CREDIT

40. When should I cancel a credit card?

A: The answer to this question depends on why you’re asking. If you’re just uncomfortable with the number of cards in your wallet, or you paid off a few and no longer have a use for them, then you don’t want to cancel them. Why? Because canceling credit cards hurts your credit score in two ways. First, it reduces the amount of credit you have available. That increases your debt-to-credit ratio (also called your utilization ratio), which accounts for about one-third of your credit score. Not good. Second, creditors want to see that you’ve been able to maintain long relationships with your lenders. If any of those cards you’re thinking about canceling are the ones you’ve had longer than the others in your wallet, you’ll especially want to think twice.

So if you no longer want a card, the best option is to shred it without closing the account. That way, it’ll still show up on your credit report, but you won’t have it around to tempt you. This strategy works in almost all cases, except if you know the card number by heart, because then you can still do damage online.

If you think that you won’t be able to control yourself, call the card company and report your card lost. When you receive the replacement card with the new number, do not memorize it.

If that advice doesn’t work for you—if you want to unburden yourself of your plastic or if a check of your credit score shows that one of the things dragging it down is an excess of available, unused credit, you should cancel cards. Do it in a methodical way. Cancel one card. Pay down debt on your other cards to bring your utilization ratio back in line (you’re best off using only 10% to 30% of your available credit). Then cancel another card. And if you’re planning to hunt for a mortgage or other major loan in the next year, wait to cancel until after the papers are signed.

When choosing which cards to cancel, if you have a choice, you want to cancel the ones with the lowest credit limits that you’ve had the least amount of time. If any of your cards have annual fees, put those on the to-be-canceled list as well.

I Also Need to Know…

Q: How many credit cards are too many?

A: I tend to think that two is a good number. You want one with a low interest rate, because if you need it in an emergency and can’t pay off the balance within the grace period, at least you won’t be up against a 20% finance charge. For your second card, aim for one that offers some kind of reward that you’ll use, whether that’s cash back, frequent-flyer miles, or hotel points. You can use this card for everyday purchases that you’ll always pay off at the end of each month, because rewards cards tend to have higher interest rates.

Q: What’s considered a good APR?

A: Your credit card’s APR—annual percentage rate—is the amount you’ll pay in interest on the money you borrow and don’t pay back within the grace period given by the credit card company, which is generally 20 to 30 days. In general, anything below about 14% is pretty good, but the rate your card charges is going to be based on a wide range of factors, including your credit score, what kind of card it is, whether the rate is fixed or variable, and how long you’ve been a customer. The better your credit score is, the lower your interest rate tends to be. Also, rewards cards generally charge more than standard cards, because you’re getting something back. And store cards are also known for heftier interest rates that often overshadow any discounts you receive for signing up.

To make matters even more complicated, a single card can have a few different APRs.

- Purchase APR. This is the standard interest rate, and the one that you should be most concerned about. It will be applied to the things you buy with the card.

- Cash-advance APR. Believe it or not, you can use your credit card to withdraw cash—a loan of sorts. Unfortunately, it comes with a high interest rate and no grace period, which means this kind of loan is for serious emergencies only.

- Balance-transfer APR. Often a separate rate is applied to balances that are transferred from another card. There is usually a teaser rate involved—0% for six months—and then the interest rate on the transferred debt will jump, often higher than the purchase APR.

- Penalty APR. Your interest rate may increase if you’re late or delinquent in your payments. Under the Credit CARD Act of 2009, it must revert back to the original rate after six consecutive months of on-time payments.

- Introductory APR. These are the offers you see in your mailbox that boast 0% APR for six months or even a year. While you may get that rate—often it’s reserved for borrowers with pristine credit—the APR will jump after the introductory period, so it’s important to find out what your new rate will be if you don’t plan on paying off the balance in time.

There are also fixed-rate and variable-rate cards. Cards that carry a fixed APR generally hold the interest rate steady, although it can still change if the company provides you with 45 days written notice. (Thankfully, credit card reforms provide that the rate at which you incur a debt will be the rate at which you are allowed to pay them off.) Variable-rate cards will carry interest rates that fluctuate on the basis of the prime or Treasury bill rate.

Before you sign up for a credit card, be sure to read and understand the terms and conditions (the fine print). Compare a few different cards to make sure you’re getting a good deal, and if the rate on your current card seems high, give the company a call and ask the company to lower it. Companies often will. For more on that, see my script in Chapter 1.

41. Should I cosign a loan for my child, significant other, or anyone else?

A: When you cosign on a loan, you’re putting your credit on the line, plain and simple. If the person you’re signing for makes any of the mistakes that damage a credit score—paying late, missing payments, defaulting—it is going on your file as a big black mark. Your credit score will be dragged through the mud right along with theirs. You’re both liable for the loan.

Worse yet, if this person loses contact with you, you’re in trouble. Let’s say you cosign a loan for a boyfriend, and you go through a messy breakup. You don’t hear from him for a few years, and when you go to get a mortgage, your credit score is 100 or 200 points lower than you thought it was. Why? He hasn’t been making the payments on that auto loan. And you don’t know it because typically the creditor doesn’t send notices to your home. They send them to the address of the person responsible for making the payments.

This scenario shows up in my e-mail inbox all too often.

Other cons of cosigning? In some states, creditors can collect the unpaid debt from you without first trying to collect from the borrower, which means that in addition to a bruised credit score, you could be stuck with the balance—as well as the late fees and collection costs. According to the FTC, studies have shown that when cosigned loans go into default, three out of four cosigners end up paying on the loan.

Even if the person you signed for is spot on with his payments, having this loan on your credit file will increase the amount of your outstanding debt, which means your utilization ratio—the amount of debt you’re carrying versus the amount you have available to you—will take a hit. If you need a loan of your own, you may be turned down because you’re already borrowing too much money.

That said, the CARD act makes it impossible for a child under 21 (say, a college student) who doesn’t have the income to support a credit card on his or her own to get a card without a cosigner. If you want your child to have a card at college, you’re either going to have to move quickly before the law takes effect (February 2010). Add him or her as an authorized user on your own card or cosign and monitor carefully. Signing up for online bill receipt payment allows you to do this more easily than waiting for paper copies to arrive in the mail because you can track spending in real time, not just once every 30 days.

For anyone other than a child in school, and anything other than a credit card, remember, when you cosign for anything, you’re taking a risk on someone who isn’t able to get a loan on his own. That means he either doesn’t have a lot of experience with credit, so he doesn’t have a credit history, or he has screwed up a few times in the past. Either way, it’s not a great gamble.

I Also Need to Know…

Q: Are there any alternatives to cosigning?

A: Your best option may be to help the borrower find the money he needs. Maybe you can help him get a second job or show him how to sell things on the Internet. If it’s a small amount, and you can afford to lend it, you can do that. I suggest enlisting the help of a company like Virgin Money, though, to manage the loan and make sure you’re repaid (for more on this, see “Should I borrow money from a family member or friend?” in Chapter 2).

If you’re dead set on cosigning, though—say your son or daughter needs a private loan for college—at least go about it the right way. For starters, always make sure that you can afford to pay the loan back on your own, just in case it comes to that. If something goes wrong, you need to be able to take over the payments without turning your own financial world upside down.

Then, maintain control of the payment stream. Have the person pay you each month, and then you pay the lender directly, so that you know that the checks are going out, and that they’re going out on time. And be sure to have copies of all of the loan papers, either from the borrower or from the lender itself. You may need these if something goes wrong.

Q: If I agree to cosign, and then I change my mind, can I be removed from the loan?

A: No. Once you sign, you’re in for the duration of the loan. If the borrower pays on time for a while, however, his or her credit may improve over time. Have that person check periodically, and if it does, suggest the loan be refinanced without your involvement.

Q: What about cosigning on an apartment or house lease?

A: It’s the same situation, although in most cases, there’s less money involved if the borrower defaults—you may be liable only for the remaining months on the lease, as opposed to the tens of thousands of dollars that could remain on an auto or other loan. But you are still putting your credit on the line, and if the tenant misses payments or gets evicted, most landlords will report that to the credit bureaus. The same rules apply: Have the person renting the apartment pay you, and then write the checks to the landlord yourself. Be sure you have enough money to cover the balance if things go wrong.

42. How can I get my credit report and credit score—for free?

A: Getting your credit report for free is easy. Several years ago, the three major credit bureaus came together to create and host a Web site, AnnualCreditReport.com, that allows you to pull one copy of your credit report from each bureau every single year. That’s three free copies total within a one-year span, and I suggest spreading them out throughout the year. Pulling one every four months means that you can stay on top of your file and spot any suspicious or inaccurate activity quickly.

Unfortunately, free, when it comes to your credit score, is a more complicated word. The information collected by each of the three major bureaus is used by a company called Fair Isaac Corporation to calculate your FICO, or credit score. That means that you have three FICO scores (you also have others; more on that momentarily), although the numbers should be relatively similar. You can buy one score from myFICO.com for about $16, or all three for about $48. It is worth buying one six months to a year before you apply for any sort of financing (a mortgage or a car loan).

I can see you scratching your head. You listen to the radio. You see those commercials on television—such as the funny one with the guy now working in some fast-food seafood joint because he didn’t go to www.freecreditreport.com and get his score. Doesn’t that mean you can get your score for free? Not exactly.

When you order a “free” credit report from that particular site, you have to sign up for a credit-monitoring service called Triple Advantage. If you don’t cancel your membership within the next seven days—the “trial period”—you’ll be billed $14.95 a month until you do cancel. So can you get one for free? Yes, but only if you get it and then cancel practically immediately.

There is another loophole that I’ve found courtesy of the Web site www.credit.com. You can get a free score from that site, which uses TransUnion data. The tool then converts your data to a letter grade, which is calibrated to all of the consumer scoring methods, including FICO and VantageScore. That way you’ll know where you stand across the board. The catch? Once you have your score, you’ll be presented with a range of credit offers. All you have to do is ignore them if you’re not in the market for a mortgage or auto loan.

I Also Need to Know…

Q: How do I read my credit report?

A: Start with your personal data. Are there any mistakes? You’re looking for red flags, such as names you’ve never gone by, addresses you’ve never occupied, or errors in your Social Security number’s digits. If all of that information is correct, move on to your accounts. Make sure that they are all ones that you’re aware of, and that the information is accurate right down to the credit limit, account status, balance, and payment history. If you have any negative information on your report, you need to check the accuracy of that too. Make sure that if you’ve declared bankruptcy, all debts included in your filing are noted on your report, and if you’ve settled debts, they should be listed as such.

Finally, you want to look at your inquiries. Every time you apply for credit, whether it’s a new credit card, an increase in your credit limit, or a loan, the lender takes a peek into your credit file. Make sure that the inquiries listed on your report are ones that you are aware of—in other words, you applied for that loan or credit card, and no one was trying to apply in your name without your knowing.

If you find an error, it’s up to you to dispute it. If it’s just a simple mistake—such as an address that needs updating—you can contact the creditor and ask to have it fixed. The creditor will send an update to each credit bureau, so follow up to make sure it does so. If your creditor is unable to make the correction, you will have to dispute it with the credit bureaus by sending a notice to each one. All three bureaus allow you to dispute information online, but where you can, you should also send a written letter. List all mistakes with a description of why the information is inaccurate and how it should be updated. Include any backup information, such as your account records, for proof, as well as your phone number and Social Security number. Give the bureau 30 days to investigate. If you don’t hear back (you should receive a letter detailing what was updated on your credit report, or an e-mail if you submitted your dispute online), follow up and keep a paper trail.

Q: Which credit score should I buy?

A: Your scores, as I said, should be in the same ballpark. A lender is going to pull only one score, with the exception of mortgage lenders, which pull all three and take the middle one. That means that if you’re applying for something such as an auto loan, it’s a good idea to ask the lender which credit bureau they rely on, so that you can pull the same score and know where you stand before heading in. If the lender won’t give up the information—most will—there are a few geographical rules of thumb: In the Southeast, most lenders will use Equifax; on the West Coast, most will use Experian; and in the Northeast, lenders tend to rely on TransUnion. If you’re applying for a mortgage, go ahead and pull a package of all three FICO scores.

You may have heard of another score, called the VantageScore. This new score was created by the three credit bureaus as a competitor to FICO. The numbers in a VantageScore don’t track the numbers in a FICO score—they’re higher—so they may confuse you. It’s tempting to buy this score because the price tag is lower. Don’t. The VantageScore is an irrelevant model at this point. It hasn’t caught on with many lenders, and as long as they are still using FICO, you want to also.

Q: I found another Web site that offers free credit reports. Is it just as good as AnnualCreditReport.com?

A: There are more than a few copycat Web sites that boast free credit reports, but there is always a catch. Many ask you to input your credit card information immediately. If they do, you’re in the wrong place. Generally you’re signing up for some sort of credit-monitoring service or other program, which will then charge you a monthly fee. That’s not to say that these services are useless, but you should know what you’re paying for and why before you click Submit.

Q: What is credit monitoring, and who needs it?

A: Credit monitoring is basically paying a company to keep an eye on your credit file at all times. There’s a large crop of services out there, including one from each credit bureau. It’s up to you to weigh the costs of the service—generally a monthly fee of $10 to $15—and determine whether you need it and if you can afford it. Good services will monitor all three credit bureaus and tell you in real time when credit is requested in your name. That way, you can stop a crime before it occurs. If, for instance, someone walks into an electronics store and attempts to apply for credit to buy a new HDTV in your name, as soon as the store attempts to look in your file and approve the application, you’ll get a text message or phone call as an alert.

On the downside, these services don’t do much for accounts you already have, so if you lose your wallet, a thief will still be able to go on a shopping spree with your credit card. Bottom line: You may be able to do just as well monitoring your credit on your own by pulling your free reports at regular intervals each year, but if having a service in place makes you feel more secure—particularly if you’ve already been a victim of identity theft—it’s probably an investment worth making. With or without monitoring, you should continue to take all precautions to protect your identity. For more on this topic, see “How do I protect my identity? What should I do if my identity has been stolen?” in Chapter 4.

43. Are the 0% credit card offers I get in the mail legitimate? Should I transfer my existing debt onto one of these cards?

A: They are legitimate, sure. But that doesn’t mean there aren’t a few catches. First of all, the 0% interest rate doesn’t last forever; in fact, in most cases, your rate will jump in six months to a year. This rate is what you call a teaser. Second, although it says 0% in the solicitation, the interest rate you receive if you apply for the card may be much, much higher. That’s because the 0% is reserved for people with stellar credit. You still have to apply and be approved.

So if you receive one of these offers, what should you do?

- Read the fine print. All of it. You need to know how long the teaser rate is going to last in order to figure out how much higher-interest-rate debt you’ll likely be able to eliminate in that time. This is the only way to figure out if this particular 0% offer is the one for you.

- Look for fees. Balance transfers typically have them. The charges vary by card, but you’ll generally pay about 3% of the balance. Look for a cap on that amount. Ideally you should pay no more than $75 to $100 for the transfer no matter how much debt you’re moving. If the details of the deal aren’t apparent, call the toll-free number on the solicitation and ask any remaining questions you have.

- Consider your credit score. A lot of people consider transferring their debt from card to card to card a good, money-saving move. In other words, your first teaser rate expires, so you move the money to another one, and again and again and again. This strategy is a good way to pay off your debt at a low or no rate of interest, but you’re doing damage to your credit score, particularly if you close each card after moving the money off it. Each time you apply for a credit card, you are allowing that lender to look at your credit file, which dings your score. Canceling a card is another hit, so be careful about the number of times you employ this tactic.

I Also Need to Know…

Q: I was approved for a card at an introductory rate of 0%, but after I transferred my balance, I was charged interest. Is this a scam?

A: No, it’s not—cards often charge a few different interest rates, in fact. There may be one for balance transfers, one for purchases, and a third for cash advances. Unless the card you applied for advertised that 0% interest rate on balance transfers—and even then, you should read the offer cover to cover to make sure you’re clear—you may have overlooked that the advertised rate applies to new purchases only.

There are still a few cards out there that will give you an introductory 0% rate on new purchases and balance transfers, despite the changing credit market and the Credit CARD Act of 2009, so there’s no reason to settle for less. CardRatings.com maintains a list of the best offers.

Q: I used to get five or six 0% credit card offers a week; now it’s more like one every two weeks. Is this a sign that my credit score has dropped?

A: It could be, but it’s more likely a sign of the larger economy. Card issuers have cut back on the number of offers they’re sending out to consumers. They’re being more and more careful about who they’re lending to and how much they’re offering. So while at one point a credit score in the high 600s would have had lots of credit card offers hitting your mailbox, these days, you really need 720 or above to get the bulk of them, and 760 or above to get the best interest rates.

That said, if you haven’t pulled your free credit report in a while, you should go ahead and do so just to make sure everything is still in order. You can pull one report a year from each of the three credit bureaus for free at AnnualCreditReport.com.

THE STATS

- 14%: The drop in credit card solicitations during the second quarter of 2008.

- Nearly 70% of financial institutions say they have cut back on credit card solicitations, according to a 2008 study by Javelin, a provider of financial services research.

- 6 in 10: The number of financial institutions limiting the amount of credit offered to customers.

- 1.34 billion: Total credit card offers in the third quarter of 2008—a huge drop from the more than 2 billion tracked quarterly in 2005 and 2006.

44. What’s a good credit score? How can I improve mine?

A: After the credit crunch of 2007–2009, the bar raised for credit scores. What is considered a good score tends to vary according to each lender’s standards, but there are some general ranges you can use to evaluate your position.

First of all, scores—and here we are taking about FICO scores, those generated by Fair Isaac Corporation and that are used for the vast majority of lending decisions in the United States—range from 300 to 850, and you want to strive for the higher end of that spectrum. Here’s the breakdown:

- Very good: 760+. You’ll easily qualify for the best interest rates.

- Good: 700–760. You’ll be viewed by lenders as a low credit risk. You may not get the best interest rates out there, but the rates you’re offered will still be competitive.

- Fair: 650–700. Lenders will consider you a moderate credit risk, and you might struggle a bit to find an affordable loan.

- Bad: 600–650. You’re in high-credit-risk territory and likely won’t be approved for loans or credit cards at competitive rates.

- Very bad: below 600. Lenders and insurance companies are likely to turn down your applications for credit, and if you happen to be approved, you’ll pay high interest rates or premiums.

If you’re not satisfied with the category your score falls into—and there’s always room for improvement—there are a few ways to give it a boost:

- Pull your credit reports. The three major credit scoring bureaus, TransUnion, Equifax, and Experian, will each allow you one free copy of your report a year. You can get yours (and I suggest spreading them out by pulling one every four months) on AnnualCreditReport.com. For more on this site, including what to look for in your file and how to dispute errors, turn to Chapter 6.

- Pay your bills on time. Yes, one day late is still considered late.

- Don’t run up your cards. You want to aim to use just 10% of the total credit available to you.

- Hang on to old cards. Your credit score benefits from long relationships with lenders, so cut them up but don’t cancel them if you can help it.

- Stop shopping for new credit. Every time you apply for a new card or loan, the lender takes a peek at your credit history, which dings your score.

- Spread your debts around. The mix of credit you have in your file—mortgages, student loans, auto loans, credit cards—shows that you can juggle debt from multiple sources.

THE MATH

How does your credit score affect your wallet? See for yourself.

Interest rates and monthly payments on a $300,000, 30-year, fixed-rate mortgage, broken down by credit score:

FICO Score: 760–850

APR: 5.675

Monthly Payment ($): 1,736

FICO Score: 700–759

APR: 5.897

Monthly Payment ($): 1,779

FICO Score: 660–699

APR: 6.181

Monthly Payment ($): 1,834

FICO Score: 620–659

APR: 6.991

Monthly Payment ($): 1,994

FICO Score: 580–619

APR: 9.024

Monthly Payment ($): 2,419

FICO Score: 500–579

APR: 10.310

Monthly Payment ($): 2,702

APR = annual percentage rate; FICO score = Fair Isaac Corporation score, or your credit score.

Source: myFICO.com, November 24, 2008. Based on national averages.

On a 36-month, $20,000 auto loan:

FICO Score: 760–850

APR: 6.686

Monthly Payment ($): 615

FICO Score: 690–719

APR: 8.229

Monthly Payment ($): 629

FICO Score: 660–689

APR: 9.451

Monthly Payment ($): 640

FICO Score: 620–659

APR: 12.087

Monthly Payment ($): 665

FICO Score: 590–619

APR: 15.270

Monthly Payment ($): 696

FICO Score: 500–589

APR: 16.285

Monthly Payment ($): 706

APR = annual percentage rate; FICO score = Fair Isaac Corporation score, or your credit score.

Source: www.myFICO.com, November 24, 2008. Based on national averages.

On a 15-year, $50,000 home equity loan:

FICO Score: 740–850

APR: 8.150

Monthly Payment ($): 482

FICO Score: 720–739

APR: 8.450

Monthly Payment ($): 491

FICO Score: 700–719

APR: 8.950

Monthly Payment ($): 506

FICO Score: 670–699

APR: 9.725

Monthly Payment ($): 529

FICO Score: 640–669

APR: 11.225

Monthly Payment ($): 575

FICO Score: 620–639

APR: 12.475

Monthly Payment ($): 615

APR = annual percentage rate; FICO score = Fair Isaac Corporation score, or your credit score.

Source: www.myFICO.com, November 24, 2008. Based on national averages.

I Also Need to Know…

Q: How is my score calculated?

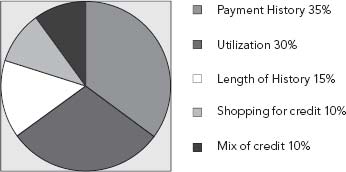

A company called Fair Isaac does most of the legwork in calculating your score on the basis of information reported to the three credit bureaus by your lenders. Here’s how it all breaks down:

- 35% is based on your payment history and whether you pay on time.

- 30% is the amount you owe compared to the credit you have available, or utilization. Credit card debt is going to drag your score down more than installment debt such as mortgages, auto, and student loans will.

- 15% is made up of the length of your credit history, with longer relationships with creditors always viewed as better.

- 10% is how often you shop for credit and open new accounts.

- The remaining 10% is based on the kind of credit you have. A mix of cards and loans is best.

Q: What if I have no credit at all?

A: You might think a blank slate is good, but having no credit at all means there is no way for lenders to evaluate you, putting you in the high-risk category by default. But no credit is better than bad credit, because you still have a shot at being approved for new accounts. Once you have your first credit card (and if you have trouble getting a traditional one, apply for a secured card where you deposit money with the issuing bank as collateral), you can build up your credit history by keeping those accounts open, paying on time, and using your card on a regular basis. That’s not to say you should buy things you can’t afford, but swiping it a few times a month for things you’ll easily be able to cover by the time the bill comes is a good idea. After a few months, the lender should show up in your credit file and you’ll be on your way to building a history. For a list of secured credit cards, go to www.cardweb.com.

45. Which is more important, paying off my credit card debt or having money in the bank?

A: This used to be a simple question with a simple answer: On a standard high-interest savings account, you’re likely earning 3% or less in interest. Your credit card, however, is probably charging you upward of 12% or 13% in interest. That’s why typically it makes sense to take the money from savings, use it to pay off the credit cards, and start rebuilding that savings account with the money you were using to pay down the credit cards. In the meantime, you have that credit card to fall back on if you do run into an emergency.

Unfortunately, “typically” was yesterday’s advice. After the credit crisis began—and card issuers started cutting lines of credit and canceling inactive accounts altogether—there was no longer a guarantee that your credit card will be there as a backup if you need it.

If paying off your credit card with your savings means you have nothing left as a backup cushion, it’s not a move I’d recommend. You can use some of the money in your savings, but by no means should you clean it out. Leave at least a thousand dollars in place in case you need it. Then, once you’re debt free, start beefing that account back up until you have about six month’s worth of expenses covered.

THE MATH

Here’s why you need savings. Say you don’t have an emergency fund, but you seem to be chugging along just fine without one. Your credit cards, thankfully, are paid off. Then you have one of those weeks. You know what I’m talking about: Your car breaks down, your dog needs to go to the vet, and you get two parking tickets inside of four days. How do you deal without a cushion to fall back on? The credit cards, of course.

Here’s what it will cost you:

Veterinary visit for a dog: $99

Auto repair bill: $811

Parking tickets: $75 each

Total if you paid with cash from your emergency fund: $1060

Total if you paid with your credit card, then made minimum payments until it was paid off: $1,613. It would take you 6 years, 6 months at an interest rate of 15%.

I Also Need to Know…

Q: How can I keep my card active without running up debt?

A: Self-control. To keep your cards active, you have to use them. But I’m talking about responsible usage, not an excuse to spend more than you can afford. Letting your card get dusty is an invitation for the company to cancel it, particularly in this market. Not only does that leave you without a reliable means of credit but it also dings your credit score because it reduces the amount of credit available to you. Buy a sandwich or a cup of coffee with your card once or twice a month, then pay it off immediately.

Q: How will I know if my card is canceled or my credit limit is cut?

A: Your credit card issuer will notify you by mail, or, if you signed up for online-only correspondence, they’ll send you an e-mail. As part of the Credit CARD Act of 2009, they are required to notify you at least 45 days in advance of any major changes in card terms. Be sure to keep on top of all changes to your interest rate and credit limit, because not knowing your spending limit could allow you to go over, and then you’ll be liable for big penalties.

46. Does my credit score affect how much I pay for insurance?

A: For home and auto, yes. For health, disability, life and long-term care, no.

Here’s the deal: Auto and home owner’s insurance companies (or property casualty insurers, as they are sometimes called) often use what’s called an insurance score to help them determine how risky a proposition you are—information that plays into how much you’ll pay in premiums and your eligibility for coverage (though it’s typically not the deciding factor). An insurance score is different than the standard credit score that your credit card company or mortgage lender uses.

In Chapter 6, I mentioned credit scores and Fair Isaac, the company that calculates the majority of them for the major credit bureaus. While Fair Isaac also sells insurance scores, most insurance companies use scores tabulated by a different company, ChoicePoint.

ChoicePoint pulls together your prior claim history and your credit history to develop your magic number, which is marketed to insurers but also to you as a ChoicePoint Attract Insurance Score. You can purchase your home insurance score or your auto insurance score for $12.95 each. As with your credit score, it comes with a detailed report, which in this case is called a CLUE, or Comprehensive Loss Underwriting Exchange report. There are separate scores and reports for auto and home insurance.

Right about now, you may be thinking: What the heck does my credit history have to do with my eligibility for car insurance?

It does seem kind of odd, but insurance companies have conducted study after study proving that customers with low credit scores file more insurance claims. They believe that your credit score is a better indicator of how much money you’ll cost them over time than even your driving record. And because insurance companies need to make money, they shy away from extending coverage to people who have filed a lot of claims in the past, or people who they believe will file a lot of claims in the future. (Or they charge these people significantly more for the coverage.)

Keep in mind, though, that this number represents only a portion of what goes into determining your eligibility for coverage and the amount you’ll pay for premiums. Companies combine the score with the other underwriting guidelines they use—your driving record with your state or your claim history as a homeowner—to evaluate your risk.

I Also Need to Know…

Q: What’s a good score?

A: ChoicePoint’s Attract scores go up to 997, and the higher you fall on that scale, the better. Here’s how they break it down:

SCORE: 776–997

RANKING: Good

SCORE: 626–775

RANKING: Average

SCORE: 501–625

RANKING: Below average

SCORE: Less than 500

RANKING: Less desirable

Q: How long does information remain on my CLUE report?

A: As with your credit report, there are federal laws specifying when and how things drop off your report. Missed payments and public records will stay on your report for 7 years, bankruptcy for 10 years, unpaid tax liens for 15 years, and inquiries into your file stay on the report for 2 years. Collection accounts remain for 7 years from the date that you initially missed the payment, and positive information can remain on your report indefinitely, although it generally drops off after 7 years as well.

Q: How do I get a copy of my Attract score or my CLUE report?

A: You are entitled to a free copy of your CLUE report once a year, which you can get by going to www.choicetrust.com (ChoiceTrust is a division of ChoicePoint) and clicking the link “Review Your FACT Act Disclosure Reports.” You can also request it by mail or phone:

CLUE Inc. Consumer Disclosure Center

Attn: FACT Act Request

P.O. Box 105295

Atlanta, GA 30348

1-866-312-8076

Just as you must with your credit score, you have to pay for your Attract score. Each score—home and auto—comes with a copy of your Equifax credit report.

Q: If my credit score is high, will my insurance score also be high? And do I need to buy both?

A: The scores have different focuses, so they’re likely to vary. If you’re concerned about your scores, you should buy both. Although ChoicePoint pulls its information from the three credit bureaus, your credit score really zeros in on whether you pay your bills on time and the amount you owe compared with the amount of credit you have available. An insurance score is likely to put more weight on the length of your credit history, because what they’re really looking for is stability. They want to know that you’ve responsibly managed credit for a long time. Also, remember that ChoicePoint Attract scores range from 500 to 997, while FICO scores range from 300 to 850.

Q: What if I find an error?

A: If you want to challenge something on your report, you should contact ChoicePoint directly. ChoicePoint will go back to the company that reported the information and verify its accuracy within 30 days.

You also have the option of adding a personal statement to your CLUE report, which can help explain your side of any negative records to insurance companies who pull the report.

In either case, you want to visit www.consumerdisclosure.com or call 1-866-718-7684.

Resources

Books

The Complete Idiot’s Guide to Improving Your Credit Score, by Lita Epstein (2007)

Includes information on key ways to use credit and how to avoid credit scams; debunks common credit myths.

Credit Repair Kit for Dummies, 2nd edition, by Steve Bucci (2008)

Step-by-step advice and tools to help get your credit back on track.

How You Can Profit from Credit Cards: Using Credit to Improve Your Financial Life and Bottom Line, by Curtis E. Arnold (2008)

Information on how you can use credit cards to actually improve your financial standing.

Pay It Down! From Debt to Wealth on $10 a Day, by Jean Chatzky (2009)

Completely updated and revised in 2009. Learn how to pay down your debt with as little as $10 a day.

Credit Bureaus

Experian

www.experian.com

901 West Bond

Lincoln, NE 68521

TransUnion

www.transunion.com

2 Baldwin Place

P.O. Box 2000

Chester, PA 19022

Equifax

www.equifax.com

P.O. Box 740256

Atlanta, GA 30374–0241

Government Resources

Federal Reserve Board

www.federalreserve.gov/Pubs/shop/#aprs

Information from the Federal Reserve Board on how to understand credit cards and how to compare credit cards; your rights while using a credit card.

Federal Trade Commission

www.ftc.gov

1-877-382-4357

The FTC offers information on loans, facts on cosigning, credit card information, information on debt as well as information on credit card balance transfers.

Web sites

Annualcreditreport.com

www.annualcreditreport.com

Request a free annual credit report.

BankRate.com

www.bankrate.com

561-630-2400

Information on credit cards, several different credit calculators, comparisons of credit cards, tips on balance transfers, and credit card news.

Credit.com

www.credit.com

415-646-0000

Comparisons of credit card interest rates, information and tips on credit cards, a free credit score estimator, answers to FAQs, tips and tools for getting out of debt as well as information on balance transfers.

myFICO

www.myfico.com

1-800-319-4433

A division of Fair Isaac Corporation, at myFICO you can obtain your credit score; and their site features credit basics, calculators, credit Q&A, current news and more.

TransUnion

www.transunion.com

To obtain a free annual credit report: 1-877-322-8228. To dispute an item on your credit report: 1-800-916-8800.