page 384

©quietbits/Shutterstock.com RF

page 385

LO12.1

Identify the most important features of common and preferred stock.

Common and Preferred Stock

Many investors face two concerns when they begin an investment program. First, they don’t know where to get the information they need to evaluate potential investments. In reality, more information is available than most investors can read. Yet, as crazy as it sounds, some investors invest in stocks without doing any research at all. As we begin this chapter, you should know that there is no substitute for researching a potential stock investment.

Second, beginning investors sometimes worry that they won’t know what the information means when they do find it. Yet common sense goes a long way when evaluating potential investments. For example, consider the following questions:

Is an increase in sales revenues a healthy sign for a corporation? (Answer: yes)

Should a firm’s profits increase or decrease over time? (Answer: increase)

Although the answers to these two questions are obvious, you will find more detailed answers to these and other questions in this chapter.

The Psychology of Stock Investing

Why invest in stocks? To answer this question, consider the returns provided by stocks over a long period of time. Since the end of World War II, the average annual return for stocks is almost 10 percent—well above the nation’s inflation rate. In fact, stock returns were substantially higher than the returns provided by more conservative investments.1

Simply put, investors who want larger returns choose stocks. And yet, you should remember three facts:

1. While the almost 10 percent average annual return on stock investments described above is enticing, keep in mind that the value of stocks can also decrease. The nation’s economy, high inflation, changes in interest rates, and a host of other factors can cause page 386stocks to decrease in value. Certainly, lower sales and lower profits or no profits can cause the stock for a specific company to decrease.

2. There is risk when you invest in stocks. These investments are not guaranteed. In fact, stock investments are a practical example of the risk-return ratio discussed in Chapter 11. Simply put: Your potential return on any investment should be directly related to the risk you assume.

3. The key to success with any investment program is often allowing your investments to work for you over a long period of time, and stocks are no exception. While some investors do make money in a short period of time, these speculators often lose money over time. A better approach is to invest for the long-term. A long-term investment program allows you to ride through the rough times and enjoy the good times. See the nearby From the Pages of ... Kiplinger’s Personal Finance feature on investing in stocks for more information.

Before you decide to purchase stocks, read this chapter. We want you to learn how to evaluate a stock and to make money from your investment decisions.

Why Corporations Issue Common Stock

Common stock is the most basic form of ownership for a corporation. Corporations issue common stock to finance their business start-up costs and help pay for expansion and their ongoing business activities. Corporate managers prefer selling common stock as a method of financing for several reasons.

A FORM OF EQUITY Important point: Stock is equity financing. Equity financing is money received from the owners or from the sale of shares of ownership in a business. One reason corporations prefer selling stock is because the money obtained from equity financing doesn’t have to be repaid and the company doesn’t have to buy back shares from the stockholders. On the other hand, a stockholder who buys common stock may sell his or her stock to another individual.

DIVIDENDS NOT MANDATORY Important point: Dividends are paid out of profits, and dividend payments must be approved by the corporation’s board of directors. A dividend is a distribution of money, stock, or other property that a corporation pays to stockholders. However, the last type of dividend is extremely unusual. Dividend policies vary among corporations, but most firms distribute between 30 and 70 percent of their earnings to stockholders. On the other hand, some corporations follow a policy of smaller or no dividend distributions to stockholders. In general, these are rapidly growing firms, such as Amazon (online sales), Alphabet, the parent company of Google (online websites), or Facebook (social networking), that retain a large share of their earnings for research and development, expansion, or major projects. On the other hand, utility companies, such as Duke Energy, and other financially secure corporations may distribute 70 to 90 percent of their earnings. Always remember that a corporation’s board of directors may choose to reduce or omit dividend payments to stockholders for any reason.

VOTING RIGHTS AND CONTROL OF THE COMPANY In return for the financing provided by selling common stock, management must make concessions to stockholders that may restrict corporate policies. For example, corporations are required to have an annual meeting at which stockholders have a right to vote, usually casting one vote per share of stock. Stockholders may vote in person or by proxy. A proxy is a legal form that lists the issues to be decided at a stockholders’ meeting and requests that stockholders transfer their voting rights to some individual or individuals. The common stockholders elect the board of directors and must approve major changes in corporate policies.

Why Investors Purchase Common Stock

Let’s begin with two basic assumptions. First, no one invests in stocks in order to lose money. Second, every investor wants to earn a better-than-average return on stock investments. How do you make money by buying common stock? Basically, there are two ways: income from dividends and dollar appreciation of stock value.

page 387

Adapted from Glassman, James K. “Worrying About the Bear? Don’t.” Kiplinger’ Personal Finance, April 2017. Copyright © 2017. The Kiplinger Washington Editors, Inc.

It’s easy to look back and say, “I wish I had invested in stocks like Southwest Airlines, American Express, Home Depot, and eBay” because returns for these stocks have been phenomenal. What characteristics or factors do these stocks and other stocks of this quality have in common?

At the time you are reading this article, are values in the stock (and the economy) increasing or decreasing? Do you think this is a good time to invest in stocks?

page 388INCOME FROM DIVIDENDS While the corporation’s board members are under no legal obligation to pay dividends, most board members like to keep stockholders happy (and prosperous). Therefore, board members usually declare dividends if the corporation’s profits are sufficient for them to do so. Since dividends are a distribution of profits, investors must be concerned about future profits.

If the board of directors declares a cash dividend, each common stockholder receives an equal amount per share. Although dividend policies vary, most corporations pay dividends on a quarterly basis. Notice in Exhibit 12–1 that Microsoft declared a quarterly dividend of $0.39 per share to stockholders who owned the stock on the record date of May 18, 2017. The record date is the date on which a stockholder must be registered on the corporation’s books in order to receive dividend payments. When a stock is traded around the record date, the company must determine whether the buyer or the seller is entitled to the dividend. To solve this problem, this rule is followed: Dividends remain with the stock until two business days before the record date. On the second business day before the record date, the stock begins selling ex-dividend. Investors who purchase an ex-dividend stock are not entitled to receive dividends for that quarter, and the dividend is paid to the previous owner of the stock.

Exhibit 12–1 Dividend Information

Information about corporate dividends is available by using the internet to access a corporation’s website or other investment sites. The numbers above each of the columns correspond to the numbered entries in the list of explanations that appear at the bottom of the exhibit.

1 Company |

2 Amount of Dividend |

3 Record Date |

4 Payable Date |

|---|---|---|---|

Microsoft |

$0.39 |

May 18, 2017 |

June 8, 2017 |

The name of the company paying the dividend is Microsoft.

The dollar amount of the quarterly dividend is $0.39.

The record date is Thursday, May 18, 2017. Stockholders must be registered on the corporate books by the record date in order to receive this quarterly dividend payment.

The dividend will be paid on June 8, 2017, to stockholders who own the stock on the record date (May 18, 2017).

Source: The Microsoft Corporation website at www.microsoft.com, accessed April 18, 2017.

For example, Microsoft declared a quarterly dividend of $0.39 per share to stockholders who owned its stock on Thursday, May 18, 2017. The stock went ex-dividend on Tuesday, May 16, 2017, two business days before the May 18 date. A stockholder who purchased the stock on Tuesday, May 16, or after was not entitled to this quarterly dividend payment. The actual dividend payment was paid on June 8, 2017, to stockholders who owned the stock on the record date. Investors are generally very conscious of the date on which a stock goes ex-dividend, and the dollar value of the stock may go down by the value of the dividend. Note: A new rule for determining the ex-dividend date for corporate stocks has been approved by the Securities and Exchange Commission. According to the new rule, dividends remain with the stock until one business day before the record date instead of two business days before the record date. This rule became effective for dividends paid after September 5, 2017. Also, note this rule did not apply to the Microsoft example, as it was paid before September 5, 2017.

DOLLAR APPRECIATION OF STOCK VALUE The price for a share of stock is determined by how much a buyer is willing to pay for the stock. The price changes when information about the firm or its future prospects is released to the general public. For example, information about future sales revenues or page 389expected earnings can increase or decrease the price for the firm’s stock. In most cases, you purchase stock and then hold on to that stock for a period of time. If the price of the stock increases, you must decide whether to sell the stock at the higher price or continue to hold it. If you decide to sell the stock, the dollar amount of difference between the purchase price and the selling price represents your profit.

Let’s assume that on April 17, 2015, you purchased 100 shares of Johnson & Johnson stock at a cost of $99 a share. Your cost for the stock was $9,900 plus $25 in commission charges, for a total investment of $9,925. (Note: Commissions, a topic covered in “Commission Charges” in this chapter, are charged when you purchase stock and when you sell stock.) Let’s also assume you held your 100 shares until April 17, 2017, and then sold them for $125 a share. During the two-year period you owned Johnson & Johnson shares, the company paid dividends totaling $6.20 per share. Exhibit 12–2 shows your return on the investment. In this case, you made money because of dividend payments and through an increase in stock value from $99 to $125 per share. As Exhibit 12–2 shows, your total return is $3,170. Of course, if the stock’s value should decrease or if the firm’s board of directors reduces or votes to omit dividends, your return may be less than the original investment.

Exhibit 12–2 Sample Stock Transaction for Johnson & Johnson

Assumptions |

|||

|---|---|---|---|

100 shares of common stock purchased April 17, 2015, sold April 17, 2017; dividends of $6.20 per share for the investment period. |

|||

Costs When Purchased |

|

Return When Sold |

|

100 shares @ $99 = |

$9,900 |

100 shares @ $125 = |

$12,500 |

Plus commission |

+25 |

Minus commission |

−25 |

Total investment |

$9,925 |

Total return |

$12,475 |

Transaction Summary |

|||

Total return |

$12,475 |

||

Minus total investment |

−9,925 |

||

Profit from stock sale |

$ 2,550 |

||

Plus dividends |

+620 |

||

Total return for the transaction |

$ 3,170 |

||

Note: The percentage of return for each year was 16 percent ($3,170 Total Return ÷ $9,925 Original Investment ÷ 2 years = 0.16 = 16 percent).

WHAT HAPPENS WHEN A CORPORATION SPLITS ITS STOCK A stock split is a procedure in which the shares of stock owned by existing stockholders are divided into a larger number of shares. In 2017, for example, the board of directors of Comcast, a media and technology company, approved a 2-for-1 stock split. After the stock split, a stockholder who had previously owned 100 shares now owned 200 shares. The most common stock splits are 2-for-1 or 3-for-1.

Why do corporations split their stock? In many cases, a firm’s management has a theoretical ideal price range for the firm’s stock. If the price per share of stock rises above the ideal range, a stock split brings the price per share back in line. In the case of Comcast, the 2-for-1 stock split reduced the price per share to one-half of the stock’s value on the day prior to the split. The lower price per share was the result of dividing the dollar value of the company by a larger number of shares of common stock. Also, a decision to split a company’s stock and the resulting lower price per share may make the stock more attractive to the investing public. This attraction is based on the belief that most corporations split their stock only when their financial future is improving and on the upswing.

Be warned: There are no guarantees that a stock’s price per share will go up after a split. This is important to understand, because investors often think that a stock split leads page 390to immediate profits. Nothing could be further from the truth. Here’s why: The total market capitalization—the value of the company’s stock and other securities—does not change because a corporation splits its stock. A company that has a market capitalization of $100 million before a 2-for-1 stock split is still worth $100 million after the split. Simply put, there is twice as many shares, but each share is worth half of its previous value before the stock split occurred. If a stock’s value does increase after a stock split, it increases because of the firm’s financial performance after the split and not just because there are more shares of stock.

Preferred Stock

In addition to or instead of purchasing common stock, you may purchase preferred stock. Preferred stock is a type of stock that gives the owner the advantage of receiving cash dividends before common stockholders are paid any dividends. This is the most important priority an investor in preferred stock enjoys. Unlike the amount of the dividend on common stock, the dollar amount of the dividend on preferred stock is known before the stock is purchased.

Preferred stocks are often referred to as “middle” investments because they represent an investment midway between common stock and corporate bonds. When compared to corporate bonds, the yield on preferred stocks is often higher than the yield on bonds. And yet, because it is a type of equity financing, preferred stock is less secure than bonds (debt) issued by the same company. When compared to common stocks, preferred stocks are safer investments that offer more secure dividends. They are often purchased by individuals who need a predictable source of income greater than that offered by common stock investments. For all other investors, preferred stocks lack the growth potential that common stocks offer and the safety of many corporate bond issues.

When compared to the sale of common stock by corporations, the issuance of preferred stock is used less often and by only a few corporations. Keep in mind that dividends on preferred stock, as on common stock, may be omitted by action of the board of directors. While preferred stock does not represent a legal debt that must be repaid, if the firm is dissolved or declares bankruptcy, preferred stockholders do have first claim to the corporation’s assets after creditors (including bondholders).

LO12.2

Explain how you can evaluate stock investments.

Evaluating a Stock Issue

Many people purchase investments without doing any research. They wouldn’t buy a car without a test drive or purchase a home without comparing different houses, but for some unknown reason, they invest without doing their homework. The truth is that there is no substitute for a few hours of detective work when choosing an investment. In reality, it is important to evaluate not only the corporation that issues the individual stock you are interested in purchasing but also the industry in which the corporation operates. For example, if the automobile industry experiences lower sales and lower profits because of the number of people unemployed and higher interest rates for auto loans, most companies in the industry will find it difficult to increase sales and profits. Also, keep in mind that the nation’s and even the world’s economy—the big picture—may impact the way a corporation operates and cause a corporate stock to increase or decrease in value.

page 391Another factor to consider when evaluating stocks is the amount of risk you are comfortable with. Some people are more willing to take risks than others. As mentioned in Chapter 11, younger investors choose more risk-oriented investments because they have more time to recover if their investments decrease in value. On the other hand, older investors tend to be more conservative and choose investments with less risk. Also, keep in mind that there are two different types of market risk you should consider when evaluating stock investments. Systematic risk occurs because of overall risks in the market and the economy. Factors such as an economic crisis, increasing interest rates, changes in consumer purchasing power, political activity, and wars all represent sources of systematic risk. Because this type of risk affects the entire market, it is not possible to eliminate the risk through diversification. Unsystematic risk affects a specific company or a specific industry. Because this type of risk affects one company or one industry, unsystematic risk can be reduced by diversifying an investment portfolio. For example, an investor who owns 20 different stocks in different industries can reduce unsystematic risk because she or he is well diversified. Anything that happens to one company in the investor’s portfolio is not likely to wipe out the value of the entire portfolio.

A wealth of information is available to stock investors, and a logical place to start the evaluation process for stocks is with the classification of different types of stock investments described in Exhibit 12–3. Once you have identified stock(s) that may help you obtain your investment goals, you may want to use the internet to evaluate a potential investment.

Exhibit 12–3 Classification of Stock Investments

When evaluating a stock investment, investors often classify stocks into these 10 categories.

Type of Stock |

Characteristics of This Type of Investment |

|---|---|

Blue chip |

A stock, issued by large, stable corporations that usually have a history of paying dividends and that generally attracts conservative investors. |

Cyclical |

A stock that follows the business cycle of advances and declines in the economy. |

Defensive |

A stock that remains stable during declines in the economy. |

Growth |

A stock issued by a corporation that has the potential of increasing sales revenues and earning profits above the average of all firms in the economy. |

Income |

An investment that pays higher-than-average dividends. |

Large cap |

A stock issued by a corporation that has a large amount of capitalization in excess of $10 billion. |

Micro cap |

A stock issued by a company that has a capitalization of between $50 million and $300 million or less. |

Midcap |

A stock issued by a corporation that has a capitalization of between $2 billion and $10 billion. |

Penny |

A stock that typically sells for less than $5 per share (or in some cases, less than $1 per share) and has a small amount of capitalization. |

Small cap |

A stock issued by a company that has a capitalization of between $300 million and $2 billion. |

page 392

The Internet

In this section, we examine some websites that are logical starting points when evaluating a stock investment, but there are many more than those described.

Today most corporations have a website, and the information these sites provide is especially useful. First, it is easily accessible. All you have to do is type in the corporation’s URL address or use a search engine to locate the corporation’s home page. Second, the information on the website may be more up to date and thorough than printed material obtained from the corporation or outside sources. Once at the corporation’s home page, look for a link to “investor relations” or “financial information.” Just by clicking on a button, you can access information on the firm’s earnings and other financial factors that could affect the value of the company’s stock. Keep in mind that the information on a company’s website is provided by the company and in some cases is created to showcase the company. Read between the lines, and verify any information or financial information that looks too good to be true.

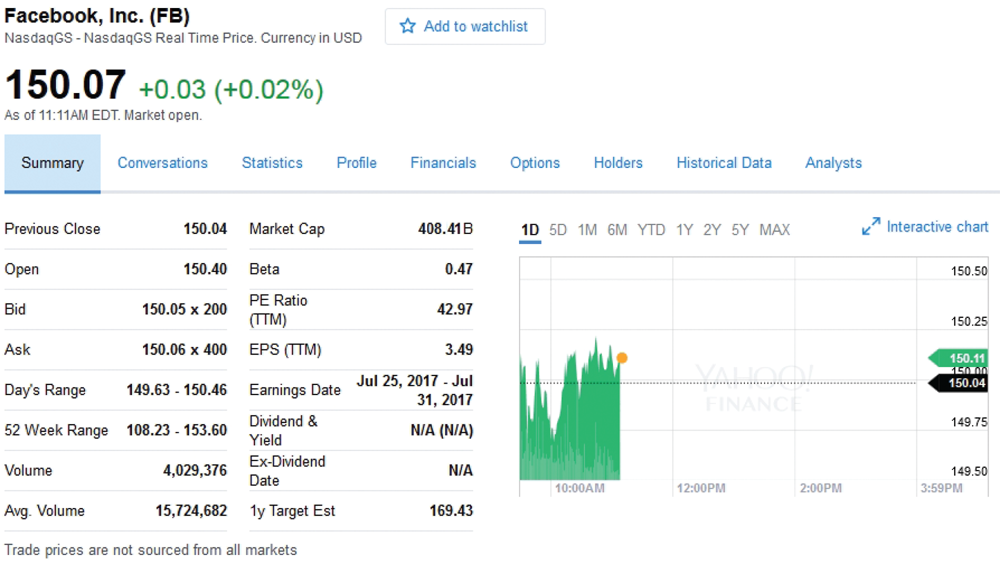

You can also use websites such as Google, Yahoo!, and other search engines to obtain information about stock investments. Take a look at Exhibit 12–4, which illustrates a portion of the summary page taken from Yahoo! Finance for Facebook, the world’s largest social networking site. In addition to the current price, the Yahoo! Finance website provides even more specific information about a particular company like Facebook. By clicking on the buttons under the headings for Statistics, Profile, Financials, Historical Data, and Analysts that are part of the screen for each corporation, you can obtain even more information. How about picking a company like The Gap (symbol GPS) or Coca-Cola (symbol KO) and going exploring on the page 393internet? To begin, enter the web address for Yahoo! Finance (finance.yahoo.com) in your computer's browser. Then enter the symbol for one of the above corporations in the Quote Lookup box and click the tab with the magnifying glass on the right. You’ll be surprised at the amount of information you can obtain with a click of your mouse.

Exhibit 12–4 A Portion of the Opening Page from the Yahoo! Finance Website for Facebook

Source: Yahoo! Inc. Yahoo! and Yahoo! logo are trademarks of Yahoo! Inc.

In addition to internet search engines and professional advisory services, you can access personal finance websites such as CNN Money (money.cnn.com) and Kiplinger’s Personal Finance (www.kiplinger.com). Both websites provide a wealth of information for the stock investor. While there are many websites that can help you learn more about investing in stocks, the following four deserve special mention: The Street (www.thestreet.com), MarketWatch (www.marketwatch.com), the Motley Fool (www.fool.com), and MSN Money (money.msn.com).

Stock Advisory Services

You can also use professional advisory services. The information ranges from simple alphabetical listings to detailed financial reports. While some of the information provided by these services is free, often there is a charge for the more detailed online information you may need to evaluate a stock investment.

Value Line (www.valueline.com), Standard & Poor’s Financial Services (www.netadvantage.standardandpoors.com), and Mergent Online (www.mergentonline.com) are three widely used advisory services that provide detailed research for stock investors. Here we will examine a detailed report for Disney, one of the world’s leading entertainment companies, that is published in The Value Line Investment Survey (see Exhibit 12–5).

Exhibit 12–5 Value Line Report for Walt Disney Corporation

“Disney,” The Value Line Investment Survey (New York: The Value Line Publishing, LLC., 2014, p. 2329.

While there is a lot of information about Disney in Exhibit 12–5, it helps to break down the entire Value Line report into different sections. For example:

Overall ratings for timeliness, safety, and technical, along with price information and projections for the price of a share of stock, are included at the top of the report.

Detailed information about revenues per share, earnings per share, dividends, total revenues, net profit, capital structure, and other important financial information is included in the middle and along the left side of the report.

Information about the type of business and prospects for the future is provided toward the bottom and in the right-hand corner.

While other stock advisory services provide basically the same types of information as that in Exhibit 12–5, it is the investor’s job to interpret such information and decide whether the company’s stock is a good investment.

Newspaper Coverage and Corporate News

Although some newspapers have eliminated or reduced the amount of financial coverage, The Wall Street Journal and most metropolitan newspapers still contain some information about stocks. Although not all newspapers print exactly the same information, they usually provide the basic information. Stocks are listed alphabetically, so your first task is to move down the table to find the stock you’re interested in. Then, to read the stock quotation, you simply read across the table. Typical information provided by newspapers includes the name of the company, stock symbol, current price information, and net change from one day to the next.

The federal government requires corporations selling new issues of securities to disclose in a prospectus information about corporate earnings, assets and liabilities, products or services, and the qualifications of top management. In addition to a prospectus, all publicly owned corporations provide an annual report to stockholders and investors that contains detailed financial data and information about the corporation. For most corporations, all it takes to obtain these information sources is a visit to a corporation’s website, call to a toll-free phone number, or a written request to the corporation’s headquarters.

page 394page 395In addition to corporate publications, you can access the Securities and Exchange Commission website (www.sec.gov) to obtain financial and other important information that a corporation has supplied to the federal government.

Finally, many periodicals, including Bloomberg Businessweek, Fortune, Forbes, Money, Kiplinger’s Personal Finance, and similar publications, contain information about stock investing.

LO12.3

Analyze the numerical measures that cause a stock to increase or decrease in value.

Numerical Measures That Influence Investment Decisions

How do you determine whether the time is right to buy or sell a particular stock? Good question! Unfortunately, there is no simple answer. In addition to the material discussed in the “Evaluating a Stock Issue” section, many investors rely on numerical measures to decide when to buy or sell a stock. We begin this section by examining the relationship between a stock’s price and a corporation’s earnings.

Why Corporate Earnings Are Important

Many financial experts believe that a corporation’s ability or inability to generate earnings in the future may be one of the most significant factors that account for an increase or decrease in the value of a stock. Simply put, higher earnings generally equate to higher stock prices. Unfortunately, the reverse is also true. If a corporation’s earnings decline, generally the stock’s price will also decline. Corporate earnings are reported in the investor’s section on a corporation’s website and in the firm’s annual report. You can also obtain information about a corporation’s current earnings by using a professional advisory service or accessing the Yahoo! Finance website or one of the other websites described in the “Evaluating a Stock Issue” section.

EARNINGS PER SHARE Many investors calculate earnings per share to evaluate the financial health of a corporation. Earnings per share are a corporation’s earnings divided by the number of outstanding shares of a firm’s common stock. Given the information in the following example, General Mills earns $2.54 per share.

page 396Most stockholders consider the amount of earnings per share important because it is a measure of the company’s profitability. No meaningful average for this measure exists, mainly because the number of shares of a firm’s stock is subject to change via stock splits and stock dividends. As a general rule, however, an increase in earnings per share is a healthy sign for any corporation and its stockholders.

PRICE-EARNINGS RATIO Another calculation, the price-earnings ratio, can be used to evaluate a potential stock investment.

The price-earnings (PE) ratio is the price of a share of stock divided by the corporation’s earnings per share of stock.

The price-earnings ratio is a key factor that serious investors use to evaluate stock investments. Generally, a price-earnings ratio gives investors an idea of how much they are paying for a company’s earning power. The higher the price-earnings ratio, the more investors are paying for earnings. For example, an investor might say that Procter & Gamble stock is selling for 24 times its current earnings. Generally, the average PE ratio for the stock market is between 15 and 25 for any specific year. Stocks with high price-earnings ratios (those above the average PE ratio for the market) often indicate investor optimism because of the expectation of higher earnings in the future. If future earnings do increase, the stock usually becomes more valuable in the future. On the other hand, a stock with a low price-earnings ratio (those below the average for the market) indicates that investors have lower earnings expectations for a company’s stock. If future earnings decrease or don’t maintain the same level of growth, the stock will become less valuable in the future.

page 397Like earnings per share, a corporation’s PE ratio is often reported on investment websites. When researching a stock, comparing the PE ratio of one company to other companies in the same industry is usually the most helpful. It is also possible to compare a company’s PE ratio against the company’s own historical PE ratios or the market in general.

PROJECTED EARNINGS Both earnings per share and the price-earnings ratio are based on historical numbers. In other words, this is what the company has done in the past. With this fact in mind, many investors will also look at earnings estimates for a corporation. The MSN Money website or similar financial websites provide earnings estimates for major corporations. At the time of publication, for example, MSN Money provided the following earnings per share estimates for Starbucks, the company that provides rich-brewed coffee, espresso beverages, and complementary food products.2

Starbucks |

This Year |

Next Year |

|---|---|---|

Yearly earnings per share estimates |

$2.13 per share |

$2..45 per share |

From an investor’s standpoint, a projected increase in earnings from $2.13 per share to $2.45 per share is a good sign. In the case of Starbucks, these estimates were determined by surveying more than 30 different analysts who track Starbucks. By using the same projected earnings amount, it is possible to calculate a projected price-earnings ratio or a projected price per share of stock. Of course, you should remember that these are estimates and are not “etched in stone.” Changes that affect the economy, industry, or company’s sales and profit amounts could cause analysts to revise the above estimates.

Dividend Yield and Total Return

One of the calculations investors use most frequently to monitor the value of their investments is the dividend yield. The dividend yield is the annual dividend amount divided by the stock’s current price per share.

An increase in dividend yield is a healthy sign for any stock investment. A dividend yield of 3.5 percent is better than a 2.8 percent dividend yield.

Although the dividend yield calculation is useful, you should also consider whether the stock’s price per share is increasing or decreasing in dollar value. Total return is a calculation that includes not only the yearly dividend amount but also any increase or decrease in the original purchase price of the investment. While this concept may be used for any investment, let’s illustrate it by using the assumptions for Pepsico—the parent company of Pepsi.

page 398

The dividend of $301 results from the payment of dividends for one year ($3.01 per-share dividend × 100 shares = $301). The capital gain of $1,100 results from the increase in the stock price from $102 a share to $113 a share ($11 per-share increase × 100 shares = $1,100). (Of course, commissions to buy and sell your stock, a topic covered in the “Commission Charges” section, would reduce your total return.)

Understanding these calculations can help you to make the best possible investment decisions. See the nearby Figure It Out! feature to work through an example.

Other Factors That Influence the Price of a Stock

The beta is a measure reported in many financial publications that compares the volatility associated with a corporation stock issue with the volatility of the stock market or an index such as the S&P 500 Index. The beta for the market is 1.0. The majority of stocks have page 399betas between 0.5 and 2.0. Generally, conservative stocks have low betas, whereas more speculative stocks have betas greater than one.

Because the beta for the stock market is based on historical financial data, the beta calculation for an individual stock is a projection of what will happen in the future. In the above example, the expectation is that Apple stock will increase by 14 percent if the market increases by 10 percent.

Because individual stocks generally move in the same direction as the stock market, most betas are positive, but it is possible for a stock to have a negative beta. A negative beta occurs when a corporation’s stock moves in the opposite direction compared to the stock market as a whole.

Although little correlation may exist between the price of a stock and its book value, book value is widely reported in financial publications. Therefore, it deserves mention. The book value for a share of stock is determined by deducting all liabilities from the corporation’s assets and dividing the remainder by the number of outstanding shares of common stock. For Southwest Airlines—a major passenger airline in the United States—book value is $13.33 per share, as illustrated below.

Some investors believe they have found a bargain when a stock’s current price per share is about the same as or lower than its book value. Be warned: Book value calculations may be misleading, because the dollar amount of assets used in the above formula may be understated or overstated on the firm’s financial statements. From a practical standpoint, most financial experts suggest that book value is just another piece of the puzzle and you must consider other factors along with book value when evaluating a possible stock investment.

page 400Two other factors can affect the price of a stock. First, predicting the future value for a share of stock is a practical example of the time value of money concepts presented in Chapter 1. The price that a successful investor is willing to pay for a share of stock is determined by

The amount of dividends you expect to receive in the future, or

A potential increase in the price for a share of stock, and/or

A combination of future dividends and a potential increase in the price of the stock.

Second, always remember that the price for a share of stock is determined by what another investor is willing to pay for it. While most successful investors use investment research and financial calculations to choose stock investments, there are times when investors may pay a high, inflated price for a share of stock. For example, the term stock market bubble is used to describe a situation in which stocks are trading at prices above their actual worth. Often the high stock prices are driven by investor optimism and irrational expectations. Unfortunately, stock market bubbles may burst because of an economic slowdown, high unemployment rates, higher interest rates, and other factors that affect the economy. The bubble for a specific stock can also burst when a company lowers estimates for future earnings or reduces or omits dividend payments to stockholders, or when stockholders begin to sell the stock for any other reason.

Making a Decision to Buy, Hold, or Sell a Stock—A Summary

Many investors have trouble making the decision to buy, hold, or sell a stock. There is always a danger of overlooking important relevant information when you use a summary like the one below. Still, it does help to develop a plan using the following suggestions to evaluate individual stocks.

Evaluate each investment. Too often, investors purchase or sell a stock without doing their homework. A much better approach is to become an expert and learn all that you can about the company (and its stock). The information in the section “Evaluating a Stock Investment” and this section will help you play detective to find the right stock. Also, Your Personal Financial Plan sheet 38 will help you summarize important information.

Access a professional advisory service such as Value Line, Standard & Poor’s, or Mergent. Sources for information from advisory services include the internet or the library. As mentioned in this chapter, some of the information may be free, but you may have to pay for the detailed information you need to evaluate a potential stock.

Analyze the firm’s finances. Look at the company’s financial information, which is available in the firm’s annual report or on many investment websites. Examine trends for sales, profits, dividends, and other important financial data.

Track the firm’s product line. If the firm’s products or services become obsolete and the company fails to introduce state-of-the art new products or services, its sales—and, ultimately, profits—may take a nosedive.

Monitor economic developments. An economic recovery or an economic recession may cause the value of a stock investment to increase or decrease. Also, watch the unemployment rate, inflation rate, interest rates, productivity rates, and similar economic indicators.

Be patient. For most people, stock investing is long-term and is not a method to get rich overnight. The secret of success for making money with stocks is often time. If you choose quality stocks based on quality research and are willing to wait, eventually your stock investments will provide average or even above-average returns. Remember: There are no guarantees when investing in stocks. Larger returns are always accompanied by increased risk when investing in stocks.

page 401

LO12.4

Describe how stocks are bought and sold.

Buying and Selling Stocks

To purchase common or preferred stock, you generally have to work through a brokerage firm. In turn, your brokerage firm must buy the stock in either the primary or secondary market. In the primary market, you purchase financial securities, via an investment bank or other representative, from the issuer of those securities. An investment bank is a financial firm that assists corporations in raising funds, usually by helping to sell new security issues.

New security issues sold through an investment bank can be issued by corporations that have sold stocks and securities before and need to sell new issues to raise additional financing for expansion, to increase the firm’s cash balance, or for any valid business purpose. New securities can also be initial public offerings. An initial public offering (IPO) occurs when a corporation sells stock to the general public for the first time. In 2017, Snap—parent company of the wildly successful social media app Snapchat—used an IPO to raise approximately $3.4 billion.3 The money from the IPO can be used for expansion or any other activity to create a larger and more successful company.

Be warned: The promise of quick profits often lures investors to purchase IPOs. An IPO is generally classified as a high-risk investment—one made in the hope of earning a relatively large profit in a short time. Depending on the corporation selling the new security, IPOs are usually too speculative for most people.

Once stocks are sold in the primary market, they can be sold time and again in the secondary market. The secondary market is a market for existing financial securities that are currently traded among investors. A corporation does not receive money each time its stock is bought or sold in the secondary market. However, the ability to obtain cash by selling stock investments is one reason why investors purchase corporate stock. Without the secondary market, investors would not purchase stock in the primary market because there would be no way to sell shares to other investors.

Secondary Markets for Stocks

When you purchase stock in the secondary market, the transaction is completed on a securities exchange or through the over-the-counter market.

page 402SECURITIES EXCHANGES A securities exchange is a marketplace where member brokers who represent investors meet to buy and sell securities. Generally, the securities issued by nationwide corporations are traded at the New York Stock Exchange or regional exchanges in the United States. There are also foreign securities exchanges—in Tokyo, London, or Paris, for example.

The New York Stock Exchange (NYSE), is one of the largest securities exchanges in the world. Most of the NYSE members represent brokerage firms that charge commissions on security trades made by their representatives for their customers. Other members are called specialists or specialist firms. A specialist buys or sells a particular stock in an effort to maintain a fair and orderly market.

Before a corporation’s stock is approved for listing on the NYSE, the corporation must meet specific listing requirements. The various regional exchanges also have listing requirements, but typically these are less stringent than the NYSE requirements. The stock of corporations that cannot meet the NYSE requirements, find it too expensive to be listed on the NYSE, or choose not to be listed on the NYSE is often traded on one of the regional exchanges, or through the over-the-counter market.

THE OVER-THE-COUNTER MARKET Not all securities are traded on organized exchanges. Stocks issued by several thousand companies are traded in the over-the-counter market. The over-the-counter (OTC) market is a network of dealers who buy and sell the stocks of corporations that are not listed on a securities exchange. Today these stocks are not really traded over the counter. The term was coined more than 100 years ago when securities were sold “over the counter” in stores and banks.

Most over-the-counter securities are traded through Nasdaq (pronounced “nazzdack”). Nasdaq is an electronic marketplace for stocks issued by over 3,000 different companies.4 In addition to providing price information, this computerized system allows investors to buy and sell shares of companies traded on Nasdaq. When you want to buy or sell shares of a company that trades on Nasdaq—say, Microsoft—your account executive sends your order into the Nasdaq computer system, where it shows up on the screen with all the other orders from people who want to buy or sell Microsoft. Then a Nasdaq dealer (sometimes referred to as a market maker) sitting at a computer terminal matches buy and sell orders for Microsoft. Once a match is found, your order is completed. They may also complete buy or sell orders from their own inventory of shares that they maintain to meet the demands of investors.

Brokerage Firms and Account Executives

An account executive or stockbroker, is a licensed individual who works for a brokerage firm and buys or sells investments for his or her clients. Before choosing an account executive, you should have already determined your financial objectives. Then you must be careful to communicate those objectives to the account executive so that he or she can do a better job of advising you. To help avoid a situation in which your account executive’s recommendations are automatically implemented, you should be actively involved in the decisions related to your investment program, and you should never allow your account executive to use his or her discretion without your approval. Watch your account for signs of churning. Churning is excessive buying and selling of securities to generate commissions. Finally, keep in mind that account executives generally are not liable for client losses that result from their recommendations. In fact, most brokerage firms require clients to sign a statement in which they promise to submit any complaints to an arbitration board. This arbitration clause generally prevents a client from suing an account executive or a brokerage firm.

page 403

Should You Use a Full-Service or a Discount Brokerage Firm?

Today a healthy competition exists between full-service and discount brokerage firms. While the most obvious difference between full-service and discount firms is the amount of the commissions they charge when you buy or sell stock and other securities, there are at least three other factors to consider. First, consider how much research information is available. Both types of brokerage firms offer excellent research materials, but you may have to pay for more detailed research information and access to professional advisory reports if you choose a discount brokerage firm.

Second, consider how much help you need when making an investment decision. Many full-service brokerage firms argue that you need a professional to help you make important investment decisions. On the other side, discount brokerage firms argue that you alone are responsible for making your investment decisions. They are quick to point out that the most successful investors are the ones involved in their investment programs. And they argue that they have both personnel and materials dedicated to helping you learn how to become a better investor. Although there are many exceptions, the information below may help you decide whether to use a full-service or discount brokerage firm.

• Full-service |

Beginning investors with little or no experience. Individuals who are uncomfortable making investment decisions. Individuals who are uncomfortable trading stocks online. |

• Discount |

People who understand the “how to” of researching stocks and prefer to make their own decisions. Individuals who are comfortable trading stocks online. |

Finally, consider how easy it is to buy and sell stock and other securities when using a full-service or discount brokerage firm. Questions to ask include:

Can I buy or sell stocks using the internet or over the phone?

What is the typical commission for a stock transaction?

Do you have a toll-free telephone number for customer use?

Is there a charge for statements, research reports, and other financial reports?

Are there any fees in addition to the commissions I pay when I buy or sell stocks?

Many people still prefer to use telephone orders to buy and sell stocks, but a growing number are using computers to complete security transactions. To meet this need, discount and most full-service brokerage firms allow investors to trade online.

See the nearby Financial Literacy in Practice feature to learn how to open a brokerage account.

Sample Stock Transactions

Once you have decided on a particular stock transaction, it is time to execute an order to buy or sell. Let’s begin by examining three types of orders used to trade stocks.

A market order is a request to buy or sell a stock at the current market price. Payment for stocks is generally required within two business days after the transaction. Today it is common practice for investors to leave stock certificates with a brokerage firm. Because the stock certificates are in the broker’s care, transfers when the stock is sold are much page 404easier. The phrase “left in the street name” is used to describe investor-owned securities held by a brokerage firm. Investors can also use two other types of stock registration—see the nearby “Money Minute Focus” feature about stock registration.

A limit order is a request to buy or sell a stock at a specified price. When you purchase stock, a limit order ensures that you will buy at the best possible price but not above a specified dollar amount. When you sell stock, a limit order ensures that you will sell at the best possible price but not below a specified dollar amount. For example, if you place a limit order to buy eBay stock for $30 a share, the stock will not be purchased until the price drops to $30 a share or lower. Likewise, if your limit order is to sell eBay for $30 a share, the stock will not be sold until the price rises to $30 a share or higher. Be warned: Limit orders are executed if and when the specified price or better is reached and all other previously received orders have been filled.

Many stockholders are certain they want to sell their stock if it reaches a specified price. A limit order does not guarantee this will be done. With a limit order, as mentioned above, orders by other investors may be placed ahead of your order. If you want to guarantee that your order will be executed, you place a special type of limit order known as a stop-loss order. A page 405stop-loss order (sometimes called a stop order) is an order to sell a particular stock at the next available opportunity after its market price reaches a specified amount. This type of order is used to protect an investor against a sharp drop in price and thus stop the dollar loss on a stock investment. For example, assume you purchased Macy’s stock at $32 a share. Two weeks after you made that investment, Macy’s reports lower than expected sales and profits and that it is closing a large number of stores. Fearing that the market value of your stock will decrease, you enter a stop-loss order to sell your Macy’s stock at $24. This means that if the price of the stock decreases to $24 or lower, the brokerage firm will sell it. While a stop-loss order does not guarantee that your stock will be sold at the price you specified, it does guarantee that it will be sold at the next available opportunity. Both limit and stop-loss orders may be good for one day, one week, one month, or good until canceled (GTC).

Before you begin investing your “real” money, you may want to practice. Today, numerous investment websites provide simulations that allow you to practice stock investing for free. To find a stock investment simulation, use an internet search engine such as Google or Yahoo! Enter the term stock practice or virtual stock game, select a site, follow the rules, and use the practice to fine-tune your investment skills.

Commission Charges

Most brokerage firms have a minimum commission ranging from $5 to $25 for buying and selling stock. Additional commission charges are based on the number of shares and the value of stock bought and sold. Note: Some brokerage firms offer free trades, but strings are attached. For example, free trades may be an introductory offer, good for a limited time, or you may have to maintain a large balance in your investment account.

Exhibit 12–6 shows the minimum amount to open an account and typical commissions charged by selected brokerage firms. Generally, full-service brokerage firms charge higher commissions than those charged by discount brokerage firms. As a rule of thumb, full-service brokers may charge approximately 1 percent of the transaction amount. In return for charging higher commissions, full-service brokers usually spend more time with each client, help make investment decisions, and provide free research information. Be warned: Often account executives at full-service brokerage firms don’t spend a lot of time with investors that have only small amounts to invest.

Exhibit 12–6 Typical Commission Charges for Stock Transactions

Brokerage Firm |

Minimum to Open an Account |

Internet Trades |

|---|---|---|

E*Trade |

$500 |

$6.95 |

Charles Schwab |

$1,000 |

$4.95 |

Fidelity |

$2,500 |

$4.95 |

Merrill Edge |

$0 |

$6.95 |

TD Ameritrade |

$0 |

$6.95 |

Source: “Best Online Brokers for Stock Trading 2017, Nerd Wallet, https://www.nerdwallet.com/blog/investing/best-online-brokers-for-stock-trading/ accessed January 6, 2017.

page 406

LO12.5

Explain the trading techniques used by long-term investors and short-term speculators.

Long-Term and Short-Term Investment Strategies

Once you purchase stock, the investment may be classified as either long term or short term. Generally, individuals who hold an investment for a year or longer are referred to as investors. Individuals who routinely buy and then sell stocks within a short period of time are called speculators or traders.

Long-Term Techniques

In this section, we discuss the long-term techniques of buy and hold, dollar cost averaging, direct investment programs, and dividend reinvestment programs.

BUY-AND-HOLD TECHNIQUE Many long-term investors purchase stock and hold on to it for a number of years. When they do this, their investment can increase in value in two ways. First, they are entitled to dividends if the board of directors approves dividend payments to stockholders. Second, the price of the stock may go up, or appreciate in value. To see how an investor using the buy-and-hold technique can earn profits from dividends and an increase in stock value, review the Johnson & Johnson investment illustrated in Exhibit 12–2. In addition to dividends and dollar appreciation of value, stock splits may increase the value of your stock investments. Just remember, there are no guarantees that a stock split will increase the value of a stock.

DOLLAR COST AVERAGING Dollar cost averaging is a long-term technique used by investors who purchase an equal dollar amount of the same stock at equal intervals. Assume you invest $2,000 in Johnson & Johnson’s common stock each year for a period of seven years. The results of your investment program are illustrated in Exhibit 12–7. Notice that when the price of the stock decreased in 2011, you purchased more shares. And when the price of the stock increased in 2012 through 2017, you purchased fewer shares. The average cost for a share of stock, determined by dividing the total investment ($14,000) by the total number of shares, is $88.33 ($14,000 ÷ 158.5 = $88.33). Other applications of dollar cost averaging occur when employees purchase shares of their company’s stock through a payroll deduction plan or as part of an employer-sponsored retirement plan over an extended period of time.

Exhibit 12–7 Dollar Cost Averaging for Johnson & Johnson

Year |

Investment |

Stock Price |

Shares Purchased |

|---|---|---|---|

2011 |

$ 2,000 |

$ 65 |

30.8 |

2012 |

2,000 |

70 |

28.6 |

2013 |

2,000 |

84 |

23.8 |

2014 |

2,000 |

95 |

21.1 |

2015 |

2,000 |

102 |

19.6 |

2016 |

2,000 |

112 |

17.9 |

2017 |

2,000 |

120 |

16.7 |

Total |

$14,000 |

|

158.5 |

|

|||

The two goals of dollar cost averaging are to minimize the average cost per share and to avoid the common pitfall of buying high and selling low. In the situation shown in Exhibit 12–7, you would lose money only if you sold your stock at less than the average page 407cost of $88.33. Thus, with dollar cost averaging, you can make money if the stock is sold at a price higher than the average cost for a share of stock.

DIRECT INVESTMENT AND DIVIDEND REINVESTMENT PLANS Today a large number of corporations offer direct investment plans. A direct investment plan allows you to purchase stock directly from a corporation without having to use an account executive or a brokerage firm. Similarly, a dividend reinvestment plan (often called a DRIP) allows you the option to reinvest your cash dividends to purchase stock of the corporation. For stockholders, the chief advantage of both types of plans is that these plans enable them to purchase stock without paying a commission charge to a brokerage firm. Note: A few companies may charge a small fee for direct and dividend reinvestment plans, but the fee is less than the commissions most brokerage firms charge. The fees, minimum investment amounts, rules, and features for both direct investment and dividend reinvestment vary from one corporation to the next. Also, with the direct investment and dividend reinvestment plans, you can take advantage of dollar cost averaging, discussed in the previous section. For corporations, the chief advantage of both types of plans is that they provide an additional source of capital. As an added bonus, they provide a service to their stockholders. For more information about direct investment plans and dividend reinvestment plans, go to https://www.sec.gov/fast-answers/answersdriphtm.html or www.dripinvesting.org.

Short-Term Techniques

Investors sometimes use more speculative, short-term techniques. In this section, we discuss buying stock on margin, selling short, and trading in options. Be warned: The methods presented in this section are risky; do not use them unless you fully understand the underlying risks. Also, you should not use them until you have experienced success using the more traditional long-term techniques described above.

page 408BUYING STOCK ON MARGIN When buying stock on margin, you borrow part of the money needed to buy a particular stock. The margin requirement is set by the Federal Reserve Board. The current margin requirement is 50 percent. This requirement means you may borrow up to half of the total stock purchase price. Although margin is regulated by the Federal Reserve, specific requirements and the interest charged on the loans used to fund margin transactions may vary among brokerage firms. Usually, the brokerage firm either lends the money or arranges the loan with another financial institution.

Investors buy on margin because the financial leverage created by borrowing money can increase the return on an investment. Because they can buy up to twice as much stock by buying on margin, they can earn larger returns. Suppose you expect the market price of a share of ExxonMobil to increase in the next three to four months. Let’s say you have enough money to purchase 100 shares of the stock. However, if you buy on margin, you can purchase an additional 100 shares for a total of 200 shares.

In the preceding example, buying more shares on margin enables you to earn more profit (less the interest you pay on the borrowed money and customary commission charges).

Keep in mind that the ExxonMobil stock in this margin transaction serves as collateral for the loan. If the value of a margined stock decreases past a certain point, you will receive a margin call from the brokerage firm. After the margin call, you must pledge additional cash or securities to serve as collateral for the loan. If you don’t have acceptable cash or collateral, the margined stock is sold and the proceeds are used to repay the loan. The exact price at which the brokerage firm issues the margin call is determined by the amount of money you borrowed when you purchased the stock. Generally, the more money you borrow, the sooner you will receive a margin call if the value of the margined stock drops.

In addition to facing the possibility of larger dollar losses because you own more shares, you must pay interest on the money borrowed to purchase stock on margin. While the interest rates for a margin transactions vary, most brokerage firms charge 1 to 3 percent above the prime rate. Normally, economists define the prime rate as the interest rate that the best business customers must pay. Interest charges can absorb the potential profits if the value of margined stock does not increase rapidly enough and the margined stocks must be held for long periods of time.

SELLING SHORT Your ability to make money by buying and selling securities is related to how well you can predict whether a certain stock’s price will increase or decrease. Normally, you buy stocks and assume they will increase in value, a procedure referred to as buying long. But not all stocks increase in value. In fact, the value of a stock may decrease page 409for many reasons, including lower sales, lower profits, reduced dividends, product failures, increased competition, product liability lawsuits, and labor strikes. In addition, the health of a nation’s economy can make a difference.

When stock prices are declining, you may use a procedure called selling short to make money. Selling short is selling stock that has been borrowed from a brokerage firm and must be replaced at a later date. When you sell short, you sell today, knowing you must buy or cover your short transaction at a later date. To make money in a short transaction, you must take these steps:

Arrange to borrow a stock certificate for a specific number of shares of a particular stock from a brokerage firm.

Sell the borrowed stock, assuming it will drop in value in a reasonably short period of time.

Buy the stock at a lower price than the price it sold for in step 2.

Use the stock purchased in step 3 to replace the stock borrowed from the brokerage firm in step 1.

When selling short, your profit is the difference between the amount received when the stock is sold in step 2 and the amount paid for the stock in step 3. For example, assume that you think General Motors stock is overvalued at $35 a share. You also believe the stock will decrease in value over the next four to six months because of lower sales revenues and profits and a large number of potential product recalls. You call your broker and arrange to borrow 100 shares of General Motors stock (step 1). The broker then sells your borrowed stock for you at the current market price of $35 a share (step 2). Also assume that four months later, General Motors stock drops to $27 a share. You instruct your broker to purchase 100 shares of General Motors stock at the current lower price (step 3). The newly purchased stock is given to the brokerage firm to repay the borrowed stock (step 4).

There is usually no special or extra brokerage charge for selling short, since the brokerage firm receives its regular commission when the stock is bought and sold. Before selling short, consider two factors. First, since the stock you borrow from your broker is actually owned by another investor, you must pay any dividends the stock earns before you replace the stock. After all, you borrowed the stock and then sold the borrowed stock. Eventually, dividends can absorb the profits from your short transaction if the price of the stock does not decrease rapidly enough. Second, to make money selling short, you must be correct in predicting that a stock will decrease in value. If the value of the stock increases, you lose.

TRADING IN OPTIONS An option gives you the right—but not the obligation—to buy or sell a stock at a predetermined price during a specified period of time. If you think the market price of a stock will increase during a short period of time, you may decide to purchase a call option. A call option is sold by a stockholder and gives the purchaser the right to buy 100 shares of a stock at a guaranteed price before a specified expiration date. With a call option, the purchaser is betting that the price of the stock will increase in value before the expiration date. If the stock’s price does increase, the purchaser will be able to purchase the stock for the lower price guaranteed by the call option and then sell it for a profit.

page 410It is also possible to purchase a put option. A put option is the right to sell 100 shares of a stock at a guaranteed price before a specified expiration date. With a put option, the purchaser is betting that the price of the stock will decrease in value before the expiration date. If the stock’s price does decrease, the purchaser will be able to purchase stock at the lower price and then sell the stock for a higher price that is guaranteed by the put option. If these price movements do not occur before the expiration date, you lose the money you paid for your call or put option.

Because of the increased risk involved in option trading, a more detailed discussion of how you profit or lose money with options is beyond the scope of this book. Be warned: Amateurs and beginning investors should stay away from options unless they fully understand all of the risks involved. For the rookie, the lure of large profits over a short period of time may be tempting, but the risks are real.

page 411

page 412

Chapter Summary

LO12.1 Corporations sell stock (a form of equity) to finance their business start-up costs and help pay for their ongoing business activities. In return for providing the money needed to finance the corporation, stockholders have the right to elect the board of directors. They must also approve major changes to corporate policies.

People invest in stock because they want the larger returns that stocks offer. Possible reasons for stock investments include dividend income, appreciation of value, and the possibility of gain through stock splits. In addition to common stock, a few corporations may issue preferred stock. The most important priority an investor in preferred stock enjoys is receiving cash dividends before any cash dividends are paid to common stockholders.

LO12.2 A wealth of information is available to stock investors. A logical place to start the evaluation process is with the classification of different types of stock investments that range from very conservative to very speculative; see Exhibit 12–3. Today, many investors use the information available on the internet to evaluate individual stocks. Information is also available from stock advisory services such as Value Line, Standard & Poor’s, and Mergent. Newspapers, corporations that issue stocks, business and personal finance periodicals, and government publications can also help you evaluate a stock investment.

LO12.3 Many analysts believe that a corporation’s ability or inability to generate earnings in the future may be one of the most significant factors that account for an increase or decrease in a stock’s price. Generally, higher earnings equate to higher stock prices, and lower earnings equate to lower stock prices. Investors can also calculate earnings per share and a price-earnings ratio to evaluate a stock investment. Whereas both earnings per share and the price-earnings ratio are historical numbers based on what a corporation has already done, investors can obtain earnings estimates for most corporations. Other calculations that help evaluate stock investments include dividend yield, total return, beta, and book value. Stock prices are also affected by what another investor will pay for a share of stock. A number of suggestions to help you evaluate a stock investment were included in this section.

LO12.4 A corporation may sell a new stock issue with the help of an investment banking firm in the primary market. Once the stock has been sold in the primary market, it can be sold time and again in the secondary market. In the secondary market, investors purchase stock listed on a securities exchange or traded in the over-the-counter market. Securities transactions are made through a full-service brokerage firm or a discount brokerage firm. Whether you trade online or use more traditional trading techniques, you must decide if you want to use a market, limit, or stop-loss order to buy or sell stock. Most brokerage firms charge a minimum commission for buying or selling stock. Additional commission charges are based on the number and value of the stock shares bought or sold and if you use a full-service or discount brokerage firm. Generally, full-service brokerage firms charge higher commissions than those charged by discount brokerage firms.

LO12.5 Purchased stock may be classified as either a long-term investment or a speculative investment. Long-term investors typically hold their investments for at least a year or longer; speculators (sometimes referred to as traders) usually sell their investments within a shorter time period. Traditional trading techniques long-term investors use include the buy-and-hold technique, dollar cost averaging, direct investment plans, and dividend reinvestment plans. More speculative techniques include buying stock on margin, selling short, and trading in options.

page 413

Key Terms

dividend reinvestment plan 407

initial public offering (IPO) 401

over-the-counter (OTC) market 402

Key Formulas

Page |

Topic |

Formula |

Earnings per share |

|

|

Price-earnings(PE) ratio |

|

|

Dividend yield |

|

|

Total return |

Total return = Dividends + Capital gain |

|

Volatility for a stock |

Increase in overall market × Beta for a specific stock |

|

Book value |

|

Self-Test Problems

Four years ago, Ken Guessford purchased 200 shares of Mountain View Manufacturing. At the time, each share of Mountain View was selling for $30. He also paid a $24 commission when the shares were purchased. Now, four years later, he has decided it’s time to sell his investment. The Mountain View share price when sold was $32.50. In addition, he paid a $36 commission to sell his shares. He also received total dividends of $1.80 per share over the four-year investment period.

What is the total amount of dividends Ken Guessford received over the four-year period?

What was the total return for Guessford’s investment?

page 414Karen and William Newton are trying to decide if they should sell or hold their investment in Oakwood Electronics, and they ask for your help. Financial information for Oakdale Electronics is below.

Company

Price When Purchased

Current Price per Share

Annual Dividend

Earnings This Year

Projected Earnings Next Year

Number of Shares Outstanding

Oakdale Electronics

$32

$26

$0.30

$34 million

$25 million

20 million shares

Based on the current price for a share of stock, calculate the dividend yield for this company.

Calculate the earnings per share for this company.

Calculate the current PE ratio for this company.

Based on this information, would you recommend to sell or hold this company?

Solutions

Total dividends = $1.80 per share dividends × 200 shares = $360.

Dividends = $1.80 per share dividends × 200 shares = $360.

Purchase price = $30 per share × 200 shares = $6,000 + $24 commission = $6,024.

Selling price = $32.50 per share × 200 shares = $6,500 – $36 commission = $6,464.

Capital gain = $6,464 selling price – $6,024 purchase price = $440.

Total return = $360 dividends + $440 capital gain = $800.

The dividend yield for this company is

The earnings per share for this company is

The current PE ratio is 15. Current price per share ($26) ÷ earning per share $1.70 = 15.

All of the calculations in this problem should be considered when making a decision to sell or hold this investment. While the company is paying a $0.30 a share dividend, the dividend yield is 1.2 percent and is comparable to current rates for certificates of deposit. For now, dividends appear to be secure because the company is earning $1.70 a share and should be able to continue to pay dividends—even with lower projected earnings next year. The PE ratio is 15, which may indicate that investors are not optimistic about future earnings growth. Also, consider two additional factors. First, the stock price has declined from $32 to $26 a share. Is there a reason why this company’s stock should rebound at this point? Second, earnings are projected to decline next year. This may lead to a further decline in stock value from its present value. Based on this information, it may be time to sell this investment and look for another one that has more potential. What do you think?

Problems

Jamie and Peter Dawson own 220 shares of Duke Energy common stock. Duke Energy’s quarterly dividend is $0.86 per share. What is the amount of the dividend check the Dawson couple will receive for this quarter? (LO12.1)

During the four quarters for 2017, the Browns received two quarterly dividend payments of $0.18, one quarterly payment of $0.20, and one quarterly payment of $0.22. If they owned 270 shares of stock, what was their total dividend income for 2017? (LO12.1)

Jim Johansen noticed that a corporation he is considering investing in is about to pay a quarterly dividend. The record date is Thursday, April 20, 2017. In order for Jim to page 415receive this quarterly dividend, what is the last date that he could purchase stock in this corporation and receive this quarter’s dividend payment? (LO12.1)

Sarah and James Hernandez purchased 140 shares of Macy’s stock at $31 a share. One year later, they sold the stock for $35 a share. They paid a broker a commission of $8 when they purchased the stock and a commission of $12 when they sold the stock. During the 12-month period the couple owned the stock, Macy’s paid dividends that totaled $1.51 a share. Calculate the Hernandezes’ total return for this investment. (LO12.1)

Wanda Sotheby purchased 120 shares of Home Depot stock at $148 a share. One year later, she sold the stock for $140 a share. She paid her broker a commission of $34 when she purchased the stock and a commission of $39 when she sold it. During the 12 months she owned the stock, she received $427 in dividends. Calculate Wanda’s total return on this investment. (LO12.1)

In September, the board of directors of Chaparral Steel approved a stock split of 2-for-1. After the split, how many shares of Chaparral Steel stock will an investor have if he or she owned 230 shares before the split? (LO12.1)

Michelle Townsend owns stock in National Computers. Based on information in its annual report, National Computers reported after-tax earnings of $9,700,000 and has issued 7,000,000 shares of common stock. The stock is currently selling for $32 a share. (LO12.3)

Calculate the earnings per share for National Computers.

Calculate the price-earnings (PE) ratio for National Computers.

Analysts that follow JPMorgan Chase, one of the nation’s largest providers of financial services, estimate that the corporation’s earnings per share will increase from $6.69 in the current year to $7.64 next year. (LO12.3)

What is the amount of the increase?

What effect, if any, should this increase have on the value of the corporation’s stock?

Currently, Boeing pays an annual dividend of $5.68. If the stock is selling for $180, what is the dividend yield? (LO12.3)

Ford Motor Company has a beta of 1.36. If the overall stock market increases by 6 percent, based on this information, how much should investors assume that Ford will increase? (LO12.3)

Casper Energy Exploration reports that the corporation’s assets are valued at $185,000,000, its liabilities are $80,000,000, and it has issued 6,000,000 shares of stock. What is the book value for a share of Casper stock? (LO12.3)

For four years, Marty Campbell invested $4,000 each year in Harley-Davidson. The stock was selling for $74 in 2014, $62 in 2015, $51 in 2016, and $59 in 2017. (LO12.5)

What is Marty’s total investment in Harley-Davidson?

After four years, how many shares does Marty own?

What is the average cost per share of Marty’s investment?

Bob Orleans invested $3,000 and borrowed $3,000 to purchase shares in Verizon Communications. At the time of his investment, Verizon was selling for $47 a share. (LO12.5)

If Bob paid a commission of $30, how many shares could he buy if he used only his own money and did not use margin?

If Bob paid a commission of $60, how many shares could he buy if he used his $3,000 and borrowed $3,000 on margin to buy Verizon stock?

Assume Bob did use margin and paid a total commission of $60 to buy his Verizon stock. Also, assume he paid another $60 to sell his stock and sold the stock for $54 a share. How much profit did he make on his Verizon stock investment?

After researching Valero Energy common stock, Sandra Pearson is convinced the stock is overpriced. She contacts her account executive and arranges to sell short 250 shares of Valero Energy. At the time of the sale, a share of common stock had a value of $65. Three months later, Valero Energy is selling for $56 a share, and Sandra instructs her broker to cover her short transaction. Total commissions to buy and sell the stock were $36. What is her profit for this short transaction? (LO12.5)

page 416

Apply Yourself for Financial Literacy

Talk with different people and ask them if they include common or preferred stocks in their investment program. Also, ask them if they feel stocks could help you achieve your investment goals.

In your own words, describe how an investment in common stock could help you obtain your investment goals.