28

Investing in Index Funds

Index funds are low-cost funds which do not require any active management.

They typically follow an index and their primary agenda is to reduce the tracking error of the fund.

A really good index fund has a minimum tracking error.

Since they do not need any fund managers the cost of managing the funds are really low as well.

The expense ratios of the funds are typically below one percentage point.

The asset management of the index fund would involve maintaining the same ratio of stocks as the index it follows.

Index funds are as close as anyone can get to secure 100% of the market returns.

Just like mutual funds, the index funds can only be sold or bought based on the previous days closing stock prices.

This is designed in such a way as these types of funds are unfit for day to day trading purposes.

The ideal scenario for holding a share of an index fund would be holding it for the long term according to John C Bogle. He was the first to start an index fund. His organization Vanguard is the leading provider of index funds today.

It is also one of the largest mutual fund companies with over 4.5 trillion dollars in assets under management.

The cost impact of the index fund with 10% average returns spanning over 3 decades and assuming that its cost is 1% would be 10% of the market returns in one year, 14% of the market returns in a decade and 24% of the market returns in 25 years.

We should also keep in mind that the goal of investing is to capture 100% of the market returns.

THE BEST INDEX FUND

Selecting an index fund is equivalent to selecting a simplistic straightforward fund with minimum charges.

All index funds were not created equal. Some are to be avoided at all costs.

Index funds that carry a sales load or commission, for example. It does not make sense to pay a front-end load or a back-end load in an index fund. The sales load is a straightforward cost which is to be avoided given the fact that the index funds with no load are available.

Front-end sales load is a fee to enter the fund, usually a percentage of invested capital. For example, if you are investing $5000 in an index fund with a sales load of 5%, you would have to pay $5250 to enter the fund and the $250 would be the front-end sales load.

Similarly, the back-end sales load is a fee that is charged to exit the fund usually a percentage of invested capital. For example, an investment of $5000 has grown to $10,000 and upon withdrawal, the index fund is charging you a back-end sales load of 5%. You would have to pay $500 upon withdrawal of $10,000.

Front-end sales are the least evil of both loads as you will be paying a straight fee before your money has grown.

The backend sales load is the worst of all evil as you would be paying a percentage of the total money being withdrawn. Usually, the invested money would have grown many folds in an index fund. You would be paying a lot of money compared to the front end load.

The best fund would be a no-load fund with minimal hidden fees like marketing fees, brokerage fees and an expense ratio less than 0.50%.

All returns calculated by the fund managing companies are pre-tax returns. Although the industries ignore taxes, they take a major chunk of the market returns. as high as 20% in some of the cases. So it makes sense to hold an index fund in a non-taxable account.

In the US, the best option would be to buy an index fund with the above-mentioned criteria through an IRA or better yet through ROTH IRA.

TAX EXEMPTIONS IN INDIA

In India, the long-term capital gains tax would be 20%. Irrespective of your age you will be taxed. Above the flat 20% tax, you may be subjected to additional 3% of tax for educational cess. It is a tax levied upon the investor to help sponsor government programs and is collected independently of other taxes.

On top of that, there may be a surcharge of up to 15% depending on the income slab of the individual.

So you would be paying about 23% to 38% of the long-term capital gains on taxes alone. To avoid paying such high amount of taxes you could avail tax exemptions.

Age Exemption

Depending on your age, you could be exempted from long-term capital gains of up to 500,000 rupees.

-

For resident individual aged 80 or above, one could avail 500,000 rupees exemption for Long-Term Capital Gains.

-

For resident individual aged 60 or above, one could avail 300,000 rupees exemption for Long-Term Capital Gains.

-

For resident individual aged below 60, one could avail 250,000 rupees exemption for Long-Term Capital Gains.

-

For a nonresident individual, irrespective of the age, the exemption limit is 250,000 rupees.

Buying a home

Another important way to levy tax exemptions would be to buy a home or build a home with the acquired capital. It should be done within the fiscal year to avail the tax exemptions in case of buying a home. A period of 3 years is given to build a new home and avail the same tax exemptions.

It should also be noted that the home under construction or the home bought is limited to one home from the capital gains as of 2017 – 2018 and it should not be sold within the following 3 years.

Capital Gains Account Scheme (CGAS)

In case, you are not able to buy the home within the specified span of time, you could deposit the capital gains in a Capital Gains Account Scheme to buy some more time without having to pay the taxes.

To avail any form of exemptions regarding the capital gains, you would have to be a resident Indian.

There are two types of schemes to choose from.

-

Deposit Scheme A

-

Deposit Scheme B

The deposit scheme A behaves like a savings account. The capital gains deposited could be flexibly withdrawn but the interest earned will be equivalent to the bank savings account interest rates.

The deposit scheme B behaves like a term deposit. The Interest earned is much more than the scheme A. But the amount deposited cannot be withdrawn for the specified period of time.

It is worth noting that the interests earned are taxable.

Capital Gains Bond

Exemptions on the long-term capital gains can be availed if you invest the capital gains on the government specified bonds.

The bonds that come under the capital gains are National Highway Authority of India (NHAI) and Rural Electric Corp. (REC). These bonds as of 2017 provide an interest rate of 5.25%. The Capital Gains invested by you will not be taxed if invested in these specified bonds but the gains arising from the interests of these investments are taxable.

A maximum of 5,000,000 rupees can be exempt by investing in these bonds. It is to be noted that this is the aggregated maximum investment allowed in these bonds.

The bonds are issued for a period of 3 years and are non-transferable, non-negotiable and cannot be offered as a security for any loans.

|

Capital Gains

|

Rs.5,000,000

|

|

Tax @20%

|

Rs.1,000,000

|

|

Interest Rate @5.25% Year 1

|

Rs.262,500

|

|

Interest Rate @5.25% Year 2

|

Rs.262,500

|

|

Interest Rate @5.25% Year 3

|

Rs.262,500

|

|

Total Return on Investment

|

44.69%

|

|

Return on Investment Per Year

|

14.89%

|

If you have paid a tax on the capital gains earned, the amount available for investment would be 4,000,000 rupees. Upon investing the taxed capital gains, you would require an annualized return of 14.89% and a total return of 44.69% for 3 years to make up for the losses in taxes and equalize the returns that you would have made by investing in government capital gains bonds.

We have not included educational cess and surcharges on the tax as it depends on the tax slab of every individual. The point to ponder is that taxes are a heavy burden on the investment and you should do everything in your power to avail tax exemptions on the Long Term Capital Gains.

VANGUARD 500 INDEX INVESTOR (VFINX)

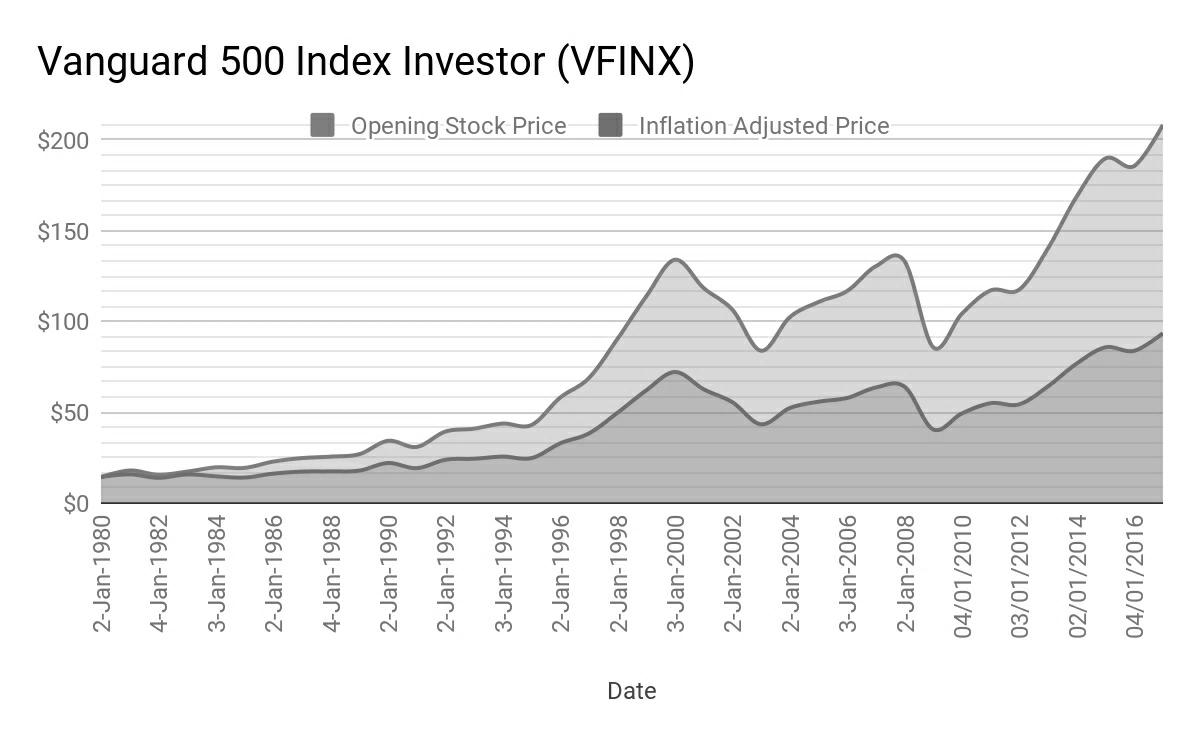

The stock prices mentioned above are much accurate for dollar-weighted returns. i.e all the capital is invested in 1988 and then we wait for the investment to reap benefits.

The nominal fund growth of the Vanguard 500 Index Investor (VFINX) is 1352% for 39 years. Your $14.34 would have grown to $208.33. Adjusting for inflation, the real returns of the index fund comes down to 587.64%. Inflation eats away your potential purchase power. The real gain in the purchase value per year is 15% pre-tax and pre-cost deduction.

This is a much realistic return to expect. VFINX has an expense ratio of 0.14% which means that you pay less in fees. You could save about $1913 for every $10,000 invested and end up spending only $329 on fees for a 10 year period.

That’s savings in cost of about 678%. In other words, you would pay 678% more in costs alone when you invest with index funds with industry average expense ratios.

Assuming a 10 percent return on investment with an expense ratio of 0.14%, you are looking forward to paying 1.4% of the market returns in cost in one year.

COMPARISON OF FUNDS

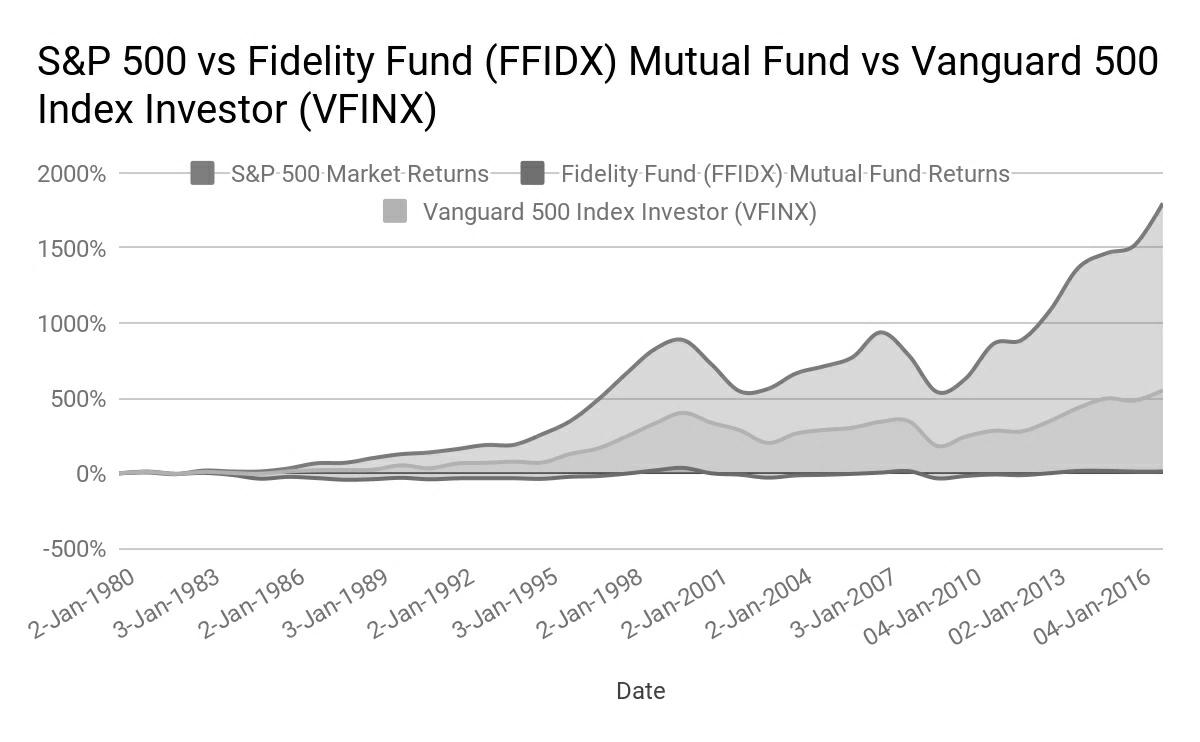

As the graph below suggests, keeping up with the index is hard. The index is a measure of potential market returns. It is the maximum return anybody can expect to attain by investing in stocks. Index fund tries to attain the market returns and lags by 91%. Even though it lags by that percentage it is 293% higher than the FFIDX mutual fund cumulative growth.

FFIDX lags the potential market returns by a staggering 652%. The mutual fund almost has the same volatility as the market itself. So the best course of action if invested in the mutual fund would be to retrieve the investment during the tech market bubble in the 2000’s.

That way, the return on investment would be 200.25% for a 12 year period and the inflation-adjusted returns would yield 111% real return on investment for FFIDX. The market returns for the FFIDX per year would have been 9.25%.

The returns are great for mid-term investment in mutual funds but for the long term, the inflation-adjusted market returns dwindle to a mere 93.383% for a 30 year period from 1988 to 2017. The real returns per year before tax are at an all-time low of 3.11%.

On the other hand, Vanguard 500 Index Investor (VFINX) fund produces a cumulative growth of 425% for a period of 12 years spanning from 1988 to 2000 which is an inflation-adjusted return of 268%. It would yield a real return of 22.41% per year before tax.

The long-term investment of VFINX is promising as well. The real returns for a period spanning from 1988 – 2017 is 358.12%. The real returns per year would be 11.9% before tax.

PEAK

Though the long-term prospects of Index funds look promising, let’s look at the scenarios where the investor buys a stock during the peak and the effect it has on the returns.

Let’s say that you have bought the Vanguard 500 Index Investor (VFINX) during the peaks of 2000’s and sold it in 2017. The stock price was at $134.03 in 2000 and the stock price was $208.33 in 2017. The nominal return on investment is at a mere 55.4%. The real returns on investment would be 10.4% for a period of 17 years. A real return on investment per year of 0.61% before tax.

Though you haven’t lost any money, you haven’t earned any money as well. The nominal return of 55.4% was solely earned during the last five years. You would have earned a total real return of $26.39 in total for every share invested in VFINX.

You could have earned 33.52 inflation-adjusted dollars for every share invested in VFINX if you invested in 2015 and sold it in 2017.

These kinds of mistakes can be easily avoided if you follow two simple strategies

-

Buy majority of the shares when there is peak pessimism.

-

Sell majority of the shares when there is peak optimism.

In the end, stock prices are just a reflection of the current mood of the economic future.

“When the price to earnings ratio of the stock is 7:1, the mood is despair and when the price to earnings ratio of the stock is 21:1, the mood is exuberance” – John C. Bogle.

Price to Earnings ratio ( P / E) is the price of the stock for every dollar of earning. It can be reliably used to measure the mood of the economy along with what the media and your colleagues have to say about the economic future of the country/stock.

When the majority of the people buy a stock, it’s time to sell and when the majority of the people sell their stock, Its time to buy. That’s how you get the best deal.

If you do not know anything about the P / E ratio and never intend to learn about it, a simple yet powerful strategy could be used to avoid such mistakes. It’s called Dollar Cost Averaging.

It's the act of depositing a set amount of money every month into buying a fund thereby spreading out the potential loss across time. It’s the most powerful way to avoid such financial blunders.

HOW COULD THE INDEX FUND BE USED TO AID IN THE ATTAINMENT OF FINANCIAL FREEDOM?

Index funds can be used for several scenarios.

-

It could be used to invest for buying a home in the long run.

-

It must be used for funding your retirement through ROTH IRA or IRA if you are in the US.

-

It could be used to attain your Long Term Dream / Midterm Dream including the ability to fund your children’s college education.

While investing in index funds, always look for ways to reduce your tax burden.