29

Investing in Fixed Deposits

These are one of the most common forms of investment in the developing nations, although not common among developed nations. These play an important role when it comes to managing emergency funds.

They are also the least sort after forms of investments but are a good fit for emergency funds.

EMERGENCY FUND!

Let’s get real. We may not need the 12 months worth of income to be available at our disposal all the time.

It should be available in our bank when it is necessary and the invested money should be flexible enough to withdraw /redeposit or avail overdraft when ever demanded.

Fixed deposits make all these possible. They are flexible enough to let you avail overdraft on the fixed deposit without any overdraft charges for 3 months or more.

In most cases, the fixed deposits can be withdrawn immediately with about 1% penalty on the interest rate.

Investing $100,000 for one year with an interest rate of 7%, you will be charged 1% of the interest rate on premature withdrawal.

$100,000 at the rate of 6% interest rate on premature withdrawal by 6 months will yield $3000 on half yearly compounded interest.

Emergency funds need not necessarily yield nil return. Any investment with 100% security and 0% risk with the possibility of withdrawing the money anytime will be a perfect fit.

CATCH UP WITH INFLATION

Growth is necessary for the emergency funds as it has to keep up with the inflation of the economy. We do not want the emergency fund to buy us a little less of something as every year goes by.

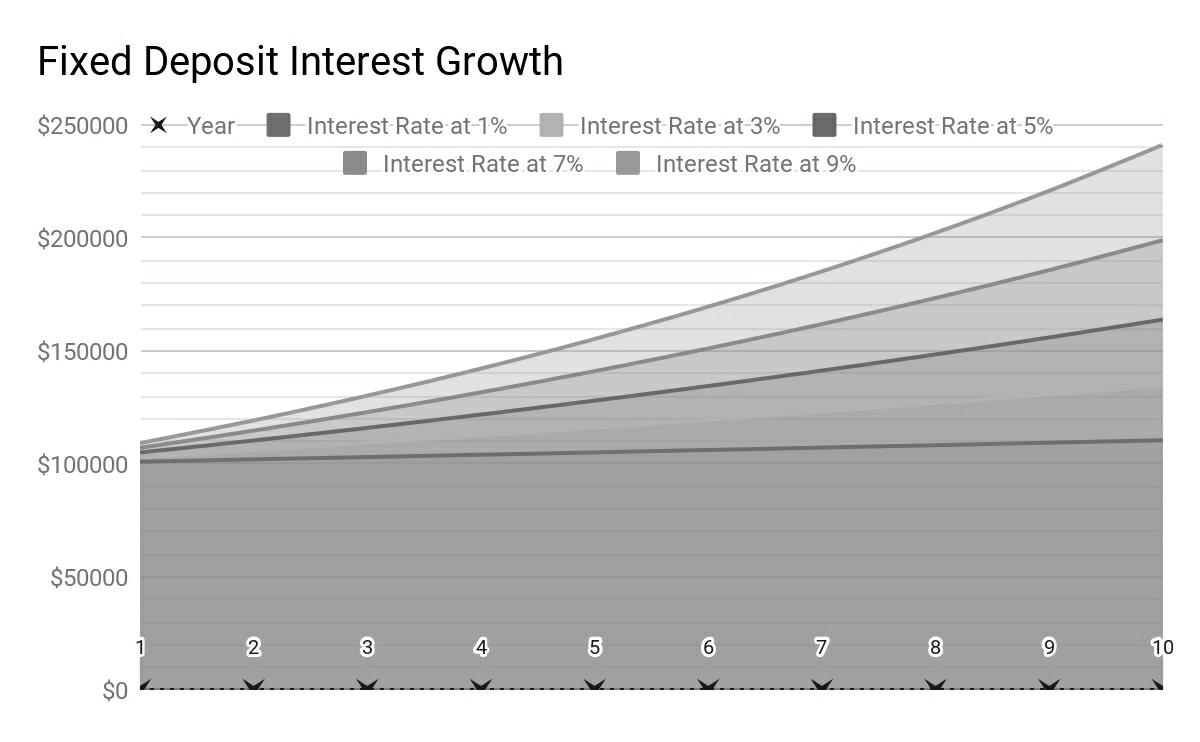

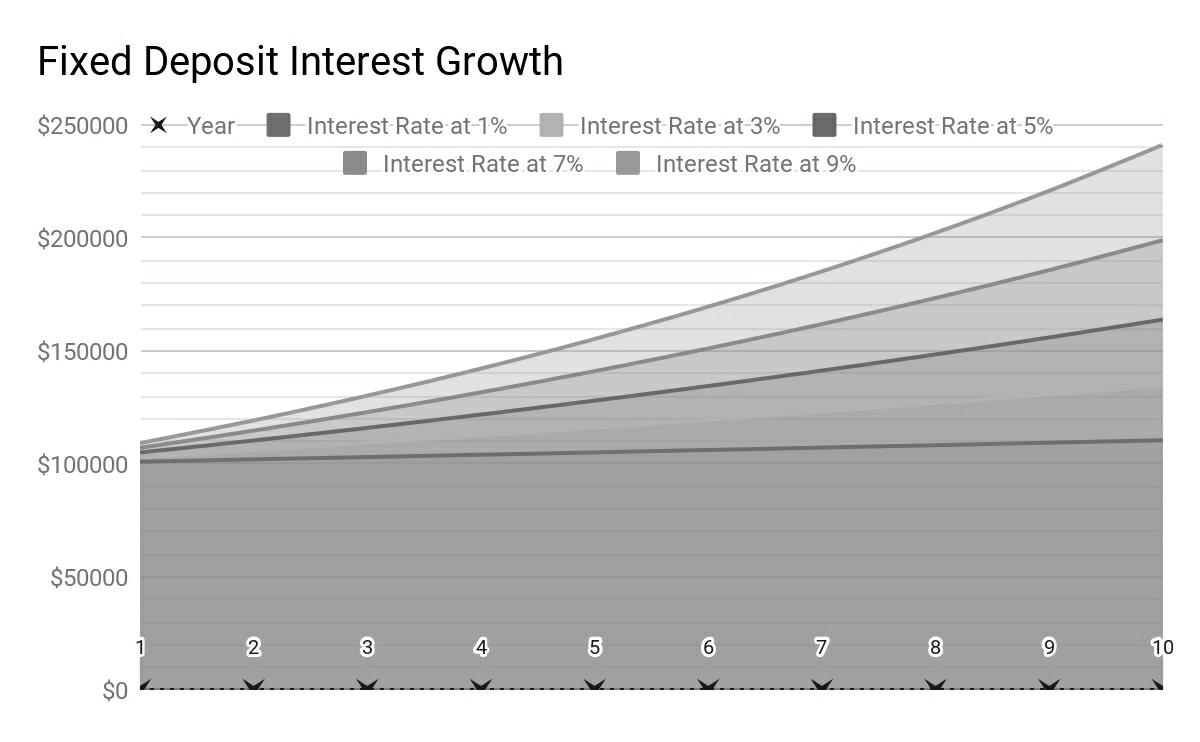

The following table assumes an emergency fund of $100,000 under the Fixed Deposit for which the interest rates are compounded half yearly.

|

Year

|

1% Interest rate

|

3% Interest rate

|

5% Interest rate

|

7% Interest rate

|

9% Interest rate

|

|

1

|

$101,002.50

|

$103,022.50

|

$105,062.50

|

$107,122.50

|

$109,202

|

|

2

|

$102,015.05

|

$106,136.36

|

$110,381.29

|

$114,752.30

|

$119,251

|

|

3

|

$103,037.75

|

$109,344.3

|

$115,969.34

|

$122,925.53

|

$130,226

|

|

4

|

$104,070.70

|

$112,649.26

|

$121,840.29

|

$131,680.90

|

$142,210

|

|

5

|

$105,114.01

|

$116,054.08

|

$128,008.45

|

$141,059.87

|

$155,296

|

|

6

|

$106,167.78

|

$119,561.81

|

$134,488.88

|

$151,106.8

|

$169,588

|

|

7

|

$107,232.11

|

$123,175.57

|

$141,297.38

|

$161,869.45

|

$185,194

|

|

8

|

$108,307.11

|

$126,898.55

|

$148,450.56

|

$173,398.60

|

$202,237

|

|

9

|

$109,392.89

|

$130,734.06

|

$155,965.87

|

$185,748.92

|

$220,847

|

|

10

|

$110,489.55

|

$134,685.50

|

$163,861.64

|

$198,978.89

|

$241,171

|

As time goes by we can double the initial deposit of emergency fund if the interests are reinvested. As discussed in the previous chapters, you can also use the Albert Einstein’s rule of 72 to find out exactly how long it takes for the money to double itself.

While shopping around for higher interest rates in your country, it is also mandatory to check the stability of the banks you are depositing them under.

The graphical representation of the growth of emergency funds in fixed deposits for its respective interest rates is shown in the above-mentioned chart.

Lehman Brothers, a bank with a 100-year-old history became bankrupt during the housing market crisis bringing the whole economic system to a standstill. One of the primary factors influencing the stability of a bank is the number of years since inception and how big the bank actually is. But these cannot be reliable measures in recent years as the 2008 housing market crash reminded us.

So it is often better to divide your fixed deposits to a minimum of 2 banks. if possible let one of them be a government-run bank as it gives you an added security.

DO YOU KNOW IF YOU COULD GET YOUR MONEY BACK IF BANKS BECOME BANKRUPT?

In such cases, the US has Federal Deposit Insurance Corporation to take care of the bankruptcy of the bank smoothly. But what about India?

India earlier had Deposit Insurance and Credit Guarantee Corporation (DICGC) which guarantees a maximum of one lakh rupees saved for both principal and interest amount in a bank for each depositor.

Fixed deposit

Fixed deposit interest rates fluctuate. It also depends on every nation and how important the bank plays a role in facilitating the functioning of the economy as a whole.

Developed nations generally provide the least interest rates. It may fluctuate between 1% to as high as 5.5% in Europe, USA, and the UK.

While developing nations interest rate may vary from 6% to as high as 14%.

The general direction the interest rate of the fixed deposit takes when the country transforms from underdeveloped to developing to developed nations is generally downwards.

Historically interest rates were a big attraction to open a bank account. Bank accounts were not mandatory and did not play an important role in the economy as it does today. Hence the primary motivation for any person to open a bank account would be the interest the money earns.

As banks begin playing a majority role in the creation of money, it pays for the government to make the bank account mandatory for every transaction.

As this happens, the banks lose the necessity to provide higher interest rates to attract new bank accounts.

In order to control the flow and the general direction of the economy, interest rates are decided by centralized banks. The central banks play a role in motivating people to either take a loan or to start saving by varying the interest rates.

In 2008, interest rates in majority of the developed nations fell to a rock bottom. As people lose the motivation to take a loan, the money in the economic system starts to dwindle. People stop paying loans and as a result, money disappears from the system.

To prevent this from happening the central bank varies the interest rate to stimulate the economy and provide price stability but during the economic crisis under extreme conditions, the central banks run out of ways to stimulate the economy and the government steps in.

The governments can pump money into the system by providing it to banks/businesses. That way the money seeps into the economy and keeps the money flowing.

When all of the tricks fail, its usual that the growth in the economic system stops, deflation starts to kick in and job cuts become a common phenomenon.

Varying interest rates is not the only way to stimulate the economy. The central banks can also buy back the treasury notes to pump money into the system.

If the inflation stops due to the economic crisis, it is usual that the central banks would have already lowered the interest rates on the bank deposit. So it does not matter what the interest rates for fixed deposits are as it is always in close proximity to the inflation.

What makes more sense is the relation between the fixed deposit interest rates and the inflation of the currency.

This relationship is sure to stay within acceptable limits at least in the developed nations.

So, it doesn’t matter if you are in a developed nation or developing nation and if there is an economic crisis in your country or not. Fixed deposits are the best way to ensure your emergency fund stays safe and earns interest at the same time while not destroying the whole purpose of having an emergency fund.