page 74

©bacho12345/123RF

page 75

LO3.1

Identify the major tax types in our society.

Taxes in Your Financial Plan

Taxes are an everyday financial fact of life. You pay taxes when you get a paycheck or make a purchase. However, most people concern themselves with taxes only immediately before April 15. Tax planning should be an ongoing process.

Planning Your Tax Strategy

Each year, the Tax Foundation determines how long the average person works to pay taxes. In recent years, “Tax Freedom Day” came in mid-April. This means that the time that elapsed from January 1 until mid-April represents the portion of the year people work to pay their taxes.

Tax planning starts with knowing current tax laws, maintaining complete and appropriate tax records, then making purchase and investment decisions that can reduce your tax liability. Your primary goal should be to pay your fair share of taxes while taking advantage of appropriate tax benefits.

Types of Tax

Most people pay taxes in four major categories: taxes on purchases, taxes on property, taxes on wealth, and taxes on earnings.

TAXES ON PURCHASES You probably pay sales tax on many purchases. Many states exempt food and drugs from sales tax to reduce the financial burden on low-income households. In recent years, all but five states (Alaska, Delaware, Montana, New Hampshire, and Oregon) had a general sales tax. An excise tax is imposed by the federal and state page 76governments on specific goods and services, such as gasoline, cigarettes, alcoholic beverages, tires, air travel, hotels, and phone service.

TAXES ON PROPERTY Real estate property tax is a major source of revenue for local governments. This tax is based on the value of land and buildings. Many people have seen significant increases in property taxes in the last decade. Some areas impose a personal property tax on the value of automobiles, boats, furniture, farm equipment, and even livestock.

TAXES ON WEALTH An estate tax is imposed on the value of a person’s property at the time of death. This federal tax is based on the fair market value of the deceased person’s investments, property, and bank accounts less allowable deductions and other taxes.

Money and property passed on to heirs may be subject to a state tax. An inheritance tax is levied on the value of property bequeathed by a deceased person. This tax is paid for the right to acquire the inherited property.

Individuals are allowed to give money or items valued at $14,000 or less in a year to a person without being subject to taxes. Gift amounts greater than $14,000 may have estate tax implications later. Amounts given for tuition payments or medical expenses are not subject to gift taxes as long as they are paid directly to the institution.

TAXES ON EARNINGS The two main taxes on wages and salaries are Social Security and income taxes. The Federal Insurance Contributions Act (FICA) created the Social Security tax to fund the old-age, survivors, and disability insurance portion of the Social Security system and the hospital insurance portion (Medicare).

For most people, the Social Security tax is 6.2 percent and the Medicare tax is an additional 1.45 percent, for a total of 7.65 percent. Your employer must also pay an equal amount. If you are self-employed, you must pay both of these parts, for a total of 15.3 percent. There are some limitations and additional surcharges owed. There is a cap on the maximum amount of wages subject to Social Security; in 2017, the amount is $127,200. There is no wage cap for the Medicare tax. In fact, if your wages are more than $200,000 (individual) or $250,000 (married filing jointly), there is an additional Medicare surtax of 0.9 percent, payable only by the employee.

Income tax is a major financial planning factor for most people. Some workers are subject to federal, state, and local income taxes. Currently, only seven states do not have a state income tax. Additionally, two states, New Hampshire and Tennessee, tax only dividend and interest income.

Throughout the year, your employer will withhold income tax payments from your paycheck, or you may be required to make estimated tax payments if you own your own business. Both types of payments are only estimates; you may need to pay an additional amount, or you may get a tax refund. The following sections will assist you in preparing your federal income tax return and planning your future tax strategies.

LO3.2

Calculate taxable income and the amount owed for federal income tax.

page 77

The Basics of Federal Income Tax

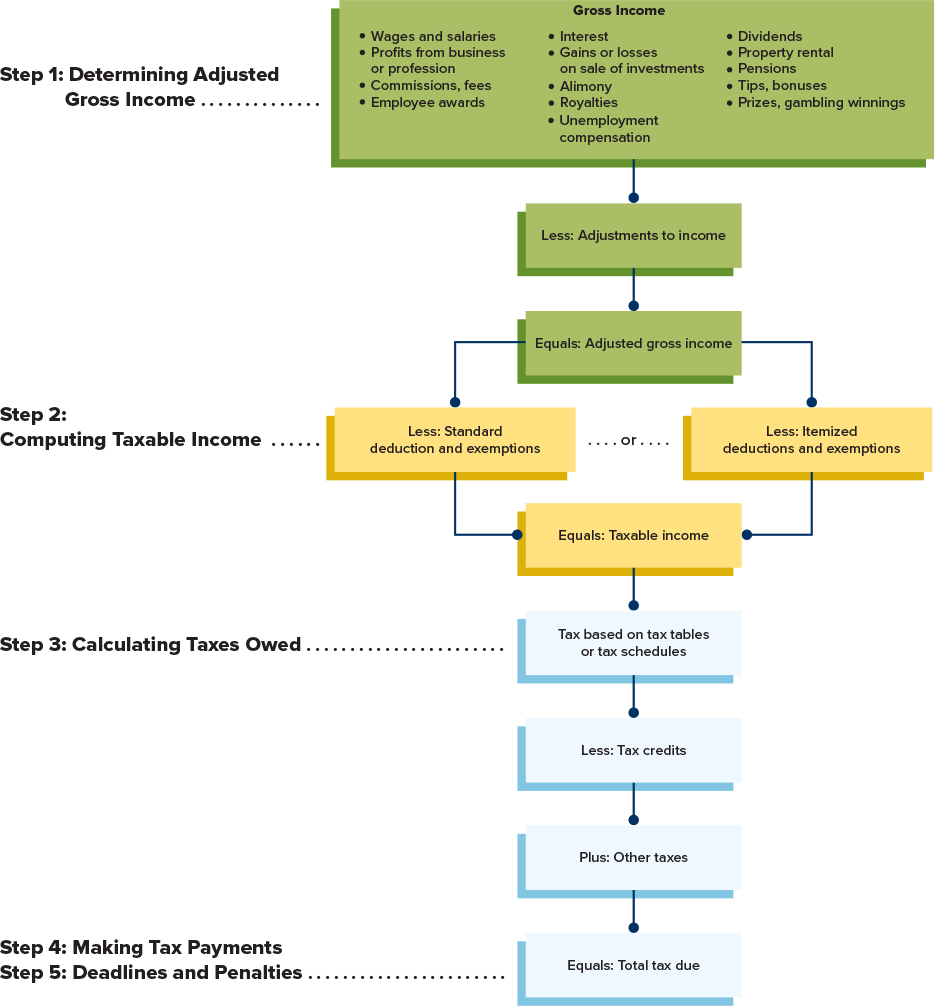

Each year, millions of Americans are required to pay their share of income taxes to the federal government. As shown in Exhibit 3–1, this process involves several steps.

Exhibit 3–1 Computing Taxable Income and Your Tax Liability

Step 1: Determining Adjusted Gross Income

This process starts with steps to determine taxable income, which is the net amount of income, after allowable deductions, on which income tax is computed.

TYPES OF INCOME Most, but not all, income is subject to taxation. Your gross, or total, income can consist of three main components:

Earned income is usually in the form of wages, salary, commission, fees, tips, or bonuses.

Investment income (sometimes referred to as portfolio income) is money received in the form of dividends, interest, or rent from investments.

Passive income results from business activities in which you do not actively participate, such as a limited partnership.

Other types of income subject to federal income tax include alimony, awards, lottery winnings, credit card sign-up bonuses, and prizes. For example, cash and prizes won on television game shows are subject to both federal and state taxes.

Total income is also affected by exclusions. An exclusion is an amount not included in gross income. For example, the foreign income exclusion allows U.S. citizens working and living in another country to exclude a certain portion ($102,100 in 2017, adjusted each year for inflation) of their income from federal income taxes.

Exclusions may also be referred to as tax-exempt income, or income that is not subject to tax. For example, interest earned on most state and city bonds is exempt from federal income tax. Tax-deferred income is income that will be taxed at a later date.

ADJUSTMENTS TO INCOME Adjusted gross income (AGI) is gross income after certain reductions have been made. These reductions, called adjustments to income, include contributions to an individual retirement account (IRA) or a Keogh retirement plan, penalties for early withdrawal of savings, and alimony payments. Adjusted gross income is used as the basis for computing various income tax deductions, such as medical expenses.

Certain adjustments to income, such as tax-deferred retirement plans, are a type of tax shelter. Tax shelters are investments that provide immediate tax benefits and a reasonable expectation of a future financial return. In recent years, tax court rulings and changes in the tax code have disallowed various types of tax shelters that were considered excessive.

Step 2: Computing Taxable Income

DEDUCTIONS A tax deduction is an amount subtracted from adjusted gross income to arrive at taxable income. Every taxpayer receives at least the standard deduction, a set amount on which no taxes are paid. As of 2017, single people receive a standard deduction of $6,350 (married couples filing jointly receive $12,700). Blind people and individuals 65 and older receive higher standard deductions.

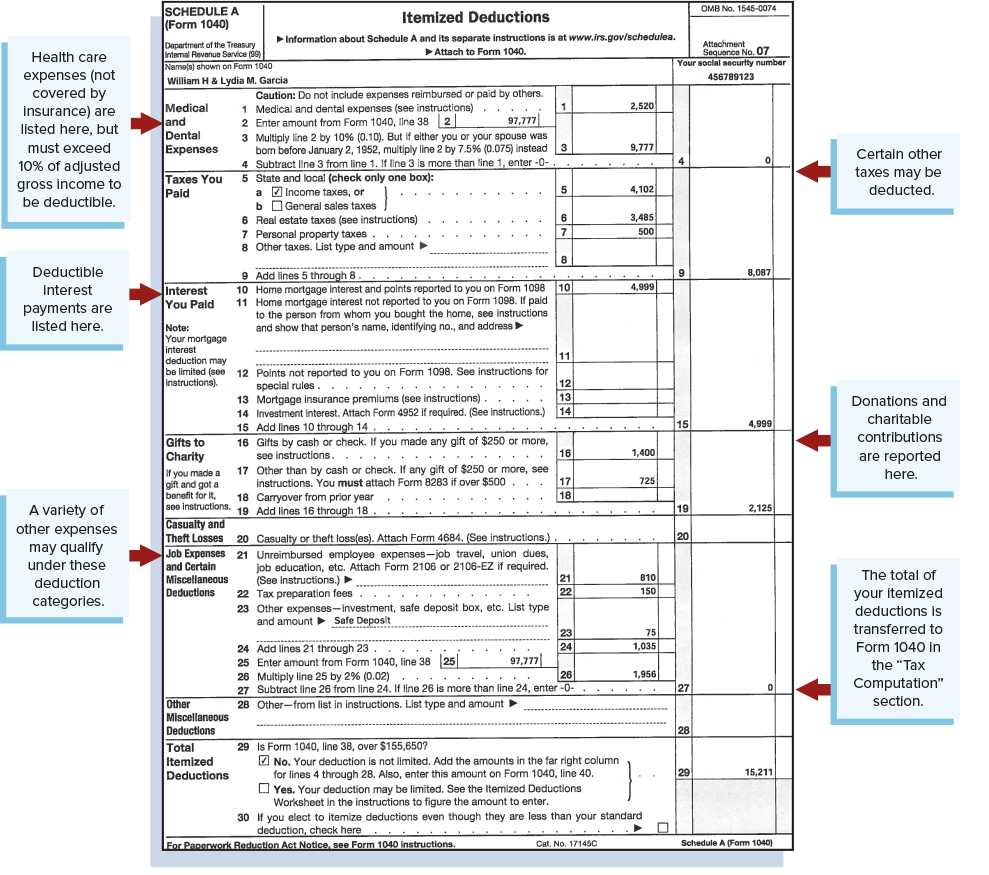

Many people qualify for more than the standard deduction. Itemized deductions are expenses a taxpayer is allowed to deduct from adjusted gross income. These deductions must be reported on a Form 1040, Schedule A form. Common itemized deductions include:

Medical and dental expenses—physician fees, prescription medications, hospital expenses, medical insurance premiums, hearing aids, eyeglasses, and medical travel that has not been reimbursed or paid by others. The amount of this deduction is the medical and dental expenses that exceed 10 percent of adjusted gross income. For taxpayers over 65, it remained at 7.5 percent of AGI through 2016.

page 78Taxes—state and local income tax, real estate property tax, and state or local personal property tax.

Interest—mortgage interest, home equity loan interest, and investment interest expense up to an amount equal to investment income.

Contributions—cash or property donated to qualified charitable organizations. Contribution totals greater than 20 percent of adjusted gross income are subject to limitations.

Casualty and theft losses—financial losses resulting from natural disasters, accidents, or unlawful acts.

Moving expenses—costs incurred for a change in residence associated with a new job that is at least 50 miles farther from your former home than your old main job location.

Job-related and other miscellaneous expenses—unreimbursed job travel, union dues, required continuing education, work clothes or uniforms, investment expenses, tax preparation fees, safe deposit box rental (for storing investment documents), and so on. The amount of this deduction is the expenses that exceed 2 percent of adjusted gross income.

page 79

The standard deduction or total itemized deductions, along with the value of your exemptions (see next section), are subtracted from adjusted gross income to obtain your taxable income. Note: For individual returns with incomes greater than $261,500 or joint returns greater than $313,800 in 2017, there are limitations to the amount of itemized deductions.

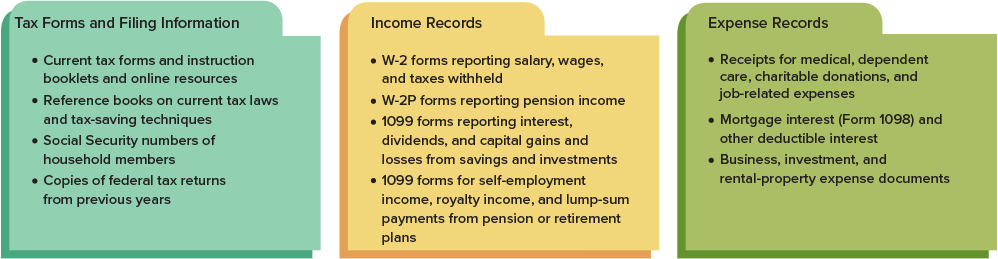

You are required to maintain records to document tax deductions, such as a home filing system (Exhibit 3–2). Canceled checks and receipts serve as proof of payment for deductions such as charitable contributions, medical expenses, and business-related expenses. Travel expenses can be documented in a daily log with records of mileage, tolls, parking fees, and away-from-home costs. See the nearby Financial Literacy in Practice feature to review deductions and exemptions.

Exhibit 3–2 A Tax Recordkeeping System

page 80Generally, you should keep tax records for three years from the date you file your return. However, you may be held responsible for providing back documentation up to six years. Records such as past tax returns and housing documents should be kept indefinitely.

EXEMPTIONS An exemption is a deduction from adjusted gross income for yourself, your spouse, and qualified dependents. A dependent must not earn more than a set amount unless he or she is under age 19 or is a full-time student under age 24; you must provide more than half of the dependent’s support; and the dependent must reside in your home or be a specified relative and must meet certain citizenship requirements. For 2017, taxable income was reduced by $4,050 for each exemption claimed. After deducting the amounts for exemptions, you obtain your taxable income, which is the amount used to determine taxes owed.

Step 3: Calculating Taxes Owed

Your taxable income is the basis for computing the amount of tax owed.

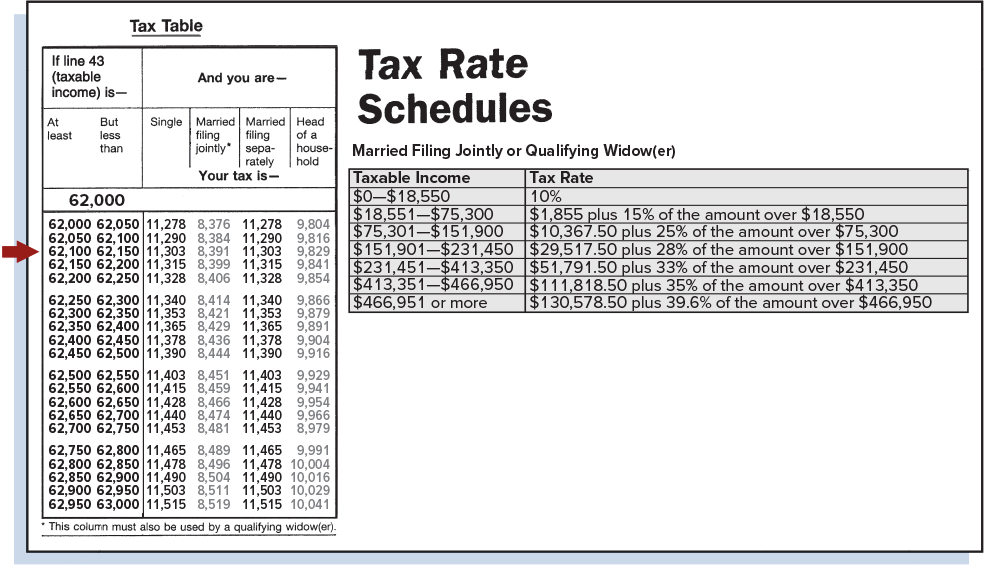

TAX RATES Use your taxable income in conjunction with the appropriate tax table or tax schedule. For 2017, the seven-rate system for federal income tax was as follows:

Rate on Taxable Income |

Single Taxpayers |

Married Taxpayers Filing Jointly |

Heads of Household |

10% |

Up to $9,325 |

Up to $18,650 |

Up to $13,350 |

15 |

$9,326–$37,950 |

$18,651–$75,900 |

$13,351–$50,800 |

25 |

$37,951–$91,900 |

$75,901–$153,100 |

$50,801–$131,200 |

28 |

$91,901–$191,650 |

$153,101–$233,350 |

$131,201–$212,500 |

33 |

$191,651–$416,700 |

$233,351–$416,700 |

$212,501–$416,700 |

35 |

$416,701–$418,400 |

$416,701–$470,700 |

$416,701–$444,550 |

39.6 |

Over $418,401 |

Over $470,701 |

Over $444,551 |

A separate tax rate schedule also exists for married persons who file separate income tax returns.

The 10, 15, 25, 28, 33, 35 and 39.6 percent rates are referred to as marginal tax rates. These rates are used to calculate tax on the last (and next) dollar of taxable income. After deductions and exemptions, a person in the 35 percent tax bracket pays 35 cents in taxes for the next dollar of taxable income in that bracket.

page 81

In contrast, the average tax rate is based on the total tax due divided by taxable income. Except for taxpayers in the 10 percent bracket, this rate is less than a person’s marginal tax rate. For example, a person with taxable income of $50,000 and a total tax bill of $8,240 would have an average tax rate of 16.5 percent ($8,240 ÷ $50,000).

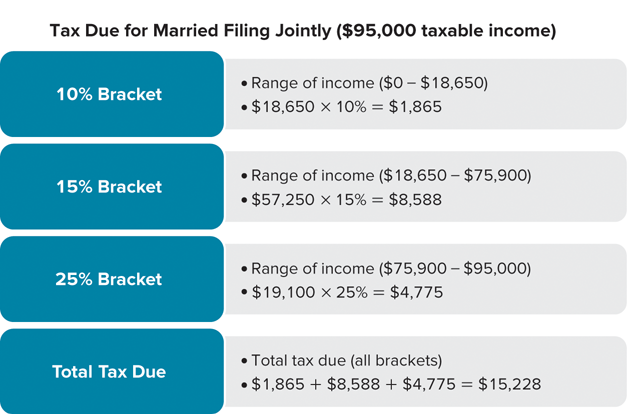

CALCULATING YOUR TAX Each of the tax rates represents a range of income levels. These are often referred to as “brackets.” Thus, if you are married filing jointly and have a taxable income of $95,000, you and your spouse are in the 25 percent tax bracket. Although most computer programs will automatically calculate the tax owed, it is helpful to understand the process to calculate the tax due. (Note: For this example, we assume that you received no other income at different rates, such as capital gains.)

page 82To calculate the tax on a specific amount of income, you must calculate the tax from each of the brackets as you progress up to your taxable income. (Note: This is the tax calculated prior to additional credits or other taxes, such as self-employment tax.)

ALTERNATIVE MINIMUM TAX Taxpayers with high amounts of certain deductions and various types of income may be subject to an additional tax. The alternative minimum tax (AMT) is designed to ensure that those who receive tax breaks also pay their fair share of taxes. The AMT was originally designed to prevent those with high incomes from using special tax breaks to pay little in taxes. However, in recent years, this tax is affecting increasing numbers of taxpayers. Some of the tax situations that can result in a person paying the AMT include high levels of deductions for state and local taxes, interest on second mortgages, medical expenses, and other deductions. Income items that can trigger the AMT are incentive stock options, long-term capital gains, and tax-exempt interest. Additional information about the AMT may be obtained at www.irs.gov.

TAX CREDITS The tax owed may be reduced by a tax credit, an amount subtracted directly from the amount of taxes owed. One example of a tax credit is the credit given for child care and dependent care expenses. Another tax credit for low-income workers is the earned-income credit (EIC) for working parents with taxable income under a certain amount. Families that do not earn enough to owe federal income taxes are also eligible for the EIC and receive a check for the amount of their credit. A tax credit differs from a deduction in that a tax credit has a full dollar effect in lowering taxes, whereas a deduction reduces the taxable income on which the tax liability is computed.

Recent tax credits also included:

Foreign tax credit to avoid double taxation on income taxes paid to another country.

Saver’s credit (formerly the retirement tax credit) to encourage investment contributions to individual and employer-sponsored retirement plans by low- and middle-income taxpayers.

Adoption tax credit to cover expenses when adopting a child under age 18.

Education credits to help offset college education expenses.

Child tax credit up to $1,000 for each dependent under the age of 17.

See the nearby Figure It Out! feature to review the different between tax deductions and tax credits.

Step 4: Making Tax Payments

You pay federal income taxes through either payroll withholding or estimated tax payments.

page 83WITHHOLDING The pay-as-you-go system requires an employer to deduct federal income tax from your pay. The withheld amount is based on the number of exemptions and the expected deductions claimed. For example, a married person with children would have less withheld than a single person with the same salary, since the married person will owe less tax.

After the end of the year, you will receive a W-2 form, which reports your annual earnings and the amounts deducted for taxes. The difference between the amount withheld and the tax owed is either the additional amount to pay or your refund. Students and low-income individuals may file for exemption from withholding if they paid no federal income tax last year and do not expect to pay any in the current year.

Many taxpayers view an annual tax refund as a “windfall,” extra money they count on each year. These taxpayers are forgetting the opportunity cost of withholding excessive amounts. Others view their extra tax withholding as “forced savings.” This is giving the government a free loan. A payroll deduction plan for savings could serve the same purpose while also earning interest on your funds.

ESTIMATED PAYMENTS Income from savings, investments, independent contracting, royalties, and pension payments is reported on Form 1099. People who receive such income may be required to make tax payments during the year (April 15, June 15, September 15, and January 15 as the last payment for the previous tax year). These payments are based on an estimate of taxes due at year-end. Underpayment or failure to make estimated payments can result in penalties and daily interest charges.

Step 5: Deadlines and Penalties

Most people are required to file a federal income tax return by April 15. If you are not able to file on time, you can use Form 4868 to obtain an automatic six-month extension.

This extension is for the 1040 form and other documents, but it does not delay your payment liability. You must submit the estimated amount owed along with Form 4868 by April 15. Failure to file on time can result in a penalty for being just one day late. Underpayment of quarterly estimated taxes may require paying interest on the amount you should have paid. Underpayment due to negligence or fraud can result in penalties of 50 to 75 percent.

The good news is that if you claim a refund several months or years late, the IRS will pay you interest. However, refunds must be claimed within three years of filing the return or within two years of paying the tax.

page 84

LO3.3

Prepare a federal income tax return.

Filing Your Federal Income Tax Return

As you prepare to do your taxes, you must first determine whether you are required to file a return. Next, you need to decide which tax form best serves you and if you are required to submit supplementary schedules or forms.

Who Must File?

Every citizen or resident of the United States and every U.S. citizen who is a resident of Puerto Rico is required to file a federal income tax return if his or her income is above a certain amount. The amount is based on the person’s filing status and other factors such as age. For example, single persons under 65 had to file a return on April 18, 2017, (for tax year 2016) if their gross income exceeded $10,000. If your gross income is less than this amount but taxes were withheld, you should file a return to obtain your refund. Also, if you can be claimed as a dependent, the income limits are lower.

Your filing status is affected by marital status and dependents. The five filing status categories are:

Single—never-married, divorced, or legally separated individuals with no dependents.

Married, filing joint return—combines the spouses’ incomes.

Married, filing separate returns—each spouse is responsible for his or her own tax; under certain conditions, a married couple can benefit from this filing status.

Head of household—an unmarried individual or a surviving spouse who maintains a household (paying for more than half of the costs) for a child or a dependent relative.

Qualifying widow or widower—an individual whose spouse died within the past two years and who has a dependent; this status is limited to two years after the death of the spouse.

In some situations, you may have a choice of filing status. In such cases, compute your taxes under the alternatives to determine the most advantageous filing status.

Which Tax Form Should You Use?

Although about 800 federal tax forms and schedules exist, you have a choice of three basic forms when filing your income tax (see the nearby Financial Literacy in Practice feature.) Recently, about 20 percent of taxpayers used Form 1040EZ or Form 1040A; about 60 percent used the regular Form 1040. Your decision in this matter will depend on your type of income, the amount of your income, the number of your deductions, and the complexity of your tax situation. Most tax preparation software programs will guide you in selecting the appropriate 1040 form.

Completing the Federal Income Tax Return

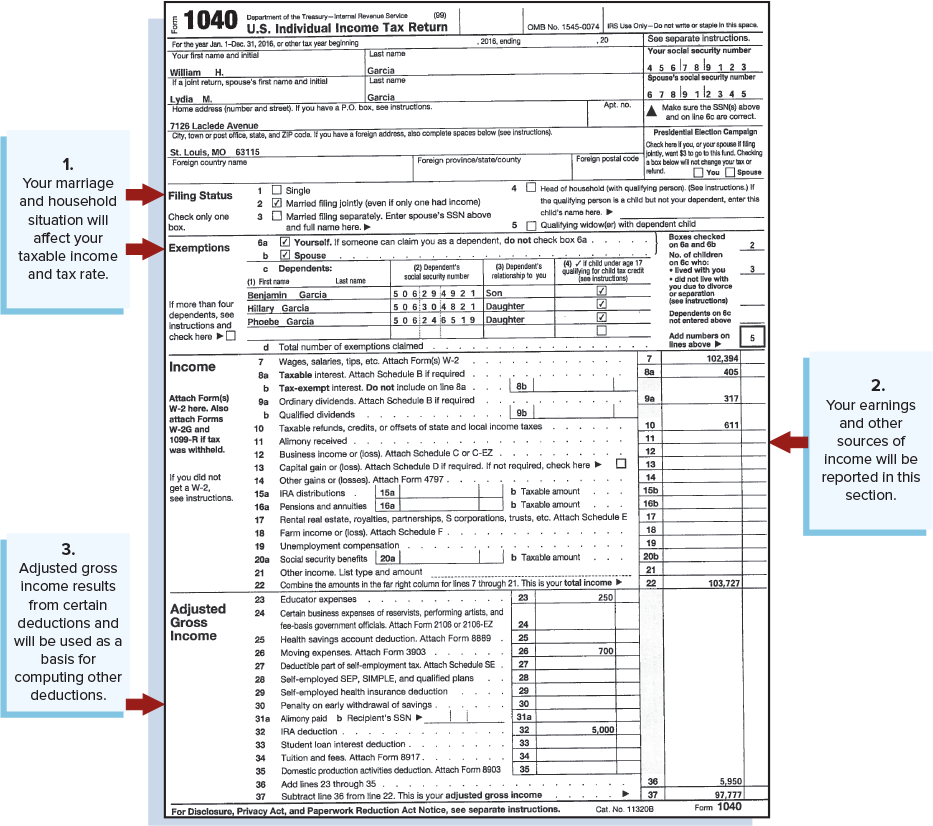

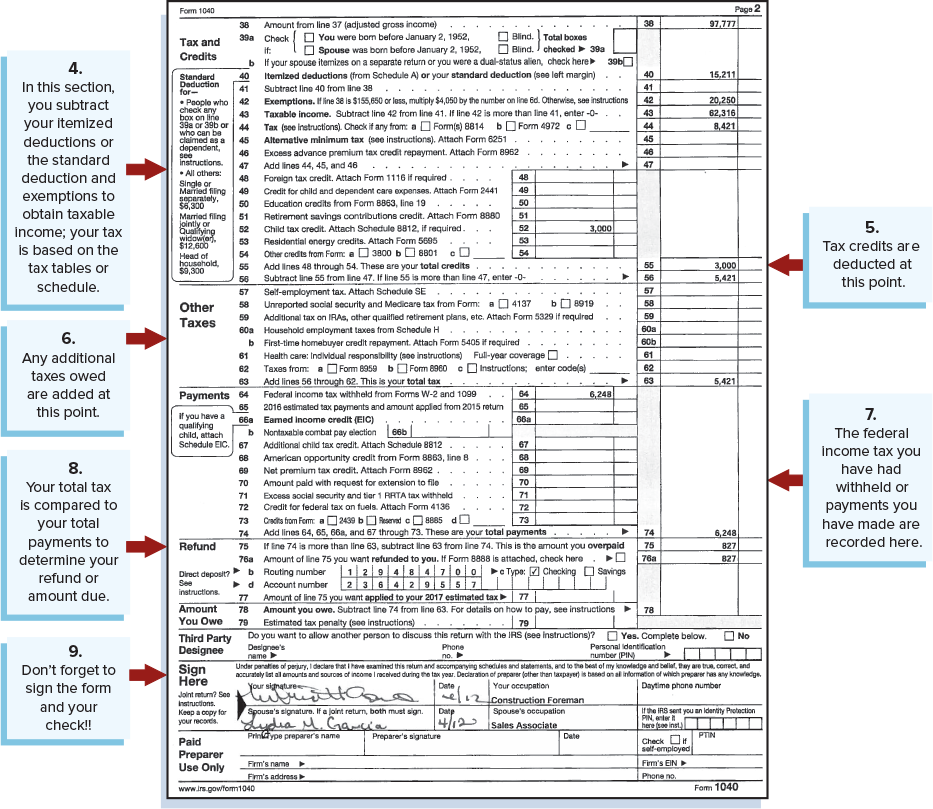

The major sections of Form 1040 (see Exhibit 3–3) correspond to tax topics discussed in the previous sections of this chapter:

Exhibit 3–3 Federal Income Tax Return—Form 1040

NOTE: These forms were used in a recent year; the current forms may not be exactly the same. Obtain current income tax forms and current tax information from your local IRS office, select post offices and libraries, or at www.irs.gov.

Source: Form 1040, Department of the Treasury.

Filing status and exemptions. Your tax rate is determined by your filing status and allowances for yourself, your spouse, and each person you claim as a dependent.

Income. Earnings from your employment (as reported by your W-2 form) and other income, such as savings and investment income, are reported in this section of Form 1040.

Adjustments to income. As discussed later in the chapter, if you qualify, you may deduct contributions (up to a certain amount) to an individual retirement account (IRA) or other qualified retirement program.

Tax computation. In this section, your adjusted gross income is reduced by your itemized deductions (see Exhibit 3–4) or by the standard deduction for your tax situation. In addition, an amount is deducted for each exemption to arrive at your taxable income. That income is the basis for determining the amount of your tax (see Exhibit 3–5).

Tax credits. Any tax credits for which you qualify are subtracted at this point.

Other taxes. Any special taxes, such as self-employment tax or health care responsibility penalties, are included at this point.

Payments. Your total withholding and other payments are indicated in this section.

Refund or amount you owe. If your payments exceed the amount of income tax you owe, you are entitled to a refund. If the opposite is true, you must make an additional payment. Taxpayers who want their refunds sent directly to a bank can provide the necessary account information directly on Form 1040, 1040A, or 1040EZ.

Changing economic and political environments often result in new tax regulations, some of which may be favorable for you while others are not. An important element of tax planning is your refund. Each year, more than 90 million American households receive an average tax refund of over $2,500 for a total of over $225 billion. Invested at 5 percent for a year, these refunds represent about $11.25 billion in lost earnings. By having less withheld and obtaining a smaller refund, you can save and invest these funds for your benefit during the year.

Your signature. Forgetting to sign a tax return is one of the most frequent filing errors.

Exhibit 3–4 Schedule A for Itemized Deductions—Form 1040

Source: Schedule A Form 1040, Department of the Treasury.

Exhibit 3–5 Tax Tables and Tax Rate Schedules

NOTE: These were the federal income tax rates for 2016 that are used for illustrative purposes for the tax return included in the chapter exhibits. Current rates may vary due to changes in the tax code and adjustments for inflation. Obtain current income tax booklets from www.irs.gov.

Source: Internal Revenue Service

page 85

page 86

page 87

How Do I File My State Tax Return?

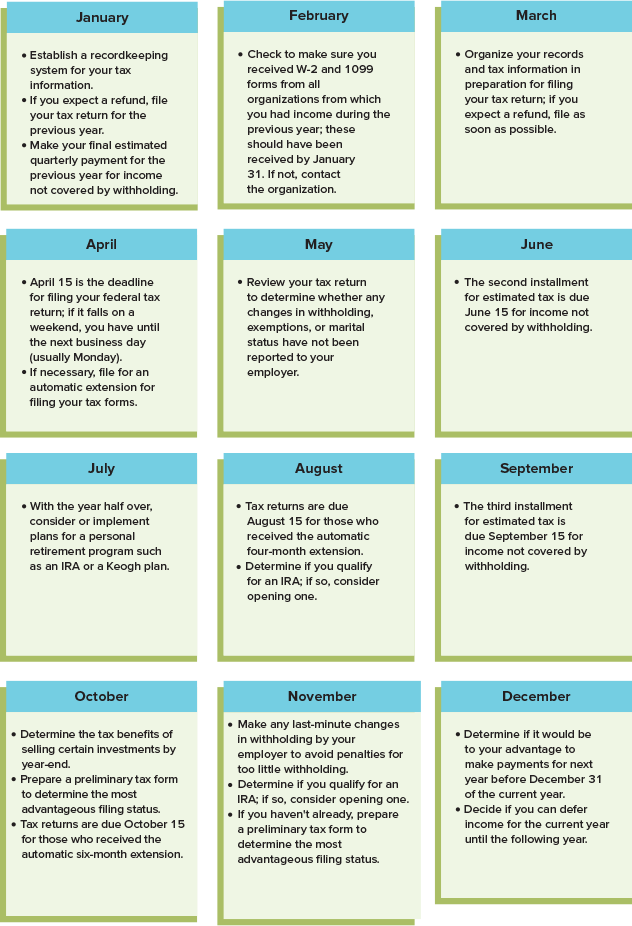

All but seven states (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming) have some type of state income tax. In most states, the tax rate ranges from 1 to 10 percent. For further information about the income tax in your state, contact the state department of revenue. States usually require income tax returns to be filed when the federal income tax return is due. For planning your tax activities, see Exhibit 3–6.

Exhibit 3–6 Tax-Planner Calendar

NOTE: Children born before the end of the year give you a full-year exemption, so plan accordingly!

How Do I File My Taxes Online?

Today, it is more common to electronically file (e-file) than send in a paper return. The IRS has reported that electronic filing of federal taxes now exceeds 123 million returns annually, which is over 90 percent of total tax returns. With e-file, taxpayers usually receive their refunds within three weeks. The cost for this service is usually between $15 and $40, with no fee in some cases.

FREE FILE ALLIANCE In recent years, the IRS has made online filing easier and less expensive. Through the Free File Alliance, online tax preparation and e-filing are available free to millions of taxpayers. This partnership between the IRS and the tax software page 88industry has encouraged more e-filing. The IRS has reported that 50 million taxpayers have used this service and potentially saved $1.5 billion on tax preparation. The online filing process involves the following steps:

Step 1 Go to www.irs.gov and click “Free File” in the “Filing and Payment” section.

Step 2 The initial IRS webpage gives guidance regarding the process. Your eligibility for Free File is based on your income level. You can click on a Free File company to begin your tax return. You should determine your eligibility with a particular company. A brief description of the criteria for each is provided. A “How to use Free File” option is also available to help you understand the process.

Step 3 Next, connect to the chosen company’s website to begin the preparation of your tax return.

Step 4 Finally, use the company’s online software to prepare your return. Your federal tax return is then filed electronically, and your tax data are stored at the vendor’s site. Taxpayers who do not qualify for the Free File Alliance program may still be able to file online for a nominal fee or use fillable forms. You don’t have to purchase the software; simply go to the software company’s internet site and pay a fee to use the tax program.

page 89Taxpayers who use the Free File Alliance are cautioned to be careful consumers. A company may attempt to sell other financial products to inexperienced taxpayers, such as expensive refund anticipation loans. Also, taxpayers using the Free File service must be aware that their state tax return might not be included in the free program.

TAX PREPARATION SOFTWARE Software packages such as H&R Block At Home and TurboTax allow you to complete needed tax forms and schedules and either print for mailing or file online. Today, most taxpayers use computers or online products for tax recordkeeping, tax form preparation, and electronic filing.

Using tax software can save you time when preparing your Form 1040 and accompanying schedules. When selecting tax software, consider the following factors:

Your personal situation—are you employed or do you operate your own business?

Special tax situations with regard to types of income, unusual deductions, and various tax credits.

Features in the software, such as “audit check,” future tax planning, and filing your federal and state tax forms online.

Technical aspects, such as the hardware and operating system requirements, and online support that is provided.

What Tax Assistance Sources Are Available?

As with other aspects of personal financial planning, many tax resources are available to assist you.

page 90IRS SERVICES If you prepare your own tax return or desire tax information, the IRS can assist in seven ways:

Publications. The IRS offers hundreds of free booklets and pamphlets that can be obtained at a local IRS office, by mail request, by telephone, or downloaded. Especially helpful is Your Federal Income Tax (IRS Publication 17). IRS publications and tax forms are available by phone at 1-800-TAX-FORM or online at www.irs.gov.

Recorded messages. The IRS Tele-Tax system gives you 24-hour access to about 150 recorded tax tips at 1-800-829-4477.

Phone hotline. Information about specific problems is available through an IRS-staffed phone line at 1-800-829-1040.

page 91Walk-in service. You can visit a local IRS office (400 are available) to obtain tax assistance.

Interactive tax assistant. The IRS has developed a query-based interactive tool that allows taxpayers to get answers for basic and advanced questions.

DVD. The IRS also sells a DVD with over 2,000 tax forms, publications, and FAQs.

IRS2Go App. This tool provides options for checking your refund status, requesting tax records, locating free tax prep help, and other interactive tools.

TAX PUBLICATIONS Each year, several tax guides are published and offered for sale. Publications such as J.K. Lasser’s Your Income Tax and The Ernst & Young Tax Guide can be purchased online or at local stores. The IRS also offers Publication 17, Your Federal Income Tax (for Individuals), which is a free resource.

THE INTERNET As with other personal finance topics, extensive information may be found on websites such as those mentioned earlier. Be sure to access reliable websites and print information for your records.

Tax Preparation Services

Over 40 million U.S. taxpayers pay someone to do their income taxes. The fee for this service can range from $40 at a tax preparation service for a simple return to more than $2,000 to a certified public accountant for a complicated return.

TYPES OF TAX SERVICES Doing your own taxes may not be desirable, especially if you have sources of income other than salary. The sources available for professional tax assistance include the following:

Tax services range from local, one-person operations to national firms with thousands of offices, such as H&R Block.

Enrolled agents—government-approved tax experts—prepare returns and provide tax advice. You may contact the National Association of Enrolled Agents at 1-800-424-4339 for information about enrolled agents in your area.

Many accountants offer tax assistance along with other business services. A certified public accountant (CPA) with special training in taxes can help with tax planning and the preparation of your annual tax return.

Attorneys usually do not complete tax returns; however, you can use an attorney’s services when you are involved in a tax-related transaction or when you have a difference of opinion with the IRS.

EVALUATING TAX SERVICES When planning to use a tax preparation service, consider these factors:

What training and experience does the tax professional possess?

How will the fee be determined? (Avoid preparers who earn a percentage of your refund.)

Does the preparer suggest you report various deductions that might be questioned?

Will the preparer represent you if your return is audited?

Is tax preparation the main business activity, or does it serve as a front for selling other financial products and services?

page 92Additional information about tax preparers may be obtained at the websites for the National Association of Enrolled Agents (www.naea.org) and the National Association of Tax Professionals (www.natptax.com).

TAX SERVICE WARNINGS Even if you hire a professional tax preparer, you are responsible for supplying accurate and complete information. Hiring a tax preparer will not guarantee that you pay the correct amount. A study conducted by Money magazine of 41 tax preparers reported fees ranging from $375 to $3,600, with taxes due ranging from $31,846 to $74,450 for the same fictional family. If you owe more tax because your return contains errors or you have made entries that are not allowed, you are responsible for paying that additional tax, plus any interest and penalties.

Beware of tax preparers and other businesses that offer your refund in advance. These “refund anticipation loans” frequently charge very high interest rates for this type of consumer credit. Studies reveal interest rates sometimes exceeding 300 percent (on an annualized basis).

What If Your Return Is Audited?

The Internal Revenue Service reviews all returns for completeness and accuracy. If you make an error, your tax is automatically refigured and you receive either a bill or a refund. If you make an entry that is not allowed, you will be notified by mail. A tax audit is a detailed examination of your tax return by the IRS. In most audits, the IRS requests more information to support your tax return. Be sure to keep accurate records. Receipts, canceled checks, and other evidence can verify amounts that you claim. Avoiding common filing mistakes helps to minimize your chances of an audit (see Exhibit 3–7).

Exhibit 3–7 How to Avoid Common Filing Errors

|

WHO GETS AUDITED? Less than 1 percent of all tax filers—fewer than 1.5 million people—are audited each year. Although the IRS does not reveal its basis for auditing returns, several indicators are evident. People who claim large or unusual deductions increase their chances of an audit. Tax advisors suggest including a brief explanation or a copy of receipts for deductions that may be questioned.

TYPES OF AUDITS The simplest and most frequent type of audit is the correspondence audit. This mail inquiry requires you to clarify or document minor questions. The office audit requires you to visit an IRS office to clarify some aspect of your tax return.

The field audit is more complex. An IRS agent visits you at your home, your business, or the office of your accountant to have access to your records. A field audit may be done to verify whether an individual has a home office if this is claimed.

The IRS also conducts more detailed audits for about 50,000 taxpayers. These range from random requests to document various tax return items to line-by-line reviews by IRS employees.

YOUR AUDIT RIGHTS When you receive an audit notice, you have the right to request time to prepare. Also, you can ask the IRS for clarification of items being questioned. When audited, follow these suggestions:

Decide whether you will bring your tax preparer, accountant, or lawyer.

Be on time for your appointment; bring only relevant documents.

Present tax evidence in a logical, calm, and confident manner; maintain a positive attitude.

Make sure the information you present is consistent with the tax law.

page 93Keep your answers aimed at the auditor’s questions. Answer questions clearly and completely. Be as brief as possible. The five best responses to questions during an audit are “Yes,” “No,” “I don’t recall,” “I’ll have to check on that,” and “What specific items do you want to see?”

If you disagree with the results of an audit, you may request a conference at the Regional Appeals Office. Although most differences of opinion are settled at this stage, some taxpayers take their cases further. A person may go to a U.S. tax court, a U.S. claims court, or a U.S. district court. Some tax disputes have gone to the U.S. Supreme Court.

page 94

LO3.4

Select appropriate tax strategies for various life situations.

Tax Planning Strategies

For people to pay their fair share of taxes—no more, no less—they should practice tax avoidance, the use of legitimate methods to reduce one’s taxes. In contrast, tax evasion is the use of illegal actions to reduce one’s taxes. To minimize taxes owed, follow these guidelines:

If you expect to have the same or a lower tax rate next year, accelerate deductions into the current year. Pay real estate property taxes or make charitable donations by December 31.

If you expect to have a lower or the same tax rate next year, delay the receipt of income until next year so the funds will be taxed at a lower rate or at a later date.

If you expect to have a higher tax rate next year, consider delaying deductions, since they will have a greater benefit. A $1,000 deduction at 25 percent lowers your taxes $250; at 28 percent, your taxes are lowered $280.

If you expect to have a higher tax rate next year, accelerate the receipt of income to have it taxed at the current lower rate.

Education Deduction or Tax Credit?

If you have paid higher education expenses this year, you should consider whether the Tuition and Fees deduction or one of the two Education credits are best for your tax situation.

The Tuition and Fees deduction allows you to reduce your adjusted gross income (AGI) by as much as $4,000 for expenses paid in the current year.

The American Opportunity Credit allows a credit of up to $2,500 (100 percent of the first $2,000 of qualified expenses and 25 percent of the next $2,000). This credit is limited to the first four years of postsecondary education and the student must be enrolled at least half-time.

The Lifetime Learning Credit is limited to $2,000, which is 20 percent of up to $10,000 of qualified education expenses. This credit can be used for part-time education and graduate school funds, as well as for education beyond the first four years.

You must choose between the Tuition and Fees deduction and one of the two credits. In addition, the taxpayer claiming the deduction or credit must be able to claim the student as a dependent or have qualified expenses for themselves or their spouse.

When considering financial decisions in relation to your taxes, remember that purchasing, investing, and retirement planning are the areas most heavily affected by tax laws.

Consumer Purchasing

The buying decisions most directly affected by taxes are the purchase of a residence, the use of credit, job-related expenses, and health care expenses.

PLACE OF RESIDENCE Owning a home is one of the best tax shelters. Both real estate property taxes and interest on the mortgage (up to $1,100,000 of the debt) is deductible (as itemized deductions) and thus reduces your taxable income.

CONSUMER DEBT Current tax laws allow homeowners to borrow for consumer purchases. You can deduct interest on loans (of up to $100,000) secured by your primary or secondary home up to the actual dollar amount you have invested in it—the difference between the market value of the home and the amount you owe on it. These home equity loans, which are second mortgages, allow you to use that line of credit for various purchases. Some states place restrictions on home equity loans.

page 95

JOB-RELATED EXPENSES As previously mentioned, certain work expenses, such as union dues, some travel and education costs, business tools, and job search expenses (even if you were not successful), may be included as itemized deductions.

HEALTH CARE EXPENSES Flexible spending accounts (FSAs), health savings accounts, and expense reimbursement accounts allow you to reduce your taxable income when paying for medical expenses or child care costs. Workers are allowed to put pretax dollars into these employer-sponsored programs. These “deposits” result in a lower taxable income. Then, the funds in the accounts may be used to pay for various medical expenses and dependent care costs.

Investment Decisions

A major area of tax planning involves decisions related to investing.

TAX-EXEMPT INVESTMENTS Interest income from municipal bonds, which are issued by state and local governments, and other tax-exempt investments is not subject to federal income tax. Although municipal bonds have lower interest rates than other investments, the tax-equivalent income may be higher. For example, if you are in the 35 percent tax bracket, earning $100 of tax-exempt income would be worth more to you than earning $150 in taxable investment income. The $150 would have an after-tax value of $97.50—$150 less $52.50 (35 percent of $150) for taxes.

page 96TAX-DEFERRED INVESTMENTS Although tax-deferred investments, with income taxed at a later date, are less beneficial than tax-exempt investments, they give you the advantage of paying taxes in the future rather than now. Examples of tax-deferred investments include:

Tax-deferred annuities, usually issued by insurance companies. These investments are discussed in Chapter 10.

Health savings accounts, available with high-deductible health insurance policies, may be utilized for current health care expenses or for retirement in future years. These investments are discussed in Chapter 9.

Retirement plans such as IRA, Keogh, or 401(k) plans. The next section discusses the tax implications of these plans.

Capital gains, profits from the sale of a capital asset such as stocks, bonds, or real estate, are also tax-deferred; you do not have to pay the tax on these profits until the asset is sold. In recent years, long-term capital gains (on investments held more than a year) have been taxed at a lower rate. See the nearby Figure It Out! feature for an example.

The sale of an investment for less than its purchase price is, of course, a capital loss. Capital losses can be used to offset capital gains and up to $3,000 of ordinary income. Unused capital losses may be carried forward into future years to offset capital gains or ordinary income up to $3,000 per year.

SELF-EMPLOYMENT Owning your own business can have tax advantages. Self-employed persons may deduct expenses such as health and certain life insurance as business costs. However, business owners have to pay self-employment tax (Social Security and Medicare) in addition to the regular tax rate.

CHILDREN’S INVESTMENTS A child under 18 or a full-time student under 24 with investment income of more than $2,100 is taxed at the parent’s top rate. For investment income under $2,100, the child receives a deduction of $1,050, and the next $1,050 is taxed at his or her own rate, which is probably lower than the parent’s rate.

Retirement and Education Plans

A major tax strategy for working people is the use of tax-deferred retirement plans such as individual retirement accounts (IRAs), Keogh plans, and 401(k) plans. Another tax strategy involves the use of education savings plans such as Coverdell Education Savings Accounts or 529 plans.

TRADITIONAL IRA The regular IRA deduction is available only to people who do not participate in employer-sponsored retirement plans or who have an adjusted gross income under a certain amount. As of 2017, the IRA contribution limit was $5,500. Workers age 50 and over were allowed to contribute up to $6,500 as a “catch up” to make up for lost time saving for retirement.

In general, amounts withdrawn from deductible IRAs are included in gross income. An additional 10 percent penalty is usually imposed on withdrawals made before age 59½ unless the withdrawn funds are on account of death or disability, for medical expenses, or for qualified higher education expenses.

ROTH IRA The Roth IRA also allows a $5,500 (2017) annual contribution, which is not tax-deductible; however, the earnings on the account are tax-free after five years. The funds from the Roth IRA may be withdrawn before age 59½ if the account owner is disabled or for the purchase of a first home ($10,000 maximum). Like the regular IRA, the Roth IRA is limited to people with an adjusted gross income under a certain amount.

Deductible IRAs provide tax relief up front as contributions reduce current taxes. However, taxes must be paid when the withdrawals are made from the deductible IRA. page 97In contrast, the Roth IRA does not have immediate benefits, but the investment grows in value on a tax-free basis. Withdrawals from the Roth IRA are exempt from federal and state taxes.

KEOGH PLAN If you are self-employed and own your own business, you can establish a Keogh plan. This retirement plan, also called an HR10 plan, may combine a profit-sharing plan and a pension plan of other investments purchased by the employee. In general, with a Keogh, people may contribute 25 percent of their annual income, up to a maximum of $54,000 (in 2017), to this tax-deferred retirement plan.

401(K) PLAN The part of the tax code called 401(k) authorizes a tax-deferred retirement plan sponsored by an employer. This plan allows you to contribute a greater tax-deferred amount ($18,000 in 2017) than you can contribute to an IRA. Workers age 50 and over may be allowed to contribute an additional $6,000 if their employer allows. However, most companies set a limit on your contribution, such as 15 percent of your salary. Some employers provide a matching contribution in their 401(k) plans. For example, a company may contribute 50 cents for each $1 contributed by an employee. This results in an immediate 50 percent return on your investment.

Tax planners advise people to contribute as much as possible to a Keogh or 401(k) plan since (1) the increased value of the investment accumulates on a tax-free basis until the funds are withdrawn, and (2) contributions reduce your adjusted gross income for computing your current tax liability.

COVERDELL EDUCATION SAVINGS ACCOUNT This account is designed to assist parents in saving for the education of their children. Withdrawals can be used for a variety of educational uses for kindergarten through college-age students. The annual contribution, limited to $2,000, is not tax-deductible and is limited to taxpayers with an adjusted gross income under a certain amount. However, as with the Roth IRA, the earnings accumulate tax-free.

529 PLAN The 529 plan is another education savings plan that helps parents save for the college education of their children. Almost every state has a 529 plan available. There is no federal tax deduction, but the earnings grow tax-free and there are no taxes when the money is taken out of the account for qualified education expenses. In addition, many states allow their residents to deduct contributions to their state plans up to a specified maximum.

Changing Tax Strategies

Each year, the tax code includes a myriad of changes. In the past several years, there have been debates over what types of tax reform would stimulate economic growth. Congress frequently passes legislation that changes the tax code. These changes require that you regularly determine how to best take advantage of the tax laws for personal financial planning.

Recent tax changes have included the following:

Advanced (premium) tax credits are available. This offers someone buying insurance through the health care exchanges an opportunity to reduce the premiums they pay. If they do not get the full credit when they pay the premium, the difference will be available as a refundable tax credit at tax time.

Penalties are being assessed for those who do not have health insurance. These penalties will be levied through a program with the IRS. Taxpayers will soon have to provide proof of health insurance with their tax return to avoid the penalty.

Employers now allow employees with health care flexible spending accounts to carry over up to $500 of unused funds.

Streamlined options are available for the home office deduction for small businesses.

page 98In addition to these and other recent tax changes, the IRS usually modifies the tax form and filing procedures yearly, so be sure to carefully consider changes in your personal situation and your income level. Well-informed taxpayers monitor their personal tax strategies to best serve daily living needs and to achieve long-term financial goals.

Flat or VAT Tax?

For many years, politicians have used tax reform as a platform to run for office. Some want to increase tax deductions to provide for certain segments, while others want to find ways to simplify the tax code. There is no denying that the tax code has become increasingly complex. The number of words in the tax code has reportedly grown from 1.4 million to more than 4 million in the last decade!

What are some options that are being proposed? First, a flat tax proposal has been around for many years. This would require that all taxpayers, regardless of income level and type, pay the same percentage. While seemingly relatively easy to implement, the reality is that this would be an increase in overall tax for quite a few people. The other alternative, a value-added tax (VAT), would add a tax to a product for each stage in the manufacturing process. It is believed that higher-income individuals would pay higher taxes since they are typically the larger consumers of goods. This has been implemented in other countries. That said, the administrative process can be a challenge for each of the companies involved in the process to remit the tax.

What do you think will happen to the tax code in five years? 10 years? 20 years?

page 99

page 100

Chapter Summary

LO3.1 Tax planning can influence spending, saving, borrowing, and investing decisions. An awareness of income taxes, sales taxes, excise taxes, property taxes, estate taxes, inheritance taxes, gift taxes, and Social Security taxes is vital for successful financial planning.

LO3.2 Taxable income is determined by subtracting adjustments to income, deductions, and allowances for exemptions from gross income. Your total tax liability is based on the published tax tables or tax schedules, less any tax credits.

LO3.3 The major sections of Form 1040 provide the basic framework for filing your federal income tax return. The main sources of tax assistance are IRS services and publications, other publications, the internet, computer software, and professional tax preparers such as commercial tax services, enrolled agents, accountants, and attorneys.

LO3.4 You may reduce your tax burden through careful planning and making financial decisions related to consumer purchasing and the use of debt, investments, and retirement planning.

Key Terms

adjusted gross income (AGI) 77

Self-Test Problems

A person had $4,102 withheld for federal income taxes and had a tax liability of $4,345. Would this be a refund or an additional amount due, and for what amount?

Based on the following information, what is the amount of taxable income?

Gross salary, $56,900

Dividend income, $160

Itemized deductions, $7,150

Interest earnings, $65

One personal exemption, $4,050

Solutions

To determine the amount of refund or additional tax due, compare the amount of tax liability with the amount withheld. The $4,345 tax liability minus the $4,102 would result in an amount due of $243.

Taxable income is calculated by adding salary, income, and dividends, and then subtracting itemized deductions and exemptions:

$56,900 + $65 + $160 − $4,050 − $7,150 = $45,925

Problems

Daniel Simmons arrived at the following tax information:

Gross salary, $62,250

Dividend income, $140

Itemized deductions, $7,000

Interest earnings, $75

One personal exemption, $4,050

Adjustments to income, $850

What amount would Daniel report as taxable income? (LO3.2)

If Samantha Jones had the following itemized deductions, should she use Schedule A or the standard deduction? The standard deduction for her tax situation is $6,350. (LO3.2)

Donations to church and other charities, $3,050

Medical and dental expenses exceeding 10 percent of adjusted gross income, $450

page 101State income tax, $920

Job-related expenses exceeding 2 percent of adjusted gross income, $1,450

What would be the average tax rate for a person who paid taxes of $6,435 on taxable income of $40,780? (LO3.2)

Based on the following data, would Beth and Roger Simmons receive a refund or owe additional taxes? (LO3.2)

Adjusted gross income, $42,140

Credit for child and dependent care expenses, $400

Amount for personal exemptions, $12,150

Itemized deductions, $11,240

Federal income tax withheld, $6,686

Tax rate on taxable income, 10 percent

If $4,323 was withheld during the year and taxes owed were $4,122, would the person owe an additional amount or receive a refund? What is the amount? (LO3.2)

Noor Patel has had a busy year! She decided to take a cross-country adventure. Along the way, she won a new car on “The Price Is Right” (valued at $15,500) and won $500 on a scratch-off lottery ticket (the first time she ever played). She also signed up for a credit card to start the trip and was given a sign-up bonus of $100. How much will she have to include in her federal taxable income? (LO3.2)

Using the tax table on page 80, determine the amount of taxes for the following situations: (LO3.3)

A head of household with taxable income of $55,000.

A single person with taxable income of $35,000.

Married taxpayers filing jointly with taxable income of $72,000.

If 300,000 people each receive an average refund of $2,500, based on an annual interest rate of 3 percent, what would be the lost annual income from savings on those refunds? (LO3.2)

Using the tax table in Exhibit 3–5, determine the amount of taxes for the following situations: (LO3.3)

A head of household with taxable income of $62,525.

A single person with taxable income of $62,001.

A married person filing a separate return with taxable income of $62,365.

Wendy Brooks prepares her own income tax return each year. A tax preparer would charge her $75 for this service. Over a period of 10 years, how much does Wendy gain from preparing her own tax return? Assume she can earn 3 percent on her savings. (LO3.3)

Julia Sims has $30,000 of adjusted gross income and $5,000 of medical expenses. She will be itemizing her tax deductions this year. The most recent tax year has a medical expenses floor of 10 percent. How much of a tax deduction for medical expenses will Julia be able to take? (LO3.3)

Allison has returned to school after five years out of the work force. She is taking one course at the local university for a cost of $1,500. To minimize her taxes, should she take a tuition and fees deduction or an education credit? (Assume a 15 percent tax rate.) (LO3.4)

Would you prefer a fully taxable investment earning 10 percent or a tax-exempt investment earning 8.25 percent? Why? (Assume a 25 percent tax rate.) (LO3.4)

On December 30, you make a $3,000 charitable donation. (LO3.4)

If you are in the 28 percent tax bracket, how much will you save in taxes for the current year?

If you deposit that tax savings in a savings account for the next five years at 8 percent, what will be the future value of that account?

Reginald Sims deposits $5,500 each year in a tax-deferred retirement account. If he is in a 28 percent tax bracket, by what amount would his tax be reduced over a 20-year time period? (LO3.4)

If a person in a 25 percent tax bracket makes a deposit of $5,000 to a tax-deferred retirement account, what amount would be saved on current taxes? (LO3.4)

|

To reinforce the content in this chapter, more problems are provided at connect.mheducation.com. |

page 102

Apply Yourself for Financial Literacy

Estimate the amount of all types of tax that you have paid in the last month. (LO3.1)

Using an online search, determine the tax deductions and credits for which you may be eligible for the current year. (LO3.2)

Compare tax services (and providers) in your area and online. Talk to friends, relatives, and others about the providers that they use. (LO3.3)

Survey friends and relatives about their tax planning strategies. Do most people get a federal tax refund or owe taxes each year? Is their situation (refund or payment) planned? (LO3.4)

REAL LIFE PERSONAL FINANCE

A SINGLE FATHER’S TAX SITUATION

Ever since his wife’s death, Eric Stanford has faced difficult personal and financial circumstances. His job provides him with a fairly good income but keeps him away from his daughters, ages 8 and 10, nearly 20 days a month. This requires him to use in-home child care services that consume a major portion of his income. Since the Stanfords live in a small apartment, this arrangement has been very inconvenient.

Due to the costs of caring for his children, Eric has only a minimal amount withheld from his salary for federal income taxes. Thus more money is available during the year, but for the last few years, he has had to make a payment in April—another financial burden.

Although Eric has created an investment fund for his daughters’ college education and for his retirement, he has not sought investments that offer tax benefits. Overall, he needs to look at several aspects of his tax planning activities to find strategies that will best serve his current and future financial needs.

Eric has assembled the following information for the current tax year:

Earnings from wages, $84,212

Interest earned on savings, $65

IRA deduction, $5,000

Checking account interest, $45

Three exemptions at $4,050 each

Current standard deduction for filing status, $9,300

Amount withheld for federal income tax, $5,825

Tax credit for child care, $1,200

Child tax credit, $2,000

Filing status: head of household

Questions

What are Eric’s major financial concerns in his current situation?

In what ways might Eric improve his tax planning efforts?

Calculate the following:

What is Eric’s taxable income? (Refer to Exhibit 3–1)

What is his total tax liability? (Use tax rate table, page 80) What is his average tax rate?

Based on his withholding, will Eric receive a refund or owe additional tax? What is the amount?

Continuing Case

FINANCIAL SERVICES: SAVINGS PLANS AND ACCOUNTS

Jamie Lee Jackson, age 26, is in her last semester of college, and graduation day is just around the corner! It is the time of year again when Jamie Lee must file her annual federal income taxes. Last year, she received an increase in salary from the bakery, which brought her gross monthly earnings to $2,550, and she also opened up an IRA, to which she contributed $300. Her savings accounts earn 2 percent interest per year, and she also received an unexpected $1,000 gift from her great aunt. Jamie was also lucky enough last year to page 103win a raffle prize of $2,000, most of which was deposited into her regular savings account after paying off her credit card balance.

Current Financial Situation

Assets:

Checking account, $2,250

Savings account, $6,900 (interest earned last year: $125)

Emergency fund savings account, $3,900 (interest earned last year: $75)

IRA balance, $350 ($300 contribution made last year)

Car, $3,000

Liabilities:

Student loan, $10,800

Credit card balance, $0 (interest paid last year: $55)

Income:

Gross monthly salary, $2,550

Monthly Expenses:

Rent obligation, $275

Utilities obligation, $135

Food, $130

Gas/Maintenance, $110

Credit card payment, $0

Savings:

Regular savings monthly deposit, $175

Rainy day savings monthly deposit, $25

Entertainment:

Cake decorating class, $40

Movies with friends, $60

Questions

Jamie Lee is trying to decide whether to use Form 1040EZ and Form 1040A to file her federal income tax return. Using the Financial Literacy in Practice feature in this chapter, choose the most appropriate federal tax filing form for Jamie to use and describe your reasoning for making this choice.

What impact on Jamie Lee’s income will the gift of $1,000 from her great aunt have on her adjusted gross income? Will there be an impact on the adjusted gross income with her $2,000 raffle prize winnings? Explain your answer.

Using Exhibit 3–1 as a guide, calculate Jamie Lee’s adjusted gross income amount by completing the table below:

Gross income

(−) Adjustments to income

= Adjusted gross income

What would Jamie Lee’s filing status be considered?

Jamie Lee has a marginal tax rate of 15 percent and an average tax rate of 11 percent. Explain why there is a difference between the two rates.

Spending Diary

“SALES TAX ON VARIOUS PURCHASES CAN REALLY INCREASE THE AMOUNT OF MY TOTAL SPENDING.”

Directions Continue your Daily Spending Diary to record and monitor your spending in various categories. Your comments should reflect what you have learned about your spending patterns and help you consider possible changes you might want to make in your spending habits. The Daily Spending Diary sheets are located in Appendix D at the end of the book and in Connect Finance.

Questions

What taxes do you usually pay that are reflected (directly or indirectly) in your daily spending diary?

How might your spending habits be revised to better control or reduce the amount you pay in taxes?

page 104

YOUR PERSONAL FINANCIAL PLAN 9

Name: Date:

Federal Income Tax Estimate

Purpose: To estimate your current federal income tax liability.

Financial Planning Activities: Based on last year’s tax return, estimates for the current year, and current tax regulations and rates, estimate your current tax liability. This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.irs.gov, www.taxlogic.com

Gross income (wages, salary, investment income, |

$ |

|

|

Less Adjustments to income (see current tax regulations) |

−$ |

|

|

Equals Adjusted gross income |

=$ |

|

|

Less Standard deduction or |

Itemized deduction |

|

|

|

Medical expenses (exceeding 10% of AGI, or 7.5% for those over 65), until 2016. |

|

$ |

State/local income, property taxes |

|

$ |

|

Mortgage, home equity loan, interest |

|

$ |

|

Charitable contributions |

|

$ |

|

Casualty and theft losses |

|

$ |

|

Moving expenses, job-related and miscellaneous expenses (exceeding 2% of AGI) |

|

$ |

|

|

Amount −$ |

Total |

|

−$ |

Less Personal exemptions |

−$ |

|

|

Equals Taxable income |

=$ |

|

|

Estimated tax (based on current tax tables or tax schedules) |

$ |

|

|

Less Tax credits |

−$ |

|

|

Plus Other taxes |

+$ |

|

|

Equals Total tax liability |

=$ |

|

|

Less Estimated withholding and payments |

−$ |

|

|

Equals Tax due (or refund) |

=$ |

|

|

What’s Next for Your Personal Financial Plan?

Develop a system for filing and storing various tax records related to income, deductible expenses, and current tax forms.

Using the IRS and other websites, identify recent changes in tax laws that may affect your financial planning decisions.

page 105

YOUR PERSONAL FINANCIAL PLAN 10

Name: Date:

Tax Planning Activities

Purpose: To consider actions that can prevent tax penalties and may result in tax savings.

Financial Planning Activities: Consider which of the following actions are appropriate to your tax situation. This sheet is also available in an Excel spreadsheet format in Connect Finance.

Suggested Websites: www.turbotax.com, taxes.about.com

Action to be taken (if applicable) |

Completed |

|

Filing status/withholding

|

||

|

||

|

||

Tax records/documents

|

||

|

||

Annual tax activities

|

||

|

||

Tax-savings actions

|

||

|

||

|

||

|

||

|

||

|

||

|

What’s Next for Your Personal Financial Plan?

Identify saving and investing decisions that would minimize future income taxes.

Develop a plan for actions to take related to your current and future tax situation.