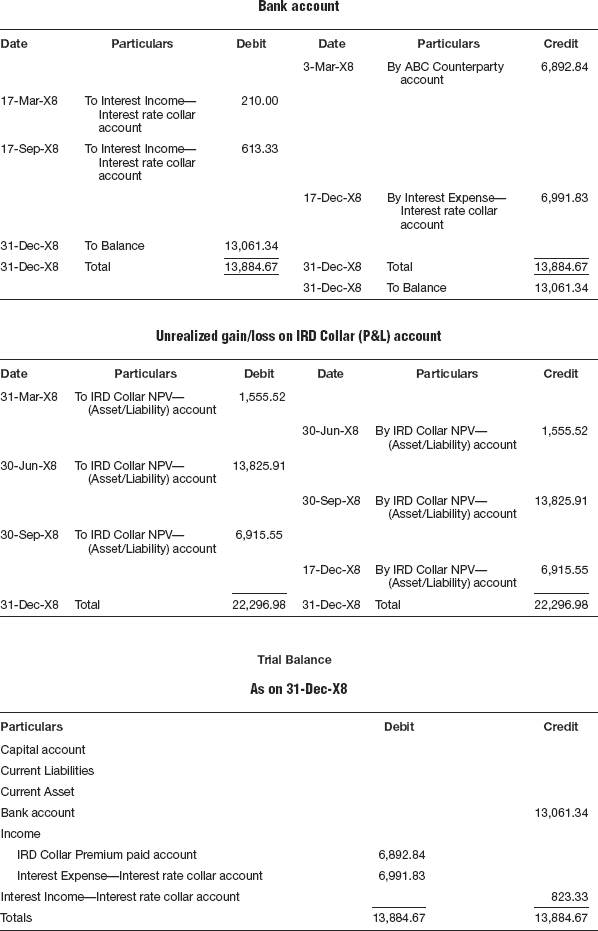

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

T-1 On purchase of interest rate collar trade:

T-2 On accounting for premium received on purchase of interest rate collar trade:

T-3 On accounting of premium received at Bank account:

T-4 On accounting of interest paid on interest rate collar:

T-5 On valuation of interest rate collar as on date:

T-6 On accounting of interest accrued on valuation date:

T-7 On reversal of interest accrued on valuation date:

T-8 On accounting of interest expense on interest rate collar:

T-9 On reversal of net present value of interest rate collar:

T-10 On valuation of interest rate collar as on date:

T-11 On reversal of net present value of interest rate collar:

T-12 On valuation of interest rate collar as on date:

T-13 On accounting of interest accrued on valuation date:

T-14 On reversal of interest accrued on valuation date:

T-15 On accounting of interest income on interest rate collar:

T-16 On reversal of net present value of interest rate collar:

T-17 On reversal of contingent entry on termination:

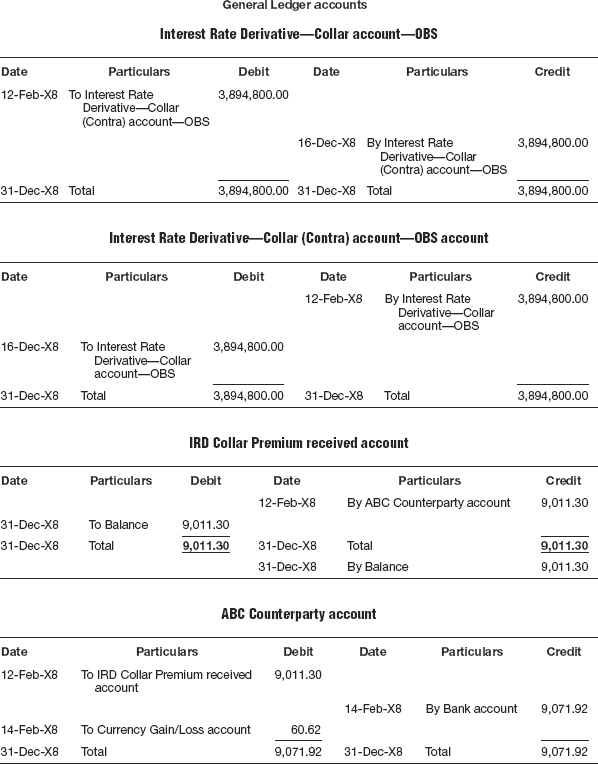

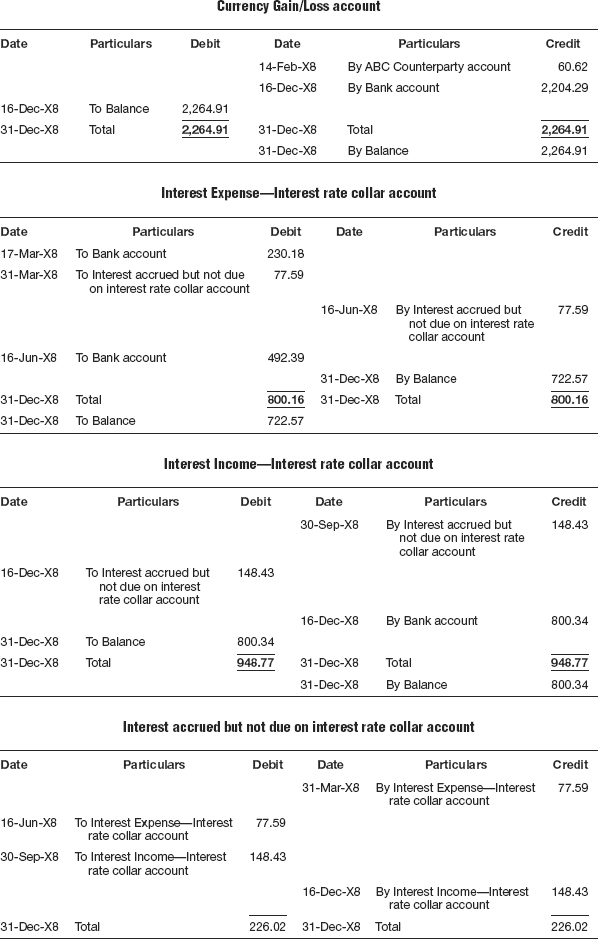

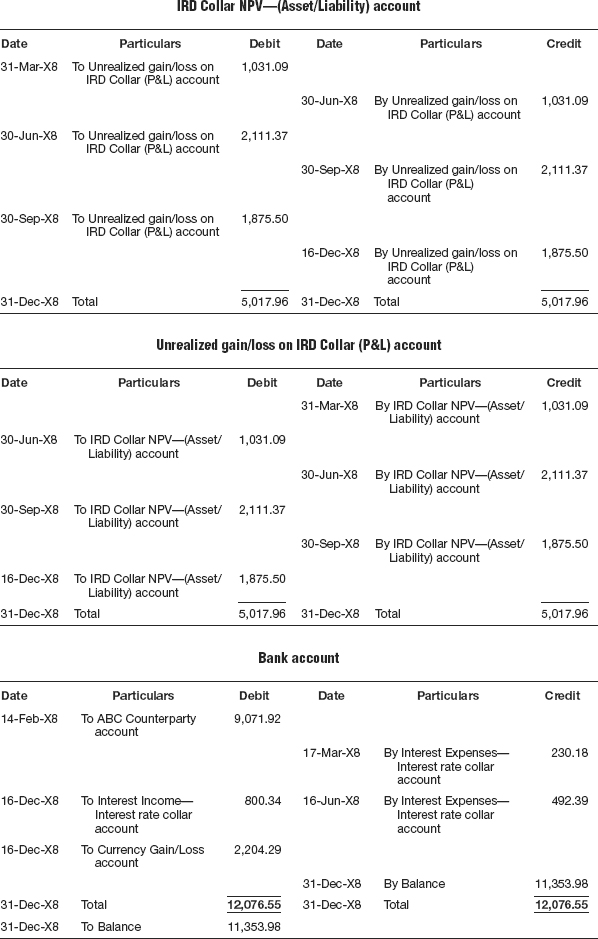

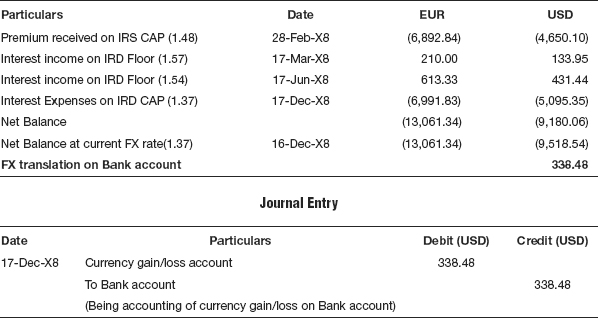

ENTRIES IN FUNCTIONAL CURRENCY

F-1 On purchase of interest rate collar trade: (T-1 @ FX Rate: 1.9474)

F-2 On accounting for premium on purchase of interest rate collar trade: (T-2 @ FX Rate: 1.9474)

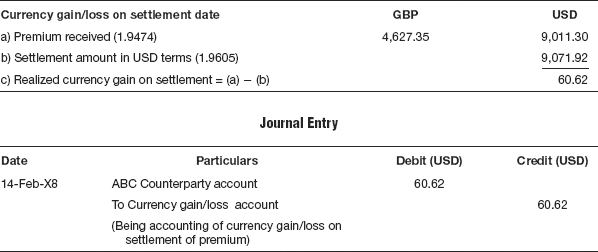

F-3 On accounting of premium received at Bank account: (T-3 @ FX Rate: 1.9605)

F-4 On accounting of currency gain/loss on settlement of premium

F-5 On accounting of interest paid on interest rate collar: (T-4 @ FX Rate: 2.0199)

F-6 On valuation of interest rate collar as on date: (T-5 @ FX Rate: 1.9951)

F-7 On accounting of interest accrued on valuation date: (T-6 @ FX Rate: 1.9951)

F-8 On reversal of interest accrued on valuation date: (T-7 @ FX Rate: 1.9951)

F-9 On accounting of interest paid on interest rate collar: (T-8 @ FX Rate: 1.9479)

F-10 On reversal of net present value of interest rate collar: (T-9 @ FX Rate: 1.9951)

F-11 On valuation of interest rate collar as on date: (T-10 @ FX Rate: 1.9954)

F-12 On reversal of net present value of interest rate collar: (T-11 @ FX Rate: 1.9954)

F-13 On valuation of interest rate collar as on date: (T-12 @ FX Rate: 1.8175)

F-14 On accounting of interest accrued on valuation date: (T-13 @ FX Rate: 1.8175)

F-15 On reversal of interest accrued on valuation date: (T-14 @ FX Rate: 1.8175)

F-16 On accounting of interest income on interest rate collar: (T-15 @ FX Rate: 1.5077)

F-17 On reversal of net present value of interest rate collar: (T-16 @ FX Rate: 1.8175)

F-18 On reversal of contingent entry on termination: (T-17 @ FX Rate: 1.9474)

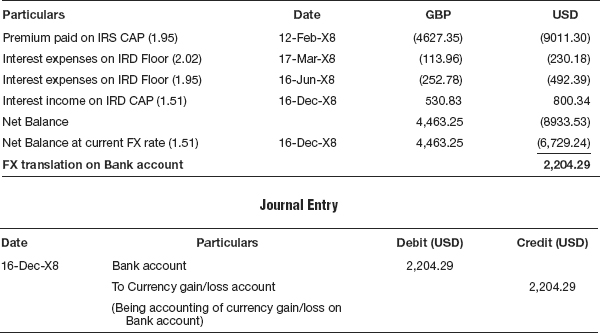

F-19 On accounting of currency gain/loss on Bank account

MEANING OF INTEREST RATE REVERSE COLLAR

An interest rate reverse collar is an instrument that gives the buyer protection against falling rates. Hence, the reverse interest rate collar represents buying an interest rate floor and simultaneously selling an interest rate cap.

- The objective is to protect the buyer from falling interest rates.

- The buyer selects the index rate and matches the maturity and notional principal amounts for the floor and cap.

- Buyers can construct zero-cost reverse collars when it is possible to find floor and cap rates with the same premiums that provide an acceptable band.

ACCOUNTING FOR INTEREST RATE REVERSE COLLAR

Accounting for an interest rate reverse collar is very similar to that of accounting for a collar instrument. In the reverse collar there are two components: the cap component and the floor component. Depending upon the strike rates of cap and floor the premium is computed. In a reverse collar, if the benchmark rate is above the cap rate on the reset date, then on the pay date interest above the cap strike rate will be paid by the buyer of the reverse collar instrument to the seller. If the benchmark rate is lower than the floor rate then the seller compensates the buyer interest to that extent.

Just as in a collar instrument, in a reverse collar the premium can be either positive or zero. It can also be negative, meaning that the buyer of the reverse collar may get a premium for taking a position.

THE TRADE LIFE CYCLE FOR INTEREST RATE REVERSE COLLAR

- Recording the trade—contingent

- Account for the premium if any on the trade

- Receive/pay the premium for the trade

- Reset the interest rate for the ensuing period

- Account for accrued interest if any on the valuation date

- Reverse the accrued interest if any on the coupon date

- Ascertain and account for the fair value on the valuation date

- Pay/receive interest on the pay date

- Termination of the trade and accounting for termination fee

- Payment or receipt of termination fee

- Maturity of the trade

- Reversal of the contingent entry on termination or maturity

- FX revaluation entries (for foreign currency trades)

- FX translation entries (for foreign currency trades)

Since the entire events above are already explained, it is not elaborated here.

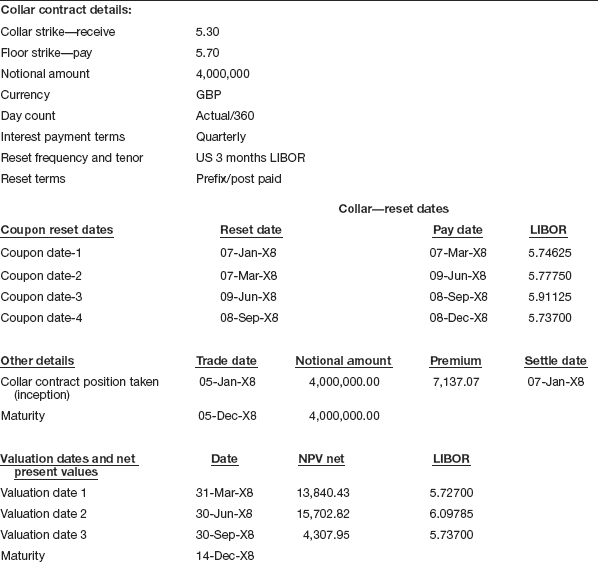

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

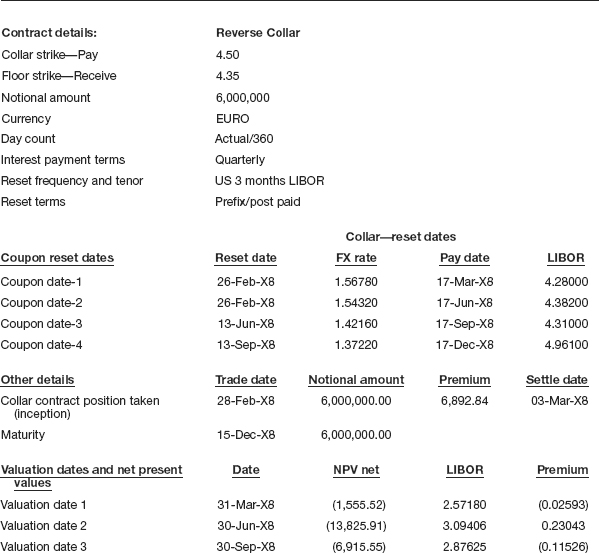

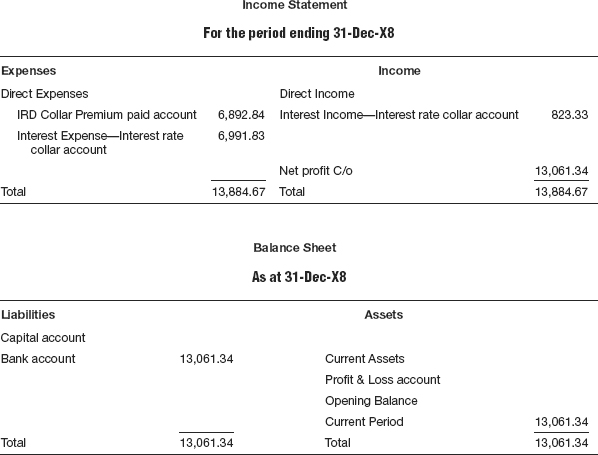

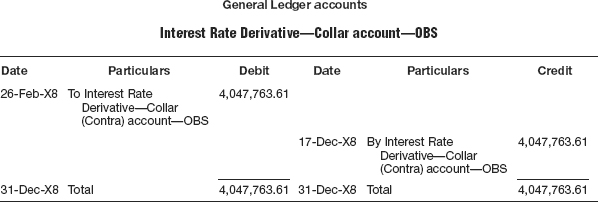

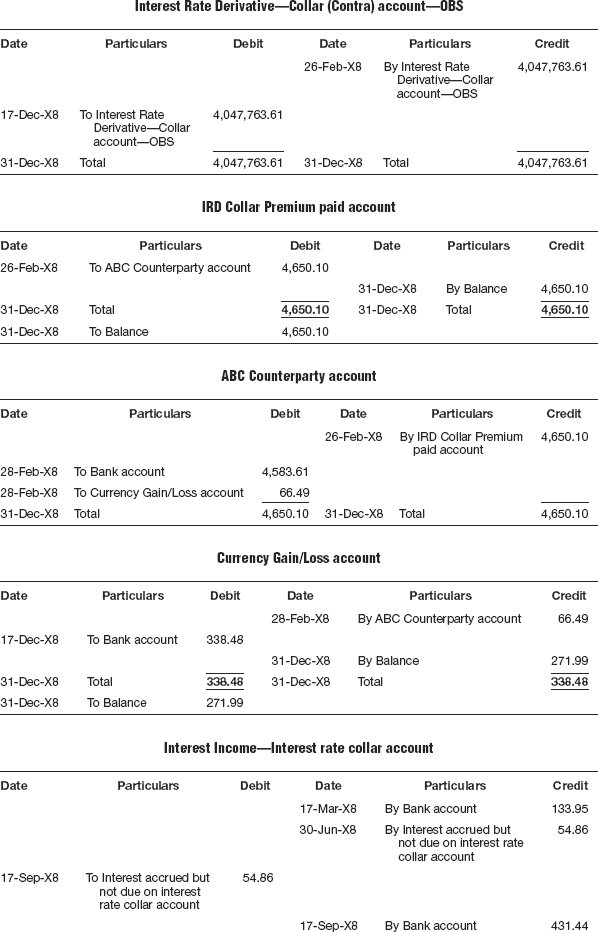

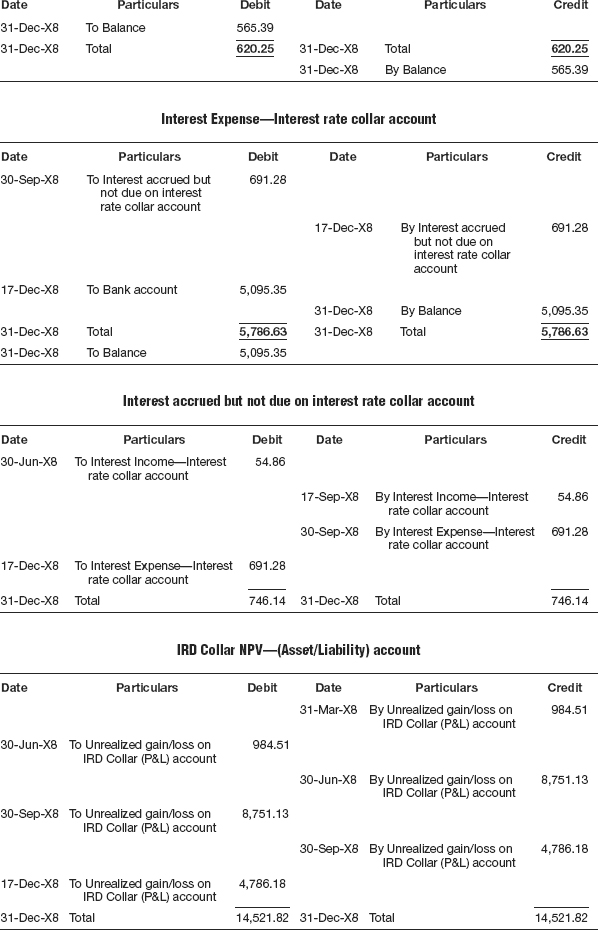

SOLUTION TO PROBLEM 1: REVERSE COLLAR

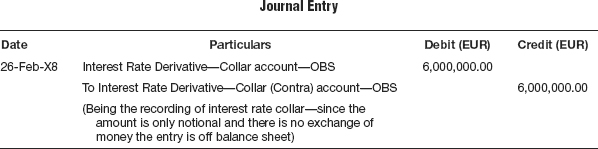

T-1 On purchase of interest rate collar trade:

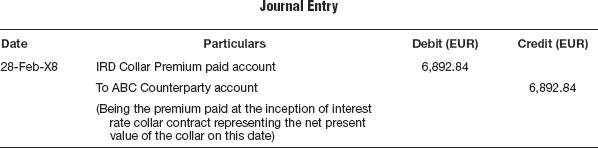

T-2 On accounting for premium received on purchase of interest rate reverse collar trade:

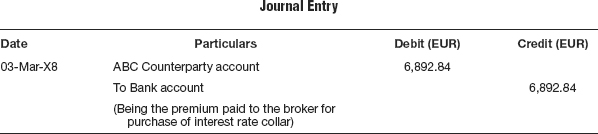

T-3 On accounting of premium received at Bank account:

T-4 On accounting of interest expenses on interest rate reverse collar:

T-5 On valuation of interest rate collar as on date:

T-6 On accounting of interest accrued on valuation date:

T-7 On reversal of interest accrual on coupon date:

T-8 On accounting of interest income on interest rate collar:

T-9 On reversal of net present value of interest rate collar:

T-10 On valuation of interest rate collar as on date:

T-11 On reversal of net present value of interest rate collar:

T-12 On valuation of interest rate collar as on date:

T-13 On accounting of interest accrued on valuation date:

T-14 On reversal of interest accrual on coupon date:

T-15 On accounting of interest income on interest rate collar:

T-16 On reversal of net present value of interest rate collar:

T-17 On reversal of contingent entry on reversal

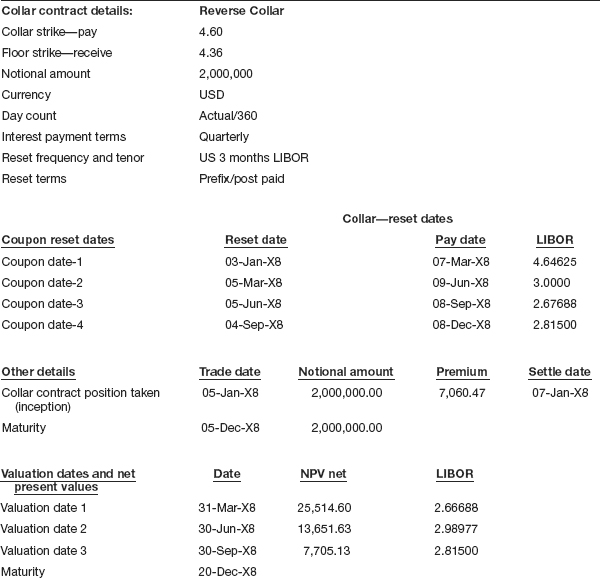

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

SOLUTION TO PROBLEM 2: REVERSE COLLAR

T-1 On purchase of interest rate collar trade:

T-2 On accounting for premium paid on purchase of interest rate collar trade:

T-3 On accounting of premium paid to Bank account:

T-4 On accounting of interest income on interest rate collar:

T-5 On valuation of interest rate collar as on date:

T-6 On reversal of net present value of interest rate collar:

T-7 On valuation of interest rate collar as on date:

T-8 On accounting of interest accrued on valuation date:

T-9 On reversal of interest accrued on pay date:

T-10 On accounting of interest income on interest rate collar:

T-11 On reversal of net present value of interest rate collar:

T-12 On valuation of interest rate collar as on date:

T-13 On accounting of interest accrued on valuation date:

T-14 On reversal of interest accrued on valuation date:

T-15 On accounting of interest income on interest rate collar:

T-16 On reversal of net present value of interest rate collar:

T-17 On reversal of contingent entry on termination:

ENTRIES IN FUNCTIONAL CURRENCY

F-1 On purchase of interest rate collar trade: (T-1 @ FX Rate: 1.4823)

F-2 On accounting for premium received on purchase of IRS Trade: (T-2 @ FX Rate: 1.4823)

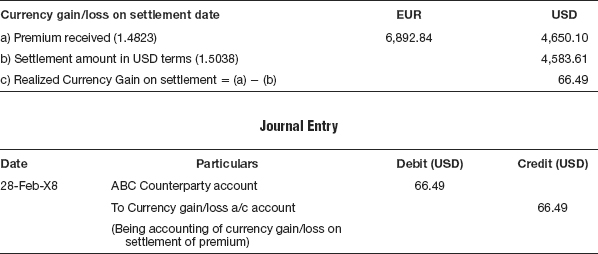

F-3 On accounting of premium received to Bank account: (T-3 @ FX Rate: 1.5038)

F-4 On accounting of currency gain/loss on settlement of premium:

F-5 On accounting of interest income on interest rate collar: (T-4 @ FX Rate: 1.5678)

F-6 On valuation of interest rate collar as on date: (T-5 @ FX Rate: 1.5800)

F-7 On reversal of net present value of interest rate collar: (T-6 @ FX Rate: 1.5800)

F-8 On valuation of interest rate collar as on date: (T-7 @ FX Rate: 1.5799)

F-9 On accounting of interest accrued on valuation date: (T-8 @ FX Rate: 1.57990)

F-10 On reversal of interest accrued on valuation date: (T-9 @ FX Rate: 1.57990)

F-11 On accounting of interest income on interest rate collar: (T-10 @ FX Rate: 1.42160)

F-12 On reversal of net present value of interest rate collar: (T-11 @ FX Rate: 1.5799)

F-13 On valuation of interest rate collar as on date: (T-12 @ FX Rate: 1.4449)

F-14 On accounting of interest accrued on valuation date: (T-13 @ FX Rate: 1. 4449)

F-15 On reversal of interest accrued on valuation date: (T-14 @ FX Rate: 1. 4449)

F-16 On accounting of interest income on interest rate collar: (T-15 @ FX Rate: 1.3722)

F-17 On reversal of net present value of interest rate collar: (T-16 @ FX Rate: 1.4449)

F-18 On reversal of contingent entry on termination: (T-17 @ FX Rate: 1.9474)

F-19 On accounting of currency gain/loss on Bank account

- An interest rate collar is an instrument that combines both a cap and a floor. The cap component of the instrument gives the investor protection against rising rates by guaranteeing that the investor will never pay above a pre-agreed rate.

- The floor component of the collar at the same time allows the investor to take advantage of the falling interest rates until the interest rate hits a predetermined rate, known as floor rate.

- A collar effectively creates an interest rate range with an upper and lower limit and depending upon where the cap and floor levels are set, will reduce or eliminate the requirement for a premium.

- An interest rate collar protects the investor against increases in interest rates beyond a predetermined level known as the cap rate, while still allowing the investor to take advantage of falling interest rates down to a predetermined level, known as the floor rate.

- The investor, however, is exposed to a further fall in the interest rates below the floor rate. In a nutshell, an interest rate collar is equivalent to that of buying a cap and selling a floor.

- Since an interest rate collar includes the buying of a cap instrument, all the benefits of a cap instrument are applicable for this instrument. Caps provide the entity with protection against unfavorable interest rate movements above the strike rate. Cap contracts are flexible as they are over-the-counter products and are customized to suit the requirements of the parties to the trade. The strike rate can be positioned to reflect the level of protection sought by the buyer or willing to be written by the seller.

- The investor will not benefit from a fall in rates below the pre-fixed floor rate. In fact, a fall in the rates below the floor rate forces the investor to compensate the counterparty to that extent.

- Unwinding the collar during its lifetime involves termination fees depending on the then prevailing market rates.

- The investor will still be exposed to interest rate movements if the term of the collar is shorter than that of the underling facility.

- An interest rate collar or other derivative instrument that includes a written option cannot be designated as a hedging instrument if it is a net written option, because the standard precludes the use of a written option as a hedging instrument unless it is designated as an offset to a purchased option. An interest rate collar or other derivative instrument that includes a written option may be designated as a hedging instrument, however, if the combination is a net-purchased option or zero-cost collar.

- The following factors taken together suggest that an interest rate collar or other derivative instrument that includes a written option is not a net-written option:

- No net premium is received either at inception or over the life of the combination of options. The distinguishing feature of a written option is the receipt of a premium to compensate the writer for the risk incurred.

- Except for the strike prices, the critical terms and conditions of the written option component and the purchased option component are the same (including the underlying variable or variables, currency denomination and maturity date). Also, the notional amount of the written option component is not greater than the notional amount of the purchased option component.

- Obviously in the case of an interest rate collar the notional amount, currency and the maturity are one and the same and hence the collar will qualify as a hedging instrument if the net present value of the instrument stays positive throughout the life of the contract and not merely at the inception of the contract. This condition will ensure that the entity will never lose on account of the hedging instrument but always has the potential to gain, which is the intention of the standard.

Theory questions

1. What is the meaning of an interest rate collar instrument?

2. Explain the benefits of an interest rate collar instrument?

3. What are the risks associated with an interest rate collar instrument?

4. What are the significant events in the trade life cycle of an interest rate collar instrument?

5. What is the meaning of an interest rate reverse collar instrument?

6. Can an interest rate collar instrument be designated as a hedging instrument?

Objective questions

1. An interest rate _________ is an instrument that gives you protection against rising rates by guaranteeing that you will never pay above a pre-agreed rate, but at the same time sets a downside (floor) rate below which you cannot benefit if rates do fall further.

a) Cap

b) Floor

c) Collar

d) None of the above

2. An interest rate collar protects you against increases in interest rates beyond a predetermined level known as the __________.

a) Floor rate

b) Cap rate

c) Average rate

d) None of the above

3. An interest rate collar provides known upside protection against a rise in rates with the potential to benefit from a fall in rates, down to a ____________.

a) Post-agreed level

b) Agreed level

c) Pre-agreed level

d) None of the above

4. A collar protects a company against adverse movement in ____________.

a) Exchange rate

b) Bank rate

c) Interest rate

d) None of the above

5. While recording the trade contingent, since an interest rate collar agreement is a notional amount and no physical exchange of money takes place, we record a __________ transaction to record the same.

a) Profit/loss entry

b) Off balance sheet entry

c) Balance sheet entry

d) None of the above

6. The cost of the collar is referred to as the _________.

a) Discount

b) Premium

c) Exchange rate

d) None of the above

7. To calculate the interest rate collar premium, several factors are considered, including _________.

a) Cap rate

b) Floor rate

c) Notional amount

d) All of the above

8. On each reset date, interest will be received if the prevailing reference rate rises above the _________.

a) Reference level

b) Floor level

c) Cap level

d) None of the above

9. A collar can be terminated anytime before the _________.

a) Reset date

b) Settlement date

c) Maturity date

d) None of the above

10. An interest rate reverse collar is an instrument that gives you protection against _________.

a) Rising interest rate

b) Exchange rate

c) Falling interest rate

d) None of the above

11. The reverse interest rate collar represents buying an interest rate _________.

a) Cap

b) Floor

c) Exchange rate

d) None of the above

12. The reverse interest rate collar represents selling an interest rate _________.

a) Cap

b) Floor

c) Exchange rate

d) None of the above

13. You will be exposed to interest rate movements if the term of the reverse collar is __________ than that of the underling facility.

a) Longer

b) Higher

c) Shorter

d) None of the above

14. In a reverse collar interest rate if the reference rate falls below the floor rate, interest will be _________.

a) Paid

b) Received

c) Rolled over

d) None of the above

15. An interest rate collar is _________.

a) Writing a floor and writing a cap

b) Buying a cap and writing a floor

c) An option on a futures contract

d) Buying a cap and buying a floor

e) None of the above

Journal questions

1. Interest rate collar—Exercise 1

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

2. Interest rate collar—Exercise 2

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

3. Interest rate reverse collar—Exercise 3

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

4. Interest rate reverse collar—Exercise 4

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.