25

STOCKHOLM

Once known almost exclusively as the birthplace of ABBA, Stockholm and Sweden are now responsible for Skype, Spotify, and the two most addicting games around: Candy Crush Saga and Minecraft. The blue-eyed, blond-haired, and at times blue-eared (it’s cold out there) people have some very talented programmers, a cashless society, and a virtue of humility called “Jantelagen”: a stark contrast to the name-dropping, constantly advertising people of Silicon Valley. Startups in Stockholm grow quickly because of the city’s early adopters and global perspective.

AGGREGATE VENTURE ACTIVITY Q4’15 - Q3’16

VC FUNDING: $1.4B

DEALS: 143

EXITS: 50

5 YEAR YoY FUNDING GROWTH: 44.1%

5 YEAR YoY DEAL GROWTH: 53.1%

Source: CB Insights

BEST AND WORST ACQUISITIONS

When Facebook acquired Instagram for $1 billion, everyone questioned the purchase… but it turned out to be a huge hit for both companies, as Instagram is now valued at over $35 billion. Unfortunately, that doesn’t hold true for Yahoo!’s multibillion-dollar acquisition of Mark Cuban’s now defunct Internet radio company. Here are a few of the biggest acquisition hits and misses made by technology companies in the past few years.

WORST

Broadcast.com bought by Yahoo! in 1999 for $5.7 billion.

Yahoo!’s ROI was 100%… that is, if ROI = Radio on the Internet.

Geocities bought by Yahoo! in 1999 for $3.6 billion.

Shut down in 2009, further cementing Yahoo!’s highly volatile history as a VC.

MySpace bought by NewsCorp in 2005 for $520 million.

The once white-hot social network was sold for $35 million in 2011.

Hotmail bought by Microsoft in 2005 for $400 million.

An e-mail platform that didn’t live up to its name.

Palm bought by HP for $1.2 billion in 2010.

HP put Palm out of its misery and shut down production of all devices in 2011.

Motorola bought by Google in 2012 for $12.5 billion.

A rare stumble for Google, Motorola was sold two years later writing down their investment by 75%.

OMGPOP bought by Zynga for $180 million in 2012.

Zynga pulled an OMG and POP’d its acquisition, shutting it down in 2013.

Lycos bought by Terra Networks for $12.5 billion in 2000.

Sold for $105 million in 2004… less than 2% of the multibillion-dollar investment.

BEST

Instagram bought by Facebook in 2012 for $1 billion when it had 15 employees.

Now estimated to be worth $35+ billion, Instagram is the go-to photosharing platform for celebs, teens, and creepers.

Android bought by Google in 2005 for $50 million.

Now installed on over 1.4 billion mobile devices and in almost all countries, it is the dominant mobile OS.

YouTube bought by Google in 2006 for $1.65 billion.

Now the biggest video platform in the world, estimated to be worth $80 billion.

DoubleClick bought by Google for $3.1 billion in 2007.

Platform that drives Google’s online advertising, and thus Google’s economic engine.

DOS bought by Microsoft for $75,000 in 1981.

DOS eventually became MS DOS… which led to a little operating system called Microsoft Windows.

Lenovo bought by IBM in 2005 for $1.25 billion.

Drove Lenovo’s business to new heights and a $10 billion market cap.

PayPal bought by eBay in 2002 for $1.5 billion

Online payment platform meet online marketplace; a match made in heaven that drove PayPal to a $35 billion market cap.

Zappos bought by Amazon in 2009 for $1.2 billion.

Zappos brought both sole and soul to Amazon.

VMware bought by EMC in 2004 for $625 million.

The company is now worth $20.6 billion.

Steve Jobs (aka NeXt Computer), bought by Apple in 1996 for $429 million. See Glossary entry “Steve Jobs.”

In 1996, Apple’s market cap was $3.1 billion. Today, it is now over $500 billion.

The Pioneer Series

Marc Benioff

Founded Salesforce.com in 1999 with the sole mission to revitalize the software industry to revamp the way that software programs were designed and distributed.

Founded Salesforce.com in 1999 with the sole mission to revitalize the software industry to revamp the way that software programs were designed and distributed.

At Salesforce, Benioff pioneered the 1/1/1 philanthropic model by which companies contribute 1% of profits, 1% of equity and 1% of employee hours back to the community it serves.

At Salesforce, Benioff pioneered the 1/1/1 philanthropic model by which companies contribute 1% of profits, 1% of equity and 1% of employee hours back to the community it serves.

Bill Campbell—Coach of the Valley

Key advisor to the founders and CEOs of Amazon, Google, Twitter, and countless Silicon Valley companies.

Key advisor to the founders and CEOs of Amazon, Google, Twitter, and countless Silicon Valley companies.

Former Apple board member and CEO/chairman of Intuit.

Former Apple board member and CEO/chairman of Intuit.

Vinod Khosla

Cofounder of Sun Microsystems and served as the first chairman and CEO of the company.

Cofounder of Sun Microsystems and served as the first chairman and CEO of the company.

Former general partner at Kleiner Perkins, and founded Khosla Ventures in 2004, which has since become one of the most recognized venture capital firms in the world.

Former general partner at Kleiner Perkins, and founded Khosla Ventures in 2004, which has since become one of the most recognized venture capital firms in the world.

Benchmark Boys—Bill Gurley, Mitch Lasky, Matt Cohler, Peter Fenton, Eric Vishria, Scott Belsky

One of the top venture capital firms in the Valley, with early-stage investments in numerous successful startups such as Dropbox, Uber, Twitter, Snapchat, and Instagram, and the six of them serve as board members for such companies.

One of the top venture capital firms in the Valley, with early-stage investments in numerous successful startups such as Dropbox, Uber, Twitter, Snapchat, and Instagram, and the six of them serve as board members for such companies.

Diane Greene

Cofounder, president and CEO of VMware, one of the largest virtualization companies in the world, which was acquired by EMC.

Cofounder, president and CEO of VMware, one of the largest virtualization companies in the world, which was acquired by EMC.

Currently the senior vice president for Google’s cloud businesses and serves on the boards of MIT and Khan Academy.

Currently the senior vice president for Google’s cloud businesses and serves on the boards of MIT and Khan Academy.

Larry Sonsini

Chairman of Wilson Sonsini, one of the preeminent law firms in the Valley.

Chairman of Wilson Sonsini, one of the preeminent law firms in the Valley.

Advised companies such as Google, Apple, Sun Microsystems, Netscape, and YouTube.

Advised companies such as Google, Apple, Sun Microsystems, Netscape, and YouTube.

Mark Zuckerberg

Founded Facebook, which is now the largest social communication platform in the world with over 1.6 billion users, in his dorm room.

Founded Facebook, which is now the largest social communication platform in the world with over 1.6 billion users, in his dorm room.

Pledged to give 99% of his Facebook shares, worth about $45 billion, toward the Chan Zuckerberg Initiative.

Pledged to give 99% of his Facebook shares, worth about $45 billion, toward the Chan Zuckerberg Initiative.

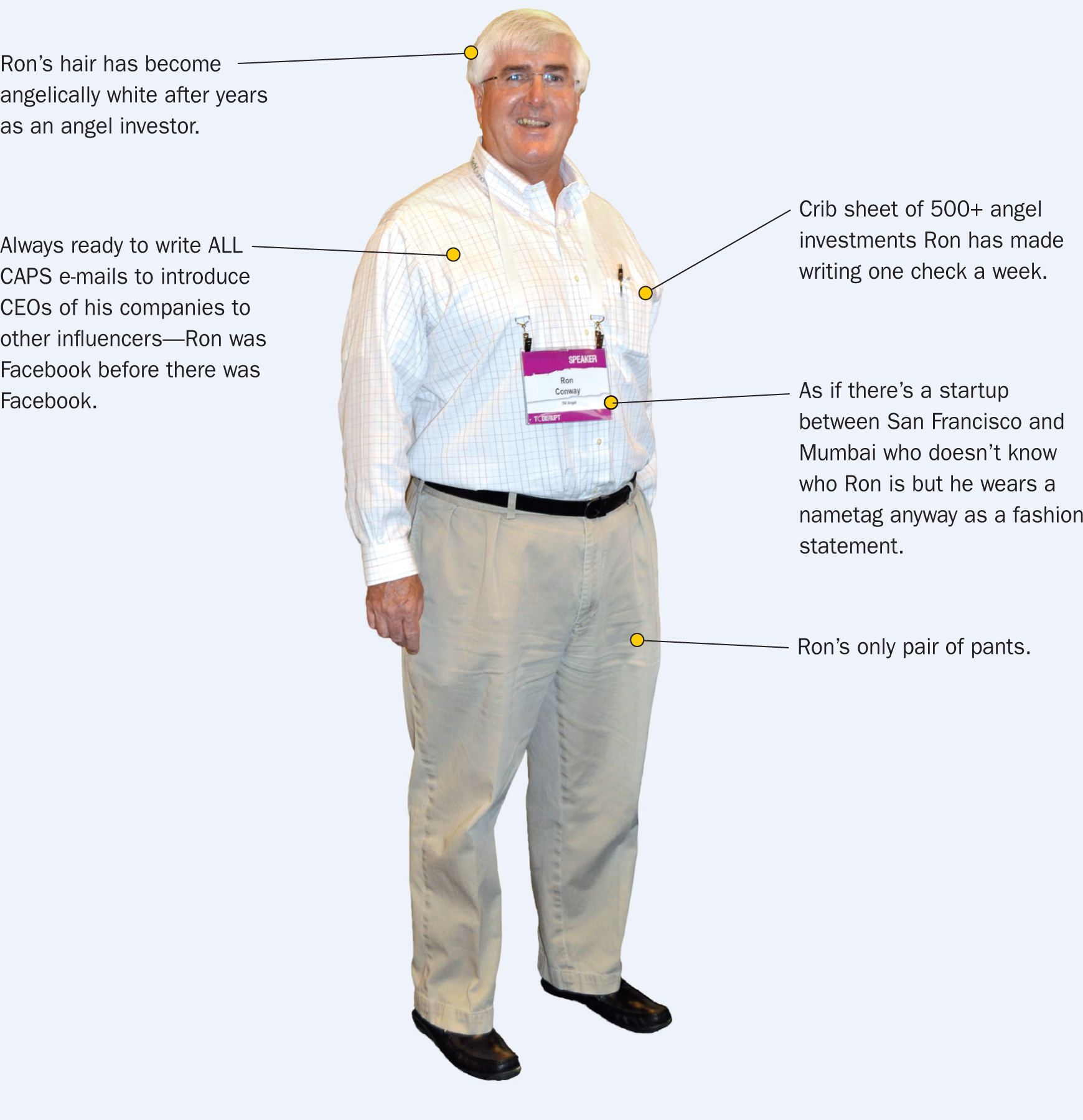

RON CONWAY

Arguably the most prolific angel investor in Silicon Valley, RON CONWAY is legendary for his ability to connect to people and make friends. His investments include early financings of Google, Facebook, Pinterest, and Twitter, and his friends include everyone from Marissa Mayer to Brian Wilson to MC Hammer. Since the mid-1990s, Conway has invested in over 600 Internet companies, and is considered to be the pioneer of angel investing. There is the right way, the wrong way, and the Conway.