REAL ESTATE/MORTGAGES

47. Should I take money from my savings account and pay off my mortgage?

A: I generally think of this as an emotional decision, rather than strictly a financial one. Having a mortgage weighs on some people’s minds—they lump it in with debt, a word and a concept with negative connotations.

But mortgage debt, in both my eyes and in the eyes of your credit report, is good debt. You’re paying toward a home that you will eventually own outright. In many cases, that home will appreciate at slightly more than the rate of inflation (I know we haven’t seen much of that lately, but things will turn around in time). You’re also getting a tax advantage, because the interest you pay on your mortgage is tax deductible.

Finally, you’re taking money that is liquid, that you can use if you have an emergency, and you’re locking it up in your home. If, down the road, you suffer a job loss or an illness, or you just need a bit of quick cash, you won’t have it available to you. Sure, you may be able to get a HELOC, but in some markets, that’s not always a given.

So my answer here is no, with one exception: If you’re retired, or getting close to it, you want to work to pay off your mortgage because you don’t want that extra payment dragging you down. To read more, check out “Should I have a mortgage in retirement?” in Chapter 7.

But when retirement is far off and your mortgage’s interest rate is low, you’ll be better off investing that money in a mix of stocks and bonds appropriate for your age and risk tolerance. What we’re looking at here is the opportunity cost you’re losing by leaving that money in savings (where it’s likely earning 1% to 2% in recent years) or putting it into your mortgage (where, if you have a good rate, your return after the tax deduction will be 3% to 4%). Ask yourself: If I invested the money in another way instead—if I put it into my portfolio—could I do better? If you put it into a 401(k) where you could get matching dollars, the answer is an absolute yes. If you put it into another account where it could grow, tax deferred, the answer is probably yes. And if you put it into a taxable account, the answer has historically been yes. History has shown that the return on your money will be worth more to you than the interest you’re paying on your mortgage. In some cases, much more.

Which leads me to another question: How much money do you have sitting in savings anyway? More than enough to cover living expenses for about six months if you were without a job or a steady source of income? If so, you should consider putting the rest in the market where it can work for you. You can invest it through an IRA or Roth IRA, if you haven’t already maxed those out, or you can open a brokerage account at any major investment firm.

THE MATH

What’s the real dollar difference between paying off that mortgage and investing the money?

Take a 30-year $250,000 mortgage fixed at an interest rate of 6%. The standard monthly payment would be $1,499, and all told, you’ll pay $539,593.

If, after 15 years, you add an extra $1,000 a month to pay that mortgage off a bit faster, you’ll save $49,781 in interest, paying a total of only $489,812. Your payoff period will be shortened by about 7.5 years.

Now let’s say that instead, you decide to invest that $1,000 at an interest rate of 8%. In the 7.5 years that you could have paid off your mortgage, you’ll have amassed more than $120,000.

Want to pay off even more? If you were to put $10,000 more a month toward that same mortgage, starting after 15 years, you’d save $115,313 total and shave more than 13 months off the life of the loan.

Investing that $10,000 a month instead at 8% for just two years, you’d have more than $259,000.

I Also Need to Know…

Q: I’ve heard that some mortgage lenders charge a penalty for prepayment. Is that true?

A: This practice used to be common, but these days, it’s not so much. Still, you should check with your lender before you prepay just in case.

Q: How do I deduct my mortgage interest?

A: You deduct home mortgage interest as an itemized deduction (meaning you can no longer take the standard deduction, the amount you’re automatically allowed to deduct if you don’t have a lot of write-offs) on Schedule A of IRS Form 1040.

Mortgage interest, in the eyes of the IRS, is interest you pay on a loan secured by either your main or second home. This loan could be the mortgage, a second mortgage, a HELOC, or a home equity loan. To take the deduction, you have to be legally obligated to pay the debt and you have to write the checks. That means if you pay a mortgage for someone else—your children or an elderly parent—you can’t deduct the interest unless you cosigned on the loan.

48. Should I get a reverse mortgage?

A: Only in specific circumstances.

A reverse mortgage allows you to draw on the equity in your home and turn it into cash—you can take that cash as a lifetime stream of payments, a lump sum, or a checking account that you draw on as you need it. If you move out of the home, you’ll repay the loan; if you die, your estate will repay it. The amount you have to repay will never exceed the value of your home. If you sell the home for more than you owe, the difference goes in your pocket (or to your heirs).

This option is only for people 62 and older who have a substantial amount of equity in their homes. The ideal candidates for a reverse mortgage are people who are in their seventies who want to stay in their home and who don’t have any other way of affording to do so. That’s because the amount of the payouts hinge on the home owner’s life expectancy; and the older the home owner, the higher the payouts will be.

While this sounds terrific, the downside of a reverse mortgage is the cost. You might pay 10% or more of the amount you borrow in fees alone, which means on a $200,000 mortgage, you could lose $20,000 to overhead. The AARP says that reverse mortgages cost $10,000 minimum to close.

At any age, though, you want to make sure that you exhaust all of your options. Could you take out a HELOC instead of a reverse mortgage? This loan will likely be cheaper. Could you sell the house and trade down to something smaller or in a less expensive neighborhood? Again, another good option. And why is it that you’re so intent on holding on to the home anyway? If you’re doing it for your children, you should be certain that they want it.

Note: Some states and local governments offer low-cost reverse mortgage options, so check with your city’s or county’s housing department about options in your area.

I Also Need to Know…

Q: How do I receive the money from a reverse mortgage?

A: You can elect to take your money as a lump sum, as a monthly paycheck of sorts, or as a line of credit (similar to a HELOC) that you can draw on as necessary. Most lenders will let you do a combination of all three, and if you change your mind and decide to switch between options, you usually have the ability to do so, although you may be charged a fee.

Keep in mind that you’re paying interest on this money eventually, so the longer you have it in your hands, the more expensive this debt is going to be. Taking the lump sum means you have all of the money the entire time you have the mortgage, giving the interest a 10-or even 20-year time frame to accrue. If you don’t need it all at once, an income stream or line of credit (the most popular option) would be better.

Q: How is my payout calculated?

A: How much you’ll get depends on how old you are, how valuable your home is, and the interest rate on the loan. The older you are, the more you’ll be able to borrow, because the assumption is that the lender will be paying you for a shorter amount of time (most reverse mortgages end when the borrower dies or moves into a nursing home or assisted-living facility). You can use the calculator on the Web site of the National Reverse Mortgage Lenders Association (www.nrmla.org) to get an estimate. Reverse mortgages can come with variable (more common) or fixed interest rates, so keep that in mind when you’re shopping around.

Note: If you and your mate are co-borrowers, the age part of the equation will be based on the younger partner.

An Example

A 65-year-old man who owns a $300,000 house in Richmond, Virginia, could get a lump-sum advance or credit line of $145,103 or a monthly payment of $915.

At age 75, he could get a lump sum or credit line of $177,744 or a monthly payment of $1,241.

At age 85, he could get a lump sum or credit line of $213,022 or a monthly payment of $1,895.

Note: This example is based on an interest rate of 4.70% (interest adjusts monthly).

Q: Can I get a reverse mortgage if I already have a current mortgage?

A: You can, but you will have to pay off your existing mortgage with some of the money you get from the reverse mortgage. So let’s take the example already given of the 65-year-old man: If that man still had $100,000 left on his mortgage, he would be able to borrow $100,000 less overall because the first $100,000 would go toward paying that amount off. So his lump sum at age 65 would be $70,000; at 75, it would be $90,000; and at 85, it would reach $125,000.

Q: Is the money I get from a reverse mortgage counted as income for the sake of taxes?

A: The IRS does not consider this money income, since it is effectively a loan. However, Medicaid would count a reverse mortgage payment as an asset, particularly if you take the lump-sum option or if you allow your monthly payments to accumulate. You should check the Medicaid eligibility requirements in your state.

Watch Out for These!

- Fees. As I said, the extra charges on this product can be high. The fees are typically rolled into the mortgage, so you may not know what you’re being charged. Ask to see a complete explanation of fees upfront.

- Aggressive sales pitches. Reverse mortgages are sold for commission, much like life insurance policies. Salespeople can come on so strong that the government requires you to meet with an approved counseling agency before signing on the dotted line. You can find a counselor through the U.S. Department of Housing and Urban Development (HUD) at www.hud.gov.

- The notion that you should take out a reverse mortgage to pay for long-term care insurance. You don’t want to borrow to pay for an insurance policy.

49. Should I have a mortgage in retirement?

A: Not if you can help it. In retirement, you want to try to lower your monthly expenses as much as possible, and eliminating a mortgage payment will be a huge help. The lack of a payment will allow you to draw less money out of your retirement funds, giving them a better chance of lasting as long as you do.

THE MATH

Earlier in this book, I discussed the general rule when it comes to withdrawing funds in retirement: Most people can count on being able to pull out about 4% from their retirement accounts each year, plus adjustments for inflation. So let’s say you’re 65, you have $500,000 invested, and the 4% rule allows you to pull out $1,667 a month (more if the $500,000 grows, less if it takes a tumble). You also receive $1,100 in Social Security benefits. That gives you $2,767 to work with each month—fairly reasonable, especially for a retiree.

But let’s say you’re still paying off your mortgage, which requires a monthly payment of $1,000. Now you only have $1,867 left to work with—and that amount has to cover food, utilities, insurance, gas, and other general living expenses. Forget about traveling. Now you may need a part-time job. In order to meet the standard of living you would be able to have without your mortgage, you would have to pull significantly more from your retirement account, which means your savings would last about half as long.

I Also Need to Know…

Q: What about the tax advantage of a mortgage?

A: This is probably the one exception to the “no mortgage in retirement” rule. However, it’s also a rare one. If you still have a fairly high income that puts you in a higher tax bracket, you may still want to capitalize on the tax advantages of having a mortgage, because you can deduct the interest paid on that loan. But in many cases, people not only retire to low-or no-tax states but they also have a small amount of taxable income, which means they don’t get much of a tax deduction in the first place.

Q: Wouldn’t I be better off investing my money?

A: That depends on your mortgage rate. In retirement, you are no longer investing as aggressively as you were when you were in your thirties or forties. If you’re following the advice of most financial advisors, which is to shift the balance from stocks to bonds and cash as you get older, then you probably have at least 60% of your portfolio in bonds and cash and only 40% invested in stocks at this point. That means that your investments will probably return a little more than 6%. Those returns in a taxable portfolio put about 4.5% in your pocket—the same amount a mortgage at 6% (one where the interest is tax deductible) costs you. But your investment returns are not guaranteed. Paying off your mortgage is. That said, this is not an argument for not saving and investing year in and year out. In the best of all possible worlds, you save and invest habitually—and you pay off your mortgage by the time you retire.

50. What’s a short sale? Which is worse for my credit score, a short sale or a foreclosure?

A: Under the terms of a short sale, you make a deal with your lender that allows you to sell the home for less than the amount you owe on the mortgage. The lender gets the money from the sale, you get nothing, but you walk away and—in most cases—no longer owe the balance on the loan (sometimes the lender can make you cough up some of the difference, which is something you need to work out at the onset).

You’ll have to convince the lender that this is the best-case scenario, and that involves outlining your financial situation, with backup: paychecks, tax returns, and credit card and bank statements. If you have just been laid off, you’ll need a letter from your former employer. If you have just gone through a divorce, you’ll have to provide the paperwork. If you’re suffering from a medical emergency, be prepared to prove it. You should be controlling your spending—high credit card debt, and particularly recent charges, can work against you, because if you’re spending elsewhere, the lender will (justifiably) wonder why you can’t afford your home.

A foreclosure, for comparison’s sake, is when your lender takes steps to repossess your property, typically three to six months after your first missed mortgage payment. If you don’t respond, the lender will file a suit against you, and you’ll receive one final notice requesting payment. You have 30 days to pay up; if you don’t, the home will be sold at auction.

To be clear: Neither of these options is ideal, for either you or the bank.

There are, however, a few benefits to a short sale: It allows you to avoid the lengthy legal process that accompanies foreclosure, and it may look slightly better to future lenders because it shows that you took initiative to talk to your lender and work out a deal.

But when you’ve reached the point that you’re considering either of these options, your credit score has likely been pummeled.

When you miss a mortgage payment (or any other debt payment, for that matter), your lender reports it to the credit bureaus, and you lose points from your score. If you miss another one, more points. And so on and so forth. By the time you’re facing foreclosure, your FICO score is likely already in the 500-point range, which is dismal.

The more important question for you now is how to build that credit back up. Understand that this process will take a good two to three years. There’s no magic bullet. You should follow the steps in the question “How do I get my credit back on track after a settlement?” Chapter 1.

One other note: Many borrowers don’t realize this, but if you sit down and negotiate with your lender—for a short sale, for instance—one part of the conversation can be about how they report it to the credit bureaus. You can ask that they report the situation more favorably, so that your credit score is less damaged, and in some cases, they will. It’s at least worth asking. Finally, always—always—get any deal you negotiate in writing.

I Also Need to Know…

Q: If I have tried—and failed—to sell short, are there any alternatives to foreclosure?

A: A deed in lieu of foreclosure allows you to hand over the keys and the title of the home to the bank. You no longer have ownership of the home, and the bank should waive the balance of the loan. Again, you need to get this agreement in writing, and it doesn’t mean it won’t affect your credit score. It’s a tougher negotiation with the lender than a short sale, particularly in recent years. With a short sale, your lender gets cash, which is preferable.

Q: Are there tax consequences if the lender forgives my debt?

A: In general, if you owe debt and the amount is forgiven, you’ll owe taxes on that amount. The IRS treats this money as taxable income. But the Mortgage Forgiveness Debt Relief Act of 2007 means that taxpayers can exclude income from debts forgiven on their principal residence in most cases. This act lasts through 2012 and includes up to $2 million of forgiven debt for singles or married couples filing jointly ($1 million for people married filing separately).

Q: I’ve seen advertisements for companies that are willing to help me avoid foreclosure. Are these legititmate?

A: I don’t want to say that none of these companies are legitimate—although some are clearly scams—but there are free services available to help you navigate this system. If you’re facing foreclosure, the last thing you need to do is cough up money when you don’t have to, and these services will sometimes charge upward of $1,000. Instead, pick up the phone and call HOPE-NOW (888-995-HOPE; www.hopenow.com). You can talk to a HUD-certified housing counselor for free, and he or she will be able to answer all of your questions. There are other groups that offer free help as well:

- HomeFree-USA (www.homefreeusa.org; 1-866-696-2369)

- Neighborhood Assistance Corporation of America (www.naca.com; 1-888-302-6222)

51. What is the difference between a home equity line of credit (HELOC) and a home equity loan?

A: First, let’s talk about how they are similar: Both of these products are secured loans, which means you’re putting up your home as collateral for the money you borrow. Both offer fairly low interest rates, allow you to deduct the interest paid, and require great credit, as well as equity in your home. Both of these products are second mortgages: You’re borrowing the equity in your home to use the cash.

Now, the differences. A home equity loan is relatively simple: You receive a lump-sum loan and pay it off through monthly payments over a set period of time, generally anywhere from 5 to 15 years, although many lenders offer periods as long as 30 years. The interest rate and the monthly payments will be fixed for the life of the loan. You probably want a home equity loan if you need a large chunk of money all at once to consolidate credit card debt or, better yet, make home improvements, the original intended purpose of home equity loans.

A HELOC, however, is more complicated. It is a pot of available money that you can draw on as you need it. It works much like a credit card in that you pay interest only on the money you borrow. The interest rate is generally variable (and tied to the prime rate), which means your monthly payment amount will vary too.

Good candidates for HELOCs are people who want to have a chunk of money in their back pocket should they ever need it—an emergency fund of sorts (not, however, to replace the equivalent of three to six months’ worth of expenses that you should have stashed in a liquid savings account)—or people who have an ongoing home improvement for which they will borrow over an extended period of time.

I Also Need to Know…

Q: How do I know how much equity I have?

A: The difference between how much you owe on your home and your home’s current value is equity.

THE MATH

Let’s say you purchase a house for $300,000, and you put 10%, or $30,000 down. For the rest, you take out a 30-year, $270,000 mortgage at an interest rate of 5%. At that point, your equity is $30,000.

After five years, if you continue to pay on your mortgage each month, your balance will be $248,765, which puts your equity at $51,235—if, and this if is big, your house is still valued at $300,000. It may be worth more now, or it may be worth less. If, for example, it’s now worth $320,000, your equity will be $71,235. If it’s only worth $280,000, your equity will be $31,235.

Q: Can I count on the money in my HELOC?

A: Not always. In the financial crisis that started around 2007, many people saw their home equity lines of credit frozen or cut off. Not only were housing prices falling—which decreases the equity you have in your home—but also people were feeling a squeeze on their wallets and missing payments as a result. As with credit cards, mortgage lenders can lower the amount of credit you have available, and many will take advantage of that option in a bad economy. After all, if you borrow more than you can afford, they risk taking a loss when you can’t afford to pay it back.

If your HELOC is frozen, you should receive a letter from your lender letting you know how much of the line you’re losing and why. It will include a phone number, and if you want to try to appeal, you should call to see if the lender will work with you. You might get a lower credit limit instead of a firm freeze, particularly if your home’s value hasn’t fallen that much (often lenders use a blanket system that assumes all values in a single area are down, which may not be the case). You can also shop around for another lender.

Q: Is a home equity line or a HELOC a good way to pay off credit card debt?

A: It could be, but only if you’re disciplined. If you decide to pay off your credit cards with a home equity loan, you had better lock those cards in a drawer, stick them in a block of ice in your freezer, or somehow be absolutely, positively sure that you’re not going to charge them back up again. If you do, you’ll not only be stuck with even more debt than you had before but you’ll also be putting your home on the line. For more on this question, see the question “Should I consolidate my debts?” in Chapter 1.

Watch Out for These!

- Minimum withdrawal amounts on HELOCs. Amounts vary, but many lenders will require you to borrow at least a certain amount, which means you could end up taking on more debt than necessary. Look for a lender with a low minimum amount.

- Fees. You can find a lender that doesn’t charge closing fees on a HELOC, but expect to pay such fees for a home equity loan. They will be rolled into the amount of the loan, so be sure you know what you’re paying for and shop around for the cheapest lender. You should expect to pay between 1% and 3% of the cost of the loan, according to the Federal Reserve Board.

- Introductory interest rates. A rate might last for six months to a year, which is great if you can pay off your debt within that time frame. If you don’t, the rate will jump, so look at not only the introductory rate but also the standard rate on a HELOC.

52. Should I refinance my mortgage?

A: The answer varies according to how long you plan to be in your home (you want to be there long enough to recover in savings any money you spend to close the refi). To run the numbers, first answer these questions:

- How much is your monthly payment?

- What is the cost to refinance?

- What would your new payment be?

Once you have the information you need in front of you—and for some of the specifics about the new loan, you may need to talk to your lender—you can figure out whether refinancing is worth it. To do that, you want to subtract the refinanced monthly payment from your current monthly payment, and divide the result into the closing costs associated with refinancing.

As long as you keep the new mortgage long enough to recover your closing costs, it makes sense to refinance. You typically want to aim to recoup your closing costs within about two years.

One final note: If you have a high-interest adjustable-rate loan, you should refinance and lock in a lower interest rate when you can. It will lower your monthly payments and help you sleep at night.

IS REFINANCING WORTH IT TO ME?

Use this worksheet to figure out whether refinancing is worth your time—and money.

- A. Your current monthly mortgage payment: $________

- B. The new monthly mortgage payment, should you decide to refinance: $________

- C. A $________—B $________= $________

- D. Closing costs associated with your new loan: $________

- E. D $________÷ C $________= $________

An Example

Two years ago, Susan took out a $200,000, 30-year, fixed-rate mortgage with an interest rate of 8%. Her monthly payment is $1,467.53. Recently, she saw that she could refinance into another 30-year fixed loan, this time with an interest rate of 5.5%. This new mortgage would bring her monthly payment down to $1,115.82—a savings of more than $350 a month. It would take her a little less than nine months to recoup her closing costs. If she is going to be in the house longer than that, she should refinance.

I Also Need to Know…

Q: Should I refinance with my current lender?

A: Sometimes lenders offer a discount to current customers who refinance with them, so find out if yours does, and then compare your lender’s terms with the terms offered by other lenders. By sticking with your current lender, you may also be able to get away with a “streamlined refi,” which is more of a loan modification than a complete refinance. That can save you a significant amount in paperwork and closing costs.

Lenders are going to have to check your credit to give you an accurate rate, which means your credit score may take a hit. Do all your shopping within a 30-day period, though, and the credit scoring bureaus will count it as one inquiry instead of multiple inquiries.

53. How do I get the best deal on a home equity loan or HELOC?

A: I hate to sound like a broken record, but you’d better shop around.

If you visit Bankrate.com, you’ll find an entire section dedicated to home equity loans and HELOCs. First, check the national averages. Then compare local ones. This step is key—the variation between the best rate and the worst in a particular local market can be as great as two percentage points. You’ll see a list of lenders in your area, the rates they are offering, and the fees and conditions tied to the loan.

If you see something you like, contact the lender. But don’t stop there. Bankrate.com doesn’t list every bank and lender in the country, so call local ones as well as credit unions (for more on credit unions, turn to Chapter 11). Once you know your options, consider the interest rate, the amount that lenders will allow you to borrow (or the credit line they’ll extend), and the monthly payment, but pay close attention to fees as well: There are likely to be charges for the application, underwriting, appraisal, and document preparation, among others. Keep in mind that HELOCs typically come with variable interest rates, which means your monthly payment will fluctuate. The law requires a cap on how much your payment can increase and on how low it can fall on the basis of a change in interest rate.

It’s okay to let the lenders know that you’re shopping around; in fact, you should, because they may be willing to negotiate by waiving a fee or knocking back the interest rate slightly.

THE MATH

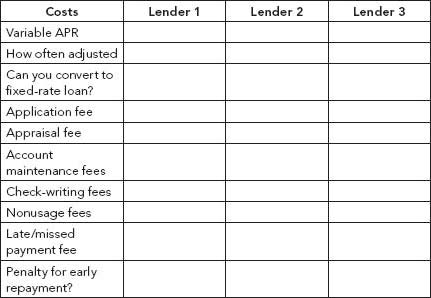

Use this worksheet to compare home equity loans:

APR = annual percentage rate.

Source: Federal Reserve Board.

Use this worksheet to compare HELOCs:

APR = annual percentage rate.

I Also Need to Know…

Q: How does my credit score affect my interest rate?

A: If your score is low enough (minimum requirements vary by lender, but less than 620 would have me worried), you may not qualify for a loan at all, or you may qualify with just one lender and your interest rate may be insurmountably high. Look at this differential from Fair Isaac Corporation (the company behind the FICO score) in the spring of 2009:

15-year, $50,000 home equity loan

Credit score 740 = APR of 8.086% and monthly payment of $480

Credit score 620=APR of 12.411% and monthly payment of $613

Difference in the monthly payment: $133

Added interest over the life of the loan: $23,949

It pays to bring your credit score up before applying. For information on how you can do that, turn to “What’s a good credit score? How can I improve mine?” in Chapter 6.

Q: How much of my equity can I borrow?

A: That depends. You shouldn’t expect to be able to borrow more than 80% of the current market value of your home, and that’s including the primary mortgage and any other debt you owe on the property. If you have a home worth $250,000 and a mortgage that still has $100,000 left to pay down, you may be able to get a home equity loan for $100,000, but likely no more than that. Remember too that we’re talking about the home’s current market value—the lender doesn’t care if you bought the home for $300,000—only how much the home is currently worth.

Q: Do you need a down payment for a home equity loan?

A: No. The equity in the home—which you’re putting up as collateral to secure the loan—serves as your “down payment.” But remember, if you don’t pay the loan off, the lender could take your home.

54. Should I buy a real estate investment property?

A: There are a few things to consider in making this decision. Some are personal—are you the type of person who can thrive under the pressure of investing in real estate?—and others are objective, about the property itself.

First, you need to have an appetite for risk. How well do you sleep at night if you’re not sure how well your investments are doing? Some people can stick their money in the stock market and ride through the inevitable ups and downs; others spend all day worrying about how much money they are losing. A real estate investor has to have a pretty high tolerance for risk, because not only do you have to worry about property values—which can go down as well as up—but you also have to worry about filling the property with tenants, and maintenance, which is never easy.

If you’re taking on the landlord and management tasks yourself (some people outsource these tasks), you should also have a few specific personality traits, including, especially, the ability to talk to people. If you’re shy or introverted, this might not be an investment for you. You need to be able to stand your ground with tenants as well as attract people to your property.

Finally—but perhaps most important—you need to evaluate your own finances. The better your credit score, the lower your interest rate on a mortgage (even a mortgage on an investment property, on which you’ll pay a higher rate than you will on a primary loan). You also need a substantial cash cushion to fall back on in case the rent doesn’t come through or unexpected fixes are needed on the property. No matter what happens, you need to be able to pay the mortgage, and even if you do your due diligence when it comes to approving tenants, there is still a chance that a rent check could be late or not come in at all. I’d aim for a cushion of at least six months’ worth of expenses, ideally a year’s worth.

Once you’ve checked these things off the list, you want to evaluate the property itself. Walk through this four-step process, used by professional real estate investor Robert Shemin:

- What is the property worth in today’s market? Talk to experts, look at comparable sales in the area, and find out what someone might pay for it right now.

- Are repairs necessary? Find a good carpenter or contractor and do a walk-through together. This professional will be able to tell you what you’ll need to fix and how much it should cost.

- What can you buy it for in today’s market? If you’re trying to flip—not rent—the property, you want a big margin—a seller who will take 30%, 40%, 50% below value. If they will only take 10% or 15% below, the market could go down more, which means you’ll either be stuck with the property or have to sell for a loss.

- What would your rental income be? If you’re planning to rent this property, this equation is simple: How much rent comes in versus how much money comes out, including the mortgage, taxes, insurance, vacancies, and repairs. To find out how much you can expect to charge for rent, look at other comparable rentals in the area.

55. How do I get a good deal on a mortgage?

A: First you need to figure out what kind of mortgage works for you.

Then you want to compare rates on that kind of loan. To figure out what kind of mortgage you want, first decide if you want a 30-year or a 15-year loan. Most people go with a 30-year, and that tends to be my advice. If you can afford a 15-year loan—which comes with higher monthly payments but will build equity faster and save you money on interest in the long run—you may want to consider that option, but many people can’t. Remember, you need to be able to foot the bill on this loan, plus taxes, plus maintenance, plus other monthly expenses, and still have money to save for retirement and other goals. And note that most loans these days don’t have prepayment penalties. So you can take a 30-year loan and prepay on a 15-year scale, which will save you interest but also give you the flexibility to scale your payments back if you get into a bind.

THE MATH

Let’s compare the 15-and 30-year time horizons, using a $250,000 loan with a fixed interest rate of 6%.

15-year fixed-rate mortgage

Monthly payment: $2,109.64

Total interest paid: $129,735.57

30-year fixed-rate mortgage

Monthly payment: $1,498.88

Interest paid: $289,595.47

Difference in interest: $160,889.90

That 15-year mortgage sounds like a good deal, right? But wait just a minute. If you were to take the 30-year mortgage instead, your monthly payment would be $610.76 less each month. If you took that savings, and invested it at an interest rate of 8%, in 30 years you’d have $910,252.

Next, fixed versus adjustable rate. Fixed-rate loans have an advantage in that there are no surprises—the rate you get at closing is the rate you’ll pay throughout the life of the loan, which means your payment won’t change, unless your home owner’s insurance policy payments and/or payments on your property taxes are added into your mortgage payments. ARMs can fluctuate with changing interest rates. Initially, the interest rate is generally lower than what you’ll find on a fixed-rate loan, and it will stay that way for anywhere from a few months to 10 years. Then, it will adjust every so often—once a month, once a year, once every three years, depending on the loan’s structure. You’re taking a risk with this mortgage, because the interest could adjust up, leaving you with a monthly payment you can’t afford.

Before you take on an ARM, ask yourself:

- Is your income enough to accommodate higher monthly payments?

- How long do you plan to own this home? If this is a starter house, an ARM may be better because you can get out of the house before the loan adjusts.

Once you know what you’re looking for, you want to compare rates on that kind of loan. Cast a wide net that covers all possible sources.

Start online to get a sense of average rates, both nationally and in your area. The Web site www.hsh.com can give you both of those and point you toward the lenders in your area with good rates. You should also check with your bank as well as with credit unions. Finally, ask friends and family members, as well as your real estate agent, for a recommendation for a mortgage broker.

In the end, you should come up with at least three options: maybe one credit union, one bank, and one broker. A broker doesn’t lend money directly; rather, he or she will work with a few lenders on your behalf. If you’ve ever used an insurance agent, it works in much the same way. Keep in mind, though, that brokers aren’t obligated to find the best deal for you, so it’s not a one-stop shop. That’s why it’s important to get a few quotes on your own as well. Also, some brokers will charge a fee for their services, typically in the form of extra costs at closing or an add-on to your interest rate. (Other brokers are paid by the lenders.) Likewise, some real estate agencies and home builders have in-house financing departments that may charge higher rates. Be sure to compare with outside lenders as well.

You should compare not only interest rates but other costs and fees as well:

- Closing costs. This is what you’ll pay for everything needed to close on the loan: application fees, title insurance, property survey charges, costs to prepare the deed and mortgage, attorney’s fees, appraisal charges, and credit report fees.

- Down payment requirement. Some lenders will require more of a down payment than others, and all will charge you private mortgage insurance if you don’t put down 20%. This insurance protects the lender if you’re unable to pay—be sure to ask about the cost of it upfront, because it will be added to your monthly payment.

- Loan origination fee. This fee is a percentage of the loan amount, charged by your lender to process the loan.

- Points. As the borrower, you pay these fees to your lender. One point is equal to 1% of the amount of the loan. You pay points at closing, or some lenders allow you to roll them into the loan (which will raise your monthly payment slightly). You can also use points to buy down your interest rate.

Ask for what’s called a “good faith estimate,” which will outline the most you’ll be charged in fees. That way, you know the worst-case scenario and whether you can afford it. Once you have all offers on the table, compare all around and pick the best deal. You can negotiate with lenders as well—often they’ll waive a fee or lower your interest rate a notch or two. It’s certainly worth asking.

I Also Need to Know…

Q: What kind of credit score do I need?

A: You should pull all three of your credit scores six months to a year before you estimate you’ll apply for a mortgage—that’ll give you enough time to dispute any inaccuracies as well as to work to bring your score up if necessary. A score of 760 and above is going to get you the absolute best rates; 700 and up will still get you pretty good rates. Below that, things start to look murky. It’s worth it, actually, to take the time to bring your credit score up before applying for loans, because you could shave off a considerable amount on your monthly payment.

Q: Does shopping around hurt my credit score?

A: It doesn’t have to hurt your score. Excessive requests for credit will bring your score down. But if you shop for mortgages within a 30-day period, the inquiries will be combined into one, meaning you’ll be dinged only once.

56. Should I sell my house without a broker?

A: It depends on your situation. Can you look at your home objectively? Do you have time to put into selling the property? Is there a deadline attached to your move? What is the market like in your area?

If there is pressure to sell your home by a certain date, you probably want to work with a real estate agent, who will likely be able to sell your home faster. But if you’re flexible, if you have time to do the work (warning: there’s a lot), and if in your area, homes are selling, albeit a bit slowly, then I see no harm in giving it a go on your own. After all, using a real estate agent can cost a seller 6% of the purchase price. On a $300,000 home, that’s $18,000. If your do-it-yourself efforts don’t work, you can always try your luck with a real estate agent secondarily.

When you decide to sell your home yourself, your first step should be preparing it for market. That means keeping the grass cut, the bushes trimmed, and the leaves raked. Small investments that up your property’s curb appeal are worth the money. Paint the shutters (or the whole house if it needs it), refinish the driveway. Adding planters or nice lawn furniture—even rocking chairs on your porch—are other inexpensive ways to improve its look. First impressions are key, and the outside of your home is the first thing a buyer notices. If it looks unkempt, many buyers won’t bother to step inside.

Before you show the interior, you’ll want to stage it. Clear any cluttered surfaces, make the rooms look as large as possible (if that means rearranging furniture, do it), and clean until the entire home is shining. Then, depersonalize it a bit by removing photographs where you can. You want buyers to be able to envision themselves—and their families—in the home. And again, if the walls are dingy, a can of paint can be a cheap fix.

Then set your price. You can get the advice of a licensed appraiser, which will run you about $300 or more (the price varies by area). It’s an investment well worth the money, but if you can’t swing it, ask a licensed real estate agent for what’s called a free comparable market analysis (i.e., what they would list the home for if you signed with them) or purchase an online appraisal based on comparable sales. Also, look at the homes for sale in your neighborhood. Your home, unless it has many noticeable upgrades, shouldn’t be too far off that track.

Finally, you need to market the property, by placing a few strategic ads in newspapers and online and spreading the word to friends and family members and even on Facebook, Twitter, and your blog. Put a sign in your yard, perhaps directing people to a listing you’ve placed online that includes pictures (FSBO.com is a good place to do this).

I Also Need to Know…

Q: Are there tips for selling a home in a bad economy?

A: One word: price. In a down economy, there are a lot of homes on the market, which means that as a seller, you’re in a competition with your neighbors, whether you like it or not. You want to price your house attractively compared with the other places around yours—that will get you the first look from buyers, which is a key advantage. Often, you’ll be able to spark a bidding war that will bring your final selling price much closer to your original goal.

Q: How much do real estate agents charge? Can I negotiate?

A: Generally, you can count on paying about 3% (for a discount agent) to 6% (for a full-service agent) of the sale price. You can and should negotiate. Invite three or four agents to your home and have them tell you how they would position it and how much commission they’d charge. Don’t be unrealistic. If one broker tells you he or she can sell your home for significantly much more than the other three, chances are good that that particular broker is aiming too high.

Q: How should I stage the home?

A: Set the stage by putting out fresh flowers and playing calm music—even have an apple pie baking in the oven. (If you don’t bake, put some cinnamon in a pot of water and let it boil on the stove…magic). Make sure the beds are made, the kids’ toys are put away, and the rooms are decluttered. Then just show the buyers around—they’ll have a lot of questions, and you should try to anticipate them in advance and prepare thoughtful answers. (Buyers won’t hesitate to ask why you’re moving. An answer like a divorce or a job loss will spell opportunity to them, so you may want to come up with something else beforehand.) Also, before a potential buyer arrives, put some time into thinking about the special features of your home that you’d like to point out. Make a list if it helps. Is there a big vegetable garden in the backyard? Do you have an outrageous number of closets or interesting molding around the windows and doors? Often, we get so used to our homes that we forget about these little details that can be attractive to other people.

One other note: When someone makes an appointment to see the home, you should be prepared with the paperwork for the off chance that the person wants to make an offer on the spot. Have blank purchase agreements ready, as well as the names of mortgage companies where a buyer can go to get prequalified. You can find offer-to-purchase templates online at Web sites such as www.docstoc.com.

Q: What’s your advice for negotiating with potential buyers?

A: The buyer must make the initial offer, and depending on what you’re asking for the home and the current real estate market, it can be well below your posted price or relatively in line with it. You then have the option to accept that offer, reject it, or make a counteroffer. In most cases, you’re going to want to counter. Often, buyers will shoot low to test the waters, but they may be willing to spend thousands more. Your counteroffer should be slightly lower than your listed price but higher than the buyer’s initial offer.

An Example

Your home is on the market for $349,000. A buyer offers $300,000. That’s more than a 10% discount off your asking price…in other words, too low for you. So you make a counteroffer of $335,000. The buyer comes back to you with an offer of $315,000. You agree to sell the home for $325,000.

Of course, negotiations can get much more complicated than that. You can drop your price by a little less but throw in another free-bee, such as updated appliances or an offer to cover the buyer’s closing costs. These are lucrative to buyers, but just make sure that you’re calculating your final bottom line—closing costs can run thousands of dollars, and you might have been able to make the sale by simply dropping the price of your home by less.

57. How much should I offer on a home?

A: Before you make an offer on a home—or for that matter, any large asset—you should assess not only the home or other asset itself but also the market and, believe it or not, the buyer.

That means doing a little due diligence. If you’re working with a real estate agent, he or she will be able to provide you with a lot of the data you need on the area. If you’re not, you can get almost everything you need from Web sites (Zillow.com for pricing; Realtor.com for comparables) and open houses: how long homes have lingered on the market and how average selling prices have compared with asking prices. That way, you’ll get an idea of how competitive the market is and whether it’s tipped in the buyer’s or seller’s favor.

Next, look at the house itself. How is it priced? Has the price been lowered since it first went on the market? Is it competitive with comparables—other homes of the same size, in the same condition, in the same neighborhood?

Finally, try to glean everything you can about the seller or sellers. Are they in a hurry to unload the home? Has the home been on the market for a long time? Why are they selling? Real estate agents, who traditionally have worked for the sellers, aren’t necessarily supposed to give you the personal lowdown on a seller’s situation. That doesn’t mean they won’t. If you find out that they have a move deadline—maybe they are starting a new job in a month—and it’s rapidly approaching, you can go a bit lower with your offer because you know that they’re under a bit of pressure.

When you have all of this information in hand, make an offer that seems fair and reasonable to you, and most important, that you can afford. In a down market with sellers desperate to move on, try 30% below the asking price. In a good market, go 5% to 10% below. You may pay full price.

Remember, you don’t want to lose the house of your dreams because you held out for an unreasonable compromise. In the same vein, any seller who still believes his home is worth what it was before the housing bubble burst is dreaming.

I Also Need to Know…

Q: Are there other negotiating points?

A: Absolutely. You can ask the seller to cover your closing costs—just make sure that your mortgage lender is on board—or install new carpet or appliances. These days, sellers are throwing in all kinds of extras to sweeten the deal, and even in a good market, if something isn’t up to snuff, it doesn’t hurt to ask for a fix. Just balance it out by the amount you offer (in other words, if you want all new appliances, you might offer a bit more).

You have even more room for negotiating if you’ve been preapproved for a loan, so get that preapproval from your mortgage company before you start making offers.

Q: I submitted an offer, but now I’m not so sure. Can I take it back?

A: Real estate laws vary by state. But in general, you can rescind on your offer up until the point that the seller accepts it. Your offer should contain a time limit so that the seller must make a decision within, say, two weeks. If they don’t meet the deadline, it is revoked automatically.

Q: Do I pay a down payment when I submit my offer?

A: In most cases, yes. You’ll submit a deposit with your offer so that the seller knows that you’re serious. But it won’t be the whole of your down payment; it will be more like 1% to 3% of the sale price. This amount varies by state (there may not be laws about this, but there are likely norms for your state or community). In a buyer’s market, you might be able to put down less, but in a seller’s market, when the competition is fierce and you want to attract the seller to your offer, you may want to offer to put down more. Once your offer is accepted, that deposit—often called earnest money—rolls into your down payment.

Note: You don’t give this money directly to the seller; in most cases, you’ll pay it to the real estate company. It will then be held in a separate trust until the offer is accepted. If it isn’t accepted, it will be returned to you. Be sure to get a receipt.

58. How much will it cost me to own (rather than buy) a home?

A: The forgotten question of homeownership: How much will it cost me to live there?

There are all kinds of expenses that pop up when you own your own home. Some are the standard ones that you would expect, such as home owner’s insurance. You want to insure your home for the cost to rebuild it, not the market value, and you don’t need to include the cost of the land your home is on. For more, see “How do I save on homeowner’s insurance?” in Chapter 9.

Another expense you can plan for is property taxes. Every county calculates these differently, so go to your assessor’s office to get an estimate of how much you’ll owe (many counties also have calculators on their Web sites and real estate agents have these on their Web sites as well). That way, you can save in advance. And if your home’s value ever goes up or down significantly, you should have the property reassessed. Some towns do assessments automatically once a year, but others let an assessment stretch as long as five years.

Other expenses, though, seem to come out of nowhere: your roof leaks or your driveway needs repaving or a tree needs to be removed before it falls on your garage.

Everyone needs an emergency fund, but if you own a home, you need one that much more for unexpected expenses such as these. You need to be able to reach into your savings account to cover these costs instead of digging out your credit card. If you don’t have one already, start working toward the goal of six months’ worth of expenses in a liquid savings or money market account. When you have that, set another goal: saving 1% to 2% of the value of your home each year to cover maintenance costs. (That’s the amount that Harvard’s Joint Center for Housing Studies estimates it’ll cost.) So if your home is worth $300,000, you’d aim to set aside about $3,000 a year. And don’t be fooled if and when you don’t spend that money one year. These costs tend to be additive. The following year, you might spend double.

Then stay on top of the big things, so that you can plan for any huge maintenance costs in advance. If your central air conditioning is on the fritz and you know that replacing the main unit will cost more than you have, start saving up in the fall so that you can buy a new one if it kicks the bucket for good next summer.

Finally, don’t forget upkeep. You can make everything from your appliances to your roof last longer if you keep up with routine maintenance. Make sure your gutters are clean, your windows and doors sealed tightly with caulk, your chimney cleaned once a year, and your smoke detector batteries replaced twice a year. Clean the filters in that air conditioning system, and have your furnace checked and cleaned once a year.

I Also Need to Know…

Q: Are there any improvements I shouldn’t make?

A: Whenever you consider making home improvements, you have to consider resale value. Chances are, your first house won’t be your last. At some point, you’ll likely be ready to sell, even if you can’t envision that time right now.

A lot of remodeling jobs add value. No seller is going to complain about updated appliances, retiling of a bathroom, or new kitchen cabinets. But combining two bedrooms into one can reduce the home’s value significantly (by and large, buyers want homes with at least three bedrooms), as can removing carpeting.

You also want to make sure that you don’t improve the home too much, because you can end up putting more money into it than the next seller is willing to pay. Maybe you did spend $75,000 on renovations, but if every house on your block is selling for $300,000 or less, most buyers won’t pay $375,000 for yours. Your price should be within about 15% to 20% of the neighborhood average, if not below.

59. I’m considering buying a home in a new area. Is there a way to estimate how much it will cost me to live there?

A: This issue is important. Too many people purchase homes thinking only about the mortgage payment and not the big picture and wind up in deep, deep debt.

It’s a vicious cycle—you buy your dream home in an expensive area, one that allows you to barely make ends meet. Then you’re drawn toward the way of life in that area: Maybe your friends are members of the country club, so you want to be too, or the neighborhood children all play a certain sport. Before you know it, your finances are completely out of hand. On the outside, you have a beautiful home in a lovely neighborhood. On the inside, though, you’re struggling to fill the refrigerator with groceries or keep the lights on.

To avoid this scenario, you need to do your research ahead of time, which isn’t easy. Many cities and towns don’t keep data on the cost of living in the area, most likely because it changes rapidly. Real estate agents will be able to give you a lot of information, because in addition to living there, they likely know the area better than most people. But remember, they’re also trying to sell houses.

I’d take to the streets, and I mean that literally. The best way to get good information is by asking people. If you don’t know anyone in the area, spend a weekend there. Go to the grocery store, check out restaurants, talk to people who live there. (You might feel timid about this, but trust me—most people love their neighborhood and are more than willing to answer your questions.) Ask them about their utility bills, the cost of groceries, and what people do in their downtime. If the entire community is centered around a beach club with sky-high yearly dues, it may not be for you or your salary. If there are lots of free activities—hiking trails, outdoor concerts, parks—it could wind up being the perfect fit.

One final note: The Web is an endless resource here as well. Although communities themselves may not track this kind of data, you can find a lot of what you’re looking for online (although I’d still recommend a short in-person visit). Many sites that offer a cost-of-living analysis charge money, but one free one that I like is the Living Wage Calculator (www.livingwage.geog.psu.edu/). Put together by Dr. Amy K. Glasmeier, a professor of geography and regional planning at Pennsylvania State University, it will tell you the average hourly wage for popular fields as well as the cost of typical expenses in popular communities and how much you’ll need to make on a monthly basis to support them. It isn’t detailed, but it does have estimates available for a large number of cities and towns.

An Example

I work in New York City, and I live a bit north of the city, in Westchester County. For my town, the Living Wage Calculator gives the following data:

Costs: Living wage (hourly)

One Adult: $13.39

One Adult, One Child: $22.60

Two Adults: $18.45

Two Adults, One Child: $27.66

Two Adults, Two Children: $34.65

Costs: Food (monthly)

One Adult: $237

One Adult, One Child: $386

Two Adults: $458

Two Adults, One Child: $607

Two Adults, Two Children: $756

Costs: Child care (monthly)

One Adult: $0

One Adult, One Child: $624

Two Adults: $0

Two Adults, One Child: $624

Two Adults, Two Children: $1,104

Costs: Medical (monthly)

One Adult: $94

One Adult, One Child: $186

Two Adults: $188

Two Adults, One Child: $280

Two Adults, Two Children: $372

Costs: Housing (monthly)

One Adult: $1,306

One Adult, One Child: $1,519

Two Adults: $1,306

Two Adults, One Child: $1,519

Two Adults, Two Children: $1,519

Costs: Transportation (monthly)

One Adult: $278

One Adult, One Child: $479

Two Adults: $556

Two Adults, One Child: $757

Two Adults, Two Children: $958

Costs: Other (monthly)

One Adult: $200

One Adult, One Child: $393

Two Adults: $400

Two Adults, One Child: $593

Two Adults, Two Children: $786

Costs: Annual taxes

One Adult: $2,473

One Adult, One Child: $3,959

Two Adults: $3,470

Two Adults, One Child: $4,971

Two Adults, Two Children: $6,118

Costs: Monthly aftertax income required

One Adult: $2,115

One Adult, One Child: $3,587

Two Adults: $2,908

Two Adults, One Child: $4,380

Two Adults, Two Children: $5,495

Costs: Annual before-tax income required

One Adult: $27,853

One Adult, One Child: $47,003

Two Adults: $38,266

Two Adults, One Child: $57,531

Two Adults, Two Children: $72,064

Now, let’s say I decided to pick up and move, and I’m thinking the South: Charlotte, North Carolina. Here’s the data for that city, from the Living Wage Calculator:

Costs: Living wage (hourly)

One Adult: $18.73

One Adult, One Child: $16.24

Two Adults: $13.17

Two Adults, One Child: $20.72

Two Adults, Two Children: $26.96

Costs: Food (monthly)

One Adult: $232

One Adult, One Child: $378

Two Adults: $448

Two Adults, One Child: $594

Two Adults, Two Children: $740

Costs: Child care (monthly)

One Adult: $0

One Adult, One Child: $572

Two Adults: $0

Two Adults, One Child: $572

Two Adults, Two Children: $1,012

Costs: Medical (monthly)

One Adult: $76

One Adult, One Child: $151

Two Adults: $152

Two Adults, One Child: $227

Two Adults, Two Children: $302

Costs: Housing (monthly)

One Adult: $667

One Adult, One Child: $740

Two Adults: $667

Two Adults, One Child: $740

Two Adults, Two Children: $740

Costs: Transportation (monthly)

One Adult: $232

One Adult, One Child: $397

Two Adults: $464

Two Adults, One Child: $629

Two Adults, Two Children: $794

Costs: Other (monthly)

One Adult: $188

One Adult, One Child: $369

Two Adults: $376

Two Adults, One Child: $557

Two Adults, Two Children: $738

Costs: Annual taxes

One Adult: $1,424

One Adult, One Child: $2,504

Two Adults: $2,115

Two Adults, One Child: $3,264

Two Adults, Two Children: $4,165

Costs: Monthly after-tax income required

One Adult: $1,295

One Adult, One Child: $2,607

Two Adults: $2,107

Two Adults, One Child: $3,319

Two Adults, Two Children: $4,326

Costs: Annual before-tax income required

One Adult: $18,164

One Adult, One Child: $33,788

Two Adults: $27,299

Two Adults, One Child: $43,092

Two Adults, Two Children: $56,083

I Also Need to Know…

Q: How do I adjust to a different cost of living?

A: It depends which way you’re moving. If you’re going to an area where the cost of living is higher than you’re used to, my hope is that you’re doing so because you’ve found a job to support that move. In general, employers pay more when the cost of living in an area is higher. You’ll need to rework your budget on the basis of your new salary and your new expenses. It’s difficult to set things right away, and I wouldn’t suggest that you try. Instead, live lean for a little while so you know that you have enough money to cover your expenses. Then, once you’ve gotten a feel for how much you’re going to be spending, you can start figuring out what portion of your salary you can save and, if there’s any left over, how much you can afford to spend on luxuries such as entertainment.

If you’re moving to an area with a lower cost of living, you may be able to save more money than you did before, provided you’re staying at the same salary level. Again, you want to rework your budget. If you were strapped for cash in your old home, give yourself a little more wiggle room so that you can sleep at night in the new location, but up your savings as well and be sure you have a hefty emergency fund in place (three to six months’ worth of expenses).

Q: What else should I check out about a place before moving?

A: Schools, schools, schools, if you have children or plan to have children while you’re living there. Do you want to buy a home in an area where real estate prices will likely hold up? Pick the one with the best schools. A source for this research is SchoolMatch (www.schoolmatch.com). You type in the county, and the site’s search engine will come up with a list of schools in that district, along with their addresses and contact information, the number of students enrolled there, and the number of full-time teachers. You can then buy a report card for the school district, for about $34, which will give you information on attendance rates, test data, school improvement plans, and public perceptions. It helps to supplement this information by talking to community members or other parents in the area to see what firsthand experiences they’ve had. (And don’t hesitate to aim higher. We moved a lot when I was a child. Before my parents bought each house, my mother would meet with the superintendent of schools for the district to see where we might be best served.)

After that, you want to look at general quality-of-life issues. Are there good employment opportunities in the area? Even if you already have a job, this question is important, because you never know what’s down the road. Does the area seem in sync with your lifestyle? If you enjoy being outdoors and hiking, you may not want to live in an urban jungle for long without knowing about nearby state parks. Can you tolerate the climate? How’s the commute or the traffic? Is there a solid public transportation system, should you need or want one? What other services are available for residents?

60. I am behind on my mortgage payments. What should I do?

A: You’re already on track since you’re asking for help instead of hiding your head in the sand, so that’s great. Your first step should be contacting your loan servicer directly. Many have workout departments with people trained to deal with your situation.

When you call, you should be armed with information. The servicer is going to want an overview of your financial situation and to want to know whether it is likely to be permanent or temporary. If a medical emergency has you out of work without pay for a month, you may just need a temporary solution. If you’ve recently gotten divorced or your income was reduced significantly because of a loss of overtime hours, you probably need a more permanent fix. The person on the other end of the line will ask for

- Proof of income, including Form W–2s, paycheck stubs, or bank statements

- Tally of monthly expenses, including utilities, food, other debt, insurance costs, and medical expenses

- Reason for default

To streamline the process, you should have all of this information in hand when you pick up the phone. You’ll also need to submit the paperwork to the loan servicer, and the faster you do that, the faster you’ll be able to get help.

In the meantime, I’d also pick up the phone and call a HUD-certified housing counselor. There’s no cost, and this person will hold your hand as you navigate the system (it can be tricky). You’ll be able to ask questions, and they will help you go over your budget. It’s possible that they’ll see something you don’t—unnecessary expenditures, perhaps—or that they’ll have suggestions for lowering your fixed expenses or even your debt payments. You can find one in your area at www.hud.gov or www.hopenow.com.

Once you’ve submitted documentation to your servicer, the company will review it, a process that can take up to 60 days. They may ask for additional information from you, including an appraisal of your home. Depending on your circumstances, you may then be approved for a loan modification or a repayment plan. If you are, you’ll receive a letter detailing the servicer’s proposal to you, including the new payment amount and due date. You’ll need to sign a modification agreement to reinstate the loan.

If, however, you’re denied, you need to start thinking about foreclosure alternatives. Your bank may allow you to do a short sale or a deed in lieu of foreclosure, which allows you to transfer the ownership of the property to the mortgage investor. For more on these, turn to “Which is worse for my credit score, a short sale or a foreclosure?” in Chapter 7.

I Also Need to Know…

Q: What is the difference between a loan modification and a repayment plan?

A: A repayment plan will redistribute the payments you missed over the next several months. This is an option for people who are facing temporary financial troubles, because it will bring you up to date on your mortgage, but your payment will be increased for the near future.

THE MATH

Let’s say your mortgage payment is $1,850 a month and because of an injury, you’re unable to work for two months. You’re on medical leave, without pay. Your emergency fund is inadequate, and during those two months, you’re unable to make your mortgage payments. Once you go back to work and a regular income, the servicer grants you a repayment plan. The total amount of missed payments—$3,700—will be distributed across your standard payment for the next 10 months. Instead of paying $1,850 a month, you’ll pay $2,220.

A loan modification, however, is a permanent change to your loan terms to make the payments more affordable. Your interest rate may be reduced or your loan term may be extended to lower your monthly payment amount. Any interest you missed will be added to the unpaid balance.

Q: What if I am not yet behind but am in danger of being there soon?

A: For a long time, there wasn’t a whole lot of help for people like you. Most of the foreclosure-prevention efforts were directed to people already delinquent, and mortgage servicers often wouldn’t even speak to customers who weren’t.

This strategy was bad for a number of reasons, including the fact that it almost encouraged people to fall behind, and it damaged their credit scores in the process. But soon after President Barack Obama took office, he instituted a program called Making Home Affordable (you can get more information at making homeaffordable.gov). Under that program, you may be eligible for what’s called a Home Affordable Modification, even if you’re not yet delinquent.

To qualify, you must be the owner and occupant of the home, the unpaid balance of the mortgage must be less than or equal to $729,750, the loan must have originated before January 1, 2009, and the mortgage payment must be more than 31% of your gross monthly income. You also need to prove that the payment amount is not affordable, because of a change in income or your expenses, and that you are at risk of default, either because your loan payment is about to go up or your income has dropped significantly.

Note: If you have missed payments, you may also be eligible for this program. In either case, you must contact your servicer to see if you qualify.

Q: How will my servicer determine if I’m qualified?

A: If you meet the minimum eligibility criteria, outlined above, your servicer will essentially go through the steps that I listed in answer to the first question. He will gather your proof of income, add the past-due charges (interest, insurance, and other costs, except for late fees, which are waived here) to your loan balance, and determine what reduction in interest will bring your mortgage payment down to 31% of your monthly income.

He will then do some math to determine if the cost of doing the loan modification under the Making Home Affordable program is less for the mortgage investor than a foreclosure (there are financial incentives from the government for servicers who offer loan modifications). If so, you’ll be given a trial period to see if you can make the new payments. If you do that successfully, you’ll receive a permanent modification that will lower your interest rate for the next five years.

After five years, the rate may increase, but by no more than 1% per year. Your interest rate will be capped at the market rate on the day your loan was modified, and it can’t surpass that cap.

Q: What if lowering the interest rate doesn’t help?

A: If a lowered interest rate still doesn’t get your payment down to 31% of your monthly income—or less—the servicer can extend your payment term, so that you have a 40-year loan instead of a 30-year loan. You’ll pay more interest over time this way, but the monthly payments will be more manageable. The servicer can do what’s called principal forbearance, which defers repayment on a portion of the loan amount until later in the repayment process. Or the servicer can forgive a portion of the debt. Note: This only happens in extreme cases and is completely optional. It’s not by any means a requirement.

Q: I was turned down for a loan modification because I am laid off. Why?

A: A loan modification is designed to be a sustainable fix. It is designed to make your payment affordable for the long haul. When you don’t have an income, a loan modification isn’t likely to help you, because even after the loan is modified, you may not be able to pay (the servicer will, of course, run the numbers to see if this is in fact true). You should still keep the lines of communication open with your servicer, though, because the servicer may work with you for a couple of months while you’re looking for work by putting off foreclosure or setting up a repayment plan.

Resources

Associations

National Association of Realtors

www.realtor.org

1-800-874-6500

Resources for both home buyers and sellers; includes current news, guides, and tools tips.

National Reverse Mortgage Lenders Association

www.nrmla.org

202-939-1760

An educational resource on reverse mortgages.

Books

Mortgages 101: Quick Answers to Over 250 Critical Questions About Your Home Loan, by David Reed (2008)

Answers to home loan questions; includes information on both simple and complex topics, definitions of the various loan types, and credit score explanations.

Mortgages for Dummies, 3rd edition, by Eric Tyson and Ray Brown (2008)

A comprehensive guide for anyone who might be entering into a mortgage; includes information on evaluating your creditworthiness, finding a lender, and refinancing.

Government Organizations

Internal Revenue Service

www.irs.gov

1-800-829-1040

Learn how to correctly make mortgage deductions; find answers to FAQs relating to real estate and mortgages.

Federal Trade Commission

www.ftc.gov

1-877-FTC-HELP (1-877-382-4357)

Federal Reserve Board

www.federalreserve.gov

U.S. Department of Housing and Urban Development (HUD)

www.hud.gov

202-708-1112

HUD aims to increase homeownership, support community development, and increase access to affordable housing free from discrimination; visit its site to find an approved counseling agency to assist with your reverse mortgage as well as homeownership information for consumers.

Tools

Living Wage Calculator

www.livingwage.geog.psu.edu/

Developed by Dr. Amy K. Glasmeier, the Living Wage Calculator will tell you the average hourly wage for popular fields, as well as the cost of typical expenses in popular communities and how much you’ll need to make on a monthly basis to support them.

Web sites

AARP

www.aarp.org

1-888-687-2277

Information about mortgages and retirement; includes a mortgage payoff calculator, recent mortgage news, and information on reverse mortgages.

Bankrate.com

www.bankrate.com

561-630-2400

Compare mortgage rates, use any of several mortgage calculators, read mortgage news, find a mortgage refinance rate, and more.

FSBO.com

www.fsbo.com

1-800-690-5802

The global For Sale By Owner real estate site. Buy, sell, or rent properties online; to list a property, packages start at $69.95.

HSH Associates Financial Publishers

www.hsh.com

1-800-873-2837

The nation’s largest publisher of mortgage and consumer loan information; on the organization’s site, you can search for a mortgage, find a loan, and access mortgage statistics, rates, information, articles, and calculators.

SchoolMatch

www.schoolmatch.com

904-230-3001

Find information on schools before relocating; access a list of and information on schools in a particular district; buy a report card for the school district (for about $34) that will give you information on attendance rates, test data, school improvement plans, and public perceptions.